Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

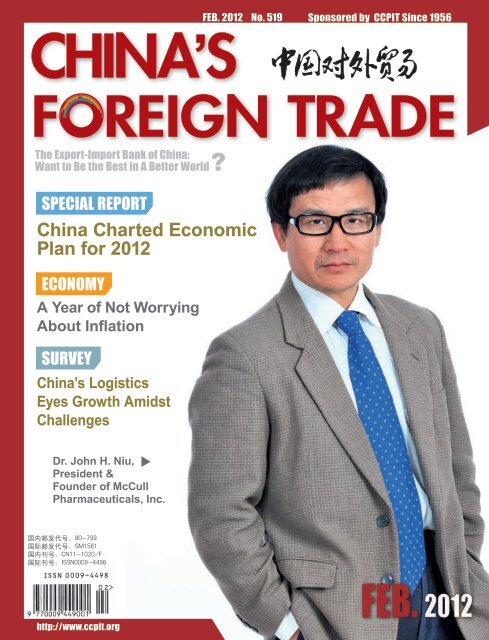

FEB. 2012 No. 519 Sponsored by CCPIT Since 1956CHINA’SF <strong>REIGN</strong> <strong>TRADE</strong>The Export-Import Bank of China:Want to Be the Best in A Better WorldSpecial reportChina Charted EconomicPlan for 2012ECONOMYA Year of Not WorryingAbout InflationsurveyChina’s LogisticsEyes Growth AmidstChallengesDr. John H. Niu,President &Founder of McCullPharmaceuticals, Inc.国 内 邮 发 代 号 :80-799国 际 邮 发 代 号 :SM1581国 内 刊 号 :CN11-1020/F国 际 刊 号 :ISSN0009-4498http://www.ccpit.org

PoliciesNew measures to boost consumptionNew measures will beintroduced to boost consumption,especially for vehicles andelectrical appliances, as exportdemand weakens, China Dailyreported.With tax rebate policies onvehicles and appliances havingexpired or due to expire, “newmeasures are in the pipeline” toboost consumption, said HuangHai, former assistant minister of commerce and member of the economic andtrade policy consulting committee affiliated to the Ministry of Commerce.“The Ministry of Commerce has drafted a proposal to continue the stimulusprograms in the coming few years, but in different ways, and they are expected tocover vehicles and those related to real estate, say household appliances,” Huangtold China Daily in an interview.The measures may include subsidies for consumers in affordable housing tobuy appliances and for those planning to change their cars.Ministry of Commerce spokesman Shen Danyang also said the ministry ismulling over launching new programs on expanding domestic consumption.Huang also disclosed that under the instructions of Premier Wen Jiabao a nationalcirculation conference, the first of its kind, will be held around April.Government officials will discuss how to introduce concrete measures toboost consumption at the conference, he added.More than 10 central government departments including the Ministry ofCommerce, the National Development and Reform Commission and the Ministryof Finance, are expected to make proposals after conducting research before theconference, Huang said.China has sought to sustain fast economic growth through boosting domesticconsumption, given the fact that export growth has been declining during thepast few months with demand weakening from the European Union, China’slargest trade partner.In November 2011, the nation’s exports increased by 13.8 percent from a yearearlier, the smallest gain since 2009, accordingto the General Administration of Customs.The Ministry of Commerce has predictedthat a slowdown in the country’s exportgrowth could continue at least into the firstquarter of 2012 with a “more severe” outlook.“This year in China will be all about tryingto ensure a soft landing,” said Jim O’Neil, chairmanof Goldman Sachs Asset Management.“Growth, under downward pressure fromweakening exports and a fall in governmentsponsoredinvestment, will have to be led bystronger personal consumption if the economyis to grow by more than 8 percent.”It was agreed at the annual Central EconomicWork Conference in December thatChina will be committed to expanding domesticconsumption and improving people’slivelihood while trying to stabilize exports.Since the global financial crisis in 2008,the government has launched a series of preferentialpolices encouraging local consumers,through subsidies, to renew or purchasehousehold appliances and cars.“No matter whether the nation’s economyslows down or not, China will have to changeits economic growth model to consumptionoriented,rather than export- or investmentdriven,”said Lu Zhengwei, chief economistwith Industrial Bank Co Ltd.China to step up land reformthis yearChina is planning to launch new pilotFigures10%China aims to expandits foreign trade byaround 10 percent yearon-yearin 2012, significantlyslower than in 2011,as the country is facing a“grim situation” in terms of boostingexports, an official from the country’stop economic planning agency said onJan. 14.3.18tChina’s central bank saidJan. 13 that the country’s foreignexchange reserves topped 3.18trillion U.S. dollars by the endof 2011, up from 2.85 trillion U.S.dollars by the end of 2010.1.6tRevenues from customs duties inChina jumped 29 percent year-on-yearto more than 1.61 trillion yuan ($256 billion)last year, Yu Guangzhou, chief ofthe General Administration of Customssaid on Jan. 12.2.45%China’s automobile sales managed togain 2.45 percent year-on-year to 18.50million units last year, the slowest growthin 13 years, the China Association of2

Quotesprojects to promote land reformsthis year, Xu Shaoshi, the country’sminister of land and resources,was quoted as saying byXinhua.The ministry will summarizeits experiences from previous pilotschemes, especially from those relatedto land acquisition, which hasbeen an issue of wide social concern,said Xu at a national conference onland resources that closed in Beijingon Jan. 9.The new pilots programs willcover the examination and approvalof urban land use, the transferringof land under collective ownership,land management that supportseconomic zones, and differentiatedpolicies on land control, accordingto Xu.In China, the latest notable disputeover land use, financing andelections last year in the village ofWukan in the southern province ofGuangdong led to months of largescalevillager protests against localauthorities.The Ministry of Land and Resourceswill start pilot programs thatallow local governments to buildrental housing on construction landunder collective ownership, drawingexperiences from previous landprotection and compensation trialprograms, said Xu.“China’s financial system stable, but potential risksremain”China’s financial system isrunning on a stable course despitethe global financial crisis.However, apparent problemsand potential risks still linger,as the crisis has not ended, PremierWen Jiabao said.Wen made the remarks atthe two-day National FinancialWork Conference that concludedon Jan. 7. The meeting,held every five years, mappedout development plans for thefinancial sector in the upcomingfive years. Similar meetingswere held in 1997, 2002 and2007.“China’s economy has maintained stable and relatively fast growth withstabilized consumer prices and improvements in people’s lives. The financialsystem is running steadily. The good momentum of economic and social developmentremains unchanged,” Wen said.“China must brace for global shocks despite gooddomestic outlook”The global economy is going to face a string of difficulties and uncertaintiesin 2012, with the evolving debt crisis in the Eurozone, the uncertainU.S. economic outlook and the slowing growth of emerging countries, ZhouXiaochuan, governor of the People’s Bank of China, said in an interviewwith Xinhua.The government must watch carefully and be ready to pick appropriatepolicy instruments to combat external shocks at any time, Zhou said.Automobile Manufacturers (CAAM)said on Jan. 12.1.7%China’s Producer PriceIndex (PPI), a main gauge ofinflation at the wholesale level,rose 1.7 percent year-on-yearin December, the National Bureauof Statistics (NBS) said onJan. 12.4.1%China’s consumerprice index (CPI), a maingauge of inflation, rose4.1 percent yearon-yearin December,down0.1 percentagepointfrom Novemberonfalling non-food prices, the NationalBureau of Statistics (NBS) said onJan. 12.$408bChina’s cross-border trade settlementin yuan under current accountshit 2.58 trillion yuan ($408 billion) bythe end of 2011 since China launchedthe pilot program in July 2009, officialfigures showed on Jan. 11.3

