Form IT05 - RETURN OF INCOME AND TAX PAYABLE

Form IT05 - RETURN OF INCOME AND TAX PAYABLE

Form IT05 - RETURN OF INCOME AND TAX PAYABLE

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

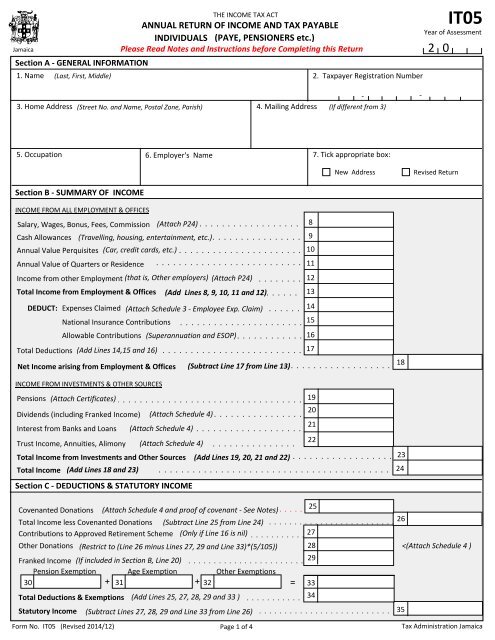

JamaicaTHE <strong>INCOME</strong> <strong>TAX</strong> ACTANNUAL <strong>RETURN</strong> <strong>OF</strong> <strong>INCOME</strong> <strong>AND</strong> <strong>TAX</strong> <strong>PAYABLE</strong>INDIVIDUALS (PAYE, PENSIONERS etc.)Please Read Notes and Instructions before Completing this ReturnSection A ‐ GENERAL INFORMATION1. Name (Last, First, Middle)2. Taxpayer Registration Number‐ ‐3. Home Address (Street No. and Name, Postal Zone, Parish) 4. Mailing Address (If different from 3)<strong>IT05</strong>Year of Assessment2 05. Occupation6. Employer's Name7. Tick appropriate box:New AddressRevised ReturnSection B ‐ SUMMARY <strong>OF</strong> <strong>INCOME</strong><strong>INCOME</strong> FROM ALL EMPLOYMENT & <strong>OF</strong>FICESSalary, Wages, Bonus, Fees, Commission (Attach P24) . . . . . . . . . . . . . . . . . . 8Cash Allowances (Travelling, housing, entertainment, etc.) . . . . . . . . . . . . . . . . 9Annual Value Perquisites (Car, credit cards, etc.) . . . . . . . . . . . . . . . . . . . . . . 10Annual Value of Quarters or Residence . . . . . . . . . . . . . . . . . . . . . . . . . . 11Income from other Employment (that is, Other employers) (Attach P24) . . . . . . . . 12Total Income from Employment & Offices (Add Lines 8, 9, 10, 11 and . 12) . . . . . . . 13DEDUCT: Expenses Claimed (Attach Schedule 3 ‐ Employee Exp. Claim) . . . . . . 14National Insurance Contributions . . . . . . . . . . . . . . . . . . . . . . 15Allowable Contributions (Superannuation and ESOP) . . . . . . . . . . . . . 16Total Deductions (Add Lines 14,15 and 16) . . . . . . . . . . . . . . . . . . . . . . . . . 17Net Income arising from Employment & Offices<strong>INCOME</strong> FROM INVESTMENTS & OTHER SOURCESPensions (Attach Certificates) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1920Dividends (including Franked Income) (Attach Schedule 4) . . . . . . . . . . . . . . . .21Interest from Banks and Loans (Attach Schedule 4) . . . . . . . . . . . . . . . . . . .Trust Income, Annuities, Alimony (Attach Schedule 4)22. . . . . . . . . . . . . . .Total Income from Investments and Other Sources (Add Lines 19, 20, 21 and 22) . . . . . . . . . . . . . . . . . .Total Income (Add Lines 18 and 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Section C ‐ DEDUCTIONS & STATUTORY <strong>INCOME</strong>(Subtract Line 17 from Line 13) . . . . . . . . . . . . . . . . . .182324Covenanted Donations (Attach Schedule 4 and proof of covenant ‐ See Notes) . . . . . 25Total Income less Covenanted Donations (Subtract Line 25 from Line 24) . . . . . . . . . . . . . . . . . . . . . . . . . 26Contributions to Approved Retirement Scheme (Only if Line 16 is nil) . . . . . . . . . . . 27Other Donations (Restrict to (Line 26 minus Lines 27, 29 and Line 33)*(5/105)) 28

