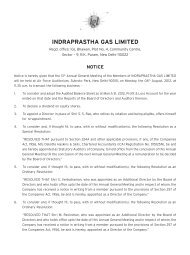

Annual Reports - Indraprastha Gas Limited

Annual Reports - Indraprastha Gas Limited

Annual Reports - Indraprastha Gas Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

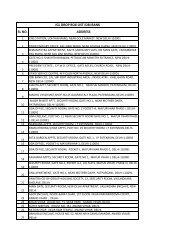

2.4 Depreciation and amortization<br />

(Also refer to Note 5)<br />

Depreciation is charged on a pro-rata basis on the straight line method over the estimated useful lives of assets,<br />

determined as follows:<br />

Mother Compressors, Online Compressors 7 years<br />

and Booster Compressors<br />

Leasehold land Over the period of lease<br />

Bunkhouses 5 years<br />

Signages 10 years<br />

All other assets Rates prescribed under Schedule XIV<br />

to the Companies Act, 1956<br />

Assets costing Rs. 5,000 or less are fully depreciated in the year of purchase. Rates of depreciation are equal to or<br />

more than Schedule XIV to the Companies Act, 1956.<br />

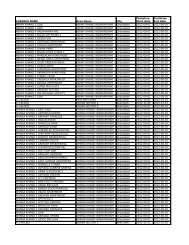

2.5 Investments<br />

Current investments are stated at the lower of cost and fair value.<br />

2.6 Inventories<br />

a) Stores and spares are valued at cost on weighted average basis. Provision for obsolescence is made where<br />

necessary.<br />

b) Stock of CNG in cascades and Natural <strong>Gas</strong> in pipelines is valued at the lower of cost on First in First out (FIFO)<br />

basis or net realisable value.<br />

c) Closing stock of Natural <strong>Gas</strong> in pipelines and cascades is estimated on a volumetric basis.<br />

2.7 Revenue recognition<br />

a) Revenue on sale of Piped Natural <strong>Gas</strong> is recognized based on consumption by the customer.<br />

b) Revenue on sale of Compressed Natural <strong>Gas</strong> (CNG) is recognized on sale of gas to customers from CNG<br />

stations.<br />

c) Income from deposits is recognized on a time proportion basis. Dividend income from investment in mutual<br />

funds is recognized, when the Company’s right to receive payment is established.<br />

2.8 Foreign currency transactions<br />

Transactions in foreign currency are translated at the exchange rates prevailing on the date of the transaction. Monetary<br />

foreign currency assets and liabilities are translated at exchange rates prevailing as at the year-end. Exchange gains or<br />

losses arising out of fluctuation in exchange rates on settlement during the year and/or translation at year-end are<br />

recognized in the profit and loss account.<br />

2.9 Borrowing costs<br />

Borrowing costs that are directly attributable to the acquisition or construction of an eligible capital asset is capitalized<br />

as a part of the cost of that asset. Other borrowing costs are recognized as an expense in the period in which they<br />

are incurred.<br />

2.10 Retirement benefits<br />

Incremental liabilities in respect of gratuity, leave encashment and sick leave are provided on the basis of actuarial<br />

valuation as at the balance sheet date and are charged to the profit and loss account. Contributions for provident<br />

fund are charged to the profit and loss account as incurred.<br />

2.11 Operating leases<br />

Lease rentals are recognized as an expense in the profit and loss account on straight-line basis over the term of the<br />

lease.<br />

45