PoliciesChina vows to continue development of west, northeastChina will continue to boost the development of the country’s less-developedwestern and northeastern regions, said a statement released after an executivemeeting of the State Council on January 9, reported Xinhua.The meeting, presided over by Premier Wen Jiabao, has approved guidelinesfor the development program of China’s west and the revitalization of the northeastold industrialbases in the country’s12th Five-Year Planperiod (2011-15), accordingto the statement.The two regionshave been at a newstarting point in history,said the statement.The vast westernregion is still a “shortplate” in the country’sregional development,and achieving its prosperityis an important but difficult task in the building of an all-round well-offsociety, it said.Priority should be given to the implementation of the strategy of large-scaledevelopment of the western region in the country’s overall regional developmentscheme, to maintain its continued stable and rapid economic and social development,said the statement.Efforts should be undertaken to keep the growth of the regional GDP and theresidents’ income higher than the national average in the five-year period, it said.More emphasis should be put on the construction of “development priorityzones” with their own development focus and priority according to their environmentalfeatures, natural resources, current development stage and developmentpotential, according to the statement.The State Council also underscored the importance of infrastructure construction,environment protection, promotion of advancedindustries and agriculture, and thedevelopment of small towns and villages,education and opening-up.The statement said that there were stillunsolved systematic and structural problemsthat have restricted the development of China’snortheastern region, and that local governmentsshould continue to deepen reformand accelerate transformation of developmentpattern in the 12th Five-Year Plan period.The State Council urged those involvedto make vigorous efforts to promote agriculturaldevelopment, further perfect modern industries,and optimize regional developmentstrategy in the northeastern provinces.Local governments should also work toensure sustainable development of resourcerichcities, improve infrastructures, enhanceenvironmental protection, boost employmentand affordable housing construction, and deepenreforms of state-owned enterprises whileaccelerating the growth of the private sector.The more developed eastern and centralprovinces should offer better assistance to thedevelopment of these regions, the statementsaid.China to support SMEs viagovt purchasingThe country’s Ministry of Finance (MOF)announced that the nation’s government departmentswill allocate at least 30 percent oftheir purchasing quota to small and mediumsizedenterprises (SMEs) from the start of2012, according to Xinhua.Figures8.3%China’s economy will grow 8.3percent this year, according to a reportby the Deutsche Bank.11.7%China’s power consumptionrose 11.7 percentyear-on-year to 4.7 trillionkilowatt hours in 2011, theState Electricity Regulatory Commission(SERC) said on Jan. 10.8%Shanghai, China’seconomic center, aims toincrease its gross domesticproduct (GDP) by 8 percentyear-on-year in 2012, agovernment official saidon Jan. 11.37%China’s land supply went up 37percent year-on-year in 2011 amid thegovernment’s tightening measure oncommercial property market, accordingto the Ministry of Land and Resources(MLR) on Jan. 7.1.43tI nsu rance companies i n China4

Meanwhile, 60 percent of the allocatedquota will be reserved for smalland micro-sized businesses, accordingto a new guideline jointly issued by theMOF and the Ministry of Industry andInformation Technology, a statement onthe MOF website said.The guideline urges relevant unitsto step up making plans to buy fromSMEs in 2012. It also forbids any institutionor any individual from impedingor restricting SMEs’ access to the governmentpurchasing market, the statementsaid.Furthermore, in regards to projectsthat are not especially oriented toSMEs, the government purchaser orpurchasing agency should first implementa 6-10 percent cut in productprices as reported by SMEs, and use thereduced pricing for bidding in order togive them advantages.The latest policy by the governmentcame after the State Council, or China’sCabinet, in October pledged strongerfiscal support for small and micro-sizedbusinesses, which includes raising thetax threshold for levying corporate,value-added taxes and business taxes.The MOF also announced lastmonth that the country will scrap thecollection of up to 22 items of administrativefees from small and micro-sizedcompanies during the January 1, 2012- December 31, 2014 period. Such feesinclude charges for companies’ registrationsand tax invoice purchases.“China faces more severe export situation in 2012”China is facing aneven more severe exportsituation featuringwithered demandand harsher competitionthis year, DeputyMinister of CommerceZhong Shan said onJan. 9.Zhong said othermajor exporters willcontinue providingstrong competition forChina, and some developingcountries are capturing market share in labor-intensive industriesas domestic labor costs rise in China.Zhong said the decline of market share had hit producers of the country’sseven major varieties of labor-intensive products: textiles, apparel,shoes, cases, furniture, toys and plastic products.“2012 trade deficit is likely”QuotesChina is likely to face a trade deficit in 2012, partly driven by the deterioratingeurozone crisis and a possible debt default by Greece, economistswarned on Jan. 9.Stephane Deo, managing director of European Economic Research withUBS AG, said China’s 2011 exports to the European Union (EU) registeredthe worst performance among the country’s main trading partners. The highlikelihood of a default by debt-ridden Greece, which some analysts predictwill happen in March, will further drag down the trade volume, making thefirst quarter the toughest for Chinese exports.reaped 1.43 trillion yuan (226.4 billionU.S. dollars) of premiums last year, up10.4 percent year-on-year, according todata from the China Insurance RegulatoryCommission (CIRC) on Jan. 7.175.1bChina’s central bank said on Jan. 30that banks lent 175.1 billion yuan ($27.77billion) to support the construction oflow-income housing in 2011.13%L a nd s a le s i n130 major Chinesecities d ropped 13percent year-on-yearin 2011, as propertymarket curbs continuedto bite the realtyindustry, accordingto the China IndexAcademy.49.88mChina’s crudesteel output postedi t s f i r s t y e a r l ydecline in November2011 to 49.88m i l l io n t o n n e s ,according to latestdata provided bythe country’s topeconomic planner.5

http://cft.ccpit.orgwww.ccpit-cft.net.cn2012/02 No.51908China would maintain its prudentmonetary policy and proactive fiscalpolicy in 2012.Special report08 China Charted Economic Plan for 201210 Official Statement on the 2011 Central Economic Work Conference13 China Aims to Balance Growth and Inflation16 Real Test is Still to Come17 Crucial Period of Change40Service demand for those over sixtywill increase dramatically.ECONOMY20 A China Round of Multilateral Trade Negotiations23 A Year of Not Worrying About Inflation26 Data Watch on China’s Foreign Trade and Investment in 2011Industrial Watch30 Agriculture Still Vital to China38 Still Young: China’s New Energy Vehicle Industry40 Opportunity Growing while Aging42 Clouds Gathering Around44 Mobile Internet Will Diversify IT Services46 How Could Chinese Private Bookstores Survive?66Manufacturing employment hasgrown faster in the US.survey48 China’s Logistics Eyes Growth Amidst ChallengesCase Study56 Safety Strategy of China’s Petro-Chemical Sector88With its five flat peaks, Mount Wutaiis a sacred Buddhist mountain.REGIONAL <strong>TRADE</strong> AND INVESTMENT60 New Starting Point in Advancing Cooperation between Poland and China62 Getting at the Pulse of the EU Debt Crisis66 Manufacturing Jobs Return to US as Asia Loses Edge68 Hawaii as a Bridge Between China and U.S70 Can Emerging Market Central Banks Bail Out Banks?

72 Central China Economic Zone Eyes Future73 Fujian Further Opens UpCover Story74 To Build a World-Class Global PharmaceuticalCompany in ChinaInfoRMATION78 2012 China Market Suppliers List80 China Fairs & Expos82 Investment Projects in Fuding, Fujian Province, ChinaLIFESTYLE84 Things from the Gallery Warehouse 4THIS IS China88 Mount Wutai — The Holy Land of Buddhism inNorthern Chinaeye on china92 Badgering China with Misleading Reports93 Why Flexibility Is a Must in China BusinessSponsored by ( 主 管 )CCPIT( 中 国 国 际 贸 易 促 进 委 员 会 )Published by ( 主 办 )Trade Development and Cooperation Center of CCPIT中 国 国 际 贸 易 促 进 委 员 会 贸 易 推 广 交 流 中 心社 长 President 杨 晓 东 Yang Xiaodong总 编 辑 Editor-in-Chief 孟 燕 星 Meng Yanxing副 社 长 Vice President 石 净 Shi Jing杨 复 强 Yang Fuqiang李 英 宏 Li Yinghong编 辑 部 副 主 任Editorial Deputy Director编 辑 部 Editorial DepartmentTel:86-10-68053271流 程 总 监 Operation Director英 文 校 审 English Polisher杨 蔚Yang Wei郭 艳 Guo Yan李 振 Li Zhen阎 漫 漫 Yan Manman竹 子 俊 Zhu Zijun崔 晓 玲 Cui Xiaoling张 越 Zhang Yue莫 雷 ( 美 )Adam Morley经 营 部 总 经 理 石 净 ( 兼 )Marketing Department Director Shi Jing副 总 经 理 Deputy Director 白 义 峰 Bai Yifeng石 林 峰 Shi Linfeng项 目 经 理 Manager 游 万 龙 You WanlongTel:86-10-68027947 李 小 冬 Li Xiaodong高 嵩 Gao Song推 广 部 总 经 理 李 英 宏 ( 兼 )Distribution Department Director Li Yinghong项 目 经 理 Manager 王 石 Wang ShiTel:86-10-68069328 王 岱 凌 Wang DailingCulture94 Eating Culture in China95 Food in Chinese秘 书 处 副 主 任Council Secretariat Deputy Director联 络 专 员 AssistantTel:86-10-68020773刘 晓 东Liu Xiaodong王 飞 Wang Fei于 洋 Yu Yang戚 英 杰 Qi Yingjie石 林 Shi LinIndex of Advertisements封 二 -011928-2952-55封 底Changchun First Automobile Works中 国 第 一 汽 车 集 团 进 出 口 公 司Weichai Power潍 柴 动 力 股 份 有 限 公 司Shaanxi Automobile Group Co., Ltd.陕 西 汽 车 集 团 有 限 责 任 公 司Zhengzhou Yutong Group Co., Ltd.郑 州 宇 通 集 团 有 限 公 司Anhui Jianghuai Automobile Co., Ltd.江 淮 汽 车Cooperation Media虚 假 新 闻 举 报 热 线 86-10-68053271General Distributor For Overseas Subscribers国 外 发 行 总 代 理China National Publications Import & Export (Group) Corporation中 国 图 书 进 出 口 ( 集 团 ) 总 公 司Add: 16, Gongti East Road Beijing, ChinaPost Code:100020地 址 : 北 京 市 朝 阳 区 工 体 东 路 16 号Tel: 86-10-65066688-8822 65063082China International Book Trading Corporation中 国 国 际 图 书 贸 易 总 公 司 (GUOJISHUDIAN)Add: Box 399, Beijing 100044, China地 址 : 中 国 北 京 399 号 信 箱 (100044)国 内 邮 发 代 号 80-799国 际 邮 发 代 号 SM1581国 内 统 一 连 续 出 版 物 号 CN11-1020/F及 国 际 标 准 刊 号 ISSN0009-4498AD LICENCE No. JXGS/G-0249广 告 经 营 许 可 证 号 京 西 工 商 广 字 第 0465 号Domestic Price 国 内 订 价 16 元 (RMB)Overseas Price 国 外 订 价 US$5设 计 制 作 北 京 锋 尚 制 版 有 限 公 司印 刷 北 京 瑞 禾 彩 色 印 刷 有 限 公 司License Mark of General Administration ofPress and Publication, the People’s Republic of China

