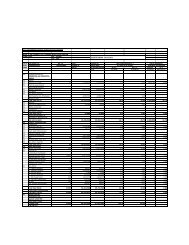

schedule - iv fixed assets - Moneycontrol.com

schedule - iv fixed assets - Moneycontrol.com

schedule - iv fixed assets - Moneycontrol.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Board of DirectorsS.B. (Ravi) PanditChairman & Group CEOAmit KalyaniDirectorAnant TalaulicarDirectorBruce CarverDirectorDeepak MalikDirectorElizabeth CareyDirectorK.V. KrishnamurthyDirector(Resigned with effect from January 18, 2010)Lila PoonawallaDirectorDr. R.A. MashelkarDirectorDr. Srikant DatarDirectorSudheer TillooDirectorFloyd RutanAlternate DirectorMark GerstleAlternate DirectorDwayne AllenAlternate DirectorKishor PatilCEO & Managing DirectorGirish WardadkarPresident and Execut<strong>iv</strong>e DirectorAnil KhatriCompany SecretaryAuditorsDeloitte Haskins & SellsChartered Accountants706, “B” wing, 7th Floor,ICC Trade Tower,International Convention Centre,Senapati Bapat Road, Pune - 411016Legal AdvisorsAZB & PartnersAdvocates & SolicitorsExpress Towers - 23rd floorNariman PointMumbai - 400 021Financial Institutions- State Bank of India- International Finance Corporation- HDFC Bank Ltd.- The Hong Kong and Shanghai BankingCorporation Ltd.- Citibank N.A.- BNP Paribas- Standard Chartered- Axis Bank Ltd.ContentsLetter from the Chairman andthe Managing Director........................ 01Letter from the Presidentand Execut<strong>iv</strong>e Director....................... 03Financial Highlights........................... 05Management discussion and Analysis....... 07Enterprise Risk Management Report........ 12Community Initiat<strong>iv</strong>es ........................ 13Directors’ Report.............................. 16Report on Corporate Governance........... 23Additional Shareholder information........ 33Standalone Financial Statements........... 39Consolidated Financial Statements......... 69Consolidated FinancialStatements of Subsidiaries................... 97Notice .......................................... 98

From the Chairman and the Managing DirectorAnnual Report 2009-2010My Dear Fellow Shareholders,Last year was an unusual and abnormal year for the global economyand all businesses by any gauge. In the following letter, we would liketo look into our performance for the last year and the opportunitiesand challenges for the year ahead of us.We started the year with a lot of uncertainty prevailing in the overallglobal business atmosphere. Our customers were not able to haveany visibility beyond a quarter. In the past, we have talked businessprospects on a long term basis with our customers. Towards the endof FY09 and majority of FY10, we were unable to converse beyonda quarter even with our long standing customers. The customersthemselves were not in a position to discuss business opportunities asthey themselves were uncertain about their future revenues.In the overall economic slump, manufacturing vertical which constitutesclose to 90% of our total revenues was the worst hit and globally largemanufacturing corporations were facing gross under-utilization of theirproduction capacities. The Automot<strong>iv</strong>e Industry also went through itsworst phase with production facilities being shut down and inventoriespiling up significantly. In 2007 close to 80 million new automobiles weresold worldwide and the same number in 2009 was about 60 million —a whopping fall of 25%. Cummins, which is our largest customer andalso a strategic partner/investor was no exception to this economicoccurrence. Cummins cut down its IT budget significantly and thus ithad a subdued effect on our revenues.The last quarter of the calendar year 2009 brought some respite tothe overall negat<strong>iv</strong>e business climate, with banking sector leading therecovery followed by a mix bag of manufacturing rev<strong>iv</strong>al. The recentdevelopments in Europe have put in a question mark to a steadyrecovery in the economic scenario. Still we believe that the firstquarter of 2010 has shown posit<strong>iv</strong>e signs indicating a cautious recovery.While the world was reeling under such trying economic circumstanceslast year, we were clear on our object<strong>iv</strong>es of 1) Quality and Product<strong>iv</strong>ity,2) Technology and Practices 3) Profitability and Liquidity and 4) Growth.As the year has panned out, we have been fairly successful in achievingour stated object<strong>iv</strong>es. With clear focus on Quality and Product<strong>iv</strong>ity wehave increased the asset repository size and asset reuse percentage,enhanced the utilization of product<strong>iv</strong>ity tools, improved CSAT coverageand rating, reduced rework efforts and improved percentage of ‘zerodefect del<strong>iv</strong>eries’ to the customers.We have been strengthening our technology and practices withconcentrated efforts on innovation directed towards creation of IPsand filing of patents. Till date we have 24 patents filed in our name (10of which were filed in April 2010), with majority of them in the areasof automot<strong>iv</strong>e electronics. This helps our positioning as a niche playerand domain expert in this area. Even with a pressure on growth andthus profits, we continued to invest in R & D. The total R & D relatedspend was 1.5% of our revenues in FY10.This year our Net Profits after Tax grew by 30% over the last year, inspite of a decline in the revenue number year on year. We were able tocontrol our costs across the organization but were diligent enough notto cut budgets in the R & D and people training areas. We were ableto have a healthy cash balance as at the year end with Cash reservesclose to Rs. 1,800 Million after routine Capital Expenditure of aroundRs. 300 Million and payments for acquiring Sparta and the balanceholding in KPIT France, KPIT Germany and SolvCentral.Growth was one area where we would have liked to perform muchbetter. This was the first year in the last 10 years where we saw a dip inrevenues year on year. Having said that, we were at least successful inarresting the revenue downfall by <strong>com</strong>ing up with innovat<strong>iv</strong>e solutionsfor our customers, reducing customer costs by shifting work offshoreand bringing in more predictability to the customer spend by executingprojects in a <strong>fixed</strong> price mode. Our share of offshore revenues for theyear stood at close to 60%, up from 55% last year and revenue from<strong>fixed</strong> price contracts increased from 18% last year to 30% this year.Thus, if we consider the volumes (billed FTEs), there was no de-growthin FY10 as <strong>com</strong>pared to FY09, due to the movement of work fromOnsite to Offshore.During the year, we <strong>com</strong>pleted the merger of Sparta Consulting Inc.,a US based SAP consulting <strong>com</strong>pany. This strengthens our SAP practiceand g<strong>iv</strong>es us a strong front end team in the US Market. We are surethat the synergies from this merger will take us a long way in creatinga niche and leadership position for ourselves in SAP.During the year, we also added Defense and Energy and Utilities toour verticals of spotlight, to have a cushion for our exposure to themanufacturing vertical. Sparta Consulting already der<strong>iv</strong>es about 50% ofits revenues from Energy and Utilities vertical which g<strong>iv</strong>es us a stronghead start in this vertical. We see good potential for growth in thisvertical. For the Defense sector, our offerings would be an extensionof our embedded and engineering solutions and we have been able tobag a couple of orders already in this area.With such a difficult year behind us, we now are poised for a goodgrowth year. We expect the Top line to grow by about 25% in USD termsin FY11 over FY10, well above the NASSCOM average industry growthprojection of 13% - 15% this year. This growth will be led by Automot<strong>iv</strong>eElectronics, SAP and Emerging Markets coupled with the new areas ofEnergy & Utilities and Defense.However, some key decisions and actions will result in a lower profitgrowth as <strong>com</strong>pared to the revenue growth. We have g<strong>iv</strong>en salaryincrements across the board for offshore employees with effect fromApril 01, 2010 which are at par with the industry averages. The rupee,in the near future depicts a trend of strengthening against the Dollarand Euro and GBP cross rates are also on a path of adverse movementduring the year. We will also continue to invest in the right areas viz. R& D, sales & marketing and people training, to fuel our future growth.We believe that these investments are an absolute must, if we wantto keep on growing well over the industry average, in the next coupleof years. We will end up forgoing some profits of the current year butwill be poised for a much better growth in the <strong>com</strong>ing years. Hence,we believe that the profit growth will be at a minimum of 5% in FY11,though it will be our endeavour to improve the profit growth beyond5%. Most of the industry, we believe, will show a lower profit growthas <strong>com</strong>pared to the revenue growth, this year.Our priorities for FY11 would be as follows:People — We want to focus on improvement of the <strong>com</strong>petency of ourpeople. This would be through trainings, certifications, Leadership1

