MyHealth Advantage - Blue Cross Blue Shield of Georgia

MyHealth Advantage - Blue Cross Blue Shield of Georgia

MyHealth Advantage - Blue Cross Blue Shield of Georgia

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2010 Broker Road ShowHealthy Employees = Healthy Businesses1

Agenda8:30 a.m. Welcome/Plan President Introduction8:50 a.m. Pharmacy Update9:05 a.m. Network Update9:20 a.m. <strong>MyHealth</strong> <strong>Advantage</strong>9:35 a.m. Productivity Solutions10:25 a.m. Break10:35 a.m. Health Care Reform Update11:25a.m. Product Update12:00 p.m. Circle <strong>of</strong> Excellence/BCBSGa.com12:15 p.m. Broker Advisory Council12:30 p.m. Q&A1:00 p.m. Adjourn2

Welcome & Plan President UpdateBrian Fetherston, DirectorLarge Group Sales3

Plan President Introduction• 9/27: Morgan Kendrick toserve as BCBSGa’s new PlanPresident• Previously served as the VicePresident <strong>of</strong> NationalAccounts for nearly fouryears• Joined the CommercialBusiness Local group team in1995 as Director <strong>of</strong> GroupSales4

PharmacyManagementJeffery Turner, VPPharmacy Solutions5

Strategic Alliance with Express ScriptsBCBSGa will continue to manage …• Integration strategy:• Account management• Formulary management• Clinical management• Clinical pharmacy programs• PA criteria management• Data analytics• Enhanced pharmacy reporting• Integrated disease managementExpress Scripts assumesresponsibility for …• Retail network andclaims processing• Specialty and mailorder pharmacy• Negotiate and maintainpharmacy networkBy establishing a strategic alliance with Express Scripts, BCBSGa will maintain itsleadership role in integrated health benefits by strengthening its core health careplatform and providing an enhanced level <strong>of</strong> service, quality and value.6

The Value <strong>of</strong> IntegrationWe leverage the size <strong>of</strong> our membership and the integration <strong>of</strong> ourpeople, programs and knowledge to <strong>of</strong>fer a one-source solution formedical and pharmacy benefits.Health.Care.Value.We focus on our members, their long-term healthoutcomes and their entire health picture. And we developour formulary by choosing medications that produce thebest health outcomes for members.We use evidence-based guidelines to educate membersand providers to encourage better-informed choices, closegaps in care and improve health outcomes.We oversee all clinical and cost-<strong>of</strong>-care strategies with afocus on overall health care costs – not just prescriptioncosts and not just medical costs.7

Pharmacy Account Management TeamMEDICAL FRONT LINE SUPPORTPHARMACY FRONT LINE SUPPORTAccount ExecutiveAccount ManagerSenior RxAccount ManagerPharmacy ServicesCoordinatorClient strategy; partner with health plan sales team; review and communicate financialanalysis for annual and/or quarterly client reviews; partner with implementation teamsDaily OperationsProvide Implementation SupportOverall Client Serviceand RetentionDirectorAccount ManagementClinicalPharmacistClinical strategy,analysis andrecommendationsEXTENDED PHARMACYSERVICE TEAMNationalSales DirectorVice PresidentSalesExecutive ClientOversight8

Engaging Members:Medication Review9

Enhancing Member CommunicationsWe combined our clinical and cost-<strong>of</strong>-care messages into onecommunication to reduce member abrasion and make astronger impact. And members won’t receive multiple lettersfocused on clinical programs.• Mailed monthly• Health-plan branded• Up to four messages are included, and they are conciseand written in plain language• Informational messages include generics, retail-to-mail andhealth tips, when space is available10

Engaging Physicians:Patient Highlights11

Engaging PhysiciansTo help ensure coordination <strong>of</strong> care and compliance,physicians receive a consolidated communication.Messaging includes:• Diabetics not on ACE/ARB or statin• Oral diabetic medication compliance• Statin and ACE/ARB compliance• Appropriate use <strong>of</strong> beta blockersand statins after a heart attack• Overutilization <strong>of</strong> asthma controllers• Polypharmacy• Drug-drug interactions• Pain management• Brand-to-generics (DAW1)• Mailed monthly; targets highest prescriber• Includes patient-specific clinical highlights and an action listthat encourages recommended adjustments to care plans12

Engaging Physicians: Patient HighlightsSAMPLEPATIENTLETTERS13

Comparing Drug EffectivenessComparative effectiveness research leads to improved quality <strong>of</strong>health care, better safety and, ultimately, more affordable healthcare.• What happens in a clinical trial <strong>of</strong>ten does not translate intowhat happens in the real world.• By analyzing our real-world pharmacy and medical data, we candetermine – and encourage – medications that have the bestmember outcomes.• We may promote medications thatincrease pharmacy costs becausewe know they result in greatersavings on the medical side.Examples:• Osteoporosis• Asthma• Chronic ObstructivePulmonary Disease14

Case Study: OsteoporosisWe determine and encouragemedications that have the bestmember outcomes.We covered Fosamax, Actonel andBoniva at the same copay level.After looking at medical claims for26,000 members, we found, whencompared to Boniva, Fosamax andActonel had:• Better compliance• Lower fracture rates• Lower total cost-<strong>of</strong>-careResult: We now require physiciansto start members on Fosamax orActonel before Boniva, and weincreased the copay for Boniva.15

Managing Our Specialty PharmacyWe manage and coordinate the care <strong>of</strong> our specialty pharmacymembers to help them achieve the best possible outcomes andreduce costs.• Patients receive coordinateddisease-specific care management.• Our medical and specialty pharmacypolicies are aligned – allowing forconsistent therapy and theelimination <strong>of</strong> cost shifting.Preventing one multiplesclerosis relapsethrough betteradherence could saveapproximately $4,700.• A recent multiple sclerosis study showed that our specialty pharmacymembers were 16% more adherent than members with anotherspecialty pharmacy. And they had lower outpatient costs, lower <strong>of</strong>ficevisit costs and lower inpatient costs.16

Network UpdateAmy Cheslock, VPProvider Engagement17

Discussion Topics‣ Network Composition‣ Contracting: New Additions and Renewals‣ Marketplace Trends‣ What’s on the Horizon?18

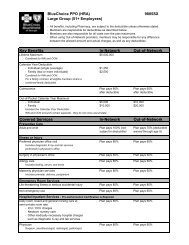

Network CompositionTraditional/Indemnity18,275 physicians195 hospitalsPPO17,283 physicians172 hospitalsOpen Access HMO/POS15,221 physicians162 hospitalsHMO/POS14,079 physicians143 hospitalsWe continue to <strong>of</strong>fer the largest statewide network across <strong>Georgia</strong>.19

2010 Notable Network AdditionsOpen Access HMO/POS Hospital Additions: Tanner Medical Center Fairview Park Medical Center Palmyra Medical Center Wayne Memorial Hospital Flint River Community HospitalOpen Access HMO/POS Physician Additions: 70 PCPs in Glynn and Camden Counties 200 Specialists in Glynn and Camden Counties20

