Director's report for 2010 - TTS Group ASA

Director's report for 2010 - TTS Group ASA

Director's report for 2010 - TTS Group ASA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

a n n u a l r e p o r t<br />

<strong>2010</strong><br />

ttS <strong>Group</strong> aSa

ttS <strong>Group</strong><br />

Historical development 6<br />

Financial highlights 8<br />

Key events <strong>2010</strong> 10<br />

Report from the CEO 12<br />

BuSineSS areaS<br />

Marine Division 16<br />

Energy Division 20<br />

Port and Logistics Division 24<br />

Chinese venture 28<br />

Momentum 30<br />

Extensive upgrading of ports 32<br />

corporate covernance<br />

in<strong>for</strong>mation<br />

Shareholder in<strong>for</strong>mation 35<br />

Corporate governance 36<br />

Senior management 40<br />

Board of Directors 42<br />

director’S <strong>report</strong> and<br />

accountS<br />

Director’s <strong>report</strong> 45<br />

PROFit anD LOSS aCCOunt anD nOtES<br />

- <strong>Group</strong> 51<br />

- ttS <strong>Group</strong> aSa 95<br />

auditor’s <strong>report</strong> 114<br />

Responsibility statement 116<br />

orGaniSation<br />

this is ttS 118<br />

Companies in the ttS <strong>Group</strong> 122<br />

financial calendar 2011<br />

- 4. quarter <strong>2010</strong>/preliminary<br />

annual result <strong>2010</strong> 24 February<br />

- 1. quarter 2011 12 May<br />

- 2. quarter 2011 17 august<br />

- 3. quarter 2011 10 november<br />

- annual general meeting 19 May

3<br />

”<br />

ttS – continuously<br />

generating profits by<br />

being the preferred<br />

global supplier <strong>for</strong><br />

handling equipment<br />

to the maritime and<br />

oil & gas industry<br />

Canada<br />

Edmonton<br />

USA<br />

Fort Lauderdale<br />

Houston<br />

Brazil<br />

Macaé

Germany<br />

Bremen<br />

Lübeck<br />

Norway<br />

Bergen<br />

Nodeland<br />

Kristiansand<br />

Drøbak<br />

Sweden<br />

Gothenburg<br />

Czech Rebublic<br />

Ostrava-Hrabová<br />

Italy<br />

Genoa<br />

Finland<br />

Tampere<br />

Greece<br />

Piraeus<br />

<strong>TTS</strong> has a worldwide network of branch offices,<br />

service stations and agents, and provides after sales service<br />

in the major shipping regions in the world.<br />

Companies in the <strong>TTS</strong> <strong>Group</strong><br />

Sales and service network<br />

Singapore<br />

Singapore<br />

Vietnam<br />

Haiphong City<br />

China<br />

Dalian<br />

Nantong<br />

Shanghai<br />

Korea<br />

Busan

<strong>TTS</strong> <strong>Group</strong> <strong>ASA</strong><br />

Bergen-headquartered <strong>TTS</strong> is a global enterprise<br />

that designs, develops and supplies equipment<br />

<strong>for</strong> marine industry and the oil & gas industry.<br />

The operations are split into three separate<br />

divisions: Marine, Energy and Port and Logistics.<br />

<strong>TTS</strong> is one of the top three largest suppliers<br />

in its market segments.<br />

<strong>TTS</strong> is listed on the Oslo Stock Exchange and<br />

the group’s annual turnover is in the region<br />

of NOK 3 200 million. With a worldwide<br />

work<strong>for</strong>ce of around 1 100, <strong>TTS</strong> has over<br />

40 years of experience in the marine industry.<br />

The group has subsidiaries in Norway, Sweden,<br />

Germany, USA, China, Finland, Korea, Czech<br />

Republic, Vietnam, Canada, Singapore, Italy,<br />

Greece and Brazil.<br />

Marine<br />

• Cruise vessel equipment<br />

• Mooring winches<br />

• Hatch covers<br />

• Anchor handling winches<br />

• Marine cranes<br />

• Davits<br />

• Mega yacht equipment<br />

• Roro equipment<br />

• Sideloading systems<br />

Energy<br />

• Drilling equipment<br />

• Drilling packages<br />

• Land rigs<br />

• Mud systems<br />

• Offshore cranes<br />

• Offshore ships equipment<br />

• Offshore winches<br />

• Roll compensated systems<br />

<strong>TTS</strong> GROUP 3-15<br />

BUSINESS AREAS 16-33<br />

CORPORATE GOVERNANCE 35-43<br />

DIRECTOR’S REPORT AND ACCOUNTS 45-116<br />

ORGANISATION 118-123<br />

Port and Logistics<br />

• Block and heavy load handling<br />

• Cargo handling<br />

• Consulting<br />

• Container terminals<br />

• Port equipment<br />

• Shiplift and transfer systems<br />

• Shipyard production lines<br />

5

3-15 <strong>TTS</strong> GROUP<br />

16-33 BUSINESS AREAS<br />

35-43 CORPORATE GOVERNANCE<br />

45-116 DIRECTOR’S REPORT AND ACCOUNTS<br />

118-123 ORGANISATION<br />

When the company was founded in 1966<br />

<strong>TTS</strong> stood <strong>for</strong> Total Transportation Systems<br />

6<br />

Today, <strong>TTS</strong> is better represented as<br />

Total Technology<br />

Solutions<br />

ESTAbLiShMEnTS<br />

1966 <strong>TTS</strong> is established.<br />

1995 <strong>TTS</strong> is listed on Oslo Stock Exchange.<br />

2002 <strong>TTS</strong> establishes joint venture in Shanghai, China.<br />

2002 <strong>TTS</strong> establishes Rep. Office in Pusan, Korea.<br />

2005 <strong>TTS</strong> establishes <strong>TTS</strong> Bohai in Dalian, China.<br />

2005 <strong>TTS</strong> establishes <strong>TTS</strong> Port Equipment AB, Gothenburg, Sweden.<br />

2005 <strong>TTS</strong> establishes <strong>TTS</strong> Marine Inc. in Florida, USA.<br />

2006 <strong>TTS</strong> establishes <strong>TTS</strong> Marine s.r.l. in Genova, Italy.<br />

2006 <strong>TTS</strong> establishes <strong>TTS</strong> Vietnam, Haiphong, Vietnam.<br />

2007 <strong>TTS</strong> establishes Sense Drill Fab AS, Norway.<br />

2007 <strong>TTS</strong> establishes Sense EDM Pte. Ltd., Singapore.<br />

2008 <strong>TTS</strong> establishes Jiangnan <strong>TTS</strong>, Nantong, China.<br />

2008 <strong>TTS</strong> establishes <strong>TTS</strong> Marine Equipment (Dalian), China.<br />

2009 <strong>TTS</strong> establishes <strong>TTS</strong> Greece Ltd., Greece.<br />

2009 <strong>TTS</strong> establishes <strong>TTS</strong> Singapore Pte. Ltd., Singapore.<br />

2009 <strong>TTS</strong> establishes <strong>TTS</strong> Marine AS, Kristiansand, Norway.<br />

<strong>2010</strong> <strong>TTS</strong> establishes <strong>TTS</strong> Brazil, Brazil.<br />

AcqUiSiTiOnS/SALES<br />

1996 <strong>TTS</strong> acquires Mongstad Engineering AS, Bergen, Norway.<br />

1997 <strong>TTS</strong> acquires Norlift AS, Bergen, Norway.<br />

2000 <strong>TTS</strong> acquires Aktro AS, Molde, Norway.<br />

2001 <strong>TTS</strong> sells <strong>TTS</strong> Construction AS, Bergen, Norway.<br />

2001 <strong>TTS</strong> acquires Hamworthy KSE AB, Dry Cargo Division.<br />

2001 <strong>TTS</strong> acquires Hydralift Marine, and sell <strong>TTS</strong>-Aktro AS.<br />

2004 <strong>TTS</strong> acquires 100 % of joint venture in Shanghai, China.<br />

2004 <strong>TTS</strong> acquires LMG, Lübeck, Germany.<br />

2004 <strong>TTS</strong> acquires Liftec Oy, Tampere, Finland.<br />

2005 <strong>TTS</strong> acquires NavCiv Engineering AB, Gothenburg, Sweden.<br />

2005 <strong>TTS</strong> acquires Kocks GmbH, Bremen, Germany.<br />

2007 <strong>TTS</strong> acquires ICD Projects AS, Ålesund, Norway.<br />

2007 <strong>TTS</strong> acquires 100 % of joint venture in Pusan, Korea.<br />

2007 <strong>TTS</strong> acquires 50 % of <strong>TTS</strong> Keyon Marine, Zhang Jia Gang, China.<br />

2007 <strong>TTS</strong> acquires Sense EDM AS, Kristiansand, Norway.<br />

2007 <strong>TTS</strong> acquires 100 % Sense MUD AS, Kristiansand, Norway.<br />

2008 <strong>TTS</strong> acquires Wellquip Holding AS, Kristiansand, Norway.<br />

<strong>2010</strong> <strong>TTS</strong> sells <strong>TTS</strong> Keyon Marine, Zhang Jia Gang, China.

