Real Options "in" Projects and Systems Design ... - Title Page - MIT

Real Options "in" Projects and Systems Design ... - Title Page - MIT

Real Options "in" Projects and Systems Design ... - Title Page - MIT

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

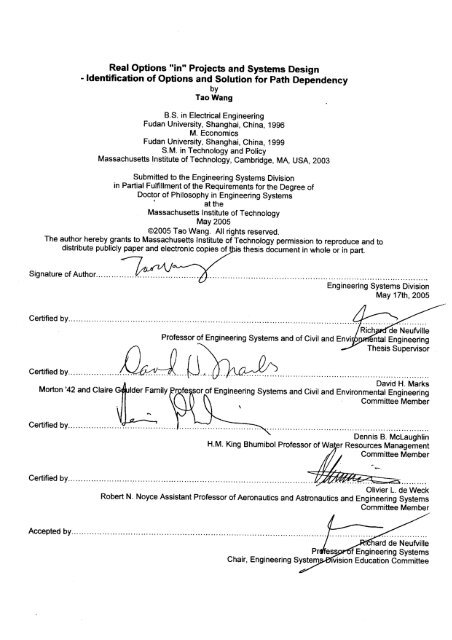

<strong>Real</strong> <strong>Options</strong> "in" <strong>Projects</strong> <strong>and</strong> <strong>Systems</strong> <strong>Design</strong>- Identification of <strong>Options</strong> <strong>and</strong> Solution for Path DependencybyTao WangB.S. in Electrical EngineeringFudan University, Shanghai, China, 1996M. EconomicsFudan University, Shanghai, China, 1999S.M. in Technology <strong>and</strong> PolicyMassachusetts Institute of Technology, Cambridge, MA, USA, 2003Submitted to the Engineering <strong>Systems</strong> Divisionin Partial Fulfillment of the Requirements for the Degree ofDoctor of Philosophy in Engineering <strong>Systems</strong>at theMassachusetts Institute of TechnologyMay 2005©2005 Tao Wang. All rights reserved.The author hereby grants to Massachusetts Institute of Technology permission to reproduce <strong>and</strong> todistribute publicly paper <strong>and</strong> electronic copies of this thesis document in whole or in part.Signature of Author…………………………………………………………………………………………………….…………..Engineering <strong>Systems</strong> DivisionMay 17th, 2005Certified by………………………………………………………………………………………………………………………….Richard de NeufvilleProfessor of Engineering <strong>Systems</strong> <strong>and</strong> of Civil <strong>and</strong> Environmental EngineeringThesis SupervisorCertified by…………………………………………………………………………………………………………………………..David H. MarksMorton '42 <strong>and</strong> Claire Goulder Family Professor of Engineering <strong>Systems</strong> <strong>and</strong> Civil <strong>and</strong> Environmental EngineeringCommittee MemberCertified by…………………………………………………………………………………………………………………………..Dennis B. McLaughlinH.M. King Bhumibol Professor of Water Resources ManagementCommittee MemberCertified by…………………………………………………………………………………………………………………………..Gordon M. KaufmanMorris A. Adelman Professor of ManagementCommittee MemberCertified by………………………………………………………………………………………………………………………….Olivier L. de WeckRobert N. Noyce Assistant Professor of Aeronautics <strong>and</strong> Astronautics <strong>and</strong> Engineering <strong>Systems</strong>Committee MemberAccepted by…………………………………………………………………………………………………………………………Richard de NeufvilleProfessor of Engineering <strong>Systems</strong>Chair, Engineering <strong>Systems</strong> Division Education Committee

3<strong>Real</strong> <strong>Options</strong> "in" <strong>Projects</strong> <strong>and</strong> <strong>Systems</strong> <strong>Design</strong>- Identification of <strong>Options</strong> <strong>and</strong> Solution for Path DependencybyTao WangSubmitted to the Engineering <strong>Systems</strong> DivisionOn May 17th, 2005 in Partial Fulfillment of theRequirements for theDegree of Doctor of Philosophyin Engineering <strong>Systems</strong>AbstractThis research develops a comprehensive approach to identify <strong>and</strong> deal with real options “in”projects, that is, those real options (flexibility) that are integral parts of the technical design. Itrepresents a first attempt to specify analytically the design parameters that provide goodopportunities for flexibility for any specific engineering system.It proposes a two-stage integrated process: options identification followed by options analysis.<strong>Options</strong> identification includes a screening <strong>and</strong> a simulation model. <strong>Options</strong> analysis develops astochastic mixed-integer programming model to value options. This approach decreases thecomplexity <strong>and</strong> size of the models at each stage <strong>and</strong> thus permits efficient computation eventhough traditionally fixed design parameters are allowed to vary stochastically.The options identification stage discovers the design elements most likely to provide worthwhileflexibility. As there are often too many possible options for systems designers to consider, theyneed a way to identify the most valuable options for further consideration, that is, a screeningmodel. This is a simplified, conceptual, low-fidelity model for the system that conceptualizes itsmost important issues. As it can be easily run many times, it is used to test extensively designsunder dynamic conditions for robustness <strong>and</strong> reliability; <strong>and</strong> to validate <strong>and</strong> improve the details ofthe preliminary design <strong>and</strong> set of possible options.The options valuation stage uses stochastic mixed integer programming to analyze howpreliminary designs identified by the options identification stage should evolve over time asuncertainties get resolved. Complex interdependencies among options are specified in theconstraints. This formulation enables designers to analyze complex <strong>and</strong> problem-specificinterdependencies that have been beyond the reach of st<strong>and</strong>ard tools for options analysis, todevelop explicit plans for the execution of projects according to the contingencies that arise.The framework developed is generally applicable to engineering systems. The dissertationexplores two cases in river basin development <strong>and</strong> satellite communications. The frameworksuccessfully attacks these cases, <strong>and</strong> shows significant value of real options “in” projects, in theform of increased expected net benefit <strong>and</strong>/or lowered downside risk.Thesis Advisor: Dr. Richard de Neufville<strong>Title</strong>: Professor of Engineering <strong>Systems</strong> <strong>and</strong> of Civil <strong>and</strong> Environmental Engineering<strong>MIT</strong> Engineering <strong>Systems</strong> Division

4Committee Member: Dr. David H. Marks<strong>Title</strong>: Morton '42 <strong>and</strong> Claire Goulder Family Professor of Engineering <strong>Systems</strong> <strong>and</strong> Civil <strong>and</strong> EnvironmentalEngineeringDirector, <strong>MIT</strong> Laboratory for Energy <strong>and</strong> the EnvironmentCommittee Member: Dr. Dennis B. McLaughlinH.M. King Bhumibol Professor of Water Resources Management<strong>MIT</strong> Department of Civil <strong>and</strong> Environmental EngineeringCommittee Member: Dr. Olivier L. de WeckRobert N. Noyce Assistant Professor of Aeronautics <strong>and</strong> Astronautics <strong>and</strong> Engineering <strong>Systems</strong><strong>MIT</strong> Department of Aeronautics <strong>and</strong> Astronautics, <strong>MIT</strong> Engineering <strong>Systems</strong> Division

5AcknowledgementsMy deepest thanks to Professor de Neufville for his guidance <strong>and</strong> help. He leads me tothe cutting edge of the research of real options “in” projects <strong>and</strong> gives me critical advice.Besides helping me embark on the promising area of real options, he gives me a lot ofimportant intangible assets, such as rigor <strong>and</strong> strictness. I significantly improved my rigorin research during the course of my doctoral study, not only knowing the importance to doevery small things right at the first time, but also raising the habit to do it – a harder part.With no doubt, this quality will benefit all my life!My special thinks to Professor Marks, Professor McLaughlin, <strong>and</strong> Professor de Weck whosit on my committee <strong>and</strong> gave me critical feedback <strong>and</strong> comments on the research,especially Professor de Weck who spent tremendous amount of effort to read <strong>and</strong>comment on every lines of this thick thesis.My heartful thanks to my friends. They help me gather important information, teach memany real world practice <strong>and</strong> knowledge, <strong>and</strong> relax me during the strenuous work. I donot know how I can fully thank all the friends <strong>and</strong> reward them.My sincere thanks to my family. My parents have supported me unwaveringly during mystudy in the US. As the only child of the family <strong>and</strong> when my mother was sick, all theirunderst<strong>and</strong>ing <strong>and</strong> encouragement helped me overcome various difficulties. My successin obtaining an <strong>MIT</strong> PhD degree will be an honor to my family, <strong>and</strong> the happiest personsin the world should be my parents. I hope to deliver this fruit to my parents to thank themfor all their nurture <strong>and</strong> care!

