Annual Report PDF file 2009 - State of Illinois

Annual Report PDF file 2009 - State of Illinois Annual Report PDF file 2009 - State of Illinois

Moody’s S&P Shares/Quality Quality Par Maturity Interest Fair CurrentRating Rating Value Date Rate Cost Value Yield Duration$ FIXED INCOME (continued) % $ $ %Finance (continued)BAA2 BBB- 3,000,000 GLENCORE FDG LLC 04/15/14 6.00 2,904,032 2,499,754 10.74 3.95CA CCC 1,117,000 GMAC LLC 09/15/11 6.88 918,107 977,375 13.61 1.91AAA AAA 3,900,000 GMAC LLC 12/19/12 2.20 3,893,799 3,885,859 2.32 3.36A1 A 3,220,000 GOLDMAN SACHS GROUP 01/18/18 5.95 3,178,536 3,170,979 6.41 6.60A1 A 8,500,000 GOLDMAN SACHS GROUP 01/15/16 5.35 8,090,609 8,376,412 5.77 5.43A1 A 985,000 GOLDMAN SACHS GROUP 11/01/12 5.45 1,015,249 1,022,700 4.34 3.04A1 A 8,400,000 J P MORGAN CHASE & CO. 01/02/13 5.75 8,365,560 8,700,059 4.77 3.10AAA AAA 3,100,000 JOHN DEERE CAPITAL CORP. FDIC GT 06/19/12 2.88 3,193,734 3,174,735 2.01 2.86AA3 A+ 3,715,000 JPMORGAN CHASE & CO. FORMERLY 01/15/18 6.00 3,929,764 3,685,238 6.10 6.61BAA2 BBB- 2,190,000 MARSH & MCLENNAN COS INC. 07/15/14 5.38 2,026,463 2,098,413 6.35 4.30A2 A 2,580,000 MERRILL LYNCH & CO INC. 02/05/13 5.45 2,535,528 2,528,622 6.29 3.17A2 A 4,700,000 MORGAN STANLEY 04/28/15 6.00 4,659,439 4,738,615 6.05 4.90A2 A 2,565,000 MORGAN STANLEY 12/28/17 5.95 2,229,989 2,506,890 6.29 6.77A2 A 4,000,000 MORGAN STANLEY GROUP INC. 03/01/13 5.30 4,002,240 4,045,335 4.91 3.28A1 A+ 3,150,000 NATIONAL RURAL UTILITIESS COOP FIN. 11/01/18 10.38 3,741,337 4,312,751 6.67 6.42A1 AA- 1,500,000 NORTHERN TRUST CORP. 08/15/13 5.50 1,521,355 1,600,257 3.90 3.66CAA3 CCC 1,896,000 NUVEEN INVESTMENTS INC. 11/15/15 10.50 1,911,998 1,308,240 19.10 4.06BAA1 A- 2,726,000 PPF FDG INC. 04/15/17 5.70 1,690,120 1,662,328 14.06 5.57BA1 BB 2,495,000 TEPPCO PARTNERS LP 06/01/67 7.00 2,399,705 1,872,772 11.96 5.66A2 A- 3,865,000 TRAVELERS COS INC 06/15/12 5.38 3,871,869 4,057,498 4.75 2.72AA2 A+ 4,250,000 US BANK NAT'L ASSN. CINCINNATI OH 10/30/14 4.95 4,254,506 4,347,469 4.27 4.71BA1 BBB- 1,002,000 VENTAS REALTY LTD PARTNERSHIP 06/01/15 7.13 1,002,000 966,930 7.87 4.78AA3 AA- 1,275,000 WACHOVIA BANK NAT'L ASSN. 11/15/17 6.00 1,122,000 1,174,601 5.88 6.66AA3 AA- 1,200,000 WACHOVIA BANK NAT'L ASSN. 02/01/37 5.85 1,204,380 1,024,804 6.80 12.47A1 AA- 2,000,000 WACHOVIA CORP. 05/01/13 5.50 2,027,360 2,043,039 4.55 3.44A1 AA- 3,100,000 WELLS FARGO & CO. NEW 01/15/10 4.20 3,030,157 3,128,910 2.04 0.53AA3 AA- 7,200,000 WELLS FARGO BANK NAT'L ASSN. 05/16/16 5.75 7,263,526 6,967,781 6.10 5.69Total Finance 164,216,847 159,283,917IndustrialsA1 AA 4,443,000 ABBOTT LABS 05/15/16 5.88 4,788,528 4,909,889 4.34 5.79BA2 BB- 3,974,000 ACE HARDWARE CORP. 06/01/16 9.13 3,918,364 3,904,455 9.47 4.98BA3 BB+ 509,000 AES CORP. 05/15/13 8.75 567,535 516,635 8.28 2.58B1 BB- 723,000 AES CORP. 10/15/17 8.00 723,000 672,390 9.22 5.90BAA1 BBB 965,000 ALTRIA GROUP INC. 11/10/13 8.50 1,014,507 1,087,961 4.97 3.70BAA1 BBB 950,000 ALTRIA GROUP INC. 11/10/18 9.70 1,056,837 1,100,395 7.52 6.38A2 BBB+ 1,440,000 AMERICAN EXPRESS BANK 10/17/12 5.55 1,457,107 1,450,726 5.47 2.98A2 A 3,500,000 ARCHER DANIELS