Recent Contract RenewalsTenet Health System Atlanta Medical Center Spalding Regional Hospital North Fulton Medical Center Sylvan Grove Hospital South Fulton Medical CenterNortheast <strong>Georgia</strong> Health System Northeast <strong>Georgia</strong> Medical Center (Gainesville & Lanier Park) Northeast <strong>Georgia</strong> Physicians Group Palmyra Medical CenterHCA Redmond Regional Medical Ctr Cartersville Medical Center Doctor’s Hospital Augusta Fairview Park Hospital Emory Eastside Medical Ctr Polk Medical Center Coliseum Medical Center Palmyra Medical Center21

Provider Network Trends‣ Accountable Care Organizations‣ Bundled Payments• Capitation• Global Payments• Episode Payments‣ Enhanced Fee for Service (Pay for Performance)‣ Shorter Term Contracts vs Longer Term Contracts‣ Payment Penalties• Readmissions• Preventable Adverse Events/Hospital Acquired Conditions‣ Hospital and Provider Consolidation22

What’s on the HorizonAnthem Care Comparison• Statewide Expansion 1 st Quarter 2011OptiNet• Continued Expansion <strong>of</strong> imaging costand quality transparency – steerageopportunitiesPay for Performance• Evolution <strong>of</strong> Primary Care Program23

360°Health<strong>MyHealth</strong> <strong>Advantage</strong>Paige Sale, Account Executive24

BCBSGaGuiding businesses and employees to better healthHow: A holistic approach that addresses members’ total health needs andengages and empowers them to change their behaviors and becomeactive participants in improving their health.360º HealthIdentify, engage, improve healthQuality Health PlansPrevent and saveDecision Support ToolsEnable and empowerCommunity Commitment and ResearchLead and transform25

360º Health:BCBSGa Fully-Insured GroupsTools & ResourcesGuidanceManagement<strong>MyHealth</strong>@bcbsga.com• <strong>MyHealth</strong> Assessment• <strong>MyHealth</strong> Record• Condition Centers• Online CommunitiesHealthcare AdvisorAudioHealth LibrarySpecialOffersTime Well Spent+ Worksite Wellness+ Dental+ Vision+ Life & Disability24/7 NurseLineFuture Moms NICU(Neonatal IntensiveCare Unit) ProgramPharmacyBehavioral HealthBipolar Disorder<strong>MyHealth</strong> <strong>Advantage</strong>+ EAPConditionCare• Asthma• Diabetes• Coronary Artery Disease• Chronic Obstructive PulmonaryDisease• Heart Failure• Kidney Disease (CKD/ESRD)ComplexCareComprehensive Medical Mgmt.<strong>Blue</strong> Distinction Specialty CentersCenters <strong>of</strong> Medical Excellence26

360º Health<strong>MyHealth</strong> <strong>Advantage</strong> WebinarWebinar Schedule• 10/26: ComplexCare& ConditionCare!• 11/9: 24/7 NurseLine& Future Moms27

<strong>MyHealth</strong> <strong>Advantage</strong>The <strong>MyHealth</strong> <strong>Advantage</strong> program communicates to memberswhen gaps in care, safety issues and opportunities for savingmoney are identified.• <strong>MyHealth</strong> Notes mailed to applicable members(approximately 1 in 5 members)• Recommendations for members to help improve healthand save money• Listing <strong>of</strong> most recent medical, lab and pharmacy claims• Links to educational information and resources• Specific ways they may be able to help save moneyon health care• Preventive reminders (if space allows)• Health Coaches field inbound calls• Monthly Provider letters for clinical issues89% <strong>of</strong> recipientsthink the <strong>MyHealth</strong>Note is easy tounderstand and72% perceive<strong>MyHealth</strong><strong>Advantage</strong> asvaluable.Q4 2009 Member Satisfaction Survey28

<strong>MyHealth</strong> <strong>Advantage</strong>: How It Works29

<strong>MyHealth</strong> <strong>Advantage</strong>:Member Communication – <strong>MyHealth</strong> NoteMember name,mailing dateand notice <strong>of</strong>confidentialityEye catchingsymbols with boldheadlines linkedto messagesinsideBackFront30

<strong>MyHealth</strong> Note:Member CommunicationMembernameTargetedsuggestionsregardingcare gaps orcost savingsopportunitiesMost recentmedical,pharmacy,and labclaimsHarvardMedicalSchoolwebsitereference31

<strong>MyHealth</strong> Note:Medication Graphic InsertNew MedicationGraphicprovides aninnovative,graphicalrepresentation<strong>of</strong> membermedicationcompliance32

<strong>MyHealth</strong> <strong>Advantage</strong>:Provider EngagementMember-specific messages sent to physicians increase compliancewith practice guidelines by 15% (5% absolute increase)Provider Care Alerts mailed monthlyMember non-adherence with tests, examsand screenings, medication therapy anddrug safety issues33

<strong>MyHealth</strong> <strong>Advantage</strong>:Member AnalysisWe monitored members with <strong>MyHealth</strong> <strong>Advantage</strong> for 12 monthsto see what effect the <strong>MyHealth</strong> Note had on increasing medicalcompliance12 groups weremonitored fora total <strong>of</strong> 12 months(159,959 lives total)• 40,176 people, or 25.1%, <strong>of</strong> the totalpopulation received at least one <strong>MyHealth</strong>Note due to an identified health opportunity• Of the 25% that received a <strong>MyHealth</strong> Note,61.4% <strong>of</strong> people received more than oneduring the 12-month period• Over 12 months, 184,121 issues wereaddressed, excluding Daily Rx Safety Alertmessages34

ResultsThe Member Analysis showed increases in complianceassociated with specific <strong>MyHealth</strong> Note messages46% showed increased compliance with clinicalrecommendations 1• 69% refilled a high blood pressure Rx when reminded 1• 60% went for annual lipid check when reminded it was overdue 1• 38% scheduled a mammogram when reminded it was overdue 123% switched to a lower cost generic medication when toldthere was an alternative 11 Based on internal review <strong>of</strong> current participants; Members acted within twelve months <strong>of</strong> receiving the initial <strong>MyHealth</strong> Note and may have been messaged more than once.35

Wellness Calendar•Easy to followdirections andsuggestions forwellness promotion•*Program overviewsto increaseawareness <strong>of</strong> thefree 360º Healthprograms availablein the core <strong>of</strong>fering*ASO Groups may have ComplexCare & <strong>MyHealth</strong> <strong>Advantage</strong> would be a buy-up for group 500+ members36

Key FeaturesEmbedded Links and ToolsThe Employer Guide givessimple, step-by-step instructionsfor accessing the materials onthe site and promoting wellnessat the workplace.37

Key FeaturesEach month features a different health topic with links to relevant360º Health programs and tools, as well as related authoritativeresources.Embedded links to access tools and resources•Link to the U.S.Government Center forDisease Control andPrevention’s (CDC) website with information aboutskin cancer and prevention.•Links to learnmore aboutrelated 360°Health andgeneralresources38