KPIT Cummins Infosystems LimitedDevelopment and Budding Leaders Program. Last year, we starteddoing some work in this area. This year we shall build on it. We shallspend extra efforts on our team members who show greater energyand <strong>com</strong>petency and we shall help them grow faster and take biggerchallenges. The recent organizational changes that we have carriedout are tailored to build leadership at second and third levels in theCompany. We would urge every team member to keep the hunger andcuriosity for knowledge and growth always ignited.Innovation — In the new global scenario, only the innovat<strong>iv</strong>e <strong>com</strong>panieswill prosper. We have been working on new product creations for thepast one year. These innovations are a must due to changing economicconditions and environmental challenges posed by energy challenges.We have seen excellent work done by some members of our team. Thisyear, we will step-up our efforts in this area. We will institutionalize allaspects of innovat<strong>iv</strong>e solutions. We want innovations to happen acrossKPIT and not just in a few pockets. We are very encouraged by theinnovations in product<strong>iv</strong>ity, IPs and value –adds, that your <strong>com</strong>panyhas done in the recent past and we are sure that we will be able tobuild on them in the next couple of years.Profitable Growth — Getting back into growth will call for additionalinvestments in sales and marketing and will also call for significant focuson creation of new products and solutions. We believe we will be ableto make the growth happen by virtue of our growth in the emergingmarkets, by virtue of growth in the US anchored by our acquisitionsand on account of more products and services that we now have tooffer. It is important for us to focus on “Profitable Growth” and notjust “Growth”. We shall necessarily build on our IPs for non-lineargrowth. We shall also build on the product<strong>iv</strong>ity improvements thatwe have invested in over the last year. We shall explore innovat<strong>iv</strong>epricing models so that “Time and Material” pricing will constitute a<strong>com</strong>parat<strong>iv</strong>ely smaller part of our in<strong>com</strong>e. We have to act<strong>iv</strong>ely thinkhow we can create value for our customer and how we can get paid forit, not on the basis of our costs, but on the basis of the value that wecreate. In order that we have a good understanding of the value thatwe create, we must look at what is valuable to the “end consumer”,who could be our customer’s customer.All the above would mean a new mindset across the organizationfrom all the colleagues of KPIT. We would also expect support andencouragement, as always, from all our investors and stakeholders.Beyond the growth of our Company and our people, we believe, wesatisfy a global need of ensuring “Green and Inclus<strong>iv</strong>e” Growth. Lastfew years have brought out that we as a humanity face challenges on2 issues – How do we ensure that all of us have inclus<strong>iv</strong>e growth andhow can it be green. Our internal operations are sensit<strong>iv</strong>e to the needof such growth.“Green and Inclus<strong>iv</strong>e” Growth for us is directed towards threemajor areas:Customers’ Products — Manufacturers’ interest in green products isgrowing, g<strong>iv</strong>en increased awareness about population growth, globalwarming and scarcity of natural resources. Our work in the areas ofHybrid Cars, Electric Cars, reducing Emissions from engines, Clusters,infotainment, lower power chips, PDM and alternate fuel vehicles,to name a few are all directed towards green end products for thecustomer.Customer Operations — The manufacturing and business operationsof the customers need to be fine tuned so that they have a minimalimpact on the environment. Our work in the areas of Supply ChainManagement, Enterprise Resource Planning, Product Life CycleManagement, Business Process Management, Business Intelligence andManufacturing Execution Systems, to name a few, is towards ensuringthat the customer operations are environment sensit<strong>iv</strong>e and friendly.Our Own Operations — Even though (being in IT domain), our serviceshave little negat<strong>iv</strong>e environmental impact, KPIT has always proact<strong>iv</strong>elyensured that we protect and improve the environment in which wework. We have designed and implemented policies which are aimedat Optimum utilization and conservation of resources like energy andpower, water, paper and other consumables, regular tree plantation,effect<strong>iv</strong>e waste management and recycling, optimizing employeetransport and reduction in environment hazardous materials likeplastic among others. These policies seek act<strong>iv</strong>e participation fromevery department and employee of the Company.This is a very fulfilling journey and we are glad that we are on ittogether.Warm Regards,Sincerely yours,S. B. (Ravi) Pandit Kishor PatilChairman & Group CEOCEO and Managing Director2

From the President and Execut<strong>iv</strong>e DirectorAnnual Report 2009-2010Dear Shareholders,The macroeconomic factors which created a negat<strong>iv</strong>e impact on the businessduring FY 2009-10 have already been well addressed in the Chairman andManaging Director’s letter. We would therefore try to look at the prioritieswhich were set by the Company for the year gone by and how we haveperformed on those parameters.For FY2010, we had broadly set the following priorities:1. QUALITY & PRODUCTIVITY – Continue to invest in improving customersatisfaction, zero-defect and on time del<strong>iv</strong>ery. Focus on del<strong>iv</strong>eringValue to customers.2. TECHNOLOGY and PRACTICES – building specific practices and offeringsmapped on to specific customers and geographies.3. LIQUIDITY & PROFITABILITY – Liquidity by managing cash, focusing onrece<strong>iv</strong>ables and capital expenditure and Profitability by improvingproduct<strong>iv</strong>ity – focus on reuse of <strong>assets</strong>, rework reduction anddeployment of tools, improving engineers’ utilization and ensuringappropriate people pyramid.4. GROWTH – continue to focus on identified list of customers includingmust win list, India strategy implementation.Quality & Product<strong>iv</strong>ityIn the last year, we have put tremendous emphasis on quality management,product<strong>iv</strong>ity improvement and customer interface processes enhancements.Asset based development to implement re-usage strategy was initiated atlarge scale. We standardized tools for project management and softwarelife cycle act<strong>iv</strong>ities. We leveraged significantly upon open source tools tobring in efficient cost management. For quick and high quality knowledgetransfer we established “Induction Portal”.As a result of all these initiat<strong>iv</strong>es we were able to expand our CSAT coverageand the average rating also improved significantly from 3.85 to 4.19 ona scale of 5. These measures have also paid well in terms of maintainingthe profitability margins despite of declining revenues. We maintained ourEBITDA margins at 20%+ level throughout the year. Our offshore revenueshave improved from 55% in FY09 to 59.79% in FY10. These product<strong>iv</strong>ityimprovement initiat<strong>iv</strong>es taken during the last few years along with theexpertise and confidence that we have gained from our customers helped usin increasing the share of ‘Fixed Price’ revenues to 30%+ from 18% in FY09.We directed all our efforts towards “del<strong>iv</strong>ery excellence” and “del<strong>iv</strong>eringvalue” to our customers. During the last year we were certified for ISO9000, CMMi Level 3 and Auto Spice Level 5.Technology & PracticesEstablished in 2007, Center for Research in Engineering Sciences andTechnology (CREST) has been our core R&D center and has been contributingsignificantly in bringing the differentiating factor in the Company’s offerings.As a result of the R&D initiat<strong>iv</strong>es, we have filed for another 16 patentsduring FY10, which takes the total number of patents filed till end of April2010 to 24. The patents filed during the year are in the areas of hybridautomot<strong>iv</strong>e technology, safety features of the car and semiconductorofferings related to high speed transmitters. We would be continuing ourwork in this direction with a more focused approach as we aim to increasethe share of IP led revenues in our total revenues.We have been working on various technologies like image processing, dr<strong>iv</strong>ersafety assistance systems and high performance <strong>com</strong>puting. These effortshave now started paying off well in terms of achieving specific R&D projectsfrom our clients in these respect<strong>iv</strong>e areas. This year, we have startedworking in the cloud <strong>com</strong>puting area, our work in parallel <strong>com</strong>puting hasresulted in reducing the execution time for automot<strong>iv</strong>e crash simulation.Hybrid technology is another area of interest for research where we areworking on the unique design, development and successful implementationof hybrid technology in a vehicle.To increase our focus on practices and help the practices to grow and bebest in Class, we have organized ourselves towards the end of the yearwhich is detailed in the ensuing paras.We have developed CLICKSERVICESMILE.<strong>com</strong>, an internet-based informationsystem, in association with DSK Toyota that will make car ownership easierfor Indian consumers. This development is significant for the Company as itis its first consumer-based product. Our industry-based approach and newvertical focus strategy have led to a consumer-based product as a meansto tap into domestic demand for automot<strong>iv</strong>e embedded software.R&D Recognition: Here are a few examples of papers our engineerspresented on various forums:• “A <strong>com</strong>prehens<strong>iv</strong>e sensor system framework for vehiclesafety” was accepted at ICVES 2009.• “Hardware/Software Tradeoffs in Automot<strong>iv</strong>e Sensor DataProcessing” was accepted for presentation at the IP-EmbeddedSystems Conference held in Grenoble, France in December2009.• Our articles “Concurrent Debuggers”; “Programming Tools forMulticore Processors”; “Functional Programming Paradigmand Concurrency” were published on an online technical site,TechOnline.Liquidity & ProfitabilitySensing the economic turmoil, we started directing our actions towardsimproving our liquidity right from the start of the year. Our cash balance ason March 31, 2010 stood at Rs. 1,799.27 million as <strong>com</strong>pared to Rs.1,671.17million as on March 31, 2009. Our focus on DSO reduction has led toimprovement in the rece<strong>iv</strong>able levels from 69 days to 66 days. Capitalexpenditure during the year was Rs.296.8 million against Rs.298.07 millionin FY09. Control on capital expenditure was a result of our approach ofensuring optimal utilization of not only our people but all <strong>assets</strong> – IT andphysical infrastructure related.Our profits for the year increased to Rs. 857.31 million from Rs. 658.52million last year, a growth of 30.19%. With our actions directed towardsproduct<strong>iv</strong>ity improvement as stated earlier and the change in revenue mixhelped by better average rupee realization as <strong>com</strong>pared to last year, wewere able to post this quantum jump in profits year on year, despite thefall in revenues.GrowthYear 2009-10 put pressure on our customers to improve their costeffect<strong>iv</strong>eness. Customers became more demanding. Value del<strong>iv</strong>ery wascritical. Your Company focused on ensuring our customers wins.During the year, we were successful in engaging with customers in China forengineering projects in automot<strong>iv</strong>e and semiconductor applications. TheCompany will invest in this important market. Besides growth opportunitiesfor the Company, this market provides us opportunity to work on challengingengineering problems.India has also been another growth region for us in FY10. Our Indiabusiness has grown by 50% during this year and we expect the growth rateto continue. In India, we have seen business growth <strong>com</strong>ing from our SAPpractice, but during the year, we have entered into engagements with largeauto players of the country. The government has also been very support<strong>iv</strong>ein terms of its mandate and policies for dr<strong>iv</strong>ing the economic growth andthus we can expect good business <strong>com</strong>ing from this market in the future.Korea, Australia and South Africa are some other markets among theemerging nations which are showing strong growth traction and thus weare very posit<strong>iv</strong>e on our emerging market growth strategy.We added a new customer segment - ‘Defense’ and ‘Public Sector Units’(PSU). In the defense sector, our offering would be end-to-end design,engineering and IT services as an extended part of our embedded softwarework. In PSU, we would be primarily offering our Business IT servicespackage. We believe these two sectors will further help us in strengtheningour presence in Indian market.With the acquisition of Sparta Consulting Inc., we have added ‘Energyand Utilities’ as a vertical to our business. Together we will seek moreopportunities for growth in this vertical and we also aim to further expandour offerings scope in this domain.3