MIDLAND CO. 03/15/18 5.45 3,586,312 3,633,860 4.72 7.05CAA1 B- 3,022,000 ASBURY AUTOMOTIVE GROUP INC. 03/15/14 8.00 2,963,945 2,508,260 12.93 3.65CAA1 B- 91,000 ASBURY AUTOMOTIVE GROUP INC. 03/15/17 7.63 91,000 64,610 13.86 5.20B2 B 1,334,000 ASHTEAD CAP INC. 08/15/16 9.00 1,346,003 1,130,565 12.27 4.87A2 A 3,000,000 AT&T INC. 02/15/14 4.85 2,999,820 3,108,911 3.96 4.11CAA2 CCC 1,928,000 ATLAS PIPELINE PARTNERS LP 06/15/18 8.75 1,928,000 1,320,680 15.33 5.50BA3 BB+ 750,000 BE AEROSPACE INC. 07/01/18 8.50 750,000 706,875 9.46 6.19BA2 B+ 828,000 BELDEN INC NEW 03/15/17 7.00 828,000 732,780 9.11 5.73A2 A 2,325,000 BELLSOUTH CAP FDG CORP. 02/15/10 7.75 2,491,503 2,396,827 2.72 0.60BAA3 BBB 2,900,000 BROWNING FERRIS INDS INC. 05/01/21 9.25 3,200,875 3,006,558 8.61 7.32B2 BB- 4,000,000 BUCKEYE TECHNOLOGIES INC. 10/01/13 8.50 4,251,250 3,720,000 10.58 3.42BAA1 BBB 1,450,000 BURLINGTON NORTHN SANTA FE CORP. 07/01/12 5.90 1,526,575 1,539,693 3.80 2.77BAA2 BBB+ 2,355,000 CARDINAL HEALTH INC. 06/15/13 5.50 2,314,997 2,374,314 5.69 3.54BA3 BB+ 3,420,000 CASE CORP. 01/15/16 7.25 3,352,870 3,082,275 9.30 4.94B2 B 2,427,000 CELLU TISSUE HOLDINGS 06/01/14 11.50 2,400,583 2,384,528 11.98 3.61B2 B 4,002,000 CENTENNIAL COMMUNICATIONS CORP. 06/15/13 10.13 4,179,330 4,127,063 9.16 1.61CAA1 B- 3,668,000 CENVEO CORPORATION 12/01/13 7.88 3,582,680 2,567,600 18.00 3.39BA3 BB 1,641,000 CHESAPEAKE ENERGY CORP. 02/15/15 9.50 1,576,591 1,653,308 9.32 4.20BA3 BB 3,000,000 CHESAPEAKE ENERGY CORP. 01/15/16 6.88 3,048,750 2,647,500 9.31 4.99B3 B 1,188,000 CHS CMNTY HEALTH SYS INC 07/15/15 8.88 1,179,613 1,164,240 9.31 4.36BA3 B+ 405,000 CINCINNATI BELL INC. NEW 07/15/13 7.25 388,800 370,575 9.85 3.30B2 B- 3,913,000 CINCINNATI BELL INC. NEW 01/15/14 8.38 3,909,384 3,619,525 10.49 3.55A1 A+ 1,700,000 CISCO SYSTEMS INC. 02/15/39 5.90 1,696,209 1,682,875 6.01 13.61A1 A+ 500,000 CISCO SYSTEMS INC. 02/15/19 4.95 498,870 502,148 4.89 7.75BA2 BB 4,225,000 CITIZENS COMMUNICATIONS CO. 01/15/13 6.25 4,023,663 3,887,000 8.93 3.02AA3 AA 2,200,000 CME GROUP INC. 02/15/14 5.75 2,207,042 2,274,336 4.15 4.04A3 A 2,315,000 COCA COLA ENTERPRISES INC. 03/03/14 7.38 2,479,194 2,760,318 3.97 3.98BAA1 BBB+ 2,835,000 COMCAST CORP. NEW 02/15/18 5.88 2,747,957 2,902,641 5.67 6.78B3 B- 3,500,000 COMMUNICATIONS & PWR INDS INC. 02/01/12 8.00 3,567,500 3,368,750 9.67 2.21BAA2 BBB 700,000 CONAGRA INC. 04/15/19 7.00 719,026 770,874 5.70 7.30BAA2 BBB 248,000 CONAGRA INC. 10/01/26 7.13 265,916 256,087 7.28 9.82BAA2 BBB 654,000 CONAGRA INC. 10/01/28 7.00 660,618 660,210 7.06 10.47CAA2 BB- 2,526,000 CONNACHER OIL & GAS LTD 12/15/15 10.25 2,494,661 1,528,230 21.98 3.98A1 A 1,000,000 CONOCOPHILLIPS 02/01/14 4.75 997,190 1,041,181 3.76 4.09A1 A 2,000,000 CONOCOPHILLIPS 02/01/19 5.75 2,028,540 2,108,751 5.07 7.40BA1 BBB 4,000,000 CONSOL ENERGY INC. 03/01/12 7.88 4,380,000 4,040,000 7.45 2.33B1 B+ 64,000 COPANO ENERGY LLC 03/01/16 8.13 65,417 60,160 9.35 4.93B3 B- 4,868,000 CRICKET COMMUNICATION 11/01/14 9.38 4,316,545 4,794,980 9.74 3.99BA2 B+ 741,000 CRICKET COMMUNICATIONS I 05/15/16 7.75 712,353 713,213 8.48 5.14ILLINOIS STATE BOARD OF INVESTMENT31

