master of applied finance - Ngee Ann-Adelaide Education Centre ...

master of applied finance - Ngee Ann-Adelaide Education Centre ...

master of applied finance - Ngee Ann-Adelaide Education Centre ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NGEE ANN-ADELAIDE EDUCATION CENTRE<strong>Ngee</strong> <strong>Ann</strong>-<strong>Adelaide</strong> <strong>Education</strong> <strong>Centre</strong> is the gateway to globalisation for the University <strong>of</strong> <strong>Adelaide</strong>, a University <strong>of</strong> excellence inpostgraduate, undergraduate and pr<strong>of</strong>essional education. It is a partnership established since 1998 between the University <strong>of</strong><strong>Adelaide</strong> and <strong>Ngee</strong> <strong>Ann</strong> Kongsi, with the vision to educate the leaders <strong>of</strong> tomorrow.Please visit: www.NAA.edu.sgThe<strong>Ngee</strong><strong>Ann</strong>Kongsi<strong>Ngee</strong> <strong>Ann</strong> Kongsi is a foundation which is actively involved ineducational, cultural and welfare activities. Founded in 1845 byChinese immigrants <strong>of</strong> the Teochew dialect group, the <strong>Ngee</strong> <strong>Ann</strong>Kongsi was formally incorporated in Singapore under the OrdinanceAct in 1933. The Kongsi has grown from a community bound by acommon heritage and genuine concern for the welfare <strong>of</strong> itsmembers to a foundation that now serves the community regardless<strong>of</strong> race, religion or social status.With more than 130 years <strong>of</strong> excellence in education, the University <strong>of</strong><strong>Adelaide</strong> is one <strong>of</strong> Australia’s oldest and most prestigious tertiaryinstitutions.At the heart <strong>of</strong> the University’s vision, achievement and impact is abelief that the experience <strong>of</strong> the student is fundamental, and thatresearch and high quality teaching have a symbiotic relationship thatunderpins and characterises the finest universities in the world.Please visit: www.ngeeann.com.sgThe University is associated with 5 Nobel Laureates, has produced106 Rhodes Scholars and 122 Fulbright Scholars, and is a member <strong>of</strong>the Group <strong>of</strong> Eight - Australia’s leading research-intensive universities.Please visit: www.adelaide.edu.au and www.go8.edu.auSCHOOL OF BUSINESSThe University <strong>of</strong> <strong>Adelaide</strong> Business School aims to excel inleadership and innovation in business education, scholarship andresearch. The School is committed to high quality education byproviding internationally recognised undergraduate andpostgraduate course work degrees and higher degrees by research.The academic staff <strong>of</strong> the Business School are committed to qualityresearch that leads the development and dissemination <strong>of</strong> businessand management knowledge and informs teaching. Our staff seek tocreate a learning environment that promotes student’s growth aspr<strong>of</strong>essionals and researchers with the highest intellectual and ethicalstandards.The courses are taught by the University teaching faculties.AWARDED5YEARACCREDITATIONfor its business programsfrom AACSB• AACSB Accreditation is a hallmark <strong>of</strong> excellence in businesseducation and has been earned by less than 5% <strong>of</strong> the world'sbusiness schools.• The curriculum <strong>of</strong> your degree will be relevant to today's dynamicbusiness environment.www.business.adelaide.edu.au/VALUESTHE PURSUIT OF EXCELLENCE:Through commitment to continuous improvement and theachievement <strong>of</strong> best practice business standards.FAIRNESS, INTEGRITY, AND RESPONSIBILITY:Encourage these values in relation to the Business School’sbehaviour and practices and those <strong>of</strong> the business, communitypr<strong>of</strong>essionals, and researchers the School educates.COLLEGIALITY:Collaborative and cooperative relationships and practices amongstaff within and across the Business School for the purpose <strong>of</strong>promoting a positive work-place culture.RIGOROUS AND HONEST INTELLECTUAL ENQUIRY ANDEXPRESSION:Quality <strong>of</strong> scholarship is at the centre <strong>of</strong> the School’s activities.ENGAGEMENT WITH LOCAL, NATIONAL, AND INTERNATIONALBUSINESS AND COMMUNITY ORGANISATIONS:For the purpose <strong>of</strong> mutual enhancement <strong>of</strong> learning.INNOVATION AND CREATIVITY:In the School’s behaviour and practice and to encourage the samefor the pr<strong>of</strong>essionals and researchers the School develops.

