721.8 kB - Poledna | Boss | Kurer

721.8 kB - Poledna | Boss | Kurer

721.8 kB - Poledna | Boss | Kurer

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

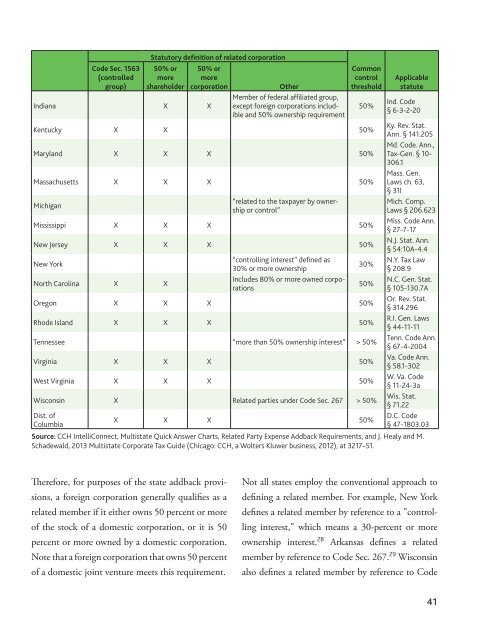

Code Sec. 1563(controlledgroup)Statutory definition of related corporation50% ormoreshareholder50% ormorecorporationIndiana X XOtherMember of federal affiliated group,except foreign corporations includibleand 50% ownership requirementCommoncontrolthresholdKentucky X X 50%Maryland X X X 50%Massachusetts X X X 50%Michigan“related to the taxpayer by ownershipor control”Mississippi X X X 50%New Jersey X X X 50%New YorkNorth Carolina X X“controlling interest” defined as30% or more ownershipIncludes 80% or more owned corporationsOregon X X X 50%Rhode Island X X X 50%Tennessee “more than 50% ownership interest” > 50%Virginia X X X 50%West Virginia X X X 50%Wisconsin X Related parties under Code Sec. 267 > 50%Dist. ofColumbia50%30%50%X X X 50%ApplicablestatuteInd. Code§ 6-3-2-20Ky. Rev. Stat.Ann. § 141.205Md. Code. Ann.,Tax-Gen. § 10-306.1Mass. Gen.Laws ch. 63,§ 31IMich. Comp.Laws § 206.623Miss. Code Ann.§ 27-7-17N.J. Stat. Ann.§ 54:10A-4.4N.Y. Tax Law§ 208.9N.C. Gen. Stat.§ 105-130.7AOr. Rev. Stat.§ 314.296R.I. Gen. Laws§ 44-11-11Tenn. Code Ann.§ 67-4-2004Va. Code Ann.§ 58.1-302W. Va. Code§ 11-24-3aWis. Stat.§ 71.22D.C. Code§ 47-1803.03Source: CCH IntelliConnect, Multistate Quick Answer Charts, Related Party Expense Addback Requirements; and J. Healy and M.Schadewald, 2013 Multistate Corporate Tax Guide (Chicago: CCH, a Wolters Kluwer business, 2012), at 3217–51.Therefore, for purposes of the state addback provisions,a foreign corporation generally qualifies as arelated member if it either owns 50 percent or moreof the stock of a domestic corporation, or it is 50percent or more owned by a domestic corporation.Note that a foreign corporation that owns 50 percentof a domestic joint venture meets this requirement.Not all states employ the conventional approach todefining a related member. For example, New Yorkdefines a related member by reference to a "controllinginterest," which means a 30-percent or moreownership interest. 28 Arkansas defines a relatedmember by reference to Code Sec. 267 . 29 Wisconsinalso defines a related member by reference to Code41