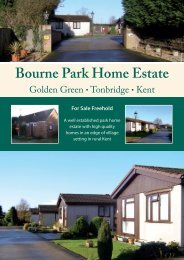

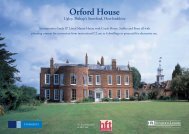

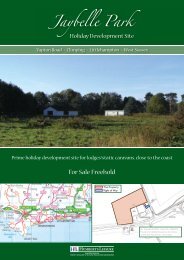

Featured property - HLL Humberts Leisure

Featured property - HLL Humberts Leisure

Featured property - HLL Humberts Leisure

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Brigid Simmonds | The year aheadBrigid Simmonds OBE,the highly respected ChiefExecutive of BusinessIn Sport and <strong>Leisure</strong>considers the year aheadfor <strong>HLL</strong> clients...Politically it would seem that we are in abit of a vacuum. Lack of decision makingat the highest levels while we wait forthe new broom of Gordon Brown? TheConservative and Liberal Democrat partiesare both consulting on tourism strategiesand there is that whiff of change, perhapsin the spring.From the <strong>property</strong> perspective however,there are a range of policies awaitingfurther consultation which will impact onindividual businesses and our market in2007. Business In Sport and <strong>Leisure</strong> (BISL),an umbrella organisation for the sport,leisure and hospitality industry who’smembership is a ‘who’s who’ of our sectorhas an eye on them all, but I thought Iwould use this opportunity to considertwo policies in more detail; the PlanningGain Supplement and the Barker Review ofland-use planning.The Planning Gain Supplement (PGS): a development tax – nothingnew in this; it has been tried twice before and on neither occasiondid it work! This one is slightly different in that it was proposedby Kate Barker (member of the Bank of England Monetary Paneland now author of two reports for Government, one lookingat housing and the most recent one on planning) as a way ofcapturing for the Treasury some of the uplift in <strong>property</strong> valuewhen planning permission was obtained. A shortage of housing,particularly in the South East of England; land acquired at little orno cost (we all wish!) but when planning permission is granted,the value of the land is much higher and the housing developertakes more of the profit. There is potentially some argument inthis theory for housing, but it become much more of a seriousissue when applied to the rest of the industry.Over the summer there were lots of rumours that theGovernment had dropped the proposal in favour of a ‘roof tax’which has been very successful in Milton Keynes. The Treasury hashowever ploughed on regardless and although many organisationsincluding the RICS and CBI have made it clear they oppose theproposal, we now have another four consultation papers on theintroduction of PGS.BISL gave written and oral evidence to the Communities and LocalGovernment Select Committee who examined PGS. We pointedout that this tax was going to be complicated. It will need anarmy of valuers to work out how much has to be paid and thenon what basis is the valuation made. What about ‘hope value’?Is it based on what you paid for it or what you hoped it might beworth when you paid for it? An equally serious question is thatif Local Authorities are going to be the main beneficiary of thePlanning Gain Supplement they will be keen to attract the sort14 Spring 2007