CDS Clearing Q&A - MarketAxess

CDS Clearing Q&A - MarketAxess CDS Clearing Q&A - MarketAxess

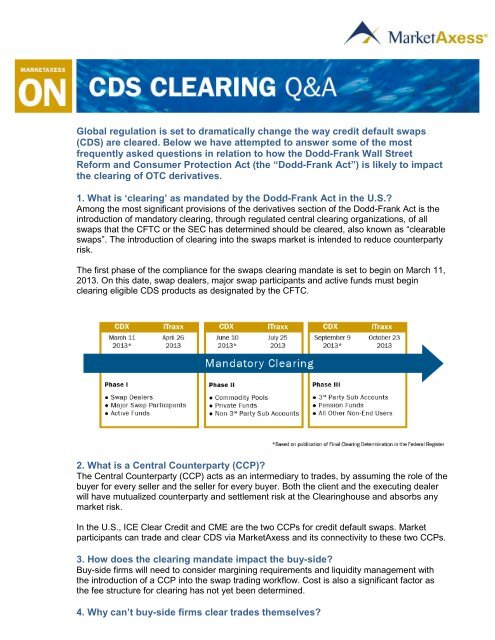

Global regulation is set to dramatically change the way credit default swaps(CDS) are cleared. Below we have attempted to answer some of the mostfrequently asked questions in relation to how the Dodd-Frank Wall StreetReform and Consumer Protection Act (the “Dodd-Frank Act”) is likely to impactthe clearing of OTC derivatives.1. What is ‘clearing’ as mandated by the Dodd-Frank Act in the U.S.?Among the most significant provisions of the derivatives section of the Dodd-Frank Act is theintroduction of mandatory clearing, through regulated central clearing organizations, of allswaps that the CFTC or the SEC has determined should be cleared, also known as “clearableswaps”. The introduction of clearing into the swaps market is intended to reduce counterpartyrisk.The first phase of the compliance for the swaps clearing mandate is set to begin on March 11,2013. On this date, swap dealers, major swap participants and active funds must beginclearing eligible CDS products as designated by the CFTC.2. What is a Central Counterparty (CCP)?The Central Counterparty (CCP) acts as an intermediary to trades, by assuming the role of thebuyer for every seller and the seller for every buyer. Both the client and the executing dealerwill have mutualized counterparty and settlement risk at the Clearinghouse and absorbs anymarket risk.In the U.S., ICE Clear Credit and CME are the two CCPs for credit default swaps. Marketparticipants can trade and clear CDS via MarketAxess and its connectivity to these two CCPs.3. How does the clearing mandate impact the buy-side?Buy-side firms will need to consider margining requirements and liquidity management withthe introduction of a CCP into the swap trading workflow. Cost is also a significant factor asthe fee structure for clearing has not yet been determined.4. Why can’t buy-side firms clear trades themselves?

- Page 2 and 3: Only “Clearing Members” (also k

Global regulation is set to dramatically change the way credit default swaps(<strong>CDS</strong>) are cleared. Below we have attempted to answer some of the mostfrequently asked questions in relation to how the Dodd-Frank Wall StreetReform and Consumer Protection Act (the “Dodd-Frank Act”) is likely to impactthe clearing of OTC derivatives.1. What is ‘clearing’ as mandated by the Dodd-Frank Act in the U.S.?Among the most significant provisions of the derivatives section of the Dodd-Frank Act is theintroduction of mandatory clearing, through regulated central clearing organizations, of allswaps that the CFTC or the SEC has determined should be cleared, also known as “clearableswaps”. The introduction of clearing into the swaps market is intended to reduce counterpartyrisk.The first phase of the compliance for the swaps clearing mandate is set to begin on March 11,2013. On this date, swap dealers, major swap participants and active funds must beginclearing eligible <strong>CDS</strong> products as designated by the CFTC.2. What is a Central Counterparty (CCP)?The Central Counterparty (CCP) acts as an intermediary to trades, by assuming the role of thebuyer for every seller and the seller for every buyer. Both the client and the executing dealerwill have mutualized counterparty and settlement risk at the <strong>Clearing</strong>house and absorbs anymarket risk.In the U.S., ICE Clear Credit and CME are the two CCPs for credit default swaps. Marketparticipants can trade and clear <strong>CDS</strong> via <strong>MarketAxess</strong> and its connectivity to these two CCPs.3. How does the clearing mandate impact the buy-side?Buy-side firms will need to consider margining requirements and liquidity management withthe introduction of a CCP into the swap trading workflow. Cost is also a significant factor asthe fee structure for clearing has not yet been determined.4. Why can’t buy-side firms clear trades themselves?

