September 2011.cdr - Punjab National Bank Institute of Information ...

September 2011.cdr - Punjab National Bank Institute of Information ...

September 2011.cdr - Punjab National Bank Institute of Information ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

wiatkc uS'kuy cSadlpuk izkS|ksfxdh laLFkkufoHkwfr [k.M] xkserh uxj] y[kumG & 226 010 ¼;w-ih-½-----cSafdax] foÙk ,oa chek {ks= esa lwpuk izkS|ksfxdh dk vxz.kh laLFkkupunjab national bankinstitute <strong>of</strong> information technologyVibhuti Khand, Gomti Nagar, Lucknow- 226 010 (U.P.)..... a premier institute <strong>of</strong> information technology in the area <strong>of</strong> banking, finance & insurancevol. VII no. 2 special edition april-september-2011ISSN 2249 –1996e-trackbusiness <strong>of</strong> future

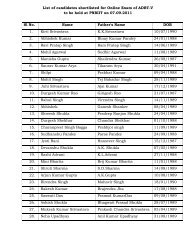

e-trackFROM THE DIRECTOR'S DESK<strong>Bank</strong>ing sector has undergone a sea change in the last two decades.These years have witnessed deregulation, liberalization and evolution <strong>of</strong>Core <strong>Bank</strong>ing Solutions. The <strong>Bank</strong>ing system has absorbed <strong>Information</strong>Technology fast and deep thus facilitating real time solutions, spectrum <strong>of</strong>customized products, handling <strong>of</strong> very large volumes <strong>of</strong> sensitivefinancial transactions, and managing critical financial data. This hascreated a need for qualified personnel not only for operations but also tomanage critical installations like Data Centers, Network Centers and Security Operation Centreetc as well as for developing and upgrading products and services. As a consequence, banks arefaced with the twin challenges <strong>of</strong> upgrading the skills <strong>of</strong> employees from being pure bankers totechno- bankers and scouting for next generation <strong>of</strong> bankers possessing technical skillsinherently.In line with vision <strong>of</strong> the bank, <strong>Punjab</strong> <strong>National</strong> <strong>Bank</strong> <strong>Institute</strong> <strong>of</strong> <strong>Information</strong> Technology,Lucknow initiated a Six months, Advanced Diploma in <strong>Bank</strong>ing Technology (ADBT)programme that prepares fresh B Tech & MCA pass outs to be employable as next generationbankers. Inputs include <strong>Bank</strong>ing & Financial System, Credit Appraisal, Financial Analysis,Project Evaluation, Legal Aspects, various Products & Services, Core <strong>Bank</strong>ing Operations, andAdvanced Concepts <strong>of</strong> Operating Systems such as Linux, Data Based Management System(Oracle-10 g), Network Management and S<strong>of</strong>t Skills etc for all round development. Theprogram is conducted through a mix <strong>of</strong> classroom instructions, hands on exercises, tutorial andassignments, case studies, interaction with Industry experts and project work/ internship. Thecourse equips the students to be ready to deliver from day one to prospective employers i.e.banks and BFSI sectors.B. K. Mahindroo(Director)3april-september 2011

e-trackCREDIT DEFAULT SWAPS: LENDER'S BOON- Pankaj K Agarwal , Neeraj AgarwalRecent move by RBI seeking out the opinion<strong>of</strong> select bankers on introduction <strong>of</strong> Credit DefaultSwaps in India has raised many eyebrows. Moreinfamous than understood, this instrument has beenblamed for exacerbating the global financial crisisby abetting downfall <strong>of</strong> giants like AIG. In spite <strong>of</strong>this the RBI move is being seen as an attempt to putlife into moribund secondary market for corporatebonds. Since the CDS evolved as a credit derivativeinstruments lot <strong>of</strong> action has been seen in otheremerging markets. South Korea and Brazil havebeen among the most actively traded countries withVenezuela trailing not far behind.In the developed world, the rapid growth <strong>of</strong>credit default swaps market led to a fundamentalchange in the trading pattern in the marketsespecially the Eurobond markets. Investors becamemore comfortable with CDS after a number <strong>of</strong>prominent corporate defaults in 2001 and 2002proved utility <strong>of</strong> these new credit derivativestructures. Since the CDS allowed investors to takelong and short positions in individual issuers, anumber <strong>of</strong> new players, mainly credit hedge funds,have taken advantage <strong>of</strong> this. It resulted into rapidshifts in buying and selling pressure and volatility <strong>of</strong>credit spreads.CDS is akin to insurance on the price loss <strong>of</strong> aninvestment due to default. In a CDS <strong>of</strong> a given credit,counterparty A pays counterparty B a periodicpayment (CDS spread) which can be thought <strong>of</strong> as aninsurance premium. In exchange party B agrees topay par for one <strong>of</strong> the issuer’s eligible bonds should adefault occur. It is similar to making a claim oninsurance policy. These counterparties are generallyreferred to as “protectionbuyer” (who pays the premium)and “protection seller” (whomakes the contingent defaultpayment or buys the eligiblebond for par in the event <strong>of</strong>default). The CDS contractsspecify what credit events are considered default, forpurposes <strong>of</strong> making the contingent claim, and whatassets aredeliverables for par.The documentation used is from InternationalSwap and Derivatives Association (ISDA).The mechanics <strong>of</strong> Credit Default Swap can beshown here:Between trade initiation and default ormaturity, protection buyer makes regular payment <strong>of</strong>default swap spread to protection seller.Following the credit event one <strong>of</strong> the following willtake place:Cash settlementPhysical SettlementThe mechanics <strong>of</strong> a CDS can be understoodwith the diagram. The protection in a CDS contractlasts until some specified maturity date. To pay forthis protection, the protection buyer makes regularpayments to the protection seller on what is knownapril-september 20114

