Records Retention Policy

Records Retention Policy

Records Retention Policy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

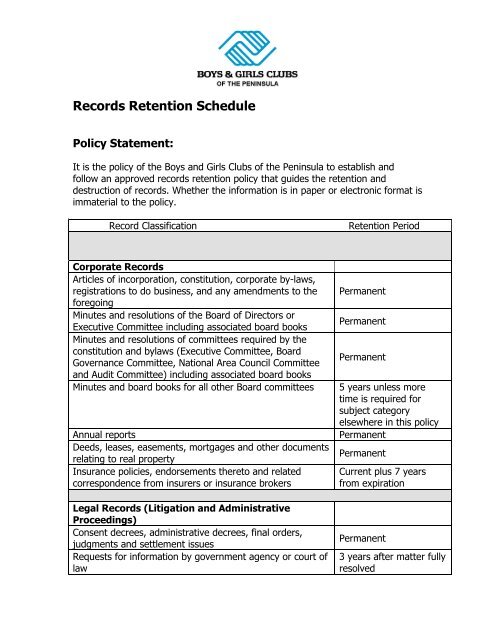

<strong>Records</strong> <strong>Retention</strong> Schedule<strong>Policy</strong> Statement:It is the policy of the Boys and Girls Clubs of the Peninsula to establish andfollow an approved records retention policy that guides the retention anddestruction of records. Whether the information is in paper or electronic format isimmaterial to the policy.Record Classification<strong>Retention</strong> PeriodCorporate <strong>Records</strong>Articles of incorporation, constitution, corporate by-laws,registrations to do business, and any amendments to theforegoingMinutes and resolutions of the Board of Directors orExecutive Committee including associated board booksMinutes and resolutions of committees required by theconstitution and bylaws (Executive Committee, BoardGovernance Committee, National Area Council Committeeand Audit Committee) including associated board booksMinutes and board books for all other Board committeesAnnual reportsDeeds, leases, easements, mortgages and other documentsrelating to real propertyInsurance policies, endorsements thereto and relatedcorrespondence from insurers or insurance brokersLegal <strong>Records</strong> (Litigation and AdministrativeProceedings)Consent decrees, administrative decrees, final orders,judgments and settlement issuesRequests for information by government agency or court oflawPermanentPermanentPermanent5 years unless moretime is required forsubject categoryelsewhere in this policyPermanentPermanentCurrent plus 7 yearsfrom expirationPermanent3 years after matter fullyresolved

Notice of demand lettersNotices of violations / citations / complaints<strong>Records</strong> that relate to ongoing or threatened litigation orother proceedingsTax <strong>Records</strong>Tax exemption applicationInformation returns (Form 990 and 5500)<strong>Records</strong>, returns, schedules, and statements relating towages paid, federal and state income tax withheld, socialsecurity tax paid and withheld from employee wages anddocumentation of employee business expensesPermanent books of account or records, includinginventories, sufficient to establish the amount of grossincome, deductions, credits, etc., and all supporting recordsof details (e.g., payroll records, canceled checks, invoices,vouchers, etc.)<strong>Records</strong> of property for which a basis must be determinedto compute gain or loss upon disposition.Accounting and Financial <strong>Records</strong>Audited financial statementsAll ledgers, accounts payable and receivable schedules, andother similar documentsBank records (including deposit and withdrawal slips), bankstatements, check registers, check receipt journals,canceled checks and other similar documentsExpense account, vouchers, petty cash records and othersimilar documentsManagement ReportsYear-endMonthlyTreasurers ReportsYear-endMonthlyContractsPayroll registers5 years after matter fullyresolved5 years after matter fullyresolvedUntil matter concludedand then subject to theschedule determined bythe <strong>Records</strong> <strong>Retention</strong>Officer.PermanentPermanent7 years after the duedate of the tax or thedate the taxes were paidwhichever is later7 years after the returnsare filedRetain until a taxabledisposition is madePermanent7 years7 years7 years4years4years5 years from completionof performance7yearsIssued 3/31/09 Page 2

Security violations, infractionsFire, theft investigationsEmergency conditionsOffice Supplies and ServicesOffice equipment recordsInternal Memoranda and CorrespondenceVoicemail messageE-mail specifically pertaining to litigation, or a category ofdocuments referenced for specific retention period shouldbe maintained with those records and destroyed inaccordance with the appropriate memorandum.Telephone messages (both incoming and outgoing)Copies of routine interdepartmental or other companycorrespondence (except official statements of policies orpositions)Calendars, schedule book, appointment books, dailyplanners and similar scheduling documents)Chronological filesGeneral statements of policies or positionsLetters and notes that required no acknowledgement orfollow-up (e.g., letter of transmittal, travel plans formeetings)3 years3 years3 years3 yearsDispose of after usePer applicable retentionmemorandumDispose of after use or30 days whichever issoonerDispose of after useDispose of after use5 yearsPermanent or untilsupersededAfter use or 1 yearwhichever is soonerIssued 3/31/09 Page 5