Journal - Allianz

Journal - Allianz

Journal - Allianz

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Allianz</strong> MexicoAROUNDTHE WORLDInvestment in a self-determined life:<strong>Allianz</strong> handed over a check forEUR 50,000 to the Street Children Projectin Mexico City<strong>Journal</strong> onthe internet<strong>Allianz</strong> <strong>Journal</strong> is going online.As of this edition, the <strong>Allianz</strong> Group’semployee magazine will be availablefor viewing at http://knowledge.allianz.com.Older editions will also be availableon the <strong>Allianz</strong> Knowledge page.The December edition of the <strong>Journal</strong>will appear exclusively in electronicform.HTTP://KNOWLEDGE.ALLIANZ.COMHelp for street kids“Original andaccessible”The Fundación Por Niños de la Calle wasfounded 19 years ago. Since then the foundationhas taken hundreds of homelesschildren and young adults off the streetsof Mexico City and provided new opportunitiesfor them. Since June, the socialinstitution has had another advocate: The<strong>Allianz</strong> Foundation for North America and<strong>Allianz</strong> Mexico have helped out with adonation of EUR 50,000. The money willgo to a project to house boys aged ten to17 in a transitional home to prepare themfor an independent life away from abuse,drugs and prostitution. The foundation’ssuccess rate is 85 percent. <strong>Allianz</strong> MexicoCEO Sergio Ghibelini announced that, inaddition to providing financial support,<strong>Allianz</strong> will also organize programs suchas computer classes to help these youngpeople to lead independent lives.WWW.ALLIANZ.MXWWW.PRONINOSDELACALLE.ORG.MX<strong>Allianz</strong> <strong>Journal</strong> is among the award winners ofthis year’s inkom Grand Prix, organized by theGerman Public Relations Association (DPRG).The <strong>Allianz</strong> Group’s magazine was honored witha Silver Award in Germany’s oldest competitionfor employee media. The nine members of thejury, made up of media scholars, academics,ALLIANZ GROUP<strong>Journal</strong>Deutsche International Ausgabe Edition 1 | 12011| 2012Space travel for beginnersCountdown in the desert2651Digital broadsideInto the netCrocodiles on the looseThailand fights the floods<strong>Journal</strong>_1-12_e_2202_P.indd 1 29.02.2012 08:54:53experts and journalists, particularly praised the magazine’s originality, journalisticrange and accessible language. “The employee medium is exemplary – fromthe design to the layout. It addresses the workforce in a professional manner,” saidthe jury.The Deutsche Telekom employee magazine, you and me, and the magazine ofthe German Organization for International Cooperation, wir, received the platinumawards. Gold went to Bosch, Deutsche Bank, Audi and the German Army. Theaward ceremony was held at the Axel Springer Publishing House in Hamburg inJune. inkom Grand Prix has been reviewing employee magazines and newspaperspublished in Germany by companies, government bodies and nongovernmentalorganizations since 1995. In the interim, the competition also been extended toinclude contenders from Austria and Switzerland.WWW.INKOM-GRANDPRIX.DE<strong>Allianz</strong> introduced a new way forcustomers to pay premiums in theIvory Coast. In June, the <strong>Allianz</strong> Côted’Ivoire Assurance Vie marketeda microinsurance life product and aSeniors requiredSince some 100 <strong>Allianz</strong> retirees took up<strong>Allianz</strong>4Good’s challenge to help out as advisers atthe startsocial social network last year (see <strong>Allianz</strong><strong>Journal</strong> 2/2012), the arrangement has expandedto two other organizations: the Social EntrepreneurshipAcademy and My Finance Coach.At startsocial <strong>Allianz</strong> senior experts can work aspanel judges or coaches and help develop socialprojects. At the Social Entrepreneurship Academythey have the opportunity to assist young socialentrepreneurs, and at My Finance Coach they canpass on their wisdom about business and financeto school children.“Our retirees have vast knowledge and valuablelife experience,” says Katharina Rauscher from<strong>Allianz</strong>4Good. “That’s exactly what we need toprofessionalize social projects and to combineentrepreneurial spirit with social commitment.”Africa: paymentby cell phonesavings product where the customer’scell phone company doubles asa premium collection center. Insteadof cash or check payments, premiumsare automatically debited fromthe customer’s cell phone account.A monthly payment of USD 1.30is deducted for the life insurancepolicy and at least USD 4.50 for thesavings plan.<strong>Allianz</strong> now offers microinsuranceproducts in eleven countries. Apartfrom countries in Africa (Egypt,Burkina Faso, Ivory Coast, Cameroun,Madagascar, Mali und Senegal),this type of insurance is also availablefor low earners in Columbia,India, Indonesia and Malaysia. TheWWW.SEAKADEMIE.DEWWW.STARTSOCIAL.DEWWW.MYFINANCECOACH.DEoverwhelming majority of morethan 3.8 million <strong>Allianz</strong> microinsurancecustomers hail from Asia.In the spring, <strong>Allianz</strong> asked ninepolicyholders from Columbia, Indiaand Indonesia who had receivedbenefits from their microinsurancepolicies about their experience. Theinterviews, which were randomlyselected from thousands of claimscases, can be seen on YouTube.<strong>Allianz</strong>4Good contributed EUR 2,500for the production of each video.WWW.ALLIANZ-AFRICA.COMWWW.YOUTUBE.COM/USER/ALLIANZ→ MICROINSURANCE CLAIM<strong>Allianz</strong> Group <strong>Journal</strong> 3/201267

AROUNDTHE WORLD<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012HallerPERSONALIAAs of August 1, 2012 RemiVrignaud took over as CEO of<strong>Allianz</strong>-Tiriac Asigurari in Romania.He moved from <strong>Allianz</strong> Elementarin Vienna where he has spenteleven years in various senior positions.His predecessor RangamBir at <strong>Allianz</strong>-Tiriac was appointedHead of Property and Casualtybusiness for <strong>Allianz</strong> Asia Pacificand became a part of the regionalmanagement team located inSingapore.Surgical insurance for horsesThere are around a million horses in Germany,but only about ten percent are medicallyinsured. Veterinary treatment, particularlyoperations, can be very costly, so in July <strong>Allianz</strong>Deutschland launched an equine insurancepolicy to cover surgical fees. Dog and catowners have been able to insure their petswith <strong>Allianz</strong> since 2008.Three types of equine insurance areavailable. All reimburse costs for certainoperations, tests performed up to theday before the intervention, medicines,consumables and up to ten days of postoperativecare. Stabling and feed are alsocovered for up to ten days if a horse hasto stay at a veterinary clinic. There is noexcess to be paid by policyholders. Annualexpenses of up to EUR 10,000 are paid bythe insurance. The premium is EUR 13 to30 per month, depending on the level ofcover chosen.WWW.ALLIANZ.DE<strong>Allianz</strong> France expandsbroker business<strong>Allianz</strong> France has taken over the P&C activities of Gan Eurocourtage, a subsidiaryof the French insurance company Groupama. The two companies reached anagreement in June. Gan Eurocourtage is one of the leading P&C insurance companieson the French broker market. After the transaction, which involved thetransfer of a premium volume of around EUR 800 million, 2,500 brokers will be partof the <strong>Allianz</strong> network in France – one of the biggest broker platforms in the country.600 Gan Eurocourtage staff will be transferred to <strong>Allianz</strong>.both pictures: ShutterstockTAMCulture for the youngFor ten years now, the <strong>Allianz</strong> CulturalFoundation and <strong>Allianz</strong> agents in Germanyhave been financing projects at communitylevel to promote European thinking. 2/3 ofthe project costs – up to EUR 2,100 maximum– are covered by the foundation,1/3 is paid by the agents. A year ago, thissuccessful concept was extended to Austria,where <strong>Allianz</strong> agents are now sponsoringmore than 20 such initiatives.One of them is the integrated kindergartenWiener Kinderfreunde (Viennese Children’sFriends), which looks after 37 girls and boysfrom twelve countries. The children learnto play instruments together, study musicand put on plays, which they then performin nursing homes and other social institutions.Michael Haller, a general agent inVienna, contributed EUR 1,000 towardsthe purchase of musical instruments andlanguage-learning games.Another example of a successful culturalinitiative comes from Waidhofen in LowerAustria, where <strong>Allianz</strong> agent Andreas Hanischsponsored the production of Dreams andNightmares at the Theater an der Mauer(TAM). In the play the 15-to-17-year-oldmembers of the junior group at TAM expresstheir dreams and desires as well astheir anxieties about the future. One aimof the campaign was to learn to talk aboutproblems and dashed hopes. Hanisch contributedEUR 1,500 towards the productionof the play and publicity in local print media.Following increased demand the <strong>Allianz</strong>Cultural Foundation will increase its budgetfor the program by 20 percent to the amountof EUR 120,000.WWW.ALLIANZ-KULTURSTIFTUNG.DEAWARDS<strong>Allianz</strong> Life made it into theranking Fortune 100 Best Companiesto Work For. The US subsidiaryof <strong>Allianz</strong> Group took part in thecompetition for the first time. Onlythree other insurance companiesacross the country made the list.Genialloyd, <strong>Allianz</strong> Italy’s directsale subsidiary, ranks first forpresence on social media among allItalian insurers according to a studycarried out by Osscom, the CatholicUniversity research center concerningmedia and communications.<strong>Allianz</strong> SE Investor Relationshas been awarded the prize for thebest IR work in Germany and in theinsurance sector in general by IRMagazine in June. On top of that,the team also won the Grand Prixas the best IR team in Europe acrossindustry borders. IR head OliverSchmidt was voted best IR professionalin Europe.WWW.ALLIANZ.FRWWW.GROUPAMA.COM89