6Table of Contents:Acknowledgements _________________________________________________________ 5Table of Contents: __________________________________________________________ 6List of Figures: ____________________________________________________________ 11List of Tables: ____________________________________________________________ 13Notations:________________________________________________________________ 15Chapter 1 Introduction _________________________________________________________ 191.1. The problem ___________________________________________________________ 201.2. Research opportunity ____________________________________________________ 211.3. Theme <strong>and</strong> Structure of the Dissertation ____________________________________ 27Chapter 2 Literature Review_____________________________________________________ 292.1. Engineering <strong>Systems</strong> <strong>and</strong> uncertainties _____________________________________ 292.2. Water Resource Planning_________________________________________________ 322.2.1. Historical development ________________________________________________ 332.2.2. Other important references______________________________________________ 382.3. Mathematical Programming ______________________________________________ 392.4. <strong>Options</strong> Theory _________________________________________________________ 442.4.1. Development of real options method ______________________________________ 442.4.2. Application of real options______________________________________________ 472.4.3. <strong>Real</strong> <strong>Options</strong> “in” <strong>and</strong> “on” projects ______________________________________ 562.5. Conclusions from the literature search______________________________________ 58Chapter 3 St<strong>and</strong>ard <strong>Options</strong> Theory ______________________________________________ 603.1. Financial <strong>Options</strong> _______________________________________________________ 603.2. Cornerstones for <strong>Options</strong> Valuation ________________________________________ 62

73.2.1. No Arbitrage_________________________________________________________ 623.2.2. Brownian motion <strong>and</strong> Wiener Processes ___________________________________ 653.3. <strong>Options</strong> Valuation Tools__________________________________________________ 713.3.1. The Black-Scholes Model ______________________________________________ 723.3.2. Valuation by Simulation _______________________________________________ 763.3.3. Binomial <strong>Real</strong> <strong>Options</strong> Valuation ________________________________________ 783.3.4. <strong>Options</strong> Valuation <strong>and</strong> Decision Tree Analysis ______________________________ 813.4. Risk-neutral Valuation ___________________________________________________ 863.5. Exotic options __________________________________________________________ 873.5.1. Types of exotic options ________________________________________________ 873.5.2. Some valuation techniques of exotic options relevant to the dissertation __________ 91Chapter 4 <strong>Real</strong> <strong>Options</strong>_________________________________________________________ 954.1. Definition of <strong>Real</strong> <strong>Options</strong> ________________________________________________ 964.2. <strong>Real</strong> <strong>Options</strong> “on” <strong>Projects</strong> _______________________________________________ 974.2.1. What are <strong>Real</strong> <strong>Options</strong> “on” projects? _____________________________________ 974.2.2. Comparison of <strong>Real</strong> options “on” projects Method <strong>and</strong> Traditional NPV Method ___ 994.2.3. Types of <strong>Real</strong> options “on” projects _____________________________________ 1024.2.4. Framework of <strong>Real</strong> options “on” projects Valuation _________________________ 1034.2.5. <strong>Real</strong> options “on” projects versus Financial <strong>Options</strong>_________________________ 1054.3. <strong>Real</strong> <strong>Options</strong> ”in” <strong>Projects</strong>_______________________________________________ 1064.3.1. What are real options “in” projects? _____________________________________ 1064.3.2. Comparison of real options “on” <strong>and</strong> “in” projects __________________________ 1104.3.3. Difficulties facing the analysis of real options “in” projects – <strong>Options</strong> Identification <strong>and</strong>Path-dependency _________________________________________________________ 1114.3.4. A Case Example on analysis of <strong>Real</strong> <strong>Options</strong> “in” <strong>Projects</strong> – Parking Garage _____ 1134.4. Possible valuation techniques for real options _______________________________ 1204.4.1. Black-Scholes Formula _______________________________________________ 1214.4.2. Simulation _________________________________________________________ 124

84.4.3. Binomial Tree_______________________________________________________ 1254.5. Some Implications of <strong>Real</strong> <strong>Options</strong> Method _________________________________ 1274.5.1. Investment with <strong>Options</strong> Thinking_______________________________________ 1274.5.2. Value of <strong>Real</strong> options Method in Different Situations________________________ 1284.6. Attack <strong>and</strong> defense of real options method__________________________________ 1294.6.1. Arbitrage-enforced pricing <strong>and</strong> real options _______________________________ 1304.6.2. What is the definition of real options? ____________________________________ 1314.6.3. <strong>Options</strong> define flexibility ______________________________________________ 132Chapter 5 Valuation of <strong>Real</strong> <strong>Options</strong> “in” <strong>Projects</strong> _________________________________ 1355.1. Analysis framework ____________________________________________________ 1365.2. <strong>Options</strong> identification ___________________________________________________ 1375.2.1. Screening model_____________________________________________________ 1385.2.2. Simulation model ____________________________________________________ 1405.3. <strong>Options</strong> analysis _______________________________________________________ 1415.3.1. Using integer programming to solve a binomial tree_________________________ 1425.3.2. Stochastic mixed-integer programming <strong>and</strong> real options constraints_____________ 1475.3.3. Formulation for the real options timing model _____________________________ 1525.4. A case example on satellite communications system __________________________ 1555.4.1. Market dem<strong>and</strong> uncertainty ____________________________________________ 1565.4.2. Formulation of the problem ____________________________________________ 1575.4.3. Parameters _________________________________________________________ 1595.4.4. The results _________________________________________________________ 1595.4.5. Discussion _________________________________________________________ 162Chapter 6 Case example: River Basin Development _________________________________ 1646.1. Case introduction ______________________________________________________ 1646.2. <strong>Options</strong> identification ___________________________________________________ 1696.2.1. Screening model_____________________________________________________ 1696.2.2. Simulation model ____________________________________________________ 189

96.3. <strong>Options</strong> analysis _______________________________________________________ 2036.3.1. Traditional sequencing model __________________________________________ 2036.3.2. <strong>Real</strong> options timing model _____________________________________________ 2166.3.3. <strong>Options</strong> analysis results _______________________________________________ 2256.3.4. Extension of real options timing model to consider multiple designs at a site _____ 228Chapter 7 Policy Implications – <strong>Options</strong> in Practice_________________________________ 2337.1. Flexibility vs. Economies of Scale _________________________________________ 2347.2. Making <strong>Real</strong> Impact of the <strong>Options</strong> Thinking _______________________________ 2367.2.1. Intrinsic Difficulties in Promoting <strong>Real</strong> <strong>Options</strong> methodology _________________ 2377.2.2. Organizational Wisdom to Advocate New Thinking_________________________ 2397.3. Uncertain <strong>Real</strong>ity <strong>and</strong> Appropriate Method ________________________________ 241Chapter 8 Summary <strong>and</strong> Conclusion_____________________________________________ 2458.1. Background ___________________________________________________________ 2458.2. <strong>Real</strong> options “in” projects _______________________________________________ 2478.3. Analysis framework for real options “in” projects ___________________________ 2518.3.1. <strong>Options</strong> identification_________________________________________________ 2538.3.2. <strong>Options</strong> analysis _____________________________________________________ 2558.4. Application of the framework – illustrated by development of strategies for a series ofhydropower dams__________________________________________________________ 2648.4.1. Screening model to identify options______________________________________ 2648.4.2. Simulation model to test other considerations ______________________________ 2708.4.3. <strong>Real</strong> options timing model to analyze real options “in” projects ________________ 2728.5. Generalizability of framework____________________________________________ 2768.6. Discussion ____________________________________________________________ 2808.6.1. Computational issue__________________________________________________ 2808.6.2. Insights for different audiences _________________________________________ 2828.6.3. Further work________________________________________________________ 286

