to Adjusted Operating Income (Loss) - Alere

to Adjusted Operating Income (Loss) - Alere

to Adjusted Operating Income (Loss) - Alere

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

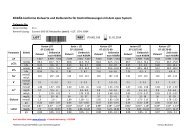

Reconciliation of GAAP <strong>Operating</strong> <strong>Income</strong> (<strong>Loss</strong>) <strong>to</strong> <strong>Adjusted</strong> <strong>Operating</strong> <strong>Income</strong> (<strong>Loss</strong>)(in thousands)For the Three Months Ended June 30, 2012<strong>Operating</strong> SegmentProfessionalDiagnosticsHealthManagementConsumerDiagnostics Corporate TotalRevenue (GAAP) $ 540,109 $ 138,590 $ 21,818 $ - $ 700,517Adjustment related <strong>to</strong> acquired software license contracts (1) 1,126 - - - 1,126<strong>Adjusted</strong> revenue $ 541,235 $ 138,590 $ 21,818 $ - $ 701,643<strong>Operating</strong> income (loss) - (GAAP) $ 63,251 $ (12,666) $ 2,699 $ (18,930) $ 34,354Adjustment related <strong>to</strong> acquired software license contracts (1) 1,126 - - - 1,126Amortization 66,428 14,312 631 - 81,371Restructuring 817 539 - 9 1,365S<strong>to</strong>ck-based compensation - - - 4,368 4,368Acquisition-related costs - - - 3,800 3,800Contingent consideration adjustments (6,901) 863 (288) (355) (6,681)<strong>Adjusted</strong> operating income (loss) $ 124,721 $ 3,048 $ 3,042 $ (11,108) $ 119,703<strong>Adjusted</strong> operating income (loss) as % of revenue 23.0% 2.2% 13.9% 17.1%(1) Estimated revenue related <strong>to</strong> acquired software license contracts that was not recognized during the second quarter of 2012 due <strong>to</strong> business combination accounting rulesReconciliation of GAAP <strong>Operating</strong> <strong>Income</strong> (<strong>Loss</strong>) <strong>to</strong> <strong>Adjusted</strong> <strong>Operating</strong> <strong>Income</strong> (<strong>Loss</strong>)(in thousands)For the Three Months Ended June 30, 2011<strong>Operating</strong> SegmentProfessionalDiagnosticsHealthManagementConsumerDiagnostics Corporate TotalRevenue $ 409,074 $ 135,572 $ 22,539 $ - $ 567,185<strong>Operating</strong> income (loss) - (GAAP) $ 49,304 $ (15,154) $ 1,902 $ (19,898) $ 16,154Amortization 61,768 18,341 860 - 80,969Restructuring 2,880 6,368 - 1,050 10,298S<strong>to</strong>ck-based compensation - - - 6,181 6,181Acquisition-related costs 6 (62) - 1,472 1,416Contingent consideration adjustments (6,972) - 228 (480) (7,224)Other (1) - - - 10 10<strong>Adjusted</strong> operating income (loss) $ 106,986 $ 9,493 $ 2,990 $ (11,665) $ 107,804<strong>Adjusted</strong> operating income as % of revenue 26.2% 7.0% 13.3% 19.0%(1) Includes expenses incurred in connection with the sale of our vitamins and nutritional supplements business.Comments:In calculating "adjusted operating income (loss)" in the schedule presented above, the Company excludes from operating income (loss) (i) certain non-cash charges,including amortization expense and s<strong>to</strong>ck-based compensation expense, (ii) non-recurring charges and income, and (iii) certain other charges and income that have asignificant positive or negative impact on results yet do not occur on a consistent or regular basis in its business. In determining whether a particular item meets one ofthese criteria, management considers facts and circumstances that it believes are relevant. Management believes that excluding such charges and income from operatingincome (loss) allows inves<strong>to</strong>rs and management <strong>to</strong> evaluate and compare the Company's operating results from continuing operations from period <strong>to</strong> period in ameaningful and consistent manner. Due <strong>to</strong> the frequency of their occurrence in its business, the Company does not adjust operating income (loss) for the costs associatedwith litigation, including payments made or received through settlements. It should be noted that "adjusted operating income (loss)" is not a standard financialmeasurement under accounting principles generally accepted in the United States of America ("GAAP") and should not be considered as an alternative <strong>to</strong> operatingincome (loss) as an indica<strong>to</strong>r of operating performance or any measure of performance derived in accordance with GAAP. In addition, all companies do not calculate non-GAAP financial measures in the same manner and, accordingly, "adjusted operating income (loss)" presented in this schedule may not be comparable <strong>to</strong> similar measuresused by other companies.Reference should also be made <strong>to</strong> the Company's financial results contained in our earnings press release respective <strong>to</strong> the periods presented in this schedule, whichinclude a more detailed discussion of the adjustments <strong>to</strong> the GAAP operating results presented above.

