Full Report - Singapore Tourism Board

Full Report - Singapore Tourism Board

Full Report - Singapore Tourism Board

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

This publication ‘STB Market Insights’ serves as a reference to the trends of specific inboundtourism markets to <strong>Singapore</strong>. All information in this publication is deemed to be correct at timeof publication.While every effort has been made to ensure the accuracy of the data in this report, the <strong>Singapore</strong><strong>Tourism</strong> <strong>Board</strong> (STB) shall not be liable for any loss or damage caused by or arising from the useof the data in this publication. Data derived from surveys cited is subject to sampling error. Usersare advised to exercise discretion when drawing any conclusion or inferences, or taking anyaction, based on the data.STB makes no representation or warranty, express or implied, as to the accuracy or completenessof any information contained in this document. Appropriate professional advice should beobtained before relying on or acting on any of the information contained in this document, andneither STB nor any of its officers, employees or agents shall be held liable for any loss ordamage, whether direct or indirect, as a result of any improper or incorrect use of the informationin this document.Consumer Research & InsightsResearch & Incentives Divisioncri@stb.gov.sg©2013 <strong>Singapore</strong> <strong>Tourism</strong> <strong>Board</strong>.All rights reserved. No part of this publication may be reproduced, distributed, stored in a retrieval system, or transmittedin any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permissionof STB, or as otherwise permitted herein.Contents of this report may be reproduced accurately in part in other publications if STB is acknowledged and attributedas copyright owner.Month of Publication: July 20133STB Market Insights – Japan

Executive SummaryJapan contributes about 5% of the total number of visitors to <strong>Singapore</strong> annually and was the 7 th largesttourist market to <strong>Singapore</strong> in 2011. Despite the earthquake and ensuing tsunami in 2011, visitor arrivalsfrom Japan in 2010 and 2011 increased by 8% and 24% year‐on‐year respectively, and is projected to growmore in 2012. In contrast, the number of outbound travellers from Japan only grew 7.8% and 1.8% in 2010and 2011 respectively.Considered experienced and sophisticated, the Japanese leisure traveller prefers experiential tourism topassive sightseeing. Apart from the usual beach destinations that they head to for a relaxing holiday,<strong>Singapore</strong> is gaining traction as a destination that offers cultural experiences, even with increasing andcheaper competition from the region. They also look for unique experiences, something that they canonly experience in a particular destination.Awareness of <strong>Singapore</strong> as a leisure destination in Japan has been on the increase, most notablyawareness of the Marina Bay Sands. This can be attributed largely to a highly successful video featuringpopular boy band SMAP at the SkyPark, which resulted in an almost 20% increase in visits to IntegratedResorts in general.On the business travel front, <strong>Singapore</strong> is benefiting from strong growth in the ASEAN region as we areseen as a springboard to the region. With more Japanese businesses setting up offices here, an ecosystemof supporting services is looking to begin operations here too, as can be seen by the number of Japanesecompanies seeking advice from the <strong>Singapore</strong> office of the Japan External Trade Organization (JETRO)increasing by 248% from 2009 to 2011(1).Methodology of STB Primary Research SourcesFigures from this report are gathered from STB internal research as well as publicly available sources. The STB’s researchsources are STB’s Overseas Visitors Survey (OVS) and the Leisure Segmentation Study (SEG), as well as various interviewsand focus groups done.Overseas Visitors Survey (OVS) – conducted annually at exit points in <strong>Singapore</strong>, the OVS covers visitors from everynationality. The sample size is usually around 28,000 per year.Leisure Segmentation Study (SEG) – conducted in 2011 in 9 key markets, SEG sought to understand the needs of differentsegments of frequent air travellers within our key markets of Australia, China, India, Indonesia, Japan , Malaysia,Philippines, Thailand and Vietnam. The sample size was 500‐900 per market, for a total of 6,000.5STB Market Insights – Japan