AnnUAL TURnOvER<br />

The <strong>TTS</strong> <strong>Group</strong>’s turnover showed<br />

a steady growth up to and including<br />

2008, in line with the company’s<br />

entry into new markets and its<br />

strengthening of activities in<br />

established business areas. In 2009<br />

and <strong>2010</strong>, the turnover fell as<br />

a result of the financial crisis and<br />

the subsequent economic downturn.<br />

<strong>TTS</strong>’ total turnover in <strong>2010</strong> was<br />

15 percent lower than in the year<br />

be<strong>for</strong>e. For 2011, it is the group’s<br />

objective again to grow turnover.<br />

MNOK<br />

4500<br />

4000<br />

3500<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

OMSETninG<br />

MNOK<br />

96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Port and Logistics<br />

Marine<br />

Energy<br />

7

3-15 <strong>TTS</strong> GROUP<br />

16-33 BUSINESS AREAS<br />

35-43 CORPORATE GOVERNANCE<br />

45-116 DIRECTOR’S REPORT AND ACCOUNTS<br />

118-123 ORGANISATION<br />

Financial highlights<br />

MARinE DiviSiOn<br />

NOK Million <strong>2010</strong> 2009<br />

Turnover 2 230.0 2 326.0<br />

EBITDA 158.7 93.7<br />

Order backlog per 31.12. 3 204.0 3 414.0<br />

EnERGY DiviSiOn<br />

NOK Million <strong>2010</strong> 2009<br />

Turnover 712.0 1 180.0<br />

EBITDA -168.6 -192.0<br />

Order backlog per 31.12. 690.0 854.0<br />

PORT AnD LOGiSTicS DiviSiOn<br />

NOK Million <strong>2010</strong> 2009<br />

Turnover 299.0 331.0<br />

EBITDA 20.6 19.6<br />

Order backlog per 31.12. 102.0 242.0<br />

8<br />

TURnOvER<br />

<strong>2010</strong><br />

Marine<br />

68.8 %<br />

2009<br />

Marine<br />

60.7 %<br />

ORDER bAckLOG<br />

<strong>2010</strong><br />

Marine<br />

80.2 %<br />

2009<br />

Marine<br />

75.7 %<br />

Energy<br />

22.0 %<br />

P&L<br />

9.2 %<br />

Energy<br />

30.7 %<br />

P&L<br />

8.6 %<br />

Energy<br />

17.3 %<br />

Energy<br />

18.9 %<br />

P&L<br />

2.6 %<br />

P&L<br />

5.4 %<br />

cOnSOLiDATED TURnOvER<br />

NOK Million<br />

1604<br />

cOnSOLiDATED EbiTDA<br />

NOK Million<br />

cOnSOLiDATED<br />

ORDER bAckLOG<br />

NOK Million<br />

2460<br />

4196<br />

3825<br />

3241<br />

2006 2007 2008 2009 <strong>2010</strong><br />

107<br />

168<br />

145<br />

2006 2007 2008 2009 <strong>2010</strong><br />

2273<br />

6949<br />

8159<br />

-84.3<br />

4510<br />

3.7<br />

3996<br />

2006 2007 2008 2009 <strong>2010</strong>

MAin FiGURES<br />

PROFIT AND LOSS ACCOUNT (NOK 1 000)<br />

<strong>2010</strong> 2009 2008 2007 2006<br />

Operating income 3 240 809 3 825 317 4 196 482 2 459 964 1 604 030<br />

Operating profit/loss be<strong>for</strong>e depresiation (EBITDA) 3 712 -84 265 145 459 167 767 107 061<br />

Operating profit/loss (EBIT) -48 267 -230 800 114 616 134 636 98 145<br />

Pre-tax profit/loss -156 103 -311 942 36 819 97 568 84 492<br />

Net profit/loss -196 656 -248 482 36 392 79 041 60 481<br />

BALANCE SHEET (NOK 1 000)<br />

Fixed assets 1 528 039 1 550 755 1 508 802 1 215 577 460 996<br />

Current assets 1 923 959 2 138 720 2 871 919 1 886 377 1 172 135<br />

Total assets 3 451 998 3 689 475 4 380 721 3 101 954 1 633 130<br />

Equity 802 734 935 883 989 056 933 596 598 061<br />

Long-term liabilities 534 638 452 876 532 297 588 878 196 635<br />

Current liabilities 2 114 626 2 300 715 2 825 808 1 579 479 838 434<br />

Total equity and liabilities 3 451 998 3 689 475 4 380 721 3 101 954 1 633 130<br />

kEY RATiOS<br />

FINANCIAL STRENGTH<br />

Equity to assets ratio (as a percentage of total capital) 23.3 % 25.4 % 22.6 % 30.1 % 36.6 %<br />

PROFITABILITy<br />

EBITDA margin 0.1 % -2.2 % 3.5 % 6.8 % 6.7 %<br />

EBIT margin -1.5 % -6.0 % 2.7 % 5.5 % 6.1 %<br />

Profit margin (pre-tax) -4.8 % -8.2 % 0.9 % 4.0 % 5.3 %<br />

Profit margin (after tax) -6.1 % -6.5 % 0.9 % 3.2 % 3.8 %<br />

RATE OF RETURN<br />

Return on equity -18.0 % -33.3 % 3.7 % 10.5 % 14.1 %<br />

Return on total capital -4.4 % -6.3 % 2.6 % 4.3 % 5.5 %<br />

SHARES<br />

Equity per share 10.75 13.78 38.18 36.20 26.59<br />

Earnings per share (NOK) -2.76 -5.72 1.41 3,40 2.92<br />

Number of shares, end of year 74 631 67 908 25 908 25 738 22 493<br />

Average number of shares 71 269 43 408 25 840 23 250 20 832<br />

Nominal value, end of year 0.50 0.50 0.50 0.50 0.50<br />

Defininitions<br />

Earnings per share: Profit after taxes divided on total number of shares at the end of the fiscal year.<br />

Profitability, equity: Profit be<strong>for</strong>e tax as a percentage of average equity.<br />

Profitability, total capital: Operating profit as a percentage of average total capital.<br />

9

3-15 <strong>TTS</strong> GROUP<br />

16-33 BUSINESS AREAS<br />

35-43 CORPORATE GOVERNANCE<br />

45-116 DIRECTOR’S REPORT AND ACCOUNTS<br />

118-123 ORGANISATION<br />

key events <strong>2010</strong><br />

<strong>TTS</strong> <strong>report</strong>ed earnings<br />

be<strong>for</strong>e depreciation<br />

of NOK 4 million, based<br />

on a turnover of NOK<br />

3 241 million. The group<br />

<strong>report</strong>ed a pre-tax loss<br />

of NOK 156.1 million.<br />

10<br />

At the start of 2011,<br />

<strong>TTS</strong> had an order backlog<br />

of NOK 3 996 million.<br />

The order intake in <strong>2010</strong><br />

was NOK 3 291 million,<br />

of which NOK 1 467<br />

million in the fourth<br />

quarter.<br />

In <strong>2010</strong>, <strong>TTS</strong> adjusted its<br />

manning in relation to<br />

the weak demand in vital<br />

markets. At the start<br />

of 2011, the number of<br />

employees in wholly<br />

owned companies<br />

was 1 057, compared to<br />

1 137 the year be<strong>for</strong>e.<br />

<strong>TTS</strong> achieved a satisfactory<br />

level of profitability in<br />

the markets <strong>for</strong> handling<br />

equipment <strong>for</strong> ships and<br />

ports, while earnings<br />

and results from activities<br />

relating to the oil and gas<br />

industry were weak.

