GFFS Consolidated w.o PSE Letter - 7-Eleven

GFFS Consolidated w.o PSE Letter - 7-Eleven

GFFS Consolidated w.o PSE Letter - 7-Eleven

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COVER SHEETPHILIPPINE SEVEN CORPORATION(Company’s Full Name)7 th Floor, The Columbia TowerOrtigas Avenue, Mandaluyong City(Company’s Address: No. Street City/Town/Province)724-4441 to 51(Company’s Telephone Number)December 31(Fiscal Year Ending)(Month & Day)Every 3 rd Thursday of July of each year(Annual Meeting)GENERAL FORM FOR FINANCIAL STATEMENTS (CONSO)(<strong>GFFS</strong>)(FORM TYPE)April 15, 2010(Date)(Amendment Designation if Applicable)__________________________________________(Secondary License Type, if any)_________________LCU__________________Cashier_________________DTU108476S.E.C. Reg. No.___________________Central Receiving Unit_________________File Number_________________Document I.D.

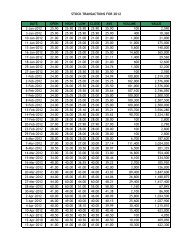

GENERAL FORM FOR FINANCIAL STATEMENTSNAME OF CORPORATION:PHILIPPINE SEVEN CORPORATION AND SUBSIDIARIESCURRENT ADDRESS:TEL. NO.: 705-52-00 FAX NO.: 705-52-62COMPANY TYPE : RETAILER PSIC:Control No.:7TH FLOOR THE COLUMBIA TOWER, ORTIGAS AVENUE, MANDALUYONG CITYIf these are based on consolidated financial statements, please so indicate in the caption.F I N A N C I A L D A T ATable 1. Balance SheetForm Type: <strong>GFFS</strong> (rev 2006)2009 2008( in P'000 ) ( in P'000 )A. ASSETS (A.1 + A.2 + A.3 + A.4 + A.5 + A.6 + A.7 + A.8 + A.9 + A.10) 2,710,676.00 2,269,797.00A.1 Current Assets (A.1.1 + A.1.2 + A.1.3 + A.1.4 + A.1.5) 1,179,007.00 923,849.00A.1.1 Cash and cash equivalents (A.1.1.1 + A.1.1.2 + A.1.1.3) 448,831.00 314,880.00A.1.1.1 On hand 92,750.00 196,813.00A.1.1.2 In domestic banks/entities 356,081.00 118,067.00A.1.1.3 In foreign banks/entitiesA.1.2 Trade and Other Receivables (A.1.2.1 + A.1.2.2) 140,140.00 151,466.00A.1.2.1 Due from domestic entities (A.1.2.1.1 + A.1.2.1.2 + A.1.2.1.3 +140,140.00 151,466.00A.1.2.2A.1.2.1.4)A.1.2.1.1 Due from customers (trade) 69,279.00 61,651.00A.1.2.1.2 Due from related parties 50,439.00 76,989.00A.1.2.1.3 Others, specify (A.1.2.1.3.1+A.1.2.1.3.2) 31,266.00 21,566.00A.1.2.1.3.1 Other receivables 31,266.00 21,566.00A.1.2.1.3.2A.1.2.1.4 Allowance for doubtful accounts (negative(10,844.00) (8,740.00)entry)Due from foreign entities, specify(A.1.3.2.1 + A.1.3.2.2 + A.1.3.2.3 + A.1.3.2.4)A.1.2.2.1A.1.2.2.2A.1.2.2.3A.1.2.2.4Allowance for doubtful accounts (negativeentry)A.1.3 Inventories (A.1.3.1 + A.1.3.2 + A.1.3.3 + A.1.3.4 + A.1.3.5 + A.1.3.6) 415,653.00 339,556.00A.1.3.1 Raw materials and suppliesA.1.4A.1.3.2 Goods in process (including unfinished goods, growing crops,unfinished seeds)A.1.3.3 Finished goods 415,653.00 339,556.00A.1.3.4 Merchandise/Goods in transitA.1.3.5 Unbilled Services (in case of service providers)A.1.3.6 Others, specify (A.1.3.6.1+A.1.3.6.2)A.1.3.6.1A.1.3.6.2Financial Assets other than Cash/Receivables/Equity investments (A.1.4.1+ A.1.4.2 + A.1.4.3 + A.1.4.4+A.1.4.5+A.1.4.6)A.1.4.1 Financial Assets at Fair Value through Profit or Loss - issued bydomestic entities (A.1.4.1.1 + A.1.4.1.2 + A.1.4.1.3 + A.1.4.1.4 +A.1.4.1.5)A.1.4.1.1 National GovernmentA.1.4.1.2 Public Financial InstitutionsA.1.4.1.3 Public Non-Financial InstitutionsA.1.4.1.4 Private Financial InstitutionsA.1.4.1.5 Private Non-Financial InstitutionsA.1.4.2 Held to Maturity Investments - issued by domestic entities(A.1.4.2.1 + A.1.4.2.2 + A.1.4.2.3 + A.1.4.2.4 + A.1.4.2.5)A.1.4.2.1 National GovernmentA.1.4.2.2 Public Financial InstitutionsA.1.4.2.3 Public Non-Financial InstitutionsA.1.4.2.4 Private Financial InstitutionsA.1.4.2.5 Private Non-Financial InstitutionsNOTE:This general form is applicable to companies engaged in Agriculture, Fishery, Forestry, Mining, and Quarrying, Manufacturing, Electricity, Gas and Water, Construction, Wholesaleand Retail Trade, Transportation, Storage and Communications, Hotels and Restaurants, Real Estate, Community, Social and Personal Services, other forms of production, and generalbusiness operations. This form is also applicable to other companies that do not have industry-specific Special Forms. Special forms shall be used by publicly-held companies andthose engaged in non-bank financial intermediation activities, credit granting, and activities auxiliary to financial intermediation, which require secondary license from SEC.Domestic corporations are those which are incorporated under Philippine laws or branches/subsidiaries of foreign corporations that are licensed to do business in the Philippineswhere the center of economic interest or activity is within the Philippines. On the other hand, foreign corporations are those that are incorporated abroad, including branches ofPhilippine corporations operating abroad.Financial Institutions are corporations principally engaged in financial intermediation, facilitating financial intermediation, or auxiliary financial services. Non-Financial institutionsrefer to corporations that are primarily engaged in the production of market goods and non-financial services.