OPINIONSGlobal<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012The court case against the punk bandPussy Riot has provoked fierce criticismin the West. How is it perceived inRussia?In Russia too there is strong criticism of thesentences, particularly from the opposition.But a large majority of the Russian populationcondemned the band’s performance inthe cathedral, and many demanded severepunishment. In other words, the court, theChurch and the political leadership, who encouragedthe court to issue these sentences,can claim to represent a majority.Speaking of the Church, what role does itplay with regard to Putin’s authority?The Russian Orthodox Church is certainlynot a classical instrument of power. Butalongside the army it continues to be theinstitution that enjoys the biggest trust ofthe Russian population. For many people– whether they’re believers or not – theChurch embodies Russian identity. You haveto realize that the Russian state had to becompletely reinvented after 1991. For overa hundred years no Russian state had ruledover such a small territory as the presentone. The Tsar’s realm was as big as the SovietUnion. It included Central Asia, Ukraineand Belarus. The population contracted byalmost a half after the collapse of the SovietUnion. And this new Russia was looking foran identity. The Church plays an importantrole in this respect. It represents Russiancontinuity, Russian identity.Is Russia safe for foreign investors?Yes and no. For major investors who enjoypolitical support in the government, it’scomparatively safe. For small and mediumsizedcompanies, on the other hand, it’sdifficult because there’s still no independentjudiciary. Economic jurisprudence in theregions continues to be a difficult issue. Ifyou are able to advance a case to the federallevel, you have a relatively good chance of afair process. In the regions, where oligarchs,governors and regional elite hold sway,your chances are slim. And when politicalinterests are at stake, the independence ofjudges at federal level leaves much to bedesired too.Could joining into the WTO help to shapean independent judiciary?It’s certainly an important step. There’salready the European Court of Human Rightsin Strasbourg and the Human Rights Charter,of which Russia is a signatory. Russians whofeel they have been unjustly treated bytheir own judicial system can go to Strasbourg.And in many cases Strasbourg hashanded down a different ruling than theRussian courts. The Russian state has alwaysrecognized these verdicts. This hasn’t hadan effect on the Russian judiciary itself so far,but the state is at least compliant. This beingthe case, it will also conform to WTO rulings.But it will take time before they are embeddedin the local legal system.Russia’s weal and woe is dependent onits oil and gas exports. How stable isPutin’s system?At the moment I see no alternative politicalforce that could replace this system. It is conceivable,however, that it will be reformedfrom the inside out, becoming more flexible,and allowing other political parties greaterlatitude. But it could also become more repressive.Both scenarios are possible, and thecountry has a history of both models. At themoment the pendulum is swinging towardsgreater repression. Greater flexibility toinclude the opposition would certainly be amore intelligent solution. I believe that themiddle classes are more willing to work constructivelywithin the system than to followa strategy of total opposition. Unfortunately,in recent months the Putin leadership hasshown little inclination to make any concessionstowards this potential.Major infrastructure projects are plannedin Russia in the coming years. Can thecountry free itself from its commoditybasedeconomy?Hardly any money has been invested inthe country’s infrastructure over the past20 years, including in pipelines, roads, andthe rail network. Much of it is in extremelybad condition. If Russia wishes to becomea state that is more than just an exporter ofcommodities, it must invest money in itsinfrastructure – and a great deal of money.The question is: how effectively will thismoney be invested? Analyses show thatroad construction in Russia is much moreexpensive than in other countries. One mustassume that corruption plays an importantrole here. This means that something mustbe done to combat corruption as well asimprove the infrastructure. But you wouldneed independent courts to do that.But even that won’t be enough. The statewould have to ensure that young engineersand scientists don’t leave the countryin droves. Russia’s innovative power hasgradually diminished over the past 20 years.Thousands of young, well-trained Russiansare moving abroad. There is in fact a braindrain, a migration of skilled workers who arevital to Russia’s development but who seeno place for themselves in the country in thecurrent circumstances. A Russian leadershipthat wishes to halt this exodus would haveto create living conditions that make itattractive for young people to remain intheir home country.WWW.SWP-BERLIN.ORGFRANK STERNBullets in orbitOn October 1, 1957 the Russians launched Sputnik 1, ushering in the dawnof the space age. Fifty-five years later, millions of objects of every shape andsize are orbiting the Earth – most of them along unknown trajectories.Astronauts and Cosmonauts are beginning to find things a bit crowded.1213

GLOBALleft and page 13: dpa / picture-alliance | right: Shutterstock<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012SATELLITE INSURANCEIn 2011, the industry’s total premium incomefrom satellite insurance worldwide was USD 800million, with losses of USD 600 million. SpaceCo’spremium income from the satellite business in2011 was approximately USD 116 million.WWW.SPACECO.EUSolar stormsIn the past two years there have been two close callson the International Space Station (ISS) when fragmentsof old spacecraft sped toward it on a collision course.They missed the ISS by sheer luck; the crew would havehad no time to take avoidance action. According to astudy published by <strong>Allianz</strong> Global Corporate & Specialty(AGCS) in July, such close encounters will become morefrequent if we fail to remove the debris that has beenaccumulating in near-Earth orbit over the past five andhalf decades and that poses an ever growing hazard forboth manned and unmanned space travel.“The space around our planet is becoming increasinglycongested,” says Thierry Colliot, head of SpaceCo, the<strong>Allianz</strong> specialist for satellite insurance. Even if westopped putting satellites into space, the problem wouldgrow, because the number of flying objects increasesexponentially with every new collision. At the momentaround 800 geosatellites, weather satellites and telecommunicationsatellites are circling the Earth in trackedorbits. But there are also 16,000 pieces of junk witha diameter of more than 10 cm, 330,000 fragmentsmeasuring 1 cm to 10 cm and 35 million pellets lessthan 1 cm in size. But even these can cause enormousdamage if they collide with a satellite or spacecraft.Traveling at a speed of 10 kilometers per second, theyare ten times faster than a speeding bullet.Orbiting fragmentsGuiding spent satellites back to Earth so that they burn upduring reentry into the atmosphere will not be enoughto solve the problem, warns Colliot. Every year we wouldneed to capture ten large pieces of debris and renderthem harmless if we want to prevent the number of flyingobjects from increasing further. In 2009, the Russiansatellite Kosmos 2251 and the US satellite Iridium 33 collided,spawning thousands of new orbiting fragments.Satellites and spacecraft are threatened not onlyby collisions with orbital debris but also by massiveonslaughts of charged particles from solar storms,which can trigger malfunctions and system failures.It is estimated that up to now about 40 satellites havebeen damaged or destroyed by solar storms. Even onEarth solar eruptions can have unforeseen consequences(see box).It’s no wonder that Colliot hears alarm bells ringing.About a quarter of the 800 satellites circling the Earth –worth a total of USD 22 billion – are insured againstdamage and malfunction. Whereas damage to geosatellites,which orbit 300 to 2,000 km above the Earth,are usually borne by the operating country, damage totelecommunication satellites, which hover 36,000 kmabove the equator and cost around USD 200 millioneach, is largely met by private providers. Every year 20to 25 insured commercial satellites are launched.When the Earth was hit by a solar hurricane in 1859 it was regardedas little more than a curiosity. The aurora borealis couldbe seen as far south as southern Europe and Cuba, and a coupleof telegraph stations caught fire.Today a solar storm of that magnitude would have unforeseeableconsequences. “In theory, such an event only occurs once every500 years,” says Michael Bruch, head of R&D at the EngineeringNetwork of <strong>Allianz</strong> Global Corporate & Specialty (AGCS). “But ofcourse that doesn’t mean that there are 350 years left before thenext one happens.”With every technical advancement mankind has achieved in thepast century, it has made itself more vulnerable to these kinds ofextraterrestrial attacks. The energy infrastructure, the backboneof today’s industrial and information society, is also its Achilles’heel. It would take far less than a superstorm like the one in 1859to wreak havoc on Earth. In March 1989, a solar storm some 20times less intense than the 1859 incident triggered such violentgeomagnetic fluctuations in overland transmission lines thatthe power grid in the Province of Quebec broke down within92 seconds and was only restored nine hours later.1415