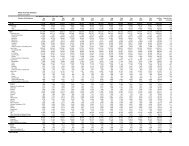

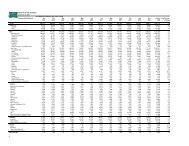

About The MarketPopulation (million) (2) 127.8 (2011)No. of Households (million) (3) 52 (as at October 1, 2010)Major Cities - Population (3)Outbound Travel (million)(4)Top 5 Travel Destinationsin 2011 (million) (5)Type of Outbound Trips (4)1. Greater Tokyo: 9.0 million2. Yokohama: 3.7 million3. Osaka: 2.7 million4. Nagoya: 2.3 million5. Sapporo: 1.9 million2008: 15.92009: 15.42010: 16.62011: 16.91. South Korea: 3.5192. China: 3.5183. Hawaii: 1.454. Taiwan: 1.435. Thailand: 1.37 Leisure <strong>Tourism</strong> (70%) Business (12%) Others (18%)Seasonality of Outbound Trips (4)6STB Market Insights – Japan

Japanese Travellers to <strong>Singapore</strong>Visitor Arrivals, <strong>Tourism</strong> Receipts and Purpose of Visit (9)2008571 (‘000)S$652 (million)40%47%4% 9%2009490S$52138%42%5%15%2010529S$60930%45%8%17%2011656S$79638%42%7%13%HolidayBusiness/MICEVisit Friends/RelativesOthers<strong>Tourism</strong> Receipts by Major Items (9)<strong>Tourism</strong> Receipts – Per Capita (9)39% 33% 37% 36%4%4%4% 4%11%10%11% 13%28%29%30% 31%$1,141$1,064$1,152$1,21218% 22% 17% 17%2008 2009 2010 2011Shopping Accommodation F&B Transportation Others2008 2009 2010 2011Weekly Flight Statistics (9)Top 5 Cities of Origin (9)1008023,14220,67117,72822,53125,00020,0002008 2009 2010 20111 Tokyo Tokyo Tokyo Tokyo6015,0002 Osaka Osaka Osaka Yokohama40207767608510,0005,0003 Nagoya Chiba Yokohama Osaka4 Yokohama Yokohama Fukuoka Nagoya0‐2008 2009 2010 2011Weekly Flight Frequency Weekly Seat Capacity5 Chiba Nagoya Nagoya Kawasaki Sightseeing & entertainment expenditure has been excluded from tourism receipts in the country breakdown due to commercial sensitivity of information. Other TR components include expenditure on airfares, port taxes, local transportation, business, medical, education and transit visitors.8STB Market Insights – Japan

The Japanese Leisure TravellerTop Travel Needs (7)Break from routineand stress; torechargeDiscovery andenlightenment; senseof achievementTop 5 Travel Considerations (7) Top Hindrances to Overseas Travel (4)Number of days available for the tripTravel companionFits the budgetTo visit friends or relativesInteresting culture / heritageSecurity concernsLanguage concernsCosts too muchDo not like foreign foodSimply don’t feel like it10STB Market Insights – Japan

Leisure Traveller in <strong>Singapore</strong>Top 5 Activities Done While In <strong>Singapore</strong> (7)Went ShoppingVisited a place or district with cultural or historicalsignificanceVisited a theme park or adventure attractionVisited friends or relativesVisited a well‐known landmark or tourist iconTop Dining Choices (7)Local Ethnic Restaurant66%Hawker Center/Food Court/Coffee Shop58%Fine‐Dining Restaurant31%Unique Dining ExperienceDining EnclaveCelebrity Chef or Award‐Winning RestaurantOthers11%11%10%9%14STB Market Insights – Japan