e-trackas premium leg. These payments last until a creditevent occurs or maturity date, whichever is earlier,and are quoted in term <strong>of</strong> an annual CDS spread. Theactual payment amounts on the premium leg areadjusted for the frequency, usually quarterly, using abasis convention that is usually actual/360.If a credit event occurs before the maturitydate <strong>of</strong> the contract, there is a payment by theprotection seller to the protection buyer. This leg iscalled protection leg. This payment equals thedifference in value between par and the price <strong>of</strong>cheapest deliverable asset <strong>of</strong> the reference entitycalculated on the face value <strong>of</strong> the protection. Ittherefore compensates the protection buyer for theloss associated with holding the same face value <strong>of</strong>an asset <strong>of</strong> the same reference entity. The protectionbuyer also typically will pay the portion <strong>of</strong> premiumthat has accrued since the previous payment date andthe time <strong>of</strong> credit event. The credit events covered byCDS frequently, as per ISDA and prevailingpractices include bankruptcy (Corporate becominginsolvent or unable to pay its debts), Failure to Pay(Failure <strong>of</strong> reference entity to make due payments,allowing for some grace period), Restructuring(Changes in the debt obligations <strong>of</strong> the referencecreditor but excluding those associated with creditdeterioration), Obligation acceleration orRepudiation or Moratorium.Following the credit event, there are two waysto settle the payment <strong>of</strong> the protection leg, the choicebeing made at the initiation <strong>of</strong> the contract. They arephysical settlement and cash settlement. Of the twophysical settlements is most widely used procedure.It warrants the protection buyer to deliver thenotional amount <strong>of</strong> deliverable obligations <strong>of</strong> thereference entity to the protection seller in return forthe notional amount paid in cash. In general there is achoice <strong>of</strong> deliverable obligations from which theprotection buyer can choose that satisfy a number <strong>of</strong>characteristics. They include restrictions o thematurity and the requirement that they be pari passumostCDS are linked to senior unsecured debt.Especially in case <strong>of</strong> restructuring event, theprotection buyer may take advantage <strong>of</strong> thissituation by buying and delivering the cheapestasset.Cash settlement is not a standard settlementmethod in CDS; it is a preferred alternative in defaultbaskets and synthetics Credit Default Obligations.In cash settlement, a cash payment is made by theprotection seller to the protection buyer equal to parminus the recovery price <strong>of</strong> the cheapest-to-deliverreference asset. The recovery rate is calculated byreferencing dealer quotes or observable marketprices over some period after the credit event hasoccurred. Economically speaking, this should havethe same value as physical settlement.Credit event, there are two ways to settle thepayment <strong>of</strong> the protection leg, the choice being madeat the initiation <strong>of</strong> the contract. They are physicalsettlement and cash settlement. Of the two physicalsettlements is most widely used procedure. Itwarrants the protection buyer to deliver the notionalamount <strong>of</strong> deliverable obligations <strong>of</strong> the referenceentity to the protection seller in return for thenotional amount paid in cash. In general there is achoice <strong>of</strong> deliverable obligations from which theprotection buyer can choose that satisfy a number <strong>of</strong>characteristics. They include restrictions o thematurity and the requirement that they be pari passu-5april-september 2011

e-trackmost CDS are linked to senior unsecured debt.Especially in case <strong>of</strong> restructuring event, theprotection buyer may take advantage <strong>of</strong> thissituation by buying and delivering the cheapestasset.Cash settlement is not a standard settlementmethod in CDS; it is a preferred alternative in defaultbaskets and synthetics Credit Default Obligations.In cash settlement, a cash payment is made by theprotection seller to the protection buyer equal to parminus the recovery price <strong>of</strong> the cheapest-to-deliverreference asset. The recovery rate is calculated byreferencing dealer quotes or observable marketprices over some period after the credit event hasoccurred. Economically speaking, this should havethe same value as physical settlement.Globally the CDS has revolutionized thecredit markets by making it easy to short credit. Itcan be very useful for those wishing to hedge currentcredit exposures or those wishing to take a bearishcredit view. Since CDS are unfunded, there is apossibility <strong>of</strong> leverage. It may be used for locking inan interest rate liability if huge funding costs arepresent. The most attractive feature <strong>of</strong> CDS is therecustomizability in terms <strong>of</strong> maturity, seniority andcurrency. Also, just as a bond can be sold to realize again or loss owing to spread movements, a CDScontract may be unwound in order to realize somemark-to-market gain or loss owing to changes inCDS spread. It has been seen that liquidity in CDSmarket has been traditionally better than cashmarket.CDS are used to hedge existing creditexposures in the portfolio and to create newexposures that could not be created otherwise, forexample, taking a short position to express anegative view. A conventional corporate “cash”instrument, for example, a regular corporate bondbundles together exposures to interest rates, swapspread, credit spread and may be currency risk also.CDS allow investors to pick from this bundle <strong>of</strong>exposures only the desired ones.It may be hoped itwill contribute to the development <strong>of</strong> a healthycorporate bond market in India.Author is Dean, Jhunjhunwala Business School,Faizabad, Co -Author is a Finance Pr<strong>of</strong>essionalThe mechanic and the surgeon story (perceptions, the devil is in the detail, the nature <strong>of</strong> bigdifferences)A heart surgeon took his car to his local garage for a regular service, where he usually exchangeda little friendly banter with the owner, a skilled but not especially wealthy mechanic."So tell me," says the mechanic, "I've been wondering about what we both do for a living, andhow much more you get paid than me..""Yes?.." says the surgeon."Well look at this," says the mechanic, as he worked on a big complicated engine, "I check howit's running, open it up, fix the valves, and put it all back together so it works good as new.. We basicallydo the same job don't we? And yet you are paid ten times what I am - how do you explain that?"The surgeon thought for a moment, and smiling gently, replied,"Try it with the engine running.."april-september 2011 6