<strong>TTS</strong> entered into an agreement<br />

with the Chinese ship building<br />

group, Dalian Shipbuilding Industry<br />

Corporation (DSIC) regarding<br />

strategic cooperation on deliveries<br />

to the offshore industry. Whenever<br />

DSIC enters into new contracts,<br />

<strong>TTS</strong> will contribute with expertise<br />

in design, marketing and delivery<br />

of drilling packages. <strong>TTS</strong> will<br />

furthermore supply equipment <strong>for</strong><br />

four jack-up rigs built by DSIC.<br />

<strong>TTS</strong> established<br />

a sales office in<br />

Macae in Brazil,<br />

to market its<br />

products and<br />

services to the<br />

offshore industry.<br />

<strong>TTS</strong> strengthened the<br />

group’s balance sheet by<br />

carrying out a private<br />

placement that provided<br />

the company with NOK<br />

42 million. Additionally,<br />

<strong>TTS</strong> has taken up a<br />

subordinated convertible<br />

loan of NOK 200 million.<br />

PHOTO: A. MARESCA<br />

<strong>TTS</strong> made an out-of-court<br />

settlement subsequent<br />

to the bankruptcy of<br />

Ability Drilling. <strong>TTS</strong><br />

purchased a land rig<br />

from the bankruptcy<br />

estate <strong>for</strong> NOK 75 million<br />

with sellers credit of up<br />

to two years. All other<br />

claims between the<br />

parties were waived.<br />

11

3-15 <strong>TTS</strong> GROUP<br />

16-33 BUSINESS AREAS<br />

35-43 CORPORATE GOVERNANCE<br />

45-116 DIRECTOR’S REPORT AND ACCOUNTS<br />

118-123 ORGANISATION<br />

PHOTO: HELGE SKODVIN<br />

12<br />

We can conclude that the many challenges affecting<br />

<strong>TTS</strong> as a result of the financial crisis are being resolved,<br />

which in turn means that the organisation may once<br />

again direct its ef<strong>for</strong>ts toward creating growth and<br />

healthy economic results.<br />

jOhAnnES nETELAnD<br />

PRESIDENT & CEO<br />

<strong>TTS</strong> GROUP <strong>ASA</strong>

We are coming back!<br />

T<br />

TS iS An inTERnATiOnAL GROUP that designs and supplies handling<br />

equipment <strong>for</strong> use onboard vessels, in ports and on installations <strong>for</strong> production<br />

of oil and gas. With activities spanning most continents, we are far more<br />

exposed to risk than had we limited our geographical field of activities. At the<br />

same time, a global presence provides us with opportunities that we may not otherwise<br />

have. The market <strong>for</strong> our products is global, and accordingly we must be present<br />

in close proximity to our customers’ operations – providing products and solutions at<br />

a competitive price and quality.<br />

Over the past two years, <strong>TTS</strong>’ owners and employees alike have experienced how<br />

tough it can be to create results. The financial crisis and the subsequent economic<br />

downturn had significant consequences and taught us valuable lessons. When<br />

summing up 2009, we used the expression “annus horribilis”, and our expectations <strong>for</strong><br />

<strong>2010</strong> were level-headed. The financial figures have now been presented, and although<br />

results have taken a positive direction, we must admit that the past year is not one<br />

to be joyously recalled with regard to <strong>TTS</strong>’ bottom line. Still, we have succeeded in<br />

maintaining the expertise in <strong>TTS</strong>, and as such we are well-equipped <strong>for</strong> the return of<br />

the markets <strong>for</strong> our products and services within all three of our business areas.<br />

<strong>2010</strong> was a good year <strong>for</strong> the Marine division, our largest division. Although<br />

the total turnover was somewhat lower than in 2009, there was a high level of activity<br />

throughout most of the year, and the operating margin showed positive development.<br />

The potential <strong>for</strong> further improvement of profitability is predominantly related to an<br />

increase in the sale of services and products in the after sales and service market.<br />

For the Port and Logistics division, <strong>2010</strong> was a year of improved results and<br />

operational margins, despite a lower turnover than the year be<strong>for</strong>e. The Energy division,<br />

however, was marked by a year of little activity and weak margins on orders in<br />

progress, and consequently its operational result were very poor.<br />

When we in spite of an unsatisfactory result <strong>for</strong> the year, we choose to assess<br />

our current situation to be far better than the one we were in at the end of 2009, this<br />

is mainly due to a solid order intake towards the end of <strong>2010</strong>. The order intake close<br />

to NOK 1.5 billion in the fourth quarter was the largest order intake since the third<br />

quarter of 2008, and one of the largest order intakes during one single quarter in the<br />

history of <strong>TTS</strong>.<br />

13

When, in conclusion, we sum up the situation <strong>for</strong> <strong>TTS</strong> as far better than twelve months<br />

ago, this relates to the fact that several factors hampering the group’s operation have<br />

either been removed or are in the process of being solved:<br />

- <strong>TTS</strong>’ dispute with the bankruptcy estate following the bankruptcy of Ability Drilling<br />

was settled out-of-court last autumn. Instead of a presumably prolonged legal<br />

process, the dispute was settled by an agreement in which <strong>TTS</strong> purchased a land<br />

rig from the bankruptcy estate <strong>for</strong> NOK 75 million with a seller’s credit of up to<br />

two years. All other claims between the parties were waived.<br />

- The ef<strong>for</strong>t to dispose of the three land rigs that <strong>TTS</strong> was left with following the<br />

bankruptcy of Ability Drilling is progressing favourably. Selling these rigs is an<br />

important step in order to reduce the group’s balance sheet. In February this year,<br />

one of these rigs was hired out on commercial terms <strong>for</strong> a period of twelve months.<br />

- The group’s capital situation has been strengthened. In July, <strong>TTS</strong> carried out a<br />

14<br />

private placing that provided the company with NOK 42 million. In January 2011,<br />

a subordinated convertible loan of NOK 200 million was issued.<br />

- Ef<strong>for</strong>ts to bring the Energy division into a position <strong>for</strong> new contracts <strong>for</strong> drilling<br />

equipment packages and cranes <strong>for</strong> offshore vessels has proven successful. In<br />

November, <strong>TTS</strong> entered into an agreement with the Chinese ship building group,<br />

Dalian Shipbuilding Industry Corporation (DSIC) – a company that <strong>TTS</strong> is familiar<br />

with through many years’ cooperation in the joint venture <strong>TTS</strong> Bohai Machinery<br />

– regarding strategic cooperation on deliveries to the offshore industry. When<br />

DSIC enters into new contracts, <strong>TTS</strong> will contribute with expertise in design,<br />

marketing, and delivery of drilling packages. Parallell to this, an agreement was<br />

made <strong>for</strong> <strong>TTS</strong> to deliver equipment <strong>for</strong> two jack-up rigs which DSIC will deliver, at<br />

a total value of NOK 460 million. In April 2011 the number of rigs was increased<br />

to four, at a total value of NOK 900 million. At the end of last year, further<br />

contracts were signed regarding deliveries of cranes to the offshore segment at a<br />

total value of NOK 50 million.

With this, we can conclude that the many challenges affecting <strong>TTS</strong> as a result of the<br />

financial crisis are being resolved, which in turn means that the organisation may<br />

once again direct its ef<strong>for</strong>ts toward creating growth and healthy economic results.<br />

The strong growth in order intake at the end of last year has continued into 2011.<br />

Furthermore, we believe that our long-term focus on developing operations in<br />

China continues to be important, and overall we expect about 40 percent of <strong>TTS</strong>’ total<br />

value creation to take place in our Chinese companies. Our expectations of the<br />

cooperation with DSIC in the energy segment are high. We are further convinced that<br />

the experiences which our customers of our first drilling packages will gain when<br />

this equipment is put to use in the coming year will provide us with a marketing<br />

advantage.<br />

As a major player within our markets, <strong>TTS</strong> has had a tradition of playing a role in<br />

restructuring the industry. We will continue to vigilantly seek solutions that will create<br />

value <strong>for</strong> our share holders.<br />

Although there is still uncertainty related to the development of <strong>TTS</strong>’ markets,<br />

2011 promises to be a year of progress within all of <strong>TTS</strong>’ business areas. We will<br />

none theless have to fight <strong>for</strong> each contract in a market with surplus capacity following<br />

several years of ‘drought’. The demand <strong>for</strong> our products and services will depend on<br />

the economic and political development in the world. If the surge of unrest in several<br />

states in the Middle East and North Africa has such consequences as a limiting in the<br />

supply of oil and gas, this will negatively affect the world economy and may reduce<br />

the willingness to invest in new equipment and purchase service and after sales<br />

support.<br />

We must there<strong>for</strong>e be prepared <strong>for</strong> setbacks, and on the whole have level-headed<br />

expectations to our turnover and results in 2011. Having said this, the potential <strong>for</strong><br />

the activities that <strong>TTS</strong> engage in are considerable, and we have a clear ambition of<br />

returning to the levels seen prior to the financial crisis. We are coming back!<br />

