with supplementary material - Watercare

with supplementary material - Watercare

with supplementary material - Watercare

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

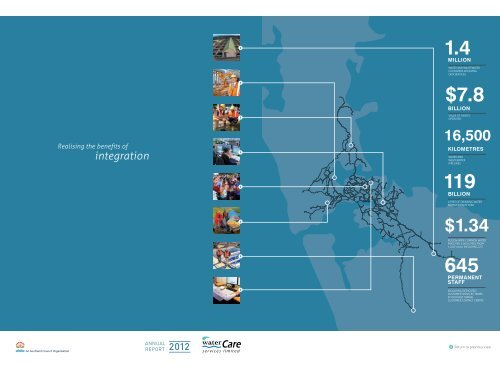

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORT<strong>Watercare</strong>’sNetworksAnd the Local Board areas that we serveGreat Barrier Island InsetRodneyHibiscus Coast and BaysUpper HarbourKaipatikiDevonport - TakapunaWaihekeHenderson - MasseyAlbert - EdenWaitemataOrakeiWhauWaitakere RangesPuketapapaMangere - OtahuhuMaungakiekie - TamakiHowickOtara - PapatoetoeManurewaPapakuraFranklinDAMWASTEWATER TREATMENT PLANTWATER TREATMENT PLANTBULK WATER SUPPLY NETWORKMAIN WASTEWATER COLLECTION NETWORKLocal BoardsReturn to contents pagewatercare’s networks PAGE 3

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTkey to PerformanceMeasurement12345678Safe and reliable waterManagement of water resources to provide a safe and reliable water supply.Healthy waterwaysManagement of wastewater discharges to maintain or improve the health of the environment.Health, safety and well-beingTo be an industry-best workplace.Customer satisfactionProviding customers <strong>with</strong> great service and great value.Stakeholder relationsTo be responsive to stakeholder requirements.Sustainable environmentTo minimise and/or mitigate the adverse impact of the company’s operations on the environment.Effective asset managementManaging assets to ensure the use of existing assets is maximised while optimising the scope, timing and costof new investments.Sound financial managementManagement of the company to meet business objectives at the lowest cost.How to read the performance rulers(Pages 26-60)<strong>Watercare</strong> uses performance rulers to measure achievements against 42 targets in the eight focus areas shown above.The way some rulers are presented has changed this year (indicated <strong>with</strong> a starhas remained the same.) although the methodology for calculating the results3e. Percentage performance: staff training.Target: 20 hours, training and study per employee.AchievedTARGET 100%This year’s performance10 20 30 40 50 60 70 80 90 1002012 SCORE100%<strong>Watercare</strong> continued to invest significantly in the training and development of staff during2011/12, <strong>with</strong> an average of 21.7 hours per employee spent undertaking training or studythroughout the year. The Engineering Graduate support group continues <strong>with</strong> 25 graduatescurrently working towards chartered status. All water and wastewater operational staff areactively encouraged to pursue formal qualifications, <strong>with</strong> 4 staff achieving Certificate orDiploma-level qualifications during 2011/12.KEYTarget metTarget not metGood performancebut could do better2008 2009 2010 201185% 90% 85% 69%Previous years’ resultsfor comparisonPAGE 4 key to performance measurementReturn to contents page

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTPerformancesummary<strong>Watercare</strong> measures and manages our sustainability performance against42 targets <strong>with</strong>in eight focus areas. The focus areas are: safe and reliablewater; healthy waterways; health, safety and well-being; customersatisfaction; stakeholder relations; sustainable environment; effective assetmanagement; and sound financial management. The chart below shows<strong>Watercare</strong>’s performance this year against a target of 100 per cent.FoCuS 795 %FoCuS 897 %percentage10095908580757065605550454035302520151097 %FoCuS 199 %FoCuS 212Safe and reliable water 97%In 2011/12, <strong>Watercare</strong> has:• Continued to supply quality drinking water to 1.4 million Aucklandresidents and businesses• Improved the security of water supply at Ardmore Water TreatmentPlant which treats 61% of Auckland’s drinking water• Greatly improved drinking water quality for the Franklin area.Outlook: Progress the $350 million Hunua No.4 water transmissionpipeline work.Healthy waterways 99%In 2011/12, <strong>Watercare</strong> has:• Continued to meet high wastewater discharge standards andlevels of service at metropolitan plants• Improved the compliance of rural wastewater treatment plantsinherited from Auckland’s legacy councils in 2010.Outlook: Continue planned infrastructure maintenance and renewalsprojects to improve the health of regional waterways.FoCuS 690 %95 %FoCuS 5100 %FoCuS 498 %FoCuS 334Health, safety and well-being 98%In 2011/12, <strong>Watercare</strong> has:• Sustained a staff and contractor focus on health and safety• Performed extremely well against a range of health, safety andwell-being measures.Outlook: Continue to invest in staff development and training.Customer satisfaction 100%In 2011/12, <strong>Watercare</strong> has:• Improved measured service levels in all contacts <strong>with</strong> customers• Introduced a range of online self-service and electronic billing options.Outlook: Ensure continuous improvement in responding quickly andefficiently to customers’ requirements.77FoCuSFoCuS66FoCuSFoCuS88FoCuSFoCuSFoCuS FoCuS55percentagepercentage10095 10090 9585 9080 8575 8070 7565 7060 6555 6050 5545 5040 4535 4030 3525 3020 2515 2010 1510FoCuSFoCuS44FoCuS FoCuS 11FoCuSFoCuS33FoCuSFoCuS22Overall scorefor focus arEA98 %56Stakeholder relations 95%In 2011/12, <strong>Watercare</strong> has:• Contributed to the development of the Long Term Plan and developed anew Statement of Intent in consultation <strong>with</strong> Auckland Council• Continued to work closely <strong>with</strong> environmental and Maori advisory groups.Outlook: Focus on engagement <strong>with</strong> local boards and other key stakeholders.Sustainable environment 90%In 2011/12, <strong>Watercare</strong> has:• Expanded the focus of reducing the impact of midges and odours to thecommunities surrounding the wastewater treatment plants and networksacquired through integration• Begun rehabilitation of the Puketutu Island <strong>with</strong> biosolids, a whole-lifeproject enabling saving to ratepayers of $22 million in real terms.Outlook: Continue to implement sustainability across the company’s activities.Each section has a keywhich highlights thescore for that particularfocus group. The aboveexample shows theoverall score for focus 3,the highlighted segmentshows how it relates tothe main wheel.7Effective asset management 95%In 2011/12, <strong>Watercare</strong> has:• Continued <strong>with</strong> the staged completion of $48 million Waikato TreatmentPlant upgrade• Delivered 97.5% of planned Infrastructure operations capital projects,<strong>with</strong>in the $243 million capital programme.Outlook: Ensure effective delivery of the Asset Management Plan for theperiod 1 July 2012 to 30 June 2022.8Sound financial management 97%In 2011/12, <strong>Watercare</strong> has:• Maintained focus on meeting interest targets and financial ratios.• Continued to concentrate on procurement efficiency, realising savingsof $3.5 million.Outlook: Maintain our focus on leveraging efficiencies and gainsfrom the integrated company.Return to contents pageperformance summary PAGE 5