e-trackDATA VIRTUALIZATION- Parul VermaINTRODUCTIONThe application infrastructure in mostbusinesses has grown organically. There are someorganizations that have adopted approaches <strong>of</strong>enterprise architecture that attempt to impose ahigh? level structure over both the businessapplications and their underlying data systems.Storage solutions, as a space in the IT industry hasalways generated enough interest in themanufacturing as well as in the trading space.There has been a radical change in the wayenterprises look at storage related issues. They havestarted to look at storage as a key component <strong>of</strong> theiroverall IT infrastructure and new storagetechnologies are in the wish list <strong>of</strong> a severalorganizations to reduce their operational cost, whileachieving better utilization rates."Storage virtualization-related investmentshave gained momentum among large and medium-sized enterprises.”Data storage virtualization is the process <strong>of</strong>abstracting, transforming, federating and deliveringdata contained within a variety <strong>of</strong> informationsources so that they may be accessed by consumingapplication or users when requested without regardto their physical storage or heterogeneous structure.This concept and s<strong>of</strong>tware is commonly used withindata integration, business intelligence, service-oriented architecture data services, cloudcomputing, enterprise search and master datamanagement.Data virtualizationleads to improved datarequirement analysis, metadatam a n a g e m e n t , a n d d a t astandards. With the boom inusage <strong>of</strong> latest IT trends in theenterprises they are forced toimprove their data governance practices. Datavirtualization has the potential to revolutionize ways<strong>of</strong> data quality assurance and improvement.Data Quality challenges in an Enterprise WorldThe “enterprise world” is in need <strong>of</strong> updatedand widely varied information with multiple datasets through repeated copying and replication. Theinconsistency in reporting leads to an ongoing needfor reconciliation <strong>of</strong> generated reports and analyses.Variance in use <strong>of</strong> commonlyaccepted referencedata concepts leads to inconsistencies andinaccuracies as well. Following are the challengesthat data quality has to face-1. Structural and Semantic inconsistency:Differences in formats, structures, andsemantics presumed by downstream dataconsumers may confuse conclusions drawnfrom similar analyses;2. Inconsistent validations: Data validation isinconsistently applied at various points in thebusiness processes, with variant impactsdownstream;7april-september 2011

e-track3. Replicated functionality: Repeatedly the representations; by incorporating our dataapplying the same (or similar) data cleansing quality techniques directly into these layers <strong>of</strong>and identity resolution applications to data abstraction we can also address most <strong>of</strong> our datamultiple times increases costs but does not quality challenges as well. Embedding data qualityensure consistency;management as part <strong>of</strong> data virtualization integrates4. Data entropy: Multiple copies <strong>of</strong> the samedata management best practices directly into thedata lead to more data silos in which theapplication infrastructure, and identifies data issuesquality <strong>of</strong> the data continues to degrade,early in the information production process, andespecially when levels <strong>of</strong> service forenables cleansing or other remediation processes toconsistency and synchronization are notbe performed before material impacts can bedefined or not met.incurred.How Data Virtualization worksCopying primary data sources into multiplesecondary repositories in preparation for reuse isactually a root cause <strong>of</strong> a number <strong>of</strong> data qualityissues. If so, then eliminating that root cause bychanging the approach to sharing data shouldalleviate many <strong>of</strong> those issues! An alternativeapproach to data sharing is data virtualization,which allows the data to remain in its primary datasource until required for specific downstream needs.Data virtualization provides layers <strong>of</strong>abstraction between the consuming applications andthe primary data sources, and these abstractionlayers present data taken from its original structuresusing canonical representations that simplify datareuse while enabling common data services to meetdownstream consumer performance and data qualityexpectations. From a business applicationperspective, the abstraction provided throughvirtualization reduces complexity by standardizingConclusionStorage virtualization has been the keydrivers for the demand in the various enterprisesegments. Virtualization removes the incumbenciesin storage and optimizes the data sharing scenario. Italso helps in securing optimal returns and reducesthe operational costs by managing data acrossengines. With load balancer and shared data acrossworkstations, virtualization helps in efficient datasharing.Author is Sr. Lecturer,Amity School <strong>of</strong> <strong>Information</strong> Technologyapril-september 2011 8

e-trackEVOLUTION AND GROWTH OF ELECTRONIC (E-PAYMENTS) IN INDIA-Bipin K S DeokarIn the last two decades, technology has played a significant role in improvingefficiency <strong>of</strong> the financial system. <strong>Information</strong> Technology (IT) and the CommunicationNetworking Systems (CNS) have revolutionalised the functioning <strong>of</strong> entire <strong>Bank</strong>ing,Financial Services and Insurance (BFSI) industries world over.In the wake <strong>of</strong> adopting IT and CNS-based banking solutions, the traditionalbanking has undergone a major transformation which has vastly changed the bankinglandscape <strong>of</strong> India. Of late, the rapid implementation <strong>of</strong> technology-based solutionsundertaken by the commercial banks has facilitated them:(i) to provide a fairly exhaustive range <strong>of</strong> products to customers;(ii) to extend the banking facilities to the vast majority <strong>of</strong> population by expanding the banking outreach,especially in the rural areas;(iii) to <strong>of</strong>fer speedier and efficient payments;(iv) to reduce the transaction cost and(v) to reduce the reliance on paper-based transactionsRBI's Initiative for e-PaymentsIn the early 1990s, the payment systems in India were mostly based on paper, with currency and chequesbeing the dominant form <strong>of</strong> payment for both retail and wholesale transactions. The electronic era in thebanking sector began in the mid 1990s when the RBI developed technology-based payment and settlementsystems. Since then, the RBI has taken several initiatives to develop and promote e-payments infrastructure;as a result, there has been a phenomenal change in the architecture and technology <strong>of</strong> payment systems inIndia.Table 1: Various E-Payment Systems Launched by RBIYearSystems Introduced1995March 2004November 2005February 2008<strong>September</strong> 2008Source: RBI (2008), Bulletin, <strong>September</strong>.Electronic Clearing Service (ECS) & theElectronic Funds Transfer (EFT) SystemReal Time Gross Settlement (RTGS) System<strong>National</strong> Electronic Funds Transfer (NEFT) SystemCheque Truncation System (CTS)<strong>National</strong> Electronic Clearing Service (NECS)9april-september 2011

