1699 KB - Otto Marine Limited

1699 KB - Otto Marine Limited

1699 KB - Otto Marine Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DisclaimerOTTO MARINE LIMITEDThis presentation and the associated slides contain confidential information about <strong>Otto</strong> <strong>Marine</strong> <strong>Limited</strong> (the “Company”) and itssubsidiaries and associates (together with the Company, the “Group”).Click to edit Master OTTO textMARINEstylesLIMITEDSecond level2011 Full Year ResultsThird levelFourth levelFifth levellBy accepting such information, the recipient agrees to keep permanently confidential all information contained herein and that it will usesuch information only for the purpose it has disclosed to the Company for participating in this presentation and not for other purposesand will not divulge any such information to any other party without the express consent of the Company. Any reproduction of suchinformation, in whole or in part, is prohibited without the permission of the Company.This presentation includes only summary information and does not purport to be comprehensive. The information contained in thispresentation ti has not been subject to independent d verification. No promise, guarantee, representation, ti warranty or undertaking, expressor implied, is made as to, and no reliance should be placed on, the fairness, accuracy, reliability, completeness or correctness of theinformation or opinions contained herein. Neither the Company, any other company within the Group or its advisors, nor any of theirdirectors, officers or employees or any representatives of such persons, shall have any responsibility or liability whatsoever (innegligence or otherwise) for any loss arising from any use of the information or any other information or material discussed.This presentation contains forward-looking statements relating to the business, financial performance and results of the Company.These statements are based on current beliefs, expectations or assumptions and are subject to unknown risks and uncertainties thatcould cause actual results, performance or events to differ materially from those described in such statements. These risks, uncertaintiesand other factors include, but are not limited to, economic conditions globally, the impact of competition, political and economicdevelopments in countries in which the Group operates and regulatory developments in those countries and internationally, foreignexchange rates, oil and gas prices and the completion of ongoing g transactions. Many of these factors are beyond the Company's abilityto control or predict. Although the Company believes that its expectations and the information in this presentation were based uponreasonable assumptions at the time when they were made, it can give no assurance that those expectations will be achieved or that theactual results will be as set out in this presentation.Nothing in this presentation constitutes and shall not in any circumstances be construed as an invitation or an offer to purchase or thesolicitation of an offer to purchase any securities issued by the Company or any advice or recommendation with respect to suchsecurities and no part of this presentation shall form the basis of or be relied upon in connection with any contract or commitmentwhatsoever.2AgendaOTTO MARINE LIMITED• Company Snapshot• Investment Merits• Business Segments1Company SnapshotClick to edit Master text stylesSecond levelThird levelFourth levelFifth levell• Financial Highlights• Industry Outlook, Growth Strategies3

OverviewOTTO MARINE LIMITEDShare StatisticsOTTO MARINE LIMITED• Offshore <strong>Marine</strong> Group – engaged in Shipbuilding / Repair & Conversion,Chartering / Leasing and Specialized ServicesShare price (Closing on 21 Feb 2012)S$0.164• Headquartered in Singapore – commercial, procurement, and treasury support toour overseas operations (Indonesia, China, UAE, Australia)Market capitalizationS$310.0 million• Shipyard in Batam Indonesia – strong management and engineering teamcapable of delivering complex and deep water offshore vessels• Strategic direction – provider of specialized offshore vessels and services inniche technical segments (i.e. seismic, subsea, offshore construction, etc)52 week high / low S$0.270 / S$0.115P/B 086 0.86Net Gearing 1.83Number of shares 1,890,429,000• Customers – primarily specialized offshore service providers in niche segments,and fleet operators in the oil and gas industry5Major shareholdersSource: Bloomberg•Yaw Chee Siew (63.65%)•Lee Kok Wah (5.28%)•Standard Chartered (4.30%)6Share StatisticsOTTO MARINE LIMITEDOTTO MARINE LIMITED<strong>Otto</strong> <strong>Marine</strong> Share Price Graph:FY2011 Resultsannouncement26 Jan 2010: Share PlacementGC Rieber Novation– 220m shares @ S$0.432Agreement13 Apr 2010: Establishment ofS$500m MTN program Cancellation of Mosvoldvessel (H7048)29 Mar 2011: seismic contractwin, chartering first MT6009PSV contract and Novation forPSVCancellation of Mosvold vessel(H7049);24 Feb 2011: FY2011 results3Q Profit WarningJuly 2011: Profit warningS$20.8 million charteragreement to AfricaSour rce: BloombergSource: Bloomberg (52 weeks from 21 Feb 2012)2Investment Merits7