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTsustainabilityimpacts ofcompany activities<strong>Watercare</strong> owns and operate assets…Initiative and Sustainability impacts Outcome to date Outlook 2012/13... <strong>with</strong> a focus on energyInternal power generation met more than 30%of <strong>Watercare</strong>’s total energy requirements in2011/12 through biogas engines and hydrogeneration from water supply dams. Theengines also provide low-grade waste heatto sustain the anaerobic digesters, whichneutralise the solid waste products andproduce biogas in the process.66Second annual carbon abatement report approved by theMinistry for the Environment, and Emissions units credited to<strong>Watercare</strong>’s account66Optimising biogas engine operating routine66Investigating benefits of increased use of off-peak energytariffs66Proposing participation in instantaneous reserves market andproposing control and operating changes to reduce powerusage and shift usage to off-peak66Assess benefits of biogas storage to achieve reducedflaring, improved engine operation and maximise peakdemand generation66Achieve energy reduction <strong>with</strong> major consumers such asthe Mangere aeration system66Work <strong>with</strong> network companies to reduce “RegionalCoincident Peak Demand”66Research initiatives such as “Contract for Differences” toreduce costs... <strong>with</strong> a thorough maintainance programmeThe Reliability-Centred Maintenance (RCM)programme provides a balance betweenenvironmental and service risk by identifyingoptimum frequency for maintenance of assetsand determining when assets can continue tobe used until they need replacing.... and plans the next assets neededMaster Planning provides a comprehensivereview of facilities to ensure that futurecapacity requirements and regulatoryrequirements needed by the growing regioncan be met in a cost-effective manner.66Completed the implementation of RCM to wholesale parts ofthe business66Reliability block models developed on an as needed basis66RCM assisting other maintenance projects66RCM assisting capital projects and equipment66Huia Water Treatment Plant and Mangere WastewaterTreatment Plant Master Plans completed66Rosedale Network Facility Plan and Rosedale WastewaterTreatment Plant Master Plan substantially completed66Programme for preparation of water network zonemanagement plans developed, 11 substantially completed66Align RCM models <strong>with</strong> SAP ERP system66Review asset failure data, update RCM Weibull data setsand run RCM model simulations to improve maintenance,procurement and design activities as well as assetperformance66Prepare other major water treatment plant master plans66Continue development of water network zonemanagement plans66Continue development of wastewater network masterplans<strong>Watercare</strong> is contributing to the rehabilitation of Auckland’s natural environment…Initiative and Sustainability impacts Outcome to date Outlook 2012/13... through rehabilitation projects<strong>Watercare</strong>’s Coastal Walkway is a 13 km publicwalking track linking important public reservesto the north (Ambury Farm Park) and south(Otuataua Stonefields).66Further rehabilitation work undertaken at OruarangiCreek mouth66Additional land purchased to enhance open space and thecoastal area66Continue to maintain the area66Integrate Coastal walkways to into the new PuketutuIsland parklandPuketutu Island will be rehabilitated <strong>with</strong>treated biosolids over a 35-year period. Thislong-term, cost-effective solution rehabilitatesa former quarry and will result in a newregional park for the people of Auckland.66Consents and appeals finalised in 2011 66Begin application of biosolids in 201366Commence enabling works as scheduled in 201266Establish Governance TrustPond Two is a former oxidation pond that willbe an ecological reserve planted <strong>with</strong> treesafter being treated <strong>with</strong> biosolids. The projectis a least-cost solution and its proximity to thetreatment plant minimises truck movements inurban areas.66Rehabilitation progressing66Submitted the Post-Closure Care Plan for approval66Continue rehabilitation.66Obtain approval for the Post-Closure Care Plan fromthe Auckland Council... through community partnershipsTree planting: throughout the Greater Aucklandarea <strong>Watercare</strong> is supporting community-ledtree-planting initiatives.The <strong>Watercare</strong> Harbour Clean-Up Trust issponsored by <strong>Watercare</strong> to remove litter fromthe Waitemata Harbour and the Tamaki Estuary.66Continued riparian planting in the Waitakere and Hunuaranges and <strong>with</strong> the Waikato RiverCare Trust66Continued native tree-planting programmes for localschools through Trees for Survival initiative66On 26 June a significant milestone was reached - a totalof 3 million litres of rubbish has been removed since theTrust began operations66New website for the Trust’s activities launched,www.harbourcleanup.org.nz and new Facebook pagewww.facebook.com/pages/<strong>Watercare</strong>-Harbour-Clean-Up-Trust/20192012988225766Continue planting project for the Waikato RiverCareTrust and in the Waitakere and Hunua ranges66Maintain support of Trees for Survival66The Trust has implemented a new contract for littercollection from July 2012PAGE 6 sustainability impacts of company activitiesReturn to contents page