e-track<strong>Bank</strong>s' Initiative for ComputerisationTechnology-based banking has shown significant improvement since the initiation <strong>of</strong> financialsector reforms in the 1990s which has facilitated speedier computerisation in the banking sector in India.Essentially, the arrival <strong>of</strong> new private and foreign banks in the mid-1990s with their superior state-<strong>of</strong>-the-arttechnology-based services for competitive advantage pushed the existing banks in India to follow suit bygoing in for the latest technologies so as to compete and retain their customer base. During 1995 to 2000,almost all commercial banks, including public sector banks, old private sector banks, Regional Rural <strong>Bank</strong>sand co-operative banks initiated efforts to adopt technology-based services and simultaneously implementan IT platform to reduce the overall operating costs and to provide new electronic information-basedservices like internet banking, on-line banking, smart cards and ATMs with the mainstream bankingtechnology.Growth <strong>of</strong> e-PaymentsIn recent years, the banking sector has made a quantum leap forward in terms <strong>of</strong> switching over frompaper-based transactions, which include use <strong>of</strong> currency notes, cheques or challans, to electronic means,which include RTGS, NEFT and other electronic modes. In order to promote e-payments system, the RBIhas intervened and mandated reasonability in pricing <strong>of</strong> transactions effected through electronic mode fortransactions above a specified threshold.The augmentation is more pronounced in terms <strong>of</strong> value than volume, reflecting the impact <strong>of</strong>shifting <strong>of</strong> high value transactions to the electronic mode. The share <strong>of</strong> electronic transactions in the totalvalue <strong>of</strong> transactions increased to a peak <strong>of</strong> 81.8% in 2008-09 from 30% in 2003-04 and in terms <strong>of</strong> volumealso, it has gradually increased to around 33% from 14% during the same period.YearTable 2: Paper-based and Electronic Tra nsactionsVolume (in thousands)Value (in Rs crore)ElectronicTotalShare <strong>of</strong>Electronic(%)PaperbasedPaperbasedElectronicTotalShare <strong>of</strong>Electronic(%)2004-05 1,166,848 230,016 1,396,864 16.5 1,04,58,895 1,09,09,497 2,13,68,392 51.12005-06 1,286,758 287,421 1,574,179 18.3 1,13,29,134 1,94,86,152 3,08,15,286 63.22006-07 1,367,280 383,358 1,750,638 21.9 1,20,42,426 3,03,17,963 4,23,60,389 71.62007-08 1,460,564 542,123 2,002,687 27.1 1,33,96,066 4,66,89,754 6,00,85,820 77.72008-09 1,395,906 682,299 2,078,205 32.8 1,24,61,202 5,59,72,211 6,84,33,413 81.8Source: RBI, Report on Trend and Progress <strong>of</strong> <strong>Bank</strong>ing in India 2008 -09 and earlier issues.april-september 2011 10

RTGS Systeme-trackThe RTGS system is one <strong>of</strong> the important e-payment channels. The system enables settlement <strong>of</strong>transactions in real- time, on a gross basis and is a fully secured funds transfer system. It was operationalisedin March 2004 for facilitating faster settlement <strong>of</strong> high value transactions and has stabilised with increasedbranch network (66,178 branches). RTGS transactions, both in terms <strong>of</strong> volume and value, have increasedsharply in a short span <strong>of</strong> its operations. Thus, the RBI has doubled the threshold limit for electronic fundtransfers using the RTGS system to Rs 2 lakh with effect from November 15, 2010.Retail Electronic Funds TransferThe retail e-funds transfer system comprises Electronic Clearing Services (ECS), Electronic FundsTransfer (EFT) and <strong>National</strong> Electronic Funds Transfer (NEFT) systems. The ECS system, NEFT, cardbasedpayment system (credit & debit) are becoming increasing popular as indicated by the increase intransactions through retail e-payment methods. During 2007-08, the volume <strong>of</strong> aggregate retail electronictransactions increased by 41.4% as compared with 32.9% in the previous year.1. ECSECS has two variants, (i) ECS Credit Clearing and (ii) ECS Debit Clearing. The credit clearingoperates on the principle <strong>of</strong> 'single debit- multiple credits' and is used for making payment <strong>of</strong> salary, pension,dividend and interests. While the Debit Clearing functions on the principle <strong>of</strong> 'single credit- multiple debits'and is used for collecting payments by utility service providers like electricity, telephone bills as well bybanks for receiving principal/interest repayments for housing and personal loans from the borrowers. Atpresent, about 18 million transactions flow through the ECS system every month across 70 centres and thesettlement takes place on T+1 basis.YearsTable 3: Transactions through Retail Electronic PaymentTransaction Volume (’000)ECS EFT/NEFT Card Payment Total PercentageCredit Debit Credit Debit Variation2004-05 40051 15300 2549 129472 41532 2289042005-06 44216 35958 3067 156086 45686 285013 24.52006-07 69019 75202 4776 169536 60177 378710 32.92007-08 78365 127120 13315 228203 88306 535309 41.42008-09 88394 160055 32161 259561 127654 667825 24.82009-10 98550 150214 66357 234209 170170 719500 7.7Transaction Values ( Rs. Crore)2004-05 20180 2921 54601 25686 5361 1087492005-06 32324 12986 61288 33886 5897 146381 34.62006-07 83273 25441 77446 41361 8172 235693 61.02007-08 782222 48937 140326 57984 12521 1041990 342.12008-09 97487 66976 251956 65356 18547 500322 -52.02009-10 117833 69819 411088 62950 26566 688256 37.6Source: RBI, Report on Trend and Progress <strong>of</strong> <strong>Bank</strong>ing in India 2008 -09 and earlier issues.11april-september 2011

