SEC Form 17-A - Philippine Stock Exchange - Far Eastern University

SEC Form 17-A - Philippine Stock Exchange - Far Eastern University

SEC Form 17-A - Philippine Stock Exchange - Far Eastern University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

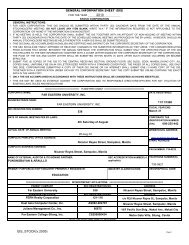

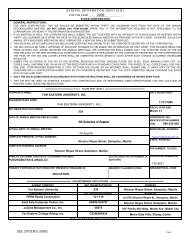

FAR EASTERN UNIVERSITYP.O. BOX 609MANILA, PHILIPPINES<strong>SEC</strong>URITIES AND EXCHANGE COMMISSION<strong>SEC</strong> FORM <strong>17</strong> - AANNUAL REPORT PURSUANT TO <strong>SEC</strong>TION <strong>17</strong>OF THE <strong>SEC</strong>URITIES REGULATION CODEAND <strong>SEC</strong>TION 141 OF THE CORPORATION CODE1. For the fiscal year ended March 31, 20102. <strong>SEC</strong> Identification Number 5383. BIR Tax Identification No. 000-225-4424. Exact name of registrant as specified in its charter <strong>Far</strong> <strong>Eastern</strong> <strong>University</strong>, Inc.5. PHILIPPINESProvince, Country or other jurisdiction ofincorporation or organization6. ____________/ / (<strong>SEC</strong> use only)/____________/Industry Classification Code:7. Nicanor Reyes Street, Sampaloc, Manila 1008Address of principal officePostal Code8. (632) 735-56-21Issuer's telephone number including area code9. NOT APPLICABLE<strong>Form</strong>er name, former address, and former fiscal year, if changed since last report.10. Securities registered pursuant to Sections 8 and 12 of the SRC, or Sec. 4 and 8 of theRSATitle of Each ClassNumber of Shares of Common<strong>Stock</strong> Outstanding and Amountof Debt OutstandingCommon <strong>Stock</strong>, P100.00 par value 9,808,448Bond with Non-Detachable Warrant,P/ 1.00 per unitNot Applicable

- 2 -11. All securities (common shares) are listed with the <strong>Philippine</strong> <strong>Stock</strong> <strong>Exchange</strong>, Inc.12. Check whether the registrant:(a) has filed reports required to be filed by Section I7 of the SRC and SRC Rule <strong>17</strong>thereunder and Sections 26 and 141 of the Corporation Code of the <strong>Philippine</strong>sduring the preceding 12 months (or for such shorter period that the registrant wasrequired to file such reports);Yes [ x ] No [ ]13. The aggregate market value of the voting stock held by non-affiliates: None

- 3 -TABLE OF CONTENTSPART I - BUSINESS AND GENERAL INFORMATION NO. OF PAGESItem 1 - Business 5Item 2 - Properties 2Item 3 - Legal Proceedings 2Item 4 - Submission of Matters ToA Vote of Security Holders 1PART II -OPERATIONAL AND FINANCIAL INFORMATIONItem 5 - Market for Issuer’s CommonEquity and Related <strong>Stock</strong>holdersMatters 3Item 6 - Management’s Discussion and 11Analysis or Plan OperationItem 7 - Financial Statements 122Item 8 - Changes in and Disagreements 1With Accountants on Accounting andFinancial DisclosurePART III -CONTROL AND COMPENSATION INFORMATIONItem 9 - Directors and Executive Officersof the Issuer 6Item 10- Executive Compensation 2Item 11- Security Ownership of CertainBeneficial Owners and Management 2Item 12- Certain Relationship and RelatedTransactions 1PART IVCORPORATE GOVERNANCEItem 13- Corporate Governance 1PART VEXHIBITS AND SCHEDULESItem 14- Exhibits and Reports on <strong>SEC</strong> <strong>Form</strong> <strong>17</strong>-Ca. Exhibits 1b. Reports on <strong>SEC</strong> FORM I7 - C 3c. Quarterly Reports 1

- 4 -PART I - BUSINESS AND GENERAL INFORMATIONItem 1. Business<strong>Far</strong> <strong>Eastern</strong> <strong>University</strong>, Inc. ("FEU or the "Corporation") was incorporated in 1933Brief Discussion of Business<strong>Far</strong> <strong>Eastern</strong> <strong>University</strong>, Inc., founded in 1928, is a private non-sectarian institution of learning.Guided by the core values of Fortitude, Excellence and Uprightness, FEU aims to be a universityof choice in Asia. Committed to the highest intellectual, moral and cultural standards, FEU strivesto produce principled and competent graduates. It nurtures a service-oriented and environmentconsciouscommunity which seeks to contribute to the advancement of the global society. Tuitionand other fees which are the main sources of its financial stability are moderate, subject togovernment regulation. The <strong>University</strong> also provides full and partial scholarships to deservingstudents. An FEU Foundation supplements the <strong>University</strong> scholarship program by providingspecial grants. The <strong>University</strong> maintains excellent facilities such as an electronic library, varioustypes of laboratories, auditorium, audio-visual and multimedia rooms, clinic, technology-basedgate security and enrollment system, gymnasiums, and spacious air-conditioned classrooms tobest serve the students. The <strong>University</strong> was granted deregulated status for five years beginningOctober 22, 2001 until October 21, 2006 per CHED Memorandum Order (CMO) No. 38, Series2001. Then, per CMO No. 52, Series of 2006, the deregulated status was extended until the endof Second Semester, SY 2006-2007. Moreover, per CMO No. 59, Series of 2007, the <strong>University</strong>was granted the same status from November 15, 2007 to November 14, 2008. On January 22,2009, through a Memorandum from the CHED Chairman, FEU’s status was extended until April30, 2009. Recently, a CHED letter addressed to President Lydia B. Echauz dated March <strong>17</strong>, 2009has extended the <strong>University</strong>’s deregulated status for another five years that is from March 11,2009 until March 30, 2014.Product:The Corporation is an educational institution. A private, non-sectarian institution oflearning comprising the following different Institutes that offer specific programs:A) Institute of Arts and Sciences (IAS)Programs:Masteral:Baccalaureate:Master of Arts (MA) major in:• Mass Communication• Letters• PsychologyBachelor of Arts major in Mass Communication (Granted permit upto recognition)Bachelor of Arts in: (Granted Government Permit to offer 1 st & 2 ndYear Levels)• English Language• Literature• Political Science• International Studies

- 5 -Bachelor of Science (BS) in Medical Technology (GrantedGovernment Permit to offer 1 st, 2 nd and 3 rd Year Levels)Bachelor of Science (BS) in BiologyBachelor of Science (BS) in:• Psychology• Applied Mathematics with Information TechnologyB) Institute of Accounts, Business and Finance (IABF)Programs:Masteral:Baccalaureate:Master of Business Administration (MBA) (Without Thesis Program)Bachelor of Science (BS) in:• Accountancy• Hotel and Restaurant Management (Granted GovernmentPermit up to Recognition)• Tourism Management (Granted Government Permit up toRecognition)Bachelor of Science in Business Administration major in:C) Institute of Education (IE)Programs:Doctoral:Masteral:• Business Economics• Financial Management• Marketing Management• Human Resource Development Management• Operations Management• Business Management• Internal Auditing• Legal ManagementDoctor of Education (Ed.D.) major in Educational AdministrationMaster of Arts in Education major in:• Educational Administration (Thesis Program)• Curriculum and Instruction (Thesis Program)• Curriculum and Instruction (Without Thesis Program)• Special Education (Thesis Program)

- 8 -Distribution methods of the products/services:Since this is an educational institution, its services are certainly focused on the students.The tuition fees of students in the following Institutes significantly contributed to the revenues ofthe <strong>University</strong>:InstitutePercentage to RevenuesInstitute of Accounts, Business 32.20%and FinanceInstitute of Arts and Sciences 13.15%Institute of Nursing 43.87%Customers:StudentsPurchases of Raw Materials: NOT APPLICABLEDistribution methods of the products/services:Since this is an educational institution, its services are certainly focused on the students.Competition:Since the school which is the main core of the business is situated in the <strong>University</strong> Belt, thecompetitors are prestigious colleges and universities within the specified area. FEU caneffectively compete with these institutions of learning because of its well-modulated tuition feessubject to government regulations, air-conditioned classrooms, electronic library and continuousimprovement of physical plant and facilities. Diverse scholarships are also offered and amagnificent line-up of cultural performances for the whole year are presented, free for allstudents. Moreover, the <strong>University</strong> recently acquired the Level III re-accredited status for mostof its Liberal Arts and Commerce programs.

- 10 -Properties leased by the corporation from FERN Realty, Inc.MonthlyRentalContractDate__Education Building – an eight (8) storey building P35,974,093.99 July 1,made of concrete materials located on plus 2009Nicanor Reyes St., Manila applicable VAT toJune 30,2010Nursing Building – an eight (8) storey buildingmade of concrete materials located onNicanor Reyes St., ManilaLaw Building – a four (4) storey building madeof concrete materials located onNicanor Reyes St., ManilaAdministration Building – a four (4) storey building madeof concrete materials located onNicanor Reyes St., ManilaGymnasium - a two (2) storey building made of concrete materialslocated on R. Papa St., ManilaThe lease contract shall not be deemed extended by implication beyond the contract period forany cause or reason whatsoever, but only by negotiation and written agreement of the LESSORand the LESSEE.

- 11 -Employees:Number of EmployeesOfficials - 12Senior Staff - 46Non-Academic:Supervisor - 64Rank-and-File - 276Academic:Lecturer - 625Regular - 375With the economic condition prevailing in the country, the corporation has no plan of hiringemployees within the ensuing twelve months. It will make use of its present employees andfaculty members to meet its manpower requirements.Inclusive Dates of CBANon-Academic July 16, 2009 - July 15, 2011Academic Sept. 1, 2009 - August 31, 2011The labor unions of the employees and the faculty members have never been on strike in thelast ten years, and pose no threat to strike in the foreseeable future. Employees and facultymembers have a harmonious relationship with the Administration.Working Capital:All of the company's working capital for its existing operation forfiscal year April 1, 2009 to March 31, 2010 was internally generated.Item 3. Legal ProceedingsHereunder is the list of the legal proceedings involving the company which are beinghandled by Atty. Enrico G. Gilera, the <strong>University</strong>’s Legal Counsel:External CasesA. Pending Court Cases as of 31 December 20091. Meynard Bathan vs. FEU, NLRC Case No. 08-11985-20092. Abner Cruz vs. FEU, NLRC Case No. 11-15913-20093. Melvira David, et al. vs. FEU, CA GR No. 1065324. Fina Gabonada vs. FEU et al; NLRC Case No. 09-13392-20085. Ma. Richelle Simon, et al, vs. NLRC Case No. 12-16513-20096. FEU-ELU (PLAC) vs, FEU, CA GR SP No. 102249

- 12 -B. Recently Dismissed cases1. Ramir Arceo, vs. FEU, NLRC Case No. 06-09197-2008; dismissed on September 29,20092. Jesus Fernando Dujua vs. FEU, NLRC Case No. 04-05603-2008; dismissed onSeptember 29, 20093. Elmer Bolanos vs. FEU/RRC Case No. 06-09197-2008; dismissed on May 29, 20094. Annabele Mercado vs. FEU, NLRC Case No. 05-04546-2007; dismissed on April 30,20095. Erlinda Ramos vs. FEU, NLRC Case No. 00-07-09644-2009; dismissed onNovember <strong>17</strong>, 2009Involvement of Directors and Officers in Certain Legal ProceedingsNone of the directors and officers were involved during the past five (5) years in any bankruptcyproceeding. Neither have they been convicted by final judgment in any criminal proceeding orbeen subject to any order, judgment or decree of competent jurisdiction, permanently ortemporarily enjoining barring, suspending, or otherwise limiting their involvement in any type ofbusiness, securities, commodities, or banking activities, nor found by any court or administrativebody to have violated a securities or commodities law.The registrant or any of its subsidiaries or affiliates is not a party to any pending legal proceedingsin which any of their property is the subject.Item 4. Submission of Matters to a Vote of Security HoldersThe registrant is not a party to any voting trust agreement. No security holder of theRegistrant holds a voting trust or any other similar agreement.Part II - OPERATIONAL AND FINANCIAL INFORMATIONItem 5. Market for Registrants Common Equity and Related <strong>Stock</strong>holders MattersDividends During the Year:Cash Dividend:DIVIDENDS DECLARED FOR THE FISCAL YEAR ENDED MARCH 31, 2009Payment/IssuedOutstandingDate Particulars Amount SharesJuly 20, 2009 P 15.00/share P 147,126,720.00 9,808,448Jan. 25, 2010 15.00/share 147,126,720.00 9,808,448P 294,253,440.00===============