20021998Tone of 1999:Pro-active fiscalpolicies2000Tone of 2001:Pro-active fiscalpolicies and prudentmonetary policiesTone of 2003:Pro-active fiscal policiesand prudent monetarypolicies2004Tone of 2005:Consolidate theachievements ofmacro-control1999Tone of 2000Do a good job inState-own enterprisesreform2001Tone of 2002:Boost domesticdemand2003Tone of 2004:Continue with themacro policesChina Charted EconomicPlan for 2012By Lesley CuiThe 2011 Central Economic Work Conference was held in Beijing fromDecember 12 to 14, 2011. As China’s highest economic meeting, it broughttogether the nation’s central and provincial government officials, the heads of thebiggest state companies and the army’s top generals.8

2006Tone of 2007:Prudent fiscal policiesand monetary policies2008Tone of 2009:Pro-active fiscal policiesand moderately loosemonetary policies2010Tone of 2011:Pro-active, prudent,flexible macro-control20112007Tone of 2008:2005Prudent fiscal policiesand tight monetarypoliciesTone of 2006:Prudent fiscal policiesand monetary policies2009Tone of 2010:Change from “maintaininggrowth” to “transformingthe pattern of economicgrowth”Tone of 2012:Pro-active fiscalpolicies andprudent monetarypolicies“Prudent monetarypolicy and proactivefiscal policy”Leaders at the conference reviewed the country’s economic works in 2011,analyzed the international and domestic economic situations, noted challengesto the country’s economic growth, and charted the country’s macroeconomicpolicies for 2012.At the meeting it was agreed that China will take a slew of measures toensure “stable and relatively fast” economic growth amid the “extremely grimand complicated” global outlook this year, while adjusting the economic structureand regulating inflationary expectations.Leaders decreed that the nation would maintain its “prudent monetarypolicy and proactive fiscal policy”, and make its macroeconomic regulationmore “targeted, flexible and forward-looking” in 2012.The Central Economic Work Conference has been held regularly by theCentral Committee of the Communist Party and the State Council, at the endof every year since 1994.The year 2012 is considered a crucial year in implementing China’s 12thFive-Year Plan (2011-2015), so the plans and strategies made in this conferencewill be significant for consolidating the sound momentum of China’s economyand further promoting the steady and relatively fast economic growth.9

Official Statement on the 2011Central Economic Work ConferenceBy Lesley CuiChinese PresidentHu Jintaoaddresses theconference.ChinesePremier WenJiabao speaksat the meeting.President Hu Jintao, Premier Wen Jiabao,top officials from the central bank, financeministry and economic planningagency as well as provincial officials attendedthe Central Economic Work Conference,held in Beijing from 12 to 14 December 2011.Their conclusions serve as a work plan for variousgovernment agencies and are announced throughshort statements.The following is a translation of the report onthe meeting by official Chinese news agency Xinhua.In his important speech delivered at the conference,Hu Jintao analyzed the current internationaland domestic situation in an all-round way,profoundly expounded on the major economicissues that must be successfully tackled in 2012and for some time to come, and put forward inclear-cut terms the overall requirements, policyguidelines, and main tasks of the economic workin 2012. In his speech, Wen Jiabao made a comprehensivereview of the economic work 2011 andspelled out the main objectives, tasks, and majorissues concerning the economic work in 2012.Achievements made in 2011The conference pointed out: In 2011, thestarting year of the 12th Five-Year Program, theparty Central Committee and the State Councilunited and led the people of all ethnic groupsin China to firmly grasp the theme of scientificdevelopment concept and to seize the thrust ofaccelerating the transformation of the mode ofeconomic development; strengthen and improvemacro-management; correctly handle the relationshipbetween maintaining steady and relatively fasteconomic development, readjusting the economicstructure, and managing the anticipated inflation;and promote the orderly shift of the economy fromone that relies on policy stimulus for growth toone that grows naturally without external stimulus.As a result of all this, the national economyhas been developing in the anticipated direction ofmacro-management with a strong momentum towardfaster growth, price stability, better economicreturns, and improved livelihood for the people.10

From a general perspective, in 2011China scored new achievement in socialisteconomic construction, politicalconstruction, cultural construction, andsocial construction as well as in buildingecological civilization and in partybuilding and realized a good beginningfor the 12th Five-Year Program.Challenges facing the ChineseeconomyThe conference stressed: Whilefully affirming achievement, we mustalso soberly realize that the contradictionsand problems of imbalance,incoordination, and unsustainability inChina’s economic development are stillquite prominent, there is downwardpressure on economic growth and thereis pressure of rising commodity prices;some enterprises are experiencing difficultiesin production and operation; thesituation in energy saving and carbonemission reduction is grim; and thereare hidden risks in the economic and financialspheres that cannot be ignored.We must remain sober-minded, and wemust step up risk assessment, preparecontingence plans as early as possible,and adopt prompt measures to effectivelydefuse the risks.Analysis of the global economicsituationThe conference held: Since the beginningof 2011, worldwide economicgrowth has slowed down, the rise ofthe international trade has dropped, theinternational financial market has beenexperiencing violent turbulences, andrisks of all kinds have clearly multiplied.In 2012, as we look at it, the overallglobal economic situation will remainextremely grim and complicated, withrising instability and uncertainty inworldwide economic recovery.Countermeasures against thecurrent economic environmentThe conference pointed out: Inthe face of the complicated, volatileinternational political and economicenvironment and the new developmentsand new changes in the operationof the domestic economy, we mustcontinue grasping the theme of thescientific development concept and thethrust of the accelerated transformationof economic development mode, firmlyfocus on expanding the strategic baseof domestic demands, put the emphasisof the expansion of domestic demandsmore on safeguarding and improvingthe people’s livelihood, accelerating thedevelopment of service industries, andincreasing the living standards of themiddle- income group. We must firmlygrasp the development of real economy,which constitutes the strong foundationof the economy, and strive to create asocial climate characterized by workingin a down-to-earth manner, starting anundertaking through diligent work, andgetting rich by running real businesses.“Maintain continuityand stability of themacroeconomicpolicy”We must firmly grasp the powerfulmotive force of accelerating reform andinnovation, seize the opportunities toachieve breakthroughs in some key areasand links as soon as possible, striveto increase the ability to make originalinnovation, make constant efforts toenhance integrated innovation, andabsorb and re-innovate imported technologies;firmly grasp the fundamentalpurpose of safeguarding and improvingthe people’s livelihood; increase financialinput; earnestly carry out importantand major tasks related to the people’slivelihood; and pay attention to raisingthe level of tolerance in the process ofdevelopment.Requirement for economic workin 2012The conference stressed: 2012 isan important year for implementing the12th Five-Year Program as it connectswhat has been done in the precedingperiod with what needs to be done insubsequent years, and our party willhold its 87th national party congress.The conference proposed that thegeneral requirement for the economicwork in 2012 is as follows: continue toimplement a proactive fiscal policy anda prudent monetary policy; maintaincontinuity and stability of the macroeco-11