GLOBALdpa / picture-alliance<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012In full flightOut of controlThis April the European Space Agency (ESA) lost contact with its Earth observation satellite Envisat,a whopping piece of equipment weighing eight tons, which is now orbiting without power about790 km above the Earth. It is estimated that Envisat could continue to hurtle through space for another150 years before breaking up and incinerating as it reenters the atmosphere. In the meantime, it hasabout a 30 percent chance of colliding with another object. That would greatly increase the numberof objects in the junkyard orbiting around earth.Satellite operators are now obliged to bring back allspace equipment at mission’s end. But only the latestgeneration of satellites has such recovery capabilities, acontrolled fall being the method most commonly used.The bulk of the space junk burns up during reentry intothe atmosphere. The rest is guided over an unpopulatedarea or the sea – at least most of the time.Uncontrolled descentdefunct satellites can be removed from orbit. Zappingthem with lasers has been mooted. Alternatively, theycould be docked to satellites, which would then carrythem piggyback fashion to Earth. Another option wouldbe to refuel satellites in space to keep them in orbit.“There are some interesting ideas out there, althoughthey would be very expensive,” says Colliot. “There isno sign of a real breakthrough just yet.”The harassed executiveglances at his watch ashe hurries through thecrowded airport terminal:just five minutes left tocheck in for his flight toFrankfurt. He can’t affordto miss this meeting;there’s an important dealat stake. This is the typeof individual <strong>Allianz</strong> istargeting with its airportadvertising campaign. Theadverts are visually strongand especially adapted tothe airport environmentso that they stand out andmake you take notice.LOIS HOYALBelieve in yourself.Last year after an uncontrolled descent the US satelliteUARS plummeted into the Pacific off the Canadian coast.There was also only a rough estimate of the reentry pathof the Russian space probe Phobos-Grunt, which fell intothe eastern Pacific in January. But it could equally havegone disastrously wrong.© <strong>Allianz</strong> SE, GermanyKatrin Green, Sprinterallianz.com/believe2With you from A-ZSome promising suggestions have been made as tohow spent rocket stages, disused space capsules andPartner of the InternationalParalympic Committee.1617

GLOBAL<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012International travelers experience a range of emotionsas they travel through an airport – stress about makingthe flight on time, concern about the journey ahead andwhat’s waiting at the other end and boredom as theyhang around at the gate before their flight. It’s not easyto attract the attention of international business travelersin such a busy environment, having to compete with athousand and one distractions. But that’s the challenge<strong>Allianz</strong> wants to meet with its 2012 airport ads.“Airport campaigns have always been frontrunners inglobal brand building,” says Christian Deuringer, headof global brand management at <strong>Allianz</strong> SE. The newand improved campaign now focuses more on digitaltechnology and integrates a mixture of advertisingapproaches, from large banners to interactive posters.The campaign will run from May to December this yearat several airports across Europe and Asia, namely Paris,Munich, Frankfurt, London, as well as Seoul, Hong Kong,Singapore and Jakarta.The ads are targeted at business travelers who take morethan three international business trips per year – you’retalking about well-educated opinion leaders and decisionmakers. “We want to raise awareness of <strong>Allianz</strong>and make a difference within members of this targetgroup; opinion leaders and decision makers who alsohave a significant influence on other people and importantbusiness decisions,” says Matthias Fichtl of <strong>Allianz</strong>Group Market Management. The various topics covered,such as roadside assistance, the sponsorship of theParalympics or financial stability should spark the interestof this very audience.© <strong>Allianz</strong> SE, GermanyCatherine Porte Arondelle, <strong>Allianz</strong> Global Assistance DoctorRaising brand awareness: the airport advertising campaign uses thought-provoking advice and bold messages<strong>Allianz</strong> Global AssistanceHelping people in over230 countries and territories.allianz-assistance.comWith you from A-ZThis QR code leads users toa video which tells the story ofone of the Paralympics athletes“Airport campaigns have always been frontrunnersin global brand building.“ Christian DeuringerThe road assistance poster, for instance, features a youngGerman who has bought an <strong>Allianz</strong> Global Assistancetravel insurance policy and is setting off on a road triparound the world in his van. “By featuring the <strong>Allianz</strong>Global Assistance services in this Global airport campaign,we are able to showcase our brand’s strength andshare our expertise and competencies, particularly inthe area of roadside assistance and medical repatriation,”says Sophy Rigommier Hunter of <strong>Allianz</strong> Global Assistance.“These are potential situations that internationalbusiness travelers can be faced with during their travels.We want them to know that <strong>Allianz</strong> Global Assistanceis the right company to rely on for a variety of travelrelated services.”Different executions suit those passengers with “lowdwell time”, namely people in hurry, or those with“high dwell time”, meaning those sitting around a gateand welcoming distraction. Thought-provoking advice,big iconic images and bold messages work best in lowdwell time sites, while high dwell sites are good placesfor interactive posters, which include new elementssuch as web links and Quick Response (QR) codes.People can then access the web link or scan in the QRcode on their smart phone to download MyTravelAid,an app that is proving to be popular among busybusiness travelers thanks to its useful travel tips andinformation, such as emergency numbers in variouscountries, a drug dictionary, translations of first-aidterms and hospital information.1819

GLOBALEveryone has seen images of the world’s slumswith their shabby corrugated iron huts, squalidopen sewers and neglected children. Accordingto the UN, a third of today’s urban population –over a billion people – live in slums. Yet the appealof an urban promised land lives on. Enormousinvestment in infrastructure will be needed inthe coming years to cope with the swelling ranksof urban dwellers. <strong>Allianz</strong> has already begun totake stock.FRANK STERNGardens by the Bay in Singapore. The first stage of themegapark was opened in June. Cost so far: EUR 650 million2021