- 13 -<strong>Stock</strong> Dividend:No stock dividend for the period April 1, 2009 to March 31, 2010 was declared.Recent Sales of Unregistered SecuritiesNot a single common share is considered unregistered security. All shares are registered with the<strong>Philippine</strong> <strong>Stock</strong> <strong>Exchange</strong>, Inc. Thus, checklist of requirements for Sale of Unregistered Securities isnot applicable.The <strong>Philippine</strong> <strong>Stock</strong> <strong>Exchange</strong>, Inc. is the principal market where the corporation’s common equity istraded.Market Prices of Common <strong>Stock</strong>s: (Phil. <strong>Stock</strong> <strong>Exchange</strong>, Inc.)Herewith are the high, low, and closing prices of shares of stock traded from April 2009 to March 2010:2009 HIGH LOW CLOSEApr 785.00 735.00 750.00May 765.00 750.00 750.00Jun 775.00 750.00 775.00Jul 800.00 735.00 750.00Aug 780.00 750.00 770.00Sep 780.00 760.00 760.00Oct 760.00 710.00 750.00Nov 790.00 735.00 750.00Dec 800.00 735.00 770.002010Jan 775.00 740.00 750.00Feb 800.00 750.00 785.00Mar 790.00 750.00 770.00High and low sale prices for each quarter are as follows:A) April 01, 2009 - March 31, 2010Period High Low CloseFirst Quarter P/ 775.00 P/ 745.00 P/ 758.33Second “ 786.67 748.33 760.00Third “ 783.33 726.67 756.67Fourth “ 783.33 746.67 768.33

- 14 -B) April 01, 2008 - March 31, 2009Period High Low CloseFirst Quarter P/ 973.33 P/ 916.67 P/ 973.33695.24 654.76 695.24 (Adjusted)Second “ 1,263.33 876.67 1,023.33902.38 697.62 807.14 (Adjusted)Third “ 683.33 573.33 610.00Fourth “ 700.00 630.00 678.33The number of shareholders on record as of March 31, 2010 was One Thousand Four HundredTwenty-Eight (1,428). Common shares issued and outstanding were 9,808,448.20 TOP FEU STOCKHOLDERS AS OF MARCH 31, 2009Title of ClassName of Beneficial OwnerNo. of Sharesand Nature ofBeneficialOwnershipCitizenshipPercentOf Class1. Common Seyrel Investment and2,807,835 – D Filipino 28.6267Realty Corporation2. Common Sysmart Corporation 2,076,839 – D Filipino 21.<strong>17</strong>403. Common Desrey, Incorporated 784,800 – D Filipino 8.00134. Common Angelina D. Palanca 314,538 – D Filipino 3.20685. Common Sr. Victorina D. Palanca 220,000 – D Filipino 2.24306. Common ICM Sisters Phil. Mission Board, 215,000 – D Filipino 2.1920Inc.7. Common Aurelio R. Montinola III 164,099 – D Filipino 1.67308. Common PCD Nominee Corporation 162,377 – D Filipino 1.6555(Filiipno)9. Common Marco P. Gutang 125,081 – D Filipino 1.275210. Common Gonzaga-Lopez Enterprises, Inc 120,136 – D Filipino 1.224811. Common Jomibel Agricultural106,479 – D Filipino 1.0856Development Corporation12. Common Lourdes R. Montinola 94,588 – D Filipino 0.964413. Common AMON Trading Corporation 62,043 – D Filipino 0.632514. Common ZARE, Inc. 49,620 – D Filipino 0.505915. Common Rosario P. Melchor 48,228 – D Filipino 0.49<strong>17</strong>16. Common Rosario Panganiban Melchor 43,782 – D Filipino 0.4464<strong>17</strong>. Common Mitos Sison 40,366 – D Filipino 0.411518. Common Consorcia P. Reyes 39,337 – D Filipino 0.401019. Common Caridad I. Santos 33,303 – D Filipino 0.339520. Common Francisca S. Monzon 33,131 – D Filipino 0.3378

- 15 -Item 6.Management’s Discussion and Analysis or Plan of OperationFinancial Position :As of March 31, 2007, total assets reached P2,701.2 million which was 20.62% higherthan the previous year’s P2,239.5 million. Total liabilities amounted to P389.3 million whichwas 6.08% higher than the previous year’s P367.0 million. Equity amounted to P2,311.9 millionwhich was 23.46% higher than the previous year’s P1,872.5 million. Current ratio was 4.68:1and debt was <strong>17</strong>% of equity.As of March 31, 2008, total assets amounted to P3,157.3 million which was 16.89%higher than the previous year’s P2,701.2 million. Total liabilities amounted to P572.1 millionwhich was 46.96% higher than the previous year’s P389.3million. Equity amounted to P2,585.2million which was 11.82% higher than the previous year’s P2,311.9 million. Current ratio was3.9:1 and debt was 22% of equity.As of March 31, 2009 total assets amounted to P3,447.3 million. Total liabilitiesamounted to P558.1 million while total stockholders’ equity reached P2,889.2 million.Compared to the previous year, assets and stockholders’ equity increased by 9.19% and 11.76 %respectively while liabilities decreased by 2.45%. Current ratio was 4.38:1 and debt was 19% ofequity.As of March 31, 2010, total assets amounted to P3,697.7 million which was 7.26% higherthan the previous year’s P3,447.3 million. Total liabilities amounted to P500.1 million whichwas 10.39% lower than the previous year’s P558.1 million. Equity amounted to P3,197.5million which was 10.67% higher than the previous year’s P2,889.2 million. Current ratio was4.97:1 and debt was 16% of equity.For the past four (4) years, total assets increased at an average rate of 13.49% or P364.5million a year. Total liabilities increased during the first two years but gradually decreased on thelast two years. On the average, liabilities increased at around P33.27 million a year.( I n M i l l i o n P e s o s )Total Increase (Decrease) Total Increase (Decrease)Year Assets Amount % Liabilities Amount %March 31, 2006 P2,239.5 P367.0March 31, 2007 2,701.2 P461.7 20.62% 389.3 P 22.3 6.08%March 31, 2008 3,157.3 456.1 16.89% 572.1 182.8 46.96%March 31, 2009 3,447.3 290.0 9.19% 558.1 (14.0) (2.45%)March 31, 2010 3,697.7 250.4 7.26% 500.1 (58.0) (10.39%)Four year average 364.55 33.27

As a result and based on the above figures, around 55.75% of each year’s net income hasbeen retained by the company, thus, the steady increase in owners’ equity as follows:( I n M i l l i o n P e s o s )IncreaseYear Owner’s Equity (Decrease) %P1,872.5March 31, 2007 2,311.9 P439.4 23.5%March 31, 2008 2,585.3 273.4 11.8%March 31, 2009 2,889.2 303.9 11.8%March 31, 2010 3,197.5 308.3 10.7%As of March 31, 2010, owner’s equity accounts for 86.47% of total assets. Since 67.2%of the company’s total assets is current, the company can pay all its liabilities and still have53.67% current assets and 32.8% non-current assets. In pesos, this would mean P1,984.40million current assets and P1,213.2 million non-current assets after paying all liabilitiesamounting to P500.1 million as of March 31, 2010.In Million %Owners’ Equity P3,197.5 86.47%Total Assets 3,697.7 100%Non-Current Assets 1,213.2 32.8%Current Assets 2,484.5 67.2%Total Liabilities 500.1 13.52%Current Assets after Total Liabilities 1,984.4 53.67%Results of OperationsFor the year 2006-2007, net income for the period was P603.5 million which was 6.1%higher than the previous year’s P568.9 million. This year’s figure consisted of 80.2% operatingprofit and 19.8% other income. Operating profit increased by P35.1 million and other income byP.89 million. As a result, net income after tax for the year increased by P34.6 million.For the year 2007-2008, net income for the period amounted to P592.9 million which was1.8% lower than the previous year’s P603.5 million. This year’s figure consisted of 78%operating profit and 22% other income. Operating profit decreased by P21.0 million while otherincome increased by P15.5 million. The combined effect resulted in a decrease in net incomeafter tax by P10.6 million.

For the year 2008-2009, net income for the period amounted to P567.0 million which was4.4% lower than the previous year’s P592.9 million. This year’s figure consisted of 74.7%operating profit and 25.3% other income. Operating profit decreased by P39.8 million whileother income increased by P13.3 million. As a result, net income after tax decreased by P25.9million.For the year 2009-2010, net income for the period amounted to P585.2 million which was3.2% higher than the previous year’s P567.0 million. This year’s figure consisted of 74.1%operating profit and 25.9% other income. Operating profit increased by P10.7 million whileother income increased by P9.02 million. As a result, net income after tax increased by P18.2million.The company’s operating profit which is largely dependent on enrollment, was up in2006-2007 when enrollment was still at the 26,000 level but went down in 2007-2008, 2008-2009 and 2009-2010 when enrollment dropped to 23,000.Enrollment Average tuition fee Operating ProfitPeriod Covered (1 st semester) rate per unit (in million Pesos)2006 - 2007 26,229 P 976.00 P540.62007 - 2008 23,928 1,043.00 519.62008 - 2009 23,291 1,100.00 479.82009 - 2010 22,885 1,155.00 490.5Other income consists largely of investment income. During the past four years, investmentincome accounted for 71.8% of the total other income. Rental income was also a factor. Itaccounted for 18.0% of such other income.Period Finance IncomeCovered Net of Finance Cost Rental Miscellaneous Total2006 – 2007 P110.4 P23.1 P - P133.52007 – 2008 101.7 25.5 21.9 149.12008 – 2009 120.7 22.9 18.8 162.42009 – 2010 110.0 39.2 22.2 <strong>17</strong>1.4442.8 110.7 62.9 616.4Four year average 110.7 27.7 15.7 154.1Percentage 71.8% 18.0% 10.2% 100%

A Look of What Lies AheadDuring the past four years, the first semester enrollment decreased from 26,229 in 2006-2007 to 22,885 in 2009-2010. However, in the second semester, the actual drop in enrollmentfrom that of the first semester was better at 5.82% compared to the usual 10% decrease.1 st Semester 2 nd Semester IncreaseYear Enrollment Enrollment (Decrease) %2006 – 2007 26,229 24,510 (1,719) (6.55%)2007 – 2008 23,928 22,510 (1,392) (5.82%)2008 – 2009 23,291 21,744 (1,547) (6.64%)2009 – 2010 22,885 21,908 ( 977) (4.27%)Four-year average : (1,409) (5.82%)For the school year 2010-2011, the first semester enrollment increased by 1,748 studentsor 7.63% better than the previous year’s 22,885. The increase in enrollment is attributed to ourimproved facilities and new course offerings. Our newly-opened branch in Makati brought in192 students. We expect the branch enrollment to be much bigger in the succeeding years.During the past four years, our tuition rates also increased at an average of 5.5% a year.For 2010-2011, our approved tuition fee increase is only 3.5%. While the current increase in rateis relatively lower than the average 5.5%, this year’s 7.6% increase in enrollment willcompensate for the lower rate increase. With the proper management of resources, we expectthat operating profit will again improve this year.With the company’s total current assets amounting to P1,984.4 million and non-currentassets amounting to P1,213.1 million (net of all liabilities) as of March 31, 2010 and with theexpected net income, the company does not foresee any cash flow or liquidity problem in thenext 12 months. The company shall easily meet all its commitments including those forimprovements in instructional and other facilities from its present reserves and from expectedfuture earnings.For the year’s ahead, management is committed to uplift academic standards even more.This will be done through continuously updating curricula, strengthening faculty, improvingservices to students and providing the best educational facilities. With an additional campus andwith sustained improvement in all fronts, plus a reasonable tuition fee hike, the <strong>University</strong> isconfident that it will increase its market share in the industry.

