See section 20 - Legal Pundits

See section 20 - Legal Pundits

See section 20 - Legal Pundits

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

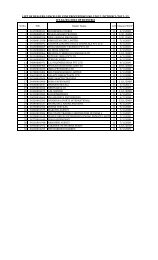

88THE FIRST SCHEDULELIST OF GOODS EXEM PTED[<strong>See</strong><strong>section</strong> <strong>20</strong>]Sl.No. DESCRIPTION OF GOODS1. Agricultural implements manually operated or animal driven2. Aids and implements used by handicapped persons3. All Bangles (except those made of precious metals)4. All seeds other than oil seeds5. Appalam, vadam, vathal and pappad6.Aquatic feed, poultry feed and cattle feed including grass, hay,straw, supplement and husk of pulses, concentrates and additives,wheat bran and deoiled cake7. Atta, Maida, Suji, Besan8. Betel leaves9. Books, periodicals and journals including maps, chart and globe10 Bread (Branded or otherwise)11. Charcoal12.Charkha, Ambar Charkha;handlooms and handloom fabrics andGandhi Topi.13. Coarse grains14. Coconut fibre15. Coconut in shell and separated kernel of coconut other than copra16. Condoms and contraceptives17. Cotton and silk yarn in hank18. Curd, Lussi, butter milk and separated milk19. Earthen pot<strong>20</strong>. Electrical energy21. Firewood except Casurina and Eucalyptus timber22.Fishnet, fishnet fabrics, fish seeds, fishing boats, fishing requisitesand prawn / shrimp seeds23. Food grains including rice and pulses24. Fresh milk and pasteurized milk25. Fresh plants, saplings and fresh flowers26. Fresh vegetables and fruits27. Garlic and ginger28.Goods taken under customs bond for re-export aftermanufacturing or otherwise

8929. Gur and Jaggery30. Hand made safety matches31. Handicrafts produced and directly sold by self help group32. Human blood, blood plasma including blood components33. Husk including groundnut husk34. Indigenous handmade musical instruments35. Items covered by Public Distribution System (except kerosene)36. Khadi garments / goods and made-ups as notified by Government37 Kumkum, bindi, alta and sindur38. Mat39.Meat, fish, prawn and other aquatic products when not cured orfrozen; eggs and livestock40. National flagNon-judicial stamp paper sold by Government Treasuries; postalitems like envelope, post card etc., sold by Government; rupee41.note, when sold to the Reserve Bank of India and cheques, looseor in book form42. Organic manure43. Plantain leaves44. Puffed rice commonly known as ‘pori’, flattened or beaten ricecommonly known as ‘aval’, parched rice commonly known as'Khoi', parched paddy or rice coated with sugar or gur commonlyknown as 'Murki'45. Raw wool46. Salt (branded or otherwise)47. Semen including frozen semen48. Silk worm laying, cocoon and raw silk49. Slate and slate pencils50. Sugar, textile and tobacco covered under the Additional Duties ofExcise (Goods of Special Importance) Act,1957 (Central Act 58of 1957)51. Tapioca52. Tender green coconut53. Toddy, Neera and Arrack pattai54. W ater other than-(i) aerated, mineral, distilled, medicinal, ionic, battery, demineralisedwater, and(ii) W ater sold in sealed container55. Bio-inputs like Bio-fertilizers, micro-nutrients, plant growthpromoters

90THE SECOND SCHEDULESl.No.PART-ALIST OF GOODS TAXABLE AT THE RATE OF ONE PER CENTAT EACH POINT OF SALE[<strong>See</strong> <strong>section</strong> 14 (1)]DESCRIPTION OF GOODS1. Articles of Gold, Silver and precious metals including jewellery madefrom gold, silver and precious metals.2. Gold, silver and other precious metals.3. Precious stones.PART-BLIST OF GOODS TAXABLE AT THE RATE OF ONE PER CENT AT THEPOINT OF LAST PURCHASE[<strong>See</strong> <strong>section</strong> 14 (1)]Sl.No.DESCRIPTION OF GOODS1. Old and beaten gold or silver jewellery.

