Tax Forms to Complete - UCI International Center

Tax Forms to Complete - UCI International Center

Tax Forms to Complete - UCI International Center

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

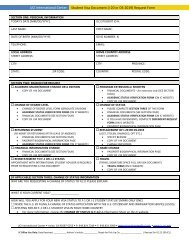

<strong>UCI</strong> <strong>International</strong> <strong>Center</strong><strong>Tax</strong> <strong>Forms</strong> <strong>to</strong> <strong>Complete</strong>Below you will find information about what forms you may need <strong>to</strong> complete depending on your visa type.Note: This is <strong>to</strong> be used as a guide, filing federal and state tax income tax forms is the personal responsibility of each international student and scholar. Information on thisform is not a substitute for advice obtained from the Internal Revenue Service or a qualified tax professional.POPULATION SITUATION FEDERAL FORMS STATE FORMSArrived in the United States in 2014You do not have <strong>to</strong> fill any forms for the 2013 tax yearF-1/J-1Was in the United States in 2013Form 8843Not NeededEarned No Money/Income in 2013STUDENTSWas in the United States for all or part of Form 8843, Form 1040NR-EZ or 1040NR Form 540NR [NR= Non-Resident]2009, 2010, 2011, 2012, 2013 year[NR= Non-Resident]Earned Money/Income 2013J-1 SCHOLARSH-1B or TNArrived in the United States in 2008 or earlierEarned Money/Income 2013BASIC TAX VOCABULARYINTERNAL REVENUE SERVICEThe taxation agency of the United States of America government <strong>to</strong> which you report your immigration status and <strong>to</strong> whom you fileyour personal Income tax return.ALIENAny person who is not a United States citizenSTUDENTPerson temporarily in the United States on an F and J visaRESEARCH SCHOLAR/TEACHERPerson who is not a student and who is temporarily in the United States on a J visaINCOME TAX RETURNStatement filed [completed and submitted] by the individual taxpayer <strong>to</strong> the Internal Revenue Service and State of CaliforniaINCOMEMoney earned by work or investments; wages, salaries, tips, some scholarship and fellowship grantsCOMPENSATION/EARNINGSMoney for work performed; wages, salariesW-2 Standard tax form showing the <strong>to</strong>tal wages paid <strong>to</strong> an employee and the taxes withheld during the calendar year: prepared by anemployer for each employee. Generally, distributed during the last week of January until the second week of February.WITHOLDINGU.S. income tax au<strong>to</strong>matically taken from your paycheckU.S. SOURCE INCOMEAll income, gain or loss from U.S. sources<strong>UCI</strong> <strong>International</strong> <strong>Center</strong> • Irvine, CA 92697-5255 • P: 949.824.7249 • F: 949.824.3090 • intl@uci.edu • www.ic.uci.eduIC Office Use Only | Revised On 03.05.2014Form 1040EZ or 1040 [You areForm 540considered a Resident Alien for taxpurposes]You do not have <strong>to</strong> fill any forms for the 2013 tax yearArrived in the United States in 2014Earned No Money/Income in 2013 Form 8843 Not NeededWas in the United States for all or part of Form 8843, Form 1040NR-EZ or 1040NR Form 540NR [NR= Non-Resident]2012 and 2013 year[NR= Non-Resident]Earned Money/Income in 2013Arrived in the United States 2010 or earlier Form 1040EZ or 1040(Resident Alien for tax purposes)Have been in the in the United States less Form 1040NR-EZ or 1040NR [NR= Nonthan183 days in 2013Resident]Have been in the United States more than Form 1040 [Resident Alien for tax183 days in 2013purposes]Form 540Form 540NR [NR= Non-Resident]Form 540

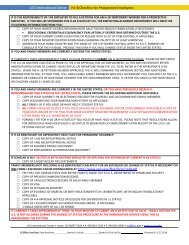

<strong>UCI</strong> <strong>International</strong> <strong>Center</strong><strong>Tax</strong> <strong>Forms</strong> <strong>to</strong> <strong>Complete</strong>2013 Income <strong>Tax</strong> Return deadline APRIL 15, 2014 (TUESDAY)List of Income <strong>Tax</strong> Preparations:H&R Blocko 4255 CAMPUS DR., UNIT B-142 IRVINE, CA 92612• Tel No. (949)856-1040• Hours of Operation: 9am <strong>to</strong> 9pm (during weekdays) 9am <strong>to</strong> 5pm (on weekends)• Look for Eileen Tsai or Phyllis Wan (<strong>Tax</strong> preparers for <strong>International</strong> Students/Scholars Resident or Non-Resident for <strong>Tax</strong> purposes)Jackson Hewitt <strong>Tax</strong> Serviceo 4840 IRVINE BLVD, STE 113, IRVINE, CA. 92620• Tel No. (714)544-0290• 6.54 miles from <strong>UCI</strong> campus (Irvine Blvd and Yale in Northwood)• Hours of Operation: 9am <strong>to</strong> 9pmoGlacier <strong>Tax</strong> Prep <strong>International</strong> <strong>Tax</strong> Preparation Software for Nonresident Aliens (Formerly known as CINTAX)https://www.glaciertax.com/A web-based nonresident tax preparation system designed primarily for students, scholars and researchers <strong>to</strong> complete the required federal tax forms.IRS –Internal Revenue Serviceo1-800-829-1040 TOLL-FREE, LIVE TELEPHONE ASSISTANCE FOR INDIVIDUALSHours of Operation: Monday – Friday, 7:00 a.m. – 7:00 p.m. your local timeNOTE: When calling, you may ask questions <strong>to</strong> help you prepare your tax return or ask about a notice you have received. Please be aware that when youconclude your discussion, their system will not permit you <strong>to</strong> return <strong>to</strong> your original responder.Disclaimer: The IC accepts no liability for the content of this information/list, or for the consequences of any actions taken on the basis of the informationprovided. We are not connected with, nor are we an affiliate with the agencies/companies listed above.<strong>UCI</strong> <strong>International</strong> <strong>Center</strong> • Irvine, CA 92697-5255 • P: 949.824.7249 • F: 949.824.3090 • intl@uci.edu • www.ic.uci.eduIC Office Use Only | Revised On 03.05.2014

![UCI International Center Social Security Number [SSN] Information](https://img.yumpu.com/47775232/1/190x245/uci-international-center-social-security-number-ssn-information.jpg?quality=85)