Top Five (5) Key Performance IndicatorsI. Test of LiquidityLiquidity refers to the company’s ability to pay its short-term current liabilities asthey fall due. This is measured by any of the following:1. Current ratio measures the number of times that the current liabilities could bepaid with the available current assets (Adequate: at least 1.5:1)March 31, 2007 4.68:1March 31, 2008 3.90:1March 31, 2009 4.38:1March 31, 2010 4.97:12. Quick ratio measures the number of times that the current liabilities could bepaid with the available quick assets (Adequate: at least 1:1)II. Test of SolvencyMarch 31, 2007 4.44:1March 31, 2008 3.67:1March 31, 2009 4.21:1March 31, 2010 4.70:1Solvency refers to the company’s ability to pay all its debts whether such liabilitiesare current or non-current. It is somewhat similar to liquidity, except that solvencyinvolves a longer time horizon. This is measured by any of the following:1. Debt to equity ratio measures the amount of assets provided by the creditorsrelative to that provided by the owner (Adequate : 100% or less)March 31, 2007 <strong>17</strong>%March 31, 2008 22%March 31, 2009 19%March 31, 2010 16%2. Debt to asset ratio measures the amount of assets provided by the creditorsrelative to the total amount of assets of the company. (Adequate: 50% or less)March 31, 2007 14%March 31, 2008 18%March 31, 2009 16%March 31, 2010 14%

3. Equity to asset ratio measures the amount of assets provided by the ownerrelative to the total assets of the company (Adequate: 50% or more)March 31, 2007 86%March 31, 2008 82%March 31, 2009 84%March 31, 2010 86%III. Test of ProfitabilityProfitability refers to the company’s earning capacity. It also refers to the company’sability to earn a reasonable amount of income in relation to its total investment. It ismeasured by any of the following:1. Return on total assets measures how well management has used its assetsunder its control to generate income (Adequate: at least equal to theprevailing industry rate).March 31, 2007 22%March 31, 2008 19%March 31, 2009 16%March 31, 2010 16%2. Return on owner’s equity measures how much was earned on the owners’or stockholders’ investment. (Adequate: at least equal to the prevailingindustry rate).March 31, 2007 26%March 31, 2008 23%March 31, 2009 20%March 31, 2010 18%3. Earnings per share measures the net income per share.March 31, 2007 103.37March 31, 2008 84.62March 31, 2009 67.44March 31, 2010 59.66

IV.Product Standard1. Teaching performance in the <strong>University</strong> is constantly being monitored tomaintain a satisfactory level of excellence.Teaching Excellence % toTotalYear Awardees Teaching force2005-2006 581 53%2006-2007 412 37%2007-2008 430 38%2008-2009 377 34%2. The <strong>Philippine</strong> Association of Colleges and Universities Commission onAccreditation (PACUCOA) has granted Certificates of Level III ReaccreditedStatus to our BSBA and Liberal Arts Programs. It has also grantedLevel II Re-accredited Status to our Elementary and Secondary EducationPrograms.The <strong>Philippine</strong> Accreditating Association of Schools, Colleges andUniversities (PAASCU), also issued a certificate of accreditation (Level II) tothe <strong>University</strong>’s Nursing Program.3. Performance of FEU graduates in their respective Board Exams is generallybetter than the national passing rate:FEUPassing RateNationalPassing RateArchitecture, June 2009 35% 37%Architecture, January 2010 39% 50%Bar Exam., 2009 37% 25%CPA, October 2009 67% 42%CPA, May 2010 42% 40%LET (Elem.), October 2009 56% 20%LET (Secondary), October 2009 31% 28%Nursing, June 2009 79% 42%

V. Market AcceptabilityBelow is a comparative schedule of first semester enrollment for the past 4 years:SYEnrollment2007-2008 23,9282008-2009 23,2912009-2010 22,8852010-2011 24,633It was estimated that the first semester enrollment for SY 2010-2011 would be4.2% higher compared to the previous year. Final figure was better with anincrease of 7.63%. All institutes, except for the Institute of Nursing, had a betterenrollment.The number of valedictorians, salutatorians and entrance merit scholars (833 in2007-2008, 798 in 2008-2009 and 663 in 2009-2010) during the past three schoolyears is an indication that FEU is one of the better choices among the variouscolleges and universities in the metropolis.Facts( I n M i l l i o n P e s o s )March 31, 2007 March 31, 2008 March 31, 2009 March 31, 2010Quick Assets 1,729.0 2,101.0 2,348.2 2,349.7Current Assets 1,820.1 2,228.7 2,443.9 2,484.5Total Assets 2,701.2 3,157.3 3,447.3 3,697.7Current Liabilities 389.3 572.1 558.1 500.2Total Liabilities 389.3 572.1 558.1 500.2<strong>Stock</strong>holder's Equity 2,311.9 2,585.2 2,889.2 3,197.5Operating Profit 540.6 519.6 479.8 490.5Other Income 133.5 149.1 162.4 <strong>17</strong>1.4Profit Before Tax 674.1 668.7 642.2 661.9Net Profit or Profit After Tax 603.5 592.9 567.0 585.2Total Outstanding shares (average) 5,838,440 shares 7,006,368 shares 8,407,408 shares 9,808,448 shares

<strong>Form</strong>ulaA. Liquidity1. Current ratio = Current assetsCurrent Liabilities2. Acid test ratio = Quick assetsCurrent LiabilitiesB. Solvency1. Debt to Equity ratio = Total liabilitiesTotal <strong>Stock</strong>holder's Equity2. Debt to Asset ratio = Total liabilitiesTotal assets3. Equity to Asset ratio = Total <strong>Stock</strong>holder's EquityTotal assetsC. Profitability1. Return on Assets = Net ProfitTotal assets2. Return on Owner's Equity = Net ProfitTotal <strong>Stock</strong>holder's Equity3. Earning per share = Net ProfitTotal Outstanding shares (average)

- 16 -FAR EASTERN UNIVERSITYSCHEDULE OF PROPERTY, PLANT & EQUIPMENT/INVESTMENT PROPERTYSCHOOL YEAR 2009 - 2010Gross Book ValueAccumulatedDepreciation Net Book Value Location ConditionI. PROPERTY, PLANT & EQUIPMENT:-L A N D 98,457,565.00 - 98,457,565.00 Manila Very GoodBUILDINGS & LAND IMPROVEMENTSNew Technology Building II 282,459,780.00 55,847,469.00 226,612,311.00 " "Alfredo Reyes Hall 115,965,314.00 29,020,575.00 86,944,739.00 " "Leasehold Improvement 107,721,258.00 18,647,599.00 89,073,659.00 " "New Technology Building-Idle Hosp. Bldg. 9,182,068.00 536,096.00 8,645,972.00 " "Science Building 101,387,260.00 16,102,659.00 85,284,601.00 " "Arts Building 21,095,350.00 6,058,121.00 15,037,229.00 " "Nicanor Reyes Hall 45,025,597.00 4,377,102.00 40,648,495.00 " "GEC & Educational Hall - - - " "Grade school - - - " "S B Covered Walk 6<strong>17</strong>,737.00 525,076.00 92,661.00 " "Covered Passage 3,202,126.00 592,700.00 2,609,426.00 " "Fence 715,360.00 546,657.00 168,703.00 " "Campus Pavilion 1,661,650.00 309,988.00 1,351,662.00 " "GSB Covered Walk 310,000.00 263,499.00 46,501.00 " "Powerhouse 296,196.00 296,196.00 - " "Chapel 708,691.00 - 708,691.00 " "Others 9,613,894.00 857,028.00 8,756,866.00 " "Grandstand 1,423,704.00 49,263.00 1,374,441.00 " "701,385,985.00 134,030,028.00 567,355,957.00EQUIPMENTSFurnitures & Fixtures 16,995,976.00 11,739,849.00 5,256,127.00 " "Electrical & Mechanical 64,765,492.00 54,561,591.00 10,203,901.00 " "Information Technology 29,995,180.00 23,221,336.00 6,773,844.00 " "Transportation Equipment 11,857,241.00 8,496,527.00 3,360,714.00 " "Miscellaneous Fixed Assets 10,645,124.00 10,645,124.00 - " "Instruments & Utensils 565,999.00 349,528.00 216,471.00 " "T o o l s 1,<strong>17</strong>7,842.00 820,838.00 357,004.00 " "Linen 299,914.00 299,914.00 - " "Museum Collection 5,519,573.00 - 5,519,573.00 " "141,822,341.00 110,134,707.00 31,687,634.00TOTAL 941,665,891.00 244,164,735.00 697,501,156.00II. INVESTMENT PROPERTY:LAND 53,394,726.00 - 53,394,726.00 " "COLLEGE OF ENGINEERING BUILDING 207,626,479.00 76,547,067.00 131,079,412.00 " "TOTAL 261,021,205.00 76,547,067.00 184,474,138.00GRAND TOTAL 1,202,687,096.00 320,711,802.00 881,975,294.00

FAR EASTERN UNIVERSITY, INC. AND SUBSIDIARIESAMOUNTS RECEIVABLE FROM DIRECTORS, OFFICERS,EMPLOYEES, RELATED PARTIES, AND PRINCIPAL STOCKHOLDERS (OTHER THAN AFFILIATES)FOR THE YEAR ENDED MARCH 31, 2010- <strong>17</strong> -Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentEndingAbellera, Evelyn C. 302.23 302.23 302.23Acab, Deborah A. 10,400.00 10,400.00 10,400.00Acosta, Venina Corazon S. 418.97 418.97 418.97Adolfo, Marlon (3,560.00) (3,560.00) (3,560.00)Africa, Dickenson Y. 200.00 200.00 200.00Agdalpen, Renato C. 2,000.00 2,000.00 2,000.00Agluba, Noreen 63.00 63.00 63.00Agorilla, Delia 660.00 660.00 660.00Albino, Maulynn 207.50 207.50 207.50Albiva, Merlyn T. 1,464.00 1,464.00 1,464.00Alcaraz, Nellie T. 8,200.00 8,200.00 8,200.00Alcazar, Nina Aiza 415.50 415.50 415.50Alfaro, Jennylyn G. (3,835.00) (3,835.00) (3,835.00)Alibania, Hazel J. 1,000.00 1,000.00 1,000.00Alo, James 600.00 600.00 600.00Alolor, Jacqueline G. (873.00) (873.00) (873.00)Amacan, Normita C. (6.45) 3,757.55 (3,764.00) (3,764.00)Amlog, Jocelyn A. 45,000.00 45,000.00 45,000.00Ampatin, Estrella V. 26,005.00 26,005.00 26,005.00Anastacio, Nanette V. (3,309.80) (3,309.80) (3,309.80)Anastacio, Teresita M. 89.74 89.74 89.74Andres, Jocelyn 90.00 90.00 90.00Anido, Cecilia I. 70,422.99 221,077.16 (150,654.<strong>17</strong>) (150,654.<strong>17</strong>)An Lim, Jaime L. (1,455.72) (1,455.72) (1,455.72)Arabia, Julieta S. (1,900.00) (1,900.00) (1,900.00)Aragon, Lloyd Jeffrey 5,000.00 5,000.00 5,000.00Arbizo, Maria Sophia 3,695.57 3,695.57 3,695.57Arejola, Romeo 200.00 200.00 200.00Arquiza, Glenda S. (9,845.50) (9,845.50) (9,845.50)Arribe, Emma B. 245.00 245.00 245.00Asilo, Ma. Cecilia 50.00 50.00 50.00Ataat, Jose 200.00 200.00 200.00Atanque, Aurora L. (2,288.82) (2,288.82) (2,288.82)Austria, Ryan 5,000.00 5,000.00 5,000.00Ayson, Rosalino P., Jr. 14,345.00 14,376.00 (31.00) (31.00)Azor, Helen A. (1,528.<strong>17</strong>) (1,528.<strong>17</strong>) (1,528.<strong>17</strong>)Azucena, Cesario 1,339.20 1,339.20 1,339.20Baconawa, Ma. Dorina M. 79.<strong>17</strong> 79.<strong>17</strong> 79.<strong>17</strong>Badiable, Charisma Mae 5,000.00 5,000.00 5,000.00Baello, Christine N. (137.50) (137.50) (137.50)Balaoro, Maria Theresa (200.00) (200.00) (200.00)Balaria, Dalmacio P. 7,500.00 7,500.00 7,500.00Bambico, Elma 311.00 311.00 311.00Banal, Enrico R. (22,<strong>17</strong>1.50) (22,<strong>17</strong>1.50) (22,<strong>17</strong>1.50)Barcellano, Francis (4,595.00) (4,595.00) (4,595.00)Barcelona, Samson V. 200.00 200.00 200.00Bartolome, Liezl DM. (58.00) (58.00) (58.00)Batungbakal, Marisa <strong>17</strong>.50 <strong>17</strong>.50 <strong>17</strong>.50Bautista, Andres D. 3,000.00 3,000.00 3,000.00Bautista, Arlene Mae DG. 1,027.00 1,027.00 1,027.00Bayan, Zenaida E. 585.50 585.50 585.50Belardo, Ma. Jeanette 1,794.53 1,794.53 1,794.53Belleza, Asuncion L. (12,289.47) (12,289.47) (12,289.47)