Johannes D. Neteland<br />

President & CEO<br />

<strong>TTS</strong> GROUP 3-15<br />

BUSINESS AREAS 16-33<br />

CORPORATE GOVERNANCE 35-43<br />

DIRECTOR’S REPORT AND ACCOUNTS 45-116<br />

ORGANISATION 118-123<br />

15

ivAR k. hAnSOn<br />

DIRECTOR<br />

MARINE DIVISION<br />

Ivar K. Hanson, Director and<br />

head of the Marine division. Until<br />

the new organisation became<br />

operative on 1 January <strong>2010</strong>,<br />

he headed the Marine Cranes<br />

division <strong>for</strong> six years. Hanson<br />

holds a Master of Science in<br />

Business Administration, as<br />

well as a degree in Mechanical<br />

Engineering, and he has worked<br />

with <strong>TTS</strong> <strong>for</strong> a total of 16 years.<br />

16<br />

Marine division<br />

For the Marine division of <strong>TTS</strong>, <strong>2010</strong> was<br />

a prosperous year. The market <strong>for</strong> marine<br />

handling equipment has been brisk, and<br />

by concentrating the group’s activities<br />

in the maritime sector into one division,<br />

<strong>TTS</strong> has been able to achieve synergies<br />

and strengthen its competitive edge.<br />

The activities in the maritime sector make up the largest part<br />

of <strong>TTS</strong>’ operations. At the start of <strong>2010</strong>, it was expected<br />

that the market would recover following a period affected by<br />

the financial crisis and economic downturn. This expectation was<br />

by a long way fulfilled. At the same time, the competitive situation<br />

intensified, owing to a considerable build up of capacity in the<br />

maritime equipment industry over the past years.<br />

– Our response to this challenge has been to concentrate all our<br />

resources within this business area, both to achieve cost synergies<br />

and to appear more uni<strong>for</strong>m and with a higher degree of power<br />

with all our products and solutions, says Ivar K. Hanson, Director<br />

and head of the Marine division.<br />

In <strong>2010</strong>, operation and results within the business area of cargo<br />

access were excellent. Furthermore, the activities related to deck<br />

equipment yielded satisfactory results. The joint venture companies<br />

in China made a particularly positive contribution. In all, the<br />

Chinese companies contributed close to a third of the division’s<br />

added value. Results from the division’s activities within service<br />

and maintenance were somewhat weaker than anticipated. Lower<br />

day rates resulted in reduced demand <strong>for</strong> maintenance.<br />

Operations<br />

Operations in the Marine division are headed from Bergen, Norway,<br />

and have been divided into four business areas: Deck equipment,<br />

comprising deck machinery, hatch covers, cargo cranes and yacht<br />

equipment; Cargo access, comprising RoRo equipment, side loading<br />

systems and equipment <strong>for</strong> cruise ships and mega yachts; Services,<br />

including repairs, maintenance, training and sale of spare parts; and<br />

finally, the joint venture companies in China constitute the division’s<br />

fourth business area.<br />

At the start of 2011, the Marine division had 667 employees,<br />

compared to 681 the year be<strong>for</strong>e, and most of these employees have<br />

an emphasis on engineering skills. The employees are distributed<br />

Turnover<br />

2326<br />

2230<br />

2009 <strong>2010</strong><br />

Order backlog<br />

3414<br />

3204<br />

2009 <strong>2010</strong><br />

EbiDTA<br />

93.7<br />

158.7<br />

2009 <strong>2010</strong>

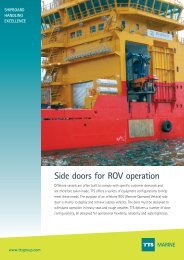

quarter ramp supplied by <strong>TTS</strong> to the<br />

world´s largest RoRo vessel, Mv Tönsberg,<br />

built at Mitsubishi heavy industries<br />

in nagasaki <strong>for</strong> Wilh. Wilhelmsen.<br />

Delivered in March 2011.<br />

<strong>TTS</strong> GROUP 3-15<br />

bUSinESS AREAS 16-33<br />

CORPORATE GOVERNANCE 35-43<br />

DIRECTOR’S REPORT AND ACCOUNTS 45-116<br />

ORGANISATION 118-123<br />

PHOTO: A. MARESCA<br />

17

18<br />

hatch covers<br />

Stern ramp and<br />

stern door<br />

Wire luffing cranes<br />

geographically, with 118 employees in Norway, 86 in Sweden, 159<br />

in Germany, 37 in the Czech Republic, 6 in Italy, 6 in Greece, 12 in<br />

the USA, 168 in China, 56 in South Korea, 8 in Singapore and 7 in<br />

Vietnam.<br />

In addition to this, the joint venture companies in China have a<br />

total of 153 employees, with 83 employees in <strong>TTS</strong> Bohai Machinery<br />

in Dalian and 70 in <strong>TTS</strong> Hua Hai in Shanghai. <strong>TTS</strong> Hua Hai owns<br />

40 percent of the manufacturing company Jiangnan <strong>TTS</strong> Ships<br />

Equipment, in Nantong, with 720 employees.<br />

In Germany, <strong>TTS</strong> Kocks and <strong>TTS</strong> Ships Equipment in Bremen<br />

merged in <strong>2010</strong>. In the first half of 2011, <strong>TTS</strong> LMG in Lübeck will<br />

<strong>for</strong>mally be incorporated into one German company with employees<br />

in Bremen and Lübeck.<br />

– Through our entire organisation we have a strong focus on<br />

achieving synergies; cost-wise by improving our purchasing routines,<br />

and income-wise by further streamlining the way in which we<br />

market and sell our products and services, says Ivar K. Hanson.<br />

In the autumn of <strong>2010</strong>, the Marine division initiated a cultural<br />

project in collaboration with the Norwegian embassy in Beijing. The<br />

aim of this project is to strengthen and improve cooperation and<br />

interaction between the division’s employees in Europe, primarily<br />

in Sweden, Norway and Germany, and the enterprises in China. The<br />

project is organised as a series of seminars with assistance from<br />

external advisors, with the aim of increasing knowledge and understanding<br />

of each other’s approaches and work methods, including<br />

relevant differences between the various European countries and<br />

different parts of China.<br />

Products<br />

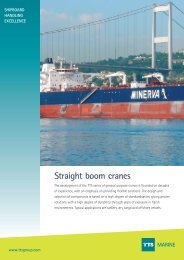

The Marine division supplies design and engineering of equipment<br />

<strong>for</strong> cargo handling and cargo access on vessels, with related functions<br />

within service and maintenance. Product development is<br />

carried out internally in each business unit and across these units.<br />

<strong>TTS</strong> is among the world’s leading suppliers of cargo handling<br />

systems <strong>for</strong> vessels; including side loading systems, RoRo equipment,<br />

hatch covers and specialist equipment <strong>for</strong> yachts and<br />

cruise ships. <strong>TTS</strong> is also one of the world’s major suppliers of hose<br />

handling systems, and holds a strong position in the market <strong>for</strong><br />

provision cranes and cargo cranes. <strong>TTS</strong> is furthermore a significant<br />

supplier of winches and deck machinery.<br />

Our portfolio of products is continuously improved and<br />

re newed, in line with the technological development and customers’<br />

requirements to efficient and functional solutions. Our focus is<br />

pre dominantly on developing our programs in service and after<br />

sales. Historically, this is an area in which <strong>TTS</strong> has had limited<br />

focus, but we are building a service function to meet our customers’

Weather and tween<br />

hatch cover<br />

Deck winches<br />

Ramp cover<br />

<strong>TTS</strong> GROUP 3-15<br />

bUSinESS AREAS 16-33<br />

CORPORATE GOVERNANCE 35-43<br />

DIRECTOR’S REPORT AND ACCOUNTS 45-116<br />

ORGANISATION 118-123<br />

requirements <strong>for</strong> standby guarantees relating to un<strong>for</strong>eseen events<br />

and regular maintenance. Our aim is to provide a solid service<br />

function <strong>for</strong> our customers throughout our products’ service life,<br />

says Ivar K. Hanson.<br />

Market outlook<br />

At the start of 2011, the order backlog of the Marine division was<br />

NOK 3 204 million, compared to NOK 3 414 million the year<br />

be<strong>for</strong>e. These figures include 50 percent of the order backlog of<br />

the joint venture companies <strong>TTS</strong> Hua Hai Ships Equipment Co. Ltd.<br />

and <strong>TTS</strong> Bohai Machinery Co. Ltd. in China.<br />

The weakened order intake is a result of the pronounced decline<br />

in the shipbuilding market until <strong>2010</strong>, and the fact that there is<br />

normally a degree of staging between the date of contracting of new<br />

vessels and orders of new equipment.<br />

– In the first half of <strong>2010</strong>, a large number of bulk carriers and<br />

tankers were contracted at shipyards in South Korea, which together<br />

with a renewed activity in the car carrier market present improved<br />

opportunities <strong>for</strong> <strong>TTS</strong>, says Hanson.<br />

In addition to equipment deliveries <strong>for</strong> RoRo vessels, the market<br />