e-trackThe ECS (credit) volumes increased by 13.5% in 2007-08 while the value increased by more than eighttimes on account <strong>of</strong> refunding the over subscription amount <strong>of</strong> IPOs floated by companies. Similarly, thevolumes under ECS (debit) which is mostly used for payment <strong>of</strong> utility bills and regular premium, increasedby 69% in 2007-08 and by 92.4% in value terms.1. EFT SystemThe EFT, which was operationalised in 1995, enabled an account holder <strong>of</strong> a bank to electronicallytransfer funds to another account holder with any other participating bank.2. NEFT SystemNEFT is a more secured which uses the SFMS messaging format with public key infrastructure (PKI)enabled digital signatures having a nation-wide network to facilitate funds transfer by the bank customers,between the networked bank branches in the country. <strong>Bank</strong>s have been increasingly using the NEFT systemfor ensuring wider reach for electronic funds movement. The daily average <strong>of</strong> the transactions is over 80,000by volume and over Rs 500 crore by value.Table 4: Transactions through EFT/NEFTYearsVolume Growth in Volume ValueGrowth in Value(000’s)(%)(Rs Crore)(%)2004-05 2549 546012005-06 3067 20.3 61288 12.22006-07 4776 55.7 77446 26.42007-08 13315 178.8 140326 81.22008-09 32161 141.5 251956 79.62009-10 66357 106.3 411088 63.2Source: RBI, Report on Trend and Progress <strong>of</strong> <strong>Bank</strong>ing in In dia 2008-09 and earlier issues.4. CTS Payment SystemThis is the latest e-payment product introduced by the RBI. The main objective <strong>of</strong> the CTS is toimprove the efficiency and to reduce the cheque processing time. The traditional clearing system requires thephysical presentation <strong>of</strong> cheques in the clearing house for payment and settlement while in CTS, theelectronic image <strong>of</strong> the cheque is sent to the clearing house.5. Transactions using CardsThe use <strong>of</strong> cards for making retail payments is one <strong>of</strong> the preferred modes in recent years. Theacceptability and convenience <strong>of</strong> this mode <strong>of</strong> payment are reflected in the increased volume <strong>of</strong> transactionsthrough cards (debit & credit) (Table 3).6. NECS SystemThis is the centralised processing <strong>of</strong> the ECS transactions. The system facilitates end-to-end seamlessposting <strong>of</strong> the NECS transactions in a straight-through processing (STP) environment.april-september 2011 12

e-trackNew Medium <strong>of</strong> <strong>Bank</strong>ingOf late, the commercial banks have moved astep ahead by launching internet banking andmobile banking.(1) Internet <strong>Bank</strong>ing:Currently, banks are providing a host <strong>of</strong>services via internet banking like,(a) utility bill payments and regularperiodical payment;(b) funds transfer across banks; and(c) integration with e-commercetransactions such as booking <strong>of</strong>tickets for air and railways.(2) Mobile <strong>Bank</strong>ing:With the rapid growth in the number <strong>of</strong>cellular subscribers in India, the banks areexploring the feasibility <strong>of</strong> using cell phones as analternative channel <strong>of</strong> delivery <strong>of</strong> bankingservices. Recently, the RBI has formulated the'Draft Operating Guidelines for Mobile Paymentsin India' through a consultative process.(3) Satellite <strong>Bank</strong>ing:A Technical Group constituted by the RBIhas since examined the proposal andrecommended the use <strong>of</strong> satellite connectivity as itwould facilitate integration <strong>of</strong> the rural branches<strong>of</strong> the banks and help them to provide efficientfunds-transfer facility to their customers.Setting up <strong>of</strong> <strong>National</strong> Payments Corporation<strong>of</strong> India (NPCI)In the Vision Document 2005-08, RBIenvisaged the setting up <strong>of</strong> an institution at thenational level to own and operate all retailpayment systems in the country. Accordingly, theIndian <strong>Bank</strong>s' Association set up a working groupwhich examined this issue and suggested themodalities for setting up an organisation to beknown as NPCI. Accordingly, it was incorporatedin December 2008 and the certificate <strong>of</strong>commencement <strong>of</strong> business was issued in April 2009.Challenges AheadIt is generally noted that the spread and reach <strong>of</strong>the e-payment services are <strong>of</strong>ten confined to certainsections <strong>of</strong> the society. Thus, there is need to focus onexpanding the geographical reach <strong>of</strong> the e-paymentservices as it is difficult to achieve financial inclusionwithout encompassing rural-India in the paymentsystem out-reach.Another area <strong>of</strong> concern for the RBI is the regulation<strong>of</strong> issuance <strong>of</strong> e-money. Besides, there are emergingchallenges the banks have to address including thosearising from large-scale IT deployment. These includethe impact <strong>of</strong> more scientific risk management,ensuring effective anti-money laundering measuresand the security concerns relating to implementation<strong>of</strong> IT in banks. Another major requirement relates todisaster recovery management and the fail-safebusiness continuity plans.ReferencesRBI, Report on Trend and Progress <strong>of</strong> <strong>Bank</strong>ingin India 2009-10 and earlier issues.RBI, Annual Report 2009-10 and earlier issues.RBI, Bulletin, <strong>September</strong> 2008 and May 2009.Reddy, Y V (2006): 'Use <strong>of</strong> Technology in thefinancial sector: Significance <strong>of</strong> concertedefforts', at the function at the IDRBT,Hyderabad on <strong>September</strong> 2.Leeladhar, V (2006): 'Payment and SettlementSystems: Select Issues', at the RegionalPayment Systems Workshop organised jointlyby the RBI & the BIS, Hyderabad on October20.<strong>Bank</strong>net India's 3rd Conference on PaymentSystems in <strong>Bank</strong>s, at Mumbai on January 10,2007.Author is Research Officer,EPW Research Foundation, Mumbai13april-september 2011

e-trackCash management is one <strong>of</strong> the important m e e t u n p r e d i c t a b l e o rareas <strong>of</strong> working capital management. Although unexpected cash needs.being the most liquid current asset, cash is the Precautionary balances are thecommon denominator to which all current assets can cash balances held in reserve forbe reduced as the other major liquid assets, like random and unforeseenreceivables and inventory ultimately get converted fluctuations like (1) floods,into cash. This emphasizes the significance <strong>of</strong> cash. strikes and failure <strong>of</strong> importantcustomers (2) bills may be presented for settlementMotives for Holding CashWhen we talk about cash management theearlier than expected (3) unexpected slow down incollection <strong>of</strong> accounts receivableterm cash is used in two senses:(4) cancellation <strong>of</strong> order <strong>of</strong> goods when customer1.is not satisfied (5) sharp increase in cost <strong>of</strong> rawThe narrow view covers currency andmaterials.generally accepted equivalents <strong>of</strong> cash likecheques, drafts, and demand deposits inbanks.3. Speculative Motive-2. The broadview <strong>of</strong> cash includes near-cash It is the desire <strong>of</strong> a firm to take advantage <strong>of</strong>assets, such as marketable securities and time temporary opportunities which present themselvesdeposits in banks. The main characteristic <strong>of</strong> at unexpected moments during the normal course <strong>of</strong>these is that they can be readily sold and business. Speculative motive helps to takeconverted into cash. They serve as a reserve advantage <strong>of</strong>pool<strong>of</strong> liquidity which provides cash quickly Delay purchase <strong>of</strong> goods on the anticipation inwhen required. They also provide a short-term price decline,investment outlet for excess cash and are also Purchase at favorable prices,useful for meeting planned outflow <strong>of</strong> funds.Purchase goods at reduced price by payingBasically there are four motives for immediate cash,maintaining cash balances-To speculate on interest rate graph by buying1. Transaction Motivesecuritieswhen interest rates are expected todecline.It refers to the holding <strong>of</strong> cash to meet routinepayments which a firm carries on in the ordinarycourse <strong>of</strong> business.2. Precautionary Motive-MANAGEMENT OF CASH-AN OVERVIEWIt means to maintain a cushion or buffer to4. Compensating Motive-- Sadhana MisraIt refers to compensate banks for providingcertain services loans. <strong>Bank</strong>s provide differentservices to the business firms, like cheque clearance,supply <strong>of</strong> credit information, fund transfer, etc. Forapril-september 2011 14

