2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

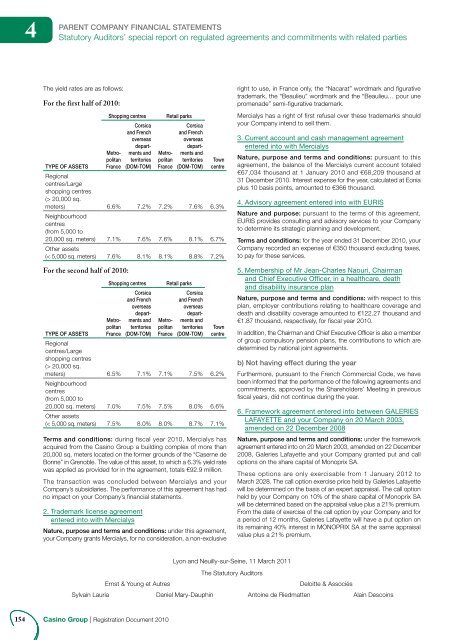

4PARENT COMPANY FINANCIAL STATEMENTSStatutory Auditors’ special report on regulated agreements and commitments with related partiesThe yield rates are as follows:For the first half of <strong>2010</strong>:TYPE OF ASSETSShopping centresMetropolitanFranceCorsicaand Frenchoverseasdepartmentsandterritories(DOM-TOM)MetropolitanFranceRetail parksCorsicaand Frenchoverseasdepartmentsandterritories(DOM-TOM)TowncentreRegionalcentres/Largeshopping centres(> 20,000 sq.meters) 6.6% 7.2% 7.2% 7.6% 6.3%Neighbourhoodcentres(from 5,000 to20,000 sq. meters) 7.1% 7.6% 7.6% 8.1% 6.7%Other assets(< 5,000 sq. meters) 7.6% 8.1% 8.1% 8.8% 7.2%For the second half of <strong>2010</strong>:TYPE OF ASSETSShopping centresMetropolitanFranceCorsicaand Frenchoverseasdepartmentsandterritories(DOM-TOM)MetropolitanFranceRetail parksCorsicaand Frenchoverseasdepartmentsandterritories(DOM-TOM)TowncentreRegionalcentres/Largeshopping centres(> 20,000 sq.meters) 6.5% 7.1% 7.1% 7.5% 6.2%Neighbourhoodcentres(from 5,000 to20,000 sq. meters) 7.0% 7.5% 7.5% 8.0% 6.6%Other assets(< 5,000 sq. meters) 7.5% 8.0% 8.0% 8.7% 7.1%Terms and conditions: during fiscal year <strong>2010</strong>, Mercialys hasacquired from the <strong>Casino</strong> Group a building complex of more than20,000 sq. meters located on the former grounds of the “Caserne deBonne” in Grenoble. The value of this asset, to which a 6.3% yield ratewas applied as provided for in the agreement, totals €92.9 million.The transaction was concluded between Mercialys and yourCompany’s subsidiaries. The performance of this agreement has hadno impact on your Company’s financial statements.2. Trademark license agreemententered into with MercialysNature, purpose and terms and conditions: under this agreement,your Company grants Mercialys, for no consideration, a non-exclusiveright to use, in France only, the “Nacarat” wordmark and figurativetrademark, the “Beaulieu” wordmark and the “Beaulieu… pour unepromenade” semi-figurative trademark.Mercialys has a right of first refusal over these trademarks shouldyour Company intend to sell them.3. Current account and cash management agreemententered into with MercialysNature, purpose and terms and conditions: pursuant to thisagreement, the balance of the Mercialys current account totaled€67,034 thousand at 1 January <strong>2010</strong> and €68,209 thousand at31 December <strong>2010</strong>. Interest expense for the year, calculated at Eoniaplus 10 basis points, amounted to €366 thousand.4. Advisory agreement entered into with EURISNature and purpose: pursuant to the terms of this agreement,EURIS provides consulting and advisory services to your Companyto determine its strategic planning and development.Terms and conditions: for the year ended 31 December <strong>2010</strong>, yourCompany recorded an expense of €350 thousand excluding taxes,to pay for these services.5. Membership of Mr Jean-Charles Naouri, Chairmanand Chief Executive Officer, in a healthcare, deathand disability insurance planNature, purpose and terms and conditions: with respect to thisplan, employer contributions relating to healthcare coverage anddeath and disability coverage amounted to €122.27 thousand and€1.87 thousand, respectively, for fiscal year <strong>2010</strong>.In addition, the Chairman and Chief Executive Officer is also a memberof group compulsory pension plans, the contributions to which aredetermined by national joint agreements.b) Not having effect during the yearFurthermore, pursuant to the French Commercial Code, we havebeen informed that the performance of the following agreements andcommitments, approved by the Shareholders’ Meeting in previousfiscal years, did not continue during the year.6. Framework agreement entered into between GALERIESLAFAYETTE and your Company on 20 March 2003,amended on 22 December 2008Nature, purpose and terms and conditions: under the frameworkagreement entered into on 20 March 2003, amended on 22 December2008, Galeries Lafayette and your Company granted put and calloptions on the share capital of <strong>Mo</strong>noprix SA.These options are only exercisable from 1 January 2012 toMarch 2028. The call option exercise price held by Galeries Lafayettewill be determined on the basis of an expert appraisal. The call optionheld by your Company on 10% of the share capital of <strong>Mo</strong>noprix SAwill be determined based on the appraisal value plus a 21% premium.From the date of exercise of the call option by your Company and fora period of 12 months, Galeries Lafayette will have a put option onits remaining 40% interest in MONOPRIX SA at the same appraisalvalue plus a 21% premium.Lyon and Neuilly-sur-Seine, 11 March 2011The Statutory AuditorsErnst & Young et AutresDeloitte & AssociésSylvain Lauria Daniel Mary-Dauphin Antoine de Riedmatten Alain Descoins154 <strong>Casino</strong> Group | Registration Document <strong>2010</strong>