KPIT Cummins Infosystems LimitedIn preparation for the growth, we have also begun investments in Practices,Subject Matter Experts and front end sales. We will further step up ourinvestments in technical talent to get ready for the “New Normal” businessenvironment. Project Management rigor, solutioning for customers throughSubject Matters Experts and Practice & Business Managers would be criticalto our success in the future.Partnership & Association:• We became a Product Partner of the Mathworks ConnectionsProgram which will help us to align our AUTOSAR based productswith the industry’s leading technical <strong>com</strong>puting software.• We are now an affiliate member of Center for Automot<strong>iv</strong>eResearch (CAR), a well known automot<strong>iv</strong>e research organizationbased in Michigan, USA. This association will enable accessto the ongoing industry initiat<strong>iv</strong>es and practices and thusstrengthen our industry ties.• In collaboration with a leading global semiconductor <strong>com</strong>panyfrom Japan, we have developed a new AUTOSAR 3.0 <strong>com</strong>patiblesoftware solution for various hardware platforms, which enableseasy design of application software without the need for newdevelopments.Our act<strong>iv</strong>e client base has grown from 128 in FY09 to 141 in FY10. We haveadded two new customers in the star customer category which increasedto 28. Cummins continues to be our top client with a revenue share of30.18%. Non Cummins star customers constituted 44.52% of our revenues.Thus we believe we have been able to achieve good results last year,focusing on the above mentioned priorities.People DevelopmentOur People are our strength. At KPIT we str<strong>iv</strong>e to create vibrant andempowering environment that stimulates improved performance. We havedesigned various programs and certifications where we are ensuring overalldevelopment of our people to move quickly to the next level of growth andthus creating a leadership pipeline to lead the performance dr<strong>iv</strong>en cultureacross the organization.As a part of our employee connect, some key initiat<strong>iv</strong>es taken during the year:1. Pulse 2009We rolled out an organization wide employee satisfaction survey andthe results were shared with all colleagues along with the action planto address the key areas of concern.2. Employee ConnectWe launched a <strong>com</strong>munication framework for strengthening connectof managers with their team members through one on one and groupmeetings. We have also sharpened focus of Leadership connect withall colleagues wherein we organized various events which coveredall our employees based across the globe.3. Campus Initiat<strong>iv</strong>esWe have started hiring from colleges where we see strengths inour domain specific areas like Mechanical Design, MECHATRONICS,Automobile Engineering Software IT like IT and Computer ScienceEngineering Graduates, Embedded technologies, etc.We have signed an MoU with Vishwakarma Institute of Technologyand another MoU with Sinhagad Group of Engineering Colleges, Puneto promote academic excellence and faculty empowerment throughresearch and mentoring initiat<strong>iv</strong>es.A KPIT Center of Excellence has been established at MKSS CumminsCollege of Engineering for Women, Pune where the sole object<strong>iv</strong>eis to encourage R & D orientation amongst students & faculty. Wehave stepped up our engagement with Business schools to add to theleadership pipeline.Budding Technologist programWe have started this program during the year, where we will sponsorprojects in colleges like Cummins College of Engineering, SinhagadCollege of Engineering and Pune Institute of Computer Technology.This program is aimed at spotting talent at an early stage and nurturea culture of innovation.4. Training Initiat<strong>iv</strong>esWe have identified key roles within the organization i.e., Projectmanagers, Technical leads and sales team and designed varioustraining programs like PROMS and ‘Tech-lead’ certification. Theseprograms are focused on developing their ind<strong>iv</strong>idual <strong>com</strong>petenciesand professional growth. Role based <strong>com</strong>petency development andcertification has been introduced to ensure people development forthe right roles and to improve product<strong>iv</strong>ity and customer satisfaction.5. Community Initiat<strong>iv</strong>esUnder our Non Profit Connect initiat<strong>iv</strong>e, we partnered with anNGO called Janawani and developed an online “GIS Based AccidentReporting System” to help the Traffic Police department. We havebeen working with Seva Sahayog NGO for the last 4 years on theirvarious initiat<strong>iv</strong>es like School kit donation dr<strong>iv</strong>e, organizing Sevafair which demonstrates products prepared by the women Self helpgroups. “Sponsor a child from Northeast India” is another uniqueinitiat<strong>iv</strong>e wherein we support children <strong>com</strong>ing from the economicallyweaker sections of the society.InfrastructureDuring the year, we have consolidated three of our Bangalore Offices toShailendra Techno Park at Whitefield which is a 65,000 sq. ft. office space.Our other facility in Bangalore is Adarsh Tech Park, Special Economy Zone(SEZ) which has 25,000 sq. ft., area. This facility will g<strong>iv</strong>e us long termbenefits on tax and duty exemptions. Our ultimate goal is to consolidateentire Bangalore operations to Adarsh Tech Park, SEZ by the end of 2011.Going ForwardWe are gearing up to respond to the changing customer preferences. Wehave got the IT and the BPO teams integrated to enable customer solutioningfor IT and also to process their operational transactions. This <strong>com</strong>binedIT & BPO service offering will help our customers to focus on their coreact<strong>iv</strong>ity, while we can take care of the business processing end-to-end. Infew select customers engineering solutions would also form part of thisintegrated approach.In order to del<strong>iv</strong>er higher value to customers we have restructured oursales and del<strong>iv</strong>ery organization to be ‘practice based’. The practiceteams would focus on specific domain thus build expertise and be ableto talk the customer’s language. Practice teams would build domain andindustry specific offerings and get geared to del<strong>iv</strong>er to the customers moreefficiently. Practice team would focus on demand generation, selling andalso del<strong>iv</strong>ering. This integrated approach would make us more <strong>com</strong>petit<strong>iv</strong>e.Customer led & Practice base organization would prepare us to achieveour business object<strong>iv</strong>es.Priorities for FY11 are based upon following themes:1. People - Development of people by – right skilling, leadershipdevelopment and acquiring right DNA.2. Innovation – Foster a culture of innovation - Practice based to bringabout best in class solutions, non linear revenues through IP basedofferings and more emphasis on building IPs and filing patents.3. Profitable Growth – Growth with focus on emerging markets, Oracleand SAP practices and Automot<strong>iv</strong>e vertical assisted by Energy andUtilities and Defense. Profitability with Product<strong>iv</strong>ity Improvement,DSO reduction, increasing Fixed price revenues, begin non-linearrevenues through asset based development and IPs.With encouragement from our customers and markets, Practice basedgo-to-market strategy, trained, certified and <strong>com</strong>petent engineers andbuilding a culture of Innovation, we are confident of bringing back growthand improving profitability.Warm Regards,Sincerely yours,Girish WardadkarPresident & Execut<strong>iv</strong>e Director4