Time Well Spent:Engage and Build EnthusiasmA portfolio <strong>of</strong> toolkits andturnkey programs for TheNetwork to use in worksitesto generate awareness <strong>of</strong>key health issues andsupport lifestyle changesamong employees.• Variety <strong>of</strong> modulesfocused on health topics• Over 400 brandedmember-facing piecesthat promote wellness• Materials housed onweb site accessible frombcbsga.com• Print on Demand solutionthrough FedEx Kinko’s39

Time Well Spent ResourcesOffice Posters, Cafeteria Table Tents, Recipes and Articles2010 Calendar40

Disability and AbsenceManagementDan PiacentiniSpecialty Dan Piacentini, Sales Manager Specialty Sales41

The Specialty ConnectionFinancial Incentives• One Solution Savings• Multi-line discount programsDENTALVISIONAdministrative Ease• Combined application• Combined billing• One ID cardClinical Connection• Vision• DisabilityLIFEDISABILITY42

Price <strong>of</strong> Absence and Lost ProductivityTotal cost <strong>of</strong> absence & lost productivity are as much as4X greater than group health costs alone 1On any given day 15% to 20% <strong>of</strong>employees are either not at workdue to an illness or injury or atwork but not fully productivePresenteeism1. Integrated Benefits Institute, CFO Survey43

Employers Report Increasing AbsenceIncidental absence/sick days• Employees use an average <strong>of</strong> 5 days per year• 14% report increased utilizationShort-term disability• 23% report incidence increasing• 15% report longer durationsFamily Medical Leave• 38% report overall incidence increasing• 36% note more intermittent leavesLong-term disability• 17% report incidence increasingSource: Mercer/Marsh Survey <strong>of</strong> Health, Productivity and Absence Management Programs 200744

Disability Claims Drive Medical CostsThere is significant overlap in the drivers <strong>of</strong> health and disabilityclaims caused by chronic conditions% Medical Costs % STD CostsMusculoskeletal 20% 20%Heart / Cardiac 14% 7%Cancer 14% 9%Digestive 9% 6%Lungs 6% 3%Source: Integration Value Study, 2007.45

Disability Claims Drive Medical CostsIndustry studies have shown:5%-10% <strong>of</strong> theemployee populationhave disability claimsThose claims account foralmost 50% <strong>of</strong> totalemployee medical cost.Employee PopulationMedical CostsSource: Integration Value Study, 2007.46

Health and Productivity ManagementCompanies with the most effective health and productivityprograms experienced superior performance in threesignificant areas:• 20% more revenue per employee• 16% higher market value• 57% higher shareholder returnsBuilding an Effective Health & Productivity Framework2007/2008 Staying@Work Report, Watson Wyatt Worldwide47

Industry Perspective - JHA48

Return to Work and Productivityroot causes that keep employees out <strong>of</strong> work longer thannecessary reach well beyond the disability incidenceClinical• Multiple conditions• Chronic conditions• Depression or anxiety• Physician relationship• Navigating the health caresystem• Compliance with treatmentplanNon-Clinical• Job satisfaction or stability• Employer’s ability toaccommodate temporaryrestrictions• Personal relationships• Legal or financial issues• Dependent/elder care• Relationship with employerThese same issues <strong>of</strong>ten reduce an employee’s productivity whileat work long, before missing any work time - “Presenteeism”49

The Disability Industry’s ChallengeTraditionally, disability management begins after one week <strong>of</strong>absence and focuses on employees proving they are disabled.These programs focus primarily on:• Enforcing duration guidelines• Evaluating functionality• Conducting transferable skillsanalyses and labor market surveys• Offering Social Security assistanceApproach <strong>of</strong>tenbecomes adversarial,leading to highermedical costs – moretests to prove disability50

Claims ProcessBehavioralHealthReviewTrainingandQualityAssuranceNurseReviewDisability Case Managerleverages resources forbest RTW outcome.ReportingandAnalysisDisabilityCaseManagerVocationalRehabSocialSecurityAdvocacy51

More Than Just a CheckOur life & disability philosophyWhen it comes to providing life and disability benefits, we provide morethan just a check. We help people move beyond a disability or loss <strong>of</strong> aloved one by providing resources to help them improve physical andemotional well-being. We don’t just manage claims – we help membersget through difficult times and return to healthy and productive lives.Our philosophy extends to outside organizations52

Member Assistance ProgramsWe provide a variety <strong>of</strong> services to help members return tohealthy, productive lives.Travel AssistanceResources andinformation whentraveling 100 miles away• Emergency medical assistance and emergencyevacuation• Travel services and pre-departure information(passport & immunization requirements,exchange rates, weather conditions, etc.)• Repatriation, dependent & travel companionassistance53

Member Assistance ProgramsResource AdvisorMember supportservices in partnershipwith BCBSGabehavioral health• 24/7 toll-free phone consultations for the whole family• Legal & financial consultations and face-to-facecounseling sessions• Online resources including state-specific willpreparation & power <strong>of</strong> attorney formsC O M I N G S O O NID TheftRecoveryBeneficiaryCompanion• Assistance in restoring identity and credit reputation• Assistance with disputing fraudulent debts• Preparation <strong>of</strong> all documents and letters for member’s signature• Lost/stolen purse or wallet benefits• 12 months <strong>of</strong> identity monitoring for victims• Assistance in obtaining death certificates• Credit report freeze for deceased• Assistance in contacting Social Security, creditors, third partiesand bill collectors to advise them <strong>of</strong> the death• Closure <strong>of</strong> accounts and utilities• Face-to-face counseling54

Short Term Disability – Maternity ClaimsA new addition to the family is such an exciting time.Changes come along with a new baby – and we’re here to help.Newborn and Parenting Resources• Congratulations card and information• Live support coaching sessions online and by phone• Screening for postpartum depression and assistancewith return-to-work• 12-month subscription to American Baby magazine• Face-to-face counseling and phone consultationsthrough the Resource Advisor program• Online Work/Life services to assist in finding childcare providers55

Disability Case Manager56

Integrated ResourcesCombining traditional disability techniques with medical servicesresults in the use <strong>of</strong> integrated multidisciplinary resourcesTraditionalEnhanced• Disability CaseManager• RN/Physician• VocationalRehabilitation• EAP/Worklife• Pharmacist• Dietician• ExercisePhysiologist• BehavioralHealth• Health Coach• Medical CaseManager• Condition Care• Future Moms• TransplantCase Manager57

Integrated Disability – GoalsImprove disability claims cost• Reduce claim incidence through early intervention• Decrease duration <strong>of</strong> disability by providing support services• Avoid repeat claimsImprove cost <strong>of</strong> care by increasing engagement in wellness programs• Early identification through disability program referrals• Use disability event as a teachable moment• Incentives to support engagementImprove member experience• Leverage health information to expedite claim determination• Address clinical + non-clinical issues• Increase awareness and use <strong>of</strong> available resources and programs58

How Does ProductivitySolutions Work?59

Integrating Health + DisabilityAs level <strong>of</strong> integration increases, so does the savings and valueto the employer and memberIntegrationBasicIntegrationProductivitySolutionsGroups2-50Groups51+60