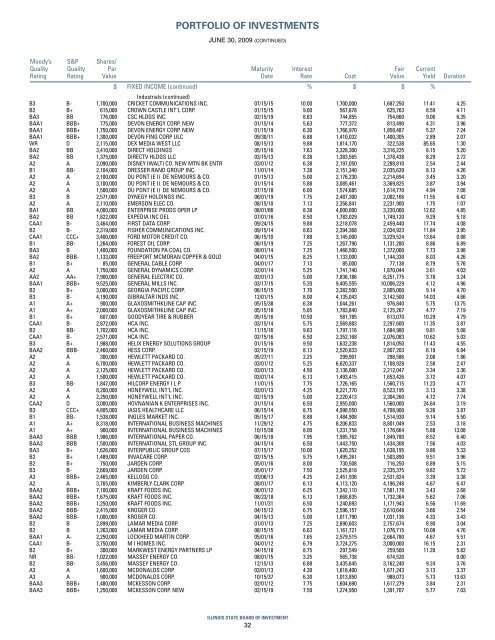

PORTFOLIO OF INVESTMENTSJUNE 30, 2009 (CONTINUED)Moody’s S&P Shares/Quality Quality Par Maturity Interest Fair CurrentRating Rating Value Date Rate Cost Value Yield Duration$ FIXED INCOME (continued) % $ $ %Industrials (continued)B3 B- 1,700,000 CRICKET COMMUNICATIONS INC. 07/15/15 10.00 1,700,000 1,687,250 11.41 4.25B2 B+ 615,000 CROWN CASTLE INT'L CORP. 01/15/15 9.00 567,678 625,763 8.59 4.11BA3 BB 776,000 CSC HLDGS INC. 02/15/19 8.63 744,855 754,660 9.06 6.35BAA1 BBB+ 775,000 DEVON ENERGY CORP. NEW 01/15/14 5.63 777,372 813,490 4.31 3.96BAA1 BBB+ 1,750,000 DEVON ENERGY CORP. NEW 01/15/19 6.30 1,766,970 1,858,487 5.37 7.24BAA1 BBB+ 1,300,000 DEVON FING CORP ULC 09/30/11 6.88 1,410,032 1,400,305 2.89 2.07WR D 2,115,000 DEX MEDIA WEST LLC 08/15/13 9.88 1,814,170 322,538 85.65 1.30BA2 BB 3,410,000 DIRECT HOLDINGS 05/15/16 7.63 3,328,300 3,316,225 8.15 5.20BA2 BB 1,375,000 DIRECTV HLDGS LLC 03/15/13 8.38 1,383,565 1,378,438 8.29 2.72A2 A 2,090,000 DISNEY (WALT) CO. NEW MTN BK ENTR 03/01/12 6.38 2,197,050 2,288,810 2.54 2.44B1 BB- 2,104,000 DRESSER RAND GROUP INC. 11/01/14 7.38 2,151,340 2,035,620 8.13 4.26A2 A 2,100,000 DU PONT (E I) DE NEMOURS & CO. 01/15/13 5.00 2,176,230 2,214,694 3.45 3.20A2 A 3,100,000 DU PONT (E I) DE NEMOURS & CO. 01/15/14 5.88 3,085,461 3,369,825 3.87 3.94A2 A 1,500,000 DU PONT (E I) DE NEMOURS & CO. 07/15/18 6.00 1,574,685 1,614,770 4.94 7.08B3 B 2,571,000 DYNEGY HOLDINGS INC. 06/01/19 7.75 2,487,300 2,002,166 11.55 6.42A2 A 2,110,000 EMERSON ELEC CO. 08/15/10 7.13 2,356,841 2,231,900 1.75 1.07BA1 BB 4,000,000 ENTERPRISE PRODS OPER LP 08/01/66 8.38 4,000,000 3,220,000 12.62 4.85BA2 BB 1,822,000 EXPEDIA INC DEL 07/01/16 8.50 1,783,029 1,749,120 9.29 5.18CAA1 B- 3,464,000 FIRST DATA CORP. 09/24/15 9.88 3,218,078 2,459,440 17.74 4.08B2 B- 2,319,000 FISHER COMMUNICATIONS INC. 09/15/14 8.63 2,394,368 2,034,923 11.84 3.95CAA1 CCC+ 3,400,000 FORD MOTOR CREDIT CO. 06/15/10 7.88 3,145,000 3,229,524 13.64 0.88B1 BB- 1,264,000 FOREST OIL CORP. 06/15/19 7.25 1,267,790 1,131,280 8.86 