nomic policy; make macro-managementmore target-specific, flexible, and forward-looking;continue to handle wellthe relationship between maintainingstable and faster economic development,readjusting economic structure, andmanaging anticipation of inflation; pushforward the transformation of economicdevelopment mode and economic structuraladjustment at an accelerated pace;strive to expand domestic demands;strive to enhance independent innovationand energy saving and carbon emissionreduction; strive to deepen reformand opening up; and strive to safeguardand improve the people’s livelihood;maintain economic stability and fasterdevelopment as well as the basic stabilityof the general price level; maintain socialharmony and stability.The conference held: To pushforward the economic and social developmentin 2012, we must lay stress ongrasping the general work guideline ofseeking progress amid stability. “Stability”refers to maintaining the basicstability of macroeconomic policies,maintaining steady and fairly rapid economicdevelopment, maintaining thebasic stability of the general price level,and maintaining overall social stability.“Progress” refers to continuing toseize and make good use of the periodof strategic opportunities, making newprogress in changing the developmentmode, scoring new breakthroughs indeepening reform and opening up, andachieving new results in improvingpeople’s livelihoods.Major tasks for economic workin 2012121. Strengthen and improve macroeconomicregulations and maintainstable and healthy economic development- Adopt proactive fiscal policiesand prudent monetary policies to preventeconomic risks;- Continue with structural tax reduction,step up investments to improvepeople’s livelihood and tighten managementof local government debts;- Fine-tune monetary polices accordingto economic situations, optimizethe credit structure and fend offfinancial risks;- Increase investment in agriculture,farmers, rural areas and affordablehousing construction, and continuesupporting technology innovation, environmentprotection, strategic emergingindustries and key infrastructureprojects.2. Reinforce supplies of agriculturalproducts- Increase subsidies to agriculturalproductions and bump up the minimumpurchase prices of grain;- Tighten rural infrastructure construction,including irrigation projects,roads and grids;- Strengthen efforts to promoterural compulsory education and secondaryvocational education, and expandcoverage of the new rural socialpension system.3. Speed up economic structuraladjustments- Encourage consumption andincrease income of residents, especiallypoorer population;- Propel innovation, protect intellectualproperty rights and sharpenindustrial competitiveness;- Cut back on outdated industrialcapacities, promote mergers andacquisitions, develop new energies,stimulate the modern service sector,invigorate the cultural industryand enhance energy conservation andemission reductions.4. Deepen reforms and furtheropen up to the outside world- Push forward the value-addedtax reform and the pilot program ofproperty tax, reform the resource taxsystem and research on the environmentprotection tax reform;- Deepen market reforms of interestrates, further reform the yuanexchange rate regime and ensure basicstability of the yuan;- Maintain steady growth of exports,upgrade export structure, expandimports and seek trade balance;- Attract foreign investments tothe central and western regions, widenoutbound investments and fight againstprotectionism in any form.5. Improve people’s livelihood- Increase the quality of education,promote employment and supportlabor-intensive industries and small andmicro-sized enterprises;- Improve the social safety net,expand pension systems and help migrantworkers in employment, housing,medical health and education of theirchildren;- Tighten funding, construction,operation and management ofaffordable housing projects, adhereto control measures of the real estatemarkets, bring house prices back toa reasonable level, expand suppliesof commercial houses and promotehealthy development of the propertymarkets.

China Aims toBalance Growth and InflationBy Cui XiaolingChina’s top leadership agreed on the generaldirection of the nation’s economicpolicy for 2012 at the annual three-dayCentral Economic Work Conference,which concluded in Beijing on Dec 14, 2011.They pledged to take a slew of measures to “makeprogress while maintaining stability” amid the“extremely grim and complicated” global outlook.The current “proactive fiscal policy and prudentmonetary policy” will be maintained.Stability as top priorityStability is still the key word at China’s annualCentral Economic Work Conference.According to a statement issued after theconference, “making progress while maintainingstability” will be the main theme of 2012. “Stabilitymeans to maintain basically steady macroeconomicpolicy, relatively fast economic growth,stable consumer prices and social stability,” thestatement said.Many analysts believe it is a sensible choiceto maintain stable growth given the internationaland domestic situations.Extremely grim global economic outlookin 2012The statement described the current globaleconomy as “extremely grim and complicated” asthe eurozone sovereign debt crisis has worsenedand economic recovery in the US remains weak.With the world economy slowing and internationalfinancial markets in chaos, the world’seconomic recovery is expected to remain unstableand uncertain, the statement said.Under the economic globalization, everycountry suffers and has to pay the cost. Quantitativeeasing policies, which are likely to be put intoplace in the United States and Europe to helpsolve the debt crises there, may create additionalinf lationary pressure on China, according toWang Tongsan, head of the Institute of Quantitativeand Technical Economics under the ChineseAcademy of Social Sciences (CASS).Faltering external demand will continue toweigh on China’s foreign trade and slow its exportgrowth in 2012, he added.Strives to shore up growth whiles reigningin inflationWhile noting the global economic malaise,Beijing conceded that China is in a tight spot itself,squeezed by both inflation and a slackeningpace of economic activity.Chinese policy makers strive to shore upgrowth while avoiding reawakening the inflationdragon, analysts said.“China must stabilize economic growth toprevent a sharp plunge, which might dampenemployment and cause social problems,” said ZhuBaoliang, deputy director of the Economic ForecastDepartment of the State Information Center,a government think tank.China’s economic growth has been slowingall year in 2011. Its GDP growth slowed to9.1 percent in the third quarter from 9.5 percentin the second quarter and 9.7 percent in the firstquarter.Growth of exports, one of the major enginesused to power China’s expansion, also slowed, to13.8 percent in November from 37.7 percent in13

January in 2011.“The global economic slump andsluggish external demand left littleroom for sharp increases in China’sexport volume. In the meantime, mostChinese exports are manufacturedgoods that face full competition andexporters tend to wage ‘price wars’when the world economy is weak, thussqueezing China’s exports,” said ZhangYansheng, a researcher of the Institutefor International Economics Researchof the National Development andReform Commission, China's top economicplanner.As China says it will continue tomaintain a prudent monetary policyand a proactive fiscal policy in the nearfuture, economists expect economicgrowth to fall below 9% and exportgrowth to slow to around 10% in 2012.China’s 4 trillion yuan fiscal stimuluspackage gives the country a quickrebound from the global economiccrisis, causes excess liquidity and putsa large debt burden on local governments.Growth of the consumer priceindex (CPI), a main gauge of inflation,eased to 4.2 percent in November, 2011from the year’s peak of 6.5 percent inJuly.However, even with the sharp fallin November, the country’s CPI rose 5.5percent year-on-year during the January-Novemberperiod, well above thegovernment’s full-year inflation controltarget of 4 percent.Although the CPI rise has slowed,there are still factors that may push upprices, including price increases triggeredby higher costs and uncertaintiesof imported inflation, said WangYiming, deputy head of the Academyof Macroeconomic Research under thecountry’s top economic planner, theNational Development and ReformCommission.Fine-tunes policiesChina will maintain “prudent”monetary policies and “proactive” fiscalpolicies, despite the easing of inflation.The yuan will be kept “basically stable”;interest rate and exchange rate reformswill continue; measures aimed at calmingthe property market will be kept;exports will be held steady whilst importsboosted to balance trade.Economists said the statementssuggested Beijing preferred to only finetuneeconomic policies, rather thanswing into an outright monetary easingmode to shore up growth, which is expectedby many analysts to slip below 9percent in 2012 for the first time in overa decade.“This year it’s a lot less drama,”said Tim Condon, an economist atING Bank in Singapore. “The statementsare much less thematic than2010 when they moved from a moderatelyloose to a prudent stance.”But China made clear that thepolicies will be flexible, which meansthe government will react when slowdowntrends are clear.“We will fine-tune monetary policyin an appropriate and timely manneraccording to the economic situation,and will use various monetary tools tokeep a reasonable growth in money andcredit,” the statement said.Economists say policy fine-tuningis already under way. Data showed Chinesebanks made 562 billion yuan ofnew loans in November, 2011, a shademore than forecast as Beijing gentlyeases tight credit conditions.China’s central bank announcedon Nov 30, 2011 it was cutting thereserve requirement ratio for its banksfor the first time in nearly three years toease credit strains and shore up businessactivity, and market watchers expectfurther reductions in 2012.Bolder steps such as cutting interestrates, however, appear premature fornow. While that may boost investment,China’s leaders fear it could also reviveinflationary pressures, especially in thehousing market, economists say.Keeps yuan value stableThe meeting noted that Chinaaims to keep the yuan’s value “basicallystable” whilst pushing ahead withreforms aimed at liberalizing the country’sinterest exchange rates.“However, the government probablywill have to take more positivemeasures to shore up economic growthin the first quarter, including slowingthe appreciation of the yuan,” Li Wei,economist at Standard Chartered Bank(China) Ltd, told China Daily.“But China doesn’t want to seelarge-scale yuan depreciation either,unless unemployment becomes a big issue,”Li said.“Through the whole year of 2012,there will be still a 2 percent appreciationof the yuan against the dollar.”A new exchange-rate regime couldpave the way for two-way currencyfluctuations, improve the reference to abasket of currencies and slow the accumulationof foreign reserves.Drives housing prices back to“reasonable level”Beijing promised to keep a tightpolicy leash on property at the conference.To ensure property prices “returnto a reasonable level”, China said it14