108.7. Contributions <strong>and</strong> Conclusion: ___________________________________________ 287References __________________________________________________________________ 289Appendices _________________________________________________________________ 299Appendix 3A: Ito’s Lemma__________________________________________________ 299Appendix 5A: GAMS code for American Call <strong>Options</strong> ___________________________ 300Appendix 5B: GAMS Code for American Put <strong>Options</strong> ___________________________ 303Appendix 5C: GAMS Code for analysis of a satellite communications system ________ 306Appendix 6A: GAMS code for the screening model______________________________ 314Appendix 6B: GAMS code for the traditional sequencing model ___________________ 319Appendix 6C: GAMS code for the real options timing model______________________ 324Appendix 6D: GAMS code for real options timing model considering multiple designs 331

11List of Figures:Figure 1-1 Overall Picture of Research ____________________________________________ 21Figure 1-2 Development of <strong>Options</strong> Theory _________________________________________ 25Figure 1-3 Contribution <strong>and</strong> generalizability of the work_______________________________ 27Figure 1-4 Structure of dissertation _______________________________________________ 28Figure 2-1 Development of Engineering <strong>Systems</strong> _____________________________________ 30Figure 2-2 Three Dimensions of Engineering <strong>Systems</strong> Linked to Each Other <strong>and</strong> to Two HighImpact Aspects of All Such <strong>Systems</strong> [Source: <strong>MIT</strong> ESD Symposium Committee, 2002]________ 31Figure 2-3 2-D View of Evaluation Practices [Source: Richard de Neufeille’s class slides for <strong>MIT</strong>course ESD.71 developed in 2004] ________________________________________________ 51Figure 3-1 Payoff Diagram for a Stock Call Option ___________________________________ 61Figure 3-2 Stock Price Movement in Numerical Example ______________________________ 64Figure 3-3 One Path of Brownian Motion (∆t = 1)____________________________________ 67Figure 3-4 Two Hundred Paths of Brownian Motion __________________________________ 68Figure 3-5 Lognormal Density ___________________________________________________ 71Figure 3-6 Distribution of Stock Price for Valuation by Simulation_______________________ 77Figure 3-7 Distribution of Exercise of Option for Valuation by Simulation _________________ 77Figure 3-8 Stock <strong>and</strong> Option Price in a One-step Binomial Tree _________________________ 78Figure 3-9 A Two-Step Binomial Tree______________________________________________ 81Figure 3-10 Decision Tree for <strong>Options</strong> Valuation_____________________________________ 83Figure 4-1 Framework of <strong>Real</strong> options “on” projects Method__________________________ 104Figure 4-2 Development of <strong>Options</strong> Theory ________________________________________ 107Figure 4-3 Expected Net Present Value for <strong>Design</strong>s with Different Number of Levels________ 117Figure 4-4 Value at Risk for 6 level design recognizing dem<strong>and</strong> uncertainty, compared todeterministic estimate _________________________________________________________ 117Figure 4-5 Option to Exp<strong>and</strong> adds significant value <strong>and</strong> improves profile of VaR___________ 119Figure 4-6: Applicability of <strong>Real</strong> <strong>Options</strong> Method ___________________________________ 129Figure 4-7 Decision Tree Analysis _______________________________________________ 133Figure 5-1: Process for Analysis of <strong>Real</strong> <strong>Options</strong> “in” <strong>Projects</strong> ________________________ 137Figure 5-2: Node representation for a binomial tree _________________________________ 144

12Figure 5-3: Scenario tree ______________________________________________________ 148Figure 5-4: Breaking path-independence of a binomial tree ___________________________ 148Figure 5-5: Contingency development plan for satellite system _________________________ 161Figure 6-1 Schematic of the hypothetical river basin _________________________________ 165Figure 6-2: Project 2 Tunnel Parameters __________________________________________ 167Figure 6-3 Potential projects on the hypothetical river _______________________________ 173Figure 6-4 Reservoir cost curve for Project 1_______________________________________ 177Figure 6-5 Volume-head curve for Project 1________________________________________ 178Figure 6-6 Reservoir cost curve for Project 3_______________________________________ 179Figure 6-7 Volume-head curve for Project 3________________________________________ 180Figure 6-8 Tornado chart for screening model ______________________________________ 186Figure 6-9 River Basin as network of nodes ________________________________________ 190Figure 6-10 A realization path of electricity price ___________________________________ 195Figure 6-11 Operating rule _____________________________________________________ 197Figure 6-12a: Simulation result for electricity price = 0.22 RMB/KWH (case 5) ___________ 201Figure 6-13 Benefit in time periods_______________________________________________ 210Figure 6-14 Electricity price movement (with recombination) __________________________ 217Figure 6-15 Illustration of Nonanticipativity Constraints in the River Basin Case __________ 221Figure 6-16: Contingency plan __________________________________________________ 226Figure 6-17: Contingency plan (if current electricity price = 0.30 RMB/KWH) ____________ 229Figure 6-18 Contingency plan for current electricity price of 0.30 KWH/RMB _____________ 231Figure 8-1: Process for Analysis of <strong>Real</strong> <strong>Options</strong> “in” <strong>Projects</strong> ________________________ 252Figure 8-2 Binomial tree _______________________________________________________ 256Figure 8-3: Scenario tree ______________________________________________________ 258Figure 8-4: Breaking path-independence of a binomial tree ___________________________ 258Figure 8-5 Tornado chart for screening model ______________________________________ 268Figure 8-6: Contingency plan for current electricity price of 0.25 KWH/RMB _____________ 274Figure 8-7 Contingency plan for current electricity price of 0.30 KWH/RMB ______________ 276Figure 8-8 Example of a path in trade space [Source: de Weck et al. 2004] _______________ 277Figure 8-9: Contingency development plan for satellite system _________________________ 279

13List of Tables:Table 2-1: Different Valuation Approaches with Examples _____________________________ 51Table 3-1 Option Valuation by Decision Tree Results _________________________________ 85Table 4-1 Revenue Estimate for Technology Development _____________________________ 100Table 4-2 NPV Valuation of Technology Development________________________________ 100Table 4-3 Approximate <strong>Options</strong> Valuation of Technology Development __________________ 101Table 4-4 Types of <strong>Real</strong> options “on” projects ______________________________________ 102Table 4-5 Comparison between real options “on” <strong>and</strong> “in” projects ____________________ 111Table 4-6 Spreadsheet for <strong>Design</strong> with Deterministic Point Forecast of Dem<strong>and</strong> ___________ 116Table 4-7 Spreadsheet for <strong>Design</strong> with One Scenario of Dem<strong>and</strong> <strong>and</strong> Option to Exp<strong>and</strong> _____ 118Table 4-8 Comparison of 3 Steps of Analysis _______________________________________ 119Table 4-9 Performance Improvements achieved with Flexible <strong>Design</strong> ____________________ 120Table 5-1: Decision on each node of a binomial lattice _______________________________ 143Table 5-2: Binomial tree for the American call option ________________________________ 144Table 5-3: Result of the stochastic programming for the American call option _____________ 146Table 5-4: Stochastic programming result for the example American put _________________ 151Table 5-5: Binomial tree for the example American put _______________________________ 151Table 5-6 Evolution of dem<strong>and</strong> for satellite system___________________________________ 157Table 5-7 C<strong>and</strong>idate architecture design for satellite system ___________________________ 159Table 6-1: Project 1 <strong>Design</strong> Alternatives __________________________________________ 166Table 6-2: Stream flow for Project 1 ______________________________________________ 166Table 6-3: Project 3 <strong>Design</strong> Alternatives __________________________________________ 168Table 6-4: Project 3 Adding Capacity to Downstream Stations _________________________ 168Table 6-5: Stream flow for Project 3 ______________________________________________ 169Table 6-6: Site index “s”_______________________________________________________ 170Table 6-7: Season index “t” ____________________________________________________ 170Table 6-8 List of Variables for the screening model __________________________________ 182Table 6-9 List of Parameters for the screening model ________________________________ 183Table 6-10 Parameters for distribution of water flows (Adjusted for 60-years span)_________ 185Table 6-11: Results from the screening model ______________________________________ 188