Control No.:GENERAL FORM FOR FINANCIAL STATEMENTSNAME OF CORPORATION:PHILIPPINE SEVEN CORPORATION AND SUBSIDIARIESCURRENT ADDRESS:7TH FLOOR THE COLUMBIA TOWER, ORTIGAS AVENUE, MANDALUYONG CITYTEL. NO.: 705-52-00 FAX NO.: 705-52-62COMPANY TYPE : RETAILER PSIC:If these are based on consolidated financial statements, please so indicate in the caption.Form Type: <strong>GFFS</strong> (rev 2006)Table 2. Income Statement2009 2008F I N A N C I A L D A T A( in P'000 ) ( in P'000 )A. REVENUE / INCOME (A.1 + A.2 + A.3) 6,679,988.00 5,868,381.00A.1 Net Sales or Revenue / Receipts from Operations (manufacturing, mining,utilities, trade, services, etc.) (fromPrimary Activity)A.2 Share in the Profit or Loss of Associates and Joint Ventures accounted for using the Equity Method6,033,322.00 5,412,969.00A.3 Other Revenue (A.3.1 + A.3.2 + A.3.3 + A.3.4 + A.3.5) 642,311.00 452,825.00A.3.1 Rental Income from Land and Buildings 52,265.00 36,502.00A.3.2A.3.3Receipts from Sale of Merchandise (trading) (from Secondary Activity)Sale of Real Estate or other Property and EquipmentA.3.4 Royalties, Franchise Fees, Copyrights (books, films, records, etc.) 303,815.00 250,856.00A.3.5 Others, specify (A.3.5.1 + A.3.5.2 + A.3.5.3 + A.3.5.4 + A.3.5.5 +286,231.00 165,467.00A.3.5.6 + A.3.5.7)A.3.5.1 Rental Income, EquipmentA.3.5.2 Commission on services 22,131.00 21,214.00A.3.5.3 Marketing income 236,503.00 136,211.00A.3.5.4 Others, net 27,597.00 8,042.00A.3.5.5A.3.5.6A.3.5.7A.4 Other Income (non-operating) (A.4.1 + A.4.2 + A.4.3 + A.4.4) 4,355.00 2,587.00A.4.1 Interest Income 4,840.00 4,187.00A.4.2Dividend IncomeA.4.3 Gain / (Loss) from selling of Assets, specify0.00 (891.00)(A.4.3.1 + A.4.3.2 + A.4.3.3 + A.4.3.4 + A.4.3.5 + A.4.3.6 + A.4.3.7)A.4.3.1 Loss on sale of property 0.00 (891.00)A.4.3.2A.4.3.3A.4.3.4A.4.4 Gain / (Loss) on Foreign Exchange (A.4.4.1 + A.4.4.2 + A.4.4.3 + A.4.4.4) (485.00) (709.00)A.4.4.1 (485.00) (709.00)A.4.4.2A.4.4.3A.4.4.4B. COST OF GOODS SOLD (B.1 + B.2 + B.3)B.1 Cost of Goods Manufactured (B.1.1 + B.1.2 + B.1.3 + B.1.4 + B.1.5)B.1.1B.1.2B.1.3B.1.4B.1.5Direct Material UsedDirect LaborOther Manufacturing Cost / OverheadGoods in Process, BeginningGoods in Process, End (negative entry)B.2 Finished Goods, BeginningB.3 Finished Goods, End (negative entry)C. COST OF SALES (C.1 + C.2 + C.3) 4,371,715.00 3,909,887.00C.1 Purchases 4,447,812.00 3,925,469.00C.2 Merchandise Inventory, Beginning 339,556.00 323,974.00C.3 Merchandise Inventory, End (negative entry) (415,653.00) (339,556.00)D. COST OF SERVICES, SPECIFY (D.1 + D.2 + D.3 + D.4 + D.5 + D.6)D.1D.2D.3D.4D.5D.6