6.89BA3 B 1,400,000 FOUNDATION PA COAL CO. 08/01/14 7.25 1,466,500 1,372,000 7.73 3.98BA2 BBB- 1,133,000 FREEPORT MCMORAN COPPER & GOLD 04/01/15 8.25 1,133,000 1,144,330 8.03 4.26B1 B+ 85,000 GENERAL CABLE CORP. 04/01/17 7.13 85,000 77,138 8.79 5.76A2 A 1,750,000 GENERAL DYNAMICS CORP. 02/01/14 5.25 1,741,740 1,870,044 3.61 4.03AA2 AA+ 7,900,000 GENERAL ELECTRIC CO. 02/01/13 5.00 7,836,186 8,251,775 3.78 3.24BAA1 BBB+ 9,525,000 GENERAL MILLS INC. 03/17/15 5.20 9,405,555 10,006,229 4.12 4.96B2 B+ 3,000,000 GEORGIA PACIFIC CORP. 06/15/15 7.70 3,382,500 2,805,000 9.14 4.70B3 B- 4,190,000 GIBRALTAR INDS INC. 12/01/15 8.00 4,135,043 3,142,500 14.03 4.66A1 A+ 900,000 GLAXOSMITHKLINE CAP INC. 05/15/38 6.38 1,044,261 976,840 5.75 13.75A1 A+ 2,000,000 GLAXOSMITHKLINE CAP INC. 05/15/18 5.65 1,783,840 2,125,267 4.77 7.19B1 B+ 607,000 GOODYEAR TIRE & RUBBER 05/15/16 10.50 581,785 613,070 10.29 4.79CAA1 B- 2,872,000 HCA INC. 03/15/14 5.75 2,569,883 2,297,600 11.35 3.87B2 BB- 1,702,000 HCA INC. 11/15/16 9.63 1,797,116 1,684,980 9.81 5.08CAA1 B- 2,571,000 HCA INC. 02/15/16 6.50 2,352,168 2,076,083 10.62 5.03B3 B+ 1,988,000 HELIX ENERGY SOLUTIONS GROUP 01/15/16 9.50 1,632,238 1,814,050 11.43 4.55BAA2 BBB- 2,460,000 HESS CORP. 02/15/19 8.13 2,520,833 2,807,203 6.19 6.84A2 A 300,000 HEWLETT PACKARD CO. 05/27/11 2.25 299,901 298,586 2.08 1.86A2 A 6,700,000 HEWLETT PACKARD CO. 03/01/12 5.25 6,620,337 7,108,928 2.58 2.47A2 A 2,125,000 HEWLETT PACKARD CO. 03/01/13 4.50 2,136,000 2,212,047 3.34 3.36A2 A 1,500,000 HEWLETT PACKARD CO. 03/01/14 6.13 1,493,415 1,653,426 3.72 4.07B3 BB- 1,847,000 HILCORP ENERGY I L P 11/01/15 7.75 1,726,165 1,560,715 11.23 4.77A2 A 8,200,000 HONEYWELL INT'L INC. 03/01/13 4.25 8,221,770 8,523,195 3.13 3.38A2 A 2,250,000 HONEYWELL INT'L INC. 02/15/19 5.00 2,220,413 2,304,260 4.72 7.74CAA2 D 3,000,000 HOVNANIAN K ENTERPRISES INC. 01/15/14 6.50 2,955,000 1,560,000 24.64 3.19B3 CCC+ 4,805,000 IASIS HEALTHCARE LLC 06/15/14 8.75 4,998,550 4,708,900 9.26 3.87B1 BB- 1,538,000 INGLES MARKET INC. 05/15/17 8.88 1,484,908 1,514,930 9.14 5.50A1 A+ 