Small GroupBasic Integration: Health + DisabilityDisability Case Manager• Adjudicates claim fairlyDisabilityClaimCore Condition Management• Asthma• Diabetes• Heart Failure• COPD• Coronary Artery Disease• Pregnancy (prior to delivery)61

An Integrated Team ApproachOur Health Coaches bringtogether the powerful resourcesonly available through BCBSGa,helping employees get the mostout <strong>of</strong> our disability and healthmanagement programsHealth CareAbsence andDisabilityManagementHEALTHCOACHWellnessProgramsTeaming together results in optimal return-to-work plan62

Integrated Approach Actions• Immediate Referral to Health Coach• Health coach assists with identifying issuesimpacting employee health and Return to Work- EAP referrals- Dealing with chronic medical conditions- Health behavior changes- Work/life servicesCollaborates with Disability Case Manager as well astraditional disability tools• Stays with Employee after Return to Work to helpprevent relapse and improve health.HEALTHCOACHClaims referred to aHealth Coachregardless <strong>of</strong> whetherdisability claimapproved or denied63

Productivity Solutions: Health + DisabilityEmployeeMedical CaseManagerBehavioralHealth CaseManagerDisability CaseManager• Adjudicatesclaim fairly• Referral to aHealth Coach iftriggers applyCore ConditionManagement• Asthma• DiabetesTriage to appropriateConditionCare and/orFuture Moms nurseIf already working with anurse, send note to thatnurse for coachingTransplantCase ManagerDisabilityClaim• Heart Failure• COPD• Coronary ArteryDiseaseIf not working withnurse – send to aHealth Coach• Pregnancy64

Pilot Case Study65

Productivity Solutions Pilot ResultsDisability claims were received earlier, which leads to moreeffective disability management and better service33% <strong>of</strong> claimsreceived before1st day absentwith an additional40% before theend <strong>of</strong> the firstweek30% <strong>of</strong> claimantsreturned to workearly, resulting inoverall averagedisabilitydurationreduced by 7calendar daysTotal year-overyearsavings is9% in totaldisability costsDisability claimpaymentturnaround timewas 21%faster than book<strong>of</strong> business• Employees on disability drove 45% <strong>of</strong> total employee medical costs(that’s in line with industry studies that have ranged from 38% to 55%)• The average medical cost for employees on disability was over 10 timesthe average <strong>of</strong> employees who didn’t file disability claims** Internal Anthem Pilot Study 2008.66

Productivity Solutions Pilot ResultsDisability claims had better outcomes when members used the<strong>MyHealth</strong> Coach program• 35% <strong>of</strong> members withdisability claims workedwith <strong>MyHealth</strong> Coach• 60% Increasedengagement in otherprogramsDisability claimants averaged 4 goalswith a health coach in the following areas:Physician RelationshipReturn to Work & Improved HealthCondition ManagementAdditional ResourcesCondition EducationSystem NavigationTreatment ComplianceSource: Internal Anthem Pilot Study 2008.67

<strong>Advantage</strong>s & Differentiators123Focus on prevention <strong>of</strong> claim as well as duration <strong>of</strong> claim• Identify “at-risk” employees prior to disability claim• Stay-at-work intervention to avoid disability claim• Earlier management to minimize duration and repeat claimsHealth Coach as the “quarterback” and primary memberpoint <strong>of</strong> contact for both medical and disability management• Referrals made regardless <strong>of</strong> disability claim status• Increase utilization <strong>of</strong> and improve communication across programsand resources• Nurses follow up with employee 30 days after return to workSimplified and improved member experience• Faster claim determination by using in-house medical information• Streamlined intake and referral process reduces hassles68

An Integrated Approach69

Productivity Solutions Materials70

Visit www.bcbsga.com/specialty71

Break72

Health CareReformCaroline Holley, DirectorPublic Affairs73

Agenda• Federal reform key elements• Implementing health care reform• Continuing need for reform• How to stay informedNote: This presentation is not intended to advise you on how tocomply with PPACA or its related regulations. This presentationis not intended to <strong>of</strong>fer legal advice. For specific questions,please consult with your own counsel or benefits advisor.74

Federal Reform Key ElementsNew Taxesand FeesMarketReformsIndividualMandateInsuranceExchangesEmployerMandate75

What It Means for BrokersEffective in 2010:• All products renewed after September 23, 2010, must:• Allow members to add dependents up to age 26regardless <strong>of</strong> student status• Eliminate lifetime and certain annual limits• For new sales and subscribers who change policiesafter 3/23/10, we will be required to make additionalchanges beginning in approximately six months, suchas removing any member cost sharing for "preventive"benefits, as defined by the legislationEffective in 2014:• Health insurance exchange will exist as a new saleschannel for individual and small group76

State Challenges to Federal Reform Legislation• 41 stateschallenging reform• 22 states havefiled lawsuits• 36 states haveintroducedlegislation or ballotinitiatives repealingall or parts <strong>of</strong>health care reform77

Agenda• Federal reform key elements• Implementinghealth care reform• Continuing need for reform• How to stay informed78

Implementing Health Care Reform• Our priority is to do what is right for our customersand members• Our strategy for implementing health care reformremains the same as our traditional strategy• We seek to create the best health care value in theindustry while advocating for healthy living• We are focused on excelling at day-to-dayexecution to deliver reliable, caring service whilemaking processes more efficient• We have clearly defined work teams working onimplementing the various provisions with 2010 and2011 implementation dates representingcommunications, finance, legislative, legal,mandates, and corporate strategy79

Implementing Health Care Reform• We implemented key parts <strong>of</strong> health carereform in advance <strong>of</strong> the deadlines becausewe believe that was in the best interest <strong>of</strong> ourmembers• Dependent Age 26• Individual Market Rescission Reforms• While we have pivoted from advocacy toimplementation, we believe affordability ismore important than ever before, and we willcontinue to work constructively withpolicymakers on this important issue80

Effective Dates <strong>of</strong> Reform Provisions2011-2013 2014 2018• Medicare <strong>Advantage</strong> cuts• Grants for small employerwellness programs• All working adults enrolled inCommunity Living AssistanceServices and Supports(CLASS) long-term careprogram, unless they opt out• Cost-sharing for preventiveservices in Medicareeliminated• Limit FSA contributions to$2,500 per year• Medical loss ratio requirement– 80% for Individual and SmallGroup; 85% for Large Groupbeginning in 2011• Individual mandate• Individual market guaranteedissue• Rating reforms for Individualand Small Group• Employer mandate• Insurance exchanges, withsubsidies up to 400% <strong>of</strong> thefederal poverty level• Medicaid expansion• Insurer fee, $8B, increasingto $14B in 2018• High-cost insurance tax –40% on single coverageover $10,200 and familycoverage over $27,50081

Regulatory Guidance on ProvisionsNotice <strong>of</strong> ProposedRulemaking:• Generally allows 30-90days for comment• Requires consideration<strong>of</strong> all formal commentswhen issuing final rule• Publication in FederalRegisterInterim Final Rule:• Generally allows 30-90days for comment• Requiresimplementation duringcomment period• Publication in FederalRegisterFinal Rule OR Final Rule with Comment:• Publication in Federal Register82