<strong>for</strong> cruise liners appears to hold opportunities <strong>for</strong> <strong>TTS</strong>. Furthermore,<br />

there is an increase in activity in the niche market <strong>for</strong> mega<br />

yachts, and the same applies to reefers. – We are looking at the<br />

possibility of deliveries to the naval <strong>for</strong>ces of several countries in<br />

connection with the refurbishment of vessels. The tanker and bulk<br />

market, however, remain slow, Hanson maintains.<br />

He adds that the Marine division also supplies specialist equipment<br />

<strong>for</strong> offshore vessels, including deck machinery, special purpose<br />

hatches as well as rescue and emergency equipment.<br />

Strategy<br />

The Marine division has an order situation that ensures full capacity<br />

utilization in 2011, and the main challenge is to sell new projects<br />

with satisfactory margins <strong>for</strong> implementation in 2012 and following<br />

years.<br />

– We must continue our ef<strong>for</strong>ts to develop and market our<br />

expertise as supplier of services. Due to the strong increase in our<br />

volume delivered in recent years, the basis <strong>for</strong> products requiring<br />

service and maintenance will continue to grow. Hence, our opportunities<br />

in this business area are significant, even if the service<br />

market in general remains weak, Hanson points out.<br />

The Marine division will continue its ef<strong>for</strong>ts to achieve cost<br />

synergies on the basis of the Momentum Project (ref. separate article<br />

on page 30-31).<br />

19

inGE GAbRiELSEn<br />

DIRECTOR<br />

ENERGy DIVISION<br />

Inge Gabrielsen is head of<br />

the Energy division, and is<br />

furthermore Director of<br />

<strong>TTS</strong> Energy AS. Gabrielsen<br />

holds a Master of Science<br />

from NTNU, the Norwegian<br />

University of Science and<br />

Technology, and was head<br />

of operations in <strong>for</strong>mer<br />

<strong>TTS</strong> Sense until 2009. He<br />

has previous experience<br />

from Subsea 7 and several<br />

Aker companies.<br />

20<br />

Energy division<br />

The Energy division concluded <strong>2010</strong> by entering<br />

into two major contracts <strong>for</strong> delivery<br />

of complete drilling packages. As a consequence<br />

of strategic co operation agreements<br />

in China, additional two contracts were<br />

signed in April 2011. The demand <strong>for</strong> land<br />

rigs and offshore cranes is expected to rise<br />

in the course of this year.<br />

At the start of <strong>2010</strong>, <strong>TTS</strong> concentrated most of the group’s<br />

activities in the oil and gas industry into the Energy<br />

division. The scope of activities is primarily development<br />

and production of advanced drilling equipment, cranes, winches and<br />

other handling equipment. Following the acquisition of Sense EDM<br />

in 2007, equipment <strong>for</strong> onshore and offshore rigs was incorporated<br />

into <strong>TTS</strong>’ product portfolio. In the same year, <strong>TTS</strong> resumed<br />

supplying offshore cranes. In <strong>2010</strong> <strong>TTS</strong> merged all Energy companies<br />

in Norway into one single company; <strong>TTS</strong> Energy AS, and<br />

by doing so achieved a more defined and efficient operational<br />

structure. Ef<strong>for</strong>ts are focused on achieving both administrative and<br />

operative synergies.<br />

As expected, the market <strong>for</strong> the Energy division’s products<br />

remained weak <strong>for</strong> most of last year. <strong>TTS</strong> has succeeded in maintaining<br />

a high level of expertise in the area, and is well-equipped to<br />

service the market with high-quality products and solutions. In<br />

<strong>2010</strong>, <strong>TTS</strong> delivered a complete drilling equipment package to<br />

Keppel FELS in Singapore. The equipment package constitutes part<br />

of a highly advanced jack-up rig <strong>for</strong> the drilling and production<br />

of oil and gas. Testing of the drilling package is expected to be<br />

completed during the second quarter of this year. In 2009, similar<br />

drilling packages were delivered to a CJ70 jack-up rig currently<br />

under construction at the Jurong Shipyard in Singapore. Testing<br />

of this drilling package will also be completed in the second quarter<br />

of this year. Both rigs have been acquired by rig operators that<br />

have been awarded drilling assignments <strong>for</strong> operating companies in<br />

the North Sea, thus providing <strong>TTS</strong> with valuable references.<br />

In <strong>2010</strong>, <strong>TTS</strong> entered into a contract with PetroVietnam Marine<br />

Shipyard Company regarding a drilling equipment package <strong>for</strong> a<br />

jack-up rig currently under construction at the Vung-Tau shipyard.<br />

The equipment is scheduled <strong>for</strong> delivery in 2011.<br />

In <strong>2010</strong>, <strong>TTS</strong> further signed a strategic cooperation agreement<br />

Turnover<br />

1180<br />

712<br />

2009 <strong>2010</strong><br />

Order backlog<br />

854<br />

690<br />

2009 <strong>2010</strong><br />

EbiDTA<br />

2009 <strong>2010</strong><br />

-192<br />

-169

<strong>TTS</strong> Energy delivers land<br />

rigs based on our internationally<br />

patented rack<br />

& pinion technology.<br />

These rigs are unique<br />

in term of mobilization,<br />

operational weight, speed<br />

of operation as well as<br />

level of automation.<br />

<strong>TTS</strong> GROUP 3-15<br />

bUSinESS AREAS 16-33<br />

CORPORATE GOVERNANCE 35-43<br />

DIRECTOR’S REPORT AND ACCOUNTS 45-116<br />

ORGANISATION 118-123<br />

21

4-11 <strong>TTS</strong> GROUP<br />

12-31 bUSinESS AREAS<br />

32-41 CORPORATE GOVERNANCE<br />

42-111 DIRECTOR’S REPORT AND ACCOUNTS<br />

112-119 ORGANISATION<br />

Offshore Modular Rig where<br />

the rack & pinion principle<br />

results in a more compact<br />

and lighter rig compared<br />

with traditional solutions.<br />

22<br />

with the Chinese shipbuilding group Dalian Shipbuilding Industry<br />

Corporation (DSIC) regarding delivery of drilling equipment to the<br />

offshore industry. Through its Energy division, <strong>TTS</strong> will contribute<br />

with expertise in design, marketing and delivery of drilling packages,<br />

whenever DSIC enters into new contracts <strong>for</strong> the delivery of such<br />

equipment. The collaboration on equipment deliveries to customers<br />

in the offshore market is organised through the joint venture<br />

company that <strong>TTS</strong> owns together with DSIC; <strong>TTS</strong> Bohai Machinery.<br />

<strong>TTS</strong> entered into an agreement with DSIC <strong>for</strong> the delivery of two<br />

drilling equipment packages <strong>for</strong> jack-up rigs, ordered by Prospector<br />

Offshore Drilling. These are scheduled <strong>for</strong> delivery in the fourth<br />

quarter of 2012. Two additional contracts <strong>for</strong> drilling equipment<br />

packages were signed in April 2011. Through its offshore company<br />

DSOC, DSIC holds options <strong>for</strong> the delivery of an additional three<br />

jack-up rigs.<br />

Following its re-entry into the crane market, <strong>TTS</strong> has developed<br />

a range of cranes <strong>for</strong> rigs and offshore vessels, anchor handling<br />

winches and other handling equipment. With its unique technology<br />

<strong>for</strong> active heave compensation, <strong>TTS</strong> has become a significant<br />

supplier of cranes and equipment <strong>for</strong> handling of heavy loads at<br />

great ocean depths. In <strong>2010</strong>, the Energy division delivered its first<br />

250 ton active heave compensated offshore crane.<br />

<strong>2010</strong> was a weak year <strong>for</strong> the Energy division’s company in<br />

Canada. As a result of the low level of activity in the market <strong>for</strong> land<br />

rigs, operations have been focused on the sale of individual components<br />

as well as after sales service.<br />

On the basis of recent years’ deliveries to the oil and gas industry,<br />

<strong>TTS</strong> has obtained a solid foundation <strong>for</strong> providing its service and<br />

after sales. In addition to the sale of spare parts <strong>for</strong> drilling rigs and<br />

cranes, <strong>TTS</strong> has developed a simulator-based training program <strong>for</strong><br />

continuous maintenance. <strong>TTS</strong> has established a 24-hour technical<br />

support <strong>for</strong> service, and the activity in this area is increasing.<br />

In <strong>2010</strong>, <strong>TTS</strong> made an out-of-court settlement with the bankruptcy<br />

estate following the bankruptcy of Ability Drilling. <strong>TTS</strong><br />

committed to purchasing a land rig from the bankruptcy estate<br />

<strong>for</strong> NOK 75 million. Ef<strong>for</strong>ts are focused on disposing of all three<br />

rigs on commercial terms.<br />

Operations<br />

The Energy division comprises all units of the <strong>TTS</strong> <strong>Group</strong> that deliver<br />

equipment to the oil and gas industry. Its main products are drilling<br />

packages, complete land rigs, as well as cranes and winches <strong>for</strong> rigs<br />

and offshore vessels.<br />

The Energy division is managed from Kristiansand in Norway.<br />

Operations are divided into the two business areas Drilling and<br />

Offshore & Subsea, of which the first is managed from Kristiansand<br />

and the latter from Bergen.