8,318,000 INTERNATIONAL BUSINESS MACHINES 11/29/12 4.75 8,206,833 8,801,049 2.53 3.18A1 A+ 900,000 INTERNATIONAL BUSINESS MACHINES 10/15/38 8.00 1,231,758 1,176,664 5.88 13.08BAA3 BBB 1,986,000 INTERNATIONAL PAPER CO. 06/15/18 7.95 1,985,762 1,849,780 8.52 6.40BAA3 BBB 1,500,000 INTERNATIONAL STL GROUP INC. 04/15/14 6.50 1,443,750 1,434,308 7.56 4.03BA3 B+ 1,626,000 INTERPUBLIC GROUP COS 07/15/17 10.00 1,620,352 1,638,195 9.86 5.33B2 B+ 1,489,000 INVACARE CORP. 02/15/15 9.75 1,495,261 1,503,890 9.51 3.96B2 B+ 750,000 JARDEN CORP. 05/01/16 8.00 730,508 716,250 8.89 5.15B3 B- 2,669,000 JARDEN CORP. 05/01/17 7.50 2,525,818 2,335,375 9.82 5.72A3 BBB+ 2,465,000 KELLOGG CO. 03/06/13 4.25 2,451,936 2,531,824 3.39 3.38A2 A 3,765,000 KIMBERLY CLARK CORP. 08/01/17 6.13 4,113,120 4,196,248 4.67 6.47BAA2 BBB+ 7,100,000 KRAFT FOODS INC. 06/01/12 6.25 7,342,110 7,581,178 3.43 2.68BAA2 BBB+ 1,675,000 KRAFT FOODS INC. 08/23/18 6.13 1,668,635 1,732,364 5.62 7.06BAA2 BBB+ 1,250,000 KRAFT FOODS INC. 11/01/31 6.50 1,240,693 1,171,943 6.56 11.69BAA2 BBB- 2,415,000 KROGER CO. 04/15/12 6.75 2,596,157 2,610,648 3.66 2.54BAA2 BBB- 1,000,000 KROGER CO. 04/15/13 5.00 1,011,790 1,031,136 4.33 3.43B2 B 2,899,000 LAMAR MEDIA CORP. 01/01/13 7.25 2,690,603 2,757,674 8.90 3.04B2 B 1,263,000 LAMAR MEDIA CORP. 08/15/15 6.63 1,161,721 1,076,715 10.08 4.76BAA1 A- 2,250,000 LOCKHEED MARTIN CORP. 05/01/16 7.65 2,579,515 2,664,780 4.67 5.51CAA1 B- 3,750,000 M I HOMES INC. 04/01/12 6.79 3,724,275 3,000,000 16.15 2.31B2 B+ 300,000 MARKWEST ENERGY PARTNERS LP 04/15/18 8.75 297,549 259,500 11.20 5.82NR BB- 1,022,000 MASSEY ENERGY CO. 08/01/15 3.25 565,738 674,520 0.00B2 BB- 3,456,000 MASSEY ENERGY CO. 12/15/13 6.88 3,435,645 3,162,240 9.24 3.76A3 A 1,600,000 MCDONALDS CORP. 03/01/13 4.30 1,618,400 1,671,243 3.13 3.37A3 A 900,000 MCDONALDS CORP. 10/15/37 6.30 1,013,850 988,073 5.73 13.63BAA3 BBB+ 1,480,000 MCKESSON CORP. 02/01/12 7.75 1,604,690 1,617,279 3.84 2.31BAA3 BBB+ 1,250,000 MCKESSON CORP. NEW 02/15/19 7.50 1,274,950 1,391,707 5.77 7.03ILLINOIS STATE BOARD OF INVESTMENT32

