2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

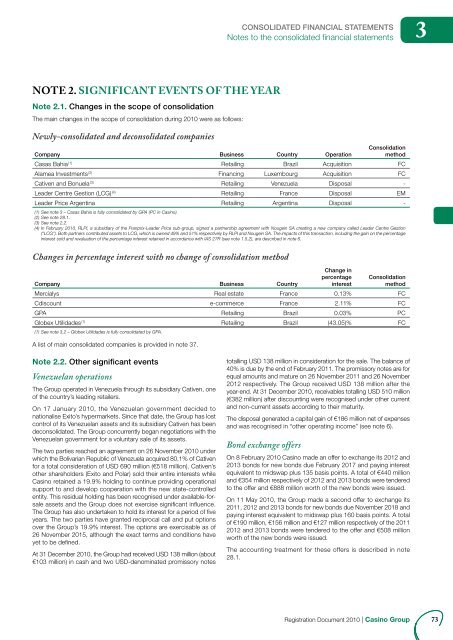

CONSOLIDATED FINANCIAL STATEMENTSNotes to the consolidated fi nancial statements3NOTE 2. SIGNIFICANT EVENTS OF THE YEARNote 2.1. Changes in the scope of consolidationThe main changes in the scope of consolidation during <strong>2010</strong> were as follows:Newly-consolidated and deconsolidated companiesCompany Business Country OperationConsolidationmethod(1)Casas BahiaRetailing Brazil Acquisition FC(2)Alamea InvestmentsFinancing Luxembourg Acquisition FC(3)Cativen and BonuelaRetailing Venezuela Disposal -(4)Leader Centre Gestion (LCG)Retailing France Disposal EMLeader Price Argentina Retailing Argentina Disposal -(1) See note 3 – Casas Bahia is fully consolidated by GPA (PC in <strong>Casino</strong>).(2) See note 28.1.(3) See note 2.2.(4) In February <strong>2010</strong>, RLPI, a subsidiary of the Franprix-Leader Price sub-group, signed a partnership agreement with Nougein SA creating a new company called Leader Centre Gestion(“LCG”). Both partners contributed assets to LCG, which is owned 49% and 51% respectively by RLPI and Nougein SA. The impacts of this transaction, including the gain on the percentageinterest sold and revaluation of the percentage interest retained in accordance with IAS 27R (see note 1.5.2), are described in note 6.Changes in percentage interest with no change of consolidation methodCompany Business CountryChange inpercentageinterestConsolidationmethodMercialys Real estate France 0.13% FCCdiscount e-commerce France 2.11% FCGPA Retailing Brazil 0.03% PC(1)Globex UtilidadesRetailing Brazil (43.05)% FC(1) See note 3.2 – Globex Utilidades is fully consolidated by GPA.A list of main consolidated companies is provided in note 37.Note 2.2. Other significant eventsVenezuelan operationsThe Group operated in Venezuela through its subsidiary Cativen, oneof the country’s leading retailers.On 17 January <strong>2010</strong>, the Venezuelan government decided tonationalise Exito’s hypermarkets. Since that date, the Group has lostcontrol of its Venezuelan assets and its subsidiary Cativen has beendeconsolidated. The Group concurrently began negotiations with theVenezuelan government for a voluntary sale of its assets.The two parties reached an agreement on 26 November <strong>2010</strong> underwhich the Bolivarian Republic of Venezuela acquired 80.1% of Cativenfor a total consideration of USD 690 million (€518 million). Cativen’sother shareholders (Exito and Polar) sold their entire interests while<strong>Casino</strong> retained a 19.9% holding to continue providing operationalsupport to and develop cooperation with the new state-controlledentity. This residual holding has been recognised under available-forsaleassets and the Group does not exercise significant influence.The Group has also undertaken to hold its interest for a period of fiveyears. The two parties have granted reciprocal call and put optionsover the Group’s 19.9% interest. The options are exercisable as of26 November 2015, although the exact terms and conditions haveyet to be defined.At 31 December <strong>2010</strong>, the Group had received USD 138 million (about€103 million) in cash and two USD-denominated promissory notestotalling USD 138 million in consideration for the sale. The balance of40% is due by the end of February 2011. The promissory notes are forequal amounts and mature on 26 November 2011 and 26 November2012 respectively. The Group received USD 138 million after theyear-end. At 31 December <strong>2010</strong>, receivables totalling USD 510 million(€382 million) after discounting were recognised under other currentand non-current assets according to their maturity.The disposal generated a capital gain of €186 million net of expensesand was recognised in “other operating income” (see note 6).Bond exchange offersOn 8 February <strong>2010</strong> <strong>Casino</strong> made an offer to exchange its 2012 and2013 bonds for new bonds due February 2017 and paying interestequivalent to midswap plus 135 basis points. A total of €440 millionand €354 million respectively of 2012 and 2013 bonds were tenderedto the offer and €888 million worth of the new bonds were issued.On 11 May <strong>2010</strong>, the Group made a second offer to exchange its2011, 2012 and 2013 bonds for new bonds due November 2018 andpaying interest equivalent to midswap plus 160 basis points. A totalof €190 million, €156 million and €127 million respectively of the 20112012 and 2013 bonds were tendered to the offer and €508 millionworth of the new bonds were issued.The accounting treatment for these offers is described in note28.1.Registration Document <strong>2010</strong> | <strong>Casino</strong> Group73