QBE Syndicate 2999 Annual Report and Accounts 2009

QBE Syndicate 2999 Annual Report and Accounts 2009

QBE Syndicate 2999 Annual Report and Accounts 2009

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Report</strong> of the directors<br />

of the managing agent<br />

The directors of <strong>QBE</strong> Underwriting Limited (QUL), the managing agent for <strong>Syndicate</strong> <strong>2999</strong>, present the syndicate’s annual report <strong>and</strong> audited financial<br />

statements for the year ended 31 December <strong>2009</strong>.<br />

This annual report is prepared using the annual basis of accounting as required by regulation 5 of the Insurance <strong>Accounts</strong> Directive (Lloyd’s <strong>Syndicate</strong> <strong>and</strong><br />

Aggregate <strong>Accounts</strong>) Regulations 2008 (the 2008 Regulations).<br />

Principal activity<br />

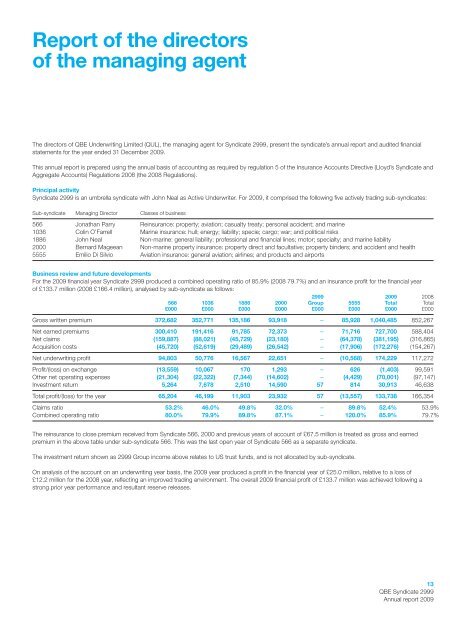

<strong>Syndicate</strong> <strong>2999</strong> is an umbrella syndicate with John Neal as Active Underwriter. For <strong>2009</strong>, it comprised the following five actively trading sub-syndicates:<br />

Sub-syndicate Managing Director Classes of business<br />

566 Jonathan Parry Reinsurance: property; aviation; casualty treaty; personal accident; <strong>and</strong> marine<br />

1036 Colin O’Farrell Marine insurance: hull; energy; liability; specie; cargo; war; <strong>and</strong> political risks<br />

1886 John Neal Non-marine: general liability; professional <strong>and</strong> financial lines; motor; specialty; <strong>and</strong> marine liability<br />

2000 Bernard Mageean Non-marine property insurance: property direct <strong>and</strong> facultative; property binders; <strong>and</strong> accident <strong>and</strong> health<br />

5555 Emilio Di Silvio Aviation insurance: general aviation; airlines; <strong>and</strong> products <strong>and</strong> airports<br />

Business review <strong>and</strong> future developments<br />

For the <strong>2009</strong> financial year <strong>Syndicate</strong> <strong>2999</strong> produced a combined operating ratio of 85.9% (2008 79.7%) <strong>and</strong> an insurance profit for the financial year<br />

of £133.7 million (2008 £166.4 million), analysed by sub-syndicate as follows:<br />

<strong>2999</strong> <strong>2009</strong> 2008<br />

566 1036 1886 2000 Group 5555 Total Total<br />

£000 £000 £000 £000 £000 £000 £000 £000<br />

Gross written premium 372,682 352,771 135,186 93,918 – 85,928 1,040,485 852,267<br />

Net earned premiums 300,410 191,416 91,785 72,373 – 71,716 727,700 588,404<br />

Net claims (159,887) (88,021) (45,729) (23,180) – (64,378) (381,195) (316,865)<br />

Acquisition costs (45,720) (52,619) (29,489) (26,542) – (17,906) (172,276) (154,267)<br />

Net underwriting profit 94,803 50,776 16,567 22,651 – (10,568) 174,229 117,272<br />

Profit/(loss) on exchange (13,559) 10,067 170 1,293 – 626 (1,403) 99,591<br />

Other net operating expenses (21,304) (22,322) (7,344) (14,602) – (4,429) (70,001) (97,147)<br />

Investment return 5,264 7,678 2,510 14,590 57 814 30,913 46,638<br />

Total profit/(loss) for the year 65,204 46,199 11,903 23,932 57 (13,557) 133,738 166,354<br />

Claims ratio 53.2% 46.0% 49.8% 32.0% – 89.8% 52.4% 53.9%<br />

Combined operating ratio 80.0% 79.9% 89.8% 87.1% – 120.0% 85.9% 79.7%<br />

The reinsurance to close premium received from <strong>Syndicate</strong> 566, 2000 <strong>and</strong> previous years of account of £67.5 million is treated as gross <strong>and</strong> earned<br />

premium in the above table under sub-syndicate 566. This was the last open year of <strong>Syndicate</strong> 566 as a separate syndicate.<br />

The investment return shown as <strong>2999</strong> Group income above relates to US trust funds, <strong>and</strong> is not allocated by sub-syndicate.<br />

On analysis of the account on an underwriting year basis, the <strong>2009</strong> year produced a profit in the financial year of £25.0 million, relative to a loss of<br />

£12.2 million for the 2008 year, reflecting an improved trading environment. The overall <strong>2009</strong> financial profit of £133.7 million was achieved following a<br />

strong prior year performance <strong>and</strong> resultant reserve releases.<br />

13<br />

<strong>QBE</strong> <strong>Syndicate</strong> <strong>2999</strong><br />

<strong>Annual</strong> report <strong>2009</strong>