Financial highlightsAnnual Report 2009-2010Rs. MillionFY10 FY09 FY08 FY07 FY06CONSOLIDATED INCOME STATEMENTSales (USD Million) 153.76 174.10 145.24 102.52 72.93Sales 7,316.41 7,931.55 5,834.53 4,637.02 3,182.15Gross Profit 3,225.91 3,464.35 2,104.27 1,753.34 1,121.02EBITDA 1,614.43 1,833.55 732.97 707.81 461.90Interest 27.41 45.47 75.47 44.64 19.18Depreciation/ Amortization 308.04 436.46 254.68 121.21 84.20Other In<strong>com</strong>e (252.53) (573.79) 198.82 12.90 0.13Profit Before Tax 1,026.45 777.83 601.64 554.86 358.65Profit After Tax 857.31 658.52 512.82 504.76 325.64CONSOLIDATED BALANCE SHEETShare Capital 157.05 156.09 155.77 149.55 72.80Reserves & Surplus 3,697.28 1,474.50 2,482.19 1,840.81 1,344.57Total Shareholders Funds 3,871.01 1,630.59 2,637.96 1,990.36 1,417.37Loans 1,107.74 1,184.76 864.86 1,222.96 874.51Minority Interest – 3.16 5.15 4.51 4.39Deferred Tax Liability 51.15 59.61 42.09 10.22 7.75Total Sources of Funds 5,029.90 2,878.12 3,550.06 3,228.05 2,304.02Fixed Assets 2,471.54 1,795.02 1,680.45 1,772.05 953.38Investments 746.98 0.31 1.09 48.81 0.11Accounts Rece<strong>iv</strong>ables 1,387.68 1,775.61 1432.2 1,101.72 867.74Cash and Bank Balances 1,052.29 1,671.17 739.79 625.35 411.35Loans & Advances 677.03 449.30 529.55 345.13 442.22less: current liabilities & provisions 1,305.62 2,813.29 833.06 665.12 370.95Miscellaneous - - 0.04 0.11 0.17Total Application of Funds 5,029.90 2,878.12 3,550.06 3,228.05 2,304.02Key RatiosRevenue growth (7.76%) 35.94% 25.82% 45.72% 26.05%EBITDA Growth (11.95%) 150.15% 3.55% 53.24% 38.97%PAT Growth 30.19% 28.41% 1.60% 55.00% 14.68%Gross Profit Margin 44.09% 43.68% 36.07% 37.81% 35.23%EBITDA Margin 22.07% 23.12% 12.56% 15.26% 14.52%PAT Margin 11.72% 8.30% 8.79% 10.89% 10.23%SG&A to Revenue 22.03% 20.56% 23.50% 22.55% 20.71%ROE 31.17% 30.85% 22.16% 29.62% 26.28%Return on Capital 21.68% 20.49% 15.13% 18.25% 17.41%Debt to Equity 0.42 0.48 0.45 0.62 0.50Cash/ Total Assets 20.92% 58.06% 20.84% 19.37% 17.85%Earnings per Share (Rs.) 10.97 8.44 6.84 6.83 4.545

KPIT Cummins Infosystems LimitedHowever with our increased focus towards various product<strong>iv</strong>ityimprovement measures and cost control initiat<strong>iv</strong>es along with theshift towards offshore revenue mix, we have been able to maintainour EBITDA margins well above 20% level for the year. These measuresinclude more Fixed Price based revenues, improved reuse of production<strong>assets</strong> from the repository, reduced rework efforts, increased zerodefect del<strong>iv</strong>eries to the customer, increased usage of automation tools,and increased customer satisfaction rating among others.7060504039%Offshore Revenues53%55%49%60%3025201515% 15%EBITDA Margin13%23%22%20100FY06FY07FY08FY09FY101050FY06FY07FY08FY09FY10Fixed Price RevenuesWe have been continuously growing our share of revenues del<strong>iv</strong>eredin a Fixed Price Mode. In Fixed Price Projects, the billing is donebased on achievement of predefined milestones del<strong>iv</strong>ered in thespecific timeframes as decided at the start of the project. Totalcost, specifications and deadlines for such projects are determinedin advance. The product<strong>iv</strong>ity measures carried out by the Company,during the last two years, have g<strong>iv</strong>en us the confidence of del<strong>iv</strong>eringprojects profitably, in a <strong>fixed</strong> price mode. Fixed Price contracts havehelped us and will aid us in the future also, in improving profitability.35302520151012%9%FP Revenues12%18%30%Forex loss for the year stood at Rs. 269 Million as <strong>com</strong>pared to Rs. 574Million last year. This reduction in the forex loss was on account of rupeeappreciation and a better hedge rate as <strong>com</strong>pared to last year. Weshould continue to see the reduction in forex loss in the next year also.Shareholders’ Funds:As a <strong>com</strong>pany we are always focused on maximizing shareholders’wealth and it is our prime object<strong>iv</strong>e to keep building on the Net Worthof the Company.Hedging Reserve is the MTM gain/loss on all of the outstanding hedgingcontracts which are due for maturity beyond 90 days from the date ofthe Balance Sheet, as calculated with respect to the closing rate as atthe date of the Balance Sheet. As on March 31, 2010, these hedgingreserves were Rs. 227 Million as <strong>com</strong>pared to Rs. 1,631 Million as atMarch 31, 2009.4500400035003000250020001500100050001,417FY061,990FY07Shareholders’ Funds2,6582,638FY083,2621,631FY094,0983,871FY10120%100%80%60%40%20%0%5Shareholders’ Fund (Rs. Million)Shareholders’ Fund without Hedging Reserve0FY06FY07FY08FY09FY10Offshore RevenuesThe revenues der<strong>iv</strong>ed from services del<strong>iv</strong>ered to the customer fromremote locations, e.g. India are classified as offshore revenues.Offshore revenues have significantly higher margins than the onsiterevenues and the <strong>com</strong>pany has been continuously increasing its revenueshare of offshore revenues which has helped in improvement of EBIDTAmargins over the period of time.Shareholding Pattern:Our shareholders include Promoters, renowned domestic and financialinstitutional investors and ind<strong>iv</strong>iduals. As on March 31, 2010 ourshareholding structure was as follows:1,4171,9902,6381,6313,87110