will uphold measures aimed at coolinghousing prices, which are still nearrecord highs, and increase the supply ofhomes.It will also push forward the trialsof property tax reform. Property-taxtrials were carried out in Shanghai andChongqing at the beginning of 2011 aspart of its efforts to curb skyrocketinghome prices and contain asset bubbles.Since April 2010, China has imposeda raft of measures aiming to calmproperty prices. They include higherdown payments, limits on the numberof houses that people can own, theintroduction of a property tax in somecities, and the construction of lowincomehousing.The government has vowed tobuild 36 million units from 2011 to2015 in an effort to give more midandlow-income households access tohousing and stabilize runaway propertyprices, with 10 million units plannedfor both 2011 and 2012.China’s housing authorities saidon Nov. 10, 2011 that the country hasalready met this year’s goal of startingthe construction of 10 million units.“The construction of affordablehomes will help curb excessive pricerises and fuel urbanization, which willin turn unleash consumption and investmentpotential and push the developmentof related industries,” said VicePremier Li Keqiang.In October 2011, 34 cities in astatistical pool of 70 major cities sawdeclines in new home prices from September,compared with 17 in September,data with the National Bureau ofStatistics showed.Cuts tax to aid economic growthMore tax reforms are on the 2012agenda as part of China’s “positive fiscalpolicies” intended to restructure andbalance the economy.An important part of the plan involvesfive tax reforms: a pilot programfor the value-added tax; one to theproperty tax; adjusting the scope andstructure of the consumption tax; expandingresource tax reform and studyingthe feasibility of an environmentaltax.Value-added tax reform, or replacingthe turnover tax with a value-addedtax, will see its first pilot program inShanghai starting on Jan 1, 2012.“This move would resolve the issueof duplicate taxes and lower the tax burden,especially for the service sector,”Liu Shangxi, deputy director of the financeministry’s Research Institute forFiscal Science, told China Daily.Liu said it hasn’t been decidedwhether the property tax pilot programin Shanghai and Chongqing would beextended to more areas or nationwide,but the tax would continue to serve as ameans of regulating the housing marketrather than a new source of fiscal revenue.“As for the consumption tax, thekey of the reform lies in changing thescope of assessment. For example, toredefine ‘luxury goods’ by moving somecosmetics products off the list,” Liusaid.China also shifted the basis of theoil and natural gas tax to value nationwidefrom volume, which raised the taxrate by about 10 times.“There will be more resources,such as coal, to be taxed by value ofproduction because easing inf lationgives more room for tax reform,” saidLiu.Environmental taxes, such as acarbon tax, are still in the researchphase and will not necessarily be implementedin the next year, but such taxeswill eventually replace some administrativefees, Liu added.These tax cuts will spur consumption,without disastrous consequencestriggered by a record 17.5 trillion yuan($2.8 trillion) of lending in 2009 and2010 that funded infrastructure projectsand real-estate speculation.Meng Chun, a senior researcherwith the State Council’s Development andResearch Center, said in a research notethat more such tax preferences should bedirected toward smaller businesses to helpthem move up the value chain and withstandthe global downturn.Tax burdens on the agriculturaland processing sectors should also beeased to stabilize food prices and easeinflationary pressure, Meng said.Fiscal revenue reached 9.73 trillionyuan by the end of November 2011, up26.8 percent year-on-year.Boosts domestic demandPolicymakers stressed the importanceof boosting domestic demandto accelerate the transformation of thegrowth model toward a more consumption-drivenone against the backdrop ofweak external demand.There will be more efforts to boostdomestic consumption. China will continueto increase the earnings of lowincomefamilies and build a strongermiddle-class. At the same time, it willdeepen education and medical reformsto keep more spending money in people’spockets.“If the country can spur domesticdemand, especially domestic consumption,it will get inexhaustible growthmomentum,” said Yao Jingyuan, aspecial researcher with the Councillor’sOffice of the State Council, or China’sCabinet.The Chinese leadership reiteratedtheir commitment to boost imports inorder to balance trade.The Ministry of Finance saidthat from 2012 China will reduce importtaxes for 730 categories of goodsincluding energy resources, parts andcomponents of strategic emerging industriesand daily necessities that couldpromote consumption.The move is likely to find favourwith European and US exporters, whohave long complained about the tradesurplus China has been running.15

Real Test is Still to ComeBearish sentiment about theChinese economy has surgedin recent months, owing largelyto three conjectures. First,China’s housing market is on the brinkof collapse. Second, China’s fiscalposition will worsen rapidlybecause of massive local governmentdebt. And, third,the collapse of undergroundcredit networks in citiessuch as Wenzhou,Zhejiang province,will lead to a broad financialcrisis across thecountry.In fact, despite itsproblems, China’s economyremains on course and it is not yetanyway near to hitting the rocks.In the last decade, skyrocketinghouse prices, except for a short respiteduring the global financial crisis, havecaused serious social discontent in China.But after years of effort, the centralgovernment has finally clamped downon housing speculation. As a result,prices fell in October 2011 for the firsttime this year, while real-estate investmentgrowth fell as well.The fall in house prices is unlikelyto turn into a rout, because the demandfor houses will remain strong even afterspeculative demand is driven from themarket. As soon as house prices fall toan affordable level, buyers will re-enterthe market and set a floor under the decline.Moreover, because there are nosubprime mortgages in China anddown payments are as high as 50-60percent, even a significant fall in houseprices will not seriously damage China’smega-banks.Over the past decade, real-estateinvestment in China has been the singlemost important contributor to fixed-assetinvestment growth and therefore, to theeconomy. Indeed, since the late 1990s, thereal-estate investment-to-GDP ratio hasbeen far higher than it was in countriesLocalgovernment debtBy Yu Yongdinglike Japan and South Korea during theirhigh-growth periods.It is simply wrong for a developingcountry with per capita GDP of around$4,400 to concentrate its resourceson producing concrete andcement. Although a significantdecline in realestateinvestment willhave a negative impacton China’s growth, aslong as the fall is nottoo drastic, it is a welcomedevelopment.Local governmentdebts are arelatively new phenomenon.In 2009,local governments were encouraged tocreate special purpose vehicles, specifically“local finance platforms” (LFPs),to supplement China’s 4 trillion yuan($628.7 billion) stimulus package. TheLFPs would borrow from banks usingfuture government revenue as collateralto finance packaged investment projectsin Chinese localities. By 2010, some6,576 LFPs had been created.There is no denying that localgovernment debt could be a tickingtime bomb for the Chinese economy.According to China’s National AuditOffice (NAO) , the total borrowing ofthese LFPs amounts to 10.7 trillionyuan, of which 79.1 percent is bankloans. But it is equally true that China’slocal government debt has so far beenmanageable, and there is no reason tobelieve that all of it is bad. In fact, forthe majority of the LFPs, the cash flowgenerated by investment so far has beenenough to meet repayment of principaland interest. According to the Industrialand Commercial Bank of China(ICBC) the largest of China’s “big four”banks 93 percent of its loans to LFPsare being repaid regularly.Indeed, the ICBC’s non-performingloan (NPL) ratio for LFP loans is as lowas 0.3 percent, while the correspondingcoverage ratio the bank’s ability to absorblosses from NPLs is 1,066 percent. Accordingto the NAO, the NPL ratio forthe 10.7 trillion yuan in local governmentdebt is roughly 2.3 percent.In addition, given that local governmentdebt comprised 27 percentof China’s GDP in 2010, and centralgovernment debt stands at 20 percentof GDP and policy loans at 6 percent,the total public debt-to-GDP ratio isapproximately 53 percent lower thanGermany’s. So, while China should notbe complacent about local governmentdebt, panic is unwarranted.Finally, there is a long history ofunderground lending and borrowing insome of China’s east coast region, especiallyin Wenzhou. Whenever monetarytightening causes bank credit toshrink, small and medium-sized privateenterprises are prepared to borrow atsuicidally high interest rates from relativesor loan sharks.In recent years, real-estate speculationhas become another importantsource of demand for undergroundloans. When real asset prices fall andcause local credit networks to collapse,not only are hundreds of families leftfinancially shattered and enterprisesbankrupted, but banks suffer collateraldamage, as occurred recently in theWenzhou region.But the severity of Wenzhou’s undergroundcredit crisis has been exaggerated.In fact, Wenzhou’s undergroundcredit accounts for less than 20 percentof total credit in the region, while theregion accounts for less than 1 percentof China’s GDP. The total volume of affectedbank credit in the crisis was justmore than 3 billion yuan, roughly 0.5percent of bank loans in the Wenzhouregion. So, the damage that the breakdownof Wenzhou’s underground creditnetworks has inflicted on the regionalbanking system is limited, with scantnational impact.Thus, despite the high likelihoodthat China’s economic growth will slowsignificantly in 2012, a hard landing isunlikely. Nevertheless, while there is noneed to be overly bearish about China’sshort-term economic prospects, becauseof the slow progress in fundamentaladjustment and further reform, China’sgrowth is ultimately unsustainable. Sothe real test is yet to come.16

