Annual Report PDF file 2009 - State of Illinois

Annual Report PDF file 2009 - State of Illinois Annual Report PDF file 2009 - State of Illinois

Moody’s S&P Shares/Quality Quality Par Fair DividendRating Rating Value Cost Value YieldFOREIGN EQUITY SECURITIES (continued) $ $ %Industrials (continued)NA NA 66,000 IHI CORP. 203,350 114,235 0.00NA NA 182,000 IMI 924,622 934,398 6.60NA NA 5,028 IMPERIAL HLDGS 59,131 37,958 5.60NA NA 72,564 IMPREGILO SPA 254,024 252,165 3.20NA NA 16,138 IMTECH NV 375,340 313,282 4.30NA NA 144,100 INABATA & CO. 487,981 586,944 2.50NA NA 25,100 INDUS HOLDING AG 441,889 379,174 7.40NA NA 35,000 INES CORPORATION 180,349 238,327 1.80NA NA 93,028 INTERTEK GROUP PLC 1,036,615 1,597,909 2.00NA NA 41,179 INVENSYS 245,746 151,568 0.70NA NA 27,000 JAPAN AIRLINES CORP. 59,098 52,050 0.00NA NA 16,000 JAPAN STEEL WORKS 215,235 197,668 1.00NA NA 228 JAPAN TOBACCO INC. 1,084,157 713,645 1.90NA NA 54,815 JERONIMO MARTINS SGPS 313,784 373,514 0.00NA NA 11,200 JS GROUP CORP. 204,653 172,960 2.70NA NA 26,176 JSC MMC NORILSK NICKEL 429,270 240,819 0.00NA NA 10,600 JTEKT CORPORATION 160,895 107,774 1.40NA NA 44,800 JUNGHEINRICH 603,098 591,941 5.80NA NA 35,000 KAJIMA CORP. 141,396 109,188 2.00NA NA 18,000 KAMIGUMI CO. 144,233 151,858 1.00NA NA 14,900 KARDEX 470,378 438,417 0.00NA NA 60,000 KATO WORKS CO. 110,073 149,868 2.90NA NA 84,000 KAWASAKI HEAVY IND 304,053 231,580 1.10NA NA 40,000 KAWASAKI KISEN 318,794 165,000 0.60NA NA 37,000 KEIHAN ELEC RAIL 145,259 157,227 1.20NA NA 6,000 KEIHIN ELEC EXP RL 47,065 46,515 0.80NA NA 53,000 KEISEI ELEC RAILWY 278,149 316,402 1.00NA NA 41,000 KELLER GROUP 281,698 373,728 3.70NA NA 61,000 KEPPEL CORP. 429,650 290,807 0.00NA NA 9,000 KINDEN CORPORATION 88,137 79,007 1.70NA NA 58,000 KINTETSU CORP. 187,381 255,480 1.20NA NA 65,000 KITZ CORPORATION 202,919 221,641 0.90NA NA 65,000 KOIKE SANSO KOGYO 144,656 196,715 2.10NA NA 39,000 KOKUYO CO. 346,628 341,151 1.80NA NA 32,700 KOMORI CORPORATION 533,691 391,444 1.70NA NA 6,111 KONE CORPORATION NPV 179,388 187,118 3.00NA NA 19,554 KONECRANES OYJ 886,098 459,409 5.40NA NA 141,000 KROSAKI CORP. 218,074 301,042 0.00NA NA 60,000 KUBOTA CORP. 453,541 495,621 0.00NA NA 3,455 KUEHNE & NAGEL AG 268,716 270,351 2.70NA NA 10,492 KUKA AKTIENGESELLSCHAFT 199,880 162,619 0.00NA NA 3,300 KURITA WATER INDS 88,597 106,711 1.10NA NA 62,100 KURODA ELECTRIC 605,405 834,780 2.20NA NA 139,000 KYODO PRINTING CO. 580,812 442,276 2.60NA NA 193,600 LAIRD PLC 515,496 494,187 0.00NA NA 12,074 LARSEN &TOUBRO 345,479 392,646 0.50NA NA 51,200 LAVENDON GROUP 271,751 105,398 4.00NA NA 19,556 LEGRAND SA 397,203 426,129 0.00NA NA 7,155 LEIGHTON HOLDINGS 168,279 135,935 6.20NA NA 4,700 LEMMINKAINEN CORP. 185,700 125,389 4.70NA NA 36,100 LEONI AG 511,139 594,463 1.70NA NA 19,759 MACQUARIE AIRPORTS 66,254 36,900 11.70NA NA 105,790 MACQUARIE INFRASTRUCTURE GROUP 277,612 122,302 14.00NA NA 64,534 MAIRE TECNIMONT SP 220,809 210,456 4.70NA NA 7,815 MAN SE 1,075,361 479,027 4.60NA NA 93,000 MARUBENI CORP. 702,550 412,541 1.60NA NA 19,500 MATSUDA SANGYO 346,885 311,442 1.60NA NA 40,453 METSO OYJ 732,714 754,661 5.30NA NA 2,695 MEYER BURGER TECHN 327,887 415,568 0.00NA NA 10,000 MINEBEA CO. 57,213 42,597 1.70NA NA 71,059 MITSUBISHI CORP. 1,819,193 1,316,821 1.90NA NA 101,000 MITSUBISHI ELEC CP 1,072,575 639,592 0.00NA NA 169,000 MITSUBISHI HVY IND 931,281 700,627 1.00NA NA 56,000 MITSUI MATSUSHIMA 64,990 80,095 2.20NA NA 62,171 MITSUI OSK LINES 699,294 404,013 1.10NA NA 28,000 MITSUI SOKO CO. 112,081 110,566 2.40NA NA 148,000 MONADELPHOUS GROUP 1,576,021 1,423,842 6.10NA NA 329,800 MORGAN CRUCIBLE CO. 564,335 515,974 7.40NA NA 60,100 MORGAN SINDALL PLC 444,984 683,922 6.10NA NA 22,000 MORITA HOLDINGS 79,410 87,786 2.60NA NA 109,559 MTR CORP. 267,049 328,675 2.10NA NA 54,936 MTU AERO ENGINES I 1,258,277 2,003,456 3.60NA NA 6,406 MURRAY & ROBERTS 60,366 41,476 4.10NA NA 111,000 NACHI FUJIKOSHI CO. 453,378 227,787 1.00ILLINOIS STATE BOARD OF INVESTMENT85