Control No.:Form Type: <strong>GFFS</strong> (rev 2006)GENERAL FORM FOR FINANCIAL STATEMENTSNAME OF CORPORATION:CURRENT ADDRESS:PHILIPPINE SEVEN CORPORATION AND SUBSIDIARIES7TH FLOOR THE COLUMBIA TOWER, ORTIGAS AVENUE, MANDALUYONGCITYTEL. NO.: 705-52-00 FAX NO.: 705-52-62COMPANY TYPE : RETAILER PSIC:If these are based on consolidated financial statements, please so indicate in the caption.F I N A N C I A L D A T ATable 2. Income StatementE. OTHER DIRECT COSTS, SPECIFY (E.1 + E.2 + E.3 + E.4 + E.5 + E.6)E.1E.2E.3E.4E.5E.62009 2008( in P'000 ) ( in P'000 )F. GROSS PROFIT (A - B - C - D - E) 2,308,273.00 1,958,494.00G. OPERATING EXPENSES (G.1 + G.2 + G.3 + G.4) 2,050,959.00 1,788,433.00G.1 Selling or Marketing ExpensesG.2 Administrative ExpensesG.3 General ExpensesG.4 Other Expenses, specify (G.4.1 + G.4.2 + G.4.3 + G.4.4 + G.4.5 + G.4.6) 2,050,959.00 1,788,433.00G.4.1Education-related expendituresG.4.2 Store operations 2,050,959.00 1,788,433.00G.4.3G.4.4G.4.5G.4.6H. FINANCE COSTS 26,483.00 25,333.00I. NET INCOME (LOSS) BEFORE TAX ( F - G - H) 230,831.00 144,728.00J. INCOME TAX EXPENSE (negative entry) (75,040.00) (60,456.00)K. INCOME AFTER TAX 155,791.00 84,272.00L. Amount of (i) Post-Tax Profit or Loss of Discontinued Operations; and (ii) Post-Tax Gainor Loss Recognized on theMeasurement of Fair Value less Cost to Sell or on the Disposalof the Assets or Disposal Group(s) constituting the Discontinued Operation (if any)L.1L.2M. Profit or Loss Attributable to Minority InterestN. Profit or Loss Attributable to Equity Holders of the Parent 155,791.00 84,272.00