some <strong>of</strong> these services banks charge fee orcommission and for others they seek indirectcompensation. The clients are usually required toe-trackFactors Determining Cash NeedsThe primary factors determining the cashneeds aremaintaina minimum balance <strong>of</strong> cash at the bank 1. Synchronization <strong>of</strong> Cash Flows- Inwhich can not be utilized for transaction purposes. determining the cash need the extent <strong>of</strong> non-The banks themselves can use this balance to earn a synchronization <strong>of</strong> cash receipts andreturn thus it is called as compensation balance.disbursements is taken into consideration asthe need <strong>of</strong> maintaining cash balances arisesfrom the non-synchronization <strong>of</strong> the inflowsand outflows <strong>of</strong> cash. If the receipts andObjectives <strong>of</strong> Cash ManagementThe two fold objectives <strong>of</strong> management are-1. Meeting The Payment Schedule- The basicobjective <strong>of</strong> cash management is to havesufficient cash to meet the disbursement needs<strong>of</strong> a firm. The advantage <strong>of</strong> adequate cash are(a) it prevents bankruptcy arising out <strong>of</strong>inability <strong>of</strong> a firm to meet its obligations, (2)the relationship with the bank is not strained,(3) it helps in fostering good relations withtrade creditors and suppliers <strong>of</strong> raw materials,(4) a cash discount can be availed <strong>of</strong> ifpayment is made within the due date.2. Minimum Funds Committed to CashBalances- Another basic objective <strong>of</strong> cashmanagement is to minimize cash balances. Indoing so two conflicting aspects have to bereconciled (1) a high level <strong>of</strong> cash balance willensure prompt payment together with all theadvantages. But it also means that a large fundwill remain idle, because cash is a non-earningasset and the firm will have to forego pr<strong>of</strong>its,(2) a low level <strong>of</strong> cash balances, may implypayments <strong>of</strong> cash perfectly balance each otherthe need <strong>of</strong> cash balances would never arise.2. Short Costs- The expenses incurred as a result<strong>of</strong> shortfall are called as short cost. The cashforecast presented in the cash budget showperiods <strong>of</strong> cash shortages. Every shortage <strong>of</strong>cash, expected or unexpected, involves a costwhich depends upon the severity, duration andfrequency <strong>of</strong> the shortfall and how theshortage is covered. The short costs includestransaction costs, borrowing costs, loss <strong>of</strong>cash discount, cost associated withdeterioration <strong>of</strong> the credit rating and penaltyrates.3. Excess Cash Balance Cost- It is the cost <strong>of</strong>having excessively large cash balances. Whenever large funds in a firm are idle, it indicatesthat the opportunity to invest those funds islost along with the interest which couldotherwise be earned on it. This loss <strong>of</strong> interestis primarily the excess cost.failure to meet the payment schedule. Thus the 4. Procurement and Management- These areaim <strong>of</strong> cash management should be to have anoptimal amount <strong>of</strong> cash balances.the costs associated with establishing andoperating cash management, staff andactivities. They are generally fixed and are15april-september 2011

e-trackmainly accounted for by salary <strong>of</strong> theconcerned staff, shortage, handling <strong>of</strong>position <strong>of</strong> a firm. Cash budget usually has threepartssecuritiesand so on. These are administrative (a) Cash Collection,cost incurred for management <strong>of</strong> cash. (b) Cash Payments,5. Uncertainty and Cash Management- It is (c) Cash Balances.seen that uncertainty and cash managementare related to each other because cash flow cannot be predicted with complete accuracy. TheEfficient cash management processes are precostincurred is keeping idle cash to take care<strong>of</strong> irregular cash collections, customer'sdefault etc. This can be reduced throughimprovement forecasting <strong>of</strong> cash paymentsand through ability to borrow through bankoverdraft.Cash Management Strategies-The basic cash management strategiesintended to minimize the operating cash balancerequirement are1. Stretching accounts payable without affectingthe credit <strong>of</strong> the firm,Conclusionrequisites to execute payments, collects receivablesand manage liquidity, managing the channels <strong>of</strong>collections, payments and accounting informationefficiently becomes imperative with growth inbusiness transaction volumes. <strong>Bank</strong>s areincreasingly becoming innovative and anticipatingthe needs <strong>of</strong> corporates towards standardization,ERP integration, reconciliation, real-time reporting,providing an end to end view <strong>of</strong> cash managementvalue chain besides <strong>of</strong>fering the ability to reach andbe reached by their own customers.References:2. Efficient inventory management, 1. Financial Management-Text and Problems byrd3. Speedy collection <strong>of</strong> accounts receivable M.Y. Khan and P.K. Jain,3 ed., Delhi: Tatathrough decentralized collections. The McGraw Hill,1999.Pg 18.1decentralized network includes- 2. www.rh.edu(a) Concentration <strong>Bank</strong>ing, 3. www.hcltech.com(b) Lock-Box System. 4. www.articlesbook.comCash BudgetIt is probably the most important tool in cashmanagement as it helps to plan and control the use <strong>of</strong>cash. Cash budget <strong>of</strong> a period highlights the cashAuthor is Librarian,Navyug Kanya P.G. Collegeapril-september 2011 16