91THE THIRD SCHEDULEPART - ALIST OF GOODS TAXABLE AT THE RATE OF FOUR PER CENTAT EACH POINT OF SALE[<strong>See</strong> <strong>section</strong> 14 (1)]Sl.DESCRIPTION OF THE GOODSNo.1. Acids2. Agricultural implements not operated manually or not driven by animal3. All equipments for communications such as, Private Branch Exchange(P.B.X.) and Electronic Private Automatic Branch Exchange(E.P.A.P.B.X) etc.4. All intangible goods like copyright, patent, replenishment licence etc.5. All kinds of bricks including fly ash bricks, refractory bricks andashphaltic roofing, earthen tiles6. All metal castings7 . All processed fruit, vegetables etc. including fruit jams, jelly, pickle, fruitsquash, paste, fruit drink and fruit juice (whether in sealed containers orotherwise)8. All types of yarn other than cotton and silk yarn in hank and sewingthread9. All utensils including pressure cookers/ pans except utensils made ofprecious metals10. Aluminium conductor steel reinforced (A.C.S.R.)11. Aluminium, aluminium alloys, their products (including intrusions) notelsewhere mentioned in this Schedule or in any other schedule12. Animal Hair –but to be a part of entry of skin & hide or raw wool13. Arecanut powder and betel nut14. Articles made of rolled gold and imitation gold including imitationjewellery15. Artificial silk yarn, polyester fibre yarn and staple fibre yarn16. Bagasse17. Bamboo18. Basic chromium sulphate, sodium bichromate, bleach liquid

9219. Bearings<strong>20</strong>. Bed sheet, pillow cover and other made-ups21. Beedi leaves22. Beltings23. Bicycles, tri-cycles, cycle rickshaws and parts, tyres and tubes thereof24. Rodenticide, insecticide and weedicide25. Bio-mass briquettes26. Bitumen27. Bone meal28. Buckets made of iron and steel, aluminium, plastic or other materials(except precious materials)29. Bulk drugs30. Candles31. Capital goods32. Castor oil33. Centrifugal, mono-bloc and submersible pump sets and parts thereof34. Chemical fertilizers, pesticides, weedicides, insecticides35. Clay including fire clay, fine china clay and ball clay36. Coal Tar37. Coffee beans and seeds, coffee powder and all forms of coffee, cocoapod, tea including green tea leaf and chicory38. Coir and coir products excluding coir mattresses39. Combs40. Computer stationery41. Cottage cheese42. Cotton and cotton waste43. Crucibles44. Cups and glasses of paper and plastics45. Declared goods as specified in <strong>section</strong> 14 of the Central Sales Tax Act,1956 (Central Act 74 of 1956)46. Drugs and medicines including vaccines, syringes and dressings,medicated ointments produced under drugs licence, light liquid paraffinof IP grade, Medical equipment / devices and implants47. Dyes, that is to say; (i) Acid dyes (ii) Ahzanee dyes (iii) Bases (iv) Basicdyes (v) Direct dyes (vi) Naphthols (vii) Nylon dyes (viii) Opticalwhitening agents (ix) Plastic dyes (x) Reactive dyes (xi) Sulphur dyes(xii) Vat dyes (xiii) All other dyes not specified elsewhere in the schedule48. Edible oils and oil cake49. Electrodes

9350. Embroidery or zari articles, that is to say, (i) imi, (ii) zari, (iii) kasab,(iv) sama, (v) dabka, (vi) chumki, (vii) gota, (viii) sitara, (ix) naqsi,(x) kora, (xi) glass bead, (xii) badla, (xiii) glzal, (xiv) embroiderymachines, (xv) embroidery needles.51. Exercise book, graph book and laboratory note book52. Feeding bottle, nipples53. Ferrous and non-ferrous metals and alloys and their scraps; non-metalssuch as aluminium, copper, zinc and extrusions of those54. Fibres of all types and fibre waste55. Coal ash, coal boiler ash, coal cinder ash, coal powder, clinker56. Fly ash57. Fried and roasted grams58. Gypsum of all forms and description59. Hand pumps and spare parts59(A) Handicraft60. Havan samagri including dhoop, sambrani or lobhana commonlyknown as agarbatti, dhupkathi or dhuphati61. Herb, bark, dry plant, dry root, commonly known as jari booti and dryflower62. Hing (Asafoetida)63. Honey64. Hose pipes and fittings thereof65. Hosiery goods66. Ice67. Industrial cables (high voltage cables, PVC or XLPE insulated wiresand cables , jelly filled cables, optical fibre cables)68. Industrial inputs and packing materials as mentioned in the Appendix69. Insulators70. IT products including computers, telephone and parts thereof,teleprinter and wireless equipment and parts thereof and cell phones,DVD and CD71. Kattha72. Kerosene lamp / lantern, petromax, glass chimney73. Kerosene oil sold through PDS74. Khandsari75. Khoya/Khoa76. Knitting wool