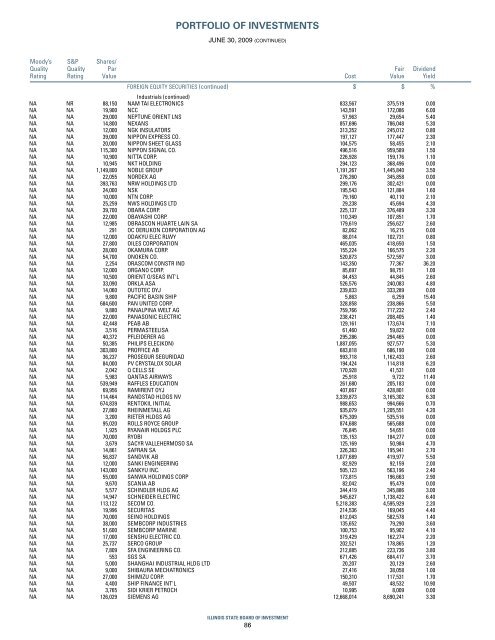

PORTFOLIO OF INVESTMENTSJUNE 30, 2009 (CONTINUED)Moody’s S&P Shares/Quality Quality Par Fair DividendRating Rating Value Cost Value YieldFOREIGN EQUITY SECURITIES (continued) $ $ %Industrials (continued)NA NR 88,150 NAM TAI ELECTRONICS 833,567 375,519 0.00NA NA 19,900 NCC 143,591 172,086 6.00NA NA 29,000 NEPTUNE ORIENT LNS 57,963 29,654 5.40NA NA 14,800 NEXANS 857,696 786,048 5.30NA NA 12,000 NGK INSULATORS 313,352 245,012 0.80NA NA 39,000 NIPPON EXPRESS CO. 197,127 177,447 2.30NA NA 20,000 NIPPON SHEET GLASS 104,575 58,455 2.10NA NA 115,300 NIPPON SIGNAL CO. 496,516 959,589 1.50NA NA 10,900 NITTA CORP. 226,928 159,176 1.10NA NA 10,945 NKT HOLDING 294,123 368,496 0.00NA NA 1,149,800 NOBLE GROUP 1,191,267 1,445,840 3.50NA NA 22,055 NORDEX AG 276,260 345,858 0.00NA NA 393,763 NRW HOLDINGS LTD 299,176 302,421 0.00NA NA 24,000 NSK 195,543 121,884 1.60NA NA 10,000 NTN CORP. 79,160 40,110 2.10NA NA 25,259 NWS HOLDINGS LTD 29,238 45,694 4.30NA NA 39,700 OBARA CORP. 225,137 376,489 3.30NA NA 22,000 OBAYASHI CORP. 110,349 107,851 1.70NA NA 12,985 OBRASCON HUARTE LAIN SA 179,619 256,627 2.60NA NA 291 OC OERLIKON CORPORATION AG 82,062 16,215 0.00NA NA 12,000 ODAKYU ELEC RLWY 88,014 102,731 0.80NA NA 27,800 OILES CORPORATION 465,035 418,650 1.50NA NA 28,000 OKAMURA CORP. 155,224 166,575 2.20NA NA 54,700 ONOKEN CO. 520,873 572,597 3.00NA NA 2,254 ORASCOM CONSTR IND 143,350 77,367 36.20NA NA 12,000 ORGANO CORP. 85,697 98,751 1.00NA NA 10,500 ORIENT O/SEAS INT'L 84,453 44,845 2.60NA NA 33,090 ORKLA ASA 526,576 240,083 4.80NA NA 14,060 OUTOTEC OYJ 239,833 333,289 0.00NA NA 9,800 PACIFIC BASIN SHIP 5,863 6,259 15.40NA NA 684,600 PAN UNITED CORP. 328,858 238,866 5.50NA NA 9,880 PANALPINA WELT AG 759,766 717,232 2.40NA NA 22,000 PANASONIC ELECTRIC 238,421 208,405 1.40NA NA 42,448 PEAB AB 129,161 173,674 7.10NA NA 3,516 PERMASTEELISA 61,460 59,822 0.00NA NA 40,372 PFLEIDERER AG 295,286 294,465 