MASTER OF APPLIED FINANCEThe program is designed to provide analytical tools and new skills in the field <strong>of</strong> <strong>finance</strong> to candidates possessing undergraduate degrees in <strong>finance</strong>or non-<strong>finance</strong> disciplines. It will provide the foundation for a career as an analyst, consultant or manager in the financial services sector comprisingbanks, investment institutions, capital market dealers, and financial planning consultancy.CAREERSA financial services analyst, consultant or manager. Diverse career paths are found in areas such as investing, treasury, risk management andcorporate restructuring.PROFESSIONAL ACCREDITATIONProvides the grounding to proceed to the pr<strong>of</strong>essional studies <strong>of</strong> the Chartered Financial Analysts Institute (CFA).4 Foundation Courses Accounting Concepts and Methods; Economic Principles; Principles <strong>of</strong> Finance; Quantitative Methods4 Finance Core CoursesEquity Valuation and Analysis; Fixed Income Securities; Options, Futures and Risk Management;Portfolio Theory and ManagementFinance Elective Courses(choose 2)Corporate Finance Theory; Real Estate Finance; Treasury and Financial Risk Management (M);Financial Statement Analysis2 Elective Courses Choose from:The <strong>finance</strong> courses not already selected from the <strong>finance</strong> electives listAND/ OR Another course within the Master <strong>of</strong> Pr<strong>of</strong>essional Accounting programAdvanced Financial Accounting; Auditing and Assurance Services; Intermediate Financial Reporting;Management Accounting* Please note that not all electives are <strong>of</strong>fered each term.NGEE ANN-ADELAIDE BOND-FREE SCHOLARSHIPSare awarded to outstanding NAA students who are enrolled in Master <strong>of</strong> Applied FinanceTerms and Conditions ApplyLEADERS OF TOMORROWfrom <strong>Ngee</strong> <strong>Ann</strong>-<strong>Adelaide</strong> <strong>Education</strong> <strong>Centre</strong>Most Outstanding Student 2011Master <strong>of</strong> Applied FinanceJohnson NeoTo be a good leader, it is important toconstantly ask questions to set one’smind thinking deeper. A great leadershould not merely accept the norm,but to challenge the norm foradvancement.Most Outstanding Student 2010Master <strong>of</strong> Applied FinanceSim Poh Koon AdrianTo equip oneself with the knowledgeto innovate. To possess the passionand integrity to guide others with aclear vision. To drive business andinspire others to greater heights <strong>of</strong>achievement.

COURSE DESCRIPTIONSFOUNDATION COURSESACCOUNTING CONCEPTS AND METHODSThis course introduces students to the fundamentals<strong>of</strong> financial accounting practice. It developsstudents’ understanding <strong>of</strong> key accountingconcepts, recording methods and measuring anddisclosing requirements. Topics include anintroduction to accounting information in decisioncontexts, the conceptual framework (SAC 1, SAC 2,the Framework), Income Statement and BalanceSheet, recording financial transactions, adjustingentries and the accounting cycle, inventory,revaluations, cost <strong>of</strong> acquisition, depreciation,introductory financial statement analysis,organisational structures (sole proprietors,partnerships, companies, not for pr<strong>of</strong>it), cash flowstatements, and other selected issues relating t<strong>of</strong>inancial reporting standards.ECONOMIC PRINCIPLESThe purpose <strong>of</strong> this module is to introduce studentsto the basic principles <strong>of</strong> macroeconomics andmicroeconomics so that they can understandeconomic events and the behaviour <strong>of</strong> the variouseconomic agents involved, analyse their impact onmarkets and propose appropriate courses <strong>of</strong> action.To do this, the student should be able to utilise thetools <strong>of</strong> economic analysis to perform company andindustry competitive analysis and shouldunderstand and be conversant with the variouseconomic indicators used.PRINCIPLES OF FINANCE (M)Risk and return are key concepts in investment. Thismodule discusses the measurement <strong>of</strong> risk andreturn. The relationship between risk and return isexamined through the various methods <strong>of</strong> valuationand asset pricing models. Capital budgetingtechniques, cost <strong>of</strong> capital and issues <strong>of</strong> capitalstructure are also covered as these enable thestudent to assess the investment plans <strong>of</strong>companies.QUANTITATIVE METHODS (M)The course will examine quantitative analysisapproaches essential for both academic and<strong>applied</strong> research with an emphasis on whatprocedures are most useful. Topics: revision <strong>of</strong>principles, characteristics <strong>of</strong> data and its collection,hypothesis testing with well behaved variables,financial econometrics, heteroscedasticity,autocorrelation, multi-collinearity, simultaneousequation (or