1086 AnnRep-Investment S04-3 - Pumpkin Patch investor relations

1086 AnnRep-Investment S04-3 - Pumpkin Patch investor relations

1086 AnnRep-Investment S04-3 - Pumpkin Patch investor relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

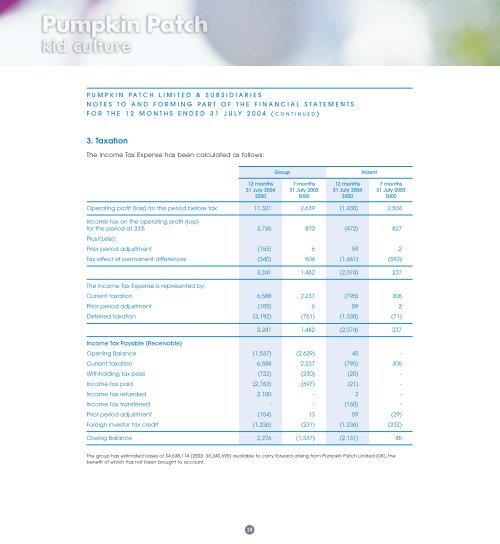

PUMPKIN PATCH LIMITED & SUBSIDIARIESNOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTSFOR THE 12 MONTHS ENDED 31 JULY 2004 (CONTINUED)3. TaxationThe Income Tax Expense has been calculated as follows:GroupParent12 months 7 months 12 months 7 months31 July 2004 31 July 2003 31 July 2004 31 July 2003$000 $000 $000 $000Operating profit (loss) for the period before tax: 11,321 2,639 (1,430) 2,504Income tax on the operating profit (loss)for the period at 33% 3,736 870 (472) 827Plus/(Less):Prior period adjustment (155) 6 59 2Tax effect of permanent differences (340) 606 (1,661) (592)3,241 1,482 (2,074) 237The Income Tax Expense is represented by:Current taxation 6,588 2,237 (795) 306Prior period adjustment (155) 6 59 2Deferred taxation (3,192) (761) (1,338) (71)3,241 1,482 (2,074) 237Income Tax Payable (Receivable)Opening Balance (1,537) (2,629) 45 -Current taxation 6,588 2,237 (795) 306Withholding tax paid (722) (230) (25) -Income tax paid (2,763) (697) (21) -Income tax refunded 2,100 - 2 -Income tax transferred - - (160) -Prior period adjustment (154) 13 59 (29)Foreign <strong>investor</strong> tax credit (1,236) (231) (1,236) (232)Closing Balance 2,276 (1,537) (2,131) 45The group has estimated losses of $4,638,114 (2003: $6,240,695) available to carry forward arising from <strong>Pumpkin</strong> <strong>Patch</strong> Limited (UK), thebenefit of which has not been brought to account.38