9477. Lac and shellac78. Leaf plates and cups79. Lignite80. Lime, lime stone, products of lime, dolomite and other white washingmaterials not elsewhere mentioned in this schedule or in any otherschedule81. Linear alkyl benzene, L.A.B. Sulphonic Acid, Alfa Olefin Sulphonate82. Maize starch, maize gluten, maize germ and oil83. Metals, alloys, metal powders including metal pastes of all types andgrades and metal scraps other than those falling under declared goods84. Mixed PVC stabilizer85. Moulded plastic footwear, Hawai chappals and straps thereof86. Napa Slabs (Rough flooring stones) and shahabad stones87. Newars88. Nuts, bolts, screws and fasteners89. Oil seeds90. Old cars91. Ores and minerals92. (i) Paraffin wax of all grade standards other than food grade standardincluding standard wax and match wax; (ii) Slack wax93. Paper and newsprint94. Paper and paper board95. Pens of all kinds including refills96. Pipes of all varieties including fittings97. Pizza Bread98. Plastic granules, plastic powder and master batches99. Porridge100. Printed material including diary, calendar etc. including works contractwhich are in the nature of printing works101. Printing ink excluding toner and cartridges102. Processed meat, poultry and fish103. Pulp of bamboo, wood and paper104. Rail wagons, engines, coaches and parts thereof105. Readymade garments106. Refractory monolithic107. Renewable energy devices and spare parts including windmill for waterpumping and generation of electricity108. Rice bran109. River sand and grit

95110. Rubber that is to say – (a) raw rubber, latex, dry ribbed sheet of all RMAGrades, tree lace, earth scrap, ammoniated latex, latex concentrate,centrifugal latex, dry crepe rubber, dry block rubber, crumb rubber,skimmed rubber and all other qualities and grades of latex (b) Reclaimedrubber all grades and qualities (c) Synthetic rubber111. Safety matches112. Sewing machine, its parts and accessories113. Ship and other water vessels including Non-mechanised boats used byfisherman for fishing114. Silk fabrics (subject to abolition of rental agreement) excludinghandloom silks unless covered by AED115. Skimmed milk powder and UHT milk116. Solvent oils other than organic solvent oil117. Spectacles, parts and components thereof, contact lens & lens cleaner118. Spices of all varieties and forms including cumin seed, aniseed, turmericand dry chillies119. Sports goods excluding apparels and footwear1<strong>20</strong>. Starch121. Tamarind, tamarind seed and powder122. Tools123. Toys excluding electronic toys124. Tractors, Threshers, harvesters and attachments and parts thereof125. Transformer126. Transmission wires and towers127. Umbrella except garden umbrella128. Vanaspati (hydrogenated Vegetable Oil)129. Vegetable oil including gingili oil and bran oil130. Waste paper131. Wet dates132. Wooden crates133. Writing Ink134. Writing instruments, geometry boxes, colour boxes, crayons and pencilsharpeners.

96PART-BLIST OF GOODS TAXABLE AT THE RATE OF FOUR PER CENT ATTHE POINT OF FIRST PURCHASE[<strong>See</strong> <strong>section</strong> 14 (1)]Sl.No.DESCRIPTION OF GOODS1. Cotton2. Groundnut not falling under Entry 45 of Part- A of this SchedulePART-CLIST OF GOODS TAXABLE AT THE RATE OF FOUR PER CENT ATTHE POINT OF LAST PURCHASE[<strong>See</strong> <strong>section</strong> 14 (1) ]Sl.No.DESCRIPTION OF GOODS1. Raw hides and skins2.Wattle bark, avaram bark, konam bark, wattle extract, Quobrachoand chestnut extract

97THE FOURTH SCHEDULEPART - ALIST OF GOODS TAXABLE AT THE RATE OF TW ELVE AND HALFPER CENT AT EACH POINT OF SALE[<strong>See</strong> <strong>section</strong> 14(1) and <strong>section</strong> 14(3)]Sl.DESCRIPTION OF GOODSNo.1 Goods not specified elsewhere in any of the SchedulesPART - BLIST OF GOODS TAXABLE AT THE RATE OF TW ELVE AND HALFPER CENT AT THE POINT OF LAST PURCHASE[<strong>See</strong> <strong>section</strong> 14 (1) ]Sl.No.1. SugarcaneDESCRIPTION OF GOODS