Institutional22.88%IFC 1.98%Lehman 4.54%Shareholding Pattern as on March 31, 2010Cargil1.87%Public23.51%Promoters30.58%Annual Report 2009-2010Material developments in human resources/industrial relationsfront, including number of people employedWe have talked in detail about the various people related initiat<strong>iv</strong>estaken by the Company during the last year. In difficult economicconditions also, we did not lose our focus on people investments. Thetotal employee count as of March 31, 2010 stood at 4,918 as <strong>com</strong>paredto 4,576 at the end of FY2009. Thus even with a reduction in the overallrevenues, we added 342 resources on a net basis. This addition can beattributed to the merger of Sparta Consulting Inc., into your Companyand also the shift of revenues from onsite to offshore which meantthat even if the absolute revenues declined, the total volume of workremained the same or increased.Cummins14.64%LiquidityYear before last and last year, with the macro economic conditionsnot being favourable, we as a <strong>com</strong>pany, took on liquidity as a primarypriority, along with profitability. We worked extens<strong>iv</strong>ely on reductionin days of sales outstanding and limited our capital expenditure.Every quarter we were able to generate posit<strong>iv</strong>e free cash flows. As aresult we have a healthy cash balance on our balance sheet. The CashBalance as at March 31, 2010 stood at Rs. 1,799 Million. The total debtoutstanding as at March 31, 2010 was Rs. 1,108 Million.6000500040003000200010002,1223,256Employees4,481 4,5764,918200018001600140012001000800600400200086411FY 06Liquidity Improvement85625FY 07CASH BALANCE (Rs. Million)DSO (Days)Internal control systems and their adequacyThe CEO & CFO certification provided elsewhere in this Annual Reportdiscusses the adequacy of internal control systems and proceduresin place.Risk and Concerns77740FY 08691,671FY 09661,799FY 1010090807060504030201000FY 06FY 07FY 08FY 09FY 10Thus to conclude, your Company’s financial position continues to bestrong. As we go into the next year, our top priorities are People,Innovation and Profitable Growth. With all our actions directed towardsthese and support from all the stakeholders, we are confident of successin the journey ahead.Cautionary StatementCertain statements under ‘Management Discussion & Analysis’describing the Company’s object<strong>iv</strong>es, projections, expectations maybe forward looking statement within the applicable securities lawsand regulations. Although the expectations are based on reasonableassumptions, the actual results could differ materially from thoseexpressed or implied, since the Company’s operations are influencedby external and internal factors beyond the Company’s control. TheCompany assumes no responsibility to publicly amend, modify orrevise any forward looking statements, on the basis of any subsequentdevelopments, information or events.A separate report on Enterprise Risk Management is provided elsewherein this Annual Report.11

KPIT Cummins Infosystems LimitedEnterprise Risk Management Report“We cannot quantify the future because it is unknown, but we havelearned how to use the numbers to scrutinize what has happened inthe past. But to what degree we should rely on the patterns of thepast to tell us what the future will be like?”Peter BernsteinThe Enterprise Risk Management (ERM) Team in your Company continuesto tackle this perennial question with a systematic approach. Thefocus is now on collecting the trends, analyzing the same and usingthe inferences to plan for better risk management. Albeit, this is achallenging task but the efforts are now on making ERM effect<strong>iv</strong>e. RiskManagement Team of your <strong>com</strong>pany closely works under the guidancefrom Top Management as well as Audit Committee and has a stronglineage in Internal Audit.Uncertainty presents both risk and opportunity, with the potential toerode or enhance value. ERM enables management to effect<strong>iv</strong>ely dealwith uncertainty and associated risk and opportunity, enhancing thecapacity to build value.The focus of ERM continues to be on tracking and monitoring of criticalentity-level risks. Operational risks are addressed through InternalMonitoring mechanisms.ERM Status:Your Company continued to monitor the entity level risks which wereidentified in the last financial year. Some of those risks are still criticalin the present scenario. Parallel to this, the ERM team of your <strong>com</strong>panyworked on understanding the various challenges of the current situationand pinpointing certain entity-level risk areas.Risk Identification was a very detailed exercise during this financialyear. The Execut<strong>iv</strong>e Management of your Company under the guidanceof the Audit Committee had taken a base of risks reported in the lastyear’s annual report (FY 2008-09) and identified six critical risk areasin your Company. It was decided that the Company would focus onthese areas and specific risks falling under these areas. Following arethe main risk areas:1. Customer2. People3. Strategy4. Del<strong>iv</strong>ery5. Finance and6. IT/Infrastructure.For each of these risk areas, owners from top management areidentified. Similarly, for each of the areas two major risks areidentified. A new set of risk indicators have been identified for theserisks. Your Company would continue to monitor the same during FY2010-2011.The ERM team of your Company continued to monitor selected risksfrom this list, based on indicators and periodical reporting was doneto the top management on the status from time to time.A detailed list of identified risks for FY 2010-2011 is g<strong>iv</strong>en below. TheERM Team of your Company will review this list from time to time inFY 2010-11 to ensure that the list remains updated.RiskNo.Risk AreaRisk Topic1. Customer Management of Relationship with Top CustomersConcentration of Customers2. People Management of important (Top) employeesCost of HR3. Strategy Absence of Correct Strategic FocusNon-conformance with defined strategy4. Del<strong>iv</strong>ery Operational ExcellenceObsolescence of Offerings / Del<strong>iv</strong>ery Models5. Finance Foreign ExchangeLiquidity6. IT andInfrastructureIntellectual Property RiskInfrastructureRisk Management Act<strong>iv</strong>ities:Following are the salient features – best practices – of the RiskManagement Act<strong>iv</strong>ities. Your Company believes that these featureswould help in proper “risk treatment”.1. The ERM team is concentrating on entity-level risks only and thattoo on selected critical ones.2. Each risk is discussed threadbare, crystallized and prioritized bythe top management.3. Each selected risk is owned by a member from the execut<strong>iv</strong>emanagement team.4. Single Point of Contact (SPOC) person has been nominated foreach risk area for clear, faster and effect<strong>iv</strong>e <strong>com</strong>municationbetween the concern risk owner and risk management team.5. Risk Indicators are identified in consultation with the Risk Owners.These indicators would help in monitoring the health status ofthat particular risk area.6. Risk Status Assessment is carried out based on Risk Indicator dataand trends.7. Risk Status for selected risks gets <strong>com</strong>piled and analyzed as thedata flows from the Risk Owners (with the support from SPOC)to the ERM team to the Top Management.8. For each risk area, the owners implement suitable RiskManagement actions. Results of these actions reflect in the RiskIndicator status.9. This Risk List is monitored with the purpose of keeping it updatedand relevant.10. There are six risk areas and twelve identified risks as statedabove. Out of which six risks are considered as top risks. For theperiod 2010-11, your Company is focusing of top six risks.With institutionalization of Risk Indicator mechanism, your Companydr<strong>iv</strong>es the Risk Management act<strong>iv</strong>ities in a methodical way. YourCompany understands that Risk Management awareness is very criticalin addressing the risks.Your Company believes that the “human” aspect of any risk is the mostimportant and therefore conscious efforts are being taken to embedRisk Management culture in the teams.12