e-trackTHE DEEP WEB MINING- Archana SahaiThe Deep Web is a vastinformation repository notalways indexed by automatedsearch engines but readilyaccessible to enlightenedindividuals. The terms DeepWeb, Hidden Web, Invisible web and Deep Netdescribe the portion <strong>of</strong> the World Wide Web that isnot visible to the public or has not been indexed bythe search engines. Some portions <strong>of</strong> the deep webconsist <strong>of</strong> dynamic pages accessible only via a formor submitted query. Web pages that are not linked toother pages are also part <strong>of</strong> the deep web. They are,in effect, invisible; search engine crawlers will notbe able to find them since they have no backlinks orinbound links.Sites that require registration prior to accesscan also be considered part <strong>of</strong> the deep net. Thesesites block the search engine spiders from browsingand indexing their web pages through protocols suchas the Robots Exclusion Standard. Furthermore,pages created by Flash and JavaScript, scriptedcontent as well as non-text content or non-HTMLfile formats in Usenet archives such as PDF andDOC documents are indexed only by some searchengines. This makes them part <strong>of</strong> the Hidden Web.The Shallow Web, also known as the SurfaceWeb or Static Web, is a collection <strong>of</strong> Web sitesindexed by automated search engines. A searchengine bot or Web crawler follows URL links,indexes the content and then relays the results backto search engine central for consolidation and userquery. Ideally, the process eventually scours theentire Web, subject to vendor time and storageconstraints.The reason for its being deep is: Search enginestypically do not index the following types <strong>of</strong> WebsitesProprietary sitesSites requiring a registrationSites with scriptsDynamic sitesEphemeral sitesSites blocked by local webmastersSites blocked by search engine policySites with special formatsSearchable databasesProprietary sites require a fee. Registrationsites require a login or passwordMany Web sites act as front ends to searchabledatabases. Complete Planet, IncyWincy Spiderand The Librarians' Internet Index provide quicklinks for quality Web database searching. Thistechnique is called split-level searching. Enter thekey phrase "searchable database" into the above formore.You can find other subject searchabledatabases by entering the keyword phrase"subject_name database" into your favorite searchengine (e.g., "jazz database," "virus database").Anaive searcher typically enters a keyword into ageneral-purpose search engine, gets too many hitsand then expends time and energy sorting throughrelevant and irrelevant results. Alternatively, theyget no hits and wonder why. It is difficult to get allrelevant hits and no irrelevant hits. <strong>Information</strong>17april-september 2011

e-trackTechnology researchers call this the Law <strong>of</strong> Recalland Precision. A search engine's web crawler useshyperlinks to uncover and index content found onthe Web. This tactic is ineffective in a search <strong>of</strong> deepweb resources. For instance, search engine crawlersdo not look for dynamic web pages that result fromqueries <strong>of</strong> databases because there are may be a lot <strong>of</strong>possible results.These limitations are, however,being overcome by the new search engine crawlers(like Pipl, The most comprehensive people searchon the web) being designed today. These newcrawlers are designed to identify, interact andretrieve information from deep web resources andsearchable databases. Google, for example, hasdeveloped the mod OAI, OAI-PMH stands forOpen Archives Initiative Protocol for MetadataHarvesting. It was designed to simplify the process<strong>of</strong> gathering information (metadata) from digitalrepositories. With OAI-PMH, collecting metadataabout digital resources is efficient and flexible.These new developments will allow the web serversto automatically show the URLs that they can accessto search engines. Another solution that is beingdeveloped by several search engines like Alacra,Northern Light and Closer Look Search arespecialty search engines that focus only in particulartopics or subject areas. For e.g. Alacra deliversbusiness information-based solutions to more than400 global financial institutions, corporations andpr<strong>of</strong>essional services firms. This would allow thesearch engines to narrow their search and make amore in-depth search <strong>of</strong> the deep web by queryingpassword-protected and dynamic databases.Author is Sr. Lecturer, Amity <strong>Institute</strong> <strong>of</strong><strong>Information</strong> Technology, Lucknow CampusMany years ago in a small Indian Village, a farmer had the misfortune <strong>of</strong> owing a large sum <strong>of</strong> money to a villagemoneylender. The Moneylender, who was old and ugly, fancied the farmer's beautiful Daughter. So he proposed abargain.He said he would forgo the farmer's debt if he could marry his Daughter. Both the farmer and his daughter werehorrified by the Proposal. So the cunning money-lender suggested that they let Providence decide the matter. He toldthem that he would put a black Pebble and a white pebble into an empty money bag. Then the girl would have to pick onepebble from the bag.1) If she picked the black pebble, she would become his wife and her father's debt would be forgiven.2) If she picked the white pebble she need not marry him and her father's debt would still be forgiven.3) But if she refused to pick a pebble, her father would be thrown into Jail.They were standing on a pebble strewn path in the farmer's field. As they talked, the moneylender bent over to pickup two pebbles. As he picked them up, the sharp-eyed girl noticed that he had picked up two Black pebbles and put theminto the bag. He then asked the girl to pick a pebble from the bag.The girl can react in the following manners:1. The girl could refuse to take a pebble.2. The girl could show that there were two black pebbles in the bag and expose the money-lender as a cheat.3. The girl should pick a black pebble and sacrifice herself in order to save her father from his debt and imprisonment.Well, here is what she did....The girl put her hand into the moneybag and drew out a pebble. Without Looking at it, she fumbled and let it fall ontothe pebble-strewn path where it immediately became lost among all the other pebbles."Oh, how clumsy <strong>of</strong> me," she said. "But never mind, if you look into the Bag for the one that is left, you will be able totell which pebble I picked."Since the remaining pebble is black, it must be assumed that she had picked the white one. And since the moneylenderdared not admit his dishonesty, the girl changed what seemed an impossible situation into an extremelyadvantageous one.MORAL OF THE STORY: Most complex problems do have a solution. It is only that we don't Attempt to think.april-september 2011 18