The Chinese economy has arrived at acrucial stage of all-round structuraladjustment. In the coming two orthree years, companies will start tofeel the pressure as economic growth will continueto slow and there is likely to be moderateinflation of between 3 to 5 percent. Given this,it is essential that the country presses ahead withstructural reforms.China does not need to worry about a hardlanding of its economy, because with its averageper capita GDP only $4,000 the economy stillhas lots of room to grow. China is a big economicpower with an extremely large domestic market.Its relatively poor and underdeveloped west,for instance, can take over production capacityfrom the east, and digest much of the excessiveproduction capacity now haunting the nationaleconomy as a whole.A basic feature of the Chinese economytoday is the excess production capacity, especiallyin the manufacturing sector, and theinadequacy of effective demand. Under such circumstances,Chinese manufacturers should beable to find ways to digest the pressure of risingcosts even if prices of raw materials rocket. Sothe Chinese economy will continue to grow forquite a long period of time.There are also three factors that provide asolid foundation for economic growth: urbanization;massive land development, which is closelyrelated to urbanization, such as the constructionof water conservancy and anti-seismic facilitiesand projects for the prevention and controlof other natural disasters; and the expansion ofconsumption.But although the Chinese economy willnot experience a hard landing, it is crucial that itundergo structural adjustment.While the Chinese economy has maintainedits high-speed growth during the pastdecade, especially since China adopted a stimuluspackage to combat the financial crisis, somefundamental issues besetting its economicdevelopment have become all the more evidentand they urgently need addressing. The mostpressing being the reliance of local governmentson land-sales-based financing, which is bothunsustainable and potentially risky.The slowdown of economic growth and theincrease in inflationary pressures are both forcesspurring China’s economic restructuring andthe effects of this restructuring are desperatelyneeded.A major factor causing economic growthto slow is the weakening investment impulse, asituation that can be directly blamed on changesin the investment sources accessible to local governmentsand the subsequent decrease in theirinvestments.The growing cost pressure on enterprisesis another factor slowing growth. Wages havecontinued to rise and the prices of raw materialsare going up day by day, eroding the low-costadvantage enjoyed by Chinese enterprises overthe past decades.Meanwhile, China will be unable to keepits inflation rate below 2 percent, as it did beforethe financial crisis, as major issuers of internationalcurrencies will continue their expansivemonetary policies, driving up the prices of rawmaterials and increasing the flow of hot moneyinto China. So moderate inflation of between3-5 percent is likely in the next few years.The relatively low rate of economic growthplus moderate inflation means some enterpriseswill start to feel the heat. Export-orientedenterprises, in particular, will find the goingharder than before, and no doubt some will gobankrupt during this process. But the structuralchanges would create a healthy environment forthose able to adapt.Government policies will undoubtedlyplay a vital role during this period of economicrestructuring and it is imperative the countrypresses ahead with reforms, including adjustmentof the central and local tax structure,implementation of structural tax reduction, advancementof the reform of State-owned enterprises,and increasing the ratio of direct financing.The coming two to three years are of vitalimportance to China’s continuing economicgrowth and there are enormous challenges toovercome. But if we can seize this opportunity,our economy will secure a solid foundation forlasting healthy development in the future.By Li DaokuiCrucial Period of Change17

ECONOMYA China Round of MultilateralTrade NegotiationsBy Aaditya Mattoo and Arvind SubramanianThe World Trade Organization’s(WTO) Doha Roundof trade negotiations is on lifesupport and there are intermittentand half-hearted efforts to resuscitateit. It would seem that the postwarframework for multilateral tradecooperation is under existential threat.It is, however, premature to draw thatconclusion.Beginning in the 1990s, when itwas becoming clear that China representeda huge market access opportunity,the United States and EuropeanUnion launched efforts to reduce China’strade barriers. This initiative was assistedby the fact that the Chinese leadership,or at least some parts of it underZhu Rongji, wanted to use the WTO asa means for furthering domestic reformand anchoring it in the WTO. Chinacommitted to substantially reducing itsbarriers in agriculture, industry, and services.China was not alone: A numberof Eastern European and other communistcountries like Vietnam also joinedthe WTO on similar tough terms.The trading system has accommodatedan emerging China. How willit adapt to and be shaped by a dominantChina? Our key argument is that whileChina will have strong reasons to sustainthe open trading order, that cannotbe taken for granted. The world needs totether China to the multilateral systemas an insurance against the small possibilitythat China will seek to translateits power into trading privilege.China’s current tradeascendancy and its implicationsChina’s trade ascendancy and presenceare not a distant phenomenon. Inmanufacturing trade, China is now alarge supplier to all the major markets,and its presence has grown significantlyover the course of the Doha Roundnegotiations. We identify the world’sten largest traders and for each of themalso identify the largest sources of supplyin the manufacturing sector. China’sshare in the major import markets hasdoubled between 2001 and 2009, and insome of the most important world marketsChina now accounts for more thana fifth of total manufacturing imports.China’s share of manufacturing importsin Japan is 35 percent, in the EuropeanUnion about 30 percent, and in theUnited States slightly over 25 percent.Two points are worth highlighting.First, in the most protected sectors,China’s share of imports in 2009is substantially greater than for overallimports and dwarfs that of any othersupplier in each of these markets. Forexample, China’s share in these sectorsin Japan is over 70 percent, inKorea over 60 percent, in Brazil about55 percent, and in the United States,Canada, and the European Union about50 percent each. Second, even in theseprotected sectors, China’s share hasincreased dramatically over the courseof the Doha Round. In many of theimporting countries, China’s share hasmore than doubled. Also striking is howmuch market share China has gained,even in countries such as Canada,Mexico, and Turkey, which have freetrade agreements with close and largeneighbors. Thus, liberalization underthe Doha agenda today, especially in thepolitically charged, high-tariff sectors,is increasingly about other countriesopening their markets to Chinese exports.In short, with some exaggerationone might say that the MFN tariff ofcountries is really a China tariff, or theChina tariff is really the least-favorednationtariff.The Green Room is the venuefor key WTO negotiations. And therethe great shared but unuttered fear isof competition from an increasinglydominant China. It seems today thatprogress in the Doha Round hingescritically on greater market opening,not in services or agriculture, but inmanufacturing (nonagricultural marketaccess or NAMA in WTO-speak).Services negotiations have been giveninsufficient attention and are nowwidely regarded as too complicated todeliver significant market opening inthis Round. In agriculture, with foodprices high and expected to remain so,import protectionism has become lesssalient. Rather, it is the threat of agriculturalexport restrictions that is moreserious, but addressing it is not on theDoha agenda anyway despite the effortsof some WTO members. So, Doha todayis mostly about the negotiations onmarket access in manufacturing. And inmanufacturing trade, as shown above,China looms large especially in themost protected sectors.But Chinese dominance perse should not have precluded mutuallybeneficial bargains. The Chinesemarket, despite China’s far-reachingWTO accession commitments, remainsprotected in a number of areas (such asfertilizers, vehicles, and certain othermanufacturing items). Moreover, asLaborde, Martin, and van der Mennsbrugghehave shown, other countrieswould also see increased exports fromthe proposed Doha liberalization byWTO members. The proposals of theUnited States and others to move furthertoward free trade in selected sectorscould translate into even greater exportgains.What then is stymieing the reciprocitymechanism that has deliverednegotiating success in the WTO inthe past? China’s trade dominance hasbeen achieved in large part by China’ssuccessful growth strategy, which hasincluded an embrace of markets and anunusually high degree of trade openness.The problem, however, is the20