Investment MeritsOTTO MARINE LIMITEDInvestment MeritsOTTO MARINE LIMITEDCustomer base includes:• Shipbuilding• delivered more than 40 OSVs in the last 5 years worth more than US$ 700m• Chartering revenue to provide steady cash flow with net order book of US$215 million(as at 31 Dec 2011)• OSVs chartered on medium to long term basis• Specialized services• service and vessel provider in strategic niche segments (seismic, subsea vessels forwell intervention, i ROV and IMR)• seismic backlog contracts worth US$15.1m as at 31 December 2011• Customer base• ABCmaritime, Esnaad, Falcon Energy Group <strong>Limited</strong>, <strong>Marine</strong> Subsea AS, NorshoreShipping, Robert Knutzen Shipholdings• Strong engineering and experienced management team• average of more than 30 years experience in offshore vessels building910Investment MeritsOTTO MARINE LIMITEDOTTO MARINE LIMITED3Business segmentsFront L to R: Reggie Thein (Director), Lee Kok Wah (Advisor to Chairman & Group CEO), Yaw Chee Siew(Chairman & Group CEO) and Heng Hock Cheng @ Heng Heyok Chiang (Director)Back L to R: William Alastair Morrison (Director), Craig Foster Pickett (Director) and Ng Chee Keong(Director)11

Business SegmentsOTTO MARINE LIMITEDOTTO MARINE LIMITEDSpecializedServicesShipbuildingShipChartering131414Shipbuilding: Complex OffshoreSupport VesselOTTO MARINE LIMITEDStrategically Located ShipyardOTTO MARINE LIMITEDStrategic focus on DNV-certified OSV suitable for North Sea harsh conditions:Small to medium AHTSLarge AHTS(< 14,000 bhp) (> 14,000 bhp)Offshore construction vesselHeadquartered in Singapore and shipyards located in Batam, Indonesia andChina• Own and operate PT Batamec in Batam, Indonesia• Close proximity to SEA shipbuilding hub• Access to marine expertise in Singapore and large pool of qualified workers inIndonesia• Supply & anchor handling role• Drilling Unit for field support and• Supports Jack-Ups & standard depth Semisubmersibles construction dutiesWork barge with300 pax accommodationPlatform supply vesselOther vessels• One of the largest yards in Batamoccupying land area of 64 hectares• Waterfront of 650 meters• 1 dry dock• 2 slipways (under construction)• To support accommodationrequirements• Transportation of cargo tooffshore oil rigs and platforms• Utility vessels• Work maintenance boats• Others15• Syncrolift ®16

The Syncrolift® : IncreasingEfficiency of YardOTTO MARINE LIMITEDShipbuilding: Strong EngineeringCapabilitiesOTTO MARINE LIMITEDWhat is itWhat itdoes• Large lifting system, which raises andlowers vessels in and out of the waterfor dry-docking ashore• Allows construction and repair of upto 16* vessels at one timeRight mix of personnel and tools needed for sophisticated vessels• Led by an in-house team of highly qualified senior engineers and navalarchitects• Software investments – 3D design software,TRIBON®o Allows precise revisions to vessel design blueprint; detailed engineeringo Increase precision, accuracy in construction engineering and thereforeenhances productivity and cost efficiencyTheAdvantage• Waterfront efficiency is multiplied• Much faster than using a drydock ortraditional vessel launch*using 10,800 bhp vessels as a benchmark1718Competitive Market ShareOTTO MARINE LIMITEDOTTO MARINE LIMITEDBatamec Shipyard-Ranked 8th inAsia AHT/AHTSnewbuildsSource: quoted from DnB NOR initiation report dated 1 February 2010192020