Reasons for Visiting <strong>Singapore</strong>The general perception Japanese leisure travellers have about <strong>Singapore</strong> as a destination is that<strong>Singapore</strong> is safe and tourist‐friendly, and a travel destination that is conducive for family‐trips.In line with the top travel needs of the Japanese being to relax and discover, the top 5 activities done in<strong>Singapore</strong> were visiting Sentosa as well as cultural/historical sites. This is partly corroborated withfeedback from STB in‐market team that tour packages to or within <strong>Singapore</strong> with a strong culturalcomponent are in demand, examples of which are packages for photo shoots with complete Indian sarimakeover and walking tours of ethnic precincts.Unique experiences that can only be found in <strong>Singapore</strong> would pique the interest of the Japanese leisuretraveller. From 2010 to 2011, the number of Japanese leisure visitors who visited the Integrated Resortsincreased from 7% to 25%, due largely to awareness created by a commercial featuring popular Japaneseboy band SMAP at the Marina Bay Sands SkyPark. Exotic dining experiences, for example, dinner in acapsule on the <strong>Singapore</strong> Flyer or dining amongst fishes at the Ocean Restaurant at Resorts WorldSentosa, caught their attention, as did dining with the skyline as the backdrop at the Marina Bay Sands’SkyPark. In line with their willingness to pay for quality, Japanese leisure travellers also appreciateguaranteed front‐row seats at the Night Safari, both for the shows and tram rides.The Japanese leisure traveller’s need for discovery extends to their culinary pursuits while in <strong>Singapore</strong>too. The majority of Japanese favour trying out ethnic restaurants and hawker centers, and they areimpressed by the cheap yet safe and good ‘street’ food that can be found in <strong>Singapore</strong> at hawker centersand food courts. They also feel that <strong>Singapore</strong> has a great variety of international dining options, but didnot seem particularly interested in celebrity‐opened or award‐winning restaurants. This could be due toJapan already having an abundance of award‐winning restaurants(13).Amongst all Japanese respondents, the top reasons for revisiting <strong>Singapore</strong> are related to hygiene factors,including safety and cleanliness. This ties in well with mitigating the top hindrance to overseas travel forthe Japanese, which is ‘security concerns’.Barriers to Visiting <strong>Singapore</strong>On the other hand, barriers to visit include the relative distance of <strong>Singapore</strong> to Japan. In fact, Japanesetend to relate to <strong>Singapore</strong> as a long‐haul destination by flight‐time. This is compounded by the fact thatthe top travel need is ‘relaxation’, and <strong>Singapore</strong> is not perceived to be a destination for relaxing.Low awareness about <strong>Singapore</strong> and a lack of differentiation when compared to other destinations areother reasons for not visiting <strong>Singapore</strong> for leisure (7). The perceived lack of a ‘real’ beach, as well as a cityimage similar to Tokyo means that <strong>Singapore</strong> does not immediately come to mind when planning a trip.Cost of a visit to <strong>Singapore</strong>, as well as preference for other SEA destinations, was also evident, whichindicates that <strong>Singapore</strong>’s rising costs compared to neighbouring countries is a barrier.Japanese travellers prefer more Japanese speaking sales personnel in shops as well as Japanese signagesat places such as attractions and public transportation hubs. While walking tours might be popular, thelack of Japanese‐speaking guides is a barrier. Technology might help bridge the gap, perhaps viaautomated audio‐visual guides with a choice of audio commentary in Japanese at ethnic precincts ortouchscreen way‐finding kiosks with directions in Japanese at key locations. Information in Japanese canalso be embedded within QR codes, which are popular and wide‐spread in Japan.15STB Market Insights – Japan

Business Traveller in <strong>Singapore</strong>Top 5 Cities of Origin (Business) (9)2008 2009 2010 20111 Tokyo Tokyo Tokyo Tokyo2 Osaka Osaka Yokohama Osaka3 Chiba Yokohama Osaka Yokohama4 Nagoya Chiba Chiba Nagoya5 Yokohama Nagoya Nagoya ChibaTop Shopping Areas Visited (19)Changi AirportOrchard RoadMarina Bay (Marina Sq/ Raffles City/ Suntec) Sightseeing & entertainment expenditure has been excluded from tourism receipts in the country breakdown due to commercial sensitivityof information. Other TR components include expenditure on airfares, port taxes, local transportation, business, medical, education and transit visitors.16STB Market Insights – Japan

