Credit Cards â Bankinginfo

Credit Cards â Bankinginfo

Credit Cards â Bankinginfo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

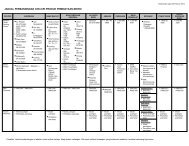

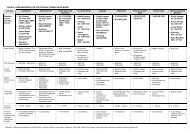

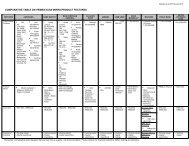

• Limit the number of credit cards basedon your needs and payment capability• Be alert of the changes in policies andrates. For example, your credit card issuermay raise its fees and charges or varysome of its T&CHOW TO AVOID BEING TRAPPED ASA BORROWER<strong>Credit</strong> card marketing strategies havebecome more aggressive and innovativeto entice credit cardholders not to payBe aware of theconsequencesof paying only theminimumrepaymentamount each monththe outstanding amounts in full and to continue carrying forwardthe outstanding balances each month. These borrowers or ‘revolvers’may think that it is beneficial and convenient to just pay only theminimum payment each month, but it is just the opposite.You should be aware of the consequences of paying only theminimum repayment amount by the due date of each month. Notonly will you incur more interest charges but also lengthen the timetaken to repay your balance. Many people do not realise the impactof accumulating their monthly credit card balances and end up withhuge debts.Below is an illustration of the repayment period and the totalinterest charged if you pay only the minimum monthly paymenteach month, i.e. 5% of the outstanding balance. For example, ifyour outstanding balance is RM1,000 and you pay only the minimummonthly payment, it will take you about 5.8 years to settle yourtotal debt and would cost you RM382 in interest charges, based onan interest rate of 18% per annum.OUTSTANDING AMOUNTSRM500 RM1,000 RM5,000 RM10,000Years Interest Years Interest Years Interest Years Interest(RM) (RM) (RM) (RM)4.2 168 5.8 382 9.6 2,097 11.2 4,2409