At the start of 2011, the Energy division had 316 employees,<br />

compared to 395 the year be<strong>for</strong>e, whereof 264 work in Norway,<br />

38 in Canada, 11 in Singapore, one in China and one in the USA.<br />

Furthermore, a sales office has been established in Macae in Brazil,<br />

with one employee.<br />

Products<br />

The Energy division designs, develops and supplies advanced<br />

equipment <strong>for</strong> onshore and offshore rigs, and <strong>for</strong> vessels serving<br />

the oil and gas industry. The products are divided into the following<br />

main categories; drilling equipment, drilling packages, land rigs, mud<br />

systems, offshore cranes, equipment <strong>for</strong> offshore vessels, offshore<br />

winches and active heave compensated systems. The development<br />

of equipment is carried out in close cooperation with the division’s<br />

customers, based on requirements <strong>for</strong> functionality, productivity,<br />

safety and quality.<br />

– We have developed a virtually complete product portfolio<br />

<strong>for</strong> the high end part of the market <strong>for</strong> drilling equipment. So far,<br />

we have primarily focused on equipment <strong>for</strong> jack-up rigs. However,<br />

we have ambitions of making deliveries to floaters by employing<br />

the heave compensation technology. We have initially developed<br />

concepts <strong>for</strong> semi-floaters, but will eventually be able to provide<br />

solutions <strong>for</strong> drill ships, Inge Gabrielsen says.<br />

Market outlook<br />

At the start of 2011, the order backlog of the Energy division was<br />

NOK 690 million, compared to NOK 854 million the year be<strong>for</strong>e.<br />

Following two years of a low level of activity, the market <strong>for</strong> the<br />

division’s products is once again on an upward trend.<br />

Our challenge is to document our competitive edge as regards<br />

technology and quality in a market marked by two major, well<br />

established suppliers. The development <strong>for</strong> the cooperation in<br />

Gulmar Atlantis is equipped with<br />

a 140 ton Ahc offshore crane from <strong>TTS</strong>.<br />

China will as such be of significant consequence; here <strong>TTS</strong><br />

has an advantage that we will take great care of, emphasises Inge<br />

Gabrielsen.<br />

The market <strong>for</strong> offshore cranes is weak. The demand <strong>for</strong> land rigs<br />

is expected to improve in 2011.<br />

Strategy<br />

For the Energy division, the main focus of 2011 is to capitalise<br />

on the product portfolio which <strong>TTS</strong> has developed; primarily<br />

through more contracts <strong>for</strong> deliveries of offshore cranes and drilling<br />

equipment <strong>for</strong> jack-up rigs.<br />

The basis <strong>for</strong> growth in the drilling equipment market is favourable,<br />

and our ambition is to go from being a small contender to a<br />

major market player in this segment. Our basis <strong>for</strong> this is that,<br />

toward 2015, another 100 jack-up rigs will be constructed worldwide,<br />

providing a favourable potential <strong>for</strong> the sale of our products.<br />

We anticipate that the demand will increase further towards the end<br />

of this year.<br />

In the market <strong>for</strong> offshore cranes, <strong>TTS</strong> will focus on the re-sale of<br />

cranes cancelled during the financial crisis and securing new orders.<br />

– In spite of a weak market <strong>for</strong> land rigs, we are convinced that<br />

the operators will gradually require more rigs. Our strategy will be<br />

to serve the high end market with automated solutions. We will<br />

make use of technology from offshore installations and approach<br />

the segment of the market that requires advanced rigs, Gabrielsen<br />

points out.<br />

The Energy division has established a sales office in Macae in<br />

Brazil, to market the division’s products to shipyards in Brazil and<br />

to offer service functions.<br />

With regard to the service market, the division’s strategy is<br />

to develop the position that <strong>TTS</strong> has built as a supplier with solid<br />

expertise and excellent training programs <strong>for</strong> customers.<br />

23

LEnnART SvEnSSOn<br />

DIRECTOR<br />

PORT AND LOGISTICS DIVISION<br />

Lennart Svensson was appointed<br />

Director of the <strong>for</strong>mer Port and<br />

Material Handling division in 2008,<br />

and continued as head of the<br />

new division, following last year’s<br />

restructuring. Svensson holds a<br />

degree in Mechanical Engineering,<br />

and has <strong>for</strong> most of his career been<br />

involved in marine cargo handling.<br />

He was previously Marketing Director<br />

of <strong>TTS</strong> Ships Equipment AB, and<br />

has been Managing Director of<br />

<strong>TTS</strong> Port Equipment AB since its<br />

establishment in 2005.<br />

24<br />

Port and Logistics division<br />

The Port and Logistics division is wellequipped<br />

to handle a growing market <strong>for</strong><br />

equipment <strong>for</strong> ports, and as an example is<br />

prequalified to participate in competitive<br />

tendering <strong>for</strong> deliveries to Rotterdam’s new<br />

container terminal. The market <strong>for</strong> lifting<br />

and transport equipment to the industry<br />

is recovering. Accordingly, the division has<br />

high expectations to operation and results<br />

in 2011.<br />

Since 2005, <strong>TTS</strong> has developed products and services <strong>for</strong> the<br />

handling of cargo in ports. Together with the traditional<br />

activities within material handling, this has become a significant<br />

business area <strong>for</strong> the group. The Port and Logistics organisation<br />

has in <strong>2010</strong> been strengthened to enhance interaction between<br />

the units in Sweden, Norway and Finland. The division has its<br />

own function <strong>for</strong> marketing and administrative services, ensuring<br />

efficient operation and proximity to customers at all stages.<br />

The Port and Logistics division products and customers make<br />

its operations less exposed to fluctuations in the market than<br />

<strong>TTS</strong>’ other divisions. Thus, turnover and results in 2009 and <strong>2010</strong><br />

have on the whole been acceptable, even though profitability<br />

between the three units of the division has varied. In <strong>2010</strong>, the<br />

division’s most prosperous operations were the ones involving<br />

development and manufacturing of port equipment.<br />

The division is managed from Gothenburg. As a result of the<br />

restructuring of <strong>TTS</strong> at the start of <strong>2010</strong>, several joint administrative<br />

functions were established to make the division less dependent on<br />

resources from other divisions and from the group administration.<br />

Operations<br />

At the start of 2011, the Port and Logistics division had 67 employees,<br />

compared to 61 the year be<strong>for</strong>e. The employees are distributed<br />

geographically; with 22 employees based in Sweden, 17 in Norway<br />

and 28 in Finland. In Sweden, the staff was increased by five<br />

employees in <strong>2010</strong>, while minor adjustments were made elsewhere.<br />

Most of the division’s employees have an emphasis on engineering<br />

skills. In Sweden, the expertise is focused on developing equipment<br />

<strong>for</strong> efficient cargo handling in ports, while in Norway it is<br />

Turnover<br />

331<br />

299<br />

2009 <strong>2010</strong><br />

Order backlog<br />

242<br />

102<br />

2009 <strong>2010</strong><br />

EbiDTA<br />

19.6<br />

20.6<br />

2009 <strong>2010</strong>

Upper deck Linkspan,<br />

Port of Gothenburg.<br />

<strong>TTS</strong> GROUP 3-15<br />

bUSinESS AREAS 16-33<br />

CORPORATE GOVERNANCE 35-43<br />

DIRECTOR’S REPORT AND ACCOUNTS 45-116<br />

ORGANISATION 118-123<br />

25

26<br />

Two tier Linkspan in<br />

hoek van holland.<br />

Transfer system from<br />

<strong>TTS</strong> handling System.<br />

Upper deck Linkspan <strong>for</strong><br />

harwich international<br />

Port, England, Uk.<br />

focused on production lines and equipment <strong>for</strong> heavy load handling<br />

in shipyards and other industries. In Finland, specialisation is on<br />

systems and vehicles <strong>for</strong> the transport of containers and loading<br />

cassettes.<br />

– A review of <strong>2010</strong> indicates that this is probably the most hectic<br />

year since <strong>TTS</strong> made equipment <strong>for</strong> cargo handling an area of focus.<br />

The level of activity was particularly high in the Gothenburg-based<br />

company per<strong>for</strong>ming the installation of a number of linkspans<br />

(special ramps linking ship to shore), passenger gangways and other<br />

terminal equipment, says Lennart Svensson.<br />

In <strong>2010</strong>, <strong>TTS</strong> delivered port equipment to Stena Line and to ports<br />

in Germany, England, Denmark and Sweden. Last year, <strong>TTS</strong> Port<br />