14Table 6-12 Sources of options value for designs _____________________________________ 189Table 6-13 List of design variables _______________________________________________ 191Table 6-14 List of Variables for the simulation model ________________________________ 192Table 6-15 List of Parameters for the simulation model _______________________________ 193Table 6-16 Parameters for the distribution of water flows _____________________________ 194Table 6-17 Portfolio of options for water resources case ______________________________ 202Table 6-18 List of variables for the traditional sequencing model _______________________ 212Table 6-19 List of parameters for the traditional sequencing model _____________________ 213Table 6-20: Paths of electricity price movement _____________________________________ 218Table 6-21 List of variables for the real options timing model __________________________ 223Table 6-22 List of parameters for the real options timing model ________________________ 223Table 6-23: Results for real options “in” projects timing model (Current electricity price 0.25RMB/KWH) _________________________________________________________________ 226Table 6-24: Results for real options “in” projects timing model (Current electricity price taken tobe 0.30 RMB/KWH)___________________________________________________________ 229Table 6-25 Three sets of design for multiple height choice _____________________________ 230Table 6-26 Different water flow corresponding to different height_______________________ 231Table 7-1 Uncertain <strong>Real</strong>ity <strong>and</strong> Appropriate Method ________________________________ 243Table 8-1 Comparison between real options “on” <strong>and</strong> “in” projects ____________________ 250Table 8-2: Binomial tree for the example American put _______________________________ 261Table 8-3: Stochastic programming result for the example American put _________________ 261Table 8-4 Parameters for distribution of water flows (Adjusted for 60-years span)__________ 267Table 8-5: Results from the screening model _______________________________________ 270Table 8-6 Sources of options value for designs ______________________________________ 270Table 8-7 Portfolio of options for water resources case _______________________________ 272Table 8-8 Configurations set Y for the river basin case_______________________________ 273Table 8-9: Results for real options “in” projects timing model (Current electricity price 0.25RMB/KWH) _________________________________________________________________ 275

15Notations:Symbol Meaninga Factor for economies of scale for satellite systemAMAX sAMIN sA stA stybcCAPD sCAPP sCap scrfC sMaximum head at site sMinimum head at site sHead at site s for season tHead at site s for season t year yFactor for economies of scale for satellite systemValue of a call optionMaximum feasible storage capacity at site sUpper bound for power plant capacity at site sIncremental capacity a evolutionary architecture design s adds over theprevious designCapital recovery factorCost coefficient for satellite architecture design sc Part of flow at site s season t to be used in the construction period tostensure a full reservoir of the next periodc jdD AqD iEee pe sE stE styCost coefficients for design parametersDown factorSatellite antenna diameter in meterDem<strong>and</strong> for satellite system for stage i under scenario qEconomic coefficients on engineering systemsEconomic coefficients on engineering systemsPower factorPower plant efficiency at site sAverage flow entering site s for season tAverage flow entering site s for season t year y

16fFC s∆F sthiH sh tThe ratio of average yearly power production during the constructionperiod over the normal production level, or option priceFixed cost for reservoir at site sIncrement to flow between sites s <strong>and</strong> the next site for season tSatellite orbital altitude in KilometerStage indexCapacity of power plant at site sNumber of hours in a seasonISL The use of inter satellite links, a binary variable in 0 or 1.jkKk tlLCCmnpP(k)<strong>Design</strong> parameter indexNode indexThe exercise price of an optionNumber of seconds in a seasonNode indexDiscounted life circle costIn a binomial tree, the mth nodes of a stageConfiguration indexValue of a put option, or risk-neutral probabilityThe path from the root node 0 at the first stage to a node kqP Hydroelectric power produced at site s for season t for time period i foristscenario qp qP stP styP tThe probability for a scenario qHydroelectric power produced at site s for season tHydroelectric power produced at site s for season t year ySatellite transmit power in WattPVC i Factor to bring cost in the ith period back to year 0PV iFactor to bring 10-year annuity of benefit back to the present value asof year 0 (now)

17PVO i Factor to bring the annuity after the 3 10-year periods till the end of 60year life span of a projectq Scenario indexQQ in,trRMBqRqRijsSqSiS stS styttTT∆TT stuVC sV SXThe number of terminal nodesUpstream inflow for season tDiscount rate (in some cases, specifically risk free interest rate)China currency unitThe real options decision variables corresponding to scenario qThe decision on whether to build the feature according to jth designparameter for ith time stage in scenario qProject index (site index for water resource case <strong>and</strong> architecturedesign index for satellite system case)Stock priceValue of underlying asset at time stage i in scenario qStorage at site s for season tStorage at site s for season t year ySeason indexTechnical limits on engineering systemsTime to expirationTechnical coefficients on engineering systemsTime interval between two consecutive stagesTarget release at site s for season tUp factorVariable cost for reservoir at site sCapacity of reservoir at site s<strong>Design</strong> vector for satellite architectural design decisionsqX Average flow from site s for season t for time period i for scenario qistX stAverage flow from site s for season t

18X styyY jYYjAverage flow from site s for season t year yYear index for the simulation model<strong>Design</strong> parameterThe set of satisfactory configurations of design parameters<strong>Design</strong> parameter in most satisfactory designyr sYstzβ jβ PInteger variable indicating whether or not the reservoir is constructed atsite sPower factor at site s for season tConfiguration decision variable, only one configuration can be builtBenefit coefficients for design parametersHydropower benefit coefficientqβ Hydropower benefit coefficient for period i <strong>and</strong> scenario qPiδiδsqωqωiφεσthe set of nodes corresponding to time stage iVariable cost for power plant at site sA joint realization of the problem parametersThe uncertain parameters for time stage i in scenario q<strong>Real</strong> options constraintsSatellite minimum elevation angle in degreesVolatilityµ Drift rateΠOutcome, or value of portfolio

19Chapter 1 IntroductionForecasts are “always wrong”!? That is, comparisons made between forecasts <strong>and</strong> theactual realizations one or two decades later show wide discrepancies. Differences of afactor of two, up or down, are typical. Moreover, the dem<strong>and</strong> that does occur is frequentlysubstantially different from what was predicted. Only exceptionally do long-termforecasts actually hit the mark, or actual dem<strong>and</strong> exceeds expectations.- In 1991, the forecasts for the US terrestrial cellular phone market were consideredoptimistic. It expected up to 40 million subscribers by the year 2000 (Ciesluk etal., 1992). The st<strong>and</strong>ardization of terrestrial cellular networks resulted in over 110million subscribers in 2000, 275% of the projection.- In 1991, forecasts for the satellite cellular phone market are similar to that of theterrestrial cellular phone market. Initiatives like Iridium <strong>and</strong> Globalstar wereencouraged by the absence of common terrestrial cellular phone st<strong>and</strong>ards <strong>and</strong>slow development of cellular networks at that time. Iridium was designedaccording to the forecast of 3 million subscribers. It only aroused the interest of50K initial subscribers <strong>and</strong> filed for bankruptcy in August 1999. Globalstar wentbankrupt on February 2002.- “Heavier-than-air flying machines are impossible.” (Lord Kelvin, Britishmathematician, physicist, <strong>and</strong> President of the British Royal Society, c. 1895)- “A severe depression like that of 1920-1921 is outside of the range of possibility.”(Harvard Economic Society – Weekly Letter, November 16, 1929)As a general rule, we can expect that the actual long-term future will be different fromwhat was projected as the most likely scenario. <strong>Design</strong>ers must expect that theengineering system will have to serve any one of a range of possibilities, <strong>and</strong> manageuncertainties proactively.

201.1. The problemWith the recognition that design context is uncertain, how to manage uncertaintiesproactively? <strong>Design</strong>ing flexibility into engineering systems with real options! <strong>Real</strong> optionstheory is a formal way to define flexibility. It models flexibility like financial options <strong>and</strong>uses options theory to value flexibility quantitatively, <strong>and</strong> thus enable us to compare thevalue of flexibility with the cost of acquiring such flexibility to decide if we want to designthe flexibility into the systems.Since the options theory has not yet been extended to physical design as our literatureresearch suggests, several problems have to be solved before real options can beapplied in designing flexibility into physical systems. The most important two are:- Where is the flexibility? Unlike financial options that are well-defined legalcontracts, real options in physical systems need to be defined before analysis.The problem is not that real options “in” projects are impossible to find. Thedifficulty lies in that there are too many variables, <strong>and</strong> thus too many possible realoptions; however, less than a small fraction of the possible real options can beconsidered. The designers need to identify the “best” opportunities, the realoptions most likely to offer good flexibility in the uncertain environment.- How to value highly interdependent/path-dependent/complex options? In physicalsystems, we meet many kinds of technical dependency that are not present in thefinance world. Large-scale engineering systems feature a great number oftechnical constraints. These constraints will force real options “in” them topresent highly interdependent <strong>and</strong> path-dependent characteristics that are nottypical in financial options. For example, the water flow continuity specifies howthe power generation capacity of a downstream dam will change when anupstream dam is built. The st<strong>and</strong>ard financial options valuation techniques suchas Black-Scholes formula or binomial tree are impotent before such complex <strong>and</strong>

