4600000 Shares Apple Computer, Inc. - The SWTPC Computer ...

4600000 Shares Apple Computer, Inc. - The SWTPC Computer ...

4600000 Shares Apple Computer, Inc. - The SWTPC Computer ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

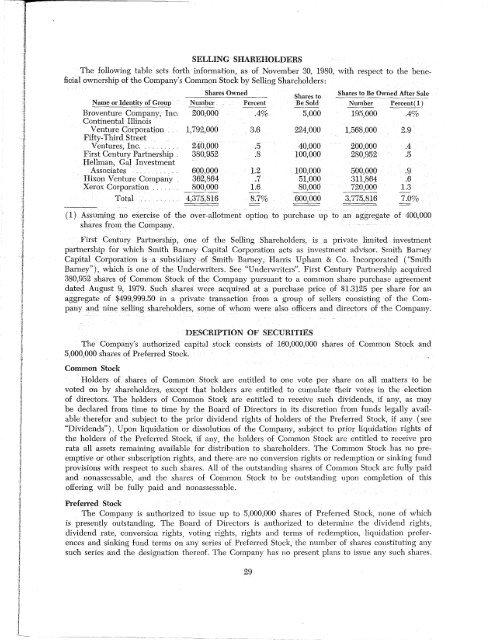

SELLING SHAREHOLDERS<strong>The</strong> following table sets forth information, as of November 30, 1980, with respect to the beneficialownership of the Company's Common Stock by Selling Shareholders:<strong>Shares</strong> Owned<strong>Shares</strong> to<strong>Shares</strong> to Be Owned After SaleName or Identity of Group Number Percent Be Sold Number Percent( I)Broventure Company,- <strong>Inc</strong>. 200;000Continental Illinois.4% 5,000 19.'5,000 .4%Venture Corporation 1,792,000Fifty-Third Street3.6 224,000 1,568,000 2.9Ventures, <strong>Inc</strong>. . ... 240,000 .5 40,000 200,000 .4First Century Partnership . 380,952 .8 100,000 280,952 .5Hellman, Gal InvestmentAssociates · 600,000 1.2 100,000 500,000 .9Hixon Venture Company 362,864 .7 51,000 311,864 .6Xerox Corporation .. 800,000 1.6 80,000 720,000 1.3Total 4,375,816 8.7% 600,000---~-3,775,816 7.0%(1) Assuming no exercise of the over-allotment option to purchase up to an aggregate of 400,000shares from the Company.First Century Partnership, one of the Selling Shareholders, is a private limited investmentpartnership for which Smith Barney Capital Corporation acts as investment advisor. Smith BarneyCapital Corporation is a subsidimy of Smith Barney, Ranis Upham & Co. <strong>Inc</strong>orporated ("SmithBarney"), which is one of the Underwriters. See "Underwriters". First Century Partnership acquired380,952 shm,es of Common Stock of the Company pursuant to a common shm·e purchase agreementdated August 9, 1979. Such shares were acquired at a purchase price of $1.3125 per share for anaggregate of $499,999.50 in a private transaction from a group of sellers consisting of the Companyand nine selling shareholders, some of whom were also officers and directors of the Company.DESCRIPTION OF SECURITIES<strong>The</strong> Company's authorized capital stock consists of 160,000,000 shares of Common Stock and5,000,000 shares of Preferred Stock.Common StockHolders of shares of Common Stock are entitled to one vote per share on all matters to bevoted on by shareholders, except that holders are entitled to cumulate their votes in the electionof directors. <strong>The</strong> holders of Common Stock are entitled to receive such dividends, if any, as maybe declared from time to time by the Board of Directors in its discretion from funds legally availabletherefor and subject to the prior dividend rights of holders of the Preferred Stock, if any (see"Dividends"). Upon liquidation or dissolution of the Company, subject to prior liquidation rights ofthe holders of the Preferred Stock, if any, the holders of Common Stock are entitled to receive prorata all assets remaining available for distribution to shareholders. <strong>The</strong> Common Stock has no preemptiveor other subscription rights, and there are no conversion rights or redemption or sinking fundprovisions with respect to such shares. All of the outstanding shares of Common Stock are fully paidand nonassessable, and the shares of Common Stock to be outstanding upon completion of thisoffering will be fully paid and nonassessable.Preferred Stock<strong>The</strong> Company is authorized to issue up to 5,000,000 shares of Preferred Stock, none of whichis presently outstanding. <strong>The</strong> Board of Directors is authorized to determine the dividend rights,dividend rate, conversion rights, voting rights, rights and terms of redemption, liquidation preferencesand sinking fund terms on any series of Preferred Stock, the number of shares constituting anysuch series and the designation thereof. <strong>The</strong> Company has no present plans to issue any such shares.29