Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Mandarin Oriental International Limited - Mandarin Oriental Hotel ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Page 18<br />

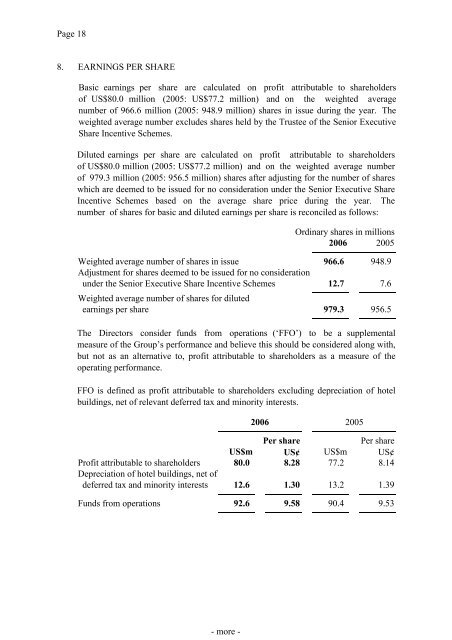

8. EARNINGS PER SHARE<br />

Basic earnings per share are calculated on profit attributable to shareholders<br />

of US$80.0 million (2005: US$77.2 million) and on the weighted average<br />

number of 966.6 million (2005: 948.9 million) shares in issue during the year. The<br />

weighted average number excludes shares held by the Trustee of the Senior Executive<br />

Share Incentive Schemes.<br />

Diluted earnings per share are calculated on profit attributable to shareholders<br />

of US$80.0 million (2005: US$77.2 million) and on the weighted average number<br />

of 979.3 million (2005: 956.5 million) shares after adjusting for the number of shares<br />

which are deemed to be issued for no consideration under the Senior Executive Share<br />

Incentive Schemes based on the average share price during the year. The<br />

number of shares for basic and diluted earnings per share is reconciled as follows:<br />

Ordinary shares in millions<br />

2006 2005<br />

Weighted average number of shares in issue 966.6<br />

Adjustment for shares deemed to be issued for no consideration<br />

under the Senior Executive Share Incentive Schemes 12.7<br />

Weighted average number of shares for diluted<br />

earnings per share 979.3<br />

948.9<br />

7.6<br />

956.5<br />

The Directors consider funds from operations (‘FFO’) to be a supplemental<br />

measure of the Group’s performance and believe this should be considered along with,<br />

but not as an alternative to, profit attributable to shareholders as a measure of the<br />

operating performance.<br />

FFO is defined as profit attributable to shareholders excluding depreciation of hotel<br />

buildings, net of relevant deferred tax and minority interests.<br />

Per share Per share<br />

US$m US¢ US$m US¢<br />

Profit attributable to shareholders<br />

Depreciation of hotel buildings, net of<br />

80.0 8.28 77.2 8.14<br />

deferred tax and minority interests 12.6 1.30 13.2 1.39<br />

Funds from operations 92.6<br />

- more -<br />

2006 2005<br />

9.58 90.4<br />

9.53