strong political perception that China’sexport success has been achieved, andcontinues to be sustained, in part by anundervalued exchange rate.It seems unlikely and politicallyunrealistic to expect China’s tradingpartners to open further their marketsto China when China is perceivedas de facto imposing an import tariffand export subsidy not just in selectedmanufacturing sectors but across theboard. The evidence on the existenceand extent of undervaluation continuesto be debated. On the one hand, in asurvey of studies on renminbi misalignmentconducted by Cline and Williamson,17 of the 18 studies concludedthat the renminbi is undervalued; theaverage estimate of the undervaluationwas 19 percent for the 2000-07 periodas a whole and considerably higher forthe 2004-07 period. On the other hand,Dunaway, Leigh, and Li argue that allestimates of renminbi undervaluationare very sensitive to underlying assumptionsabout models and parameters andtherefore not reliable. Nevertheless, thefear persists that China will gain evengreater market share as a result of anytrade liberalization in the Doha Round,not just in countries’ own markets butalso in third markets, in each of whichthe effects of the exchange rate are likelyto be felt.One sign of this fear is that industrialand especially developing countriesare increasingly resorting to contingentprotection against imports from China.For example, the share of developingcountry antidumping actions againstChina (as a share of their total actions)increased from 19 percent in 2002 to 34percent in 2009. The corresponding figuresfor industrial countries were 11 and27 percent, respectively. But recourseto this instrument will become moredifficult when China attains marketeconomy status in 2016. Moreover, theproduct-specific transitional safeguardsthat were negotiated at the time of China’sWTO accession are due to expirein 2013. This leaves countries even moreanxious about competition from China.Consider most starkly Brazil’spredicament. Its currency has appreciatedsharply (40 percent) over the lastfew years, while those of competitors inAsia, especially China, have not. Brazilhas been trying desperately and repeatedlyto use capital controls to stem thesepressures on the currency. Its importsfrom China have surged, especially inthe most protected sectors. The politicaleconomy would have to be very odd ifBrazil, under the current circumstances,would lower trade barriers in these verysectors. And Brazil’s tariffs in these sectorsare about 25 percent on average. Itis therefore not surprising that BrazilianFinance Minister Guido Mantegasaid in January 2011 that in relation toexchange-rate policies, “China and theUnited States are the worst offenders.This is a currency war that is turninginto a trade war.” In fact, Brazil hassubmitted a proposal to the WTO arguingin favor of contingent protectionmeasures against imports from countrieswith undervalued exchange rates.Recently, the government raised, by 30percentage points, a tax on cars with alarge percentage of imported parts afterChinese-made car imports surged.From an economic perspective,it is the multilateral trade balance ofcountries that is important, which couldbe influenced by the exchange rate. Butgiven China’s large global trade surplus,the bilateral trade imbalance relativeto China, which has been attributedin part to China’s currency policy, hasbecome a political problem for manycountries.In effect, the whole basis for exchangingtrade policy concessions is beingundermined because a de facto tradepolicy instrument, the exchange rate,is seen as nullifying these concessionswhile remaining beyond the scope ofmultilateral negotiations and discipline.What China gives by way of trade concessions,it is seen as undoing throughits exchange-rate policy. This connectionbetween the exchange rate and reciprocaltrade liberalization has not receivedadequate attention and may be key tounderstanding the predicament today.A corollary of our analysis is thatunless Chinese currency policy changessignificantly, and unless there can becredible checks on the use of such policiesin the future, the perception weoutlined above will remain. There aresome signs that China has slowly butsurely embarked on a process of internationalizingits currency that will overtime eliminate the undervaluation ofthe renminbi. The horizon for renminbiinternationalization is as yet unclear butit is unlikely to happen over the nextyear or two.The dominance to comeWithin the next twenty yearsChina is likely to be economicallydominant: By 2030, China’s marketbasedGDP is projected to equal that ofthe United States, its purchasing powerparity-based (PPP-based) GDP will betwice that of the United States, its tradein goods will be nearly two times thatof the United States and Europe, whilethe renminbi stands a good chance ofnipping at the heels of the dollar, if noteclipsing it, as the main reserve currency.These projections do not requireChina to grow at anything close to thetorrid rates of 11 percent that Chinahas posted in the last fifteen years. Theyrequire China to grow at just under 7percent a year over the next two decades.Nor do these projections requireChina to maintain its current trajectoryof steeply rising openness.An economically dominant Chinawill be a China that, like other leadingpowers, acts out of self-interest, at leaston key issues. But it is not necessarilya China that will seek to roll backthe open trade and financial systembequeathed by the United States afterWorld War II. The view that Chinawill broadly continue the current systemrelies on the fact that it is exceptionallyopen.Taking account of China’s sizeand the fact that large countries tend totrade less than small countries, Chinais an exceptionally big importer andtrader. China’s openness, measured interms of trade outcomes, is far greaterthan anything achieved by the UnitedStates in the post-war period and re-21

ECONOMYsembles the levels of openness achievedby the United Kingdom at the heightof empire. To recap those numbers, theratio of trade to GDP for the UnitedStates rarely exceeded 15 percent duringPax Americana compared with China’scurrent ratio of 57 percent.The fact of China’s trade dependencewill tend to create a strong stakefor China in maintaining an open tradingand financial system. Historiansand political scientists have argued thattrade, and the intertwining of intereststhat it brings, is no guarantee againsteconomic or military conflict: Germanyjust prior to World War I was also amajor trader. But there are two criticaldifferences: China is trade dependent ina way that the United States and Germanynever were, and moreover, givenChina’s low levels of income, China’sstake in openness might be greater becauseits rise to prosperity, on which thelegitimacy of its government is predicated,will depend upon an open system.Moreover, the depth of China’sinternational integration may itselfpreclude protectionist measures. Industrialcountry firms have made largerelationship-specific investments inChina, outsourcing assembly and intermediategoods and services production;Chinese firms have formed strong linkswith locally established foreign manufacturingfirms, foreign banks, retailers,telecommunications and transportproviders, and are increasingly investingabroad. As a result, the business functionsof Chinese customers and suppliersof goods and services are highlyintertwined with their counterparts inother countries. Any protectionist actionwould threaten these relationshipsand be self-destructive. This mutual dependencesituation gives rise to politicaleconomy forces that could counteractprotectionist pressures.There is another reason for believingthat China’s stake in an open systemis deepening. China is in fact promotingand seeking the rise of the renminbi.The latest five-year plan states the goalof renminbi internationalization and“gradually” realizing renminbi convertibility.Over the last two years, it hastaken several steps to promote the internationaluse of the renminbi in tradeand financial transactions. As a result,the stock of renminbi-denominatedbonds issued overseas is expected toreach between 180 billion and 200 billiondollars from negligible amounts afew years ago.In this sense, it is encouraging thatChina is becoming more of a routineparticipant in WTO dispute settlementproceedings both as an initiatorof disputes and as a respondent. It isalso encouraging that so far, China haslargely agreed to comply with the termsof WTO dispute settlement proceedings.For example, of the eight casesbrought by the United States, three havebeen resolved by a memorandum of understanding,two are pending decision,and in three China has alleged compliancewith the decision of the DisputeSettlement Body.8 China’s actual compliancewill take some time to ascertainespecially given the vast amount of economicactivity controlled or directed bythe state. But there are indications thatChina takes its WTO commitmentsseriously.ConclusionAlthough we have framed thefuture issues for the trading systemaround China because of China’s likelydominant role, we recognize that futurenegotiations will not be just aboutChina. Indeed, other countries willhave a lot at stake in specific areas. Forexample Latin American exporters willbe key players in agriculture, the oil exporterson issues related to energy accessand foreign investment, and the UnitedStates and Europe on all issues. Futurenegotiations will thus have an essentialmultilateral character and trade-offsacross sectors will have to meet the demandsof some or all of these countries.But our contention is that the broadnature of issues involving China affordsthe possibility for securing satisfactoryreciprocal deals.There is also the question of China’swillingness to engage in this newagenda. We cannot be sure, of course,but three factors might be at play. First,the agenda includes issues that Chinahas an important stake in pursuing:clear investment rules, restraints onclimate-change-related trade action, aswell as assured access to resources (oiland food) and markets overseas.Second, the challenges for anopen system from the “decline of thewest” should not be underestimated. Ifgrowth in industrial countries does notrecover, income distribution continuesto worsen, and economic opportunitiescontinue to shrink, the intellectualand political consensus in favor of openmarkets, in which China has a strongstake, will come under threat. There arealready ominous portents.Third, even on those issues whereChina is currently defensive, there areincipient signs of domestic politicalshifts in line with shifting developmentpriorities. For example, China isbeginning to change its exchange-ratepolicy because of the need to curb risinginflation, to reduce export dependence,and to internationalize the renminbi.Similarly, China is taking action on climatechange because it sees competitiveadvantage in being the leader in greentechnology and because the retreat ofthe Himalayan glacier threatens its supplyof water. China also might eventuallymove away from or beyond its currenttechnology policy because it has itselfbecome an exporter of technology. If reformistsin China could use the relativelyone-sided WTO accession process toimplement key changes in policy, thensurely a more symmetric WTO negotiationcan empower progressive forcesnow to advance reforms that are in anycase in the broader national interest. Inthis respect, it would help for China toarticulate its vision for and role in forgingthe new system.The WTO has been, and cancontinue to be, unique among all the internationalinstitutions, a vital and effectiveforum for cooperation between themajor nations, even one that will be asdominant as China. The current DohaAgenda may be dying, but the WTO isalive and, with the right agenda, couldyet flourish. It could provide a muchneededgrowth boost to the status quopowers, and a means to consolidatecompetitiveness for the new powers. For,China it could provide an opportunityto signal its commitment to multilateralismand to being a benign hegemony, apanda bear rather than a dragon.(Author: from the Peterson Institutefor International Economics)22