system) solution, time series modellingand co-integration, logit and probit, non-linearregression, other approaches to developing models,hypothesis testing when variables arenot well behaved.ACCOUNTING CORE COURSESADVANCED FINANCIAL ACCOUNTINGThis course focuses on the theory and practice <strong>of</strong>corporate investments and transactions between thecompany and other parties (for example relatedparties and superannuation funds). It investigatesvarious theories and their applications relating tomanagement incentives for the provision <strong>of</strong>corporate information and its use in capital markets.Topics include company consolidations(pre-acquisition, intra-group transactions, minorityinterest), associates and joint ventures, foreigncurrency translations, related parties, segmentreporting and superannuation.AUDITING AND ASSURANCE SERVICEThe course examines the principles and practices <strong>of</strong>internal and external auditing. Topics: auditing as acomponent <strong>of</strong> recurrent and strategic activities, riskassessment, internal control, systems evaluation,forensic accountability, and contemporary auditissues and challenges.INTERMEDIATE FINANCIAL REPORTINGThis course extends students' knowledge <strong>of</strong>corporate external financial reporting. It focuses oncorporate disclosure and measurement issues andpractices in a regulated environment. Topics includemeasurement <strong>of</strong> income, assets, and liabilities(including provision accounting), accounting forIncome Tax, non-current assets (acquisition,subsequent cost or revaluation model, impairment <strong>of</strong>individual assets and cash generating units),intangible assets and goodwill, accounting forleases, employee benefits and share basedpayments, foreign currency transactions, andaccounting for financial instruments (includinghedging).MANAGEMENT ACCOUNTINGThe course introduces students to contemporarymanagement accounting concepts and techniques.Topics: the role <strong>of</strong> accountants in internaldecision-making; tools used to design and developcosting systems; preparation <strong>of</strong> budgets and theirrole as a planning and control tool; otherdecision-making tools including CVP analysis,pricing decisions, inventory issues and costs <strong>of</strong>quality; fraud.FINANCE CORE COURSESEQUITY VALUATION & ANALYSISThe course analyses companies from afundamental perspective in order to derive anintrinsic value for stock. Topics: Fundamentalanalysis, determination <strong>of</strong> growth, discount cashflows models including dividend discount models,free cash flow models and residual income models;relative valuation models including price-earningsand price-book multiples; valuation <strong>of</strong> privatecompanies, start up companies, companies withnegative earnings and mergers and acquisitions.FIXED INCOME SECURITIESThis course examines the valuation <strong>of</strong> fixed-incomesecurities, the market operations and management<strong>of</strong> risk. Topics include: valuation <strong>of</strong> bonds, termstructure <strong>of</strong> interest rate, measuring and managinginterest rate risk, corporate bond market, passiveand active bond portfolio management,performance measurement, securitisation andinterest rate derivatives.OPTIONS, FUTURES & RISK MANAGEMENTThis course examines the function and operationderivative markets serve in <strong>finance</strong>. To begin, thecourse identifies relationships that must hold insuch markets if there are to be no arbitrageopportunities. The course then covers optionspricing using the Binomial and Black-Scholesapproach, as well as describing a wide range <strong>of</strong>futures and options dealing strategies, along withtheir applications to hedging and risk management.Currency and fixed-interest derivatives are alsoconsidered as well as swaps, options on futuresand some alternative exotic options.PORTFOLIO THEORY & MANAGEMENTThis course is an in-depth study <strong>of</strong> the fundsmanagement theory and practice. Participants willfirst develop a strong theoretical knowledge <strong>of</strong> assetpricing, market efficiency and funds management.Students will then be exposed to the managedfunds industry and be required to apply theirtheoretical knowledge to understand the process <strong>of</strong>developing, managing and evaluating these assets.In addition, students will practically develop anInvestment Policy Statement (or a Statement <strong>of</strong>Advice) for an investor, forecast characteristics <strong>of</strong>various asset classes in an economy, and be able tocreate an investment vehicle to satisfy investors'needs. The students will also learn variousstrategies to manage funds, issues that impactperformance, and issues in benchmarking andperformance evaluation. Equities, Fixed IncomeSecurities, Commodities, Real Estate, AlternateFunds, Emerging, Developing and Developedmarkets will be examined in the context <strong>of</strong> portfolioconstruction.