Expansion of Chartering Operations(as at 31 December 2011)OTTO MARINE LIMITEDGeographical OperationsOTTO MARINE LIMITEDTwo forms of charteringFleet on operationExpected own charter fleet• 31 owned;(No. of vessels)1x Subsea vessel, 1x 21k bhp AHTS, 4x 10k bhp AHTS, 4x 6k bhp AHTS, 1x7k bhp AHTS, 1x 8k bhp AHTS, 2x 61m maintenance, 1x 75m WMV, 4x 40mAHTS, 1x 300men accommodation work barge, 1 4streamers seismic vsl;5tug, 5 barge10 15 25 57 65• 26 operating vessels – 1x 16k bhp AHTS, 2x 5k bhp AHTS, 1x 5dwt PSV, 2x3dwt PSV, 3x 3k bhp Tugs, 1x barge, 1x LCT and 15 x inshore vessels• 8 joining in 2012/2013;2x 21k bhp AHTS, 2x 12k bhp AHTS, 2x 6k bhp AHTS, 1x 7kbhp; 1x 75mWMV08 09 10 11 12FStrategic partnerships (up to 49% equity interest)• 4 operational;4x 5k bhp AHTSWe expect to grow our chartering income rapidly, on the back ofthe growth in our charter fleet sizeExpected JV charter fleet(No. of vessels)1 6 7 4 408 09 10 11 12F21OTTO MARINE LIMITEDSpecialised ServicesOTTO MARINE LIMITED• Provides marine geophysical services, 2D and 3D "high-density" marine seismicacquisition services to O&G players• Niche market that commands better marginsI. Seismic i operator –Reflect Geophysical (81.8% 8% owned)* Orient Explorer* Reflect Scorpio* Pacific TitanII.Subsea operator - Surf Subsea Inc (19.2% owned)*Surf ChallengerInvestor Relations Contact : Kamal Samuel | Tel: 6438 2990 | Email: kamal@financialpr.com.sg 232324

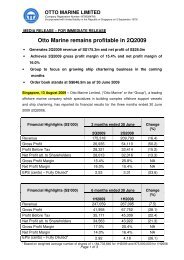

OTTO MARINE LIMITEDFY 2011 results summaryOTTO MARINE LIMITED4Financial HighlightsRevenue 10.2% S$520.8mGross Profit95.6% S$4.0mOperational Expenses87.0%S$60.0mPATMIS$67.7m Loss26Historical PerformanceOTTO MARINE LIMITEDProfit & LossFY2011 vs. FY2010OTTO MARINE LIMITEDRevenue(SGD millions)579.8483.6425.22314.0147.3520.8314.551.341.8113.22006 2007 2008 2009 2010 2011PATMI4Q3Q2Q1QFYS$’million FY2011 FY2010 Change %Total Revenue 520.8 579.8 (10.2)Gross Profit 4.0 90.8 (95.6)Gross Profit Margin (%) 0.8 15.7 (94.9)Profit/(Loss) Before Tax (72.5) 37.6 N.M.(SGD millions)41.920.2(67.7)56.8 52.3 40.7 72006 2007 2008 2009 2010 20114Q3Q2Q1Q(38.3)(19.8)(16.6) FYNet Profit/(Loss) (att. to Share Holders) (67.7) 40.7 N.M.Net Profit/(Loss) Margin (%) (13.0) 7.0 N.M.Earnings /(Loss) Per Share(SGD cents)(3.58) 2.17 N.M.2728