Control No.:Form Type: <strong>GFFS</strong> (rev 2006)GENERAL FORM FOR FINANCIAL STATEMENTSNAME OF CORPORATION:PHILIPPINE SEVEN CORPORATION AND SUBSIDIARIESCURRENT ADDRESS:7TH FLOOR THE COLUMBIA TOWER, ORTIGAS AVENUE, MANDALUYONG CITYTEL. NO.: 705-52-00 FAX NO.: 705-52-62COMPANY TYPE :PSIC:If these are based on consolidated financial statements, please so indicate in the caption.Table 3. Cash Flow StatementsF I N A N C I A L D A T A2009 2008( in P'000 ) ( in P'000 )CASH FLOWS FROM OPERATING ACTIVITIESNet Income (Loss) Before Tax and Extraordinary Items 230,831.00 144,728.00Adjustments to Reconcile Net Income to Net Cash Provided by Operating ActivitiesDepreciation 203,906.00 179,639.00Amortization, specify: Amortization of software 3,054.00 2,105.00Amortization of Deferred Lease 1,476.00 1,902.00Amortization of Deferred Revenue on Finance Lease (1,310.00) (1,310.00)Amortization of Deferred Revenue on Exclusivity Contract (3,914.00) 0.00Others, specify: Provision for Doubtful Accounts 9,798.00 7,070.00Impairment of Goodwill 0.00 4,611.00Loss on Sale of Property & Equipment 0.00 891.00Loss on Typhoon Damages 3,285.00 0.00Interest Expense (Net) 21,644.00 21,146.00Write-down of Property, Plant, and EquipmentChanges in Assets and Liabilities:Decrease (Increase) in:Receivables 1,646.00 (78,402.00)Inventories (76,096.00) (15,583.00)Other Current Assets (56,530.00) (51,262.00)Others,specify:Increase (Decrease) in:Trade and Other Payables 180,338.00 264,265.00Income Taxes Paid (68,855.00) (39,568.00)Others,specify: Interest Received 3,138.00 2,181.00Other current liabilities 68,451.00 53,937.00Net pension 19,839.00 5,712.00A. Net Cash Provided by (Used in) Operating Activities (sum of above rows) 540,701.00 502,062.00CASH FLOWS FROM INVESTING ACTIVITIES(Increase) Decrease in Long-Term Receivables(Increase) Decrease in InvestmentReductions/(Additions) to Property, Plant, and Equipment (362,394.00) (415,096.00)Others, specify: Proceeds from sale of property & equipment 0.00 14,983.00Additions to Software and other programs costs (286.00) (6,788.00)Collection of Lease Receivable 2,783.00 2,888.00Deposits and other noncurrent assets (29,598.00) (22,184.00)B. Net Cash Provided by (Used in) Investing Activities (sum of above rows) (389,495.00) (426,197.00)CASH FLOWS FROM FINANCING ACTIVITIESProceeds from:Loans 510,000.00 40,000.00Long-term DebtIssuance of SecuritiesOthers, specify:Payments of:(Loans) (500,000.00) (85,000.00)(Long-term Debt) 0.00 0.00(Stock Subscriptions)Others, specify (negative entry):Effect of exchange rate on cash & equivalents for the yearInterest Paid (27,255.00) (24,859.00)C. Net Cash Provided by (Used in) Financing Activities (sum of above rows) (17,255.00) (69,859.00)NET INCREASE IN CASH AND CASH EQUIVALENTS (A + B + C) 133,951.00 6,006.00Cash and Cash EquivalentsBeginning of year 314,880.00 308,874.00End of year 448,831.00 314,880.00