GRADUATE ATTRIBUTES• The ability to identify and analyse contemporary thinking and developments within the fields <strong>of</strong> accounting, auditing, business law andbusiness systems, which are set in the context <strong>of</strong> the management and governance <strong>of</strong> organisations that interface with securities markets,governments and societies• An understanding <strong>of</strong> the application <strong>of</strong> accounting methods and techniques and their contribution to financial planning, control, performancemeasurement and decision-making by management and investors• Advanced critical and strategic thinking skills, capabilities and competencies in relation to accounting and business analysis issues andproblems• Ability to apply technical and analytical skills, using relevant decision frameworks and empirical research evidence, to address specificaccounting and business system problems• The ability to think creatively and generate innovative solutions by developing a capability in the accounting discipline that can record, analyse,report and interpret complex financial and other corporate information• Skills in identifying and solving accounting and business analysis problems emerging from strategic developments in practice and regulation• The ability to adopt multiple perspectives in applying planning, control and evaluation techniques to the operational, financial, andenvironmental dimensions <strong>of</strong> an organization and its sub-units• Ability to communicate ideas effectively in both informal group discussions and formal presentations• Ability to produce both complex research reports intended for review by academics and/or experts, and management reports intended fordecision-making by general managers• Sound written and oral communication skills, particularly in relation to presenting articulate analyses and arguments• Pr<strong>of</strong>iciency the use <strong>of</strong> electronic databases, web searching, ethnographical investigative methods, and the preparation <strong>of</strong> multimediapresentations• A deep appreciation <strong>of</strong> continuous change and improvement in organisations and societies• An understanding <strong>of</strong> the importance <strong>of</strong> lifelong learning in fields <strong>of</strong> accounting, regulatory frameworks, business systems and management• An awareness <strong>of</strong> their potential responsibilities as practising members <strong>of</strong> a pr<strong>of</strong>essional accounting body• Ability to take a leadership role in their pr<strong>of</strong>ession and the wider business community• A heightened understanding <strong>of</strong> ethical issues and dilemmas that will be faced as accounting pr<strong>of</strong>essionals who advise and provide services toclients or managements• A sensitivity to cultural and social issues, particularly concerned with organisations that operate internationally• Knowledge and understanding covering the breadth <strong>of</strong> the discipline <strong>of</strong> <strong>finance</strong>, leading to the ability to competently analyse financialinstruments and world financial markets at an advanced level that is internationally recognised• Provide knowledge and understanding <strong>of</strong> issues associated with pricing and trading financial instruments in equity, fixed income andderivatives markets• Ability to formulate and test trading strategies along with an understanding <strong>of</strong> how to benchmark and manage diversified funds• Knowledge <strong>of</strong> the key factors involved in determining investment policy statements suitable for clients with differing investment pr<strong>of</strong>ilesCOURSE DESCRIPTIONSACCOUNTING / FINANCE ELECTIVECOURSEFINANCE ELECTIVE COURSESFINANCIAL STATEMENT ANALYSISThis module comprises Singaporean, Asian andinternational case studies based on listedcompanies in various industries. The cases requireparticipants to analyse and interpret financial andnon-financial information from the perspectives <strong>of</strong>investment and credit analysts. In the process,participants learn how to construct and interpretprojected statements <strong>of</strong> income, financial positionsand cash flows.CORPORATE FINANCE THEORYThis course will focus on the investment andfinancing decisions and policies <strong>of</strong> corporations.There will be a focus on theory, and it emphasisesskills in developing economic explanations forfinancial phenomena. Additionally, the course willaim to provide some opportunities for the practicalimplementation <strong>of</strong> the main concepts covered.TREASURY AND FINANCIAL RISKMANAGEMENT (M)The course examines the process and instrumentsused in treasury management and their application inhedging risk and creating risk pr<strong>of</strong>iles. Topics:money market instruments and managementincluding yield curve, convexity and price value <strong>of</strong>basis point, bond portfolio management, bondhedging and trading; derivatives including futures,interest rate swaps, currency swaps, creditderivatives; the management <strong>of</strong> market, credit,liquidity and operations risks, and computing thevalue <strong>of</strong> risk. These issues are examined from theview point <strong>of</strong> both financial and non-financialorganisations.REAL ESTATE FINANCE & INVESTMENTReal estate is a significant investment focus inmanaging investor portfolios. This course looks atthe issues in financing and investing in real estatewith an emphasis on commercial real estate. Itcovers the general context <strong>of</strong> real estate as aninvestment, including the role and contribution <strong>of</strong>property trusts versus direct investment, anddiscusses what differentiates real estate from otherassets. Valuation models are investigated (includingcash flow models, and comparative valuation andthe influence <strong>of</strong> real options value). Real estateinvestment financing is investigated, looking atproject financing as well as general investment.Lastly issues in project development areconsidered. Building on the Business Schoolsexisting links with the American Real Estate andUrban Economics Association, the course coversthe tools for direct investors and advisors to makebetter decisions with respect to real estateinvestment, using case studies <strong>of</strong> Singaporean,Australian and international projects and investmentoutcomes to illustrate the issues involved.