Equipment was approved as one of three potential suppliers <strong>for</strong> a<br />

fully automated transport system <strong>for</strong> Rotterdam’s new container<br />

terminal. An announcement on the choice of system and supplier<br />

is expected during the autumn of 2011.<br />

–We have made considerable investments in the development of<br />

a system <strong>for</strong> automatic container handling, and should <strong>TTS</strong> be<br />

chosen as preferred supplier, this would constitute a major project<br />

<strong>for</strong> the division over the next few years. There will be two-three<br />

other major port terminal projects, with a focus on automation of<br />

manual systems, maintains Svensson.<br />

Not all areas within the division kept up the same level of activity<br />

in <strong>2010</strong>. As a consequence of the financial crisis, the market <strong>for</strong><br />

our operations in Finland has been weak <strong>for</strong> the past two years. A<br />

weak order intake resulted in a temporary reduction in manning in<br />

the first half of <strong>2010</strong>. After the summer holidays, there has been an<br />

increase in the demand <strong>for</strong> cassette loadings systems and translifters<br />

<strong>for</strong> customers in shipping and other industries.<br />

The market <strong>for</strong> equipment <strong>for</strong> heavy load handling and production<br />

lines to the industry was expected to be weak in <strong>2010</strong>. In Norway,<br />

the focus was there<strong>for</strong>e on deliveries of lifting equipment to repair<br />

yards. <strong>TTS</strong> collaborates with another technology company relating<br />

to the development of a separate system <strong>for</strong> the lifting of ships, and<br />

has commenced marketing of this system. In collaboration with<br />

wind power producers, a considerable ef<strong>for</strong>t has been made to<br />

develop heavy lift and logistics solutions <strong>for</strong> the transport and<br />

installations of offshore wind turbines and wind power plants.<br />

Products<br />

<strong>TTS</strong> has an extensive product portfolio <strong>for</strong> cargo handling in ports.<br />

In addition to linkspan and passenger gangways, this further comprises<br />

automatic mooring devices and systems <strong>for</strong> handling containers<br />

and cassettes. The cassettes are further suited <strong>for</strong> special<br />

transport requirements related to production, e.g. in the steel and<br />

paper industries. Additionally, <strong>TTS</strong> has developed a complete AGV<br />

system (Automated Guided Vehicles) <strong>for</strong> the handling of containers<br />

in container terminals.<br />

Through is activities in Norway, <strong>TTS</strong> has <strong>for</strong> a number of years<br />

been a supplier of production lines to shipyards and of systems and<br />

solutions dealing with heavy load handling, both in shipyards and<br />

other industries.<br />

In recent years, <strong>TTS</strong> has invested development resources on<br />

heavy lift and logistics solutions in connection with establishment<br />

and installation of onshore and offshore wind power plants. The

demand <strong>for</strong> such systems is growing as a result of the steadily<br />

increasing size of the wind turbines. <strong>TTS</strong> has considerable knowhow<br />

with regard to heavy lifts, and uses this to develop solutions<br />

that ensure a safe and efficient transport of installations with a<br />

height up to 90 meters.<br />

Market outlook<br />

At the start of 2011, the order backlog of the Port and Logistics<br />

division was NOK 102 million, compared to NOK 242 million the<br />

year be<strong>for</strong>e.<br />

– We have prepared <strong>for</strong> a slight growth in turnover and results<br />

in 2011 compared to last year, despite the fact that parts of our<br />

markets are experiencing surplus capacity and price pressure,<br />

maintains Svensson.<br />

The Port and Logistics division delivers the majority of its<br />

products and services to customers in Europe, but it also has<br />

deliveries to countries in Asia. In <strong>2010</strong>, the division entered into<br />

contracts <strong>for</strong> linkspans to Australia and New Zealand.<br />

The division will continue to focus on the marketing of linkspan<br />

and passenger gangways towards port authorities and commercial<br />

players in Northern Europe and Great Britain. The market <strong>for</strong><br />

heavy lift equipment to repair yards in Europe and Asia is considered<br />

to be significant. Furthermore, the Port and Logistics division<br />

considers Brazil to be an interesting market <strong>for</strong> heavy lift equip-<br />

ment and production lines, provided that plans <strong>for</strong> the establishment<br />

of new shipyards in Brazil are carried through.<br />

Strategy<br />

In 2011, the Port and Logistics division will focus on achieving even<br />

more synergies between its units with regard to marketing of<br />

products and services. The organising of <strong>TTS</strong> entails that each<br />

division is fully responsible <strong>for</strong> operation and economy, which Port<br />

and Logistics as the smallest division has adjusted to.<br />

– At a higher level, we are concerned with the fact that we,<br />

through our deliveries, contribute to ensuring the requirement <strong>for</strong><br />

efficiency through the greatest possible use of automated systems,<br />

and that environmental considerations are safeguarded through the<br />

use of electricity as a principal energy source, says Svensson.<br />

He maintains that the division to a higher degree wishes to be<br />

seen as a system supplier rather than a product supplier. – We will<br />

focus intensely on developing and strengthening our position as<br />

supplier of systems <strong>for</strong> cargo handling in container terminals.<br />

The division bases itself on the fact that the increase in world<br />

trade over time will compel new and automated solutions <strong>for</strong> cargo<br />

handling in ports. – In this perspective, our challenge is to maintain<br />

and develop our expertise through participation in specific projects.<br />

Hence, we must continue to focus on product development and<br />

sales, emphasises Lennart Svensson.<br />

27

3-15 <strong>TTS</strong> GROUP<br />

16-33 bUSinESS AREAS<br />

35-43 CORPORATE GOVERNANCE<br />

45-116 DIRECTOR’S REPORT AND ACCOUNTS<br />

118-123 ORGANISATION<br />

New phase in our Chinese venture<br />

<strong>TTS</strong> has a long tradition of collaboration and operations in China. Presently, we are about to<br />

initiate a new phase in our Chinese venture. We hope that it will be as eventful and promising<br />

as the cooperation on development and production of maritime equipment.<br />

Last autumn, <strong>TTS</strong> entered into an agreement with the<br />

Chinese shipbuilding group Dalian Shipbuilding Industry<br />

Corporation (DSIC) regarding strategic cooperation on<br />

delivery of drilling equipment to the rig market. When DSIC enters<br />

into new contracts, <strong>TTS</strong> will contribute with expertise in design,<br />

marketing and delivery of drilling packages through its Energy<br />

division.<br />

28<br />

– Chinese shipyards aim to become leading suppliers to the<br />

offshore industry and this agreement offers <strong>TTS</strong> a great oppor tunity<br />

to strengthen our position in this market, says Johannes D.<br />

Neteland, President and CEO of the <strong>TTS</strong> <strong>Group</strong>.<br />

Two-dimensional cooperation<br />

Cooperation in China within the field of energy has two dimen sions.<br />

With respect to DSIC, the agreements entails that <strong>TTS</strong> is to be DSIC’s<br />

preferred partner and supplier of drilling equipment when ever<br />

the shipbuilding group takes on assignments <strong>for</strong> customers in the<br />

rig market. With regard to <strong>TTS</strong> Bohai Machinery, the cooperation<br />

means that the joint venture company establishes a separate<br />

offshore organisation <strong>for</strong> production of drilling equipment and<br />

offshore cranes to sell these to Chinese yards.<br />

Making the most of each others advantages<br />

<strong>TTS</strong> Bohai Machinery is well established in Dalian, with 83 employees<br />

and operations within engineering, production and sale of marine<br />

cranes to shipyards in China. Within this niche, the company has<br />

taken a market share of just under 25 percent. Now that <strong>TTS</strong> Bohai<br />

Machinery is entering the rig market, the company will enter into<br />

agreements with subcontractors regarding the construction of<br />

drilling equipment, and will handle its own production and assembly.<br />

A steering committee with representatives from <strong>TTS</strong> Energy and<br />

<strong>TTS</strong> Bohai Machinery shall be responsible <strong>for</strong> further developing<br />

this cooperation.<br />

– The basis <strong>for</strong> this cooperation is that <strong>TTS</strong> Energy in Norway<br />

develops products and solutions, while production and assembly<br />

takes place in China. Thus, the parties competitive advantages are<br />

utilised <strong>for</strong> our common good, says Inge Gabrielsen, Director of<br />