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentBeltran, Charity J. <strong>17</strong>5.00 <strong>17</strong>5.00 <strong>17</strong>5.00Belza, Mercedes A. 7,060.00 7,060.00 7,060.00Bonaobra, Salvador B. (750.00) (750.00) (750.00)Brawner, Dalisay G. 40.00 40.00 40.00Briones, Domingo J. 10,079.00 120.90 9,958.10 9,958.10Brocal, Cynthia M. 24.00 24.00 24.00Buenaventura, Alexander V. 7,060.00 7,060.00 7,060.00Buenaventura, Olga C. 27,213.00 27,213.00 27,213.00Buenavida, Amelia 165.00 165.00 165.00Bueno, Marivic 10,000.00 10,000.00 10,000.00Bulanhagui, Nida B. 620.00 620.00 620.00Bustamante, Ma. Christine H. 8,600.00 8,600.00 8,600.00Caagbay, Elpidio Z. (5,305.00) (5,305.00) (5,305.00)Cabaltica, Leilani A. 4,210.55 4,210.55 4,210.55Cabantac, Ricardo R. 7,060.00 7,060.00 7,060.00Cadorna, Rosemarie S. 656.20 656.20 656.20Cagadas, Ruly 200.00 200.00 200.00Cajucom, Mary Grace A. 440.00 440.00 440.00Calizar, Dexter A. 3,126.10 3,126.10 3,126.10Camacho, Joseph C. 600.00 600.00 600.00Cando, Cromwell N. 1,248.00 1,248.00 1,248.00Canilao, Fe V. 359,792.04 280,069.32 79,722.72 79,722.72Cao, Marilou F. (4,867.00) (4,867.00) (4,867.00)Capacio, Glenn (7,300.00) (7,300.00) (7,300.00)Caramanza, Edward M. 9,000.00 9,000.00 9,000.00Cardona, Enrico 200.00 200.00 200.00Cariquitan, Daisy 308.00 308.00 308.00Carpio, Miguel M. (13,086.34) (13,086.34) (13,086.34)Castanas, Baby Theress 82.50 82.50 82.50Castro, Joeven R, 4,555.00 4,555.00 4,555.00Cauba, Harvey A. 4,364.78 716.88 3,647.90 3,647.90Cecilio, Ma. Elaine 3,795.89 3,795.89 3,795.89Cerrer, Redentor A. 200.00 200.00 200.00Chan, Jeffrei Allan (6,927.00) (6,927.00) (6,927.00)Chu, Connie 195.20 195.20 195.20Chua, Ryan Gilbert 5,000.00 5,000.00 5,000.00Clemente, Luisa DC. 3,615.90 2,600.90 1,015.00 1,015.00Codinera, Virgilio B. 79.72 79.72 79.72Cometa, Ma. Victoria D. (7,775.00) (7,775.00) (7,775.00)Concepcion, Gerald G. 250.00 250.00 250.00Concha, Jhonalyn M. 10,900.00 10,900.00 10,900.00Cordero, Nelma 1,195.00 1,195.00 1,195.00Cruz, Anita B. 25,000.00 25,000.00 25,000.00Cruz, Anna Lisa D. (944.00) (944.00) (944.00)Cruz, Christybel O. 928.75 928.75 928.75Cruz, Eloisa G. 3,362.50 3,362.50 3,362.50Cruz, Janet R. 200.00 200.00 200.00Cruz, John Ross R. (4,500.00) (4,500.00) (4,500.00)Cruz, Jose Noel 200.00 200.00 200.00Cruz, Maricar 5,000.00 5,000.00 5,000.00Cruz, Maritess 9.16 9.16 9.16Cruz, Precita P. (1,400.00) (1,400.00) (1,400.00)Cruz, Reynaldo J. 934.05 934.05 934.05Cruz, Rosalie dela 6.68 6.68 6.68Cruz, Sandra Lyn D. 523.01 523.01 523.01Culala, Harold John D. (5,835.00) (5,835.00) (5,835.00)Cunanan, Fernando M. 3,309.80 2,284.77 1,025.03 1,025.03Custodio, Joselito 50.00 50.00 50.00Dado, Rorylyn H. (1,000.00) (1,000.00) (1,000.00)Dapla, Walter 3,851.29 3,851.29 3,851.29Davalos, Zenaida R. (499.20) (499.20) (499.20)Ending

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentDeatras, Jeffrey (2,861.29) (2,861.29) (2,861.29)Delloro, Evelyn 748.00 748.00 748.00Demagante, Rey Francis G. 50.00 50.00 50.00Destura, Blanca 224.56 224.56 224.56Diaz, Aeneas Eli (10,000.00) (10,000.00) (10,000.00)Dingding, Quintin P. 70.00 70.00 70.00Dino, Kristopher 400.00 400.00 400.00Dizon, Mercy G. (800.00) (800.00) (800.00)Doria, Jeanette V. (260.00) (260.00) (260.00)Duena, Teodoro C., Jr. (6,000.00) (6,000.00) (6,000.00)Dulay, Sofronio C. (10,636.95) (10,636.95) (10,636.95)Dumadag, Norma M. 27,015.20 25,798.20 1,2<strong>17</strong>.00 1,2<strong>17</strong>.00Dumas, Marvin C. 150.00 150.00 150.00Dumdumaya, Myline Marie P. (1,200.00) (1,200.00) (1,200.00)Duque, Ronald 50.00 50.00 50.00Echauz, Lydia B. (20,362.80) (20,362.80) (20,362.80)Elman, Mario B. (1,800.00) (1,800.00) (1,800.00)Enriquez, Emiliana 50.00 50.00 50.00Escosia, Aurora A. 23,699.77 23,699.77 23,699.77Eser, Myline S. 33,035.86 33,035.86 33,035.86Espino, Kristine 112.00 112.00 112.00Espinosa, William V. 6,431.00 6,431.00 6,431.00Esquibel, Elizabeth 5,000.00 5,000.00 5,000.00Estabillo, Ma. Luz 529.50 529.50 529.50Estacio, Ma. Vivian G. (1,625.01) (1,625.01) (1,625.01)Esteban, Alejandro L. 5,000.00 5,000.00 5,000.00Estonanto, Mark Ronald L. 374.85 374.85 374.85Estonanto, Mavi Issel L. 32,221.65 32,221.65 32,221.65Estrella, Gloria 1,460.37 1,460.37 1,460.37Estrella, Luisito P. (300.00) (300.00) (300.00)Fabito, Evelyn 2,163.00 2,163.00 2,163.00Fabros, Marietta 5,295.67 5,295.67 5,295.67Federigan, Melissa 946.25 946.25 946.25Felizardo, Dante A. 10,000.00 10,000.00 10,000.00Feraren, Mitchell 50.00 50.00 50.00Fernandez, Benedict T. III (4,400.00) (4,400.00) (4,400.00)Fernandez, Dante Roel 699.00 699.00 699.00Fernando, Gerry V. 967.00 967.00 967.00Fesalbon, Hermond F. 7,729.34 7,729.34 7,729.34FEU Consumer's Coop. 3,295.85 3,295.85 3,295.85FEU Credit Union 1,560.92 1,560.92 1,560.92Fiesta, Erlinda P. 8,532.50 8,532.50 8,532.50Figer, Reggy C. 24,300.00 24,300.00 24,300.00Flojo, Flordeliza 168.50 168.50 168.50Flores, Hanonica S. 50.00 50.00 50.00Flores, Miguela T. (102.50) (102.50) (102.50)Flores, Roberto C. (32,250.00) (32,250.00) (32,250.00)Florida, Ma. Corazon M. (1,800.00) (1,800.00) (1,800.00)Foe, Jonathan 100.00 100.00 100.00Frades, Francisca B. (130.00) 347.85 (477.85) (477.85)Frias, Wilmer 5,000.00 5,000.00 5,000.00Fuentes, Ma. Leda J. 7,060.00 7,060.00 7,060.00Galiza, Miguela S. 45,000.00 45,000.00 45,000.00Gallardo, John 13,000.40 13,000.40 13,000.40Garcia, Dolores A. 50,000.00 50,000.00 50,000.00Garcia, Earl Jimson R. 6,000.00 6,000.00 6,000.00Garcia, Lourdes C. 16.41 16.41 16.41Garcia, Muriel B. (6,500.00) (6,500.00) (6,500.00)Garcia, Mylene M. 10,000.00 10,000.00 10,000.00Garcia, Severino M. 330,762.36 236,201.52 94,560.84 94,560.84Garin, May C. 25,000.00 15,000.00 10,000.00 10,000.00Ending

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentGenota, Jaime F. 822.32 822.32 822.32Gil, Aurora H. - PMSI 7,060.00 7,060.00 7,060.00Go-Monilla, Ma. Joycelyn A. 280.31 280.31 280.31Gonzaga, Jemabel 505.00 505.00 505.00Gonzales, Fortune N. 397.50 397.50 397.50Gubio, James B. (6,000.00) (6,000.00) (6,000.00)Guevarra, Remedios P. 4,297.00 4,297.00 4,297.00Gupit, Dolores S. (26,896.39) (26,896.39) (26,896.39)Gutang, Marco P. (2,353.33) (2,353.33) (2,353.33)Guzman, Jericho D. 8,460.00 8,460.00 8,460.00Guzman, Jimmy 150.00 150.00 150.00Hernandez, Alma R. (1,337.50) (1,337.50) (1,337.50)Hernandez, Angeline A. 7,491.70 816.<strong>17</strong> 6,675.53 6,675.53Hilario, Jacqueline E. 662.50 662.50 662.50Hore, Lelioso G. 300.00 300.00 300.00Ibasco, Lourdes 350.00 350.00 350.00Ignacio, Lourdes D. (350.00) (350.00) (350.00)Iguas, Jose A. (980.00) (980.00) (980.00)Imbang, Ma. Nathalie A. 3,772.50 3,772.50 3,772.50Inciong, Cherry Wyne E. 7,500.00 7,500.00 7,500.00Irabagon, Miramar 6,000.00 6,000.00 6,000.00Isidro, Rosalina B. (593.75) (593.75) (593.75)Israel, Marietta C. 5,000.00 5,000.00 5,000.00Jabile, Joel E. 50.00 50.00 50.00Javier, Anabella G. 8,162.50 8,162.50 8,162.50Jesus, Angelita SD. 0.08 0.08 0.08Jimenez, Arsenia S. 5,970.00 5,970.00 5,970.00Jimenez, Marietta 2,290.86 2,290.86 2,290.86Jonson, Joyce Lisa B. (48,424.97) (48,424.97) (48,424.97)Jose, Corazon V. 2,058.57 2,058.57 2,058.57Jose, Haidee R. (1,446.80) (1,446.80) (1,446.80)Junio, Nenitha L. 767.00 767.00 767.00Kenny, Isabel 14,000.00 14,000.00 14,000.00Lagula, Janette 1<strong>17</strong>.50 1<strong>17</strong>.50 1<strong>17</strong>.50Lamboson, Roger C. (4,000.00) (4,000.00) (4,000.00)Lantin, Rommel 1,383.31 1,383.31 1,383.31Lapastora, Milagros P. 7,406.80 5,335.00 2,071.80 2,071.80Lapuebla, Alfredo N. 2,490.00 121.60 2,368.40 2,368.40Larano, Leonora 5,848.75 5,848.75 5,848.75Larda, Edmundo D. (1,500.00) (1,500.00) (1,500.00)Laudato, Emmanuel N. (1,200.00) (1,200.00) (1,200.00)Laurente, Jaime R. 1,650.25 1,650.25 1,650.25Lauro, Jocelyn P. 10,856.00 10,856.00 10,856.00Lazaro, Ma.Teresita A. 3,205.00 3,205.00 3,205.00Legaspi, Heidi 1,000.00 1,000.00 1,000.00Leon, Emma Rose H. 16,500.00 16,500.00 16,500.00Lewis, Salome 1,147.50 1,147.50 1,147.50Liggayu, Michael 200.00 200.00 200.00Lim, Nathaniel L. 3<strong>17</strong>.00 3<strong>17</strong>.00 3<strong>17</strong>.00Lintag, Graciel A. 1,180.16 1,180.16 1,180.16Listana, Mary Rose 1,012.50 1,012.50 1,012.50Lizaso, Marcelino N. 400.00 400.00 400.00Lopez, Anastacio, Jr. L. (230.00) (230.00) (230.00)Lopez, Antonio P., Jr. 15.34 15.34 15.34Lopez, Fernando M. 250.00 250.00 250.00Lopez, Mercedita P. 252.50 252.50 252.50Loza, Luningning R. 748.00 748.00 748.00Lugtu, Blyth 5.00 5.00 5.00Macadangdang, Luzviminda (137.50) (137.50) (137.50)Macalaguing, Mateo D. Jr. 10,000.00 10,000.00 10,000.00Macaraeg, Paul 6,436.23 6,436.23 6,436.23Ending