Control No.:Form Type: <strong>GFFS</strong> (rev 2006)GENERAL FORM FOR FINANCIAL STATEMENTSNAME OF CORPORATION:PHILIPPINE SEVEN CORPORATION AND SUBSIDIARIESCURRENT ADDRESS:7TH FLOOR THE COLUMBIA TOWER, ORTIGAS AVENUE, MANDALUYONG CITYTEL. NO.: 705-52-42 FAX NO.: 705-52-62COMPANY TYPE : RETAIL PSIC:If these are based on consolidated financial statements, please so indicate in the caption.Table 4. Statement of Changes in Equity(Amount in P'000)Unrealized gain onF I N A N C I A L D A T ACapital StockAdditional Paid-in available-for-sale RevaluationCapitalfinancial assets during IncrementTreasury Stocks Retained Earnings TOTALthe yearBalance, 2006 237,938.00 293,525.00 0.00 (2,923.00) 81,242.00 609,782.00A.A.1 Correction of Error(s)A.2 Changes in AccountingPolicyB.C.Restated Balance 237,938.00 293,525.00 0.00 0.00 (2,923.00) 81,242.00 609,782.00SurplusC.1 Surplus (Deficit) onRevaluation of PropertiesC.2 Surplus (Deficit) onRevaluation of InvestmentsC.3 Currency TranslationDifferencesC.4 Other Surplus (specify)2,999.00 2,999.00C.4.1 AppraisalIncrease invalue of landD. Net Income (Loss) for the Period 54,828.00 54,828.00E. Dividends (negative entry)F. Appropriation for (specify)F.1G. Issuance of Capital StockG.1 Common StockG.2 Preferred StockG.3 OthersH. Unrealized gain on available-for-sale0.00financial assets during the yearI. Balance, 2007 237,938.00 293,525.00 0.00 2,999.00 (2,923.00) 136,070.00 667,609.00I.1 Correction of Error (s)I.2 Changes in AccountingPolicyJ. Restated BalanceK. SurplusK.1 Surplus (Deficit) on0.00Revaluation of PropertiesK.2 Surplus (Deficit) onRevaluation of InvestmentsK.3 Currency TranslationDifferencesK.4 Other Surplus (specify)K.4.1L. Effect of change in tax rate in 2009 231.00 231.00M. Net Income (Loss) for the Period 84,272.00 84,272.00N. Dividends (negative entry)O. Appropriation for (specify)N.1P. Issuance of Capital StockO.1 Common StockO.2 Preferred StockO.3 Others - Stock Dividends 23,725.00 (23,725.00) 0.00Q. Balance, 2008 261,663.00 293,525.00 0.00 3,230.00 (2,923.00) 196,617.00 752,112.00R. Net Income (Loss) for the Period 155,791.00 155,791.00S. Issuance of Capital StockO.1 Common StockO.2 Preferred StockO.3 Others - Stock Dividends 26,098.00 (26,098.00) 0.00T. Balance, 2009 287,761.00 293,525.00 0.00 3,230.00 (2,923.00) 326,310.00 907,903.00

Control No.:Form Type: <strong>GFFS</strong> (rev. 2006)GENERAL FORM FOR FINANCIAL STATEMENTSNAME OF CORPORATION:CURRENT ADDRESS:PHILIPPINE SEVEN CORPORATION AND SUBSIDIARIES7TH FLOOR THE COLUMBIA TOWER, ORTIGAS AVENUE, MANDALUYONG CITYTEL. NO.: 705-52-42 FAX NO.: 705-52-62COMPANY TYPE : RETAIL PSIC:If these are based on consolidated financial statements, please so indicate in the caption.A.Table 5. Details of Income and Expenses, by source(applicable to corporations transacting with foreign corporations/entities)2009 2009F I N A N C I A L D A T A( in P'000 ) ( in P'000 )REVENUE / INCOME (A.1 + A.2) 6,688,562.00 5,879,928.00A.1 Net Sales or Revenue / Receipts from Operations (manufacturing, mining,utilities, trade, 6,033,322.00 5,412,969.00services, etc.) (from Primary Activity) (A.1.1 +A.1.2)A.1.1 Domestic 6,033,322.00 5,412,969.00A.1.2 ForeignA.2 Other Revenue (A.2.1 +A.2.2) 655,240.00 466,959.00A.2.1 Domestic 655,240.00 466,959.00A.2.2 Foreign, specify (A.2.2.1+A.2.2.2+ A.2.2.3+ A.2.2.4+ A.2.2.5+A.2.2.6+A.2.2.7+ A.2.2.8+A.2.2.9+A.2.2.10)A.2.2.1A.2.2.2A.2.2.3A.2.2.4A.2.2.5A.2.2.6A.2.2.7A.2.2.8A.2.2.9A.2.2.10B. EXPENSES (B.1 + B.2) 6,532,771.00 5,795,656.00B.1 Domestic 6,532,771.00 5,795,656.00B.2 Foreign, specify (B.2.1+B.2.2+B.2.3+B.2.4+B.2.5+B.2.6+B.2.7+B.2.8+B.2.9+B.2.10)B.2.1B.2.2B.2.3B.2.4B.2.5B.2.6B.2.7B.2.8B.2.9B.2.10