Community Contribution at KPIT CumminsAnnual Report 2009-2010Community Contribution is one of the core values of KPIT Cummins.While every <strong>com</strong>pany is, in essence, an economic entity and hastherefore to perform on economic parameters, we believe that it ismore than just an economic entity. A <strong>com</strong>pany is rooted in the societyfrom which it der<strong>iv</strong>es all its inputs — such as physical infrastructure, orhuman infrastructure like its own people, or customers. Every <strong>com</strong>panythat draws so much from its society must g<strong>iv</strong>e something back in return.That is why Community Contribution is an essential value for us.Today KPIT Cummins’ <strong>com</strong>munity initiat<strong>iv</strong>es span a wide range oftenets that includes ethics, values and transparency. Branded as‘Beyond business’ we <strong>com</strong>mit to benefit the society at large — notlimiting to cultural or physical boundaries. We make this happen byinvolving energies and efforts of employees but not restricting to justcontribution of funds. We hold this value very dearly, as we realize ourresponsibilities as a global organization, and therefore have dedicatedourselves to creating happy <strong>com</strong>munities, by proact<strong>iv</strong>ely involvingourselves in <strong>com</strong>munity welfare initiat<strong>iv</strong>es.Some of the Community Contribution programs organized by us duringthe year are as g<strong>iv</strong>en below:1. Non-Profit Connect: We strongly believe that we should leverageour IT expertise to serve the <strong>com</strong>munities we choose to work with.Thus under this forum we work with schools and NGOs to provideIT related support which includes <strong>com</strong>puter training programsconducted by KPites, providing <strong>com</strong>puters, up gradation of theirsoftware, support for their hardware related queries, websitedevelopment, applications development, etc.• We partnered with an NGO called Janwani, that focuses onUrban Development and developed for them an online “GISBased Accident Reporting System”. This system has beendesigned to help the Traffic Police Department enter allrelevant details of an accident including exact location inthe city Relat<strong>iv</strong>es of the victims can also access informationthrough this application. This application has been launchedin Pune in July 2009.• In collaboration with Janawani, KPIT Cummins hasdeveloped web-based application for Participatory budgetof Pune Municipal Corporation (PMC). This application hashelped citizens to register their suggestions without havingto visit the ward office. This unique application is part of thePMC’s effort to increase public participation in areas thatimpact l<strong>iv</strong>es of citizens such as the Budget creation process.Through this web-based solution Citizens can register theirsuggestions online. On submission of a suggestion, wardlevel engineers evaluate the suggestion and then approveor disapprove the same. This step has helped in increasingpeople participation from 2000 in last year to 6000 in theyear 2009. The application helped to maintain transparencyof the Budgeting Process also.2. Let Us G<strong>iv</strong>e: L<strong>iv</strong>ing by our Core Value of Community Initiat<strong>iv</strong>eentails g<strong>iv</strong>ing generously to those in dire need, thereby helpingto improve their l<strong>iv</strong>es. Under this initiat<strong>iv</strong>e KPites contribute tosocial causes through various donations• We are working with Seva Sahayog, an umbrella organizationof various NGOs, for the last 4 years. They conducted asurvey for identifying causes for school dropout and have<strong>com</strong>e up with a detailed analysis of the same. One of thekey reasons that came to light from this survey is povertyof the school children due to which their families cannotafford the basic things needed for their education such asbooks, school bag, etc. Seva Sahayog thus launched the“School Kit Donation Dr<strong>iv</strong>e” and KPIT has been supportingthis initiat<strong>iv</strong>e for the last two consecut<strong>iv</strong>e years. In thefirst year, i.e. 2008, we raised Rs.1,25,000/- and stood3rd among 15 other IT <strong>com</strong>panies from Pune thatparticipated in the dr<strong>iv</strong>e. This benefitted approx. 625school children from the underpr<strong>iv</strong>ileged sections ofsociety. In 2009 this dr<strong>iv</strong>e witnessed participation fromover 500 colleagues from Pune and we raised a fund ofRs.1,87,800/- that directly benefitted 939 children. Over 80colleagues and their families also participated in assemblyand distribution of the school kits.Chairman Mr. Ravi Pandit distributing School Kits to children• Along with Seva Sahayog we have been organizing theSeva Fair, an exhibition of various products by women SelfHelp Groups, for the past three years. Colleagues visit thestalls with great enthusiasm and their response has beenoverwhelming. Each year the amount collected has beenapprox. Rs. 1 lakh and these proceeds have been utilizedfor furthering their goals.• The initiat<strong>iv</strong>e “Let’s Make a Difference in Their Life” waslaunched for the Children from rural and underpr<strong>iv</strong>ilegedareas of Bhugaon near Pune. Under this program we ranthe following act<strong>iv</strong>ities:Chairman Mr. Ravi Pandit distributing Books to childreno A library has been setup in Bhugaon village with around1,000 books in association with Akshar Bharati.o Out of the 939 school kits assembled in 2009, 100School kits have been distributed to these children.• “Sponsor a child from North–East India” — This is a uniqueinitiat<strong>iv</strong>e through which children from these parts of thecountry who belong to economically weaker sections of13

KPIT Cummins Infosystems Limitedthe society are provided education, lodging and boardingin the bigger cities in hostels. KPIT has been supportingthis initiat<strong>iv</strong>e for two consecut<strong>iv</strong>e years. In the first yearwe were able to sponsor 10 children and in the second yearwe have got sponsorships for 15 children staying in Pune.The hostel in Pune ac<strong>com</strong>modates approx. 55 children andKPIT has sponsored the remaining 40 children this year.The sponsorship from KPIT also takes care of the overallmaintenance of the hostel. Our volunteers visit the childsponsored by them and also occasionally take them forpicnics or to their homes.• Being a responsible global corporate citizen we havestood in support of victims of various natural calamities.We appealed to all of our colleagues to make a voluntarydonation for “Karnataka Flood Relief Fund” in October 2009and we have donated Rs.1,31,384/- for this cause.• Nobody can do everything, but everyone can do something.Considering this we have organized various donation dr<strong>iv</strong>eslike Clothes donation, Books donation, Toys donation forwhich we have got a good response. One of the mostsuccessful and sustainable such dr<strong>iv</strong>es has been the “BloodDonation Dr<strong>iv</strong>e”. Once in a quarter we organize a BloodDonation camp in our premises. We are happy to say thatwe donate more than 800 blood bags per year. Due to thegoodwill we have built with the blood banks over these pastfew years, we are today in a position to get blood in caseof emergency for our colleagues and their families on thevery same day with a single phone call.Circles for the children. We have also undertaken otheract<strong>iv</strong>ities like guiding them about various career options,value education, etc. KPIT has also contributed an amountof Rs. 560,000/- towards furthering the goals of Surajya.• The Bangalore Community Initiat<strong>iv</strong>e Team (VCARE):hastaken a <strong>com</strong>mendable step in adopting a Government LowerPrimary School located close to one of our offices. Thisschool houses about 80 students from 1st to 5th standard,most of them hailing from below poverty line families. In anattempt to provide them the basic necessities, the VCAREteam visited the school and identified few areas for whichwe could join hands with the school authorities to providethese children better environment for schooling. Joininghands with Akshaya Patra Foundation, which providesMid Day Meals, VCARE decided to help provide NutritiousFood to these school kids as a first step. On the eve ofChildren’s day VCare, Community Initiat<strong>iv</strong>e BangaloreTeam organized various events and act<strong>iv</strong>ities for thesechildren such as drawing and dance <strong>com</strong>petitions. Classtoppers were felicitated and gifted school bags. Booksfor Library, benches for classrooms, organizing culturalevents, emphasis on sanitation, uniforms and shoes for kids,knowledge sharing act<strong>iv</strong>ities are also some of the otherinitiat<strong>iv</strong>es in the pipeline. The school adoption programhas rece<strong>iv</strong>ed a tremendous response from the Bangalorecolleagues. In addition to this KPIT has contributed anamount of Rs. 3 lakhs towards the recurring expenses of10 schools for children from underpr<strong>iv</strong>ileged sections ofsociety in Bangalore city.KPites @ Blood Donation Dr<strong>iv</strong>e3. Count Me In: We strongly believe, <strong>com</strong>munity initiat<strong>iv</strong>es shouldnot be restricted to just contribution of funds, it must necessarilyinvolve the energies and efforts of people. This Club focuses ondirect involvement of KPites with the underpr<strong>iv</strong>ileged sectionsof society wherein we work closely with NGOs, schools, etc.• Our Chairman Mr. Ravi Pandit released a documentary filmon ‘Aarogya Rakshak’ project (Village Health Workers)which was created entirely by the Theatre and Photographyclub members of KPIT. Our volunteers travelled to remotevillages to understand the background of the movement,its operations and the challenges faced. They interviewedvarious stakeholders of the project such as the founder,doctor, Village Health Workers and villagers. Thisdocumentary is being used by the NGO to create awarenessabout this project in other villages across India. In additionto this a donation of Rs. 35,230/- was made to the NGOinvolved in this project at the launch of the documentary.The fund was raised by way of sale proceeds fromPhotography Exhibition put up by KPites at our premises inOctober, 2008.• In another unique initiat<strong>iv</strong>e a group of 15 highly <strong>com</strong>mittedand enthusiastic KPites have been visiting the slums nearYerawada on every Saturday evening to anchor StudyKPites Bangalore Volunteers @ Muncipal Primary School• In March 10, 55 children from Vijaynagara Govt. School,Bangalore along with their teachers and the VCarevolunteers from Bangalore, visited Jawaharlal NehruPlanetarium and Visvesvaraya Museum. The visit wasorganized by the VCare team.4. Tree dom — This Club works towards creating awareness amongstemployees on environmental issues and taking steps to conservingthe environment.• There are several villages and houses that are still withoutelectricity in India. Villagers use dry wood in large quantitiesto light a fire and this has an adverse impact on theenvironment. KPIT Cummins decided to make a differencein the l<strong>iv</strong>es of some of these villagers. In collaborationwith an NGO “Ecosolutions” we distributed 30 solar lampsin three villages in and around Pune in December, 2009.We have got encouraging reports from the villagers — theyare able to save 50% fuel. We have decided to extend thisinitiat<strong>iv</strong>e to some more homes in this year.• For the past 2 years KPIT celebrates Environment Week onthe occasion of Word Environment Day and g<strong>iv</strong>en below are14

