Transform Tomorrow - Aegon

Transform Tomorrow - Aegon Transform Tomorrow - Aegon

Impact on Aegon’s financial metrics2012 key metrics Before exchange After exchangepro forma 2012DriverHolding excess capital EUR 2.0 billion EUR 1.6 billionCapital base ratio 76.7% 75.1% EUR 400 million cash paymentIGD solvency ratio 230% 224%Interest cover 4.2x 4.8xHigher interest cover driven by ending paymentof preferred dividendNumber of common shares 1,943 million 2,081 million* Conversion from preferred to common sharesEarnings per share EUR 0.69 EUR 0.67Return on commonshareholders’ equityShareholders’ equityper common share**7.1% 6.7%EUR 8.47 EUR 8.76Higher share count partly offset as payment ofpreferred dividend will endHigher common shareholders’ equity, partlyoffset by ending payment of preferred dividendHigher common shareholders’ equity, partlyoffset by higher common share count20* Includes 14.1 million common shares which represent 1/40 of the economic equivalent of 563 million common shares B** Excluding revaluation reservesNote: above metrics are based on a number of assumptions, including Aegon share price of EUR 4.75

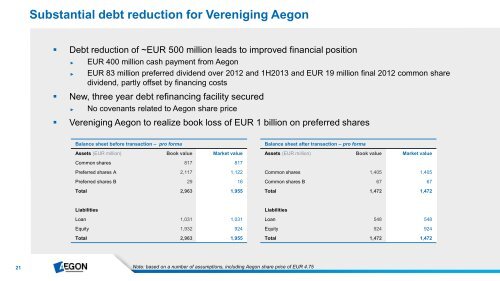

Substantial debt reduction for Vereniging Aegon• Debt reduction of ~EUR 500 million leads to improved financial position►►EUR 400 million cash payment from AegonEUR 83 million preferred dividend over 2012 and 1H2013 and EUR 19 million final 2012 common sharedividend, partly offset by financing costs• New, three year debt refinancing facility secured►No covenants related to Aegon share price• Vereniging Aegon to realize book loss of EUR 1 billion on preferred sharesBalance sheet before transaction – pro formaAssets (EUR million) Book value Market valueBalance sheet after transaction – pro formaAssets (EUR million) Book value Market valueCommon shares 817 817Preferred shares A 2,117 1,122Preferred shares B 29 16Total 2,963 1,955Common shares 1,405 1,405Common shares B 67 67Total 1,472 1,472LiabilitiesLoan 1,031 1,031Equity 1,932 924Total 2,963 1,955LiabilitiesLoan 548 548Equity 924 924Total 1,472 1,47221Note: based on a number of assumptions, including Aegon share price of EUR 4.75

- Page 1 and 2: Transform TomorrowLondon, 21 March

- Page 3 and 4: Execute on strategic transformation

- Page 5: Our products and services have neve

- Page 8: Successfully growing our fee-based

- Page 12 and 13: Capture growth in Protection and Ac

- Page 14 and 15: Realizing ambition to become a lead

- Page 16 and 17: Aegon to cancel all preferred share

- Page 18 and 19: All preferred shares exchanged for

- Page 22 and 23: Vereniging Aegon agreed to give up

- Page 24 and 25: Continued delivery of strong result

- Page 26 and 27: Net income benefits from investment

- Page 28 and 29: Sales increase demonstrates strengt

- Page 30 and 31: Successful repositioning of Spanish

- Page 32 and 33: Strong operational free cash flows

- Page 34 and 35: Upcoming eventsMarchMayJuneAugustAn

- Page 36 and 37: Focus on delivering on targetsAchie

- Page 38 and 39: Limited exposure in general account

- Page 40 and 41: Gross deposits increases in asset m

- Page 42 and 43: Higher underlying earnings• Ameri

- Page 44 and 45: The Netherlands• Underlying earni

- Page 46 and 47: New Markets• Underlying earnings

- Page 48 and 49: Capital allocated to run-off busine

- Page 50 and 51: Investments general accountAegonINV

- Page 52 and 53: Credit losses in the US trending do

- Page 54 and 55: For questions please contact Invest

Substantial debt reduction for Vereniging <strong>Aegon</strong>• Debt reduction of ~EUR 500 million leads to improved financial position►►EUR 400 million cash payment from <strong>Aegon</strong>EUR 83 million preferred dividend over 2012 and 1H2013 and EUR 19 million final 2012 common sharedividend, partly offset by financing costs• New, three year debt refinancing facility secured►No covenants related to <strong>Aegon</strong> share price• Vereniging <strong>Aegon</strong> to realize book loss of EUR 1 billion on preferred sharesBalance sheet before transaction – pro formaAssets (EUR million) Book value Market valueBalance sheet after transaction – pro formaAssets (EUR million) Book value Market valueCommon shares 817 817Preferred shares A 2,117 1,122Preferred shares B 29 16Total 2,963 1,955Common shares 1,405 1,405Common shares B 67 67Total 1,472 1,472LiabilitiesLoan 1,031 1,031Equity 1,932 924Total 2,963 1,955LiabilitiesLoan 548 548Equity 924 924Total 1,472 1,47221Note: based on a number of assumptions, including <strong>Aegon</strong> share price of EUR 4.75