Financial<strong>Options</strong><strong>Real</strong> <strong>Options</strong>"on" <strong>Projects</strong>Financial<strong>Options</strong><strong>Real</strong> <strong>Options</strong> "in" <strong>Projects</strong><strong>Real</strong> <strong>Options</strong>"on" <strong>Projects</strong>Financial<strong>Options</strong>21special interdependent/path-dependent options. We need an innovative optionsvaluation approach to deal with technical interdependency/path-dependency.-1.2. Research opportunityThis work studies engineering design <strong>and</strong> real options from a unique perspective -engineering systems. Engineering <strong>Systems</strong> Division (ESD) is a new organization at <strong>MIT</strong>tackling the large-scale engineering challenges. The nature of ESD is interdisciplinary tostudy the common traits across a wide range of engineering, for example, aeronautics,astronautics, civil <strong>and</strong> environmental engineering, electrical <strong>and</strong> computer engineering,etc.This study integrates three threads of research – engineering systems with regard touncertainties, real options, <strong>and</strong> mathematical programming – to attack an area currentlyknown little by systems designers. The area is proactive management of uncertainties inengineering systems. See Figure 1-1.DeterministicDynamicPassive RecognitionProactive ManagementTrendTransportation systemsWater ResourcesPlanningSatellite systemsApplicationDomains ofEngineering<strong>Systems</strong>. . . . . .Available toolsMathematicalProgrammingSymstemsSimulationDynamics. . . . . .<strong>Options</strong>Theory. . . . . .<strong>Options</strong> TheoryDetails see Figure 1-2Figure 1-1 Overall Picture of Research

22The first thread - engineering systems with regard touncertaintiesThe third thread is the major trend that engineering systems design develops fromdeterministic to dynamic. See the horizontal arrow in Figure 1-1.By deterministic, we mean the design practice based on design parameters that are notsequences of probability functions at multiple points in time. A typical deterministicdesign practice forecasts expected values of uncertain parameters, <strong>and</strong> uses thoseexpected values as inputs for further analysis <strong>and</strong> design. Optimization with such designparameters often leads to economies of scale. To a first order, economies of scale arecommon in industries where cost largely depends on the envelope to the structure (aquantity expressed in terms of the square of the linear measure), <strong>and</strong> capacity dependson the volume (a quantity expressed in terms of the cube of the linear measure). In suchsituations, total cost grows approximately to the 2/3 power of capacity (de Neufville, 1990;Chenery, 1952).By dynamic, we mean the design practice taking into consideration the designparameters that are sequences of probability functions at multiple points in time. Forexample, in the design of a series of hydropower stations on a river, the dynamic natureof water flow is considered. The water flow follows a certain distribution <strong>and</strong> is taken as afamily of r<strong>and</strong>om variables indexed by time. Using the dynamic thinking of design,economies of scale resulted from deterministic design may disappear because of thepossibility of underutilization of the facility when the circumstances are unfavorable.Dynamic thinking has a more accurate underst<strong>and</strong>ing of reality than deterministic thinking,<strong>and</strong> thus provides better designs in a forever-changing world.In practice, dynamic thinking is sometimes only applied to the technical part of the design,while the economic or social perspectives are dealt with deterministically. For example,people may design a series of hydropower stations on a river with the underst<strong>and</strong>ing that

23water flow is stochastic, but take another important uncertain variable, price of electricity,as constant using the forecasted expected value. This kind of incomplete dynamicthinking prevails if designers are solely focused on the engineering side while losing sightof important economic <strong>and</strong> social uncertainties. The incomplete dynamic thinking withoutsufficient attention to both technical <strong>and</strong> social stochasiticity will render inadequate, if notmisleading, results.Moreover, in the reign of dynamic design, we are developing from passive recognition toproactive management of uncertainties. Passive recognition of uncertainty leads peopleto do something now to withst<strong>and</strong> the worst scenarios; proactive management ofuncertainty leads people to prepare to do something in the future to avoid downsiderisks <strong>and</strong> take advantage of upside potential. In some sense, traditional robustness is away of passive recognition of uncertainty 1 . Robustness is a property to withst<strong>and</strong>unfavorable situations without actively changing a system. Proactive management ofuncertainty, however, requires the design can be reinforced in a timely manner whenunfavorable things happen, not necessary to do everything now. The non-traditional partof proactive management of uncertainty is about taking advantage of upside potential.We can be opportunist to benefit from a better-than-expected situation! In short, passiverecognition of uncertainty misses the part of reality that people can take actions whenreality unfolds.Since engineering systems cover a broad range, the dissertation will study in-depth aspecific area of engineering systems – water resources systems – <strong>and</strong> develop a generalframework applicable to other systems, with a brief case example on satellitecommunications systems to show the generalizability of the framework.1 Here we do not intend to devalue the importance of robustness. In many cases, robustness is amust in design.

24The second thread – options theoryAfter the modern options theory was founded by Black, Scholes, <strong>and</strong> Merton (1973) 1 ,options theory <strong>and</strong> thinking has been gradually extended to broader areas in both finance<strong>and</strong> non-finance, from financial options to real options “on” projects to real options “in”projects. See the rightmost arrow in Figure 1-1. <strong>Options</strong> theory yields insights intouncertainty <strong>and</strong> flexibility that enhance the ability of human beings to deal with foreverchangingenvironment.A real option is a right, but not obligation, to do something for a certain cost within or at aspecific period of time. The valuation of real options provides important insights into thevalue of opportunity or flexibility. <strong>Real</strong> options are extension of financial options. Whilefinancial options are traded on exchanges <strong>and</strong> over-the-counter markets, real options arenot traded. <strong>Real</strong> options is more a methodology for valuing investments or designingflexibility.<strong>Real</strong> options can be categorized as those that are either “on” or “in” projects (de Neufville,2002). <strong>Real</strong> options “on” projects are financial options taken on technical things, treatingtechnology itself as a ‘black box’”. <strong>Real</strong> options “in” projects are options created bychanging the actual design of the technical system. For example, de Weck et al (2004)evaluated real options “in” satellite communications systems <strong>and</strong> determined that theiruse could increase the value of satellite communications systems by 25% or more.These options involve additional fuel for orbital maneuvering system (OMS) onboradsatellites in order to achieve a flexible design that can adjust capacity according to need.One dimension of the general development of options theory is depicted in Figure 1-2.With the development of the options theory (as the arrow represents passage of time),the scope of application (as represented by the area of bubbles) is exp<strong>and</strong>ing, fromfinancial options to real options “on” projects to real options “in” projects. <strong>Real</strong> options1 Their l<strong>and</strong>mark Black-Scholes model (1973) won the Nobel Prize in 1997

25“in” projects further exp<strong>and</strong> the options thinking into physical systems, adding flexibilityinto physical systems systematically with full awareness of uncertainties. With thesuccess of the options theory <strong>and</strong> its key insights into uncertainty, it has bright prospectsto improve engineering systems design in meeting customer dem<strong>and</strong>s <strong>and</strong> regulatoryrequirements as well as increasing its economical feasibility or profitability.In general, real options “in” systems require a deep underst<strong>and</strong>ing of technology.Because such knowledge is not readily available among current options analysts, therehave so far been few analyses of real options “in” projects, despite the importantopportunities available in this field. Moreover, the data available for real options “in”project analysis is of much poorer quality than that of financial options or real options “on”projects. <strong>Real</strong> options “in” projects are different <strong>and</strong> need an appropriate analysisframework - existing options theory has to adapt to the new needs of real options “in”projects.<strong>Real</strong> <strong>Options</strong> "in" <strong>Projects</strong><strong>Real</strong> <strong>Options</strong>"on" <strong>Projects</strong><strong>Real</strong> <strong>Options</strong>"on" <strong>Projects</strong>Financial<strong>Options</strong>Financial<strong>Options</strong>Financial<strong>Options</strong><strong>Options</strong> TheoryFigure 1-2 Development of <strong>Options</strong> Theory