98THE FIFTH SCHEDULELIST OF GOODS TAXABLE AT THE RATE OF TWENTY PER CENTAT THE POINT OF FIRST SALE[<strong>See</strong> <strong>section</strong> 14 (1)]Sl.NoDESCRIPTION OF GOODS1. Molasses2. Petrol and diesel3. Rectified spritTHE SIXTH SCHEDULELIST OF GOODS TAXABLE AT THE RATE OF THIRTY FIVEPER CENT AT THE POINT OF FIRST SALE[<strong>See</strong> <strong>section</strong> 14 (1)]Sl.NoDESCRIPTION OF GOODS1. Liquor including IMFL and imported liquor from foreigncountries

99Appendix[<strong>See</strong> Entry No.68 under Part A ofthe Third Schedule](The Industrial Inputs and packing materials to be taxed @ 4% )S.No.As provided under theCentral Excise TariffAct, 1985 (Central Act5 of 1986)HeadingNo.Sub-HeadingNo.Description1. 15.01 … Animal (including fish) fats andoils, crude, refined or purified2. 15.06 … Glycerol, Crude, Glycerol Watersand Glycerol lyes.3. 15.07 … Vegetable waxes (other thantriglycerides), beeswax, other insectwaxes and spermaceti, whether ornot refined or coloured degras,residues resulting from thetreatment of fatty substances oranimal or vegetable waxes4. 15.08 … Animal or vegetable fats boiled,oxidized, dehydrated, sulphurised,blown, polymerized by heat invacuum or in inert gas or otherwisechemically modified, inediblemixtures or preparations of fats andoils of this chapter5. 17.02 … Liquid glucose (nonmedicinal)6. ... 2<strong>20</strong>4.10 Denatured ethyl alcohol of anystrength7. 26.02 … Manganese ores and concentrates,including ferruginous manganeseores and concentrate with amanganese content of <strong>20</strong>% or more,calculated on the dry weight8. 26.03 … Copper ores and concentrates9. 26.04 … Nickel ores and concentrates10. 26.05 … Cobalt ores and concentrates11. 26.06 … Aluminium ores and concentrates

10012. 26.07 … Lead ores and concentrates13. 26.08 … Zinc ores and concentrates14. 26.09 … Tin ores and concentrates15. 26.10 … Chromium ores and concentrates16. 26.11 … Tungsten ores and concentrates17. 26.12 … Uranium or Thorium ores andconcentrates18. 26.13 … Molybdenum ores and concentrates19. 26.14 … Titanium ores and concentrates<strong>20</strong>. 26.15 … Niobium, Tantalum, Vanadium orZirconium ores and concentrates21. 26.16 … Precious metal ores andconcentrates22. 26.17 … Other ores and concentrates23. 26.18 … Granulated slag (slag sand) from themanufacture of iron or steel24. … 2707.10 --- Benzole25. … 2707.<strong>20</strong> ---Toluole26. … 2707.30 Xylole27. … 2707.40 Naphthalene28. … 2707.50 Phenols29. … 2707.60 Creosote oils30. … 2710.90 Normal Paraffin31. … 2711.12 Butadine32. ... 2714.10 Bitumen33. 28.01 ... Fluorine, Chlorine, Bromine andIodine34. 28.02 … Sulphur sublimed or precipitatedcolloidal sulphur35. 28.03 … Carbon (carbon blacks and otherforms of carbon not elsewherespecified or included)36. 28.04 … Hydrogen, rare gases and other nonmetals37. 28.05 … Alkali or alkaline-earth metals, rareearth metals, scandium and yitriumwhether or not intermixed or interalloyed mercury38. 28.06 … Hydrogen chloride (hydrochloricacid) chlorosulphuric acid39. 28.07 … Sulphuric acid and anhydrides