The Economic Lure of South-East AsiaASEAN has seen strong economic growth and real GDP growth amongst the ASEAN‐10 countries areprojected to grow 5.5% annually from 2013 to 2017 (14), compared to the projected real GDP growth inJapan of 2.5% (15). After the triple‐disasters in 2011, there is also the feeling amongst Japanese businessesthat they must diversify their operations and not rely too heavily on domestic production.With <strong>Singapore</strong> seen as a springboard to the region, more Japanese businesses have been consideringstarting operations in <strong>Singapore</strong>. According to the Japan External Trade Organization (JETRO), agovernment‐related organisation that works to promote mutual trade and investment between Japan andthe rest of the world, the number of Japanese companies seeking advice from its <strong>Singapore</strong> office jumped248% from 2009 to 2011 (1). This trend can also be seen in the number of Japanese services firms settingup shop in <strong>Singapore</strong>(16).Barring the global downturn in 2009, <strong>Singapore</strong> has seen the number of Japanese business travellersincrease gradually; almost every other Japanese visitor to <strong>Singapore</strong> is a business traveller. Apart fromvisiting for business or conventions/meetings, we see a growing trend of companies planning incentivetrips for their staff to <strong>Singapore</strong> too. This is especially so for the larger incentive groups (>1,000 pax),which saw 70% more bookings after the Marina Bay Sands opened as there is now enough capacity toabsorb their large group size into one accommodation venue; previously only Swissôtel The Stamford hadthe required capacity.What Japanese Business Travellers Spent On and What They BoughtThe proportion of Japanese business travellers visiting <strong>Singapore</strong> is much greater than the proportion ofJapanese outbound business travellers; over 40% of Japanese travellers visit <strong>Singapore</strong> for business,whereas less than 15% of outbound travellers from Japan are travelling for business.From 2008, the expenditure of Japanese business travellers in <strong>Singapore</strong> has been increasing. This couldbe due to an increasing number of Japanese business travellers choosing hotels that are mid‐tier andabove, leading to a corresponding increase in accommodation expenditure. This is significant since a largecomponent of their expenditure is in the form of accommodation, and the Japanese business travellerspent a larger proportion of their in‐destination expenditure on accommodation than the global average.Also without bucking the trend set by their leisure counterparts, Japanese business travellers spent less onshopping while in <strong>Singapore</strong> than the global average. In terms of what they bought in <strong>Singapore</strong>,Japanese business travellers bought more ‘Confectionery and Food Items’, which is in line with theirpractice of buying ‘omiyage’, and ‘Fashion and Accessories’, but bought less ‘Consumer Technology andGadgets’ and ‘Watches and Clocks’ than the global average. Overall, Japanese business travellers spent asimilar proportion on shopping items as compared to their leisure counterparts.Making time for shopping, every other Japanese business traveller visited the shops at Changi Airport.Less than 1 in 5 of them visited our most popular shopping districts (Orchard Road and the Marina Bayarea), while less than 1 in 10 of them ventured anywhere else.17STB Market Insights – Japan