26The third thread - mathematical programmingMathematical programming seeks to maximize or minimize a real or integer functiongiven certain constraints on the variables. Mathematical programming studiesmathematical properties of maximizing or minimizing problems, formulates real worldproblems using mathematical terms, develops <strong>and</strong> implements algorithms to solveproblems. Sometimes mathematical programming is mentioned as optimization oroperations research. Mathematical programming has many topics. Some of the majortopics are linear programming, non-linear programming, <strong>and</strong> dynamic programming.Mathematical programming has also developed from deterministic to dynamic, <strong>and</strong>stochastic versions of the topics have been developing.Mixed-integer programming is a useful tool for the purpose of options analysis. A 0-1binary variable can neatly represent the options decision regarding whether to excise anoption or not. Stochastic programming is the method for modeling optimization problemsthat involve uncertainty. The goal of the formulation is to find some policy that is feasiblefor the data instances <strong>and</strong> maximizes the expectation of some function of the decisions<strong>and</strong> the r<strong>and</strong>om variables. Combining stochastic programming <strong>and</strong> mixed-integerprogramming is a promising tool to model real options.The Intersection of the three threadsOverall, this study identifies a point where engineering systems design needs proactivemanagement of uncertainties, real options “in” projects need more development, <strong>and</strong>stochastic mixed-integer programming provides an appropriate tool for the study (seeFigure 1-1). The intersection of several areas is often fertile soil to integrate existingknowledge <strong>and</strong> generate innovative ideas inspired by the knowledge of distinctive areas.

27General applicability <strong>and</strong> case examplesAs shown in Figure 1-3, the contribution of the work would be providing a generalapproach that large-scale engineering systems can use for their specific systems todesign flexibility. Case examples will be drawn on two different large-scale engineeringsystems, namely, water resources systems <strong>and</strong> satellite communications systems,showing the generalizability of the approach as well as helping illustration of theapproach. The case examples also provide a foundation for water resources engineers<strong>and</strong> satellite systems engineers to add more details <strong>and</strong> serve for actual application. Thecore of the approach is a screening model to identify options <strong>and</strong> a mixed-integerprogramming real options timing model to analyze options.Analyiswith<strong>Options</strong>ThinkingGeneralMore DetailsEngineering <strong>Systems</strong>River Basin SatelliteDevelopment <strong>Systems</strong>"…"This workFigure 1-3 Contribution <strong>and</strong> generalizability of the work1.3. Theme <strong>and</strong> Structure of the DissertationThis dissertation proposes a two-stage options identification <strong>and</strong> analysis framework todesign flexibility (real options) into physical systems, with case examples on river basindevelopment <strong>and</strong> satellite communications systems.The structure of the dissertation is as in Figure 1-4: Chapter 2 reviews literature onengineering systems, water resources planning, mathematical programming, <strong>and</strong> optionstheory. Chapter 3 introduces st<strong>and</strong>ard options theory. Its focus is on the optionsvaluation models <strong>and</strong> their key assumptions. Chapter 4 introduces real options,

28especially the difference between real options “on” <strong>and</strong> “in” projects. Chapter 5 developsthe general two-stage framework for options identification <strong>and</strong> analysis in engineeringsystems. Chapter 6 presents a detailed case example on a river basin using the twostageframework. Chapter 7 develops some policy implications for the framework ondesigning flexibility into physical systems. Chapter 8 summarizes <strong>and</strong> concludes thedissertation.BackgroundChapter 2 Literature review- Engineering systems- Water resources planning- Mathematical Programming- <strong>Options</strong> theoryChapter 3 St<strong>and</strong>ard options theoryChapter 4 <strong>Real</strong> options- <strong>Real</strong> options "on" projects- <strong>Real</strong> options "in" projects- Valuation techniquesFramework <strong>and</strong> applicationChapter 5 Valuation of real options in engineering systems- Two-stage framework- <strong>Options</strong> identification- <strong>Options</strong> analysis- Satellite communications systems case exampleChapter 6 Case example: river basin developmentWrap-upChapter 7 Policy implicationsChapter 8 Summary <strong>and</strong> conclusionFigure 1-4 Structure of dissertation

29Chapter 2 Literature ReviewThis study integrates three threads of research – engineering systems with regard touncertainties, real options <strong>and</strong> mathematical programming – to attack an area currentlyknown little by systems designers. The area is proactive management of uncertainties insystems design. This chapter explores historical <strong>and</strong> intellectual developments in areasrelated to the study in this dissertation.2.1. Engineering <strong>Systems</strong> <strong>and</strong> uncertaintiesEngineering systems is a new discipline spawned by the development of modernengineering science. As Roos [1998] noted:“Engineering systems are increasing in size, scope, <strong>and</strong> complexity as a result ofglobalization, new technological capabilities, rising consumer expectations, <strong>and</strong>increasing social requirements. Engineering systems present difficult designproblems <strong>and</strong> require different problem solving frameworks than those of thetraditional engineering science paradigm: in particular, a more integrativeapproach in which engineering systems professionals view technological systemsas part of a larger whole. Though engineering systems are very varied, they oftendisplay similar behaviors. New approaches, frameworks, <strong>and</strong> theories need to bedeveloped to underst<strong>and</strong> better engineering systems behavior <strong>and</strong> design.”In comparison to Engineering <strong>Systems</strong>, the other current paradigm in academic settingsis referred to as Engineering Science. We can study the development of EngineeringScience <strong>and</strong> Engineering <strong>Systems</strong> on a time line. The invention of computers in the1940s’ <strong>and</strong> the following development of computers push the development of engineeringstudies. In one direction, it pushes the rapid development of Engineering Science on

30every area in a more <strong>and</strong> more detailed <strong>and</strong> thorough fashion. In the other direction,starting with the development of system models – use of linear programming in majorengineering areas, the discipline of Engineering <strong>Systems</strong> grows gradually. In the 1970s’,the engineering education <strong>and</strong> research extends to the intersection of social factors <strong>and</strong>engineering. Carnegie Mellon University established its Engineering <strong>and</strong> Public Policy(EPP) program, <strong>and</strong> Prof Richard de Neufville founded the Technology <strong>and</strong> PolicyProgram (TPP) at <strong>MIT</strong>. Increasingly, engineering research <strong>and</strong> practice are overlappingmore <strong>and</strong> more with each other, <strong>and</strong> with social sciences. In 2000, <strong>MIT</strong> started itsexperiment on Engineering <strong>Systems</strong> Division (ESD) to address these interdisciplinaryneeds <strong>and</strong> the formation of the new disciplinary area of Engineering <strong>Systems</strong>. For the<strong>MIT</strong> ESD history, Roos [2004] had a good introduction. Hastings [2004] described theplan for the future of <strong>MIT</strong> ESD. He said, “What is needed is the development of a holisticview of these systems that takes into account all the issues associated with them.”Figure 2-1 depicts the time line. In short, Engineering <strong>Systems</strong> offer large strategic view,while Engineering Science gives a specific technical view.Use of Linear Programmingin major areasEstablishment of<strong>MIT</strong> ESDLarge Strategic ViewInvention ofcomputersSocialEngineering <strong>Systems</strong>factors<strong>Systems</strong>modelsNew Program: <strong>MIT</strong> TPP, CMU EPP1950 1970 2000TimeMore detailedtechnical processEngineering ScienceFigure 2-1 Development of Engineering <strong>Systems</strong>Specific Technical ViewWhile engineering systems face a lot of issues, two of the issues are most important:uncertainty <strong>and</strong> complexity. The other key aspects of engineering systems are technical,people/organization, <strong>and</strong> context. See Figure 2-2. Moses [2004] discussed fundamental

31issues associated with large-scale, complex engineering systems, such as complexity<strong>and</strong> uncertainty, flexibility. This dissertation focused on one of the two important aspectsof uncertainty. De Neufville et al. [2004] discussed the particularly significant long-termfundamental issue for planning, design <strong>and</strong> management of engineering systems -uncertainty. Moses [2004] wrote “non-traditional system properties are of great interest inEngineering <strong>Systems</strong>, partly because some of them, such as flexibility <strong>and</strong> sustainability,have not been sufficiently studied.”UncertaintyPeople/OrganizationContextTechnicalComplexityFigure 2-2 Three Dimensions of Engineering <strong>Systems</strong> Linked to Each Other <strong>and</strong> to TwoHigh Impact Aspects of All Such <strong>Systems</strong> [Source: <strong>MIT</strong> ESD Symposium Committee,2002]“Engineering systems designers have long recognized that design context is uncertain<strong>and</strong> forecasts are ‘always wrong,’ as numerous observers have documented (such asAscher, 1978; Makridakis, 1979a, 1979b, 1984, 1987, 1989, 1990; US Office ofTechnology Assessment, 1982; de Neufville <strong>and</strong> Odoni, 2003). That is, comparisons