101thereof, Olcum40. 28.08 … Nitric acid, sulphonitric acids41. 28.09 … Diphosphorus, pentaoxide,phosphoric acid and polyphosphoricacids42. 28.10 … Oxides or boron; boric acids43. 28.12 … Halides and halide oxides of nonmetals44. 28.13 … Sulphides of non-metals;commercial phosphorus trisulphide45. 28.14 … Ammonia, anhydrous or in aqueoussolution46. 28.15 … Sodium hydroxide (caustic soda),potassium hydroxides (causticpotash); peroxides of sodium orpotassium47. 28.16 … Hydroxide and peroxide ofmagnesium; oxides, hydroxides andperoxides of strontium or barium48. … 2818.10 Alumium hydroxides49. 28.19 … Chromium oxides and hydroxides50. 28.<strong>20</strong> … Manganese oxides51. … 2821.10 Iron oxides and hydroxides52. 28.22 .. Cobalt oxides and hydroxides,commercial cobalt oxides53. 28.23 … Titanium oxide54. 28.25 … Hydrazine and hydroxylamine andtheir Inorganic salts, other Inorganicbases, other metal oxides,hydroxides and peroxides55. 28.26 … Fluorides, fluorosilicates, fluoroaluminates and other complexfluorine salts56. 28.27 … Chlorides, chloride oxides andchloride hydroxides, bromides andbromide oxides; Iodides and Iodideoxides57. 28.29 … Chlorates and Perchlorates;bromates and Perbromates, Iodatesand periodates

10258. 28.30 … Sulphides, Polysulphides59. 28.31 … Dithionites and sulphoxylates60. 28.32 … Sulphites, Thiosulphites61. … 2833.10 Copper sulphate62. 28.34 … Nitrites, nitrates63. 28.35 … Phosphinates (hypophosphites),phosphonates (Phosphites);phosphates and polyphosphates64. 28.36 … Carbonates,peroxocarbonates(percarbonates),commercial ammonium carbonatescontaining ammonium carbanate65. 28.37 … Cyanides, cyanide oxides andcomplex cyanides66. 28.38 … Fulminates, cyanates andthiocynates67. 28.40 … Borates, peroxoborates (perborates)68. ... 2841.10 Sodium dichromate69. ... 2841.<strong>20</strong> Potassium dichromate70. 28.44 ... Radioactive chemical elements andradio active isotopes (including thefissile chemical elements andisotopes) and their compounds;mixtures and residues containingthese products71. 28.45 ... Isotopes other than those of headingNo.28.44 compounds, Inorganic ororganic of such isotopes, whether ornot chemically defined72. 28.46 ... Compounds, Inorganic or organic ofrare earth metals of yitrium or ofscandium or of mixtures of thesemetals73. 28.48 ... Phosphides, whether or notchemically defined, excludingferrophosphorus74. ... 2849.10 Calcium carbide75. ... 2901.90 Ethylene, Propylene76. 29.02 ... Cyclic Hydrocarbons77. 29.03 ... Halogenated derivatives ofHydrocarbons

10378. 29.04 ... Sulphonated, nitrated or nitrosatedderivatives of hydrocarbons,whether or not halogenated79. ... 2905.10 Methanol80. ... 2905.90 Di-Ethylene Glycol, Mono EthyleneGlycol, Tri-Ethylene Glycol,Ethylene Glycol, Heavy EthyleneGlycol81. 29.06 .. Cyclic alcohols and theirhalogenated, sulphonated, nitratedor nitrosated derivatives82. 29.08 ... Halogenated, sulphonated, nitratedor nitrosated derivatives of phenolsor phenol alcohols83. 29.09 ... Ethers, ether-alcohols peroxides,ether peroxides, ketone peroxides(whether or not chemically defined)and their halogenated, sulphonated,nitrated or nitrosated derivatives84. 29.10 ... Epoxides, Epoxyalcohols,epoxyphenols and epoxythers, witha three membered ring and theirhalogenated, sulphonated, nitratedor nitrosated derivatives85. ... 2910.00 Ethylene Oxide86. 29.11 ... Acetals and hemiacetals, whether ornot with other oxygen function andtheir halogenated, sulphonated,nitrated or nitrosated derivatives87. 29.12 ... Aldehydes, whether or not withother oxygen function; cyclicpolymers of aldehydes;paraformaldehyde88. 29.13 ... Halogenated, sulphonated, nitratedor nitrosated derivatives of productsof heading No. 29.1289. 29.15 ... Saturated acyclic monocarboxylicacids and their anhydrides, halides,peroxides and peroxyacids, their