GLOBALShutterstock | page 20/21: IbrahimRothFact-finding tour in virgin territory: Futures and trends analyst Peter KöferlShabby huts, squalid open sewers, filthy children – a third of city dwellers live in slumsWhat remains of these drawing board dreams depends not least onwhether enough private investors can be found who recognize theirbusiness potential. The public sector can be ruled out as an investorin many parts of the world due to a lack of resources. The situationis dire because without infrastructure renovation, expansion andconstruction the megacities of this world are in danger of descendinginto chaos. Meanwhile the influx from the countryside continues:in 2050 around 70 percent of the world population will be living incities, compared to 50 percent of the earth’s seven billion inhabitantstoday. They are the engine of economic growth and produce between60 and 80 percent of a country’s GDP. But they also emit 70 percentof greenhouse gases and already consume almost 80 percent of theworld’s energy supply.Some estimates predict that a global investment of around USD 40billion will be needed in the next 25 years to achieve the eco-friendlyand sustainable renovation and expansion of urban infrastructure.40 billion! City planners and politicians have proposed integratedsolutions that cover everything needed for city life – from energy andwater supply to civil security, public transport, schools, universities,hospitals, nursing homes and waste disposal. However, the ecofriendlyconversion of a huge metropolis is much more difficult andcostly than building a new city from scratch.The ideal cityPeter Köferl, in charge of future and trend analysis at <strong>Allianz</strong>’sEconomic Research and Corporate Development, describes it asthe green transformation of the urban landscape. This has alreadybegun in some places: London hosted the first “green” OlympicGames. Copenhagen will be the first climate-neutral city by 2025,and Munich will be run entirely on renewable energy the same year.Many experts regard Singapore as a prime example of an ideal city.“As it’s an island state, the city cannot simply expand; it has to continuouslyreinvent itself,” said Siemens executive officer Roland Busch,head of Infrastructure & Cities, in an interview with the FrankfurterRundschau in April. “They go about it in an intelligent way.”Singapore is living proof that it’s possible to cope with a high populationdensity with the help of innovative models for water treatmentand waste recycling and that cities can be supplied more efficientlyand with less environmental impact than rural areas, where distancesare greater and networks less dense. Admittedly, the Lion State isone of only a few countries that can afford such intelligent solutions.Moreover, compared to metropolises such as Tokyo, New York, SãoPaulo, Bombay and Manila, this city-state of five million inhabitantsis still relatively easy to manage. But even on a larger scale, efficiencyand the intelligent use of resources is not entirely utopian. The questionremains: where is the money for these billion-dollar projectsgoing to come from, given the dearth of public funding.Against this background some good could come out of the financialcrisis. Current low interest rates have meant that investors such aslife insurance companies and pension funds, which are supposed tofind long-term, profitable and safe investment opportunities for theircustomers, have been wringing their hands to find viable alternativesolutions. Investment in the sustainable renovation and constructionof urban infrastructure – requiring, as mentioned, an injection ofUSD 40 billion in the next 25 years – could be the answer. This is especiallytrue as some of them offer stable returns on projects spanningseveral decades, which will be less affected by fluctuations in thecapital markets. Notoriously cash-strapped city councils would havethe option of tapping into nongovernment resources, and investorscould make long-term plans and invest directly in future growth.The era of dream returns may be over, and a new normality withits modest profits has arrived. But a return of seven percent is notinconceivable for green development projects – and this over thelong term. “Nevertheless, this is largely new territory for investors,”says Peter Köferl. “Currently there is no climate-friendly urbaninfrastructure investment class.” <strong>Allianz</strong> is exploring what form asuitable investment might take. Green-infrastructure funds orenergy-efficiency funds would be two possibilities. A first stepwould be for policymakers to provide investment security anda stable investment climate.Bumpy pathThere will be no shortage of projects that could be of interest toinvestors in the foreseeable future, although the path to a greenurban future will probably still be pretty bumpy. For years expertsat climate conferences have been calling for a huge reduction incarbon dioxide emissions. At a local level this could be achieved byconverting urban transport systems, switching energy sources andrenovating housing and public buildings to be more energy-efficient.Be that as it may, a carbon-free world, particularly in Asian thresholdcountries, still seems a distant dream. China and India for instancecontinue to fuel their economic growth with coal, and India is nowproducing cheap cars that the middle classes can also afford.What an urban future will finally look like, which strategies will beemployed to counter climate change, which transport systems willbe given priority, how water supplies will be secured so that groundwaterlevels remain stable – the answers to all these questions couldsoon be formulated with the help of input from private investors.2223

Strategy“The accusations areunfounded”Jay Ralph<strong>Allianz</strong><strong>Allianz</strong> is the first company in the world to set up a committee at board level to adviseon the consideration of ecological and social issues in corporate decision-making.We spoke to Jay Ralph, head of the ESG Board (Environmental, Social and Governance),about the rationale behind the “eco board”.INTERVIEW: MICHAEL GRIMMMr. Ralph, was the foundation of theESG Board a reaction to NGOs’ concernsabout Alianz’s investments in coal inChina and asset management’s clientinvestments in funds that include commoditiesfutures?The accusations made at our Annual GeneralMeeting in May were not the trigger, butrather a catalyst for our move to set up anESG Board. As an insurer and asset manager,Shutterstockwe have the power to influence key issues.We want to use this influence in a responsiblemanner and manage it via our newESG process.Does <strong>Allianz</strong> now intend to stop thesekinds of investments?The first “official action” taken by the ESGBoard was to enter into dialog with the NGOsconcerned. In July, we met with Greenpeacein Hong Kong and Oxfam in Berlin. The<strong>Allianz</strong> investments in coal in China are quitelow compared to our other investments.Together with Greenpeace, we are lookingat whether to sell these interests or ratheruse our status as an investor to encouragebetter environmental practices.When we met with Oxfam, we listened totheir concerns and brought in our investmentexperts to respond in detail. To date,we have not received any response to ourpoints and factual evidence refuting theirpast accusations.So what arguments and facts has <strong>Allianz</strong>provided to refute the Oxfam concerns?The accusations are simply unfounded andeasy to refute, and additionally require amore in depth understanding of the subjectmatter. At our Annual General Meeting inMay, we made it clear to Oxfam that we donot invest our policyholders’ funds in eithercommodities or in commodity index funds.Only our asset managers, PIMCO and <strong>Allianz</strong>Global Investors invest some customer assetsin commodity index futures. They representless than two percent of our 3rd party assets.Around one third of this amount can be attributedto agricultural commodities. Theseinvestments allow farmers to hedge againstfluctuating prices: farmers want to makesure that they receive a minimum price fortheir harvest. They need a financial partnerto share the risk of fluctuating prices.Our customers generally make long-terminvestments. They do not buy real commoditiesor withdraw them from the market. Theymay make money when prices fall as wellas when they rise. They do not trade in themonth when the commodities are delivered,when prices are most likely to fluctuate. Whatis more, our customers have tended to investanti-cyclically, which helps to stabilize themarket. A withdrawal of these investors wouldhave a negative impact on both farmers andcommodity prices.So who is to blame for the price hikein agricultural commodities?According to the UN FAO and the OECD,the primary drivers of food prices areweather events, population growth, risingconsumption on emerging markets, tradebarriers and the increasing use of agriculturalland for biofuel production. The currentprice rise in grains due to drought in theU.S. are clear evidence to this assertion.<strong>Allianz</strong> and most experts are convinced thatthe price of the future follows the price ofthe physical commodity, not the other wayaround. However, if commodity futureshave an influence on food prices, then awithdrawal of our investments would havea negative impact on the individuals Oxfamwould like to protect.What can <strong>Allianz</strong> do to minimize theimpact of rising food prices on the poor?Investor withdrawal would be fatal. Risingprices confirm that the gap between supplyand demand is still widening. In order tocombat this, we need more investments inagricultural productivity, food productionand distribution. A withdrawal of long-terminvestors in commodity and index fundswould be negative, too.Farmers in the US benefit from crop insuranceand a highly developed futures market. Currently,most farmers in developing countriesand emerging markets do not have theseoptions available to them. <strong>Allianz</strong> will considerwhether micro-crop insurance andmicro-futures might benefit both the farmerand consumer in developing markets. If so,we will consider how we might participate.So does this mean that the issue is “doneand dusted” from <strong>Allianz</strong>’s point of view?The dialog with Oxfam would appear to haveended, but the matter is not closed as faras we are concerned. As an NGO, Oxfam iscommitted to an issue that is also importantto us. We believe that the widening foodsupply gap is one of the three biggest challengesfacing us, along with climate changeand demographic development, and webelieve that we can play our part in findinga solution.What specific role will the ESG Boardplay in this process?The ESG Board will ensure that, in our dialogwith internal and external experts, we canidentify key social and ecological issues in atimely manner, assess them correctly anddevelop pragmatic implementation options.Differences in the laws, cultures and basicphilosophies of stakeholders in the morethan 70 markets in which we operate meanthat we will not arrive at a uniform way toaddress each and every issue. Nevertheless,we want to serve our insurance andinvestment clients in a sustainable way andare conscious of our responsibility to society.This is why the ESG Board will offer our localcompanies content-related guidance onimportant ESG topics. However, for somecritical topics we will issue binding rules,such as those related to the ban on <strong>Allianz</strong>investments in certain weapons manufacturersor the prohibition on all weaponstransactions in crisis-ridden regions, bothof which already apply.The role of the ESG Board is not simplyto restrict certain transactions, it is alsocharged with the promotion of sustainability.Our positions will be influencedand formed by listening to NGOs and otherexternal stakeholders. This dialog will assistus in achieving our aspiration to be oneof the leaders in sustainable insurance andinvestments.2425

