REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

REGISTRATION DOCUMENT - Bourbon

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

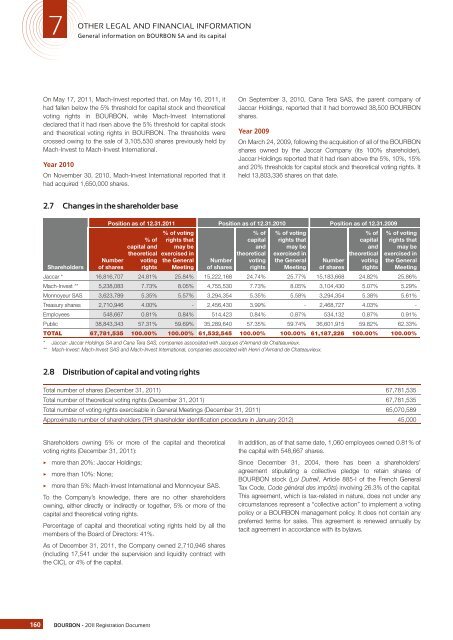

7GeneralOTHER LEGAL AND FINANCIAL INFORMATIONinformation on BOURBON SA and its capitalOn May 17, 2011, Mach-Invest reported that, on May 16, 2011, ithad fallen below the 5% threshold for capital stock and theoreticalvoting rights in BOURBON, while Mach-Invest Internationaldeclared that it had risen above the 5% threshold for capital stockand theoretical voting rights in BOURBON. The thresholds werecrossed owing to the sale of 3,105,530 shares previously held byMach-Invest to Mach-Invest International.Year 2010On November 30, 2010, Mach-Invest International reported that ithad acquired 1,650,000 shares.On September 3, 2010, Cana Tera SAS, the parent company ofJaccar Holdings, reported that it had borrowed 38,500 BOURBONshares.Year 2009On March 24, 2009, following the acquisition of all of the BOURBONshares owned by the Jaccar Company (its 100% shareholder),Jaccar Holdings reported that it had risen above the 5%, 10%, 15%and 20% thresholds for capital stock and theoretical voting rights. Itheld 13,803,336 shares on that date.2.7 Changes in the shareholder basePosition as of 12.31.2011 Position as of 12.31.2010 Position as of 12.31.2009% ofcapital andtheoreticalvotingrights% of votingrights thatmay beexercised inthe GeneralMeeting% ofcapitalandtheoreticalvotingrights% of votingrights thatmay beexercised inthe GeneralMeeting% ofcapitalandtheoreticalvotingrights% of votingrights thatmay beexercised inthe GeneralMeetingNumberNumberNumberShareholders of sharesof sharesof sharesJaccar * 16,816,707 24.81% 25.84% 15,222,168 24.74% 25.77% 15,183,668 24.82% 25.86%Mach-Invest ** 5,238,083 7.73% 8.05% 4,755,530 7.73% 8.05% 3,104,430 5.07% 5.29%Monnoyeur SAS 3,623,789 5.35% 5.57% 3,294,354 5.35% 5.58% 3,294,354 5.38% 5.61%Treasury shares 2,710,946 4.00% - 2,456,430 3.99% - 2,468,727 4.03% -Employees 548,667 0.81% 0.84% 514,423 0.84% 0.87% 534,132 0.87% 0.91%Public 38,843,343 57.31% 59.69% 35,289,640 57.35% 59.74% 36,601,915 59.82% 62.33%TOTAL 67,781,535 100.00% 100.00% 61,532,545 100.00% 100.00% 61,187,226 100.00% 100.00%* Jaccar: Jaccar Holdings SA and Cana Tera SAS, companies associated with Jacques d’Armand de Chateauvieux.** Mach-Invest: Mach-Invest SAS and Mach-Invest International, companies associated with Henri d’Armand de Chateauvieux.2.8 Distribution of capital and voting rightsTotal number of shares (December 31, 2011) 67,781,535Total number of theoretical voting rights (December 31, 2011) 67,781,535Total number of voting rights exercisable in General Meetings (December 31, 2011) 65,070,589Approximate number of shareholders (TPI shareholder identifi cation procedure in January 2012) 45,000Shareholders owning 5% or more of the capital and theoreticalvoting rights (December 31, 2011):3 more than 20%: Jaccar Holdings;3 more than 10%: None;3 more than 5%: Mach-Invest International and Monnoyeur SAS.To the Company’s knowledge, there are no other shareholdersowning, either directly or indirectly or together, 5% or more of thecapital and theoretical voting rights.Percentage of capital and theoretical voting rights held by all themembers of the Board of Directors: 41%.As of December 31, 2011, the Company owned 2,710,946 shares(including 17,541 under the supervision and liquidity contract withthe CIC), or 4% of the capital.In addition, as of that same date, 1,060 employees owned 0.81% ofthe capital with 548,667 shares.Since December 31, 2004, there has been a shareholders’agreement stipulating a collective pledge to retain shares ofBOURBON stock (Loi Dutreil, Article 885-I of the French GeneralTax Code, Code général des impôts) involving 26.3% of the capital.This agreement, which is tax-related in nature, does not under anycircumstances represent a “collective action” to implement a votingpolicy or a BOURBON management policy. It does not contain anypreferred terms for sales. This agreement is renewed annually bytacit agreement in accordance with its bylaws.160BOURBON - 2011 Registration Document