104halogenated, sulphonated, nitratedor nitrosated derivatives90. 29.16 ... Unsaturated acyclicmonocarboxylic acids, cyclicmonocarboxylic acids, theiranhydrides, halides, peroxides andperoxyacids, their halogenated,sulphonated, nitrated or nitrosatedderivatives91. 29.17 ... Polycarboxylic acids, theiranhydrides, halides, peroxides andperoxyacids, their halogenated,sulphonated, nitrated or nitrosatedderivatives92. 29.18 ... Carboxylic acids with additionaloxygen function and theiranhydrides, halides, peroxides andperoxyacids, their halogenated,sulphonated, nitrated or nitrosatedderivatives93. 29.19 ... Phosphoric esters and their salts,including lactophosphates, theirhalogenated, sulphonated, nitratedor nitrosated derivatives94. 29.<strong>20</strong> ... Esters of other inorganic acids(excluding esters of hydrogenhalides) and their salts, theirhalogenated, sulphonated, nitratedor nitrosated derivatives95. 29.21 … Amine-function compounds96. 29.22 … Oxygen-function amino-compounds97. 29.23 … Quaternery ammonium salts andhydroxides; lecithins and otherphosphominolipids.98. 29.24 … Carboxyamide-functioncompounds; amide-functioncompounds of carbonic acid99. 29.25 … Carboxyamide-function compounds(including saccharin and its salts)and imine- function compounds

105100. 29.26 … Nitrile-function compounds101. 29.27 … Diazo, Azo-or-azoxy compounds102. 29.28 … Organic derivatives of hydrazine orof hydroxylamine103. 29.30 … Organo-sulphur compounds.104. 29.31 … Ethylene Diamine Tetra AceticAcid, Nitrillo Triacetric Acid andtheir derivatives105. 29.32 … Heterocyclic compounds withoxygen heteroatom(s) only.106. 29.33 … Heterocyclic compounds withnitrogen heteroatom(s) only107. 29.34 … Nucleic acids and their salts; otherheterocyclic compounds108. 29.35 … Sulphonamides109. 29.38 … Glycosides, natural or reproducedby synthesis and their salts, ethers,esters and other derivatives110. 29.39 … Vegetable alkaloids, natural orreproduced by synthesis, and theirsalts, ethers, esters and otherderivatives.111. 29.42 … Ethylene Diamine Tetra AceticAcid, Nitrilo Triacetric Acid andtheir derivatives.112. 32.01 … Tanning extracts of vegetableorigin; tannis and their salts, ethers,esters and other derivatives113. 32.02 … Synthetic organic tanningsubstances; inorganic tanningsubstances; tanning preparations,whether or not containing naturaltanning substances, enzymaticpreparations for pre-tanning.114. 32.03 … Colouring matter of vegetable oranimal origin (including dyeingextracts but excluding animalblack), whether or not chemicallydefined; preparations based oncolouring matter or vegetable or

106animal origin as specified in Note 2to this Chapter.115. 32.04 … Synthetic organic colouring matterwhether or not chemically defined;preparations based on syntheticorganic colouring matter asspecified in Note 2 to this Chapter;synthetic organic products of a kindused as fluorescent brighteningagents or as luminophores, whetheror not chemically defined.116. 32.05 … Colour lakes; preparations based oncolour lakes, as specified in Note 2to this Chapter117. … 3<strong>20</strong>7.10 Glass frit and other glass in theform of powder, granules, or flakes.118. … 3<strong>20</strong>7.90 Others119. 32.11 … Prepared driers1<strong>20</strong>. … 3215.90 Printing ink whether or notconcentrated or solid121. 35.01 … Casein, caseinates and other caseinderivatives, casein glues122. 35.07 … Enzymes; prepared enzymes notelsewhere specified or included123. 38.01 … Artificial graphite; colloidal orsemi-colloidalgraphite;preparations based on graphite orother carbon in the form of pastes,blocks, pastes or other semimanufacturers124. 38.02 … Activated carbon, activated naturalmineral products, animal black,including spent animal black125. 38.04 … Residual lyes from the manufactureof wood pulp, whether or notconcentrated, desugared orchemically treated, including ligninsulphonates, but excluding tall oil ofheading No.38.03126. 38.06 … Rosin and resin acids, andderivatives thereof, rosin spirit and