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTThe valve intake tower at Cosseys Dam.KEYEnvironmentalSocialEconomic<strong>Watercare</strong> builds major new infrastructure where needed for the growth of AucklandInitiative and Sustainability impacts Outcome to date Outlook 2012/13... water supply infrastructureHunua No.4 Watermain will provide for populationgrowth and increased security of water supply tothe Auckland region through approximately 35kmof trunk watermain from Manukau City to centralAuckland. Approx. $350m cost.66Redoubt Rd to Campbell Rd (28km) under construction in stages overthe next 4 years66Areas of advance works already completed to coordinate <strong>with</strong>infrastructure works by others66Progress design and consents for futurestages of the project between Epsom andKhyber Pass66Continue construction in theManukau area... wastewater treatment infrastructureCentral Interceptor will provide for populationgrowth, mitigate risks of pipe failure and reducewastewater overflows in central Auckland. Thecentral wastewater interceptor will go from centralAuckland to the Mangere Wastewater TreatmentPlant. Approx. $800m.66Concept design completed66Consultation and preparation of consent application continuing66Final drafts of consent application documents are complete andundergoing final review66Complete resource consent application forsubmission by August 201266Public notification of main works packagelate 2012; hearing early 2013<strong>Watercare</strong> contributes to the well-being of communitiesInitiative and Sustainability impacts Outcome to date Outlook 2012/13... improving their neighbours’ quality of lifeMidge control: <strong>Watercare</strong> is minimising the impactof midges on the local communities near Mangereand Rosedale wastewater treatment plants byreducing midge populations and habitats.Odour control: <strong>Watercare</strong> is minimising the impactof odour on the local communities living near thewastewater treatment plants.... making things easy for customersMonthly billing will enable households to spreadthe cost of water across the year and detect leaksmore easily. They were previously billed on athree-monthly or six-monthly basis.Volumetric charging of wastewater enableshouseholds to be charged for what they really use.Before, the cost of wastewater was mostly a fixedcharge integrated in the rates. Households hadlittle economic interest in using water more wisely.Water demand management promotes efficientand wise use of water. It is seen as key topromoting the sustainable use of the region’swater resources.... engaging <strong>with</strong> stakeholdersEngaging <strong>with</strong> the community: <strong>Watercare</strong>is engaging in open communication <strong>with</strong>stakeholders using a variety of methods.... investing in staffThe Graduate Engineering Programme enablesengineering graduates to gain widespreadexperience and exposure during their earlycareer years <strong>with</strong> <strong>Watercare</strong>.66Conducted regular field surveys of midge species and numbers66Proactive measures used for controlling midge breeding grounds66Enclosed odorous processes66Operated biofilter odour beds66Held regular meetings <strong>with</strong> odour auditors and local community66Since 1 July 2012, all Aucklanders receive a monthly bill66Monthly billing undertaken following customer consultationand feedback66Since 1 July 2012, wastewater charges are not included in Council ratesany longer and are mostly based on volume66Adopted a target of 15% reduction in water demand by 2025 throughthe Regional Water Demand Management Plan66Started preparing demand management tools to achieve the target66The new 2012 wastewater tariff underwent public consultation as partof the development of the Auckland Plan66Continued to deliver the Adopt A Stream initiative in Auckland schools,The Rain Forest Express and increased use of social media in deliveringkey messages66Held open Board meetings <strong>with</strong> agendas and minutes available online.66Held 5 public open days to explain the Central Interceptor project andreceive community feedback66Held public meetings in Helensville and in Kumeu, Huapai andRiverhead in relation to wastewater servicing66Extensive engagement <strong>with</strong> Local Boards66Continuing support of Engineering Graduate group activities66In-house mentoring group continuing to run successfully66Continuing support of IPENZ-recognised professionaldevelopment workshops66Continue midge control programmes66Continue to undertake odour monitoringprogrammes66Continue to respond to odour complaints66Support given to Aucklanders by increasedstaff and training at <strong>Watercare</strong>’s contactcentre66Support given to Aucklanders by increasedstaff and training at <strong>Watercare</strong>’scontact centre66Continue existing programmes66Continue preparing more tools to achievethe targets66Set up the monitoring of demand acrossthe region66Continue Adopt A Stream and <strong>Watercare</strong>ledscience lessons66Continue the Rain Forest Express service66Undertake customer service survey66<strong>Watercare</strong> will continue to developgraduate engineers by providing arange of experiences during their earlypostgraduate years and ongoing supporttowards them achieving chartered statusReturn to contents pagesustainability impacts of company activities PAGE 7

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTChairman’sreport“<strong>Watercare</strong> is building on the significant efficienciesrealised since integration to balance the need forgrowth <strong>with</strong> excellent levels of service.”<strong>Watercare</strong>’s first full year as an integratedwater and wastewater service provider hasbeen a successful one.I am pleased to commend the managementand staff of <strong>Watercare</strong> for their work inbuilding on last year’s integration process,and acknowledge the contribution of myBoard colleagues.In the year and a half since November 2010,the company can claim many successes, butin my mind there are two achievements whichstand out:• the seamless transition from a bulk supplierserving six customers to a retail businessservicing 1.4 million customers, <strong>with</strong> noimpact on the service delivery to thosecustomers, and• the contribution <strong>Watercare</strong> continues tomake to the success of Auckland as one ofthe world’s most liveable cities through thedelivery of safe, reliable drinking water andenvironmentally sustainable collection andtreatment disposal of wastewater.As we look to the year ahead and beyond,<strong>Watercare</strong> will continue to manage competingdemands on its resources and funding. Thismeans the business must prioritise whenmaking decisions about Auckland’s futurewater and wastewater needs.This city is growing at a fast pace, so<strong>Watercare</strong> needs to be able to supply for peaksummer water use and meet the demandfor wastewater services for an increasingpopulation at affordable prices.<strong>Watercare</strong> is forecasting $4.8 billion incapital investment over the next 10 years.The majority of that investment is directedtowards renewing and improving the existinginfrastructure, whilst ensuring sufficientcapacity is available to cope <strong>with</strong> growthprojections.Key infrastructure projects in the next10 years include:• the Hunua No.4 Watermain pipeline, whichwill provide for growth and improve securityof supply to central Auckland and the NorthShore ($350 million)• North Harbour watermain duplication toprovide for growth on the North Shore andin Rodney and improve security of supplyfrom key water sources ($265 million)• upgrade of the Huia Water Treatment Plant($185 million) to renew existing assets andimprove security of supply• expansion of the Waikato Water TreatmentPlant (which is a staged upgrade of theexisting plant) to 150 mega-litres per day• upgrade and expansion of the rural watertreatment plants ($100million)• expansion of the biological nutrient removal(BNR) treatment capacity at the MangereWastewater Treatment Plant ($135 million)• the Northern Interceptor, which will caterfor growth in West Auckland and the NorthShore, and improve performance of theexisting wastewater system leading to theRosedale plant ($168 million)• the Central Interceptor – an $800 millionproject which will cater for growth in centralAuckland, replacing aged assets nearing theend of their lives and significantly reducingcombined sewer overflows, and• the Waterfront Interceptor – a $135 millionproject designed to address combined seweroverflows in Herne Bay and Grey Lynn.Whilst <strong>Watercare</strong> is planning ahead tosafeguard the security of Auckland’s watersupply, it is essential that all consumersendeavour to reduce the amount of waterused individually. To that end, <strong>Watercare</strong>is actively supporting the promotion ofawareness of water consumption <strong>with</strong>volumetric charging and monthly billing;minimising leaks while lifting networkefficiency; and working <strong>with</strong> major users toencourage a focus on water conservation.The <strong>Watercare</strong> board comprises a range ofskills and it is our role to ensure investmentdecisions are economically sound and aligned<strong>with</strong> the strategic outcomes sought by ourshareholder, Auckland Council.During this year, Pat Snedden retired fromthe <strong>Watercare</strong> board – his constructive andthoughtful contribution during his nine-yeartenure was greatly appreciated. At the end of2011 we welcomed Mike Allen to the board.<strong>Watercare</strong> is committed to delivering waterand wastewater services that meet the needsand expectations of this growing region. Ourfocus for the coming year is to maintain a highlevel of service delivery and increase muchneededsystem capacity.A successful year requires the contributionof a large number of people and processestogether <strong>with</strong> the establishment andmaintenance of key relationships, bothexternal and internal.My thanks to you all.Ross B KeenanChairmanPAGE 8 chairman’s reportReturn to contents page