some of the act<strong>iv</strong>ities arranged for the same:o KPIT Green Valley — We have planted 150 samplingson the Baner Hills, which is in the surrounding vicinityof our Pune office. We have adopted the saplings andwill take care of them for next three years.o An Awareness Program on organic farming wasarranged with the help of Maharashtra OrganicFarming Federation (MOFF).o Over 2,000 employees participated in the oath takingfor a cleaner and greener environment that was ledby our Chairman Mr. S. B. (Ravi) Pandit.• “Take as much as you need dr<strong>iv</strong>e” was organized to reducefood wastage in cafeteria. Our colleagues supported theinitiat<strong>iv</strong>e by reducing daily waste from 15 kg to 6 kg.What Beneficiaries say…“I am the only earning member supporting mychildren’s education. Thanks to KPIT today Iam a proud owner of this tea stall that bringsme a monthly in<strong>com</strong>e of Rs. 4,000 and I amable to support my family.” Mrs. Dighe (TeaStall owner)“Ritesh dada has taught us how to speak inEnglish and also tells us nice stories. Speakingin English will help me be<strong>com</strong>e an engineerlike him.” Rahul is one of the students inRitesh’s Class – Teach for India initiat<strong>iv</strong>e“From my early childhood we have haddifficulty seeing objects after the sunset.The only light we had was the fire we usedto cook food and an earthen lamp. This Lamphas more light with which my grandchildrencan do their school work and also read theirstories to me” Kantabai, village woman fromKusarpeth village near Pune, on rece<strong>iv</strong>ing thesolar lamp.“As an NGO we need software support forfulfilling our mission to create awarenessand enhance peoples’ participation on manyissues of c<strong>iv</strong>ic importance. The KPIT team isalways more than willing to help us. The Company has <strong>com</strong>e forwardto support this social cause by developing web-enabled softwarefor participatory budgeting. This platform helped enhancing theparticipation triple fold” Kishori Gadre Director, MCCIA (Janwani).Janwani, is an NGO promoted by MCCIA and is closely associated withKPIT Cummins.Experiences of our volunteers‘I am with KPIT for last 5.5 years. When in India I have worked withthe Surajya Community Initiat<strong>iv</strong>es. It was a great learning and joy towork for the slum around Yerwada. The experience I had with the threeslums is worth mentioning. The kids over there are very energeticAnnual Report 2009-2010and that makes me get involved with them. I had decided to continueworking with Surajya when I got the opportunity to spend time onregular basis on Saturdays and I also enjoy spending any other freetime I get with these children.’…Santosh Sandbhor — Tech Lead (Automot<strong>iv</strong>e)‘Weekly act<strong>iv</strong>ity of spending time with underpr<strong>iv</strong>ileged kids, playingwith them, teaching, sharing good things with them has been anextremely gratifying experience for me. It is like getting back tochildhood. It helps me unwind, release the stress which builds upin the entire week and helps me rejuvenate so as to look forward tothe forth<strong>com</strong>ing week. Plus it has g<strong>iv</strong>en me an insight to the problemsthey are facing, the areas which need improvement and as a responsiblecitizen I feel it is our duty to g<strong>iv</strong>e something back to the society. InitiallyI used to crib about not having certain things, always demanding formore, now I have started counting my blessings. Overall, it has beena fabulous experience till now and I intend to continue’.…Prajakta Kataria — (Software Engineer)“I got a chance to work with Chafekar Trust, Chinchwad, Pune whichinvolved imparting basic <strong>com</strong>puter education to under pr<strong>iv</strong>ilegedstudents of the Chafekar Trust. The glitter in the eyes of those childrenand their aspirations about life, considering the facts such as familybackground, no exposure to <strong>com</strong>puters at all, etc., made me realizethe true potential that was untouched”…Tejas Joshi — (Software Engineer)MetricsAll our initiat<strong>iv</strong>es are Metrics dr<strong>iv</strong>en. We measure the number ofbeneficiaries and the number of colleagues involved in each initiat<strong>iv</strong>e.We aim for achieving an employee involvement which is equal toor greater than 1.5 times of our employee strength in a g<strong>iv</strong>en year.Happy to say that we are consistently achieving this target. Below isthe result of our work.14000120001000080006000400020000Graphical presentation of No. of BeneficiariesV/s Employee envloved13,13711,88010,156668 1772007-20083,0712008-2009No. of beneficiariesNo. of Employees Involved2009-201015

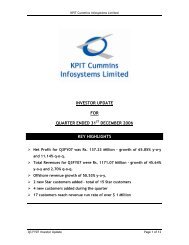

KPIT Cummins Infosystems LimitedDirectors’ reportDear Shareholders,The Directors are pleased to present the Nineteenth Annual Report together with the Audited Accounts of the Company for the Financial Yearended March 31, 2010.Performance of the CompanyParticularsStandalone2009-2010Consolidated2009-2010USDMillionRupeesMillionUSDMillionRupeesMillionTotal Sales and In<strong>com</strong>e 90.19 4,270.45 154.52 7,316.41Total Expenses 62.30 2,949.86 120.42 5,701.97PBDIT 27.89 1,320.58 34.10 1,614.43Profit/(Loss) before Tax (PBT) 19.04 901.73 21.68 1,026.45Profit/(Loss) after Tax (PAT) 16.57 784.50 18.11 857.31Profit Available for appropriation 16.57 784.50 18.11 857.31Result of OperationsThe global meltdown has made a significant impact on the growthof the IT industry and the economy at large and KPIT is no exceptionto this. Revenue growth in the fiscal has declined, with total sales inrevenue terms being <strong>com</strong>parat<strong>iv</strong>ely lower than previous year. Due to theglobal meltdown, like other IT <strong>com</strong>panies, the Company also decidedto shift its onsite operations to offshore. The change in this businessmodel, resulted into a decline in revenues. However the total volumeof business and the number of employees working on the projects haveremained almost same as previous year. The Company has managed tosustain its trend of growth in profits. In light of the same, the resultof operations is reported herein below.Total consolidated revenue for the fiscal year 2009-10 (FY10) wasRs. 7,316.41 Million. Gross Profit and Earnings before depreciation,interest and tax (EBITDA) are Rs.3,225.91 Million and Rs.1,614.43Million, respect<strong>iv</strong>ely. Gross profit margin improved by 0.41% to 44.1% ofthe revenue. Net profit after tax grew by 30.19% to Rs.857.31 Million.The revenues for the year on a consolidated basis in USD terms areUSD 154.52 Million as against USD 174.10 Million during the previousyear. Average realization rate was Rs. 47.35 per US Dollar.Standalone revenue for the fiscal year 2009-10 (FY10) was Rs. 4,270.45Million. Gross profit is at Rs.1,945.55 Million. Net profit after tax grewby 24.98% to Rs.784.50 Million.Transfer to ReservesWe propose to transfer Rs. 79 Million to the General Reserve. Anamount of Rs. 704.21 Million is proposed to be retained in the Profit& Loss Account.D<strong>iv</strong>idendThe Directors are pleased to re<strong>com</strong>mend a d<strong>iv</strong>idend @ 35% (Rs. 0.70)per equity share of face value of Rs. 2/- each on the paid-up equityshare capital of the Company.Share CapitalThe Company allotted 480,080 equity shares of Rs. 2/- each, to theemployees under the ESOP schemes in the financial year 2009-10.The outstanding issued, subscribed and paid-up capital of the Companyas on March 31, 2010 is 78,523,041 shares (of Rs. 2/- each).Manpower StrengthThe Company had 4,918 employees as on March 31, 2010. During theyear there was a net addition of 1,719 employees. The employeestrength increased by 5.9% over the previous year.CRISIL RatingsCRISIL has confirmed the financial credit rating of AA-/ Stable for therevised bank limits of Cash Credit and Term Loan facilities and P1+ forBank Guarantee & Letter of Credit for the Company.QualityThe Company is highly <strong>com</strong>mitted to security standards raised by theIndustry. The Company has been awarded 9001:2008 and 27001:2005certificates by TUV Nord Cert GmbH. for providing SoftwareDevelopment, Product Engineering, Product Support, etc.Institutional HoldingAs on March 31, 2010, the institutional holding in the Company was22.88%. This excludes the following (i) approximately 4.54% held byLB India Holdings Mauritius II Limited, an affiliate of Lehman Brothers,US and its PAC, (ii) approximately 1.98% held by International FinanceCorporation, Washington, and (iii) approximately 1.87% held byCargill Mauritius Limited (CML). Including the aforementioned threeshareholders, total institutional holding as on March 31, 2010 stoodat 31.27%.Information about the Subsidiary CompaniesAs on March 31, 2010 the Company had nine subsidiaries:1. KPIT Infosystems Inc. (KPIT US) was incorporated in 1998, inthe US, for catering to the demand of US based customers. TheCompany holds 100% of the share capital and voting power of KPITUS. KPIT US earned revenues of Rs. 3,483.74 Million (previous yearRs. 4,139.90 Million) and recorded a profit of Rs.12.60 Million(previous year profit of Rs. 40.99 Million) ended on March 31, 2010.2. KPIT Infosystems Limited (KPIT UK) was incorporated in 1996,in UK, for catering the demand of customers based out of UK &Europe. The Company holds 100% of the share capital and votingpower of KPIT UK. During the year, KPIT UK has earned revenuesof Rs. 872.60 Million (previous year Rs. 1,170.40 Million) andregistered a loss of Rs.6.64 Million (previous year profit of Rs.9.53 Million).3. KPIT Cummins Global Business Solutions Limited (KPIT GBS)was incorporated in 2005 as a wholly owned subsidiary of theCompany in India for rendering business process outsourcingand other business solutions. KPIT GBS specializes in providingBPO/KPO services and consulting in Governance & RegulatoryCompliance. KPIT GBS reported a profit of Rs. 145.66 Millionfor the year ended March 31, 2010 (previous year a loss of Rs.74.41 Million) on revenues of Rs. 516.64 Million (previous yearRs. 486.40 Million).16

