Luxembourg Regulated Investment Vehicles - Alfi

Luxembourg Regulated Investment Vehicles - Alfi

Luxembourg Regulated Investment Vehicles - Alfi

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

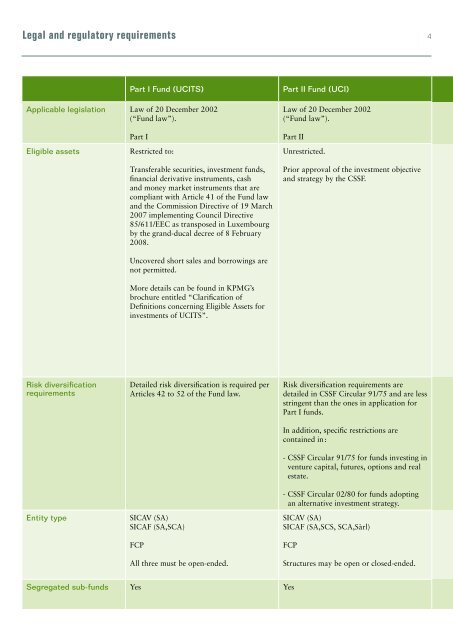

Legal and regulatory requirements4Part I Fund (UCITS)Applicable legislation Law of 20 December 2002(“Fund law”).Part II Fund (UCI)Law of 20 December 2002(“Fund law”).Eligible assetsPart IRestricted to:Transferable securities, investment funds,financial derivative instruments, cashand money market instruments that arecompliant with Article 41 of the Fund lawand the Commission Directive of 19 March2007 implementing Council Directive85/611/EEC as transposed in <strong>Luxembourg</strong>by the grand-ducal decree of 8 February2008.Uncovered short sales and borrowings arenot permitted.More details can be found in KPMG’sbrochure entitled “Clarification ofDefinitions concerning Eligible Assets forinvestments of UCITS”.Part IIUnrestricted.Prior approval of the investment objectiveand strategy by the CSSF.Risk diversificationrequirementsEntity typeDetailed risk diversification is required perArticles 42 to 52 of the Fund law.SICAV (SA)SICAF (SA,SCA)FCPAll three must be open-ended.Risk diversification requirements aredetailed in CSSF Circular 91/75 and are lessstringent than the ones in application forPart I funds.In addition, specific restrictions arecontained in :- CSSF Circular 91/75 for funds investing inventure capital, futures, options and realestate.- CSSF Circular 02/80 for funds adoptingan alternative investment strategy.SICAV (SA)SICAF (SA,SCS, SCA,Sàrl)FCPStructures may be open or closed-ended.Segregated sub-funds Yes Yes