Interim Final RulesTo date, Interim Final Rules (IFR) havebeen published on:• Dependent coverage for children up to age 26• Early retiree re-insurance program• Grandfathering• Grievance & Appeals• High Risk Pool• Internet tool• Lifetime and annual limits• Patient protections• Pre-existing condition exclusions• Preventive care• Rescissions• Tax credit for small businesses83

Medical Loss Ratio• 2011: 85% in Large Group market• 2011: 80% in Small Group and Individualmarkets• Does not apply to ASO groups• We are awaiting additional federalguidance as to how it will be calculatedand what will be included84

Rate ReviewHHS Request for Information (RFI):• Legislation provides authority to develop rate reviewguidelines for states along with $250M in grants• HHS, DOL, and Treasury published RFI April 13• WLP, AHIP, BCBSA, NAIC submitted responses by May 14National Association <strong>of</strong> Insurance Commissioners (NAIC):• NAIC actuarial task force developed & submitted RFIresponse in early May85

Dependent Coverage for Children Up to Age 26Who:• Existing members’ dependents who would have lost dependent benefitson or after June 1, 2010, based on their birthday, will now be eligible tocontinue benefits• This includes specialty products such as vision, dental and pharmacy• Exceptions noted belowWhen:• Existing members’ dependents who would have lost dependentWhy:• The extension is designed to fill the coverage gap between June andSeptember 23, 2010 when the dependent care provision in health carereform legislation takes effectExceptions:• Administrative Services Only (ASO), fully or partially self fundedaccounts with more than 100 lives, and fully insured accounts with morethan 100 lives are able to opt out <strong>of</strong> the extension – we will work withthese groups individually to meet their needs86

Dependent Coverage for Children Up to Age 26• Definition <strong>of</strong> dependent• Special open enrollment period must be <strong>of</strong>fered• Will not impact “grandfathered” status• Other coverage is irrelevant if the plan is notgrandfathered; if a group is grandfathered thiswill be determined by the group• Can price for tiers:• Individual• Individual + 1• Family• Can’t limit benefit packages87

Early Retiree Reinsurance ProgramWho:• Fully insured and self-insured groups, regardless <strong>of</strong> size, are eligible• Applies to persons between the ages <strong>of</strong> 55 and 64When:• Employers can submit for reimbursement for claims between $15,000and $90,000 for Medical, Surgical, Hospital services (including mentalhealth); Prescription Drug costs; Member cost-share payments (copays,coins, deductible)Why:• HHS requires use <strong>of</strong> reimbursement to: (1) reduce premiums or healthbenefit costs; (2) reduce contributions, co-payments, deductibles,coinsurance, or other out-<strong>of</strong>-pocket costs for plan participantsHow:• Applications will be available from HHS and will be submitted by theclient directly to HHS• Applications will be processed on a first-come, first-served basis• We will assist with appropriate reporting and information88

Early Retiree Reinsurance Program:RequirementsIn order to participate in the retiree reinsurance program,the sponsor’s employment-based plan must:• Be certified by the Secretary <strong>of</strong> HHS• Have programs in place that have generated orhave the potential to generate cost savings forchronic and high-cost conditions• Have a written agreement in place with itshealth insurance issuer or plan to ensure anyPHI disclosure required to meet the program’sspecifications meets HIPAA guidelines• Attest that policies and procedures are in placeto protect against fraud, waste and abuse underthe plan89

Early Retiree Reinsurance:Qualifying Reimbursable Costs• Plan sponsors (employers) can submit forreimbursement <strong>of</strong> payments for:• Medical, Surgical, Hospital services (including mental health)• Prescription Drug costs• Member cost-share payments (co-pays, coins, deductible)• Other benefits that may be specified by the Secretary• Eligible expenses do not include those for “exceptedbenefits” under HIPAA, which would include long-termcare benefits, as well as stand-alone dental and visionplans• For Fully-insured plans, premiums are not eligible forreimbursement• Reimbursement will be made at 80% <strong>of</strong> cumulativeclaims between $15,000 and $90,000 per member in agiven plan year90

Early Retiree Reinsurance:Use <strong>of</strong> Reimbursement Funds• Funds must be used to lower overall healthcosts for enrollees• HHS encourages plan sponsors (employers)to use their reimbursement under the programfor both <strong>of</strong> the following purposes:• To reduce the plan sponsor’s health benefitpremiums or health benefit costs• To reduce health benefit premium contributions,co-payments, deductibles, coinsurance, or otherout-<strong>of</strong>-pocket costs, or any combination <strong>of</strong> thesecosts, for plan participants• Reimbursement cannot be used as generalrevenue for the plan sponsor (employer)91

Grandfathering <strong>of</strong> Existing Members:Overview (GROUP)• “Grandfather” provision allows existing membersto keep their products, except, requires allproducts renewed after September 23, 2010 to:• Allow members to add dependents up to age 26regardless <strong>of</strong> student status• Eliminate lifetime and certain annual limits• New sales <strong>of</strong> insured groups, and groups whochange policies after 3/23/10, will not be“grandfathered”• Additional changes apply with next plan yearbeginning on or after 9/23/10• Plans must provide information aboutgrandfather status to subscribers92

Grandfathering <strong>of</strong> Existing Members:Overview (INDIVIDUAL)• “Grandfather” provision allows existing membersto keep their products, except, requires allproducts renewed after September 23, 2010 to:• Allow members to add dependents up to age 26regardless <strong>of</strong> student status• Eliminate lifetime maximums• New sales and subscribers who change policiesafter 3/23/10, will not be “grandfathered”• Additional changes apply with next plan yearbeginning on or after 9/23/10• Plans must provide information aboutgrandfather status to subscribers93

Grandfathering <strong>of</strong> Existing Members:HHS GuidanceChanges that will cause loss <strong>of</strong> grandfathering:• Eliminating all (or substantially all) benefits to diagnoseor treat a particular condition• Increasing coinsurance at all• Increasing fixed amount cost-sharing too much• Increasing copayments too much• Reducing employer or employee organizationcontributions too much• Reducing an overall annual dollar limit or adding a newoverall annual dollar limit• Ensuring that consumers switch to a less richgrandfathered plan• If a plan is bought by or merges with another plan toavoid complying with PPACA• If a fully insured client changes policies or insurers• Changing from ASO to fully-insured94

Grandfathering <strong>of</strong> Existing Members:HHS Guidance (cont’d)Changes that won’t cause loss <strong>of</strong> grandfathering:• Adding family members <strong>of</strong> an individual who is enrolledin a grandfathered plan• Adding new employees to a grandfathered plan• One or more individuals enrolled on March 23, 2010,cease to be covered (provided that the plan orcoverage has continuously covered someone sinceMarch 23)• Voluntary changes to increase benefits• Amendments required to conform to legalrequirements/changes• Voluntary adoption <strong>of</strong> other PPACA consumerprotections• Changing third-party administrators (TPAs), providedthe change doesn’t violate the standards described onthe previous slide95