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentMacario, Christopher 50.00 50.00 50.00Magayaga, Lea Q. (7,059.99) (7,059.99) (7,059.99)Magtoto, Eliseo 200.00 200.00 200.00Malinao, Marivic 110.00 110.00 110.00Maliwat, Herminia I. 607,752.15 206,292.60 401,459.55 401,459.55Malot, Edmund Francis 100.00 100.00 100.00Manalili, Golda P. 50.00 50.00 50.00Manansala, Paolo 81.58 81.58 81.58Mangahas, Roser Benjamin 1,397.00 1,397.00 1,397.00Manicsic, Teresa B. 84.00 84.00 84.00Manigan, Alma C. 7.61 7.61 7.61Manlapaz, Divine Grace 5,000.00 5,000.00 5,000.00Manlapaz, Victor 1,200.00 1,200.00 1,200.00Manrique, Elenita <strong>17</strong>,000.00 <strong>17</strong>,000.00 <strong>17</strong>,000.00Mazo, Flaviano S. 780.00 780.00 780.00MC Entee, Keneline M. 3,928.90 3,928.90 3,928.90Medina, Joy E. (409.52) (409.52) (409.52)Medina, Ma. Ana Karina S. 25.94 25.94 25.94Medina, Merle S. (1,075.25) (1,075.25) (1,075.25)Medrano, Rosalinda 935.50 935.50 935.50Membrot, Ezitiel R. 2,150.00 2,150.00 2,150.00Mendoza, Cecilia H. (6,186.77) (6,186.77) (6,186.77)Mendoza, Florina M. 300.00 300.00 300.00Mendoza, Jobert 10,000.00 10,000.00 10,000.00Menorca, Emmanuel S. (250.00) (250.00) (250.00)Mercado, Annabelle K. 3,758.55 3,758.55 3,758.55Miguel, Emmanuel C. 6,619.60 6,619.60 6,619.60Milarpis, Joel 4,000.00 4,000.00 4,000.00Miranda, Dennis 4,100.00 4,100.00 4,100.00Monong, Cora 6,000.00 6,000.00 6,000.00Morimonte, Bonifacio D. 500.00 500.00 500.00Mortell, Gideon 5,237.46 5,237.46 5,237.46Nagal, Glenn Z. 330,762.36 236,201.52 94,560.84 94,560.84Narval, Antonio G. 520.80 520.80 520.80Natera, Malvin G. 4,121.97 4,121.97 4,121.97Nava, Delfin D. 767.00 767.00 767.00Nicer, Joselito C. (65,500.85) (65,500.85) (65,500.85)Nietes, Raymond G. 16,689.30 16,689.30 16,689.30Ninobla, Magnolia <strong>17</strong>0.00 <strong>17</strong>0.00 <strong>17</strong>0.00Ninubla, Shiela 1,018.53 1,018.53 1,018.53Nolasco, Maria Sylva 1,775.00 1,775.00 1,775.00Noriega, Mariwilda I. (7,306.55) (7,306.55) (7,306.55)Nuestro, Sarah Joyce 10,947.97 65.74 10,882.23 10,882.23Nulla, Mila R. 21,433.75 21,433.75 21,433.75Ocampo, Wilfredo T. 1,150.00 1,150.00 1,150.00Olipas, Lorina L. 200.00 200.00 200.00Ong, Emil 4<strong>17</strong>.53 4<strong>17</strong>.53 4<strong>17</strong>.53Orjalo, Victoria G. 200.00 200.00 200.00Ortiz, Jose (4,882.00) (4,882.00) (4,882.00)Ortiz, Milixa Lourdes B. 5,000.00 5,000.00 5,000.00Oyzon, Gualberto J. 3,002.80 3,002.80 3,002.80Padilla, Maria Eleanor T. 1,430.50 1,430.50 1,430.50Pahutan, Ludivinia M. (200.00) (200.00) (200.00)Palparan, Karoline L. (900.00) (900.00) (900.00)Pamintuan, Jose Edmundo E. 100.00 100.00 100.00Pante, Ronald S. 600.00 600.00 600.00Paraiso, Lourdes Oliva C. 84,847.50 84,847.50 84,847.50Paras, Renato 50,000.00 50,000.00 50,000.00Pasag, Maribeth 315.00 315.00 315.00Pascua, Jennifer J. 40,977.91 40,977.91 40,977.91Pascual, Perfecto 350.00 350.00 350.00Ending

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentPatricio, Natividad 598.75 598.75 598.75Paz, Rosalinda Z. 8,805.00 8,805.00 8,805.00Pekson II, Enrique Arvin (43,488.12) (43,488.12) (43,488.12)Perez, Crismin 10,591.34 10,591.34 10,591.34Perez, Jose R. Jr. 52.20 52.20 52.20Pimentel, Stephanie 285.00 285.00 285.00Pineda, Rodolfo G. (149.99) (149.99) (149.99)Ponsaran, Levy C. 2,450.00 2,450.00 2,450.00Portiz, Ellen 207.50 207.50 207.50Pring, Melanie 5,000.00 5,000.00 5,000.00Publico, Hilario Q. 5,376.50 5,376.50 5,376.50Puertollano, Derek 250.00 250.00 250.00Pulmano, Zelmo 8,000.00 8,000.00 8,000.00Querijero, Glen Hilario M. 5,000.00 5,000.00 5,000.00Quiambao, Arlene 358.50 358.50 358.50Quijano, Virginia A. 7,220.00 7,220.00 7,220.00Quintanar, Janeth A. 5,366.56 5,366.56 5,366.56Quinto, Myrna P. 7,060.00 7,060.00 7,060.00Quirimit, Luzviminda 1,942.77 1,942.77 1,942.77Ragonjah, Homer Jay D. 15.00 15.00 15.00Ramon, Elizabeth A. de - PMSI 7,060.00 7,060.00 7,060.00Ramones, Rhozallino C. 5,000.00 5,000.00 5,000.00Ramos, Erlinda L. 10,000.00 10,000.00 10,000.00Ramos, Leonora A. 1,532.89 1,532.89 1,532.89Ramos, Ma. Theresa L. 853.81 853.81 853.81Rana, Aurelio Y. (3,132.92) (3,132.92) (3,132.92)Rapirap. Raquel T. 8,288.00 8,288.00 8,288.00Rasalan, Julia 772.50 772.50 772.50Remiendo, Noraliza A. 10.00 10.00 10.00Remigio, Warley 100.00 100.00 100.00Retardo, Victor C. (600.00) (600.00) (600.00)Reyes, Byron M. 200.00 200.00 200.00Reyes, Herbert D. 4,555.00 4,555.00 4,555.00Reyes, Melodia S. 6,834.00 6,834.00 6,834.00Reyes, Ruby 572.50 572.50 572.50Reymundo, Samuel 50.00 50.00 50.00Rivera, Myrna T. (1,420.25) (1,420.25) (1,420.25)Rizada, Ryan Joseph 9,159.80 9,159.80 9,159.80Ronda, Ma. Lea A. 300.00 300.00 300.00Rosa, Giovanni dela 551.63 551.63 551.63Rosario, Alma del - PMSI (7,060.00) (7,060.00) (7,060.00)Rosario, Hilario - PMSI 14,120.00 14,120.00 14,120.00Rosete, Dwight Benedict N. (500.00) (500.00) (500.00)Roxas, Ronald L. 8,000.00 8,000.00 8,000.00Rubillos, Leonardo I. (600.00) (600.00) (600.00)Ruzol, Hipolito S. 300.00 300.00 300.00Sabaupan, Sylvette G. 23,364.75 23,364.75 23,364.75Sabaybay, Jocelyn L. 666.00 666.00 666.00Saldua, Eder John (5,000.00) (5,000.00) (5,000.00)Salonga, Lea 50.00 50.00 50.00Salud, Alann M. (520.00) (520.00) (520.00)Salvacion, Dennis C. (3,000.00) (3,000.00) (3,000.00)Salvador, Esther D. 18.00 18.00 18.00San Pablo, Ma.Cecilia A. 492.25 402.25 90.00 90.00Sante, Nova C. (981.25) (981.25) (981.25)Santiago, Christopher G. 9,638.<strong>17</strong> 9,638.<strong>17</strong> 9,638.<strong>17</strong>Santiago, Edwin B. 50.00 50.00 50.00Santiago, Genine 1,130.00 362.46 767.54 767.54Santillan, Vivian M. 190.00 190.00 190.00Santos, Arwind 49,990.00 49,990.00 49,990.00Santos, Carmelita C. (1,391.64) (1,391.64) (1,391.64)Ending

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentSantos, Danilo B. 2,645.25 2,645.25 2,645.25Santos, Dinia 251.25 251.25 251.25Santos, Glecerio 200.00 200.00 200.00Santos, Mary Lord 5,000.00 5,000.00 5,000.00Santuile, Aida M. 8,000.00 8,000.00 8,000.00Sapitula, Preciosa S. 1,586.57 1,586.57 1,586.57Sarita, Larry 50.00 50.00 50.00Sarmiento, Lina Q. 5,691.62 4,753.25 938.37 938.37Sayco, Marjorie 206.50 206.50 206.50Sido, Ma. Victoria P. 125.80 125.80 125.80Sin, Glenda S. 7,060.00 7,060.00 7,060.00Sinang, Rolando R. 7,263.50 7,263.50 7,263.50Sincioco, Mary Ann 207.50 207.50 207.50Siongco, Ma. Teresita 2,000.00 2,000.00 2,000.00Sioson, Annabelle P. 60.00 60.00 60.00Sioson, Yolanda J. 57,480.00 57,480.00 57,480.00Soliman, Norma P. 7,060.00 7,060.00 7,060.00Sopoco, Anna Marie M. 1,890.00 1,890.00 1,890.00Soria, Eulegio E. 1,000.00 1,000.00 1,000.00Sta. Ana, Noemi V. 311.00 311.00 311.00Tabaloc, Edgardo U. Jr. 51.58 51.58 51.58Tabaniag, Flordeliza 63.75 63.75 63.75Tablizo, Anne Margareth 206.50 206.50 206.50Tagle, Susan M. 5,051.41 5,051.41 5,051.41Tamay, Shariff M. 5,000.00 5,000.00 5,000.00Tamayao, Olivia E. 4,996.60 4,996.60 4,996.60Tan, Carolina M. - PMSI 7,060.00 7,060.00 7,060.00Tan, Cedrick - PMSI (4,875.00) (4,875.00) (4,875.00)Tan, Derrick - PMSI 15,187.00 15,187.00 15,187.00Tan, Mary Joyce P.- PMSI 7,060.00 7,060.00 7,060.00Tan, Ryanne 1<strong>17</strong>.50 1<strong>17</strong>.50 1<strong>17</strong>.50Tapalgo, Elyn M. Jr. (2,657.50) (2,657.50) (2,657.50)Tecson, Rhenalyn 311.00 311.00 311.00Teoxon, Lucio 379.82 379.82 379.82Tibayan, Florencia C. 305.00 305.00 305.00Tiburcio, Jaime, Jr. 2,007.50 2,007.50 2,007.50Timbugan, Josefina - PMSI 7,060.00 7,060.00 7,060.00Tirazona, Renato A. 1,992.92 1,992.92 1,992.92Togado, Illumar I. 4,000.00 4,000.00 4,000.00Tomas, Eden A. 943.00 943.00 943.00Torres, Maruja T. 206.50 206.50 206.50Trinidad, Alfredo D. 329.07 329.07 329.07Trinidad, Josefina <strong>17</strong>0.00 <strong>17</strong>0.00 <strong>17</strong>0.00Tuazon, Nino M. 356.25 356.25 356.25Unidad, Kim Ryan 100.00 100.00 100.00Ureta, Peter 9,397.10 9,397.10 9,397.10Usita, Laarni P. 23,069.00 23,069.00 23,069.00Uy, Moira B. 4,000.00 4,000.00 4,000.00Uyson, Leslie Marie C. 15,372.00 6,113.92 9,258.08 9,258.08Valdez, Ferdinand 1,000.00 1,000.00 1,000.00Valdez, Gloria 1,237.50 1,237.50 1,237.50Valencia, Jean Pauline S. (5,198.00) (5,198.00) (5,198.00)Valencia, Ma. Theresa L. 530.00 530.00 530.00Valenzuela, Edwin E. 300.00 300.00 300.00Valmonte, Alejandra Monica 205.25 205.25 205.25Varilla, Edglyn G. 5,140.61 5,140.61 5,140.61Vera, Antonio 0.03 0.03 0.03Vera, Jose Rizalito c. (5,400.00) (5,400.00) (5,400.00)Vera, Sebastian (2,300.00) (2,300.00) (2,300.00)Verances, Ma. Laline V. (841.50) (841.50) (841.50)Vergara, Flocerfida - PMSI (35,220.00) (35,220.00) (35,220.00)Ending

