2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

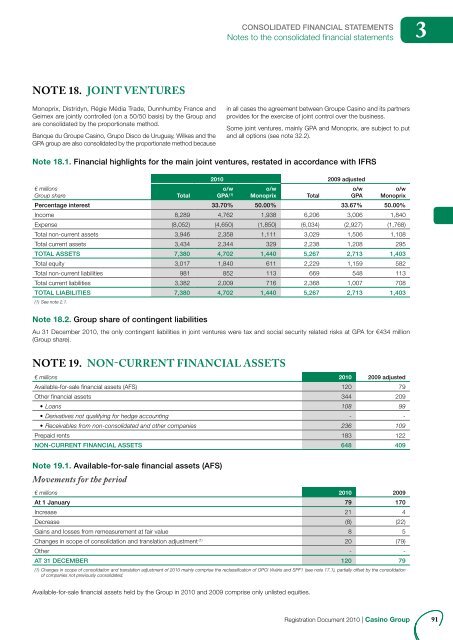

CONSOLIDATED FINANCIAL STATEMENTSNotes to the consolidated fi nancial statements3NOTE 18. JOINT VENTURES<strong>Mo</strong>noprix, Distridyn, Régie Média Trade, Dunnhumby France andGeimex are jointly controlled (on a 50/50 basis) by the Group andare consolidated by the proportionate method.Banque du <strong>Groupe</strong> <strong>Casino</strong>, Grupo Disco de Uruguay, Wilkes and theGPA group are also consolidated by the proportionate method becausein all cases the agreement between <strong>Groupe</strong> <strong>Casino</strong> and its partnersprovides for the exercise of joint control over the business.Some joint ventures, mainly GPA and <strong>Mo</strong>noprix, are subject to putand all options (see note 32.2).Note 18.1. Financial highlights for the main joint ventures, restated in accordance with IFRS€ millionsGroup shareTotal<strong>2010</strong> 2009 adjustedo/wGPA (1)o/w<strong>Mo</strong>noprixTotalo/wGPAo/w<strong>Mo</strong>noprixPercentage interest 33.70% 50.00% 33.67% 50.00%Income 8,289 4,762 1,938 6,206 3,006 1,840Expense (8,052) (4,650) (1,850) (6,034) (2,927) (1,768)Total non-current assets 3,946 2,358 1,111 3,029 1,506 1,108Total current assets 3,434 2,344 329 2,238 1,208 295TOTAL ASSETS 7,380 4,702 1,440 5,267 2,713 1,403Total equity 3,017 1,840 611 2,229 1,159 582Total non-current liabilities 981 852 113 669 548 113Total current liabilities 3,382 2,009 716 2,368 1,007 708TOTAL LIABILITIES 7,380 4,702 1,440 5,267 2,713 1,403(1) See note 2.1.Note 18.2. Group share of contingent liabilitiesAu 31 December <strong>2010</strong>, the only contingent liabilities in joint ventures were tax and social security related risks at GPA for €434 million(Group share).NOTE 19. NON-CURRENT FINANCIAL ASSETS€ millions <strong>2010</strong> 2009 adjustedAvailable-for-sale financial assets (AFS) 120 79Other financial assets 344 209• Loans108 99• Derivatives not qualifying for hedge accounting- -• Receivables from non-consolidated and other companies236 109Prepaid rents 183 122NON-CURRENT FINANCIAL ASSETS 648 409Note 19.1. Available-for-sale financial assets (AFS)<strong>Mo</strong>vements for the period€ millions <strong>2010</strong> 2009At 1 January 79 170Increase 21 4Decrease (8) (22)Gains and losses from remeasurement at fair value 8 5Changes in scope of consolidation and translation adjustment (1) 20 (79)Other - -AT 31 DECEMBER 120 79(1) Changes in scope of consolidation and translation adjustment of <strong>2010</strong> mainly comprise the reclassifi cation of OPCI Vivéris and SPF1 (see note 17.1), partially offset by the consolidationof companies not previously consolidated.Available-for-sale financial assets held by the Group in <strong>2010</strong> and 2009 comprise only unlisted equities.Registration Document <strong>2010</strong> | <strong>Casino</strong> Group91