Grandfathering <strong>of</strong> Existing Members:Transition PeriodChanges that went into effect after March 23, 2010will not cause the loss <strong>of</strong> grandfathered status if thechange was …• Filed with a state insurance department on orbefore March 23, 2010, or• Made pursuant to a contract entered into on orbefore March 23, 2010, or• Made by plan amendment adopted on or beforeMarch 23, 2010Changes adopted prior to release <strong>of</strong> the interimfinal rule (June 14, 2010) may be revoked toavoid loss <strong>of</strong> grandfathered status96

Grandfathering <strong>of</strong> Existing Members:Collective Bargaining Agreements• Maintain grandfathered status untilagreement ends• After that time substantial changes willimpact grandfathered status• Required to implement provisions required<strong>of</strong> all grandfathered plans97

Grandfathering <strong>of</strong> Existing Members:BCBSGa’s Position• We believe many groups and individualswill want to maintain grandfathered status• We will grandfather most standard and nonstandardbenefit plans• As we continue to work to simplify our plan<strong>of</strong>ferings, we may retire some existing plans• We will support those who wish to remain“grandfathered” as this will allow them tokeep their current plan and benefit levels98

What is Required Based onGrandfather StatusProvisionGrandfatheredplanNon-grandfatheredplanNo lifetime limits on coverage for all plans X XNo rescissions <strong>of</strong> coverage when people get sick andhave previously made an unintentional mistake ontheir applicationExtension <strong>of</strong> parents’ coverage to young adults under26 years oldX XNo coverage exclusions for children with pre-existingconditionsXX(grandfathered Individualplans are exempt)Restricted annual benefit limits allowed for essentialhealth benefitsX XXXPreventive care coverage with no cost-sharingNo prior authorization and no increased cost-sharingfor emergency services (in or out <strong>of</strong> network)Abide by “essential health benefits” requirementsdefined by HHSXXX99

Grandfathering <strong>of</strong> Existing Members:BCBSGa’s Position - GROUPFor standard large and small group plans:• Renewals on or after October 1, 2010, untilMarch 23, 2011, will be quoted as grandfatheredplans, unless:• Group has elected to implement non-grandfatheredplans• Group has requested buy-down options• Group’s plan is being retired/not grandfathered• All new insured business will be sold nongrandfatheredbenefit plans• In future years, we may <strong>of</strong>fer grandfatheredgroups buy-downs• Regulations tightly limit the extent <strong>of</strong> buy down options• No buy-down options available for 2010100

Grandfathering <strong>of</strong> Existing Members:BCBSGa’s Position - INDIVIDUAL• Portfolio will include:• Grandfathered products• Closed non-grandfathered compliant products(no new enrollees will be allowed)• Open non-grandfathered compliant products(all new enrollees will be placed in these plans)• All new plan designs will be added to the opennon-grandfathered portfolio• Some products may be retired as we look foradditional simplification• We may look to <strong>of</strong>fer grandfathered individualsbuy-downs in order to take full advantage <strong>of</strong> theflexibility in the regulations and still maintain theirgrandfathered status101

Options for “Grandfathered” Plans• Continue <strong>of</strong>fering the plan or coverage ineffect on March 23, 2010, with limitedchanges• Significantly change the plan or coverage tocomply fully with the newly enacted healthcare reform legislation• No longer <strong>of</strong>fer any plan102

Grievances and AppealsPPACA requires fully insured and self-fundedplans to, at a minimum:• Have an internal claims and appeals process• Provide notice <strong>of</strong> an external appeals process• Allow an enrollee to review his or her file, presentevidence during the appeals process, andcontinue to receive coverage pending outcome• Implement an external review process103

Grievances and AppealsInterim Final Rule requires:• Applies to individual plans and fully insured and self-funded group plans• Non-grandfathered plans only• Must follow state or federal appeals processes• Benefit determinations subject to internal review include:• Whether a service is a covered benefit• Imposition <strong>of</strong> pre-existing condition or other benefit limits• Medical necessity and experimental treatment determinations• A determination to rescind coverage• Plans must ensure that internal review processes are fair and impartial• Individuals must be notified <strong>of</strong> their rights to internal reviews and externalappeals in a “culturally and linguistically appropriate manner”• Consumer protections for the external review process are required forcertain benefit determinations and decisions to rescind coverage104

Grievances and AppealsFor plan years before July 1, 2011, insurers in stateswith an existing, health care reform compliantexternal review process may follow that process• If the state external review process is not compliant,or if there is no applicable state external reviewprocess, the federal standard (not yet published)must be followed.• For self-insured plans, unless the state externalreview process applies, the federal standard (notyet published) must be followed.All non-grandfathered fully insured and self-fundedgroup health plans must meet the new consumerprotection standards for internal and external reviewfor plan years on and after September 23, 2010.105

High Risk PoolsThe law calls for the creation <strong>of</strong> new High RiskPools (HRPs) in all 50 states and D.C. to includethose who have been unable to obtain healthcoverage because <strong>of</strong> a:• Pre-existing health condition• Private insurance being unaffordableHigh Risk Pools that are run by the federalgovernment will require a denial letter for healthinsurance which requires underwriting within sixmonths prior to application to the high risk pool106

HHS Internet Tool• Launched on July 1, 2010• Supported by informationfrom all insurance plans• Currently uses legal names,not brand names <strong>of</strong> plans• Phase II is being developednow and will likely launch inOctober107

Lifetime and Annual Dollar Limits• The following are exempt from the changes inlimits:• MSAs, HSAs, FSAs• HRAs coupled with other group health plans• Stand alone retiree only HRAs• Restricts annual limits with respect to “essentialhealth benefits”• Awaiting more specific definition <strong>of</strong> “essential health benefit”• Good faith compliance required until final guidance• Can exclude all benefits for a specific condition• Treatment limits may still apply (e.g., day or visitlimits), however, some states have rejectedthese limits• Annual dollar limits requirement does not applyto grandfathered Individual plans108

Lifetime and Annual Dollar Limitscont’dMini-med plans may petition the Secretary for awaiver <strong>of</strong> the annual limits rule until 2014 if itresults in a significant decrease in access or asignificant increase in premiumsIncludes new notification requirements such as:• Individuals who have reached a lifetime limitmust be notified that the limit no longer applies• Notification <strong>of</strong> special enrollment109

Patient ProtectionsDesignating Providers• If plan requires a primary care provider (PCP),must provide notice that member can designateany PCP• Pediatrician can be child's primary care provider• Does not allow requirements for referral or preauthorizationto see OB-GYN or pediatrician forprimary care services• Allows pre-authorization requirements for specialtyservices from OB-GYN or pediatrician• Does not allow choice <strong>of</strong> out-<strong>of</strong>-network provideras PCP110

