PT First State Investments Indonesia launches balanced mutual fund ...

PT First State Investments Indonesia launches balanced mutual fund ...

PT First State Investments Indonesia launches balanced mutual fund ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

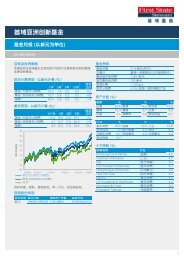

<strong>PT</strong> <strong>First</strong> <strong>State</strong> <strong>Investments</strong> <strong>Indonesia</strong> <strong>launches</strong> <strong>balanced</strong> <strong>mutual</strong><strong>fund</strong> <strong>First</strong> <strong>State</strong> <strong>Indonesia</strong>n USD Balanced Plus FundPress releaseJakarta, 8 August 2012On 8 August 2012 <strong>PT</strong> <strong>First</strong> <strong>State</strong> <strong>Investments</strong> <strong>Indonesia</strong> (FSI <strong>Indonesia</strong>) has launched <strong>balanced</strong> <strong>mutual</strong> <strong>fund</strong> <strong>First</strong><strong>State</strong> <strong>Indonesia</strong>n USD Balanced Plus Fund (FSI USD Balanced Plus Fund). The <strong>fund</strong> obtained effective letter fromBapepam-LK on 28 May 2012 and has been offered to public starting 8 August 2012 at NAV of USD 1.00/unit. The<strong>fund</strong> charges subscription fee of minimal 1% and maximum 2%, and redemption fee of maximal 2%.FSI <strong>Indonesia</strong> believes that now is the right time to launch a USD-denominated <strong>balanced</strong> <strong>mutual</strong> <strong>fund</strong>. "Measurestaken by the Fed to keep interest rates low at 0.25% will last until the end of 2014, so investors will have to rearrangetheir asset allocation and transfer most of their assets to investments that potentially offer attractive yields comparedwith placement in USD time deposits so that the overall wealth will not be eroded by inflation. But on the other hand,the high volatility of the capital markets also requires investors to invest wisely and carefully. FSI USD Balanced PlusFund is a <strong>mutual</strong> <strong>fund</strong> designed to achieve a mix of capital appreciation and provide long-term income by investing in a<strong>balanced</strong> portfolio of USD-denominated equity and debt securities traded in both domestic and overseas markets aswell as in USD-denominated domestic money market instruments, by applying an active and disciplined approach toinvesting in high quality assets. As a <strong>balanced</strong> <strong>fund</strong>, FSI USD Balanced Plus Fund allocates a minimum of 25% and amaximum of 75% in equities, and a minimum of 25% and a maximum of 75% in debt securities and money marketinstruments, thereby potentially providing maximum performance out of the capital market," said Hario Soeprobo,President Director of FSI <strong>Indonesia</strong>. Hario further stated that the <strong>fund</strong> employs the aggregate performance of theJakarta Composite Index/JCI (in USD, 50%), <strong>Indonesia</strong>n government bonds denominated in USD with a maturityperiod of 5 years (35%) and average interest of 1-month USD time deposits (15%) as its benchmark.Eli Djurfanto, Head of Fixed Income at FSI <strong>Indonesia</strong> is optimistic that FSI USD Balanced Plus Fund will deliverattractive returns. “With allocation in equity and fixed income instruments traded in local and foreign bourses, investorcan enhance their return potential with optimal diversification vis-à-vis a simple investment in USD time deposits. Forfixed income portion of the <strong>fund</strong>, for the time being we are allocating it in USD-denominated <strong>Indonesia</strong>n governmentbonds.”Hazrina R. Dewi, Head of Equity at FSI <strong>Indonesia</strong> adds that FSI <strong>Indonesia</strong> has a unique feature of being one of thevery few asset managers in <strong>Indonesia</strong> that employs a bottom-up approach in its investment process. More specifically,the expertise of FSI <strong>Indonesia</strong>’s investment team pivots on comprehensive and rigorous equity research, whichenables the tim to identify stocks that offer the potential for long-term superior returns.“The launching of this <strong>fund</strong> completes the range of products that FSI <strong>Indonesia</strong> has, said Hario Soeprobo, PresidentDirector of FSI <strong>Indonesia</strong>. Prior to the launch of this <strong>fund</strong>, FSI <strong>Indonesia</strong> has been managing five equity <strong>mutual</strong> <strong>fund</strong>s:<strong>First</strong> <strong>State</strong> IndoEquity Sectoral Fund, <strong>First</strong> <strong>State</strong> IndoEquity Dividend Yield Fund, <strong>First</strong> <strong>State</strong> IndoEquity Value SelectFund, <strong>First</strong> <strong>State</strong> IndoEquity Peka Fund and <strong>First</strong> IndoEquity High Conviction Fund; two <strong>balanced</strong> <strong>fund</strong>s: <strong>First</strong> <strong>State</strong><strong>Indonesia</strong>n Balanced Fund and <strong>First</strong> <strong>State</strong> <strong>Indonesia</strong>n MultiStrategy Fund; one fixed income <strong>fund</strong>: FSI Bond Fund; and1 money market <strong>fund</strong>: <strong>First</strong> <strong>State</strong> <strong>Indonesia</strong>n Money Market Fund.***