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentVergara, Melchor - PMSI (7,060.00) (7,060.00) (7,060.00)Vergara, Oliver Francis - PMSI (7,060.00) (7,060.00) (7,060.00)Vergara, Regidor - PMSI (7,060.00) (7,060.00) (7,060.00)Vergara, Romeo - PMSI 21,180.00 21,180.00 21,180.00Verzosa, Bobby 100.00 100.00 100.00Vibar, Enrico B. 7,200.00 7,200.00 7,200.00Vicera, Desmond M. 200.00 200.00 200.00Victoria, Michael S. (640.00) (640.00) (640.00)Villaceran, Eugenio V. (18,230.98) 7,060.00 (25,290.98) (25,290.98)Villamiel, Carminda (29,288.90) (29,288.90) (29,288.90)Villanueva, Ace R. 26.98 26.98 26.98Villanueva, Jonas V. (13,073.00) (13,073.00) (13,073.00)Villanueva, Ma. Concepcion 5,000.00 5,000.00 5,000.00Villapando, Marimel A. 200.00 200.00 200.00Villar, Gerald 7,060.00 7,060.00 7,060.00Vivas, Cherry Mae 300.00 300.00 300.00Woolsey, Nida B. 278.00 278.00 278.00Yabis, Geraldine 97.50 97.50 97.50Yang, Gloria 45,000.00 45,000.00 45,000.00Yanzon, Gina 500.00 500.00 500.00Yap, Caridad P. (4,841.00) (4,841.00) (4,841.00)Yatco, Ma. Carmen S. 29,320.00 29,320.00 29,320.00Zaldivar, Ramil P. 5,000.00 5,000.00 5,000.00Zulueta, Michael R. 7,000.00 7,000.00 7,000.00FACULTY ADVANCESP 2,825,974.91 - 1,269,875.56 - 1,556,099.35 1,556,099.35Aguilos, Susan S. 2,983.13 2,983.13 2,983.13Alona, Elizabeth V. (5,295.67) (5,295.67) (5,295.67)Altares, Priscilla S. (37.62) (37.62) (37.62)Anastacio, Nanette v. (5,295.67) (5,295.67) (5,295.67)Ansano, Bela R. 11,590.42 11,590.42 11,590.42Austria, Rex S. (2,160.00) (2,160.00) (2,160.00)Avengoza, Rosalie J. (6,518.64) (6,518.64) (6,518.64)Badiola, Jose Luisito V. (0.52) (0.52) (0.52)Bautista, Mary Grace S. (5,295.67) (5,295.67) (5,295.67)Cano, Charito F. 847.27 847.27 847.27Castro, Lawrence Christopher 1,765.22 1,765.22 1,765.22Cruz, Sandra Lyn E. 44,290.05 44,290.05 44,290.05Dimalibot, Martina Geraldine Q. 1,926.98 1,926.98 1,926.98Estacio, Ma. Vivian G. 3,832.70 3,832.70 3,832.70Gariguez, Mariflor N. 10,591.34 10,591.34 10,591.34Garin, May C. 5,534.22 5,534.22 5,534.22Isip, Amando F. (1,323.91) (1,323.91) (1,323.91)Javier, Nancy Joan M. 5,295.67 5,295.67 5,295.67Jose, Franco C. (6,619.59) (6,619.59) (6,619.59)Malay, Ernesto B. 20,910.00 20,910.00 20,910.00Martinez, Zenaida S. (7,943.50) (7,943.50) (7,943.50)Minas, Geraldine C. (2,100.00) (2,100.00) (2,100.00)Narciso, Wilfrida B. 5,295.67 5,295.67 5,295.67Naui, Elizabeth S. (50.00) (50.00) (50.00)Pacot, Marilou M. (7,943.50) (7,943.50) (7,943.50)Permalino, Albert Emmanuel S. 7,060.89 7,060.89 7,060.89Sagarino, Gavino N. (5,295.67) (5,295.67) (5,295.67)Salcedo, Liezel Donatila M <strong>17</strong>,190.24 <strong>17</strong>,190.24 <strong>17</strong>,190.24Salunga, Loida P. 14,960.54 14,960.54 14,960.54Salvado, Rowena E. 22,160.26 22,160.26 22,160.26Santos, Buenvenida 3,971.75 3,971.75 3,971.75Santos, Katherine Vera A. (32.50) (32.50) (32.50)Ending

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentSantos, Melody Christian R. 3,909.51 3,909.51 3,909.51Simo, Rickson Jay (21,182.72) (21,182.72) (21,182.72)Tia, Christopher B. (0.03) (0.03) (0.03)Trinidad, Josefina M. 1,690.82 1,690.82 1,690.82Villanueva, Rosalie R. (10,591.34) (10,591.34) (10,591.34)Villegas, Ma. Marissa M. (10,591.34) (10,591.34) (10,591.34)Villorente, Elizabeth F. 1,323.91 1,323.91 1,323.91Vinluan, Renato A. 2,028.62 2,028.62 2,028.62Total P 2,916,856.23 - 1,269,875.56 P - 1,646,980.67 1,646,980.67Ampatin, Estrella V. (560.00) (560.00) (560.00)Cabasada, Albert R. III 26,099.35 26,099.35 26,099.35Caratao, Jinky Rosario 6,800.00 6,800.00 6,800.00Cruz, Reynaldo J. (5,000.00) (5,000.00) (5,000.00)Diwa, Alvin S. 31,783.91 31,783.91 31,783.91Frades, Francisca B. (451.32) (451.32) (451.32)Garin, May C. 46,130.23 46,130.23 46,130.23Molina, Mark Oliver P. (5,232.06) (5,232.06) (5,232.06)Paraiso, Lourdes Oliva 0.20 0.20 0.20Pizaro, Arthur 1,200.00 1,200.00 1,200.00Sarabia, Juliet S. 4,755.00 4,755.00 4,755.00Soria, Eulegio 1,777.00 1,777.00 1,777.00Tolentino, Rosula R. 8,646.70 8,646.70 8,646.70Villanueva, Romulo 5,212.00 5,212.00 5,212.00Villar, Gerald 20,388.77 34.30 20,354.47 20,354.47Yang, Gloria G. 11,760.00 11,760.00 11,760.00EndingTOTAL P 3,070,166.01 - 1,269,909.86 P - 1,800,256.15 1,800,256.15JANUARY 2008 - MARCH 2010Abala, GenP 155.00 P 155.00 155.00Abanco, Nini Paz M. (155.00) (155.00) (155.00)Abella, Bernard 3.88 3.88 3.88Adil, Mary Antoinette 200.00 200.00 200.00Agnes, Reynold D. 30,128.00 25,128.00 5,000.00 5,000.00Agudong, Julito A. 1,480.00 1,480.00 1,480.00Aguila, Fitzgerald 11,000.00 1,895.09 9,104.91 9,104.91Aguilar, Manuel P. 1,500.00 3,823.50 1,500.00 3,823.50 3,823.50Aguilar, Sarah Joy A. 19,650.00 19,650.00 19,650.00Agustin, Ma. Theresa A. 10,792.75 10,465.05 327.70 327.70Ahmadzadeh, Teresita 710.62 1,094.45 810.62 994.45 994.45Alagao, Ma. Cristina T. 183.68 550.00 367.01 366.67 366.67Alarde, Crispulo, Jr. 660.00 76,565.00 60,695.85 16,529.15 16,529.15Alcoberes, Philip Jay N. (1,000.00) (1,000.00) (1,000.00)Alcoriza, Jennifer M. (600.00) (600.00) (600.00)Aldeguer, Christine Carpio 4,140.00 1,780.00 2,360.00 2,360.00Alimuin, Sylvia A. 1,350.12 8,682.00 6,566.12 3,466.00 3,466.00Alvarez, Alfredo R. 20,588.20 18,961.45 1,626.75 1,626.75Andrada, Gaylene H. (733.40) 1,147.00 947.00 (533.40) (533.40)Angel, Heherson M. 3,243.00 281.25 2,961.75 2,961.75Angeles, Lemuel 600.00 100.00 500.00 500.00Anido, Cecilia I. 4,386.67 1,009,285.90 5,823.82 1,007,848.75 1,007,848.75An Lim, Jaime L. 119,500.00 88,182.00 <strong>17</strong>6,682.00 31,000.00 31,000.00Apolonio, Jerry D. 431.50 281.50 150.00 150.00

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentArabia, Julieta S. 16,629.90 92,992.80 83,336.90 26,285.80 26,285.80Arago, Teodulfo A. 2,253.40 1,<strong>17</strong>8.00 1,075.40 1,075.40Areola, Vina 7,700.00 7,700.00 7,700.00Arquiza, Glenda 73,000.00 <strong>17</strong>9,724.25 199,130.25 53,594.00 53,594.00Arriola, Eric John C. (200.00) 200.00 200.00 (200.00) (200.00)Asis, Amelia B. 5,064.50 64.50 5,000.00 5,000.00Atanacio, Heidi C. 3,467.00 3,467.00 3,467.00Atanque, Aurora L. 14,789.40 32.00 18,632.00 (3,810.60) (3,810.60)Ayson, Paulino 632.75 632.75 632.75Ayson, Rosalino P. 10,027.63 12,757.30 15,956.28 6,828.65 6,828.65Baccay, Yolanda A. 20,000.00 8,611.05 27,057.55 1,553.50 1,553.50Badiola, Jose Luisito V. 200.00 200.00 200.00Baello, Christine N. 22,271.00 18,610.65 3,660.35 3,660.35Baja, Lauro 996.25 996.25 996.25Balaoro, Maria Theresa (200.00) 100.00 100.00 (200.00) (200.00)Balarosan, Edna G. 2,193.34 28,970.00 13,314.59 <strong>17</strong>,848.75 <strong>17</strong>,848.75Balita, Paulita C. 34,708.73 46,000.00 58,921.96 21,786.77 21,786.77Bantayan, Maria Emilia R. 8,350.00 2,639.92 5,710.08 5,710.08Baquiran, Leonidez 200.00 200.00 200.00Barro, Liana M. 11,095.02 10,<strong>17</strong>5.02 920.00 920.00Barroga, Junalyn 145.00 145.00 145.00Batan, Ericson S. 1,516.60 1,516.60 1,516.60Batoon, Allen 850.00 850.00 850.00Bautista, Juan Andres 10,572.00 10.00 10,562.00 10,562.00Baylon, Milagros D. 297.50 297.00 0.50 0.50Bejo, Noel B. 4,604.50 634.50 3,970.00 3,970.00Belardo, Amy G. 1,750.00 23,665.50 1,750.00 23,665.50 23,665.50Belaya, Vina Grace C. (1,862.40) 4,412.70 2,295.90 254.40 254.40Belleza, Asuncion L. 40,811.00 93,547.74 96,900.74 37,458.00 37,458.00Bello, Yolanda L. 8,492.00 5,078.75 3,413.25 3,413.25Beltran, Edna M. 7,500.00 37,985.00 32,985.00 12,500.00 12,500.00Beltran, Manuel D. 550.00 600.00 (50.00) (50.00)Belza, Mercedes A. 14,583.80 62,089.09 64,257.91 12,414.98 12,414.98Bengo, Manuelito V. 36,653.99 32,126.84 4,527.15 4,527.15Bernado, Norma V. 13,400.90 8,702.35 4,698.55 4,698.55Bernardo, Rodrigo G. 21,412.00 6,999.00 6,999.00 21,412.00 28,411.00Bilan, Jeanette L. 1,326.18 1,326.18 1,326.18Bingculado, Roger B. 2,500.00 38,000.00 22,500.00 18,000.00 18,000.00Bisco, Melanie C. 10,000.00 10,000.00 10,000.00Bolo, Benjamin A. 69,121.09 62,454.41 6,666.68 6,666.68Botaslac, Benjamin D. 27,959.00 2,959.00 25,000.00 25,000.00Brillo, Eva B. 100,000.00 93,333.33 6,666.67 6,666.67Brillon, Cherish Aileen A. (25.00) (25.00) (25.00)Buen, Jennifer T. 6,948.00 5,029.00 1,919.00 1,919.00Buenafe, Ma. Belinda G. 1,773.76 80.01 1,693.75 1,693.75Buendia, Ma. Esperanza 20,000.00 20,000.00 20,000.00Bueno, Marivie 370.75 370.75 370.75Buot, Joseph 600.00 600.00 600.00Buquid, Apolonio A. 18,653.00 18,153.00 500.00 500.00Burac, Joseph T. 32,215.50 8,331.80 23,883.70 23,883.70Bustamante, Maria Christine H. 600.00 49,649.00 41,354.00 8,895.00 8,895.00Caagbay, Elpidio Z. 71,000.00 58,000.00 13,000.00 13,000.00Cabaltica, Leilani A. 57,386.67 145,183.50 163,721.42 38,848.75 38,848.75Cabasada, Albert R. III (12,300.00) 24.00 24.00 (12,300.00) (12,300.00)Cabilto, Gerardo P. 10,800.00 12,000.00 21,800.00 1,000.00 1,000.00Cabinta, Ma. Dolores B. 65,312.00 37,812.00 27,500.00 27,500.00Cabrera, Alicia M. 7,100.65 4,212.00 2,888.65 2,888.65Cabrera, Roberlyn V. 36,000.00 4,000.00 32,000.00 32,000.00Cada, Leonardo F. 13,650.66 12,463.76 1,186.90 1,186.90Cajucom, Cherry S. 4,386.67 14,590.00 11,327.92 7,648.75 7,648.75Cajucom, Marie Christine B. 850.00 850.00 850.00Ending