0.00NA NA 50,385 PHILIPS ELEC(KON) 1,887,055 927,577 5.30NA NA 303,800 PROFFICE AB 683,818 686,190 0.00NA NA 36,237 PROSEGUR SEGURIDAD 993,718 1,162,433 2.60NA NA 84,000 PV CRYSTALOX SOLAR 194,424 114,818 6.20NA NA 2,042 Q CELLS SE 170,928 41,531 0.00NA NA 5,983 QANTAS AIRWAYS 25,918 9,722 11.40NA NA 539,949 RAFFLES EDUCATION 261,680 205,183 0.00NA NA 69,956 RAMIRENT OYJ 407,667 428,801 0.00NA NA 114,464 RANDSTAD HLDGS NV 3,339,873 3,165,302 6.30NA NA 674,839 RENTOKIL INITIAL 988,653 994,666 0.70NA NA 27,860 RHEINMETALL AG 935,079 1,205,551 4.20NA NA 3,200 RIETER HLDGS AG 675,309 535,516 0.00NA NA 95,020 ROLLS ROYCE GROUP 874,688 565,688 0.00NA NA 1,925 RYANAIR HOLDGS PLC 76,845 54,651 0.00NA NA 70,000 RYOBI 135,153 184,277 0.00NA NA 3,679 SACYR VALLEHERMOSO SA 125,169 50,984 4.70NA NA 14,861 SAFRAN SA 326,383 195,941 2.70NA NA 56,837 SANDVIK AB 1,077,689 419,977 5.50NA NA 12,000 SANKI ENGINEERING 82,929 92,159 2.00NA NA 143,000 SANKYU INC. 505,123 563,196 2.40NA NA 55,000 SANWA HOLDINGS CORP 173,815 196,663 2.90NA NA 9,670 SCANIA AB 82,042 95,479 0.00NA NA 5,577 SCHINDLER HLDG AG 344,419 345,886 3.00NA NA 14,947 SCHNEIDER ELECTRIC 945,627 1,138,422 6.40NA NA 113,122 SECOM CO. 5,218,383 4,595,929 2.20NA NA 19,996 SECURITAS 214,536 169,045 4.40NA NA 70,000 SEINO HOLDINGS 612,043 582,578 1.40NA NA 38,000 SEMBCORP INDUSTRIES 135,652 79,290 3.60NA NA 51,600 SEMBCORP MARINE 100,753 95,902 4.10NA NA 17,000 SENSHU ELECTRIC CO. 319,429 162,274 2.20NA NA 25,737 SERCO GROUP 202,521 178,865 1.20NA NA 7,809 SFA ENGINEERING CO. 212,885 223,736 3.80NA NA 553 SGS SA 671,426 684,417 3.70NA NA 5,000 SHANGHAI INDUSTRIAL HLDG LTD 20,207 20,129 2.60NA NA 9,000 SHIBAURA MECHATRONICS 27,416 38,058 1.00NA NA 27,000 SHIMIZU CORP. 150,310 117,531 1.70NA NA 4,400 SHIP FINANCE INT'L 49,507 48,532 10.90NA NA 3,765 SIDI KRIER PETROCH 10,995 8,009 0.00NA NA 126,029 SIEMENS AG 12,668,014 8,690,241 3.30ILLINOIS STATE BOARD OF INVESTMENT86

