2002-2004 Catalog - St. Charles Community College

2002-2004 Catalog - St. Charles Community College

2002-2004 Catalog - St. Charles Community College

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

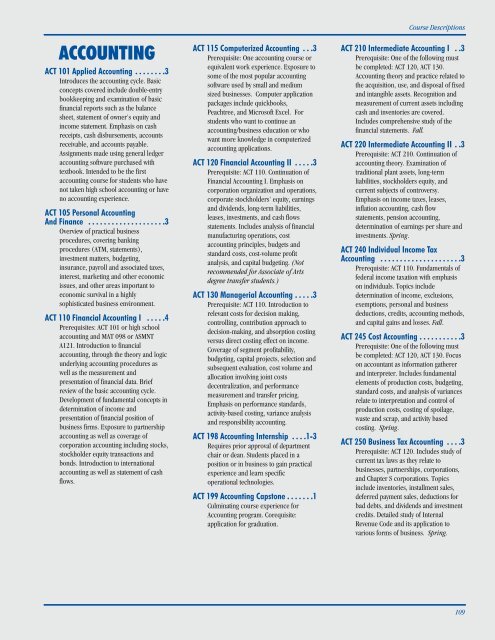

ACCOUNTINGACT 101 Applied Accounting . . . . . . . .3Introduces the accounting cycle. Basicconcepts covered include double-entrybookkeeping and examination of basicfinancial reports such as the balancesheet, statement of owner's equity andincome statement. Emphasis on cashreceipts, cash disbursements, accountsreceivable, and accounts payable.Assignments made using general ledgeraccounting software purchased withtextbook. Intended to be the firstaccounting course for students who havenot taken high school accounting or haveno accounting experience.ACT 105 Personal AccountingAnd Finance . . . . . . . . . . . . . . . . . . . .3Overview of practical businessprocedures, covering bankingprocedures (ATM, statements),investment matters, budgeting,insurance, payroll and associated taxes,interest, marketing and other economicissues, and other areas important toeconomic survival in a highlysophisticated business environment.ACT 110 Financial Accounting I . . . . .4Prerequisites: ACT 101 or high schoolaccounting and MAT 098 or ASMNTA121. Introduction to financialaccounting, through the theory and logicunderlying accounting procedures aswell as the measurement andpresentation of financial data. Briefreview of the basic accounting cycle.Development of fundamental concepts indetermination of income andpresentation of financial position ofbusiness firms. Exposure to partnershipaccounting as well as coverage ofcorporation accounting including stocks,stockholder equity transactions andbonds. Introduction to internationalaccounting as well as statement of cashflows.ACT 115 Computerized Accounting . . .3Prerequisite: One accounting course orequivalent work experience. Exposure tosome of the most popular accountingsoftware used by small and mediumsized businesses. Computer applicationpackages include quickbooks,Peachtree, and Microsoft Excel. Forstudents who want to continue anaccounting/business education or whowant more knowledge in computerizedaccounting applications.ACT 120 Financial Accounting II . . . . .3Prerequisite: ACT 110. Continuation ofFinancial Accounting I. Emphasis oncorporation organization and operations,corporate stockholders' equity, earningsand dividends, long-term liabilities,leases, investments, and cash flowsstatements. Includes analysis of financialmanufacturing operations, costaccounting principles, budgets andstandard costs, cost-volume profitanalysis, and capital budgeting. (Notrecommended for Associate of Artsdegree transfer students.)ACT 130 Managerial Accounting . . . . .3Prerequisite: ACT 110. Introduction torelevant costs for decision making,controlling, contribution approach todecision-making, and absorption costingversus direct costing effect on income.Coverage of segment profitability,budgeting, capital projects, selection andsubsequent evaluation, cost volume andallocation involving joint costsdecentralization, and performancemeasurement and transfer pricing.Emphasis on performance standards,activity-based costing, variance analysisand responsibility accounting.ACT 198 Accounting Internship . . . .1-3Requires prior approval of departmentchair or dean. <strong>St</strong>udents placed in aposition or in business to gain practicalexperience and learn specificoperational technologies.ACT 199 Accounting Capstone . . . . . . .1Culminating course experience forAccounting program. Corequisite:application for graduation.Course DescriptionsACT 210 Intermediate Accounting I . .3Prerequisite: One of the following mustbe completed: ACT 120, ACT 130.Accounting theory and practice related tothe acquisition, use, and disposal of fixedand intangible assets. Recognition andmeasurement of current assets includingcash and inventories are covered.Includes comprehensive study of thefinancial statements. Fall.ACT 220 Intermediate Accounting II . .3Prerequisite: ACT 210. Continuation ofaccounting theory. Examination oftraditional plant assets, long-termliabilities, stockholders equity, andcurrent subjects of controversy.Emphasis on income taxes, leases,inflation accounting, cash flowstatements, pension accounting,determination of earnings per share andinvestments. Spring.ACT 240 Individual Income TaxAccounting . . . . . . . . . . . . . . . . . . . . .3Prerequisite: ACT 110. Fundamentals offederal income taxation with emphasison individuals. Topics includedetermination of income, exclusions,exemptions, personal and businessdeductions, credits, accounting methods,and capital gains and losses. Fall.ACT 245 Cost Accounting . . . . . . . . . . .3Prerequisite: One of the following mustbe completed: ACT 120, ACT 130. Focuson accountant as information gathererand interpreter. Includes fundamentalelements of production costs, budgeting,standard costs, and analysis of variancesrelate to interpretation and control ofproduction costs, costing of spoilage,waste and scrap, and activity basedcosting. Spring.ACT 250 Business Tax Accounting . . . .3Prerequisite: ACT 120. Includes study ofcurrent tax laws as they relate tobusinesses, partnerships, corporations,and Chapter S corporations. Topicsinclude inventories, installment sales,deferred payment sales, deductions forbad debts, and dividends and investmentcredits. Detailed study of InternalRevenue Code and its application tovarious forms of business. Spring.109