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentCamaclang, Merlita J. 6,569.62 63,534.00 46,103.62 24,000.00 24,000.00Camana, Love V. 2,675.00 27,888.25 26,775.75 3,787.50 3,787.50Campomanes, Carolina 1.00 6.00 (5.00) (5.00)Canare, Sabino C. (375.00) (375.00) (375.00)Cando, Cromwell N. 4,000.00 36,696.85 37,000.00 3,696.85 3,696.85Canilao, Fe V. 104,386.67 8,970.00 105,507.92 7,848.75 7,848.75Canosa, Michelle 20,000.00 20,000.00 20,000.00Cao, Marilou F 18,925.75 18,425.75 500.00 500.00Capacio, Glenn (5,000.00) (5,000.00) (5,000.00)Capili, Leslie Ann V. 100.00 1,920.00 (1,820.00) (1,820.00)Capili, Regina R. (418.13) 6,623.85 3,464.87 2,740.85 2,740.85Carino, Raquel G. 4,598.00 4,598.00 4,598.00Carlos, Salome S. (850.00) 498.50 498.50 (850.00) (850.00)Carpio, Miguel M. 53,124.50 204.50 52,920.00 52,920.00Carpio, Rustica 1,788.00 1,788.00 1,788.00Castillo, Carolina 24,000.00 45,937.00 34,937.00 35,000.00 35,000.00Castro, Joeven R. 5,158.79 8,970.02 6,280.06 7,848.75 7,848.75Casuco, Leonida S. (14,614.40) 35,002.50 8,002.50 12,385.60 12,385.60Cayetano, Lovella M. 6,000.00 25,000.00 29,681.81 1,318.19 1,318.19Chastein, Cherry R. 10,000.00 10,000.00 10,000.00Chua, Wilson S. 5,000.00 4,450.00 550.00 550.00Ciubal, Willie Y. 3,150.00 136.00 3,886.00 (600.00) (600.00)Corpuz, Cristina R. 650.00 150.00 500.00 500.00Cotorno, Lorine B. 13,600.00 8,800.00 4,800.00 4,800.00Cruz, Benjamin F. 25,000.00 30,000.00 (5,000.00) (5,000.00)Cruz, Christybel O. 45,000.00 40,500.00 4,500.00 4,500.00Cruz, Noel L. 20,433.91 46,956.47 66,796.13 594.25 594.25Cruz, Rebecca S. 30,992.50 992.50 30,000.00 30,000.00Cuibillas, Jorge P. 8,464.50 5,043.75 3,420.75 3,420.75Culala, Harold John D. 30,000.75 21,000.75 9,000.00 9,000.00Dacayanan, Marites G. (237.04) 5,014.50 5,014.50 (237.04) (237.04)Daguman, Ian 650.00 650.00 650.00Dalton, Juanita 6<strong>17</strong>.50 6<strong>17</strong>.50 6<strong>17</strong>.50Damasco, Charmaine Gay 1,022.00 1,639.50 (6<strong>17</strong>.50) (6<strong>17</strong>.50)Davalos, Zenaida R. 250.00 250.00 250.00David, Melvira C. (335.00) (335.00) (335.00)Decena, May Celine 272.00 272.00 272.00Defino, Lorna M. 492.00 222.00 270.00 270.00Destura, Blanca 10,749.58 74,690.25 51,638.43 33,801.40 33,801.40Diamante, Fernan M. 26,430.20 5,672.00 20,758.20 20,758.20Diaz, Joel 850.00 850.00 850.00Dimaano, Jessalyn 15,000.00 15,000.00 15,000.00Dimalibot, Ma. Martina Geraldine 200.00 200.00 200.00Diorico, Marites C. 24,487.60 15,812.50 8,675.10 8,675.10Dios, Rolando Gerald 200.00 200.00 200.00Dizon, Kenneth Earl I. 200.00 200.00 200.00Doble, Jon Derek 52,800.00 24,000.00 28,800.00 28,800.00Doctolero, Priscila L. 737.25 664.50 72.75 72.75Domingo, Ernesto E. 200.00 200.00 200.00Dominguez, Rex S. 24,339.66 39,100.00 63,439.16 0.50 0.50Dones, Irene P. 27,400.00 1,344.00 28,844.00 (100.00) (100.00)Dublin, Marietta T. 1,756.15 68.00 1,688.15 1,688.15Ducut, Mirela G. 37,164.60 30,342.20 49,398.10 18,108.70 18,108.70Dulalia, Nelson M. 1,450.00 (1,450.00) (1,450.00)Durban, Joel M. 966.60 (966.60) (966.60)Dy Kam, Felicidad 1,025.00 (1,025.00) (1,025.00)Echauz, Lydia B. 50,000.00 57,549.35 50,000.00 57,549.35 57,549.35Eleazar, Glenda C. 34,386.67 44,984.75 43,967.11 35,404.31 35,404.31Enriquez, Rex Cezar P. (200.00) 975.00 975.00 (200.00) (200.00)Ermitano, Nolivienne C. (237.50) (237.50) (237.50)Escobia, Irma L. <strong>17</strong>,500.01 16,250.01 1,250.00 1,250.00Ending

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentEscobia, Jaime T. 23,300.00 20,970.00 2,330.00 2,330.00Escosia, Aurora A. 5,869.06 28,775.75 27,096.31 7,548.50 7,548.50Esguerra, Anna Leah R. 200.00 200.00 200.00Esguerra, Marissa B.. 203.00 563.00 (360.00) (360.00)Espinosa, William V. 56,420.00 62,420.00 (6,000.00) (6,000.00)Espiritu, Elizabeth O. 1,537.34 11,868.90 4,114.70 9,291.54 9,291.54Estacio, Ma. Vivian G. 13,773.33 34,408.50 19,499.74 28,682.09 28,682.09Estrella, Luisito P. 5,700.00 <strong>17</strong>,500.00 22,400.00 800.00 800.00Evangelista, Erika <strong>17</strong>,375.00 <strong>17</strong>,375.00 <strong>17</strong>,375.00Evangelista, Rey M. 28,309.19 92,850.60 62,706.25 58,453.54 58,453.54Fajardo, Rolando 2,150.00 (2,150.00) (2,150.00)Ferareza, Rimar 250.00 250.00 250.00Fernandez, Rosana S. (2,500.00) 6,366.60 6,366.60 (2,500.00) (2,500.00)Fernando, Gerry V. 20,000.00 64,392.01 51,540.47 32,851.54 32,851.54Fernando, Rogelio E. 5,000.00 1,000.00 4,000.00 4,000.00Fiesta, Erlinda P. 55,913.20 3,000.00 52,913.20 52,913.20Flora, Dolores 10,774.33 8,388.67 2,385.66 2,385.66Flores, Floriza Ann 18,000.00 18,000.00 18,000.00Flores, Ma.Cecilia D. 100.00 100.00 100.00Flores, Miguela Trinidad 43,333.33 39,000.00 72,750.00 9,583.33 9,583.33Flores, Roberto C. 140,000.00 56,000.00 84,000.00 84,000.00Flores, Teresita T. 3,090.50 66.50 3,024.00 3,024.00Foronda, John Clarence 1,000.00 1,000.00 1,000.00Fortaleza, Ramon M. 2,011.35 2,011.35 2,011.35Frades, Francisca B. 37,482.00 38,990.25 61,022.25 15,450.00 15,450.00Fronda, Adelaida C. (1,000.00) 5,273.75 972.00 4,301.75 (1,000.00) 3,301.75Galo, Crispin L. 6,550.25 6,550.25 6,550.25Garcia, Dolores A. 100.00 100.00 100.00Garcia, Miriam 9,038.12 21,392.25 20,753.12 9,677.25 9,677.25Garcia, Mylene M. 20,035.00 18,035.00 2,000.00 2,000.00Garcia, Myllah D. 7,615.90 7,576.90 39.00 39.00Garcia, Severino M. 66,664.00 206,974.75 <strong>17</strong>3,638.75 100,000.00 100,000.00Garrido, Elma C. 5,775.45 0.50 5,774.95 5,774.95Gaspillo, Rudy M> 20,621.55 20,621.55 20,621.55Gella, Delia D. 200.00 200.00 200.00Gella, Frederick S. (2,000.10) (2,000.10) (2,000.10)Gemzon, Elena F. 3,655.33 9,145.00 4,951.58 7,848.75 7,848.75Gerardo, Elsa F. 975.00 (975.00) (975.00)Gervacio, Ma. Cristina SJ. (240.00) 5,383.00 5,383.00 (240.00) (240.00)Gilera, Enrico G. 68,315.74 100,855.50 79,<strong>17</strong>1.24 90,000.00 90,000.00Golloso, Helen E. 4,499.99 5,000.00 (500.01) (500.01)Gonzales, Emmanuel S. 629.25 629.25 629.25Gorod, Flordeliza N. 66,630.92 57,186.52 9,444.40 9,444.40Grasparil, James Andrew (1,575.00) (1,575.00) (1,575.00)Guarin, Ellen G. 400.00 400.00 400.00Gubio, James B. 2,400.00 24,702.60 14,254.20 12,848.40 12,848.40Guevarra, Dorvin H. 32,034.93 18,<strong>17</strong>1.74 13,863.19 13,863.19Guevarra, Ma. Theresa M. (425.00) 31,8<strong>17</strong>.50 28,647.80 3,169.70 (425.00) 2,744.70Guevarra, Remedios P. 50,020.00 25,020.00 25,000.00 25,000.00Gurrea, Ruby 200.00 200.00 200.00Gusi, Rechilda D. 821.40 11,134.05 4,609.90 7,345.55 7,345.55Gutierrez, Lucita A. 29,080.50 28,<strong>17</strong>2.50 908.00 908.00Guzman, Barbara Michelle 910.50 933.50 (23.00) (23.00)Guzman, Guillerma M. 31,963.00 4,963.00 27,000.00 27,000.00Guzman, Ma. Corazon A. 21,503.44 22,503.44 (1,000.00) (1,000.00)Hatt, Cielito Sanvictores 12,111.35 979.50 14,065.85 (975.00) (975.00)Hernandez, Jan Joseph S. 1,186.45 1,186.45 1,186.45Hizon, Irma L. 6,586.00 6,386.00 200.00 200.00Ibalio, Dyann A. 7,295.80 7,295.00 0.80 0.80Ignacio, Lourdes D. 30,991.57 35,000.00 50,991.57 15,000.00 15,000.00Iguas, Jose A. 11,107.70 9,486.75 15,800.05 4,794.40 4,794.40Ending

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentInciong, Cherry Wyne 477.00 7,402.00 6,699.00 1,180.00 1,180.00Indico, Julie Ann 348.50 348.50 348.50Ireneo, Elsa A. 20,000.00 20,000.00 20,000.00Isidro, Teresita L. 4,241.00 62,890.76 26,872.99 40,258.77 40,258.77Jamisod, Rafael 600.00 600.00 600.00Jamon, Romano M. 200.00 200.00 200.00Janagap, Fe Q. 52,274.90 37,921.65 14,353.25 14,353.25Jarlos, Anna Liza 3,655.33 32,070.00 12,936.58 22,788.75 22,788.75Jauco, Magdalena 7,303.10 3,182.75 4,120.35 4,120.35Javier, Mary Jacquelou 200.00 200.00 200.00Jerusalem, Violeta L. 45,737.28 118,694.50 <strong>17</strong>3,801.26 (9,369.48) (9,369.48)Jesus, Angelita SD. 4,386.67 58,964.58 45,381.25 <strong>17</strong>,970.00 <strong>17</strong>,970.00Jimenez, Arsenia S. 28,150.00 18,150.00 10,000.00 10,000.00Jintalan, Elma C. 42,290.00 34,000.00 8,290.00 8,290.00Joloya, Ma. Aura Christine 361.00 234.00 127.00 127.00Jose, Angelina P. 341,383.87 50,000.00 341,383.87 50,000.00 50,000.00Julio, Beata R. 16,897.45 1,618.50 15,278.95 15,278.95Junio, Nenitha L. 125.00 125.00 125.00Kenny Isabel 50,000.00 50,000.00 50,000.00Knuttel, Jens 7,948.30 7,948.30 7,948.30Ko, Robert H. 192.00 62.00 130.00 130.00Kuan, Robert 543,032.13 50,000.00 543,032.13 50,000.00 50,000.00Lacanilao, Gary 375.00 375.00 375.00Ladera, Renville M. (38.00) 28,136.75 23,000.00 5,098.75 5,098.75Lajara, Galilea R. 91,256.09 80,426.19 10,829.90 10,829.90Lakian, Teodosio (1,650.00) (1,650.00) (1,650.00)Lamorena, Juditha M. 42,000.00 192,012.28 167,321.10 66,691.18 66,691.18Lansang, Brenda 650.00 116,377.52 116,827.52 200.00 200.00Lapastora, Milagros 6,665.00 76,345.85 69,138.50 13,872.35 13,872.35Lauro, Jocelyn P. 9,799.00 38,297.00 39,521.88 8,574.12 8,574.12Laxamana, Rachel D. 23,380.00 21,042.00 2,338.00 2,338.00Lee, Nestor 4,386.67 1,483.25 4,6<strong>17</strong>.67 1,252.25 1,252.25Leon, Angelito Y. 53,970.00 45,000.00 8,970.00 8,970.00Leon, Emma Rose H. 3,741.00 23,674.75 41,265.75 (13,850.00) (13,850.00)Leon, Jocelyn E. 2,193.34 10,730.00 3,930.59 8,992.75 8,992.75Leonardo, Marietta 20,515.00 22,285.00 (1,770.00) (1,770.00)Leonardo, Violeta M. 135,299.50 110,299.50 25,000.00 25,000.00Lepon, Ma. Luisa M. 250.00 5,000.00 8,250.00 (3,000.00) (3,000.00)Letrero, Bernard 1,550.00 162.75 62.75 1,650.00 1,650.00Lim, Royce Randall 200.00 200.00 200.00Limon, Miguel Antonio P. 100.00 100.00 100.00Lindo, Alicia C. 15,624.00 26,947.90 37,629.95 4,941.95 4,941.95Lojo, Joanne Marie 20,000.00 20,000.00 20,000.00Lopez, Antonio C. 26,244.62 20,512.15 18,432.12 28,324.65 28,324.65Lopez, Mercedita P. 46,239.00 <strong>17</strong>,947.00 28,292.00 28,292.00Lopez, Ricardo S. 15,891.80 19,936.66 32,828.42 3,000.04 3,000.04Lopez, Ruelda A. 5,000.00 5,000.00 5,000.00Loyola, Voltaire 72.00 72.00 72.00Lumacad, Fernando B. (32,539.00) 50.33 50.33 (32,539.00) (32,488.67)Luyun, Teofilo P. Jr. 8,446.94 9,570.00 10,168.19 7,848.75 7,848.75Mabborang, Mishel T. 200.00 200.00 200.00Macalintal, Connie SJ. 6,345.01 5,000.01 1,345.00 1,345.00Macapagal, Arnualdo B. 45,950.50 240,847.74 236,788.00 50,010.24 50,010.24Macaraig, Melinda 11,755.30 8,994.50 2,760.80 2,760.80Macasaet, Grace Minerva 1,044.00 5,092.75 6,101.00 35.75 35.75Madria, Emenvenciano 650.00 650.00 650.00Magayaga, Lea Q. 1,200.00 800.00 400.00 400.00Magbuhat, Frances Ann 15,000.00 15,000.00 15,000.00Magmanlac, Mark Roland 20,000.00 20,000.00 20,000.00Mahilum, Rosalinda S. 200.00 200.00 200.00Malcampo, Agnes C. 35,085.00 25,539.56 9,545.44 9,545.44Ending