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTdirectors’profilesRoss Keenan, 68BCom, FCITChairmanRoss Keenan joined the <strong>Watercare</strong> board in March 2010 and wasappointed Chairman in December 2010. He is an experiencedcompany director, <strong>with</strong> corporate governance and executiveexperience across a diverse range of companies including airways,tourism, telecommunications, health and property development.Ross has particular knowledge and experience in the retail andwholesale water and wastewater services industry and previouslyserved as the Chairman of Metro Water Limited.General disclosure of interests:Chair, Allied Work Force Group Ltd; Chair, Ngai Tahu Tourism Ltd;Director, Ngai Tahu Seafood Ltd; Director, Touchdown LtdDavid Clarke, 53BE (Hons), ME, BBS, MBA, MInstD, FNZIMDeputy Chairman; Chair of the Capital Review GroupDavid Clarke has considerable experience in the areas ofbiotechnology, IT, health, food and related sectors. He has beenthe inaugural chair for multiple technology industries andhas strong commercial and governance skills. His backgroundincludes engineering, finance, marketing and sales. David is afellow of the New Zealand Institute of Management and memberof the NZ Institute of Directors.General disclosure of interests:Chairman, Optima Corporation Ltd – Software (Ambulance/Firesystems and Airlines Rostering); Chairman, TRGG Ltd – RadiologyServices; Chairman, NZ Institute of Rural Health; Chairman, KordiaLtd; Chairman, Skin Institute; Director, Hawkins Watts Ltd – Penrosebased food company; Director, Cranleigh Merchant Bankers; Director,FarmIQ Systems Ltd; Director, Ngai Tahu Tourism Ltd; Director, HyndsGroup Ltd; Trustee, South Auckland Foundation (Middlemore/CMDHB)Peter S Drummond, 59MNZM, AFInstDPeter Drummond is an experienced director and chairman, <strong>with</strong>extensive international business management and marketingexpertise. He was previously Chairman of <strong>Watercare</strong> and bringsextensive knowledge of the wholesale and retail water servicesindustry. He has also served on the boards of Vector, MidCentralHealth and HortResearch Ltd, as well as a large range ofcommunity organisations such as Variety - The Children’s Charity.Peter rejoined the <strong>Watercare</strong> Board in March 2010.General disclosure of interests:Chairman, United Fire Brigade Association; Chairman, ApplianceConnection Ltd; Chairman, <strong>Watercare</strong> Harbour Clean Up Trust; Chairman,Variety Medical Missions South Pacific; Chairman, Ngati Whatua o Orakiwhai maia; International President Variety Childrens Charity; Director,NARTA New Zealand Ltd; Director, NARTA International Pty LtdCatherine Harland, 50BA, PGDipBus (Marketing), MBA, JPCatherine Harland has a background in research, consultancy andpublic policy in local and central government. She was a localgovernment member in Auckland for 15 years, serving on andchairing major regional and city committees. Currently, Catherineis project leader at the New Zealand Institute, an independentthinktank. Previously, she worked <strong>with</strong> AUT University’s Instituteof Public Policy and was engaged in consultancy work <strong>with</strong> theAuckland water industry. Catherine is a Justice of the Peace andserved on the Auckland Observatory and Planetarium Trust Boardfor 11 years, five of those as Chair.General disclosure of interests:Director, McHar Investments Ltd ; Director, Interface Partners Ltd;Trustee, Auckland Restorative Justice Trust; Trustee, One Tree HillJubilee Educational TrustSusan Huria, 52FPRINZ, MInstDChair of the Organisation CommitteeSusan Huria is a specialist in the Maori sector, working<strong>with</strong> Maori organisations on constitutional reviews, boardappointments, support and strategic advice. She hasextensive governance, marketing communications andgeneral management experience. Susan was an executiveat Auckland International Airport and worked in marketingand communications for 10 years, before starting her ownmanagement practice, Huria Anders, in 2000.General disclosure of interests:Deputy Chair, AgResearch Ltd ; Director, Northland PortCompany Ltd; Director and Shareholder, Huria Anders Ltd;Director and Shareholder, Susan Huria (2003) Associates Ltd;Director and Shareholder, Te Ara Tika Properties Ltd ; Director,Vermilion Design Ltd; Director, Airways Corporation of NewZealand Ltd; Director, Veterinary Enterprises Group Limited;Trustee, First FoundationTony Lanigan, 64BE (Hons), PhD, FIPENZ, MICETony Lanigan is a professional civil engineer (FIPENZ),project-management consultant and former General Managerof Fletcher Construction. He was Chancellor of AucklandUniversity of Technology and a director of InfrastructureAuckland. Tony is currently Vice Chairman of Habitat forHumanity in New Zealand and Chair of theNZ Housing Foundation. He is a Director of theNZ Transport Agency (NZTA).General disclosure of interests:Vice Chairman, Habitat for Humanity International; Director, NZHousing Foundation; Director, NZ Transport Agency; Director,Hargrave Project Management Limited; Director, A G Lanigan &Associates LimitedMike Allen, 51LLB, BComMike Allen has extensive experience in investment bankingand general management in both New Zealand and the UK.He has previously consulted to the Australasian water andinfrastructure sectors. Mike is chairman of EnvironmentalInvestments Limited.General disclosure of interests:Chairman: Coats plc; Director, Guinness Peat Group: Director,Godfrey Hirst Limited; Director, Innoflow Australia Limited;Director, Tower Insurance; Director, Tainui Group HoldingsLimited; Director, Breakwater Consulting LimitedJeff Todd, 70CBE, BCom, FCA, FInstDChairman of the Audit and Risk CommitteeJeff Todd is a chartered accountant and company director,and was formerly managing partner for New Zealand andthe Pacific for Price Waterhouse (now PwC). He is a formerChairman of the Southern Cross Medical Care Society,Southern Cross Healthcare Trust and The New ZealandGuardian Trust Company Ltd, and Director of the ReserveBank of New Zealand and the ANZ Banking Group (NZ) Ltd.Jeff has a particular interest in corporate governance and is afellow of the NZ Institute of Directors.General disclosure of interests:Chairman, Dynasty Hotel Group Limited; Chairman, SanfordLimited; President, Auckland Medical Research Foundation;Trustee, Goodfellow Foundation; Trustee, ChristianHealthcare TrustPAGE 10 Directors’ profilesReturn to contents page