<strong>TTS</strong>’ Energy division.<br />

<strong>TTS</strong> Bohai Machinery already supplies cranes to the offshore<br />

market, and further plans to offer winches and other lifting equip-<br />

ment to AHTS vessels and subsea vessels. Adding drilling equipment<br />

to the productrange will strengthen the company’s profile as offshore<br />

supplier.<br />

conducive to quality control<br />

DSIC has set aside large areas <strong>for</strong> use as premises and facilities <strong>for</strong><br />

the production of equipment to this market. The Energy division<br />

will be represented by two-three engineers to ensure quality control<br />

and documentation in connection with the establishment of an<br />

organisation and the construction of premises. The Chinese must<br />

follow international standards of quality, and our main task is to<br />

continuously revise developments and projects according to these<br />

standards.<br />

DSIC has already constructed 11 jack-up rigs and has contracts<br />

<strong>for</strong> the delivery of six more rigs. Four of these will be delivered to<br />

Prospector Offshore Drilling in the fourth quarter of 2012 and in<br />

2013, with advanced drilling equipment packages from <strong>TTS</strong> Energy.<br />

Taking a firm position<br />

– These contracts entail the recognition that <strong>TTS</strong> as a supplier is<br />

considered equal to the two major players in the industry and to other<br />

makers of drilling equipment. Provided that we maintain our competitive<br />

edge with regard to price and quality, this cooperation<br />

provides us plenty of opportunity to build up a portfolio that will<br />

make <strong>TTS</strong> the third alternative in this segment, emphasises Gabrielsen.<br />

He points out that <strong>TTS</strong>’ history as a supplier of complete drilling<br />

packages is short. The initial contract <strong>for</strong> such a delivery was<br />

entered into with Jurong Shipyard in Singapore in June 2007.<br />

– It has been an demanding journey, however, we are about to<br />

take up a position which in both technical terms and business terms<br />

entails great opportunities.<br />

Strengthening our service function<br />

Gabrielsen maintains that by building a portfolio of rigs with <strong>TTS</strong><br />

drilling equipment, one opens a market <strong>for</strong> service and after sales<br />

support. – In order to service rigs operating in Asian waters, we are<br />

currently establishing a service hub consisting of our employees in<br />

Singapore and our new representative in Shanghai. There are further<br />

plans of a service station in Dubai. Thus, <strong>TTS</strong> will be seen to have a<br />

competitive edge as regards both expertise and availability.

DSic has already constructed 11 jack-up rigs and has contracts <strong>for</strong><br />

the delivery of six more rigs. Four of these will be delivered to<br />

Prospector Offshore Drilling in the fourth quarter of 2012 and in<br />

2013, with advanced drilling equipment packages from <strong>TTS</strong> Energy.<br />

29

3-15 <strong>TTS</strong> GROUP<br />

16-33 bUSinESS AREAS<br />

35-43 CORPORATE GOVERNANCE<br />

45-116 DIRECTOR’S REPORT AND ACCOUNTS<br />

118-123 ORGANISATION<br />

Progress to continue<br />

with “Momentum”<br />

The Marine division is enjoying helthy growth. However, no matter how good something<br />

is it can always be improved. Hence, internal processes and routines are under critical<br />

scrutiny in order to improve <strong>TTS</strong>’ competitive edge and profitability. As a project,<br />

“Momentum” will contribute to our continued improvement.<br />

” Momentum” is the name of a project to cover three<br />

business-critical areas; work processes, product<br />

development and strategic purchasing. The Business<br />

Process Reengineering Project deals with professionalising the<br />

way in which work is per<strong>for</strong>med, in order to make our organi sation<br />

more efficient and increase productivity.<br />

improved work processes<br />

The most important parameters of any enterprise are its human<br />

capital and the business processes. We have technically skilled<br />

employees in the Marine division, yet we know that the organisation<br />

of and execution of projects can be carried out in a more<br />

efficient manner. As an example, we should have systems <strong>for</strong><br />

a common database, enabling engineers in various countries to<br />

work on the same project more ef<strong>for</strong>tlessly. The same applies<br />

to the way in which we present our tenders. It is essential that<br />

we set certain standards and are disciplined in applying these,<br />

says Ivar K. Hanson, Director and head of the Marine division.<br />

Our approach to these challenges has been to bring out<br />

examples of best practise in our organisation, and <strong>for</strong>m strategies<br />

<strong>for</strong> putting this practice into effect throughout the rest of<br />

the organisation.<br />

– We have identified best practice in the Marine division at<br />

the business unit Cargo Access in Gothenburg, and we have<br />

agreed to define and introduce these processes as work procedures<br />

<strong>for</strong> the entire division in the present year. Parallel to this,<br />

we are introducing the Balanced Scorecard to measure key<br />

per<strong>for</strong>mance indicators, continues Hanson.<br />

Offering improved products<br />

The main aim of the product development project is to further<br />

develop and optimise the product portfolio <strong>for</strong> cargo cranes, deck<br />

machinery and hatch covers.<br />

– During the spring of 2011, we will have in place a product<br />

30<br />

portfolio in these areas that will improve our competitive edge<br />

significantly. Product development is also about improving the<br />

purchasing of components.<br />

– Removing two out of three suppliers leaves us with a choice<br />

of suppliers that will reduce the overall cost in the supply chain.<br />

By grouping our purchases in component families, it is easier<br />

to obtain favourable prices, the director of the Marine division<br />

points out.<br />

Trimming suppliers<br />

The project <strong>for</strong> strategic purchasing involves both the standardisation<br />

of technical components in products and the improvement<br />

of processes by purchasing such components. The project group<br />

is assisted by external consultants.<br />

– In the course of 2011, we will arrive at cross-divisional<br />

standard solutions involving a reduction in the number of com-<br />

ponent and choice of supplier. In principle, our purchases shall<br />

be made as close to the customer as possible, as long as this<br />

does not compromise our high standard of quality. At the same<br />

time, purchases shall be improved through routines that group<br />

volumes at the lowest possible prices.<br />

Ivar K. Hanson emphasises that all units in the division are<br />

taking part in “Momentum”, including the joint ventures in<br />

China. These companies are, to an increasingly greater degree,<br />

becoming integrated in operations and development.<br />

– The “Momentum” project will enable us to guard market<br />

shares and provide the foundation <strong>for</strong> even better earnings once<br />

the market starts to gain momentum, concludes the divisional<br />

director.

Ahc kran under testing på<br />

<strong>TTS</strong> Marine Shanghai<br />

PHOTO: HELGE SKODVIN<br />

The business Process Reengineering Project deals<br />

with professionalising the way in which work is<br />

per<strong>for</strong>med, in order to make our organi sation more<br />

efficient and increase productivity<br />

31

3-15 <strong>TTS</strong> GROUP<br />

16-33 bUSinESS AREAS<br />

35-43 CORPORATE GOVERNANCE<br />

45-116 DIRECTOR’S REPORT AND ACCOUNTS<br />

118-123 ORGANISATION<br />

Extensive upgrading of port<br />

using <strong>TTS</strong> equipment<br />

Through its Port and Logistics division, <strong>TTS</strong> is involved in a large-scale modernisation<br />

of port facilities in a number of ports in Northern Europe. Stena Line’s new Superferries<br />

underlines the demand <strong>for</strong> more efficient and com<strong>for</strong>table flow of traffic.<br />

in recent years, Stena Line has invested large sums in new<br />

ships <strong>for</strong> the ferry service in the Baltic Sea and the North Sea.<br />

The shipping company has built two Superferries; Hollandica<br />

and Britannica, which at 240 meters in length are the largest<br />

Superferries in the world able to carry both passengers and freight.<br />

The investments have been based on a clear strategy <strong>for</strong> efficient<br />

cargo handling and expansion of Stena Line’s ferry terminals in<br />

Harwich and Hoek van Holland. Furthermore, substantial upgrades<br />

have been completed in the port facilities that Stena Line makes<br />

use of in Loch Ryan in Scotland, in Belfast, Gothenburg, Karlskrona,<br />

Gdynia and Kiel.<br />

– Stena Line has chosen <strong>TTS</strong> as business partner <strong>for</strong> these<br />

assignments, based on our expertise and experience with similar<br />

projects. We have been responsible <strong>for</strong> conducting exploratory<br />

analysis and concept development in each individual case, says<br />

Lennart Svensson, Director of the Port and Logistics division. The<br />

final deliveries <strong>for</strong> Stena Line were completed last autumn.<br />

improving traffic flow<br />

<strong>TTS</strong> has delivered double-tier linkspans, which are bridges linking<br />

ship and shore, with two transport corridors in and out of the<br />

vessel from the upper and lower deck. This ensures an optimum<br />

flow of traffic in and out of the ferries. Installations have been<br />

carried out with minimal disruption to the regular ferry schedule.<br />

32<br />

– Our transport of goods and passengers has continued without<br />

delays. The installations and the work executed on the quayside<br />

were carried out in a very satisfactory manner, says Pim de Lange,<br />

Area Director in Stena Line.<br />

Automatic mooring system<br />

Furthermore, <strong>TTS</strong> has delivered a new automatic mooring system<br />

and passenger gangway to Stena Line’s ferry terminal in Gothenburg.<br />