32made between forecasts of the level of dem<strong>and</strong> <strong>and</strong> the actual realizations one or twodecades later show wide discrepancies. Differences of a factor of two, up or down, aretypical. Moreover, the dem<strong>and</strong> that does occur is frequently substantially different fromwhat was predicted. For example, the forecasts of the need for telephone services madein the 1980s failed to anticipate the explosion in use (<strong>and</strong> need for infrastructure) causedby the use of cell phones, <strong>and</strong> did not anticipate the change in the distribution ofconnection times – longer as regards constantly on Internet connections, <strong>and</strong> shorter asregards text messaging. Only exceptionally do long-term forecasts actually hit the mark.As a general rule, we can expect that the actual long-term future dem<strong>and</strong> for engineeringsystems design will be different from what was projected as the most likely scenario.<strong>Design</strong>ers must expect that the engineering system will have to serve any one of a rangeof possibilities, <strong>and</strong> manage uncertainties proactively.” (de Neufville, Ramírez, <strong>and</strong> Wang,2005).Though people understood that the design context is uncertain, people still applieddeterministic tools to analyze the problem because the computational cost was notaffordable during the early years. With the development of computers <strong>and</strong> theories, thetrend of design enters into a dynamic reign. People study the uncertain context <strong>and</strong>recognize the inherent uncertain world. Furthermore, people are exploring how tomanage the uncertainties proactively with smarter design.2.2. Water Resource PlanningEngineering systems study covers a lot of different systems, for example transportationsystems, satellite communication systems, <strong>and</strong> water resources systems. One of thesystems focused in this dissertation is water resource planning, especially with regard tofacilities design, an area that came into maturity by 1980, though the prevailingmethodology does not consider the design issues in the full context of the changing <strong>and</strong>uncertain world. This dissertation develops an analysis framework that in some way

33builds on the st<strong>and</strong>ard water resources planning, <strong>and</strong> extends the usage of theframework to other engineering systems with a case example in satellite communications.2.2.1. Historical developmentAfter economic analysis was brought into water resource planning studies, research onwater resource planning with regard to facilities design can be divided into three phases:mathematical programming, multiobjective analysis, <strong>and</strong> risk recognition.Mathematical programmingMathematical programming is the major tool used in water resource planning. Maass etal. (1962) summarized the contributions of the Harvard Water Program (1955 – 1960).They introduced the most advanced techniques at that time: such as linear programming,mathematical synthesis of streamflow sequences, <strong>and</strong> computer simulation. This studylaid foundations for future development of water resource planning.Hufschmidt <strong>and</strong> Fiering (1966) described a river basin computer simulation modelthoroughly. Before computers became generally available, the simulation models werephysical models scaled to maintain static or dynamic similitude. The simulation model ofHufschmidt <strong>and</strong> Fiering dealt with a large number of r<strong>and</strong>omly selected designs, includedgeneration of long hydrologic sequences, <strong>and</strong> measured outcomes in economic terms.Their model was much more advanced than the then prevailing physical simulations.They tested 20 r<strong>and</strong>omly selected designs for 250 years (3000 months) of simulatedoperations. The 3 designs with the highest net benefits were subjected to furtheranalysis using single-factor <strong>and</strong> marginal analysis methods. The model was written inFORTRAN. The computer used was the IBM 7094 that had 32,768 directly addressable

34memory (whereas modern computers have memory measured in Gigabytes!) It tookabout 7.5 minutes of computation for one single operation of simulation for 250 years.Jacoby <strong>and</strong> Loucks (1974) developed an approach to the analysis of complex waterresource systems using both optimization <strong>and</strong> simulation, not as competing techniquesbut as interacting <strong>and</strong> supplementing methods. They used preliminary screening modelsto select several alternative design configurations; then they simulated the preferreddesigns using the same annual benefit, loss, <strong>and</strong> cost functions. They estimated theexpected benefits for each state for each 5-year period from 1970 to 2010.Major <strong>and</strong> Lenton (1979) edited a book on a study, led by David Marks, of the RioColorado river basin development in Argentina. Their system of models consisted of ascreening model, a simulation model <strong>and</strong> a sequencing model. The screening model is amixed-integer programming model with about 900 decision variables, including 8 0-1integer variables, <strong>and</strong> about 600 constraints. Objectives were incorporated either into theobjective function or as constraints on the system. Multiobjective criteria underlay thewhole formation of the model. The simulation model evaluated the most promisingconfigurations from the screening model in terms of net benefits <strong>and</strong> hydrologicalreliability. The runs from the simulation model improved the configurations from thescreening model. The simulation model was operated with 50 years of seasonal (4-month) flows. The sequencing model scheduled a c<strong>and</strong>idate configuration optimally in 4future time periods, taking into account benefits over time, budget constraints, constraintson the number of farmers available, <strong>and</strong> project interrelationships. The mixed-integerprogramming sequencing model had about 60 continuous variables, 120 integervariables, <strong>and</strong> 110 constraints depending on the exact configuration being modeled.Loucks, Stedinger, <strong>and</strong> Haith (1981) summarized the art of water resource planning untilthen, such as evaluation of time streams of benefits <strong>and</strong> costs, plan formulation, objectivefunctions <strong>and</strong> constraint equations, Lagrange multipliers, Dynamic Programming, LinearProgramming, Simulation, probability <strong>and</strong> distribution of r<strong>and</strong>om events, stochasticprocesses, <strong>and</strong> planning under uncertainty.

35After 1980, there are relatively fewer articles on the topic regarding facilities design <strong>and</strong>planning of big river basins. The interests shift more to operating policies of reservoirs,water supply, water quality, environmental issues. This trend is coherent with the trend inthe Western countries to stop building or even tear down dams, in favor of moreenvironmental considerations rather than short term gain on agricultural <strong>and</strong> hydropowerbenefits of big water projects. It is also partly because the art had been pretty maturethat developments in water resource planning theory became less concerned with thedesign of water resource facilities. Another reason for this is that most economical sitesfor water projects have almost all been built in North America or Europe, the remainingsites are marginal <strong>and</strong> economical benefits can not overweigh the environmental costs tosociety. With the decrease of interest in the construction of big water river projects, theliterature on this topic has been less, correspondingly. William (1996) argued two basicapproaches of water resources planning – that of the Corps of Engineers <strong>and</strong> otherconstruction agencies <strong>and</strong> that of the U.S. Environmental Protection Agency (EPA) <strong>and</strong>other regulatory agencies - are both incomplete. The requirements of the variousregulatory approaches are making it almost impossible to construct major facilities for anypurpose, <strong>and</strong> water resource analysts were reluctant to challenge them. A morecomplete approach is needed to reach better results.The development of big dams in developing countries has not slowed down. Sinha, Rao<strong>and</strong> Lall (1999) presented a screening model for selecting <strong>and</strong> sizing potential reservoirs<strong>and</strong> hydroplants on a river basin. A linked simulation-optimization framework is used. Theobjective function is to meet annual irrigation <strong>and</strong> hydropower dem<strong>and</strong>s at prescribedlevels of reliability. Sizing of reservoirs <strong>and</strong> hydroplants, <strong>and</strong> evaluation of objectivefunction <strong>and</strong> constraints <strong>and</strong> their derivatives are done as part of simulation. Theformulation is applied to river basins in India. Sinha, Rao, <strong>and</strong> Bischof (1999) presentedan optimization model for selecting <strong>and</strong> sizing potential reservoir <strong>and</strong> hydropower plantsites on river basins. The model used a behavior analysis algorithm that allows operationof the reservoir system with realistic operating policies. The model is developed in thecontext of river basins in India. Dahe <strong>and</strong> Srivastava (2002) extended the basic yield