4. KPIT Infosystems GmbH (KPIT Germany) was added as a step downsubsidiary in 2005. In the financial year 2009-10, KPIT UK acquiredthe balance shareholding of 40% in KPIT Germany. KPIT Germanyis now a 100% subsidiary of KPIT UK. This subsidiary is <strong>com</strong>pletelyfocused on huge automot<strong>iv</strong>e market in Germany to expand ourcustomer base in this segment with a vision to be<strong>com</strong>e No. 1global product engineering partner to the automot<strong>iv</strong>e industry.KPIT Germany reported a loss of Rs. 18.04 Million for the yearended March 31, 2010 (previous year a profit of Rs. 5.49 Million)on revenues of Rs. 503.44 Million (previous year Rs. 651.97 Million).5. KPIT Infosystems Inc. [a.k.a. SolvCentral.<strong>com</strong> Inc.] (SolvCentral),based in US was added as a step down subsidiary in 2005when KPIT US acquired 90% of its shares. In the financial year2009-10, KPIT US acquired the balance shareholding of 10% inSolvCentral. SolvCentral is now a 100% subsidiary of KPIT US.SolvCentral is focused in the Business Intelligence (BI) space inthe US market. SolvCentral reported a loss of Rs. 0.66 Millionduring the year ended March 31, 2010 (previous year loss ofRs. 3.54 Million) with revenues of Rs. 128.90 Million (previousyear Rs. 187.52 Million).6. KPIT Infosystems France SAS (KPIT France) was formerly knownas P<strong>iv</strong>olis. KPIT France has provided direct presence in Francewhich is an important market in European region from KPIT’sgrowth perspect<strong>iv</strong>e. In the Financial year 2009-10 KPIT Francereported a profit of Rs. 6.13 Million during the year (Previous yeara profit of Rs. 12.64 Million) with revenues of Rs. 341.97 Million(previous year Rs. 345.96 Million).7. KPIT Infosystems Central Europe Sp.z o.o., (KPIT Poland),was promoted by the Company as its wholly owned subsidiaryin Poland in August 2006. KPIT Poland is providing near shorecentre to the customers based out of Europe, who are lookingforward to outsourcing from India based service providers. KPITPoland reported a loss of Rs. 5.52 Million during the year endedMarch 31, 2010 (previous year loss of Rs. 23.26 Million) onrevenues of Rs. 33.15 Million (previous year Rs. 55.73 Million).8. Sparta Consulting Inc. (Sparta Inc.) merged into KPIT US onOctober 30, 2009 and is now a wholly owned subsidiary of KPIT US.The total consideration for merger of Sparta Inc., with KPIT US isupto USD 38 Million to be paid in a phased manner. Sparta Inc., aCalifornia, US-based <strong>com</strong>pany and a leading provider of high endSAP solutions is one of the fastest growing SAP consultancies inNorth America. With the merger of Sparta Inc., the Company’sbusiness model will be further strengthened to focus more onselect industries like Automot<strong>iv</strong>e and Industrials and achievemarket leadership by creating best in class SAP practice. It wouldalso help leverage the Company’s global presence especially inEurope and Asia Pacific.9. Sparta Infotech India Pr<strong>iv</strong>ate Limited (Sparta India), was asubsidiary of Sparta Inc. Consequent to the merger for Sparta Inc.,with KPIT US, Sparta India is now a subsidiary of KPIT US. SpartaIndia was incorporated to cater Sparta’s India based clientele.Sparta Inc. (consolidated) reported a profit of Rs. 29.85 Millionduring the period ended March 31, 2010 on revenues of Rs. 578.70Million. (Sparta’s figures of revenue and Profit have been taken intoconsideration for post-merger period i.e. after October 30, 2009till March 31, 2010)Particulars required as per Section 212 of the Companies Act, 1956As per Section 212 of the Companies Act, 1956, we are requiredto attach the Directors’ Report, Balance Sheet and Profit and LossAccount of all the above subsidiaries. The Company had applied to theGovernment of India for an exemption from such attachment as wepresent the audited consolidated financial statements in the annualreport. We believe that consolidated financial statements present a fulland fair picture of the state of affairs and the financial condition of aAnnual Report 2009-2010<strong>com</strong>pany, and are accepted globally. Government of India has grantedus an exemption from <strong>com</strong>plying with Section 212(8) vide its letterdated March 17, 2010. Accordingly, this annual report does not containthe financial statements of these subsidiaries. Statement pursuant toSection 212 of the Companies Act, 1956, is g<strong>iv</strong>en elsewhere in thisAnnual Report. The Company will make available the audited annualaccounts and related detailed information of the subsidiary <strong>com</strong>panies,where applicable, upon request by any member of the Company. TheCompany will also upload the accounts of the ind<strong>iv</strong>idual subsidiarieson its official website. These documents will also be available forinspection during business hours at our registered office.DirectorsPursuant to Article 72 of the Articles of Association of the Companyread with Section 256 of the Companies Act, 1956, Mr. Anant Talaulicar,Mr. Amit Kalyani and Dr. Srikant Datar retire by rotation at the ensuingAnnual General Meeting and, being eligible, offer themselves forre-appointment.Mr. Girish Wardadkar was re-appointed as the President & Execut<strong>iv</strong>eDirector of the Company for a further period of f<strong>iv</strong>e years with effectfrom January 19, 2010. Mr. Girish Wardadkar’s re-appointment asPresident & Execut<strong>iv</strong>e Director is subject to the approval of themembers of the Company in general meeting. A detailed profile ofMr. Girish Wardadkar forms part of the notice of this ensuing meeting,which is attached with this Annual Report.Mr. K. V. Krishnamurthy resigned from the directorship of the Companywith effect from January 18, 2010. The Company has immenselybenefitted from the expert professional guidance of Mr. K. V.Krishnamurthy. The Board places on record its sincere appreciationfor all the help and guidance provided by him.AuditorsThe Statutory Auditors, M/s. Deloitte Haskins & Sells, CharteredAccountants, retire at the ensuing Annual General Meeting and haveconfirmed their eligibility and willingness to accept the office, ifre-appointed.Corporate GovernanceA separate section on Corporate Governance with a detailed<strong>com</strong>pliance report thereon is annexed to this annual report. TheAuditors’ Certificate in respect of <strong>com</strong>pliance with the provisionsconcerning Corporate Governance, as required by Clause 49 of theListing Agreement, is also annexed.Management Discussion and AnalysisA detailed review of the operations, performance and future outlookof the Company and its business is g<strong>iv</strong>en in the Management Discussionand Analysis, which forms a part of this Report.Responsibility Statement of the Board of DirectorsPursuant to Section 217(2AA) of the Companies Act, 1956 your Directorsconfirm that:i) in the preparation of the accounts for the financial year endedMarch 31, 2010, the applicable accounting standards have beenfollowed and there has been no material departure;ii) the Directors have selected such accounting policies andapplied them consistently and made judgements and estimatesthat were reasonable and prudent so as to g<strong>iv</strong>e true and fairview of the state of affairs of the Company at the end of thesaid financial year and of the profit of the Company for thesaid financial year;iii) the Directors have taken proper and sufficient care for themaintenance of adequate accounting records in accordancewith the provisions of Companies Act, 1956 for safeguarding the<strong>assets</strong> of the Company and for preventing and detecting fraud17