Credit Cards â Bankinginfo

Credit Cards â Bankinginfo

Credit Cards â Bankinginfo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

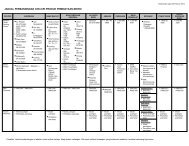

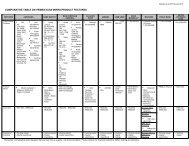

Read andunderstandthe terms andconditions for the useof the credit cardTERMS AND CONDITIONS (T&C)Normally, the credit card issuer willprovide you with a document on the T&Cof the credit card together with the card.You may be considered to have acceptedthe T&C specified in the document onceyou start using the credit card or uponsigning the acknowledgement of receiptfor the credit card. Therefore, you shouldread and understand the T&C beforesigning the agreement and using yourcredit card as it is a binding documentbetween you and the credit card issuer.Generally, the T&C covers the following:• The types of charges imposed• Rights and responsibilities of thecardholder and the credit card issuer• Usage of the credit card• Terms of repayment and liability forunauthorised transactions• Lodgement procedures for complaints,investigation and resolution• Secrecy of information• OthersConsult your credit card issuer promptlyif you need further clarification on theT&C. If you do not agree with the givenT&C, you may consider cancelling the creditcard by informing the credit card issuerand returning the credit card to the creditcard issuer immediately.UNDERSTANDING THE CHARGESAPPLICABLE FOR CREDIT CARDIt is important for you to understandthe various charges involved in the usageof credit cards. As long as you use yourcredit card wisely and settle payments ontime, you can minimise unnecessarycharges imposed on you. The following arethe common charges that you may incur:4