Section D ‐ <strong>TAX</strong> COMPUTATIONCOMPUTATION <strong>OF</strong> <strong>INCOME</strong> <strong>TAX</strong> <strong>PAYABLE</strong>Dividends Received from Companies Resident in Jamaica (Complete Schedule 4 and attach certificates) . . . . .Statutory Income less Dividends at Line 36. (Subtract Lines 36 from Line 35) . . . . . . . . . . . . . . . . . . . . .Income at Nil Rate (Threshold)Statutory Income less Dividends at line 36 less ThresholdTax on Dividends Received from Companies Resident in JamaicaTotal Tax on Statutory Income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Tax on Statutory Income less Dividends at Line 36 and Threshold(Subtract Line 38 from Line 37 ‐ Restrict to zero) . . . . .(Line 39 x Rate_____%) . . . . . . . . . . . . .(Complete Schedule 4 and attach certificates)(Add Line 40 and Line 41). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Tax Credits (Excluding previous refund claims):P.A.Y.E. Tax Deducted by Employer (Attach P24's) . . . . . . . . . . . . . . . . 43Double Taxation Relief (Attach Certificates)44. . . . . . . . . . . . . . . . . .45Tax deducted from Other Sources (Attach Certificates) . . . . . . . . . . . . .Total Tax Credits (Add Lines 43, 44 and 45 ‐ Must not exceed value in Line 40) (See Note 1 below). ...46Tax deducted from Dividends received from companies resident in Jamaica (Must not exceed Line 41). . . . 46aNET <strong>TAX</strong> <strong>PAYABLE</strong> / (REFUNDABLE) (Subtract Lines 46 and 46a from . Line . . 42) . . . . . . . . . . . . . . . . . . . . . .47Note 1 ‐ The restriction is not applicable to any person whose income is specified in Section 12 (1) (h) (z) or (ab) of The Income Tax Act36373839404142Preparer's Details ‐ (To be completed if prepared by person other than Taxpayer)Preparer's Name (Individual/Firm)AddressTRNFOR <strong>OF</strong>FICIAL USEContact NumberSection E ‐ DECLARATIONNote:Any false statement herein will render you liable to penalties and/or criminalproceedings.I declare, to the best of my knowledge and belief, that this return and accompanyingschedules and statements are a true, correct and complete representation of the whole ofmy income for the year stated.Taxpayer's SignatureDatePage 2 of 4

