2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

2010 REGISTRATION DOCUMENT (3.4 Mo) - Groupe Casino

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

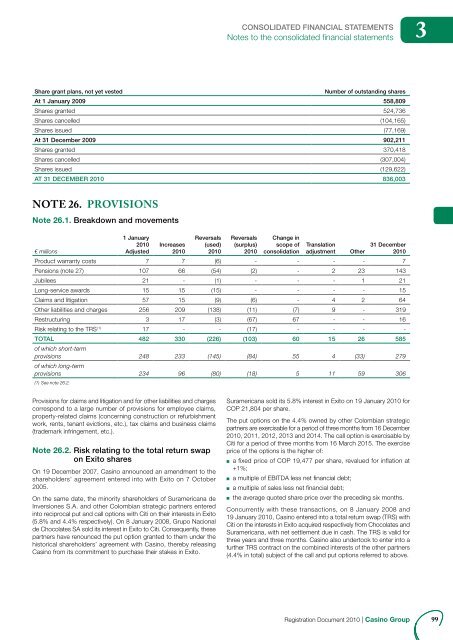

CONSOLIDATED FINANCIAL STATEMENTSNotes to the consolidated fi nancial statements3Share grant plans, not yet vestedNumber of outstanding sharesAt 1 January 2009 558,809Shares granted 524,736Shares cancelled (104,165)Shares issued (77,169)At 31 December 2009 902,211Shares granted 370,418Shares cancelled (307,004)Shares issued (129,622)AT 31 DECEMBER <strong>2010</strong> 836,003NOTE 26. PROVISIONSNote 26.1. Breakdown and movements€ millions1 January<strong>2010</strong>AdjustedIncreases<strong>2010</strong>Reversals(used)<strong>2010</strong>Reversals(surplus)<strong>2010</strong>Change inscope ofconsolidationTranslationadjustmentOther31 December<strong>2010</strong>Product warranty costs 7 7 (6) - - - - 7Pensions (note 27) 107 66 (54) (2) - 2 23 143Jubilees 21 - (1) - - - 1 21Long-service awards 15 15 (15) - - - - 15Claims and litigation 57 15 (9) (6) - 4 2 64Other liabilities and charges 256 209 (138) (11) (7) 9 - 319Restructuring 3 17 (3) (67) 67 - - 16Risk relating to the TRS (1) 17 - - (17) - - - -TOTAL 482 330 (226) (103) 60 15 26 585of which short-termprovisions 248 233 (145) (84) 55 4 (33) 279of which long-termprovisions 234 96 (80) (18) 5 11 59 306(1) See note 26.2.Provisions for claims and litigation and for other liabilities and chargescorrespond to a large number of provisions for employee claims,property-related claims (concerning construction or refurbishmentwork, rents, tenant evictions, etc.), tax claims and business claims(trademark infringement, etc.).Note 26.2. Risk relating to the total return swapon Exito sharesOn 19 December 2007, <strong>Casino</strong> announced an amendment to theshareholders’ agreement entered into with Exito on 7 October2005.On the same date, the minority shareholders of Suramericana deInversiones S.A. and other Colombian strategic partners enteredinto reciprocal put and call options with Citi on their interests in Exito(5.8% and 4.4% respectively). On 8 January 2008, Grupo Nacionalde Chocolates SA sold its interest in Exito to Citi. Consequently, thesepartners have renounced the put option granted to them under thehistorical shareholders’ agreement with <strong>Casino</strong>, thereby releasing<strong>Casino</strong> from its commitment to purchase their stakes in Exito.Suramericana sold its 5.8% interest in Exito on 19 January <strong>2010</strong> forCOP 21,804 per share.The put options on the 4.4% owned by other Colombian strategicpartners are exercisable for a period of three months from 16 December<strong>2010</strong>, 2011, 2012, 2013 and 2014. The call option is exercisable byCiti for a period of three months from 16 March 2015. The exerciseprice of the options is the higher of:■■■■a fixed price of COP 19,477 per share, revalued for inflation at+1%;a multiple of EBITDA less net financial debt;a multiple of sales less net financial debt;the average quoted share price over the preceding six months.Concurrently with these transactions, on 8 January 2008 and19 January <strong>2010</strong>, <strong>Casino</strong> entered into a total return swap (TRS) withCiti on the interests in Exito acquired respectively from Chocolates andSuramericana, with net settlement due in cash. The TRS is valid forthree years and three months. <strong>Casino</strong> also undertook to enter into afurther TRS contract on the combined interests of the other partners(4.4% in total) subject of the call and put options referred to above.Registration Document <strong>2010</strong> | <strong>Casino</strong> Group99