Consolidated Balance SheetOTTO MARINE LIMITEDConsolidated Cashflow StatementOTTO MARINE LIMITEDS$’million 31 Dec 2011 31 Dec 2010S$’million FY2011 FY2010Current assets 952.8 857.8Net cash used in operating activities (114.7) (159.5)Non-current assets 682.6 679.5Net cash from (used in) investing activities 33.8 (147.2)Total assets 1,635.4 1,537.3Net cash from financing activities 21.0 250.3Current liabilities 857.4 708.9Non-current liabilities 418.1 358.5Net decrease in cash and cash equivalent (59.9) (56.4)Total liabilities 1,275.5 5 1,067.4Cash and cash equivalent at beginning of year 149.7 227.1Net Asset Value Per Share (SGD cents) 19.04 24.85Net Gearing Ratio # 1.83 1.04Note: # Total borrowings less cash and bank balances over equity29Effects of exchange rate changes on the balance of cashheld in foreign currencies_ (21.0)Cash and cash equivalent at end of year 89.8 149.730Revenue BreakdownOTTO MARINE LIMITEDGross Profit BreakdownOTTO MARINE LIMITEDRevenue (S$’mil)Gross Profit & MarginFY2011304.0, 58%86.0, 17%130.8, 25%FY2010478.6, 82%38.7, 7%62.6, 11%57.1 55.030.334 3.4FY2010FY2011ShipbuildingCharteringSpecialisedServices11.9%78.6%5.4%18.1%(15.4)FY2010FY2011(35.7)-27.3%-17.9%Shipbuilding, ship repair and conversion Chartering Specialised ServicesGross Profit (S$’m)Gross Profit Margin3132

Addressing concernsOTTO MARINE LIMITEDAddressing concernsOTTO MARINE LIMITEDImmediate Concern 1 – 2 cancelled vessels (Hull No. 7048 and Hull No. 7049)• Management is evaluating various options on hand to deal with the cancelledvessels• May either sell these vessels at market value or aim at amalgamating them in theGroup’s fleet to charter them out• These very sophisticated vessels are sister vessels to ‘Deep Sea 1’ that recentlyattained the coveted maritime class certification from DNV• Already a number of enquiries for these vessels• World market for this size AHTS has improved in the past months as evidenced bythe rise in the charter rates in the North SeaImmediate Concern 2 – Streamline Reflect Geophysical’s s Operations•Intensify marketing efforts to improve utilization of the vessels• Target projects which h are physically proximate to minimize i i mobilization time so asto maximize full production revenue•Change cost structure t for vessels from fixed to variable•Seek synergy within the Group to manage the vessels as compared to outsourcing4142OTTO MARINE LIMITEDRecent Corporate UpdatesOTTO MARINE LIMITED• 29 Dec 2011: Amendments to Trust Deed relating to the S$500 million MTN program6Q&A• 29 Dec 2011: Sales of 49% shareholding interest in West African Invest Ltd, includingtwo 300 men Accommodation Recent Corporate Work Barge for UpdatesUS$26.6 million• 19 Dec 2011: Group’s subsidiary, Go <strong>Marine</strong> Group incorporates wholly-owned owned subsidiary,Go Swordfish Pte Ltd in Singapore• 16 Dec 2011: <strong>Otto</strong> <strong>Marine</strong> deploys 8,000bhp AHTS in Africa; bringing total vessel countin Africa to 5• 13 Dec 2011: <strong>Otto</strong> <strong>Marine</strong> delivered two 40m AHTS , “SWORDFISH 4” and“SWORDFISH 5” and deployed towards Australia and New Zealand• 12 Dec 2011: <strong>Otto</strong> <strong>Marine</strong> sold one offshore vessel to its JV Company and also breaksinto the India market• 30 Nov 2011: Entered into a Joint Venture to form <strong>Otto</strong> Limin <strong>Marine</strong> Pte Ltd, which will beinvolved in the ownership and operation of vessels44

Recent Corporate UpdatesOTTO MARINE LIMITED• 14 Nov 2011: <strong>Otto</strong> <strong>Marine</strong> announced that Mr. Lee Kok Wah will retire as President andGroup CEO; Mr. Yaw Chee Siew will assume as the Executive Chairman and CEO of<strong>Otto</strong> <strong>Marine</strong> Group• 14 Nov 2011: Announcement of 3QFY2011 results• 4 Nov 2011: <strong>Otto</strong> <strong>Marine</strong> sold Hull No. 7061 for a consideration of US$19 million• 2 Nov 2011: Exercise of option to acquire shares of Go <strong>Marine</strong> Group Pty Ltd• 28 Oct 2011: Profit warning for 3QFY2011 results due to volatility in forex rates and reduceddrevenue from Reflect Geophysical Pte Ltd• 14 Oct 2011: Mr. Lum Kim Wah to resign as COO & Senior Executive Vice President;Deputy President, Mr. Aw Chin Leng to assume Mr. Lum’s functions45