- Page 1 and 2: 2009ANNUALREPORTILLINOISSTATEBOARDO

- Page 3 and 4: BOARD MEMBERSCHAIRMANRonald E. Powe

- Page 5 and 6: International Equity 17%U.S. Equity

- Page 7 and 8: % Investment Returns June 30201510T

- Page 9 and 10: FINANCIAL HIGHLIGHTSFISCAL YEARS EN

- Page 11 and 12: FINANCIALSTATEMENTS2009ILLINOIS STA

- Page 13 and 14: MANAGEMENT’S DISCUSSION AND ANALY

- Page 15 and 16: STATEMENT OF NET ASSETSJUNE 30, 200

- Page 18 and 19: Note 2Deposits, Investments, and In

- Page 20 and 21: Note 2 (continued)Deposits, Investm

- Page 22 and 23: Note 2 (continued)Deposits, Investm

- Page 24 and 25: Note 3 General StateMember Systems

- Page 26 and 27: Note 4PensionsPlan DescriptionAll o

- Page 28 and 29: SUPPLEMENTALFINANCIALINFORMATION200

- Page 30 and 31: Moody’s S&P Shares/Quality Qualit

- Page 34 and 35: Moody’s S&P Shares/Quality Qualit

- Page 36 and 37: Moody’s S&P Shares/Quality Qualit

- Page 38 and 39: Moody’s S&P Shares/Quality Qualit

- Page 40 and 41: Moody’s S&P Shares/Quality Qualit

- Page 42 and 43: Moody’s S&P Shares/Quality Qualit

- Page 44 and 45: Moody’s S&P Shares/Quality Qualit

- Page 46 and 47: Moody’s S&P Shares/Quality Qualit

- Page 48 and 49: Moody’s S&P Shares/Quality Qualit

- Page 51 and 52: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 53 and 54: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 55 and 56: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 57 and 58: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 59 and 60: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 61 and 62: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 63 and 64: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 65 and 66: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 67 and 68: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 69 and 70: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 71 and 72: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 73 and 74: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 75 and 76: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 77 and 78: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 79 and 80: PORTFOLIO OF INVESTMENTSJUNE 30, 20