STRATEGYRothAGENCY FUTURE PROGRAM (AFP)AFP describes the business model for the agency channel,integrating many ideas from <strong>Allianz</strong> companies. It supports<strong>Allianz</strong> companies taking part in the program with a “healthcheck” of their agency channels, integrating local strength andcustomizing the approach to their respective needs. So far theprogram has been rolled out in Austria, the Czech Republic,Germany, France, India, Italy, Spain and Switzerland.Louis de Montferrand (left) and Johan van Tholen“It really works”They’re still one of the biggest sources of revenue in the <strong>Allianz</strong> Group: in 2011,<strong>Allianz</strong> agents accounted for premium income of around EUR 34 billion worldwide,30 billion of which came from Europe. But gross written premiums and customernumbers are dwindling – as they have been for years. A new business model shouldhalt this downward trend.FRANK STERNThis is not <strong>Allianz</strong>’s first attempt to bringits agency channel back on a growth track.There were quite a number of initiatives inthe past, both in the Group companies andat Holding level but there was no breakthrough.The Agency Future Program (AFP)is set to change that, at least according tothe project leader Johan van Tholen. “Wedeveloped the program together with companieswith strong agency distribution andhave tested it extensively in Germany andFrance,” he says, “and it really works.” Hesounds slightly surprised himself.Before the AFP was launched at the endof 2010, van Tholen and his team analyzedthe current shortcomings in Europeanagency sales and pinpointed two fundamentalproblem areas. Firstly, there’s oftena lack of meaningful data at the point ofsale to provide pertinent advice. Secondly,agents have too little personal contact withcustomers because they are up to their eyesin paperwork. On average, only about onein five policyholders receives extensiveagency support. The rest often only knowtheir insurance agent from hearsay. It isspecifically these customers who are indanger of jumping ship and going to thecompetition.Plenty of optionsYet personal contact and one-on-oneadvice are actually an agent’s forte. “That’san advantage that no other channel has tooffer,” says Louis de Montferrand, ProgramLeader Distribution. “If that doesn’t work,there will be a point where you have to askyourself what this sales channel is actuallyShutterstockfor.” After all, there are plenty of otheroptions. This is where AFP comes in.According to the sales experts, if agencysales are to survive in the future, there hasto be a marked increase in the percentageof customers with multiple policies. Not onlydo such customers remain loyal for longerbut it’s also more efficient to administerseveral policies for one customer instead ofjust one. In the major European markets ofGermany, France and Italy there’s still quitesome room for maneuver: until now most<strong>Allianz</strong> customers there have only had oneinsurance policy.This recipe for success sounds relativelysimple: agents will be given more breathingspace to carry out their own work – customercare and support – by trimming theagency processes and transferring administrativetasks, such as preparing claimsreports, making appointments, enteringcustomer data, to the back office. “This willallow us to concentrate on the strengths ofthe agency channel,” says van Tholen. Theconcept appears to be paying off: the testphase in Germany and France revealed thatby reorganizing agencies, productivity canbe boosted by over 25 percent.However, more time on the sofa alone isn’tenough to keep customers loyal. Accordingto van Tholen, who, like his team membersworked in sales himself in the past, somethinghas to change in the consultation andselling process. At the moment it focusesless on the interests and needs of customersthan on policy sales, notes the Dutchman:“It should be the other way round. A structuredanalysis of the customer’s situation isa key improvement of the AFP project andthe starting point of a trusting relationship.”Of course an agent only finds out what hiscustomers really need if he stays in closecontact with them, and not by sending anewsletter once every blue moon.Inadequate rulesAll the same, agents need reliable customerdata to have any prospect of success duringa customer consultation. That’s anotherweak point. Clear rules on collecting andstoring customer data have so far been asinadequate as automatic data exchangebetween back office staff and agencies. Thedigital world offers enormous opportunitiesfor improved distribution processes. In Francefor example, at the start of every week agentsreceive a list from the agency system Lagonof those customers who, according to theavailable data, would be most responsive toa sales consultation. The system even identifiesthe products they are most likely to buy,so that these can be mentioned during thesales talk.Van Tholen believes that people stillwant advice from agents even in the eraof internet and direct sales. “Many customersstill welcome professional advice,particularly in complex life matters,” hesays. “It’s a question of trust, and that’swhere agents excel.” But this strengthcan only be exploited if agents know whothey’re dealing with.<strong>Allianz</strong> Austria set the stage for the newbusiness model some years ago. The LifeCheck model placed customer support atthe focus of the selling process. Since thenagents have been asking policyholdersspecific, structured questions about theirpersonal situation, discussing their aspirationsand plans and proposing solutionsto realize them.The Austrian approach proved successful,making the new sales process a milestonein the development of the Agency FutureProgram: customers’ willingness to recommendthe company to others increasedmeasurably, and cancelation rates fell. Thenew customer approach is being widelyused under the name of Pro3 in Germanyand S’Energy in France. Initial test runs haveresulted in much improved sales figuresand increased customer satisfaction.The AFP project was launched in the CzechRepublic in April and in Spain and India inMay. “The concept works everywhere,” saysvan Tholen. “It will secure the future of theagency channel as one of the key pillarsof <strong>Allianz</strong>.”JOHAN.VAN_THOLEN@ALLIANZ.COM2627

STRATEGY<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012Brand guardians: (from left)Tobias Unterguggenberger, PatriciaSchulz-Moll, Steffen DrögslerBRAND VALUESTop 10 financial services companies, 2010USD billions 0 36 9 12 15American ExpressJP MorganHSBCGoldman SachsCitiAxaMorgan Stanley<strong>Allianz</strong>Timmichtions in Brazil, Germany, France, Slovakia, Turkey andthe USA to stop using the words <strong>Allianz</strong>, Alliance andAlianza as a trademark or brand name. In some casesthe dispute had to be referred to the trademark andpatent offices or the courts. “Our legal clout varies fromcountry to country, depending on how established ourown trademark is and the business fields in which it isused,” explains Steffen Drögsler.SantanderVisaAmong insurance companies <strong>Allianz</strong> ranks second behind Axa, and eighthif banks are included. Top dog among financial services providers is AmericanExpress. The most valuable brand across all sectors is Coca Cola, valued byInterbrand at just under USD 72 billionSource: InterbrandValue and impactMore than ten years ago, <strong>Allianz</strong> began to rename those subsidiaries that werestill operating under their local brand names in their respective markets. In somecountries this presented no problem, in others it was a case for the courts.FRANK STERNBefore the Columbian subsidiary Colseguros could berenamed <strong>Allianz</strong> Colombia in May this year, the lawyersin <strong>Allianz</strong> Group Legal & Compliance department hada lot on their plate. Alianza Fiduciara, a small asset managementfirm in Bogotà, had gone to court because of arisk of confusion – and was able to invoke long-standingtrademark rights. “Usually it’s the other way round,” saysTobias Unterguggenberger, who is responsible alongwith Steffen Drögsler for trademark protection at GroupLegal. In the end the quarrel was settled out of court.That’s how trademark disputes frequently end, but moreoften than not <strong>Allianz</strong> can tip the scale in its favor. “It’soften enough to make clear which trademark rights wehave in each country,” says Unterguggenberger. In 2011,<strong>Allianz</strong> was able to persuade companies and organiza-<strong>Allianz</strong> has now had its name registered worldwide –except in countries like Eritrea and Somalia, where notrademark protection exists. Since the company beganto implement its one-trademark policy seriously, manysubsidiaries have switched over to the <strong>Allianz</strong> brand.Italy came under the <strong>Allianz</strong> logo in 2007 and Francein 2009 – important milestones on the road to a globalbrand name. Today 80 percent of the Group’s turnoveris generated under the <strong>Allianz</strong> name, compared to just65 percent in 2007. “We want to invest in a single strongbrand, instead of spreading our influence over five or ten,”says Patricia Schulz-Moll of Group Market Management.Established brand names are like a promise that instillstrust and reassurance and for which customers areprepared to dig deeper into their pockets. However, itmay take years before they become rooted in people’sminds. “As a company you have to be prepared to investin a brand name and see it as a value,” Schulz-Mollexplains. “In order to achieve that goal you sometimeshave to relinquish a locally established brand name.”Russia is a case in point. Until early this year <strong>Allianz</strong>operated there through three subsidiaries using variousbrand names. One was Rosno, one of the best-knowninsurance companies in the country. Since April, followingmergers with industrial insurer <strong>Allianz</strong> Russia, andP&C insurer Progress Garant, Rosno has been operatingas <strong>Allianz</strong> Russia.The name change carries its own risks. “During atransitional period we will continue to take advantage ofthe familiarity of the local brand name Rosno in Russia.After two years we’ll change over completely to the<strong>Allianz</strong> name,” says Schulz-Moll. It was not certain thatthe changeover would meet with unanimous approvalwith customers. However, Russians also appreciate financialstability, international renown, trust and reliability –especially in these uncertain times. <strong>Allianz</strong> specificallyemphasized these values in its advertising campaign.“A campaign with Russian feeling,” says Drögsler.The fact that investment in a global brand is a smartmove is evident from the contribution it can make tothe value of the company. According to “Best GlobalBrands 2011”, a ranking drawn up by the brand consultantInterbrand, the <strong>Allianz</strong> brand is worth around2829