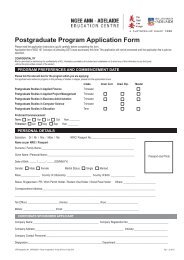

PRE-REQUISITE QUALIFICATIONA recognised undergraduate program.DURATION OF PROGRAMMaster <strong>of</strong> Applied Finance: 2 - 5 yearsPROGRAM STRUCTUREMaster <strong>of</strong> Applied Finance12 Courses consisting <strong>of</strong>:4 Foundation Courses4 Finance Core Courses2 Finance Elective Courses2 Elective CoursesASSESSMENTIndividual assignments, group work, test, tutorial participation, casestudies and written examinationFEESApplication Fee*: S$200.00 (upon application submission)Fee Per Course: S$2,250.00Total Tuition Fee: S$27,000The above fees are subjected to prevailing GST.Course fees are inclusive <strong>of</strong> course notes and examination fees.Course fees are charged on the basis <strong>of</strong> the number <strong>of</strong> courses enrolledin a given trimester.* Fully refundable if unsuccessful in meeting the entry requirementsENQUIRYTel: +65 6738 2910Email: registrar@NAA.edu.sg<strong>Ngee</strong> <strong>Ann</strong>-<strong>Adelaide</strong> <strong>Education</strong> <strong>Centre</strong>97 Tank Road, Level 3 Teochew Building, Singapore 238066www.NAA.edu.sgINTAKE3 intakes a year: January, May, SeptemberONE TYPICAL TRIMESTEROF 16 WEEKSFor each coursework module, classes are facilitatedin two flexible intensive blocks <strong>of</strong> weekend classesin a given term <strong>of</strong> 16 weeks commencing January,May and September.The following depicts a typical trimester:PRE-INTENSIVE BLOCK• Collection <strong>of</strong> course materials• Pre-reading1ST WEEKEND INTENSIVE• Weekend classes* are held over Friday, Saturdayand Sunday.POST 1ST WEEKEND INTENSIVE• Assignment writing• Revision and self study• Pre-reading for 2nd intensive2ND WEEKEND INTENSIVE• Weekend classes* are held over Friday, Saturdayand Sunday.POST 2ND WEEKEND INTENSIVE• Assignment writing and submission• Revision and exam preparations* A typical intensive weekend teaching block isas follows:Friday: 7.00 p.m. - 10.00 p.m.Saturday: 1.00 p.m. - 8.00 p.m.Sunday: 9.00 a.m. - 4.00 p.m.DISCLAIMERThe information contained in this publication is correct at the time <strong>of</strong> printingbut may be subject to change without notice. Updates may occur - please checkthe website for the latest information. <strong>Ngee</strong> <strong>Ann</strong>-<strong>Adelaide</strong> <strong>Education</strong> <strong>Centre</strong> andthe University <strong>of</strong> <strong>Adelaide</strong> assume no responsibility for the accuracy <strong>of</strong>information provided by third parties.© The University <strong>of</strong> <strong>Adelaide</strong> 2011. CRICOS Provider Number 00123MCPE Registration No. 199703922RPeriod <strong>of</strong> registration: 14 Sep 2010 to 13 Sep 2014PRINT JULY 2012