- Page 81 and 82: PORTFOLIO OF INVESTMENTSJUNE 30, 20

PORTFOLIO OF INVESTMENTSJUNE 30, <strong>2009</strong> (CONTINUED)Moody’s S&P Shares/Quality Quality Par Maturity Interest Fair CurrentRating Rating Value Date Rate Cost Value Yield Duration$ FIXED INCOME (continued) % $ $ %Industrials (continued)B3 B- 1,700,000 CRICKET COMMUNICATIONS INC. 07/15/15 10.00 1,700,000 1,687,250 11.41 4.25B2 B+ 615,000 CROWN CASTLE INT'L CORP. 01/15/15 9.00 567,678 625,763 8.59 4.11BA3 BB 776,000 CSC HLDGS INC. 02/15/19 8.63 744,855 754,660 9.06 6.35BAA1 BBB+ 775,000 DEVON ENERGY CORP. NEW 01/15/14 5.63 777,372 813,490 4.31 3.96BAA1 BBB+ 1,750,000 DEVON ENERGY CORP. NEW 01/15/19 6.30 1,766,970 1,858,487 5.37 7.24BAA1 BBB+ 1,300,000 DEVON FING CORP ULC 09/30/11 6.88 1,410,032 1,400,305 2.89 2.07WR D 2,115,000 DEX MEDIA WEST LLC 08/15/13 9.88 1,814,170 322,538 85.65 1.30BA2 BB 3,410,000 DIRECT HOLDINGS 05/15/16 7.63 3,328,300 3,316,225 8.15 5.20BA2 BB 1,375,000 DIRECTV HLDGS LLC 03/15/13 8.38 1,383,565 1,378,438 8.29 2.72A2 A 2,090,000 DISNEY (WALT) CO. NEW MTN BK ENTR 03/01/12 6.38 2,197,050 2,288,810 2.54 2.44B1 BB- 2,104,000 DRESSER RAND GROUP INC. 11/01/14 7.38 2,151,340 2,035,620 8.13 4.26A2 A 2,100,000 DU PONT (E I) DE NEMOURS & CO. 01/15/13 5.00 2,176,230 2,214,694 3.45 3.20A2 A 3,100,000 DU PONT (E I) DE NEMOURS & CO. 01/15/14 5.88 3,085,461 3,369,825 3.87 3.94A2 A 1,500,000 DU PONT (E I) DE NEMOURS & CO. 07/15/18 6.00 1,574,685 1,614,770 4.94 7.08B3 B 2,571,000 DYNEGY HOLDINGS INC. 06/01/19 7.75 2,487,300 2,002,166 11.55 6.42A2 A 2,110,000 EMERSON ELEC CO. 08/15/10 7.13 2,356,841 2,231,900 1.75 1.07BA1 BB 4,000,000 ENTERPRISE PRODS OPER LP 08/01/66 8.38 4,000,000 3,220,000 12.62 4.85BA2 BB 1,822,000 EXPEDIA INC DEL 07/01/16 8.50 1,783,029 1,749,120 9.29 5.18CAA1 B- 3,464,000 FIRST DATA CORP. 09/24/15 9.88 3,218,078 2,459,440 17.74 4.08B2 B- 2,319,000 FISHER COMMUNICATIONS INC. 09/15/14 8.63 2,394,368 2,034,923 11.84 3.95CAA1 CCC+ 3,400,000 FORD MOTOR CREDIT CO. 06/15/10 7.88 3,145,000 3,229,524 13.64 0.88B1 BB- 1,264,000 FOREST OIL CORP. 06/15/19 7.25 1,267,790 1,131,280 8.86 6.89BA3 B 1,400,000 FOUNDATION PA COAL CO. 08/01/14 7.25 1,466,500 1,372,000 7.73 3.98BA2 BBB- 1,133,000 FREEPORT MCMORAN COPPER & GOLD 04/01/15 8.25 1,133,000 1,144,330 8.03 4.26B1 B+ 85,000 GENERAL CABLE CORP. 04/01/17 7.13 85,000 77,138 8.79 5.76A2 A 1,750,000 GENERAL DYNAMICS CORP. 02/01/14 5.25 1,741,740 1,870,044 3.61 4.03AA2 AA+ 7,900,000 GENERAL ELECTRIC CO. 02/01/13 5.00 7,836,186 8,251,775 3.78 3.24BAA1 BBB+ 9,525,000 GENERAL MILLS INC. 03/17/15 5.20 9,405,555 10,006,229 4.12 4.96B2 B+ 3,000,000 GEORGIA PACIFIC CORP. 06/15/15 7.70 3,382,500 2,805,000 9.14 4.70B3 B- 4,190,000 GIBRALTAR INDS INC. 12/01/15 8.00 4,135,043 3,142,500 14.03 4.66A1 A+ 900,000 GLAXOSMITHKLINE CAP INC. 05/15/38 6.38 1,044,261 976,840 5.75 13.75A1 A+ 2,000,000 GLAXOSMITHKLINE CAP INC. 05/15/18 5.65 1,783,840 2,125,267 4.77 7.19B1 B+ 607,000 GOODYEAR TIRE & RUBBER 05/15/16 10.50 581,785 613,070 10.29 4.79CAA1 B- 2,872,000 HCA INC. 03/15/14 5.75 2,569,883 2,297,600 11.35 3.87B2 BB- 1,702,000 HCA INC. 11/15/16 9.63 1,797,116 