Press ReleaseProduct SummaryFund nameFund typeInvestment managerCustodian bankNotaryLegal consultantPublic accountantDenominationInvestment objectiveInvestment guidelinesInvestment strategyBenchmarkDividend distribution policyFIRST STATE INDONESIAN USD BALANCED PLUS FUNDOpen-end <strong>fund</strong> (CIC) - Balanced<strong>PT</strong> <strong>First</strong> <strong>State</strong> <strong>Investments</strong> <strong>Indonesia</strong>Citibank, N.A., JakartaNy. Poerbaningsih Adi Warsito, SHRoosdiono & PartnersPricewaterhouseCoopers (Tanudiredja, Wibisana & Rekan)USDTo achieve capital appreciation and deliver income in the long term by applying anactive, discipline approach in a <strong>balanced</strong> portfolio investment that comprises USDdenominatedequity, fixed income and money market instruments.• Equity: 25%-75%• Fixed income &/or money market instruments: 25%-75%The <strong>fund</strong> can invest in offshore instruments as per regulatory allowance. Wheninvesting in offshore instruments, the <strong>fund</strong> will adhere to the prevailing laws andregulations in <strong>Indonesia</strong> and the country that serve as the basis for the issuance of theinstrument.FSI USD Balanced Plus Fund is a USD denominated <strong>balanced</strong> <strong>fund</strong> that is activelymanaged with a <strong>balanced</strong> portfolio strategy between equity and fixed income/moneymarket instruments.50% JCI (in USD) + 35% 5-year USD-denominated <strong>Indonesia</strong>n government bond +15% average interest on 1-month USD time depositNo dividends will be paid out. Investment returns accumulated in FS INDONESIANUSD BALANCED PLUS FUND will be reinvested into the <strong>fund</strong>.Biaya-biayaManagement fee: max 2.5%Custodian fee: max. 0.20%Subscription fee: min. 1% and max. 2%In the case where subscription is done without the involvement of a <strong>mutual</strong> sellingagent, then the Investment Manager has the prerogative to lower the subscriptionfee.Redemption fee: max. 2%Switching fee: max. 2%The minimum subscription and its subsequent top-up amounts are set at USD 1,000(one thousand US Dollars).Minimum pembelianMinimum balanceUnits offeredShould the <strong>fund</strong> be sold through an appointed <strong>mutual</strong> <strong>fund</strong> selling agent, the sellingagent – after prior notification to the Investment Manger – has the discretion to lowerthe minimum subscription and its subsequent top-up amounts. Nonetheless, suchamount shall not be lower than USD 100 (one hundred US Dollars).USD 1,000 (one thousand US Dollars) or 1.000 (one thousand) units1.000.000.000 (one billion) units