STRATEGYboth pictures: <strong>Allianz</strong>Russiaspecial<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012Rebranding can be tricky: in Columbia an assetmanagement firm complained about the useof the <strong>Allianz</strong> brand name. Even switching fromMondial to <strong>Allianz</strong> Global Assistance doesn’talways run smoothlyIn the land ofonion domesEUR 5.4 billion and last year achieved the greatestgrowth in value among European financial serviceproviders. As far as global insurance companies areconcerned, only Axa was valued higher (EUR 6.7 billion).It is therefore understandable why Unterguggenbergerand his colleagues are keeping a close eye on the brandname. Any dilution of the brand would significantly reduceits value and impact.The brand guardians are currently busy overseeing theglobal transformation of the Mondial Group to <strong>Allianz</strong>Global Assistance. The switch from red to blue in 28countries will take several years. “It’s clear that rebrandingon this scale sometimes calls for special solutions,”says Tobias Unterguggenberger.sistance: there’s already a Global Assistance in Italy, and<strong>Allianz</strong> wanted to avoid a dispute. Moreover, the MondialAssistance name has been retained for some majorclients such as Air France that are associated with otherinsurance companies. A link from the website of theFrench airline to the portal of a travel insurance companyusing the <strong>Allianz</strong> logo would not look good.Such solutions may soon be needed more often. <strong>Allianz</strong>plans to enter new business fields with its Assistancecompany – in the health sector for example. “That’swhere new challenges for brand management await us,”Unterguggenberger believes.In Italy, for example, <strong>Allianz</strong>’s travel insurer and roadsideassistance company goes by the name of <strong>Allianz</strong> As-WWW.INTERBRAND.COM3031

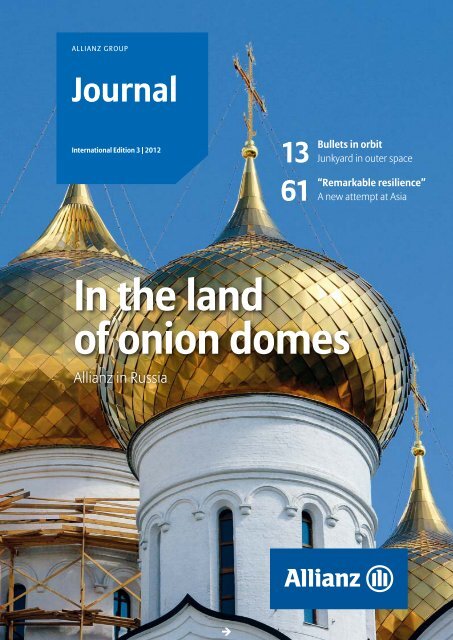

RUSSIASPECIALRussia – a country that can shed two time zones but still have nine; acountry in which onion domes shoot out of the ground like mushroomsafter a summer shower; a country in which the men manage – by dint ofvodka and tobacco – to keep their life expectancy down to 62. A countryin which the president and prime minister regularly swap jobs, and carsare paid for in cash. Welcome to a country that cannot be understoodwith the mind alone.TEXTS: FRANK STERNShutterstock all pictures | also page 35: Stern (where not indicated otherwise)<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012Birches. Birches, as far as the eye can see. When youtravel by train to the Russian boondocks – and they beginat Moscow’s city limits – you inevitably end up in a birchforest. The Canadians have their maples, the Germanstheir oaks. The Russians have their birches. “They’re veryhardy,” says Olga, our companion. Most Russian womenare called Olga by the way. Vera Alexandrowna Emelinais one of the few exceptions. But more about that later.Another defining facet of the country, in which a populationsmaller than that of Bangladesh lives in an area morethan a hundred times the size, are the onion-domedtowers. Garish and golden, bright and bulging, theyrise up in ever increasing numbers into the Russian sky,announcing the resurrection of the Russian OrthodoxChurch following decades of wanton impiety. Not onepage of a bible would pass between its spiritual leader,Patriarch Kirill, und Russia’s President Vladimir Putin,whom the churchman sometimes likes to praise as agift from God.Not everyone in the country sees the current presidentas a blessing. There has been overt opposition to Putin’ssystem of “controlled democracy”, at least in this giganticcountry’s capital. But behind the birch forests, sup-port for the former KGB officer appears solid. Even ifhe doesn’t endorse everything that the Kremlin does,there’s no denying that Putin has given the country acertain amount of stability, says one of the people wetalked to. “There’s no one in sight who could lead thecountry apart from him.”Weal and woeOf course stability could quickly evaporate if worldmarket prices for oil and gas go through the floor.These commodities are inextricably linked to Russia’sweal and woe, says Professor Professor Hans-HenningSchröder from The Foundation for Science and Politicsin Berlin (See interview on page 10). Its commodityeconomy makes the country extremely susceptibleto cyclical fluctuations on the world market. When theprice of crude oil collapsed on the international stockexchanges three years ago, Russia’s GDP plummetedby eight percent.But no one can deny that Russia, of which the lyricistFyodor Tyutchev once said, “cannot be understood withthe mind alone”, has enormous potential. Many Westerncompanies are counting on a sustained boom, setting3233

RUSSIASPECIAL<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012The nouveaux riches throw away their roubles in trendyrestaurants like there’s no tomorrow, while the rest meetup in the park to drink a few beers and make music. It’sas though the metropolis of 10 million people is tryingto catch up with Western developments of the past decadesin fast forward mode. Avant-garde, decadence andflower power – it’s all happening.The sun sets behind the Christ the Savior Cathedral onthe other side of the Moskva, bathing the river in a softlight. In February, members of the female punk rock bandPussy Riot stormed the altar and called on the VirginMary to save Russia from Putin. In August, they weresentenced to two years in a prison colony. Patriarch Kirillsaw the stunt as the work of the devil himself.A couple of crazy motorcyclists race along the riversidestreet at breakneck speed, stretch limos cruise pass ata leisurely pace, and on the Moskva Bridge a young girltakes off her T-shirt and reveals bare breasts to increaseher chances of a cheap lift – taxis cost a fortune inMoscow. She doesn’t have to wait long.A nose foropportunitiesHe has already stood at the helmof a market leader. Now HakanDanilesson has to demonstrate howto become one. That’s quite a task:at the moment <strong>Allianz</strong> Russia is stilla far cry from the top.all pictures: Stern (where not indicated otherwise)Hakan Danielsson“Our goal is to be among the top three,” Diekmannexplained in July in an interview with the Russian newspaperVedomosti. Only then will the company be ableto help shape the market. On the other hand, Russiamust be prepared to concede such a position to <strong>Allianz</strong>,Diekmann continued. “We know how to do things,” saidthe <strong>Allianz</strong> boss. “We know how to operate an insurancebusiness sustainably over the long term and bring ourconsiderable expertise to bear.”“There’s no greater vote of confidence in the businessworld than the transfer of brand rights to a subsidiary,”he says.At the same time Rosno was renamed, the P&C andindustrial insurers Progress Garant and <strong>Allianz</strong> Russiawere also merged with Rosno. Hakan Danielsson makesno bones of the fact that things didn’t go smoothlywithin the trio of companies. Many employees jumpedship during the restructuring process, and it wasn’talways the weakest ones. Danielsson now wants to starta new chapter, and he seems to have found the rightwords – quite literally: after just one year in the country,the mathematics graduate speaks astonishingly goodRussian. “Not perfect,” he says, “but people can understandme.” For months on end he burned the midnightoil after work to learn the language.Danielsson, the father of a son and daughter, likes thelanguage, and he has a good rapport with people.“Swedes and Russians have a lot in common,” he believes.“We both play ice hockey, we love hunting andfishing. We have our dachas in the woods and oursaunas. You could say that Sweden is a mini version ofRussia.” Except that, as he said, Sweden’s somewhatmore boring. Danielsson favors growth markets whereeverything is still in flux. “It’s just that there’s moregoing on – in both the positive and negative sense,”Since April, Rosno, together with the industrial insurance arm, and Progress Garantoperate under the <strong>Allianz</strong> Russia name“Sweden is really boring,” says Hakan Danielsson abouthis homeland. “Because it’s so stable.” That’s not veryinteresting for a man for whom the goal is the journeyitself. But for the moment the 51-year-old can’t complainabout being bored. Order and stability aren’t wordsthat spring to mind when it comes to Russia, whereDanielsson has been living for over a year. Before movingto Moscow he was the CEO of the Swedish insurancecompany Länsförsäkringar –market leader amongSweden’s P&C insurers. “When we increased our marketshare by 0.2 percent it was a big celebration. It’s just nofun,” he says.About a year ago <strong>Allianz</strong> chief Michael Diekmannbrought him in as head of subsidiary Rosno. Althoughthe company is well known in Russia, it only ranks eighthin P&C and sixth in life insurance – outside of the realmDiekmann thinks appropriate for a global company.This also applies to corporate governance. Russia iscurrently ranked 143rd on Transparency International’scorruption perception index. Dubious practices are commonplacein the Russian business world, and those whodon’t play the game are often left out in the cold. “Wesometimes lose business,” confirms Hakan Danielsson.On the other hand, international investors are lookingfor business partners with a clean sheet. “Like us.”At a meeting in Moscow in July, which was attended by500 employees from various Group companies, MichaelDiekmann again emphasized the importance of imageand reputation, particularly in times in which financialservice providers are widely viewed with mistrust. Hewould rather relinquish lucrative business than put thecompany’s reputation at risk, he said. Diekmann seesthe fact that Rosno has been operating under the <strong>Allianz</strong>brand since April as a tribute to local management.In Moscow, <strong>Allianz</strong> CEO Michael Diekmann answered employees’ questions aboutthe future of <strong>Allianz</strong> in RussiaSjukow3637