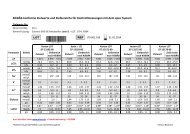

Reconciliation of GAAP <strong>Operating</strong> <strong>Income</strong> (<strong>Loss</strong>) <strong>to</strong> <strong>Adjusted</strong> <strong>Operating</strong> <strong>Income</strong> (<strong>Loss</strong>)(in thousands)For the Six Months Ended June 30, 2012<strong>Operating</strong> SegmentProfessionalDiagnosticsHealthManagementConsumerDiagnostics Corporate TotalRevenue (GAAP) $ 1,058,466 $ 269,374 $ 43,806 $ - $ 1,371,646Adjustment related <strong>to</strong> acquired software license contracts (1) 2,412 - - - 2,412<strong>Adjusted</strong> revenue $ 1,060,878 $ 269,374 $ 43,806 $ - $ 1,374,058<strong>Operating</strong> income (loss) - (GAAP) $ 133,430 $ (32,022) $ 3,064 $ (35,060) $ 69,412Adjustment related <strong>to</strong> acquired software license contracts (1) 2,412 - - - 2,412Amortization 129,313 28,636 1,351 - 159,300Restructuring 5,611 1,256 - 26 6,893S<strong>to</strong>ck-based compensation - - - 8,242 8,242Non-cash charge associated with acquired inven<strong>to</strong>ry 4,681 - - - 4,681Acquisition-related costs - - - 5,261 5,261Contingent consideration adjustments (6,325) 3,167 (204) 1,725 (1,637)<strong>Adjusted</strong> operating income (loss) $ 269,122 $ 1,037 $ 4,211 $ (19,806) $ 254,564<strong>Adjusted</strong> operating income (loss) as % of revenue 25.4% 0.4% 9.6% 18.5%(1) Estimated revenue related <strong>to</strong> acquired software license contracts that was not recognized during the second quarter of 2012 due <strong>to</strong> business combination accounting rulesReconciliation of GAAP <strong>Operating</strong> <strong>Income</strong> (<strong>Loss</strong>) <strong>to</strong> <strong>Adjusted</strong> <strong>Operating</strong> <strong>Income</strong> (<strong>Loss</strong>)(in thousands)For the Six Months Ended June 30, 2011<strong>Operating</strong> SegmentProfessionalDiagnosticsHealthManagementConsumerDiagnostics Corporate TotalRevenue $ 824,886 $ 278,635 $ 46,128 $ - $ 1,149,649<strong>Operating</strong> income (loss) - (GAAP) $ 109,566 $ (27,087) $ 5,263 $ (40,683) $ 47,059Amortization 117,129 38,228 1,729 - 157,086Restructuring 4,858 10,589 - 1,050 16,497S<strong>to</strong>ck-based compensation - - - 11,989 11,989Acquisition-related costs 6 74 - 3,199 3,279Contingent consideration adjustments (6,883) - (225) 1,269 (5,839)Other (1) - - - 23 23<strong>Adjusted</strong> operating income (loss) $ 224,676 $ 21,804 $ 6,767 $ (23,153) $ 230,094<strong>Adjusted</strong> operating income as % of revenue 27.2% 7.8% 14.7% 20.0%(1) Includes expenses incurred in connection with the sale of our vitamins and nutritional supplements business.Comments:In calculating "adjusted operating income (loss)" in the schedule presented above, the Company excludes from operating income (loss) (i) certain non-cash charges,including amortization expense and s<strong>to</strong>ck-based compensation expense, (ii) non-recurring charges and income, and (iii) certain other charges and income that have asignificant positive or negative impact on results yet do not occur on a consistent or regular basis in its business. In determining whether a particular item meets one ofthese criteria, management considers facts and circumstances that it believes are relevant. Management believes that excluding such charges and income from operatingincome (loss) allows inves<strong>to</strong>rs and management <strong>to</strong> evaluate and compare the Company's operating results from continuing operations from period <strong>to</strong> period in ameaningful and consistent manner. Due <strong>to</strong> the frequency of their occurrence in its business, the Company does not adjust operating income (loss) for the costs associatedwith litigation, including payments made or received through settlements. It should be noted that "adjusted operating income (loss)" is not a standard financialmeasurement under accounting principles generally accepted in the United States of America ("GAAP") and should not be considered as an alternative <strong>to</strong> operatingincome (loss) as an indica<strong>to</strong>r of operating performance or any measure of performance derived in accordance with GAAP. In addition, all companies do not calculate non-GAAP financial measures in the same manner and, accordingly, "adjusted operating income (loss)" presented in this schedule may not be comparable <strong>to</strong> similar measuresused by other companies.Reference should also be made <strong>to</strong> the Company's financial results contained in our earnings press release respective <strong>to</strong> the periods presented in this schedule, whichinclude a more detailed discussion of the adjustments <strong>to</strong> the GAAP operating results presented above.