Patient ProtectionsEmergency Room Services• Cannot impose pre-authorization for ER services• Notification requirements are permitted post-treatment• Includes out-<strong>of</strong>-network ERs• More restrictive administrative requirements <strong>of</strong> coverage limitsnot allowed• Cannot exceed in-network copayments and coinsurance• Other cost sharing (e.g., deductibles) are allowed if it is thesame as those imposed on other out <strong>of</strong> network benefits• Does not ban provider balance billing; member can stillbe balanced billed• Insurer required to pay provider the greater <strong>of</strong>:• Their median payment to in-network ER provider,• The amount that would be paid if the plan used the samemethod for ER as it uses for other out <strong>of</strong> network services(such as UCR), or• The amount that would be paid by Medicare111

Pre-Existing Condition Exclusions• Insurers required to guarantee issuecoverage for kids under 19 in theindividual market• Regulation defines pre-existing conditionexclusion through a HIPAA definition thatcaptures coverage denials as pre-existingcondition exclusion• Applies to grandfathered group plans• Does not apply to grandfatheredIndividual health products112

Preventive CareProvision that requires health insurers <strong>of</strong> non-grandfatheredhealth plans to cover preventive services with no membercost sharing beginning on or after September 23, 2010.• States’ cost-sharing cannot be applied to preventiveservices recommended by• U.S. Preventive Services Task Force (USPSTF)• Advisory Committee on Immunization Practices (ACIP) <strong>of</strong>the Centers for Disease Control and Prevention• States’ cost sharing cannot be applied to recommendedvaccinations, and screenings and preventive care forinfants, children, adolescents, and women supported by theHealth Resources and Services Administration (HRSA)• Waiting for definition <strong>of</strong> Essential Health BenefitsWe will remove all member cost-share for in-networkpreventive care from our non-grandfathered products issuedor renewed on or after September 23, 2010.113

Rescissions• Requires rescissions to be based on:• An act, practice, or omission that constitutes fraud, orintentional misrepresentation <strong>of</strong> material fact• If member makes a mistake in eligibility, canterminate coverage prospectively – notretroactively• Will allow for appeals – more guidance to beissued• Requires 30-day notice• Applies to grandfathered plansNote: BCBSGa implemented this provision May 1, 2010,well ahead <strong>of</strong> the effective date in the legislation.114

Tax Credit for Small BusinessesWho:• Employers with fewer than 25 employees• Average annual compensation less than $50,000• Beginning in 2014, only available for coverage <strong>of</strong>fered in ExchangeWhen:• 2010: maximum credit is 35% <strong>of</strong> employer-paid premiums; for taxexemptorganizations, the maximum is 25% <strong>of</strong> employer-paid premiums• 2014: maximum increases to 50% <strong>of</strong> employer-paid premiums; for taxexemptorganizations, it increases to 35% <strong>of</strong> employer-paid premiumsWhy:• Designed to encourage small businesses to <strong>of</strong>fer health coverage forthe first time or enable them to maintain the coverage they already have.Example Scenario:Here's a look at how a business with 10 employees could benefit:• Wages: $250,000 total, or $25,000 per worker• Employee health care costs: $70,0002010 Tax Credit: $24,500 (35% credit) • 2014 Tax Credit: $35,000 (50% credit)115

Agenda• Federal reform key elements• Implementing health care reform• Continuing need for reform• How to stay informed116

Medical Costs Continue to RiseU.S. National Health Expenditures (trillions)$3.010%$2.5$2.0$1.5$1.357.0%8.6%$1.47$1.609.0%$1.738.3%6.9%$1.85$1.986.8%$2.116.7%$2.246.1%$2.40 (P)6.1% (P)9%8%7%6%5%4%$1.03%$0.52%1%$0.02000 2001 2002 2003 2004 2005 2006 2007 2008 (P)0%Source: National Health Expenditure Accounts, CMS117

Where Does TheHealth Insurance Dollar Go?118

Hospital Cost-ShiftingAggregate Hospital Payment-to-Cost Ratios, 1981-2006Cost shiftSource: Avalere Health analysis <strong>of</strong> American Hospital Association Annual Survey data, 2005, for community hospitals.(1)Includes Medicaid Disproportionate Share payments.119

Lessons From MassachusettsThe results from Massachusetts demonstrate continued need toimplement responsible reform that addresses cost and quality:• Covered about half <strong>of</strong> the uninsured (already exhibitedlowest uninsured rate in U.S.)• Premium costs for individuals in Massachusetts are thesecond highest in the U.S.• Overall, the costs <strong>of</strong> Massachusetts health reforms havebeen much higher than expected• Lack <strong>of</strong> an effective, enforceable individual mandate onlyexacerbates the cost issue in Massachusetts, and there isevidence <strong>of</strong> enrollment gaming120

Agenda• Federal reform key elements• Implementing health care reform• Continuing need for reform• How to stay informed121

Implementation Communications• BCBSGa has several teams working onimplementing the various provisions with2010 and 2011 implementation dates• BCBSGa will be sending communicationsto employers, individuals and brokersabout upcoming changes122

2010 Mid-Term Elections123

2010 Mid-Term Elections124

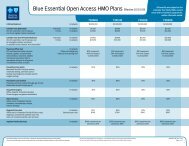

Product UpdateLynn Zimmermann, DirectorSmall Group Sales125

Federal MentalHealth Parity126

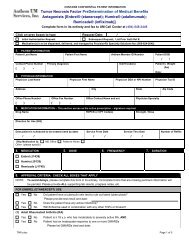

Federal Mental Health ParityWHY is thishappening?To ensure Members receive equal treatment formental health/substance abuse services whencompared to other medical services.WHO doesthis affect?All Groups with 51+ employees.New Groups and Renewing Groups (renewing 10/1/10 orlater).WHAT isaffected?The mental health and substance abuse benefits.WHAT datesare important?10/1/10 – This applies to New Groups and RenewingGroups on or after this date.127

Federal Mental Health Parity –Changes Effective 10/1/10The standard HMO, POSand PPO products will nowhave in-network outpatient<strong>of</strong>fice visits and pr<strong>of</strong>essionalservices billed by the facilitysubject to the PCP/PreferredPhysician copay. The innetworkoutpatient facilityservices will remain 100%not subject to the deductible.The <strong>Blue</strong> Essential productwill return to the original innetworkoutpatient MH/SAbenefits prior to the July 1,2010 changes.In-networkOutpatientFacility(includingPHP/IOP)In-networkOutpatientPr<strong>of</strong>essional in aFacilityIn-networkOutpatient OfficeStandardHMO, POSand PPO PlansNo Deductible,Plan Pays 100%PCP / PreferredPhysician CopayPCP / PreferredPhysician Copay<strong>Blue</strong> EssentialPlansSubject toDeductible, thenPlan pays 80%$20 copay for OVcharge only, thenplan pays 50%(HMO & POS) or60% (PPO)$20 copay for OVcharge only, thenplan pays 50%(HMO & POS) or60% (PPO)128

Healthcare Reform Immediate Provisions• Dependent age 26• Lifetime and annual limits• Preventive care• Pre-existing conditions waiting periods• Patient protection (PCP and ER)• Grandfathering129