RUSSIASPECIALhe says. “And you can exert a stronger influence ondevelopments.”Meanwhile he’s traveled all over the country and introducedhimself to the staff in many of the 92 branchoffices between Kaliningrad and Kamtchatka. He’s quickto answer when asked which place he liked best on histravels: “Vladivostok,” he says, the city at the easternextreme on the Sea of Japan. “It looks like San Francisco,”he gushes. “The sun on the snow-covered hills with theharbor below – indescribable.”the German he’s talking to looks at him askance – aRussian author recently described her country as big andlazy – Danielsson explains: compared to the Germans,the Russians are much better at experimenting. “Theytry things out, and if they don’t work, they try somethingelse. Russians have a nose for opportunities, whereasGermans organize a working group and draft plans.”That’s cleared up then.ale pictures: Stern (where not indicated otherwise)Stories fromthe Volga<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012The people he’s met have great entrepreneurial spirit,he says, praising the qualities of the natives. And whenWWW.ALLIANZ.RURUSSIA<strong>Allianz</strong> Russia1991 Ost-West <strong>Allianz</strong> (subsequently<strong>Allianz</strong> Russia) founded2002 <strong>Allianz</strong> acquires a 45 percent stake in Rosno2003 Rosno Life Insurance founded2007 <strong>Allianz</strong> becomes sole owner of Rosno2010 <strong>Allianz</strong> launches pension fund business in Russia2012 Rosno, Progress Garant and <strong>Allianz</strong> Russia are mergedand marketed under the <strong>Allianz</strong> brand nameP&C INSURANCE – ROSNO• Gross premiums written 2011 EUR 535 million• Market position 8th• 5,400 employees• 10,000 agentsLIFE INSURANCE – ALLIANZ ROSNO LIFE• Gross premiums written 2011 EUR 60 million• Market position 6th• 370 employees• 4,500 agents(Data: <strong>Allianz</strong> Russia)MoscowRussian Insurance marketPopulation 140 millionArea17 million square kilometersINSURANCE PENETRATION(premiums as percentage of GDP 2011)• All insurance 2.4• Life insurance 0.1• P&C insurance 2.3• Position worldwide 53INSURANCE DENSITY 2011Life insurance premiums per capita USD 8P&C insurance premiums USD 295(Data: Swiss Re, sigma no. 3/2012)Stretching more than 3,500kilometers, the Volga is Europe’slongest riverOne of the first times she went to see a customer, Vera AlexandrownaEmelina was thrown out after barely uttering the word “insurance”.Today, the physics graduate is the head of the Volga directorate of <strong>Allianz</strong>Russia covering an area bigger than Poland.Vera Alexandrowna Emelina worked for ten years as anengineer on the Soviet space program. Then MichailGorbatchov turned the world upside down, the SovietUnion broke up, and Emelina, who earned a distinction intheoretical physics at university, lost her job. The countryhad no more money to reach for the stars.Vera Emelina belongs to that generation of Russianswhose life plans were disrupted in the social upheavalof 20 years ago. “Everything changed with perestroika,”she says. “And mainly for the best.” Emelina tried to findher place in the new order, making ends meet by sellinginsurance in her hometown of Nizhny Novgorod. Shewasn’t put off by setbacks like the one with the bakery3839

privateRUSSIASPECIAL“Russian women can do everything,”says Vera Emelina, “even soften thehearts of the most prickly customers.Men are too undiplomatic and toounwilling to compromise.”(From left) Irina Petryankina, MarinaPogudina and Tatyana Pintchuk are herbest sales peopleIn Yaroslavl, on the other hand, Sergei Milykh (left) and Ilya Murachov holdtheir own against top seller Elena Balnikovaall pictures: Stern (where not indicated otherwise)Like his colleague Emelina in Nizhny Novgorod, it neveroccurred to Garin to leave his hometown for Moscow,although salaries in the capital are two to three timeshigher than in the provinces. The few times that he hasto travel to the head office for meetings are enough forhim, says the 44-year-old. Garin loves the Volga, thedream of every angler. His dacha is 70 kilometers outsidethe city. He chops logs for the woodburner and saunahimself. In the winter temperatures can easily fall belowminus 20 degrees – he goes ice bathing with his daughter.His three-year-old son is still too young for suchadventures.You could say that Garin has made it. It’s not surprisingthat he finds the new era liberating. In the past, livingstandards of most people used to be pretty similar; todaythere are massive differences. But Garin prefers a systemin which everyone can take control of his or her life. “It’snot a question of being rich,” he says. “Freedom is muchmore important – being able to determine your own lifeand to make use of the opportunities available to you.”The younger generation often has other ideas: “Some ofthem are very demanding,” Garin has noted. Potentialtrainees’ attitude of entitlement makes it difficult for himto find new staff. “The young ones want everything atonce, immediately.”Renaissance of faithVera Emelina, the managing director in Nizhny Novgorod,on the Volga 400 kilometers downstream, has fewerproblems with trainees. She recruits many of themdirectly from university, and the majority of her agentshave an academic degree. “Most young people stayhere,” she says. “We don’t have any worries about theup-and-coming generation.” The same applies to thepopulation in general. A renaissance of religious faithmeans that families are once again opting to have morechildren, says the mother of two boys and two girls. Sheadopted her youngest daughter from an orphanage.Emelina manages 14 branch offices with a total of1,200 agents, and she earns money where others have tofight for business. “Car insurance is our most profitablebusiness segment,” says the director, who also managesthe most successful branch office in the region – Nizhny<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012Yevgeny GarinToday, 600,000 people live in Yaroslavl, situated 300 kilometers northeast of Moscow where the Kotorosl River meets the Volgaboss, who threw her out before she could barely puta foot in the door. “He’d recently been cheated by aninsurance company,” she relates. “Bad timing.” Todayhe’s one of her most loyal customers.Yevgeny Garin, head of the <strong>Allianz</strong> agency in Yaroslavlon the Volga 300 kilometers northeast of Moscow, alsochanged careers. After completing his studies, whichhe began under the Red Star, he found himself out ofwork. Like many others at the time he tried his luck as atraveling salesman. Garin bought and sold anything thatcould make money. It was good training: In 1996, after alean period of three years, he managed to land a job inthe sales department of a local brewery. Since 2007 hehas been managing the Rosno branch in Yaroslavl. The<strong>Allianz</strong> logo is now emblazoned on the office building.Last year, he and his 25-strong staff in Yaroslavl andthe surrounding area collected 64 million roubles (EUR1.6 million) in premiums. Industrial insurance (energy,chemicals and transport) is the greatest contributor at27 million roubles. Yaroslavl, an old trading town with ahistory dating back one thousand years, is more than apopular tourist destination; it’s also an important locationfor industry. This year, Garin wants to increase premiumincome by ten million roubles.In cashAlthough companies transfer their insurance premiumsvia bank transfers, private customers tend to pay theiragents in cash. The agents take the money to the agencyat regular intervals, where it is held in a safe before beingtaken to a bank. It’s a complicated and inscrutableprocedure and a real headache for <strong>Allianz</strong> Russia’s CEOHakan Danielsson: “Such capital flows are difficult tomonitor.” He’s hoping that the increasing popularity ofthe internet will encourage more customers to switchto online banking in future. Garin will then be able toscrap his safe.4041