e-trackNEWSIndian banks are now gearing up for the second Nokia Siemens Launches New Way to Deliverphase <strong>of</strong> IT upgradationBroadbandThe first phase <strong>of</strong> IT upgradation in banks waslargely on migration to a core banking system,which allowed for consolidation <strong>of</strong> banking services<strong>of</strong>fered across regions and channels. Indian banksare now gearing up for second wave <strong>of</strong> ITinvestment. Indian banks' IT expenditure isexpected to touch Rs 10,000 crore annually in 4-5years as they get ready for their second wave <strong>of</strong> ITinvestments mainly in automated data storage,compilation, upgradation and analysis, CRM etc.RBI's IT Vision 2011-17 also sets priorities forcommercial banks to move forward from their corebanking solutions to enhanced use <strong>of</strong> IT in areas likemanagement information systems, regulatoryreporting, overall risk management, financialinclusion and customer relationship management(Source:www.banknetindia.com)Google Inc. has opened up its Google Plus socialnetworkGoogle Inc. has openedup its Google Plus socialnetwork to everyone aftertesting it with a limitedaudience for 12 weeks.Google Plus is theonline search leader's attempt to compete withFacebook, by far the world's most populous onlinesocial network with more than 750 million users.Google also made Plus's "Hangouts" feature—which lets users video chat with multiple peopleat a time— available on smartphones with frontfacingcameras. The feature currently works withphones running Google's Android system. Googlesays support for Apple devices is coming soon. Anew service called "Hangouts On Air," meanwhile,lets users broadcast their videos online or view thesevideos as spectators.(Source: economictimes.indiatimes.com)Global telecom infrastructure firm Nokia SiemensNetworks launched a new way to deliver broadband- the "liquid net".The new method allows a networkoperator to set up a self-adapting network that canserve variable capacity and coverage requirements,based on demand.Some <strong>of</strong> the aims <strong>of</strong> the newapproach are to share resources to meetunpredictable broadband demand, and to enhancethe quality <strong>of</strong> broadband services across the globe.Liquid net will free up unused capacity and allocateit instantly across the whole network wherever andwhenever it is required. Capacity in today'sconventional networks is typically frozen inseparate places, at individual base station sites, inparts <strong>of</strong> the core network that manage voice and dataservices, or in the optical and IP transport networks.(Source: www.siliconindia.com)HCL Technologies Signs Deal with Deutsche<strong>Bank</strong>HCL Technologies Wednesday said it hadsigned a five-year multi-million dollar deal with theDeutsche bank's capital markets arm to provide itapplication support solutions. The service factorydelivery model implemented by HCL is expected tosignificantly enhance productivity, driven bytransparent service level agreements (SLAs) andperformance metrics. The transformationalprogramme, which will result in significant vendorconsolidation, involves the management <strong>of</strong> keybanking applications that are the backbone to theDeutsche <strong>Bank</strong>'s critical businesses.(www.siliconindia.com)19april-september 2011

e-trackBOOK REVIEWThe Difficulty <strong>of</strong> Being Good: On the Subtle Art <strong>of</strong> DharmaBy Gurcharan DasIn his new book, Gurcharan Das turns to theMahabharata in order to answer the question, 'why begood?', and discovers that the epic's world <strong>of</strong> moralhaziness and uncertainty is closer to our experience asordinary human beings than the narrow and rigidpositions that define most debatein this fundamentalistage <strong>of</strong> moral certainty.He runs through the backbone <strong>of</strong> the epic quickly,so the reader is up to speed on what the story is and whothe main characters are. Even for readers who perhapsare familiar with the epic, this is a good refresher. Thisbook is written in a `lets get to the point quickly' style, butas a reader you realize that it is a palate cleanser for thecomplex meals to come ahead.It is about characters from Mahabharata, theirstories, actions and moral implications <strong>of</strong> those. Eachchapter focuses on a different character, and examines anepisode from the Mahabharata about the character andlooks at the morality <strong>of</strong> the situation. To give you an idea<strong>of</strong> what I am talking about, here are the names <strong>of</strong> somechapters:Duryodhana's envyDraupadi's courageYudhistara's dutyArjuna's despairBhishma's selflessnessThe central event appears to be the episode <strong>of</strong>Queen Draupadi's humiliation in the King's court. Onewould normally assume that this particular scene was adramatic episode. But that the central scenes wereArjuna's dilemma or even Karna's demise. But what theauthor is exploring is the question <strong>of</strong> Dharma. And thecentral question <strong>of</strong> Dharma is posed by the humiliatedQueen to the assembly <strong>of</strong> Nobles. The book looks at themoral dilemmas that various characters faced throughoutMahabharata, and analyzes them from differentperspectives.For example: When Draupadi is first told thatYudhishthira has lost her in the game <strong>of</strong> dice, she asks:Whom did you lose first, yourself or me?The book takes you to the answer <strong>of</strong> Bhishma whotells Draupadi that iti s t r u e t h a tYu d h i s t h i r a l o s thimself first, and sohe is not competent towager Draupadi. Aperson who has losthimself is no longerfree to wager thatwhich doesn't belongto him. On the otherhand, a wife doesb e l o n g t o h e rhusband, and even ifhe is not free, she islegally his, and he isallowed to stake her. Bhishma concludes that this is acomplex matter and he cannot solve Draupadi'sdilemma.He states: As dharma is subtle, my dear, I fail toresolve your question in the proper way.The book is filled with such questions, and theirprobable moral implications, and to me, that's whatmakes it great.After going through this book, we realize howmuch we want to read the Mahabharata. Most <strong>of</strong> ourknowledge <strong>of</strong> it comes from the TV serial. But there iscertainly a lot more to Mahabharata than what we havegathered so far. The book quotes extensively from theMahabharata, and although the subject itself is not light,the writing makes it clear and easy to read.The Difficulty <strong>of</strong> being Good , dwells on the goal<strong>of</strong> dharma, moral well being. It addresses the centralproblem <strong>of</strong> how to live our lives in an examined wayholdinga mirror up to us and forcing us to confront themany ways in which we deceive ourselves and others.What emerges is a doctrine <strong>of</strong> dharma that we can applyto our business decisions, political strategies andinterpersonal relationships-in effect, to life itself.Sanjay SrivastavaLibrarian, PNBIITapril-september 201120