- Page 36 and 37: Moody’s S&P Shares/Quality Qualit

- Page 38 and 39: Moody’s S&P Shares/Quality Qualit

- Page 40 and 41: Moody’s S&P Shares/Quality Qualit

- Page 42 and 43: Moody’s S&P Shares/Quality Qualit

- Page 44 and 45: Moody’s S&P Shares/Quality Qualit

- Page 46 and 47: Moody’s S&P Shares/Quality Qualit

- Page 48 and 49: Moody’s S&P Shares/Quality Qualit

- Page 51 and 52: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 53 and 54: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 55 and 56: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 57 and 58: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 59 and 60: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 61 and 62: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 63 and 64: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 65 and 66: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 67 and 68: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 69 and 70: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 71 and 72: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 73 and 74: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 75 and 76: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 77 and 78: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 79 and 80: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 81 and 82: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 83 and 84: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 85: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 89 and 90: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 91 and 92: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 93 and 94: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 95 and 96: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 97 and 98: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 99 and 100: PORTFOLIO DATAFISCAL YEARS ENDED JU

- Page 101 and 102: INVESTMENT TRANSACTIONS WITH BROKER

- Page 103 and 104: RESTRICTED INVESTMENTSPublic Act 95

- Page 105: STAFF AND INVESTMENT MANAGERSEXECUT

PORTFOLIO OF INVESTMENTSJUNE 30, <strong>2009</strong> (CONTINUED)Moody’s S&P Shares/Quality Quality Par Fair DividendRating Rating Value Cost Value YieldFOREIGN EQUITY SECURITIES (continued) $ $ %Industrials (continued)NA NR 88,150 NAM TAI ELECTRONICS 833,567 375,519 0.00NA NA 19,900 NCC 143,591 172,086 6.00NA NA 29,000 NEPTUNE ORIENT LNS 57,963 29,654 5.40NA NA 14,800 NEXANS 857,696 786,048 5.30NA NA 12,000 NGK INSULATORS 313,352 245,012 0.80NA NA 39,000 NIPPON EXPRESS CO. 197,127 177,447 2.30NA NA 20,000 NIPPON SHEET GLASS 104,575 58,455 2.10NA NA 115,300 NIPPON SIGNAL CO. 496,516 959,589 1.50NA NA 10,900 NITTA CORP. 226,928 159,176 1.10NA NA 10,945 NKT HOLDING 294,123 368,496 0.00NA NA 1,149,800 NOBLE GROUP 1,191,267 1,445,840 3.50NA NA 22,055 NORDEX AG 276,260 345,858 0.00NA NA 393,763 NRW HOLDINGS LTD 299,176 302,421 0.00NA NA 24,000 NSK 195,543 121,884 1.60NA NA 10,000 NTN CORP. 79,160 