NOTES <strong>AND</strong> INSTRUCTIONS FOR COMPLETION <strong>OF</strong> <strong>IT05</strong>INDIVIDUALS (PAYE, PENSIONERS etc.)This form is to be completed by persons whose source of income is from salaries or wages, pensions, dividends, bankinterest and other income from which tax has been deducted at source that is, taxed under Pay As You Earn (PAYE).PAYE persons in receipt of income from other sources not taxed at source should complete Self‐Employed Return <strong>Form</strong>S04.Please type or print the required information. Do NOT use a pencil. Use blue or black ink pen only. All dollar valueamounts in Sections B and C should be rounded to the nearest whole number. All sections MUST be completed.This Return together with the relevant certificates are to be submitted at any Revenue Service Centre or Tax Office afterDecember 31 st (of the Year of Assessment), but not later than the 15 th of March of the following year. Returns may alsobe filed online at www.jamaicatax‐online.gov.jmSECTION A ‐ GENERAL INFORMATIONBox 7: New AddressPlease tick appropriate box if there hasbeen a change of address since filing of thelast Return.Box 7: Revised ReturnPlease tick appropriate box if this Return isa revised Return, that is, changes are beingmade to a previously‐submitted Return.SECTION B – SUMMARY <strong>OF</strong> <strong>INCOME</strong>Line 11: Annual Value of Quarters orResidencei) Where rent is paid directly to theemployee or the Landlord the fullamount is taxable.ii) Where the employer is the Landlord ofthe accommodation provided theMarket Value is the taxable sum.iii) Where the employee is required to livein the accommodation provided by theemployer the value of the benefit shallnot exceed 30% of his emolument(excluding the value of theaccommodation).iv) Where the employee livesin accommodation owned or operated byan approved Charitable Organization thevalue of the benefit shall not exceed 30%of his emolument (excluding the value ofthe accommodation).Line 14: Expenses ClaimedExpenses exclusively incurred in acquiringthe income which were not reimbursed bythe employer, may be claimed here.Attach Schedule 3 – Employee ExpenseClaim.<strong>INCOME</strong> FOM INVESTMENTS & OTHERSOURCESLines 20 – 22: Dividends, Interest andAnnuitiesIn arriving at the amount exclude CapitalDistributions as these are not subject toincome tax. The gross amount of incomearrived at should be entered. Any creditfor income tax deducted will be given inSection D – Tax Computation. Attachcertificates and/or warrants.SECTION C – DEDUCTIONS & STATUTORY<strong>INCOME</strong>Line 25: Covenanted DonationsEnter any amounts made in respect ofannuities or other annual paymentssecured by deed of covenant in favour ofthe University of the West Indies, theUniversity of Technology or any otherapproved institution. (Attach proof)Line 28 – Other DonationsThe amount or value of a donation to anApproved Charitable Organization(whether money or property) should notexceed the allowable deduction of 5% ofStatutory Income. This is calculated as5/105 or 1/21 of Line 26 minus Line 27 andLine 33(i.e. (5/105)*(Line 26 – Line 27 – Line 33)Line 30 ‐ 32:Exemptions• If under 55 years, $80,000 of incomederived from a Statutory PensionScheme or a Superannuation Schemeapproved by the Commissioner Generalis exempt from tax.• If 55 years or over, $80,000 of incomefrom pension and any other source isexempt from tax.• If 65 years or over, $80,000 of incomederived from any source is exemptfrom tax.• If permanently incapacitated, thetotal income from salary and pensionis exempted. Persons who arepermanently incapacitated must becertified as being disabled by theMinister responsible for SocialSecurity on the advice of the ChiefMedical Officer, Ministry of Health.SECTION D ‐<strong>TAX</strong> COMPUTATIONLine 36: Tax on dividends received fromcompanies resident in Jamaica. Tax Ratesare:Jan. 1, 2009 ‐ May 31, 2012: 0%Jun 1, 2012 ‐ Mar. 31, 2013: 5%April 1, 2013 ‐ : 15%Line 38: Income Tax ThresholdAll individuals including pensionersresident in the island are entitled to thefollowing annual tax‐free amounts:• 2001 ‐ 2004 : $120,432• 2005 : $144,768• 2006 & 2007 : $193,440These notes are for use as a guide to the correct completion of the form. Before any section is completed, the notes relating to it should be read.The notes have no binding force and do not affect the right of the company to object on matters affecting its liability. If there are other points onwhich guidance is needed, information can be obtained from the nearest Collector of Taxes or the Tax Help Unit (Call toll free: 1‐888‐<strong>TAX</strong>‐HELP).Page 3 of 4

NOTES <strong>AND</strong> INSTRUCTIONS FOR COMPLETION <strong>OF</strong> <strong>IT05</strong>INDIVIDUALS (PAYE, PENSIONERS etc.)• 2008: $196,872 (N B: January 1 toJune 30: Threshold was $193,440/12 x6 = $ 96,720. July 1 to December31:Thresholdwas$200,304/12 x6=$100,152)• 2009: $270,504 (NB: January 1 toJune 30: Threshold $220,272/12 x 6 =$ 110,136. July 1 to December 31:Threshold $320,736/12 x 6 =$160,368)• 2010 – 2012 : $441,168• 2013 & 2014 : $507,312• 2015 ‐ : $557,232Non‐resident persons and non‐residentpensioners are not entitled to the tax‐freeamounts. Residents are to calculate tax atthe appropriate rate on the balance ofstatutory income after applying the taxthreshold to arrive at income tax onstatutory income.Line 41 ‐ Tax on Dividends receivedfrom Companies Resident in Jamaica.Tax credits are not allowed against taxon dividends as this is a Final Tax.Lines 43 ‐ 45: CreditsAll credits claimed are to be substantiatedby the submission of the relevantcertificates, for example Withholding TaxCertificates, Contractor’s levyReceipts/Certificates.Any balance payable should be remittedwith your Return to the Collector of Taxeson or before March 15.These notes are for use as a guide to the correct completion of the form. Before any section is completed, the notes relating to it should be read.The notes have no binding force and do not affect the right of the company to object on matters affecting its liability. If there are other points onwhich guidance is needed, information can be obtained from the nearest Collector of Taxes or the Tax Help Unit (Call toll free: 1‐888‐<strong>TAX</strong>‐HELP).Page 4 of 4