36model <strong>and</strong> presented a multiple-yield model for a multiple-reservoir system consisting ofsingle-purpose <strong>and</strong> multipurpose reservoirs. They argued the model could act as a betterscreening tool in planning by improving the efficiency <strong>and</strong> accuracy of detailed analysismethods such as simulation. The model is applied to a system of eight reservoirs in India.The application <strong>and</strong> development of simulation-optimization frameworks in the US hasnever been stopped, though it is less on construction <strong>and</strong> more on management ofexisting facilities. Nishikiwa (1998) used a similar simulation-optimization approach forthe optimal management of the city of Santa Barbara's water resources during a drought.The objective is to minimize the cost of water supply subject to water dem<strong>and</strong> constraints,hydraulic head constraints to control seawater intrusion, <strong>and</strong> water capacity constraints.The decision variables are monthly water deliveries from surface water <strong>and</strong> ground water.Draper et al. (2003) presented an economic-engineering optimization model ofCalifornia's major water supply system. They argued that the economic-engineeringoptimization model could suggest a variety of promising approaches for managing largesystems. The model is deterministic. Lefkoff <strong>and</strong> Kendall (1996) evaluated yields from aproposed ground-water storage facility using a nonlinear optimization model of theCalifornia State Water Project (SWP) <strong>and</strong> the Central Valley Project (CVP). Modelconstraints include the major hydrologic, regulatory, <strong>and</strong> operational features of bothprojects, including mass continuity, facility capacities, regulatory st<strong>and</strong>ards, <strong>and</strong> deliverycontracts.Development of powerful computers <strong>and</strong> computer programs such as GAMS improvedthe performance of previous methodologies <strong>and</strong> enabled the solution of much biggerproblems. Meanwhile, researchers have never stopped to search for better algorithmsfor water resources optimization problems. Anderson <strong>and</strong> Al-Jamal (1995) used nonlinearprogramming to develop a methodology for simplification of complicated hydraulicnetworks. Kim <strong>and</strong> Palmer (1997) presented a Bayesian Stochastic DynamicProgramming model to investigate the value of seasonal flow forecasts in hydropowergeneration. Watkins <strong>and</strong> McKinney (1997) introduced Robust Optimization (RO) as aframework for evaluating these trade-offs <strong>and</strong> controlling the effects of uncertainty in

37water resources screening models. Sinha <strong>and</strong> Bischof (1998) observed that theautomatic differentiation method may greatly benefit the convergence of the optimizationalgorithm of reservoir systems to determine optimal sizes for reservoirs.Multiobjective analysisThere are many different objectives for water resource planning, such as national orregional income maximization, income redistribution, environmental quality, social wellbeing,national security, self-sufficiency, regional growth <strong>and</strong> stability, <strong>and</strong> preservation ofnatural areas. Some objectives can be easily expressed in monetary terms, while somecannot. Some (or all) objectives are conflicting <strong>and</strong> non-commensurable. Multiobjectiveanalysis does not yield a single optimal solution, but identifies the production possibilityfrontier (or in other words, Pareto Frontior) <strong>and</strong> trade-offs among objectives.Cohon <strong>and</strong> Marks (1974) discussed an application of multiobjective theory to the analysisof development of river basin systems. Major (1974) provided a case of the application ofMultiobjective analysis to the redesign of the Big Walnut Dam <strong>and</strong> reservoir in Indiana.Major <strong>and</strong> Lenton (1979) demonstrated the application of mathematical modeling <strong>and</strong>multiobjective investment criteria to river basin development.Risk recognitionThe above-mentioned studies transformed technical parameters into expected totalannual net efficiency benefits (or the utility for human <strong>and</strong> society) <strong>and</strong> maximized the netefficiency benefits (or utility) to obtain the “optimal design”. They carefully consideredtechnical uncertainties, such as that of waterflow, <strong>and</strong> used dynamic models. However,they did not take into account uncertainties in the human <strong>and</strong> social sphere. Ignoring thehuman <strong>and</strong> social uncertainties, the methodology cannot reach the “optimal design” (if

38such designs exist) by simply recognizing the technical uncertainties. Any technicalsystems are to serve human’s needs.Recent studies on water resource planning are more explicitly taking human, social,environmental uncertainties into account. Morimoto <strong>and</strong> Hope (2001, 2002) appliedprobabilistic cost-benefit analysis to hydroelectric projects in Sri Lanka, Malaysia, Nepal,<strong>and</strong> Turkey. Their results were in the form of distributions of NPV. These studiesrecognized the uncertainties from human, social, <strong>and</strong> environmental perspectives. Butthey did not take into account the value of options, or the flexibility. Decision-makers donot passively succumb to fate <strong>and</strong> they will respond to the uncertain environment.Increasingly, the real options concept has been introduced to water resources planning<strong>and</strong> management (US National Research Council, 2004).2.2.2. Other important referencesBased on Manne (1961, 1967), Hreisson (1990) dealt with the problem of obtaining the“optimal design” of hydroelectric power systems regarding sizing <strong>and</strong> sequencing. Theconclusion was to make the current marginal value of each new project equal to thediscounted weighted average of the long-term marginal unit cost of all future projects. Hefurther investigated economies of scale <strong>and</strong> optimal selection of hydroelectric projects.The tradeoff between large <strong>and</strong> small projects was studied by weighting the lost salesduring the period of excess capacity against the benefit of using larger projects due to theeconomies of scale. All his studies were based on a deterministic view. If uncertaintiesregarding the dem<strong>and</strong> <strong>and</strong> supply are high, the rules Hreisson developed may bemisleading.The fact that there is great uncertainty about the future loads on the infrastructure systemhas two implications for design, as Mittal (2004) has documented: the optimal size of thedesign should be smaller than that defined by Manne (1961, 1967), that is, planned for a

39shorter time horizon; yet the design should be easy to adjust for the range of possiblelong-term futures.Aberdein (1994) illustrated the case of excess electricity on the South Africainterconnected grid resulted from the mismatch between planned capacity <strong>and</strong> actualdem<strong>and</strong>. He stressed the importance of incorporating risks into power station investmentdecisions.Cai, McKinney,<strong>and</strong> Lasdon (2003) argued that the interdisciplinary nature of waterresources problems requires the integration of technical, economic, environmental, social,<strong>and</strong> legal aspects into a coherent analytical framework. Their paper presented thedevelopment of a new integrated hydrologic-agronomic-economic model, with the abilityto reflect the interrelationships between essential hydrologic, agronomic, <strong>and</strong> economiccomponents, <strong>and</strong> to explore both economic <strong>and</strong> environmental consequences of variouspolicy choices.Some papers available on the website of the World Commission on Dams(http://www.dams.org) are very helpful. For example, Fuggle <strong>and</strong> Smith (2000) prepareda report presenting background information on China’s dam building program, financing,<strong>and</strong> policy development. Clarke (2000) reported the findings of a global dam surveycovering 52 countries <strong>and</strong> 125 large dams. This report provides data for the uncertainfactors, such as the project schedule performance data, actual-to-planned hydropowerenergy out, <strong>and</strong> many others.2.3. Mathematical ProgrammingMathematical programming seeks to maximize or minimize a real or integer functiongiven certain constraints on the variables. Mathematical programming studies

40mathematical properties of maximizing or minimizing problems, formulates real worldproblems using mathematical term, develops <strong>and</strong> implements algorithms to solve theproblems. Sometimes mathematical programming is mentioned as optimization oroperations research. As early as 1665, Newton developed his method of finding aminimum solution of a function. The first book on mathematical programming – Methodsof Operations Research (Morse <strong>and</strong> Kimball) - was written in 1946, but it was classifiedbecause of its extensive contribution in World War II - everything from how best to useradar or hunt submarines to getting supplies to the troops efficiently. In 1951, theunclassified version of Methods of Operations Research got published.Fundamental mathematical programming topicsMathematical programming has many topics. Some of the fundamental topics are linearprogramming (first developed by Dantzig in 1948), non-linear programming (firstdeveloped by Kuhn <strong>and</strong> Tucker in 1951), <strong>and</strong> dynamic programming (first developed byBellman in 1957).A Linear Program (LP) is a problem that can be expressed as follows (the so-calledSt<strong>and</strong>ard Form):MaxS.t.cxAx ≤ bx ≥ 0where x is the vector of variables to be solved for, A is a matrix of known coefficients,<strong>and</strong> c <strong>and</strong> b are vectors of known coefficients.A Nonlinear Program (NLP) is a problem that can be put into the formMax F(x)S.t. g i (x) ≤ 0 for i = 1, ..., n where n >= 0h j (x) ≥ 0 for j = n+1, ..., m where m >= n