Only “<strong>Clearing</strong> Members” (also known as “Futures Commission Merchants – FCMs”) can havea direct relationship with the Central Counterparty. A customer transaction (non-clearingmember) is done through and guaranteed by the <strong>Clearing</strong> Member. The <strong>Clearing</strong> Member isthen liable for any/all outstanding payments should the customer default.Thus, <strong>Clearing</strong> Members are faced with strict CCP membership requirements including:regulatory oversight, minimum net capital, financial and other filings, customer disclosures,and risk management protocols.5. What <strong>CDS</strong> instruments are required clear through a CCP?For the Phase 1 clearing deadline on March 11, 2013, eligible high grade and high yield <strong>CDS</strong>indices traded in the client-to-dealer markets are required to clear through a CCP. Weanticipate additional <strong>CDS</strong> instruments to be added.6. What is ‘certainty of clearing’?With the emergence of mandatory OTC <strong>Clearing</strong>, it is essential for <strong>Clearing</strong> Member firms toextend credit to the client in order for a trade to clear. By incorporating this process at thepoint of trade execution, it provides the marketplace with an assurance that the trade willperform as expected; thus reducing counterparty risk and unrealized costs. Currently there isno industry consensus on how to achieve ‘certainty of clearing.’6. How is ‘certainty of clearing’ performed?Despite the current uncertainty, there are four different outstanding concepts on how the‘certainty of clearing’ workflow would be maintained:1. Ping – The swap execution facility (SEF) will message or “ping” the FCM chosen onthe trade by the client to inquire on credit limits. If approved, the SEF will take themessage and relay back to the Dealer for execution. If rejected, the client will need tocontact its FCM to upsize credit limits.2. Push – The FCM will ‘push’ a daily file to the SEF with specific client credit limits.Each time a trade is executed, the SEF will draw down from these limits.3. Credit Hubs – The purpose of the Credit Hub is to act as a central service, providingconnectivity between all participants involved on the trade. Through connectivity to theCredit hub, the FCM and the client will have the ability to monitor their credit limits inreal-time and track utilization ratios by specific products, risk limits and other factors.Credit Hubs are unregulated third party service providers which are not held liableshould a trade not clear.4. Plus One (ICE only) – Similar to a credit limit; however, specific to ICE trades only.This options also gives the FCM the ability to manage client credit limits acrossmultiple SEF’s. Limits are controlled through a combination of margin-bases riskthresholds, maximum clip sizes, real-time kill switchs, and real-time monitoring ofcredit.<strong>MarketAxess</strong> is agnostic as to how the industry will leverage these facilities. We are preparedto establish connectivity to all facilities. <strong>MarketAxess</strong> has already built technology toaccommodate the proposed options and can quickly implement once the rules are finalized.7. What role does a SEF play in the clearing process?Once SEF rules are finalized, products that are required to clear will then also be required totrade on a SEF.

OTC Derivatives <strong>Clearing</strong> GlossaryIndustry Terms Acronym DescriptionCentral Counterparty CCP Institution that stands between counterparties toreduce market riskDerivatives <strong>Clearing</strong>OrganizationDCOA CCP that provides clearing servicesDesignated ContractsMarketDCMAn electronic exchange (similar to SEF) thatfacilities tradesSwap Execution Facility SEF Electronic platform for regulated swap trading andclearingFutures CommissionMerchantFCM<strong>Clearing</strong> Member CM Same as FCMAn association that solicits or accepts orders onbehalf of a <strong>Clearing</strong> ParticipantExecuting Broker EB Counterparty on one side of an executed trade<strong>Clearing</strong> Participant CP A counterparty who engages in trading through aneligible CM or FCMPrime Broker PB Provides specialty services to the hedge fundcommunitySwap Dealer SD A “person” who holds itself out as a dealer inswaps or makes a market in swapsMajor Swap Participant MSP A “person” who maintains a substantial position inswaps for any of the major swap categoriesCommodities Exchange Act CEA Establishes the statutory framework under whichthe CFTC operatesSwap Data Repository SDR A central facility for swap data reporting andrecordkeepingICE Clear Credit ICE A CCP for eligible North American credit defaultswapsChicago MercantileExchangeCMEA CCP for eligible North American credit defaultswapsOrder Management System OMS Electronic system developed to execute ordersRisk Management System RMS Electronic system developed to manage andmaintain riskSelf RegulatoryOrganizationSROAn exchange or association that enforces financialand sales requirements for its members