40,110 2.10NA NA 25,259 NWS HOLDINGS LTD 29,238 45,694 4.30NA NA 39,700 OBARA CORP. 225,137 376,489 3.30NA NA 22,000 OBAYASHI CORP. 110,349 107,851 1.70NA NA 12,985 OBRASCON HUARTE LAIN SA 179,619 256,627 2.60NA NA 291 OC OERLIKON CORPORATION AG 82,062 16,215 0.00NA NA 12,000 ODAKYU ELEC RLWY 88,014 102,731 0.80NA NA 27,800 OILES CORPORATION 465,035 418,650 1.50NA NA 28,000 OKAMURA CORP. 155,224 166,575 2.20NA NA 54,700 ONOKEN CO. 520,873 572,597 3.00NA NA 2,254 ORASCOM CONSTR IND 143,350 77,367 36.20NA NA 12,000 ORGANO CORP. 85,697 98,751 1.00NA NA 10,500 ORIENT O/SEAS INT'L 84,453 44,845 2.60NA NA 33,090 ORKLA ASA 526,576 240,083 4.80NA NA 14,060 OUTOTEC OYJ 239,833 333,289 0.00NA NA 9,800 PACIFIC BASIN SHIP 5,863 6,259 15.40NA NA 684,600 PAN UNITED CORP. 328,858 238,866 5.50NA NA 9,880 PANALPINA WELT AG 759,766 717,232 2.40NA NA 22,000 PANASONIC ELECTRIC 238,421 208,405 1.40NA NA 42,448 PEAB AB 129,161 173,674 7.10NA NA 3,516 PERMASTEELISA 61,460 59,822 0.00NA NA 40,372 PFLEIDERER AG 295,286 294,465 0.00NA NA 50,385 PHILIPS ELEC(KON) 1,887,055 927,577 5.30NA NA 303,800 PROFFICE AB 683,818 686,190 0.00NA NA 36,237 PROSEGUR SEGURIDAD 993,718 1,162,433 2.60NA NA 84,000 PV CRYSTALOX SOLAR 194,424 114,818 6.20NA NA 2,042 Q CELLS SE 170,928 41,531 0.00NA NA 5,983 QANTAS AIRWAYS 25,918 9,722 11.40NA NA 539,949 RAFFLES EDUCATION 261,680 205,183 0.00NA NA 69,956 RAMIRENT OYJ 407,667 428,801 0.00NA NA 114,464 RANDSTAD HLDGS NV 3,339,873 3,165,302 6.30NA NA 674,839 RENTOKIL INITIAL 988,653 994,666 0.70NA NA 27,860 RHEINMETALL AG 935,079 1,205,551 4.20NA NA 3,200 RIETER HLDGS AG 675,309 535,516 0.00NA NA 95,020 ROLLS ROYCE GROUP 874,688 565,688 0.00NA NA 1,925 RYANAIR HOLDGS PLC 76,845 54,651 0.00NA NA 70,000 RYOBI 135,153 184,277 0.00NA NA 3,679 SACYR VALLEHERMOSO SA 125,169 50,984 4.70NA NA 14,861 SAFRAN SA 326,383 195,941 2.70NA NA 56,837 SANDVIK AB 1,077,689 419,977 5.50NA NA 12,000 SANKI ENGINEERING 82,929 92,159 2.00NA NA 143,000 SANKYU INC. 505,123 563,196 2.40NA NA 55,000 SANWA HOLDINGS CORP 173,815 196,663 2.90NA NA 9,670 SCANIA AB 82,042 95,479 0.00NA NA 5,577 SCHINDLER HLDG AG 344,419 345,886 3.00NA NA 14,947 SCHNEIDER ELECTRIC 945,627 1,138,422 6.40NA NA 113,122 SECOM CO. 5,218,383 4,595,929 2.20NA NA 19,996 SECURITAS 214,536 169,045 4.40NA NA 70,000 SEINO HOLDINGS 612,043 582,578 1.40NA NA 38,000 SEMBCORP INDUSTRIES 135,652 79,290 3.60NA NA 51,600 SEMBCORP MARINE 100,753 95,902 4.10NA NA 17,000 SENSHU ELECTRIC CO. 319,429 162,274 2.20NA NA 25,737 SERCO GROUP 202,521 178,865 1.20NA NA 7,809 SFA ENGINEERING CO. 212,885 223,736 3.80NA NA 553 SGS SA 671,426 684,417 3.70NA NA 5,000 SHANGHAI INDUSTRIAL HLDG LTD 20,207 20,129 2.60NA NA 9,000 SHIBAURA MECHATRONICS 27,416 38,058 1.00NA NA 27,000 SHIMIZU CORP. 150,310 117,531 1.70NA NA 4,400 SHIP FINANCE INT'L 49,507 48,532 10.90NA NA 3,765 SIDI KRIER PETROCH 10,995 8,009 0.00NA NA 126,029 SIEMENS AG 12,668,014 8,690,241 3.30ILLINOIS STATE BOARD OF INVESTMENT86