RUSSIASPECIALtop row: dpa / picture-alliance<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012Novgorod. “That only works of course if you manage riskwisely,” she says. For instance, Emelina’s branch officeinsures the entire vehicle fleet of the regional administrationof Nizhny Novgorod – generating 18 millionroubles in premium income annually. There are fewclaims: If a public official is involved in an accident, it’salways the other party’s fault.Unlimited<strong>Allianz</strong> is one of the insurers of the new ZenitStadium in St. Petersburg (left photo) and ofthe Olympic village in Sochiall pictures: Stern (where not indicated otherwise)The managing director is less happy with agriculturalinsurance. “It’s a very risky business which is hard tomake money from,” she says. “We pay out our entireincome in claims.” There was no let-up this year either:Along the Volga, in the southern Urals and westernSiberia ongoing drought was causing devastating cropfailure. In some places the area’s officials and farmerswere so desperate that they were calling on divine help:Orthodox priests held public masses, in which the entirecommunity prayed for rain.The Russian Agricultural Ministry is not expecting amiracle though. It has lowered its forecasts for wheatproduction to 80-85 million tons – ten to 15 million tonsless than in 2011.opportunitiesFor an industrial insurance company like <strong>Allianz</strong> GlobalCorporate & Specialty (AGCS), Russia should be somethingof a country of unlimited opportunities – theoreticallyspeaking at least. In practice, many obstacles are put inits way. One of them is the state’s considerable influenceon the economy. Moreover, many industrial sectors areringed off from foreign competition. Many major companiesalso use so-called captives to cover their risksinternally, which removes a large share of business fromthe insurance market. Others, such as Gazprom, dabblein the insurance market themselves.Another handicap is the Russians’ general unwillingnessto insure themselves against risks. This doesn’tjust apply to the man on the street; many companiesare also notoriously under-insured or not insured at all,says Willy Schaugg, regional manager of AGCS for Russia,formerly known as <strong>Allianz</strong> Russia. In April it was integratedinto Rosno, which has now assumed the name<strong>Allianz</strong> Russia.“Imagine a company wanting to build a production plantin Vladivostok,” says the Swede. “One of our local representativesis available as a direct contact on site, andan <strong>Allianz</strong> expert from the USA flies over the next day toanalyze the specific risks for the company in question.”That would send a really strong signal to the market, saysDanielsson. No other company could come up with sucha combination of local presence and global know-how.Despite the ongoing obstacles, Werner Lellinger, untilApril CEO of the AGCS subsidiary <strong>Allianz</strong> Russia, sees realprogress: “The market is opening up more and more –not least because the financial stability of the insuranceindustry is becoming an issue for Russian companies aswell,” he says. “They appreciate <strong>Allianz</strong>’s high rating.”<strong>Allianz</strong> has insurance program agreements with around60 of the 150 biggest companies listed on the Russianstock exchange, including Sovcomflot, one of the world’sleading tanker companies, and the energy giantsGazprom, Lukoil and Rosneft.In the coming years, Russia will spend billions on expanding its railway networkand purchasing modern trains. The Sapsan, built by Siemens, currently only operatesbetween Moscow and St. Petersburg and between Moscow and Nizhny Novgorodprojects for the Winter Games in Sochi, including the icehockey arena and the Olympic Village.Monuments to Minin and Pocharski, the leaders of the 1611 uprisingagainst the Polish invasion, can be found here in Nizhny Novgorod, as isthe case in many other Russian citiesDespite a difficult start, AGCS in Russia was able to boostits turnover from USD 38 million to USD 100 millionbetween 2006 and 2011. And this wasn’t just the resultof cooperation with foreign businesses in Russia whichthe company insures, such as Toyota, VW and Siemens.<strong>Allianz</strong> is now also a sought-after partner in the Russianeconomy. After integrating the industrial insurance arm<strong>Allianz</strong> Russia CEO Hakan Danielsson is hoping for evengreater penetration of the market.Schaugg and Lellinger are also expecting a boost fromthe major sporting events that will take place in Russiain the coming years: the World Summer Student Gamesin 2013, the Winter Olympics in 2014, the Ice HockeyWorld Championships in 2016 and the World Cup soccerchampionship in 2018. The Russian Ministry of Sport hasestimated that EUR 16 billion needs to be invested. <strong>Allianz</strong>is one of the companies underwriting the constructionof the New Zenit Stadium in St. Petersburg and also someBut the prospects for insurers go far beyond the investmentsneeded for these major sporting events. In thecoming years Russia will have to spend huge sums on itsailing infrastructure if it doesn’t want to fall behind othercountries. For the expansion and revamping of its railwaynetwork and the procurement of new trains alone, thegovernment plans to raise EUR 380 billion by 2030 – aneconomic stimulus package from which the insuranceindustry will surely also benefit.4243

RUSSIASPECIALdpa / picture-allianceStern<strong>Allianz</strong> Group <strong>Journal</strong> 3/2012Nicholas HallJack Frost inthe tankThere’s nothing like a Russian winter. “Even the best diesel freezesat minus 40 degrees,” says Nicholas Hall, head of Mondial Assistancein Moscow. For a company specializing in roadside assistance, it soundslike an advertisement. “Business is booming in winter,” he says.There’s a video clip in which a BBC reporter somewherein Siberia throws a pot of boiling hot coffee into the airwhich instantaneously turns to snow – a vivid demonstrationof what winter in Russia is really like, says NicholasHall. “At such extreme temperatures even our technicianssometimes have problems reaching a vehicle that hasbroken down,” reports the Brit – not to mention fixingthe car when they get there. “If you removed your glovesin these temperatures your fingers would drop off,” saysHall. That being the case, there’s only one option: towthe car to the workshop.In 2011, the call center at Mondial Assistance in Moscowreceived about 45,000 emergency breakdown calls, mostof them during the winter, when Jack Frost flexes hismuscles. The number of staff is then increased from theusual 75 to over 100. Many international carmakers suchas BMW, Mitsubishi, Volvo, Peugeot and Lamborghini relyon the services of the <strong>Allianz</strong> subsidiary, which launchedoperations in Russia in 2008. In the past year the companyhas widened its activities to Ukraine, Kazakhstanand Belarus.Currently, around 550,000 vehicles are insured withMondial Assistance against breakdowns due to frostdamaged batteries and other rigors that can occuron Russia’s roads. No insurer covers more cars. At themoment the roadside assistance service accounts formost of Mondial’s turnover, which reached EUR 5.5million last year – 75 percent up on the previous year.This year, turnover could hit the eight million euro mark,and if business continues to grow as planned, Hall says,that figure could reach EUR 15 to 17 million in three orfour years’ time.The market is dominated by Russian insurers, who oftenkeep newcomers at bay by with rock-bottom prices. However,people are beginning to recognize that dumpingprices do not equate with quality. “We purposely positionourselves as a company that, although not the cheapest,offers excellent service,” says Hall. “And it pays off.”In the area of roadside assistance Mondial AssistanceRussia, which will be renamed <strong>Allianz</strong> Global Assistancein October, cooperates with service companies in 110of the larger cities nationwide. Their range is limitedto a manageable radius though, since carmakers areunwilling to cover the cost of services in every corner ofthis vast country. So a tow back home could turn out tobe a pretty expensive proposition for anyone who breaksdown in the wilds of Kamchatka.On his trips to St. Petersburg, Irkutsk, Novosibirsk andSamara, Nicholas Hall has been able to get an impressionof just how big the country is. “The distances are completelydifferent to what we’re used to,” says the 55-yearold,whose family lives in the UK. He’s also warmed tohis current workplace in Moscow. “I feel safer in Moscowthan I do in London,” he says. “In London there are CCTVcameras all over the place. They’re useful but, in the worstcasescenario, you could be dead before anyone comesto your aid. Here in Moscow there are simply more policeon the street.”But feeling safe can be illusory. A case in point was thebomb attack in January 2011 carried out by terroristson the Domodedovo Moscow airport, indiscriminatelykilling 36 people: Russians, Kyrgyz, Tajiks, Uzbeks,Germans, British and Austrians. Over 150 people wereinjured. Two of Hall’s colleagues were in the vicinityat the time of the explosion. Fortunately, both escapedunscathed.4445