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTchiefexecutive’sreport“Our focus for the coming year is to maintain ahigh standard of service to meet the expectationsof a continually growing region.”Over the last year, <strong>Watercare</strong> has continuedto mature as an integrated business.While Auckland’s growing populationdrives increasing demand for water andwastewater services, <strong>Watercare</strong> is working toreduce water demand and expand capacityin the system where required, while alsomaintaining service level standards andminimising costs to customers.Since November 2010, <strong>Watercare</strong> hasbrought into place the operational andretailing functions of the former six localnetwork operators and councils, <strong>with</strong>outcompromising service delivery toour customers.Each day, we deliver the things ourcustomers want from us: secure and safedrinking water, and the collection, treatmentand disposal of wastewater in a way thatkeeps our environment and waterwayshealthy.of safe drinking water to our customers,and that enable their wastewater to becollected and treated while minimisingimpacts on our environment. This is evenas we integrated some under-performingwater and wastewater assets from theformer local network operators into themainstream network.Following integration we quickly moved toimprove treatment at the non-metropolitanwater treatment plants, including theinstallation of process upgrades atWarkworth and Wellsford to meet arequired increase in performance.We also introduced process changes toimprove effluent quality at non-compliantwastewater treatment plants, whilecompliance was maintained at allother metropolitan wastewatertreatment plants.Future-proofing the water andwastewater network<strong>Watercare</strong>’s aim is to develop, operate,maintain and replace assets over the longterm in order to deliver high-quality servicelevels and meet foreseeable future needs.Reducing water demand now defers theneed for expensive upgrades and is animportant focus for us.<strong>Watercare</strong>’s services are delivered via$7.8 billion worth of assets – Auckland’sentire water and wastewater infrastructure– and we are focused on using Aucklanders’investment in these assets wisely and well.This year, by striving for efficiencies suchas integrated programme delivery andproject design modification, we finishedthe year having completed the scheduledinfrastructure programme, spending97 per‐cent of our $243 million budget.In this year’s Annual Report I am pleased toshare the excellent progress <strong>Watercare</strong> ismaking in delivering those services.We are a company which carefully focusesits efforts and resources in order to deliverwhat our shareholder requires and what our1.4 million customers expect.My hope is that, over time, we will seegreater public recognition of <strong>Watercare</strong>’srole. Here are some of the achievementsthat I believe deserve a mention.Water and wastewater service deliveryThis year we have delivered water andwastewater services <strong>with</strong>out majorinterruption, and maintained excellentlevels of service.Every day, our network teams are on thejob throughout Auckland maintaining the16,500-kilometre network of pipes andplants that enable the continuous supply“Since integration in November 2010, <strong>Watercare</strong> has achievedregional cost efficiencies of more than $100 million.”The majority of the established waterassets – most of which are gravity supplied– continue to serve us well. Much of therequired upgrade work has been completed,is underway or is planned.Our two largest wastewater treatmentplants are state of the art. The high qualityof treatment at Mangere means we candischarge close to the shore. An internationalexpert group recently advised that the2003-2007 upgrade was “an outstandingsuccess story in relation to protection ofpublic health and the environment” and thecondition of Manukau Harbour hasbenefited substantially.<strong>Watercare</strong> plans capital works projectswhich future-proof for growth anddevelopment in the Auckland region, andwhich replace ageing infrastructure andensure security of water supply.New significant infrastructure can be subjectto long lead times, sometimes a decade ormore. This requires considerable foresightand planning from <strong>Watercare</strong>, workingclosely <strong>with</strong> Auckland Council.In the last two years, completed majorinfrastructure includes Project Hobson, theSwanson Branch Wastewater Storage Tank,and Southwestern Interceptor upgrades.PAGE 12 chief executive’s reportReturn to contents page

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTThe new tariff will address inconsistentcharging across the former council areas.The tariff was selected by Auckland Council,based on principles of equity and fairness,and approved by the <strong>Watercare</strong> boardfollowing public consultation in early 2012as part of the council’s Long Term Plan.Many Aucklanders will benefit from thischange as they will be paying less thanthey did in 2011/12, but some householdswill face increases compared to whatthey paid during that period previously.Recognising that some customers stillstruggle to manage their household costs,<strong>Watercare</strong> established the Water UtilityConsumer Assistance Trust in late 2011.While the trust receives funding from<strong>Watercare</strong>, it operates independently. Thetrust has the ability to grant remissionsto residential customers who meet itseligibility criteria and are deemed to bestruggling to manage their water and/orwastewater costs.In 2011/12, 150 customers were registered<strong>with</strong> the Water Utility Consumer AssistanceTrust. To date, 52 customers have hadhardship relief approved by the trust.We have also continued refining ourcentralised contact centre. Here, at oursingle point of contact for all calls to<strong>Watercare</strong>, we are now seeing consistentlyhigh levels of service against service targets,such as response to incidents, notification ofshutdowns, correspondence and complaints.In the lead-up to 1 July 2012, we preparedfor the implementation of monthly billing.Shifting the billing frequency to monthly – alarge project which meant reconfiguringa number of systems all at the sametime – is a business change that has beenimplemented because it benefits both ourcustomers and <strong>Watercare</strong>.Customer feedback had indicated thatmanaging home budgets would be easier ifthey received a bill every month, rather thana large bill every quarter or six months. Andfrom a business perspective, while monthlybilling adds some initial cost to <strong>Watercare</strong>,this change – along <strong>with</strong> the company’sgradual shift to electronic billing – willalso create savings over time, helping thebusiness to minimise water and wastewatercharges to our customers.SustainabilityOur commitment to protecting theenvironment is embedded in our businessand operations. The company is focused ondelivering services that balance the needsto provide critical infrastructure to a growingregion, while also ensuring our operations andservices are delivered in a sustainable way.This year, having employed a full-timeSustainability Manager, we began expandingour corporate sustainability programme,capitalising on the work done by the<strong>Watercare</strong> ‘Zero Waste’ group. We are alsopartnering <strong>with</strong> EcoMatters Environment“Our commitment to protecting the environment is embeddedin our business and operations.”Trust to help our domestic customers achievewater savings at home, and continuing otherexternal sustainability initiatives while alsoplanning new ones <strong>with</strong>in <strong>Watercare</strong>’s newsustainability framework.Examples of our sustainability activities thisyear include the following:• Our core business sustainability impactssuch as:• internal power generation, whichin 2011/12 met more than 30% of<strong>Watercare</strong>’s total energy through biogasengines and hydro generation fromwater supply dams• projects such as the Hunua No.4Watermain and Central Interceptor,which will provide for population growth• direct community engagement whichenables <strong>Watercare</strong> to integratecommunity needs into projectdevelopment• Through the Adopt A Stream programme,our dedicated educator helped nearly 6000students learn about water and its vital role<strong>with</strong>in our environment• The <strong>Watercare</strong> Harbour Clean-Up Trustcontinued overseeing the removal of litterfrom Auckland’s habours and promoting theconcept of rubbish-free waterways• In close consultation <strong>with</strong> iwi and AucklandCouncil, work is underway on PuketutuIsland to rehabilitate its 40 hectares ofquarried land <strong>with</strong> biosolids from theMangere Wastewater Treatment Plant.Preparation for building the biosolidsplacement area has begun and the site isscheduled to be operational in October2013. Over time, as the site is graduallyrehabilitated, more and more land will berelinquished back to Auckland Council andopened to the public. On completion of thequarry rehabilitation in 35 year’s time, thewhole island will be available as publicopen space.Although the tragic accident that took thelife of our colleague Philomen Gulland andseriously injured Ian Winson, James Millard andHarry Barnett was recorded in last year’s AnnualReport, the event is so strongly embedded inour memories that it just seems too prematureto consign it to history. Since the accident,<strong>Watercare</strong> has supported the families ofPhilomen and Ian and we’ve also endeavouredto aid the recovery of Ian, James and Harry.We are pleased that they are making steadyprogress. The Department of Labour is takingproceedings against <strong>Watercare</strong>.As we move into the second half of 2012,I am heartened by the progress we have madeas a business, and the commitment showndaily by all our staff in providing high-qualitywater and wastewater services to the peopleof Auckland.K M FordChief ExecutivePAGE 14 chief executive’s reportReturn to contents page