Key FindingsAfter 5 years of currency appreciation, the Japanese yen is depreciating and is projected to depreciatefurther over the next 3 years (17). Despite this, Japanese outbound travel is still expected to grow; albeit ata slower pace (18). To continue to entice the Japanese visitor to <strong>Singapore</strong>, some points to keep in mindwould be their need for quality, attention to details as well as language. Specifically:In every aspect of the Japanese traveller’s stay, their experience in travelling and relativesophistication as travellers should be taken into account. Offerings should be angled towards creatingunique experiences and indelible memories, rather than aspirational ‘check‐box ticking’.Feedback from trade partners in Japan has indicated that tour packages that includes culturalactivities (whether full‐packages or free‐and‐easy packages) are the most popular with Japanesetourists, no matter the destination. This interest in culture might be a manifestation of one of their toptravel needs, that of ‘discovery and enlightenment’.Trip itineraries for the Japanese market should take into account their limited number of daysavailable for trips in general; apart from the Golden Week (end‐April to 5 th of May) and Silver Week(mid‐September) holidays, Japanese usually do not take long absences from work for overseas travel.Safety – both in terms of security and knowing what to expect – is a big consideration for the Japanesetraveller. Apart from the obvious need for a sense of security, the Japanese traveller wants structuredand predictable experiences, going so far as to follow instructions in guidebooks to a T.Accommodation options chosen by Japanese travellers to <strong>Singapore</strong> are moving towards higher‐tierofferings, and communication to them should reflect this. There is also the expectation of higherstandards of service at higher‐tier offerings.Japanese like to buy ‘gifts and souvenirs’, though they tend to shun large physical items either forgifting or as a souvenir. Individually‐packed food items are a popular choice.The language barrier is an inconvenience that extends throughout the entire stay of the Japanesetraveller, affecting both leisure and business travellers. Technology might help bridge the gap;examples are via automated audio‐visual guides at ethnic precincts, touchscreen way‐finding kiosks atkey locations or embedding information in Japanese within QR codes.Collaterals must provide the Japanese with enough details for it to be a stand‐alone informationsource and they must be written specifically for the Japanese market and not just a literal translationfrom another language.Bibliography1. Kin, Kwan Weng. Japanese companies look to <strong>Singapore</strong>. s.l. : The Straits Times, 2012.2. Ministry of Internal Affairs and Communications. The Statistical Handbook of Japan 2012.3. —. Japan 2012 Statistical Yearbook.4. JTB Corp., Japanese <strong>Tourism</strong> Marketing Co. All About Japanese Overseas Travelers. 2012.5. Japan <strong>Tourism</strong> Marketing Co. Historical Statistics ‐ Japanese Tourists Travelling Abroad. <strong>Tourism</strong> Statistics. [Online] [Cited: 03 29, 2013.]6. Euromonitor International. Passport ‐ <strong>Tourism</strong> Flows Outbound in Japan. 2012.7. <strong>Singapore</strong> <strong>Tourism</strong> <strong>Board</strong>. Leisure Segmentation Study. 2011.8. Horwitz, Rachael. Celebrating 2013 in the global town square. Twitter Blog. [Online] 01 02, 2013. [Cited: 07 27, 2013.]9. <strong>Singapore</strong> <strong>Tourism</strong> <strong>Board</strong>. Annual <strong>Report</strong> on <strong>Tourism</strong> Statistics. 2008/2011.10. Ministry of Health, Labour and Welfare; Japan. Introduction to the revised Child Care and Family Care Leave Law. 2008.11. PhoCusWright. Japan Online Travel Traffic <strong>Report</strong>. 2012.12. Google‐IPSOS. Understanding The Mobile Customer ‐ Our Mobile Planet: Japan. 2012.13. Steinberger, Michael. Tokyo Tops Paris With More Michelin Stars and Better Food. s.l. : Bloomberg, 2013.14. Organisation for Economic Co‐operation and Development. Southeast Asian Economic Outlook 2013: With Perspectives on China and India.15. Kaneko, Kaori. Japan forecasts real GDP growth of 2.5 percent in year from April. s.l. : Reuters, 2013.16. Chan, Fiona. More Japanese services firms in S'pore. s.l. : The Straits Times, 2013.17. Economist Intelligence Unit. Country <strong>Report</strong> ‐ Japan. 2012.18. Business Monitor International. Japan <strong>Tourism</strong> <strong>Report</strong>. 2012.19. <strong>Singapore</strong> <strong>Tourism</strong> <strong>Board</strong>. Overseas Visitors Survey. 2012; Jan‐Sep.20. Japan National <strong>Tourism</strong> Organisation. <strong>Tourism</strong> Statistics 2012. 2012.21. Japan <strong>Tourism</strong> Marketing Co. JTM Outbound Statistics. 2012.18STB Market Insights – Japan

www.stb.gov.sg