1,684,980 9.81 5.08CAA1 B- 2,571,000 HCA INC. 02/15/16 6.50 2,352,168 2,076,083 10.62 5.03B3 B+ 1,988,000 HELIX ENERGY SOLUTIONS GROUP 01/15/16 9.50 1,632,238 1,814,050 11.43 4.55BAA2 BBB- 2,460,000 HESS CORP. 02/15/19 8.13 2,520,833 2,807,203 6.19 6.84A2 A 300,000 HEWLETT PACKARD CO. 05/27/11 2.25 299,901 298,586 2.08 1.86A2 A 6,700,000 HEWLETT PACKARD CO. 03/01/12 5.25 6,620,337 7,108,928 2.58 2.47A2 A 2,125,000 HEWLETT PACKARD CO. 03/01/13 4.50 2,136,000 2,212,047 3.34 3.36A2 A 1,500,000 HEWLETT PACKARD CO. 03/01/14 6.13 1,493,415 1,653,426 3.72 4.07B3 BB- 1,847,000 HILCORP ENERGY I L P 11/01/15 7.75 1,726,165 1,560,715 11.23 4.77A2 A 8,200,000 HONEYWELL INT'L INC. 03/01/13 4.25 8,221,770 8,523,195 3.13 3.38A2 A 2,250,000 HONEYWELL INT'L INC. 02/15/19 5.00 2,220,413 2,304,260 4.72 7.74CAA2 D 3,000,000 HOVNANIAN K ENTERPRISES INC. 01/15/14 6.50 2,955,000 1,560,000 24.64 3.19B3 CCC+ 4,805,000 IASIS HEALTHCARE LLC 06/15/14 8.75 4,998,550 4,708,900 9.26 3.87B1 BB- 1,538,000 INGLES MARKET INC. 05/15/17 8.88 1,484,908 1,514,930 9.14 5.50A1 A+ 8,318,000 INTERNATIONAL BUSINESS MACHINES 11/29/12 4.75 8,206,833 8,801,049 2.53 3.18A1 A+ 900,000 INTERNATIONAL BUSINESS MACHINES 10/15/38 8.00 1,231,758 1,176,664 5.88 13.08BAA3 BBB 1,986,000 INTERNATIONAL PAPER CO. 06/15/18 7.95 1,985,762 1,849,780 8.52 6.40BAA3 BBB 1,500,000 INTERNATIONAL STL GROUP INC. 04/15/14 6.50 1,443,750 1,434,308 7.56 4.03BA3 B+ 1,626,000 INTERPUBLIC GROUP COS 07/15/17 10.00 1,620,352 1,638,195 9.86 5.33B2 B+ 1,489,000 INVACARE CORP. 02/15/15 9.75 1,495,261 1,503,890 9.51 3.96B2 B+ 750,000 JARDEN CORP. 05/01/16 8.00 730,508 716,250 8.89 5.15B3 B- 2,669,000 JARDEN CORP. 05/01/17 7.50 2,525,818 2,335,375 9.82 5.72A3 BBB+ 2,465,000 KELLOGG CO. 03/06/13 4.25 2,451,936 2,531,824 3.39 3.38A2 A 3,765,000 KIMBERLY CLARK CORP. 08/01/17 6.13 4,113,120 4,196,248 4.67 6.47BAA2 BBB+ 7,100,000 KRAFT FOODS INC. 06/01/12 6.25 7,342,110 7,581,178 3.43 2.68BAA2 BBB+ 1,675,000 KRAFT FOODS INC. 08/23/18 6.13 1,668,635 1,732,364 5.62 7.06BAA2 BBB+ 1,250,000 KRAFT FOODS INC. 11/01/31 6.50 1,240,693 1,171,943 6.56 11.69BAA2 BBB- 2,415,000 KROGER CO. 04/15/12 6.75 2,596,157 2,610,648 3.66 2.54BAA2 BBB- 1,000,000 KROGER CO. 04/15/13 5.00 1,011,790 1,031,136 4.33 3.43B2 B 2,899,000 LAMAR MEDIA CORP. 01/01/13 7.25 2,690,603 2,757,674 8.90 3.04B2 B 1,263,000 LAMAR MEDIA CORP. 08/15/15 6.63 1,161,721 1,076,715 10.08 4.76BAA1 A- 2,250,000 LOCKHEED MARTIN CORP. 05/01/16 7.65 2,579,515 2,664,780 4.67 5.51CAA1 B- 3,750,000 M I HOMES INC. 04/01/12 6.79 3,724,275 3,000,000 16.15 2.31B2 B+ 300,000 MARKWEST ENERGY PARTNERS LP 04/15/18 8.75 297,549 259,500 11.20 5.82NR BB- 1,022,000 MASSEY ENERGY CO. 08/01/15 3.25 565,738 674,520 0.00B2 BB- 3,456,000 MASSEY ENERGY CO. 12/15/13 6.88 3,435,645 3,162,240 9.24 3.76A3 A 1,600,000 MCDONALDS CORP. 03/01/13 4.30 1,618,400 1,671,243 3.13 3.37A3 A 900,000 MCDONALDS CORP. 10/15/37 6.30 1,013,850 988,073 5.73 13.63BAA3 BBB+ 1,480,000 MCKESSON CORP. 02/01/12 7.75 1,604,690 1,617,279 3.84 2.31BAA3 BBB+ 1,250,000 MCKESSON CORP. NEW 02/15/19 7.50 1,274,950 1,391,707 5.77 7.03ILLINOIS STATE BOARD OF INVESTMENT32