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTgovernance<strong>Watercare</strong> is a wholly owned subsidiary of Auckland Council (theShareholder). The Board of Directors (the Board) and management of<strong>Watercare</strong> remain committed to ensuring that the company applies bestpracticegovernance policies and procedures. The Board is ultimatelyresponsible for all decision making by the company.Operational responsibility is delegatedto the Chief Executive by way of a formaldelegated authority framework. The Boardcomprises eight independent, non-executivedirectors. Their profiles and disclosures ofinterests are published on page 10. Directors,including the chair, are appointed by theShareholder.1. ACCOUNTABILITYShareholderThe Board is appointed by the Shareholderto govern <strong>Watercare</strong> in accordance <strong>with</strong>the statutory obligations and in accordance<strong>with</strong> the agreed Statement of CorporateIntent (SCI).The SCI sets out the activities to beundertaken by <strong>Watercare</strong> and specificeconomic, social and environmentalobjectives for the company. It establishesperformance targets which are used tomeasure the company’s performance.<strong>Watercare</strong> must consult <strong>with</strong> the Shareholder,Local Boards, the Maori Statutory Board andthe public during the development of theSCI. The Shareholder’s comments regardingthe draft SCI were presented to the public atone of <strong>Watercare</strong>’s public Board meetings.Prior to the Board adopting the draft SCIin 2011/12, the public was invited to theBoard meeting on 26 May 2011 to considerShareholder comments on the SCI.<strong>Watercare</strong> delivered the 2011/12 SCI tothe Shareholder on 30 June 2011, and thedocument is available on the companywebsite www.watercare.co.nz.Performance<strong>Watercare</strong> is required by legislation toreport quarterly to Auckland Councilthrough the Accountability andPerformance Committee. The performanceof the company against the measures inthe SCI is reported to the Board monthlyand to the Shareholder quarterly. Thisannual report records performanceof the company against non-financialperformance measures included in the SCI.The non-financial performance measuresare set out on pages 113-115. A wider setof measures including social, economic,environmental and selected SCI measureshave been grouped under eight headingsand the performance of the companyagainst these is reported on pages 24-61.These measures are selected to reflect theperformance of the integrated companyacross a broad base.2. TRANSPARENCY AND OPENNESSLegislative framework<strong>Watercare</strong> is a limited liability companyregistered under the Companies Act 1993,and a local government organisation.The Local Government Acts of 1974 and2002 define the role and duties of localgovernment organisations in New Zealand.The legislative framework enabling andgoverning <strong>Watercare</strong>’s operations as theregional provider of water and wastewaterservices in Auckland is largely found inthree Acts and amendments:1. Local Government (Tamaki MakaurauReorganisation) Act 20092. Local Government (Auckland Council)Act 20093. Local Government (AucklandTransitional Provisions) Act 2010The company’s obligations to deliver waterand wastewater services for Auckland areestablished under Part 5 section 57(1) ofthe Local Government (Auckland Council)Act 2009 which stipulates that an Aucklandwater organisation:(a) must manage its operations efficiently<strong>with</strong> a view to keeping the overallcosts of water supply and wastewaterservices to its customers (collectively)at the minimum levels consistent<strong>with</strong> the effective conduct of itsundertakings and the maintenance ofthe long-term integrity of its assets; and(b) must not pay any dividend ordistribute any surplus in any way,directly or indirectly, to any owner orshareholder; and(c) is not required to comply <strong>with</strong> section68(b) of the Local Government Act2002 (avoiding the requirement to pay adividend); and(d) must have regard for public safety (forexample, the safety of children in urbanareas) in relation to its structures.Also under the legislative framework:• the company became a Council ControlledOrganisation on 1 July 2012, and mustremain a CCO of Auckland Council at leastuntil 30 June 2015• at least two Board meetings a year arerequired to be held in public; before 30June to consider the Council’s commentson the draft SCI, and after 1 July to considerthe company’s performance under the SCIin the previous year• the company’s financial statements, theSCI and specified long-term plans must beaudited by the Auditor–General, or by anauditor acting on behalf of theAuditor–General.Company goals and strategiesThe goals and strategies for <strong>Watercare</strong> areset as part of the process of developing theSCI in association <strong>with</strong> the Shareholder and<strong>with</strong> approval by the <strong>Watercare</strong> Board ofDirectors. The process follows the receipt ofthe Mayor of Auckland’s letter of expectationwhich includes the vision and objectives forAuckland and the outcomes sought by theAuckland Plan. A draft SCI is then preparedby <strong>Watercare</strong> as the basis of consultation<strong>with</strong> the Shareholder which identifies therelationship between <strong>Watercare</strong>’s activityand delivery of the outcomes sought bythe Mayor and those specified <strong>with</strong>in theAuckland Plan. Prior to final adoption bythe Board, comment on the final draft SCIis invited from Local Boards, the MaoriStatutory Board and key stakeholders. Thisyear, <strong>Watercare</strong> hosted a joint workshopbetween the Board and Auckland Councilcouncillors to discuss water and wastewaterstrategy as a precursor to the developmentof a new water strategy, as required as partof the Auckland Plan.Return to contents pagegoverence PAGE 17

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORT<strong>Watercare</strong>’s objectives are closely aligned <strong>with</strong>those of Auckland Council, Local Boards and keystakeholders such as tangata whenua.Of special importance are the Local Boardswhich represent local communities undera co-governance model <strong>with</strong> the AucklandCouncil governing body. <strong>Watercare</strong>maintains purposeful relationships <strong>with</strong> theLocal Boards chairs and members arrangedthrough a dedicated company executivewhich ensures flexible, transparent andtimely communication and ready access tomeaningful information. The relationshipand channels of communication recognisethe diverse needs of Local Boards andcommunities and the varying level ofinterest in <strong>Watercare</strong>’s services and projects.Performance of the Board and ChiefExecutiveThe performance of the Board is reviewedby the Shareholder annually, both inrelation to the Board as a whole and thecontribution of its individual members.Board remuneration is determined by theShareholder. The performance of the ChiefExecutive is reviewed annually by the Board.Transparency in reporting<strong>Watercare</strong> remains committed totransparent reporting. Recognising this, thecompany publishes:• an annual Statement of CorporateIntent (SCI)• an annual Financial Plan• annual and long-term Asset ManagementPlan (AMP)• an annual report that reports performanceagainst the SCI, non-mandatory measures,and the United Nations’ Global ReportingG3 Initiative guidelines (see page 116)• an overview of current water storage levelsand other information published weekly• special reports and project newsletters forinterested parties.The Board agenda, papers and minutes ofthe previous meeting are made available inadvance of the Board meeting through thecompany website.Below: Members of the <strong>Watercare</strong> Board of Directors visit Ardmore Water Treatment Plant: from left,Tony Lanigan; Catherine Harland; Susan Huria; Ross Keenan (Chairman); and Jeff Todd; <strong>with</strong> StuartUrquhart, Operations Controller and Gil Miers, Treatment Plant Manager.Setting standards of conduct for staff<strong>Watercare</strong> demands the highest standardsof behaviour from its staff. All policiesgoverning the conduct of employees arepublished on the company’s intranetincluding: Business Conduct and EthicsPolicy, Gift and Inducement Policy Conflictof Interest Policy, Control of DiscretionaryExpenditure and Protected DisclosuresPolicy. All contracts managed by staffmust be in writing. The policies also setout the delegated authority <strong>with</strong>in thecompany. <strong>Watercare</strong>’s projects are subjectto internal probity reviews, and externalprobity auditors are appointed to provideadditional assurance on major projects.Complaints disclosureAny complaints against the company andthe quality of response are recorded. Targetshave been set for the management ofthese processes and the level of serviceis reported in the Annual Report, to theShareholder quarterly, to the Board monthlyand are made public at the board meetingsand published on <strong>Watercare</strong>’s website.WhistleblowingThe company has a specific policy toreceive and deal <strong>with</strong> information aboutany serious wrong-doing <strong>with</strong>in thecompany, as required by the ProtectedDisclosures Act 2000. <strong>Watercare</strong>’s policyprescribes how its <strong>Watercare</strong> staff andothers report matters of serious wrongdoing,and provides contacts to whom suchreporting can be made. The policy definesserious wrong-doing and applies to presentand past employees, and to any individualeither seconded to or working on a contractbasis for <strong>Watercare</strong>.3. INTEGRITYCorporate governance charterThe charter defines the duties andobligations of the Board and Boardmembers covering fiduciary duty, duty ofcare, diligence, legal and statutory dutiesand conflicts of interest. It incorporatesthe principles of the New Zealand Instituteof Directors’ Code of Proper Practice forDirectors, relevant sections of thePAGE 18 GovernanceReturn to contents page