107rosin oils, run gums127. 38.07 … Wood tar, wood tar oils, woodcreosol, wood naptha, vegetablepitch, brewers pitch and similarpreparations based on rosin, resinacids or on vegetable pitch128. 38.09 … Finishing agents, dye carriers toaccelerate the dyeing or fixing ofdye-stuffs and other products andpreparations (for example, dressingsand mordants) of a kind used intextile, paper, leather or likeindustries, not elsewhere specifiedor included129. 38.12 … Prepared rubber accelerators;compound plasticisers for rubber orplastics, not elsewhere specified orincluded anti-oxidising preparationsand other compound stabilizers forrubber or plastics130. 38.14 … Reducers and blanket wash/rollerwash used in the printing industry131. 38.15 … Reaction initiaters, reactionaccelerators and catalyticpreparations, not elsewherespecified or included132. 38.17 … Mixed alkybenzenes and mixedalkynapthalenes, other than those ofheading No.27.07 or 29.02133. 38.18 … Chemical elements doped for use inelectronics, in the form of discs,wafers or similar forms; chemicalcompounds doped for use inelectronics134. 38.23 … Industrial monocarboxylic fattyacids, acid oils from refining,industrial fatty alcohols135. … 3824.90 Retarders used in the printingindustry136. … 3901.10 LLDPE/LDPE137. … 3901.<strong>20</strong> HDPE

108138. 39.02 … Polymers of propylene or of otherolefins, in primary forms139. … 3904.10 PVC140. 39.06 … Acrylic polymers in primary forms141. 39.07 … Polyacitals, other polyethers andepoxide resins, in primary forms,polycarbonates, alkyd resins,polyalyesters and other polyesters,in primary forms142. … 3907.60 Polyethylene Terephthalate Chips143. 39.08 … Polyamides in primary forms144. 39.09 … Amino-resins polyphenylene oxide,phenolic resins and polyurethanes inprimary forms145. 39.10 … Silicones in primary forms146. 39.11 … Petroleum resins, coumaroneindeneresins, polyterpenespolysulphides, polysulphones andother products specified in Note 3 tothis Chapter, not elsewherespecified or included in primaryforms147. 39.12 … Cellulose and its chemicalderivatives, and cellulose ethers, notelsewhere specified or included inprimary forms148. 39.13 … Natural polymers (for example,alginic acid) and modified naturalpolymers (for example, hardenedproteins, chemical derivatives ofnatural rubber), not elsewherespecified or included, in primaryforms.149. 39.14 … Ion-exchangers based on polymersof heading Nos.39.01 to 49.13 inprimary forms.150. 39.19 … Self adhesive plates, sheets, filmfoil, tape, strip of plastic whether ornot in rolls.151. … 39<strong>20</strong>.32 Flexible plain films152. 39.23 … Articles for the packing of goods, of

109plastics; namely, boxes, cases,crates, containers, carboys, bottles,jerry cans and their stoppers, lids,caps of plastics (but not includinginsulated ware)153. 40.01 … Natural Rubber, balata, guttapercha, Guayule, chicle and similarnatural gums, in primary forms or inplates, sheets or strips.154. 40.02 … Synthetic rubber and factice derivedfrom oils in primary forms or platessheets or strip; mixtures of anyproduct of heading No.40.01 withany product of this heading, inprimary forms or in plates, sheets orstrip.155. 40.03 … Reclaimed rubber in primary formsor in plates, sheets or strip.156. 40.05 … Compounded rubber unvulcanisedin primary forms or in plates, sheetsor strip, other than the forms andarticles of unvulcanised rubberdescribed in heading No.40.06157. 47.01 … Mechanical wood pulp, chemicalwood pulp, semi-chemical woodpulp and pulps of other fibrouscellulosic materials158. 48.19 … Cartons (including flattened orfolded cartons) boxes (includingflattened or folded boxes) cases,bags and other packing containersof paper board whether inassembled or unassembledcondition.159. 48.21 … Paper printed labels and paperboardprinted labels.160. 48.23 … Paper, self adhesive tape andprinted wrappers used for packing161. … 5402.42 Partially Oriented Yarn, polyesterstexturised yarn and waste thereof

110162. …. 5503.<strong>20</strong> Polyester staple fibre and polysterstaples fibre fill163. … 5503.<strong>20</strong> Polyester staple fiber waste164. … 6304.10 Sacks and bags of a kind used forthe packing of goods of jute or ofother textile based fibres of headingNo.53.03165. 70.07 … Carboys, bottles, jars, phials ofglass of a kind used for the packingof goods, stoppers, lids and otherclosures of glass166. 83.09 … Stoppers, caps and lids (includingcrown corks, screw caps andpouring stoppers) capsules forbottles, threaded bungs, bungcovers, seals and other packingaccessories of base metal.