A Year of Not WorryingAbout InflationBy Wei Li, Stephen Green• We expect CPI inflation to average 2.0% and 3.6%, respectively, in 2012 and 2013• We think of inflation as a three-year cycle; 2012 will be the bottom• We expect another RRR cut before end-2011, and five more cuts in 2012One of our non-consensuscalls for 2012 is very lowCPI inf lation in China.We expect CPI inflation todrop sharply in H1, before rising above4% y/y again in Q3-2013. We forecastaverage inflation at 2.0% in 2012 and3.6% in 2013 (see Chart 1). Here are thefoundations of our view:1. We believe that China has beenon a three-year inflation cycle for thepast decade, largely driven by policymakingdynamics. We see no reason forthis to have changed.2. Weaker external demand willexacerbate downward price pressures formost of 2012.3. Food is key to China’s CPI cycle.We expect 2012 to be characterisedby both strong supply growth and morerestrained demand growth (due to sloweroverall household income growth).4. With monetary policy still intransition, overall demand should bottomout only in Q1-2012; this shouldset us up for a turnaround in Q2 and astronger H2. We look for 6% q/q annualisedGDP growth in Q1-2011,rising to 12% in Q4. PMI readings arealso likely to remain below 50 in Q1.5. Barring a sudden demand shockfrom Europe, we do not expect a quickturnaround in policy, and monetarypolicy easing should continue to begradual. Given that prices take time toreact to recovering demand, we do notexpect CPI inflation to begin rising iny/y terms until mid-2012.6. Actual consumer price inflationmay well be higher than official CPIinflation, but we still believe officialinflation is an accurate portrayal of thetrend.The recurring three-yearinflation cycleChart 1 provides a straightforwardillustration of the three-year inflationcycle. Since 1999, China has had threeinflation cycles: April 1999 to April2002; May 2002 to around September2005; and July 2006 to July 2009. Thesecycles have two factors in common:1. Each one lasts about three years.2. Inflation rises in the first twoyears and declines in the third year.This is not a coincidence. We believethe three-year cycle reflects howthe economy and policy makers work.Generally speaking, after a year of ris-Chart 1:Three-year inflation cycles follow a consistent patternCPI inflation, % y/y10%Chart 2: CPI inflation breakdown by food and non-foodSub-components of CPI basket, weighted contributions, ppt10%8%6%Official CPI inflation8%6%Food contribution4%4%2%0%-2%Our CPI inflationforecast2%0%-2%Non-food contribution-4%Jan-99 Jan-01 Jan-03 Jan-05 Jan-07 Jan-09 Jan-11 Jan-13Sources: CEIC, Standard Chartered Research-4%Jan-99 Jan-01 Jan-03 Jan-05 Jan-07 Jan-09 Jan-11Sources: CEIC, Standard Chartered Research23

ECONOMYChart 3: Composition of the food basketSub-components of food basket, weightings, %45%40%35%30%25%20%15%10%5%0%MT VE GR AQ FR ED EG OTSources: CEIC, Standard Chartered ResearchChart 4: Breakdown of food inflation by food categorySub-components of food basket, weighted contribution, ppt25%20%15%10%5%0%-5%Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11Sources: CEIC, Standard Chartered ResearchChart 5: Pork prices are fallingLive pig and piglet prices, CNY/kg, 3mma4035302520151050Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-1125%20%15%10%Sources: CEIC, Standard Chartered Research5%0%-5%4035302520151050ing inflation, policy makers become worried aboutthe risk of an inflationary spiral and start to tightencredit. Suppliers of goods will also increase capacityafter having enjoyed improving profits for some time.These reactions lead to a decline in inflation after ayear or so.We expect China’s three-year inflation cyclesto continue, given that there is little evidence of bigstructural changes in the economy or significantchanges in the policy-making apparatus. This suggeststhat CPI inflation will fall in H1-2012, to around 1.3%y/y by July, according to our forecasts (after rising fortwo years from August 2009 to a peak of 6.5% in July2011). We expect y/y inflation to bottom out in H2-2012, and rise above 4% again in Q3-2013.A benign food inflation outlook for 2012Food is a key driver of China’s CPI inflation.Chart 2 shows the breakdown of contributions to CPIinflation into food and non-food sub-categories (on aweighted basis). Since 1999, food has been responsiblefor over 70% of overall CPI inflation, on average, despiteaccounting for only 31% of the basket.Chart 3 shows our estimates of the compositionof the CPI food basket. Meats (MT) are the mostconsumed foods in China, accounting for about 22%of the food basket. Pork (PO) is the most importantmeat, accounting for about 9.7% of the food basket(and 2.9% of the total CPI basket). Non-pork (NP)meats together account for about 12.2% of the foodbasket. The next most important food categories arefresh vegetables (VE) and grains (GR), accounting for9.7% and 9.0% of the food basket, respectively. Theyare followed by aquatic products (AQ ), fresh fruits(FR), edible oils (ED) and eggs (EG), with respectivefood basket weightings of 7.7%, 6.0%, 3.7% and 2.9%.‘Other foods’ (OT), those not included in the abovementionedcategories, together account for 39.3% ofthe food basket.Chart 4 shows how each type of food has affectedoverall food inflation since 2006. As one can see,meats (especially pork) and ‘other foods’ have dominated.Fresh vegetables and fruit were also importantdrivers of food inflation from March 2009 to November2010, but their supply fluctuates, so their effectsare less persistent. Grain inflation has been risingsince 2010, but given that the floor for grain prices islargely controlled by the government and grain stocksseem sufficient at the moment, we see little inflationrisk here.Pork prices have started falling, as we show inChart 5. The profitability of pig farming has improvedconsiderably, with the pig-to-feedstuff ratio (a measureof profitability) having recovered to above 7.0 as of November2011 from a low of 4.9 in June 2010, accordingto the Ministry of Agriculture (MoA); see Chart 6.Pig stocks are rising as a result of this improved profitability.According to MoA data, the number of sows24

ebounded to more than 48.8mn inOctober 2011 from a low of 45.8mn inAugust 2010, which suggests more pigsupply down the road.We expect pork inflation to dropsharply. Chart 7 shows historical porkinflation and our forecasts for 2012-13.We look for an 11% y/y price declineby July 2012. As a result, the weightedcontribution of pork inflation to overallCPI inf lation should drop from1.7ppt in June 2011 to -0.3ppt by July2012.Chart 8 shows our forecasts foroverall food inflation in 2012-13. Weexpect it to fall from 8.8% y/y in November2011 to around 3.3% by September2012. Food inf lation shouldstart to pick up gradually in H2-2012after policy easing in H1, and acceleratefurther to above 10% y/y in Q4-2013.Non-food inflation forecastsfor 2012-13We show our forecasts for y/y nonfoodinflation in Chart 9. We expectit to decline further to around 0.2% byJuly 2012 from 2.2% in November 2011,and stay close to zero for the remainderof 2012 before gradually recovering towards1.9% by end-2013.Us versus consensusInflation will not become a concernagain for the State Council until2013, in our view. We believe this is thelesson of the three-year inflation cycle.The current market consensus forecastsfor average CPI inflation are 3.75% for2012 and 4.25% for 2013, according toa Bloomberg survey of 12 economists.Our more benign CPI inflationforecasts (average of 2.0% for 2012 and3.6% for 2013) suggest that Beijing willhave quite a lot of room to manoeuvreon monetary policy in 2012. The transitionto monetary loosening has begun,but it will be a gradual process. Aftera first cut in the required reserve ratio(RRR) on 1 December, we expect anothercut before the year-end, as a preemptivemove to offset the negativeimpact on market sentiment of the 1January release of the December PMI(which we expect to fall further below50). We expect another five RRR cutsin 2012.Chart 6: Pork supply has recovered significantlyPig-to-feedstuff ratio (LHS, %), pig stock, 3mma (RHS, ’000)Chart 7: Pork inflation is expected to fall sharplyPork inflation, historical data and forecasts, % y/y8.58.07.57.06.56.05.55.04.5Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11470,000465,000460,000455,000450,000445,000440,000435,000430,000100%80%60%40%20%0%-20%40%Jan-05 Jan-07 Jan-09 Jan-11 Jan-13Sources: CEIC, Standard Chartered ResearchSources: CEIC, Standard Chartered ResearchChart 8: Food inflation forecasts for 2012-13 Chart 9: Non-food inflation forecasts for 2012-13Food inflation, historical and forecast, % y/yNon-food price index, SA; non-food inflation, % y/y25%20%15%10%5%0%-5%-10%Jan-00 Jan-02 Jan-04 Jan-06 Jan-08 Jan-10 Jan-124%3%2%1%0%-1%-2%-3%Jan-00 Jan-02 Jan-04 Jan-06 Jan-08 Jan-10 Jan-12135130125120115110Sources: CEIC, Standard Chartered ResearchSources: CEIC, Standard Chartered Research25