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORT<strong>Watercare</strong>’s Board of Directors applies its specialistknowledge through subcommittees such as the Audit andRisk Committee and the Capital Projects Review Group.New Zealand Exchange Limited (NZX)Corporate Governance Best Practice Codeand the Securities Commission’s nineprinciples of corporate governance.Disclosures of interestA register of directors’ interests ismaintained by <strong>Watercare</strong> and is updatedas and when necessary. Directors’ interestsare a standard agenda item at every Boardmeeting. Any disclosure of interest isrecorded in the meeting minutes and theparticipant refrains from taking part inthe discussion or voting on any relatedresolution. In 2011/12, Board membersdisclosed a potential conflict of interest ontwo occasions.Audit and Risk CommitteeThe Board is responsible for appointing themembers of the Audit and Risk Committee.The committee’s role is to assist the Boardto fulfil its responsibilities in the areasof financial reporting and to provideassurance regarding compliance <strong>with</strong>internal controls, policies and procedures.Its responsibilities are established in theAudit and Risk Committee Charter whichis reviewed annually. The committee hasno delegated authority. In carrying out itsduties, the committee meets regularly <strong>with</strong>the external and internal auditors (both <strong>with</strong>and <strong>with</strong>out management present) and themanagement of the company. At least onemember must have accounting or financialmanagement expertise. The chairman of theBoard may not be chairman of the Audit andRisk Committee. The current chairman of theAudit and Risk Committee is Jeff Todd. All<strong>Watercare</strong>’s directors receive the papers ofthe Audit and Risk Committee inadvance, and all are invited to attendcommittee meetings.Organisation CommitteeFollowing completion of the integrationprocess the Board established anOrganisation Committee to provide a linkbetween the Chief Executive and the Boardaround senior staff remuneration andorganisational development. The committeeconsists of two Board members: Susan Huriaas Chair, and Ross Keenan. The Committeeprovides a reference point for the ChiefExecutive in matters around organisationalchange and succession planning.Capital Project Review GroupThe Capital Projects Review Group (theGroup) is chaired by a member of the<strong>Watercare</strong> Board of Directors, currentlyDavid Clarke, and includes other Boardmembers and senior management asrequired. The Group is responsible forreviewing the process and formulation ofthe company’s Asset Management Plan(AMP), including a review of the businessdrivers and prioritisation methodologyincluded <strong>with</strong>in the AMP framework. TheGroup also reviews the capital planningand expenditure process, the projectreporting framework and the developmentof specific strategic projects. Papers that<strong>Watercare</strong> Governance Planning Cycle*approvalFinal ShareholderDraft SOI negotiated and revisedSO Ia do pt e dTariffs set andFunding PlanapprovedAprMart i o nFebMayl t aJunJanare reviewed by the Group are circulatedto all Board members and all members ofthe Board of Directors can attend Groupmeetings. All major capital projects requireapproval of the full Board.Regular independent reviews<strong>Watercare</strong> subjects its planning,operations and reporting to review byindependent consultants on a regularbasis. This year, the Board and the Auditand Risk Committee received reportsfrom specialist advisers on risk andcontrol issues to inform the maintenanceand development of good practice andprocedures. The company is committedto a culture of continuous improvementand seeks independent feedback fromspecialist advisers as necessary to achievethis objective.f c o n s uAnnual Repo r tand PlanbeginsFinancialprocessA s s e t M a n a g e m e n tSOI ProcessAsset Management PlanFinancial Planning ProcessAnnual Report* From 1 July 2012, <strong>Watercare</strong> will produce a Statement of Intent (SOI) rather than an SCI.DecJulAugNovr i fSepOctT aShareholderpresentationtariff-settingPl a nof expectationreceivedMayoral letterTariff options preparedS O Id r a f tp r e p a r e dReturn to contents pageGovernance PAGE 19

