Manugraph India Ltd. (MIL) ` 52.5 (12/07/12)

Manugraph India Ltd. (MIL) ` 52.5 (12/07/12)

Manugraph India Ltd. (MIL) ` 52.5 (12/07/12)

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

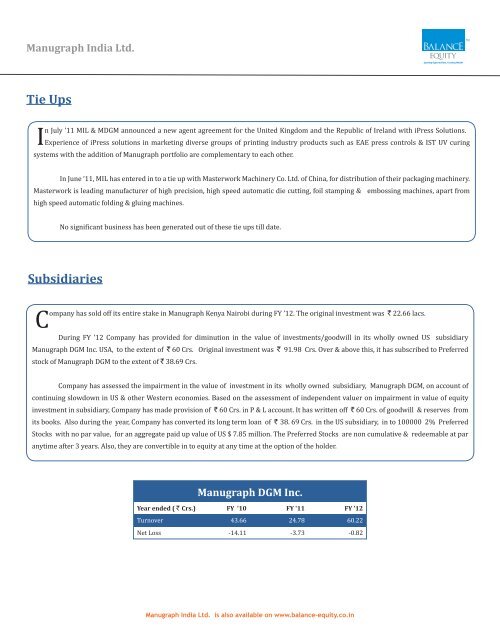

<strong>Manugraph</strong> <strong>India</strong> <strong>Ltd</strong>.TMTie UpsIn July ’11 <strong>MIL</strong> & MDGM announced a new agent agreement for the United Kingdom and the Republic of Ireland with iPress Solutions.Experience of iPress solutions in marketing diverse groups of printing industry products such as EAE press controls & IST UV curingsystems with the addition of <strong>Manugraph</strong> portfolio are complementary to each other.In June ‘11, <strong>MIL</strong> has entered in to a tie up with Masterwork Machinery Co. <strong>Ltd</strong>. of China, for distribution of their packaging machinery.Masterwork is leading manufacturer of high precision, high speed automatic die cutting, foil stamping & embossing machines, apart fromhigh speed automatic folding & gluing machines.No significant business has been generated out of these tie ups till date.SubsidiariesCompany has sold off its entire stake in <strong>Manugraph</strong> Kenya Nairobi during FY ’<strong>12</strong>. The original investment was ` 22.66 lacs.During FY ’<strong>12</strong> Company has provided for diminution in the value of investments/goodwill in its wholly owned US subsidiary<strong>Manugraph</strong> DGM Inc. USA, to the extent of ` 60 Crs. Original investment was ` 91.98 Crs. Over & above this, it has subscribed to Preferredstock of <strong>Manugraph</strong> DGM to the extent of ` 38.69 Crs.Company has assessed the impairment in the value of investment in its wholly owned subsidiary, <strong>Manugraph</strong> DGM, on account ofcontinuing slowdown in US & other Western economies. Based on the assessment of independent valuer on impairment in value of equityinvestment in subsidiary, Company has made provision of ` 60 Crs. in P & L account. It has written off ` 60 Crs. of goodwill & reserves fromits books. Also during the year, Company has converted its long term loan of ` 38. 69 Crs. in the US subsidiary, in to 100000 2% PreferredStocks with no par value, for an aggregate paid up value of US $ 7.85 million. The Preferred Stocks are non cumulative & redeemable at paranytime after 3 years. Also, they are convertible in to equity at any time at the option of the holder.<strong>Manugraph</strong> DGM Inc.Year ended ( ` Crs.) FY '10 FY '11 FY '<strong>12</strong>Turnover 43.66 24.78 60.22Net Loss -14.11 -3.73 -0.82<strong>Manugraph</strong> <strong>India</strong> <strong>Ltd</strong>. is also available on www.balance-equity.co.in