Provision:Dependent Age 26130

Dependent Age 26WHY is thishappening?To extend dependent coverage to age 26.WHO does thisaffect?Existing members’ dependents who would have lostdependent benefits on or after May 1, 2010, based on theirbirthday or graduation from post secondary school. AllPlans and All Funding Arrangements for:New Groups and Renewing Groups (renewing 10/1/10 orlater), regardless <strong>of</strong> grandfathered status.WHAT isaffected?The dependent age limit on all plan designs.WHAT datesare important?10/1/10 – This applies to New Groups and RenewingGroups on or after this date.131

Provision:Lifetime andAnnual Limits132

Lifetime and Annual LimitsWHY is thishappening?WHO does thisaffect?WHAT isaffected?WHAT datesare important?To ensure Members are covered without dollar limitsfor Essential Health Benefits.This affects all Plans and all Funding Arrangements for:New Groups and Renewing Groups (renewing 10/1/10 orlater), regardless <strong>of</strong> grandfathered status.All Plans and all Funding Arrangements.New Groups and Renewing Groups (renewing 10/1/10 orlater), regardless <strong>of</strong> grandfathered status.The dollar value <strong>of</strong> Lifetime and Annual limits for essentialhealth benefits (EHB).Phased 3-year approach allowed. (BCBSGa has decidedto remove all limits now.)January 2014 – All limits pertaining to EHB must beremoved from New Groups and Renewing Groups by thisdate.133

Examples <strong>of</strong> Essential Health Benefits• Alcoholism-related services• Ambulance services• Asthma education• Diabetic supplies• Mental health and substance use disorder services, including behavioralhealth treatment. BCBSGa previously removed all visit and dollar limitsfor Mental Health & Substance Abuse services for all market sizes.• Diagnostic services ($300 limit on <strong>Blue</strong> Essential Plans must be removed)• Durable Medical Equipment• Hospice• Infusion therapy• Pharmacy• TMJ limits• We expect HHS to further define Essential health benefits at some point inthe future134

Provision:Preventive Care135

Preventive CareWHY is thishappening?To ensure Members get their Preventive CareServices covered.WHO does thisaffect?This affects all Plans and all Funding Arrangements for:New Groups and non-grandfathered Renewing Groups(renewing 10/1/10 or later).WHAT isaffected?All Plans and all Funding Arrangements.New Groups and non-grandfathered Renewing Groups(renewing 10/1/10 or later).Billing Procedures and Cost-Sharing Requirements.WHAT datesare important?10/1/10 – This applies to New Groups and Renewingnon-grandfathered Groups on or after this date.136

Provision:Pre-existingConditions WaitingPeriods Exclusion137

Pre-existing Conditions Waiting PeriodsWHY is thishappening?WHO does thisaffect?WHAT isaffected?WHAT datesare important?To remove pre-existing condition limitations.To allow Members under the age <strong>of</strong> 19 with Pre-ExistingConditions access to coverage without having to completethe Pre-Existing Waiting Period.Members under the age <strong>of</strong> 19 (Adults not until 2014).New Groups and Renewing Groups (renewing 10/1/10 orlater), regardless <strong>of</strong> grandfathered status.All Plans and All Funding Arrangements.New Groups and Renewing Groups (renewing 10/1/10 orlater), regardless <strong>of</strong> grandfathered status.Contracts with Pre-Existing Condition Waiting PeriodsExclusions.10/1/10 – This applies to New Groups and Renewing Groupsafter this date for members under 19.2014 – This will apply to all New Groups and Renewinggroups for all members <strong>of</strong> all ages.138

Provision:Patient Protection(PCP/ER)139

Patient Protection (PCP/ER)WHY is thishappening?To provide Members protections as it relates to choosingand utilizing Primary Care Providers and EmergencyServices.WHO does thisaffect?All Members.These provisions were already included in BCBSGa’sstandard plan designs.WHAT isaffected?BCBSGa is already in compliance with these provisions:Primary Care Provider Section Procedures.Emergency Services Cost-Sharing and Pre-authorizationProcedures.WHAT datesare important?BCBSGa is already in compliance, no changes requiredfor any dates.140

Provision:Grandfathering141

GrandfatheringWHY is thishappening?To allow employer groups who keep their existing planprior to March 23, 2010 to be exempt from the newproduct and rating framework that is effective in 2014.WHO does thisaffect?Employer Groups with Group coverage in effect onMarch 23, 2010.WHAT isaffected?Plan designs that BCBSGa has grandfathered.WHAT datesare important?10/1/10 – This applies to New Groups and RenewingGroups on or after this date.142

Marketing Materials143

Marketing MaterialsNeed an overview on Health Care Reform?144

Marketing MaterialsSeveral <strong>of</strong> our marketing materials have been updated to reflect thenew Health Care Reform changesMarketing Materials• Benefit summaries• Productcomparison gridsAgentAccess• Effective10/1benefit summaries& productcomparison gridswill be locatedbehind the securelogin145

Circle <strong>of</strong> ExcellenceBroker Advisory CouncilBCBSGa.comLynn Zimmermann, DirectorSmall Group SalesBrian Fetherston, DirectorLarge Group Sales146

Circle <strong>of</strong> ExcellenceBroker Bonus Program2010 Circle <strong>of</strong> Excellence3 Tier Levels• Elite• Champion• <strong>Advantage</strong>2010 Additional Broker BonusNew fully insured medical contractsbonus increase from $20 to $40 percontract!New ASO medical contracts includingSpecific Stop Loss bonus increasefrom $8 to $16!• <strong>Advantage</strong>, Champion & Eliteagencies eligible• New Sales Effective 9/1/10-12/31/10• Bonuses paid monthly & within 90days <strong>of</strong> the effective date. Groupswithin the 2-99 segment147

Broker Tiering ProgramAgency NameCurrent TierDesignationScorecardCurrentTier Score148

BCBSGa.com ReinventedSite EnhancementsNew look & feel to ourlanding pageSimplified navigationAt a glance view <strong>of</strong>health info.Side by side view <strong>of</strong>claims & benefit info.Take a tourhomepageaccessBrokers clickhere for moreinformation149

BCBSGa.com Reinvented150

BCBSGa.com Reinvented360 0 Health Tools151

BCBSGa.com ReinventedProvider Finder152

BCBSGa Broker Advisory Council• Purpose: Provide a forum forproviding feedbackregarding opportunities topromote the continuousimprovement <strong>of</strong> our mutualbusiness in GA• 12 Elite & Champion brokermembers• 6/9: Inaugural BrokerAdvisory Council meetingheld at the IntercontinentalHotel in Buckhead• 10/27: Follow up BrokerAdvisory Council meetingto occur153

Q&AThank you!154

<strong>Blue</strong> <strong>Cross</strong> and <strong>Blue</strong> <strong>Shield</strong> <strong>of</strong> <strong>Georgia</strong>, Inc., is an independent licensee <strong>of</strong> the <strong>Blue</strong> <strong>Cross</strong> and <strong>Blue</strong><strong>Shield</strong> Association. The <strong>Blue</strong> <strong>Cross</strong> and <strong>Blue</strong> <strong>Shield</strong> names and symbols are registered marks <strong>of</strong> the<strong>Blue</strong> <strong>Cross</strong> and <strong>Blue</strong> <strong>Shield</strong> Association.155