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentMaliwat, Herminia I. 112,145.31 103,224.00 110,110.37 105,258.94 105,258.94Mamaid, Melanie P. 39,684.00 39,3<strong>17</strong>.33 366.67 366.67Manalansan, Paolo F. 6,250.00 10,063.00 12,713.00 3,600.00 3,600.00Manalo, Evelyn P. 10,000.00 10,000.00 10,000.00Manalo, Marilou 15,000.00 15,000.00 15,000.00Manaois, Mario B. 2,104.20 2,104.20 2,104.20Manguerra, Laarni C. 1,000.00 5,000.00 5,000.00 1,000.00 1,000.00Marcelino, Ariel Christopher 19,669.00 <strong>17</strong>,702.10 1,966.90 1,966.90Marcelo, Gerry A. 4,386.67 8,257.00 5,473.05 7,<strong>17</strong>0.62 7,<strong>17</strong>0.62Marcial, Maridel S. 14,444.51 671.00 13,619.26 1,496.25 1,496.25Mariano, Maria Lourdes A. 9,196.00 9,196.00 9,196.00Maristela, Teresita 215.00 215.00 215.00Martin, Wilhelmina E. 2,901.25 1,406.25 1,495.00 1,495.00Mateo, Jacinto C. Jr. 35,024.25 30,024.25 5,000.00 5,000.00Mazo, Flaviano S. 9,781.77 13,326.75 10,867.50 12,241.02 12,241.02Medel, Mervin 200.00 200.00 200.00Medina, Buenaventura Jr. 1,050.00 1,050.00 1,050.00Medina, Joy E. 600.00 43,193.25 42,483.73 1,309.52 1,309.52Melchor, Elizabeth P. 1,336.50 724.50 612.00 612.00Mendoza, Cecilia H. 200.00 200.00 200.00Mendoza, Gloria A. 7,447.25 2,419.25 5,028.00 5,028.00Mendoza, Simplica A. 12,203.00 25,702.68 (13,499.68) (13,499.68)Menez, Karren G. 6,000.00 34,738.00 39,740.00 998.00 998.00Menorca, Emmanuel S. 27,642.00 13,300.76 14,341.24 14,341.24Mercado, Valerie Grace P. 30,000.00 30,000.00 30,000.00Mesina, Karen T. (4,000.00) (4,000.00) (4,000.00)Miguel, Emmanuel C. 200.00 200.00 200.00Mina, Enrique N. 293.50 200.00 93.50 93.50Minas, Geraldine C. 9,316.00 12,288.00 (2,972.00) (2,972.00)Mintu, Cynthia B. 2,110.50 1,800.00 310.50 310.50Mitra, Melvin P. 552.35 552.35 552.35Molina, Ma. Olivia G. 59,120.00 49,120.00 10,000.00 10,000.00Molina, Mark Oliver P. 4,386.67 8,970.00 5,507.92 7,848.75 7,848.75Monderin, Victor C. 2,577.00 321.50 2,255.50 2,255.50Monfero, Rowena A. 6,000.00 36,149.75 38,404.00 3,745.75 3,745.75Montano, Moses M. 941.67 941.67 941.67Montinola, Aurelio R. III 274,838.73 50,000.00 274,838.73 50,000.00 50,000.00Montinola, Gianna R. 387,795.94 50,000.00 387,795.94 50,000.00 50,000.00Montinola, Lourdes R. 1,800,488.76 50,000.00 1,800,488.76 50,000.00 50,000.00Morilla, Toriana A. 850.00 850.00 850.00Mostajo, Esmeralda D. 12,000.00 53,998.00 55,438.75 10,559.25 10,559.25Nagal, Glenn Z. 0.33 200,000.00 198,000.66 1,999.67 1,999.67Nagtalon, Leo Angelo 640.00 640.00 640.00Najjar, Mary Chastine T. 3,130.80 33,752.90 27,364.40 9,519.30 9,519.30Naui, Elizabeth S. (93.75) 272.00 272.00 (93.75) (93.75)Navarro, Lilibeth C. 200.00 200.00 200.00Nebril, Jonathan A. 5,000.00 2,025.00 2,118.00 4,907.00 4,907.00Nicdao, Lazaro B. 8,758.80 1,114.70 8,762.80 1,110.70 1,110.70Nicer, Joselito C. 22,272.72 61,754.50 55,608.72 28,418.50 28,418.50Nicolas, Crispinita 190.00 190.00 190.00Nob, Rene M. (1,800.00) (1,800.00) (1,800.00)Norcio, Glen R. 644.00 744.00 (100.00) (100.00)Noriega, Mariwilda 11,616.76 40,448.13 28,733.16 23,331.73 23,331.73Nuestro, Sarah A. 150.00 150.00 150.00Nulla, Mila R. 43,857.00 118,933.95 98,974.00 63,816.95 63,816.95Oaferina, Gemmalyn A. (1,000.04) 9,451.25 10,382.55 (1,931.34) (1,931.34)Olivares, Joh Paul T. 78,200.00 57,200.00 21,000.00 21,000.00Omampo, Rolando B. 27,278.00 27,278.00 27,278.00Ondevilla, Miel Kristian 4,500.00 110.00 1,010.00 3,600.00 3,600.00Orias, Ronito B. 4,000.00 713.01 2,713.01 2,000.00 2,000.00Orolfo, Teodora C. 11,184.00 60,763.35 66,913.00 5,034.35 5,034.35Ending

Name and Designation of DebtorBeginningBalanceAdditionsDeductionsAmountAmountDeducted Written-OffCurrent Non-CurrentOrozco, Glorina P. 14,366.50 14,366.50 14,366.50Pacquing, Elizabeth P. 4,386.67 19,561.50 11,777.55 12,<strong>17</strong>0.62 12,<strong>17</strong>0.62Padilla, Leo A. 348.50 348.50 348.50Padual, Jennifer C. 30,000.00 5,000.00 25,000.00 25,000.00Pagdilao, Menchie C. 100.00 100.00 100.00Paguirigan, Viviana 1,443.25 1,443.25 1,443.25Pahutan, Ludivinia M. (1,000.00) 3.25 3.25 (1,000.00) (1,000.00)Pal, Salvacion A. 10,000.00 6,439.65 15,006.00 1,433.65 1,433.65Palaje, Joseph M. 400.00 400.00 400.00Palencia, Marjueve M. (1,000.00) 800.00 800.00 (1,000.00) (1,000.00)Palis, Fernando F. 2,250.00 8,688.45 10,081.30 857.15 857.15Palparan, Karoline L. 35,569.51 5,569.51 30,000.00 30,000.00Panesa, Isabelita A. 3,892.55 2,757.50 1,135.05 1,135.05Panganiban, Don Brendo 20,000.00 20,000.00 20,000.00Pantas, Felix L. Jr. 5,492.01 22,132.75 11,927.26 15,697.50 15,697.50Panzo, Salome V. 1,087.50 362.50 725.00 725.00Paraiso, Jesus R. 65,430.95 15,607.25 49,823.70 49,823.70Paras, Renato 50,000.00 50,000.00 50,000.00Pascua, Jennifer J. 4,000.00 650.00 650.00 4,000.00 4,650.00Pascual, Danilo S. 9,<strong>17</strong>5.00 9,<strong>17</strong>5.00 9,<strong>17</strong>5.00Pataunia, Ma. Cecilia C. (1,583.50) 343.00 343.00 (1,583.50) (1,583.50)Paz, Rosalinda Z. 13,160.00 28,521.75 25,984.25 15,697.50 15,697.50Pearson, Lou Dominic 57,663.75 57,663.75 57,663.75Pelaez, Felimon P. 7,344.00 594.00 6,750.00 6,750.00Pening, Teodoro 10,655.42 70,342.05 28,<strong>17</strong>7.67 52,819.80 52,819.80Perez, Hector 2,166.66 43,851.25 40,563.91 5,454.00 5,454.00Perez, Winnie E. (50.00) 37,954.25 37,954.25 (50.00) (50.00)Pineda, Rodolfo G. (655.25) (655.25) (655.25)Pizaro, Arthur P. 4,500.00 9,023.00 5,923.00 7,600.00 7,600.00Polido, Maria Myrel M.. 7,500.00 15,855.50 22,105.50 1,250.00 1,250.00Ponsaran, Levy C. 1,500.00 5,628.75 3,478.75 3,650.00 3,650.00Presas, Heinrich G. (2,500.00) 20,000.00 20,000.00 (2,500.00) (2,500.00)Punsalan, Angelita 973.25 161.75 811.50 811.50Quijano, Arianne 10,000.00 10,000.00 10,000.00Quinto, Myrna P. 46,905.00 43,405.00 3,500.00 3,500.00Ramirfez, Marnel 20,000.00 20,000.00 20,000.00Ramos, Bernadette 39,000.00 6,850.91 44,996.96 853.95 853.95Ramos, Henry C. 9,000.00 5,000.00 5,000.00 9,000.00 9,000.00Ramos, Leonora A. 34,575.00 6,975.00 27,600.00 27,600.00Ramos, Rebben Japheth 15,000.00 15,000.00 15,000.00Ramos, Teodorica L. 44,000.00 37,500.00 6,500.00 6,500.00Rana, Aurelio Y. 120,422.10 46,387.75 74,034.35 74,034.35Rapirap, Raquel T. 59,136.67 54,187.00 91,141.59 22,182.08 22,182.08Rayos, Nancy 20,000.00 20,000.00 20,000.00Reambonanza, Maria Teresita 20,000.00 20,000.00 20,000.00Remiendo, Nora Liza A. 2,333.34 27,201.00 31,867.67 (2,333.33) (2,333.33)Restor, Nerissa A. 30,784.00 28,500.90 2,283.10 2,283.10Resuello, Heidi 200.00 200.00 200.00Retardo, Victor Cezar 25,027.00 5,027.00 20,000.00 20,000.00Reyes, Melodia S. 8,773.33 34,160.00 19,387.08 23,546.25 23,546.25Reyes, Mercedes C. <strong>17</strong>,036.60 47,104.15 38,482.40 25,658.35 25,658.35Reyes, Richard R. (212.00) 3,192.00 264.00 2,716.00 2,716.00Reyes, Richard Anthony 20,000.00 20,000.00 20,000.00Reyes, Richard Glenn C. 31,405.50 27,098.75 4,306.75 4,306.75Reyes, Rosa M. 0.25 0.25 0.25Rimano, Joy S. 2,490.00 5,550.00 7,673.33 366.67 366.67Rito, Estrellita S. 15,253.<strong>17</strong> 10,253.<strong>17</strong> 5,000.00 5,000.00Rosal, Josefina T. 43,940.00 28,940.00 15,000.00 15,000.00Rosario, Enrico 450.00 150.00 300.00 300.00Rosario, Ma. Theresa O. 4,155.50 2,3<strong>17</strong>.75 1,837.75 1,837.75Rosario, Warly Evelyn 10,288.96 26,954.15 25,537.46 11,705.65 11,705.65Ending