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTSuzanne Naylor, OperationsHeadworks Engineer,and Anin Nama, NetworkManager Operations, <strong>with</strong><strong>Watercare</strong> Board membersat Cosseys Dam in theHunua Ranges.4. STEWARDSHIPIndemnity and insurance<strong>Watercare</strong> has executed a deed ofindemnity <strong>with</strong> each director whichindemnifies the director in accordance<strong>with</strong> the company’s constitution, andgrants certain rights in respect of access todocuments and the maintenance of liabilityinsurance cover.Board meetingsThe Board had seven Board meetingsscheduled during the year. In addition, itsmembers met three times in workshopsto allow the Board to progress matters ofpolicy to finality. The matters discussedwere later dealt <strong>with</strong> at Board meetingsonce the policies and strategies werefinalised. At two meetings the publicwas invited to provide feedback (one onperformance for the previous year and theother on the SCI for the following year).The Board invites the public to attend allpublic sessions of Board meetings.Risk management<strong>Watercare</strong>’s framework for risk identification,measurement and reporting is welldeveloped, and meets the requirements ofthe Australian and New Zealand Standard4360. There are regular external reviewsto ensure the company meets and exceedsgood-practice measures in risk management.As part of the risk management framework,the company has established a Risk SteeringCommittee which meets six times per yearto monitor emerging risk and risk-mitigatingactions and strategies. The committeecomprises the Chief Executive, seniormanagement, the internal auditor andthe risk manager. Risks that have seriousconsequences are in turn directly monitoredby the Board, <strong>with</strong> updates presented toeach Board meeting.External auditorThe Auditor-General is the auditor of thecompany’s financial statements. The Auditor-General has appointed Jamie Schmidt,using the staff and resources of Deloitte,to undertake the external audit work onbehalf of the Auditor-General, in accordance<strong>with</strong> the Auditor-General’s Audit Standards,which incorporate New Zealand AuditingStandards. Deloitte has no relationship<strong>with</strong> the company outside of the audit andrelated assurance activities. This satisfies theindependence requirements of the Auditor-General and the Institute of CharteredAccountants of New Zealand.Regulators<strong>Watercare</strong> is subject to regulation in planning,health and environmental matters. Theprincipal regulators include Auckland Council,Waikato Regional Council and the Ministry ofHealth. The company also engages <strong>with</strong> thesebodies by providing input on the impacts ofexisting and proposed policy and regulationon <strong>Watercare</strong>’s activities.Advisory groups<strong>Watercare</strong> has a standing consultative andadvisory committee, the EnvironmentalAdvisory Group that comments on companyplans and projects in 2011/12. TheEnvironmental Advisory Group comprisesexperts who advise on how the company’sactivities impact on the environment. Inaddition, <strong>Watercare</strong> is developing a newMaori advisory group, the Mana WhenuaForum, which will advise <strong>Watercare</strong> onhow its plans and operations impact onMaori and on the relationship between thenatural environment and Maori. The reportof the Environmental Advisory Group and asummary of the new Mana Whenua Forumcan be found on pages 22 and 23.Other stakeholders<strong>Watercare</strong> consults extensively <strong>with</strong>the Shareholder, the Accountability andPerformance Committee, environmentalregulators, special interest groups andadvisory groups. Considerable effortis also put into engaging <strong>with</strong> partiesand communities likely to be affectedby the activities of the company in theirneighbourhood. The performance of<strong>Watercare</strong>’s performance is very closelymonitored in terms of the level and qualityof the service provided to both customersand the community. The level of service isreported to the Board monthly and to theShareholder on a quarterly basis.Official information requestsIn 2011/12, <strong>Watercare</strong> received 12 requestsunder the Local Government OfficialInformation and Meetings Act 1987.The average response rate was 7.3 days.Board Member Attendance2011/12Date Appointed Date Retired Attendance at Boardmeetings/workshopsAttendance at Audit& Risk CommitteeAttendance at CapitalProjects Working GroupRoss Keenan (Chairman) March 2010 10/10 4/5 4/4David Clarke (Deputy Chairman,Chair Capital Projects Working Group)July 2008 10/10 4/4Mike Allen Dec 2011 4/5 0/1Susan Huria July 2008 9/10Peter Drummond March 2010 7/10 4/4Jeff Todd (Chairman, Audit & Risk Committee) May 2007 10/10 5/5Catherine Harland May 2011 10/10 5/5Tony Lanigan May 2011 9/10 4/4Pat Snedden Dec 2002 Dec 2011 5/5 3/3PAGE 20 GovernanceReturn to contents page

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORT<strong>Watercare</strong> at worklocal boardrelationshipsLocal Boards are a key part of Auckland’s governance, enabling localrepresentation and decision-making on behalf of local communities.There are 21 Local Boards throughout the Auckland region fromRodney to Franklin.Pictured left to right: Central Interceptor Project Manager Mike Sheffield discusses the project <strong>with</strong> Albert-Eden Local Board members and Council Parks staff;contractors installing new water filtration equipment at the Pukekohe Water Treatment Plant; Planning Manager Belinda Petersen talks <strong>with</strong> local residentsat a Central Interceptor community open day.<strong>Watercare</strong> recognises the important roleof Local Boards in local decision-makingand community representation, and hasworked to build purposeful relationships<strong>with</strong> the board chairs and membersbased on flexible, transparent and timelycommunication.An operational engagement plan has beendeveloped, agreed and is in place <strong>with</strong> theLocal Boards to help facilitate the workingrelationship. This is supported by a dedicatedstaff executive who works to help maintainthe relationships and communication flows.The nature of <strong>Watercare</strong>’s relationship <strong>with</strong>various Local Boards varies due to the rangeof issues, local priorities and varying levelsof community interest. To date, the majorityof Local Board engagement has focused onareas where there is significant activity orpublic interest. However, the major premisefor all Local Board communication has been afree flow of information regarding issuesof mutual interest consistent <strong>with</strong> a nosurprises approach.Notable activities over the past 12 monthshave been <strong>with</strong> Rodney Local Board inengaging <strong>with</strong> the Helensville communityto obtain resource consents for thewastewater treatment plant, and <strong>with</strong> theKumeu, Huapai and Riverhead communityto prepare for new wastewater connections.Similarly, <strong>Watercare</strong> has communicated<strong>with</strong> the Franklin Local Board and keystakeholders during installation of the new$14 million Pukekohe local watermain.Local Boards in the central area haveprovided <strong>Watercare</strong> <strong>with</strong> constructivefeedback on works in local parks associated<strong>with</strong> the proposed Central Interceptorproject, and feedback from the boards wasincorporated into five public open daysheld along the proposed route.<strong>Watercare</strong> has also worked <strong>with</strong> the LocalBoards to help increase understandingof the Auckland-wide network dischargeconsent application which will build onthe work previously undertaken on theNorth Shore in authorising and managingwet-weather overflow impacts on sensitivereceiving environments.<strong>Watercare</strong>’s issues that impact LocalBoards are diverse and varied, and requirea variety of approaches. The company willcontinue to remain flexible and responsivein working <strong>with</strong> Local Boards to best meettheir individual needs.In the coming 12 months, <strong>Watercare</strong>will look to build on the excellentfoundation established and remainresponsive to the needs of Local Boards inrepresenting the interests of their diverselocal communities.Return to contents pagelocal board relationships PAGE 21

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTEngagement<strong>with</strong> tangatawhenuaMana Whenua Forum<strong>Watercare</strong> has recently consulted <strong>with</strong> hapu and iwi fromthroughout Tamaki Makaurau on their preferred form ofengagement <strong>with</strong> <strong>Watercare</strong>. Following a series of hui(meetings), a resolution was passed to establish aMana Whenua Forum in conjunction <strong>with</strong> <strong>Watercare</strong>.Hapū and iwi in Tāmaki Makaurau have agreed to sign aRelationship Agreement <strong>with</strong> <strong>Watercare</strong>. The Forum willcomprise designated representatives from eachMana Whenua entity.The Relationship Agreement has been designed topromote partnership, protection, and focused action.An associated Charter has been prepared which includesthe following principles:• Relationship Building – Building understanding andenhancing the relationship between mana whenuaand <strong>Watercare</strong>• Integrity – Ensuring cultural integrity and respect• Opportunities – Identifying opportunities of mutual interestand benefit• Best practice – Advising on best practices for meeting<strong>Watercare</strong>’s cultural, environmental, social and economicresponsibilities• Efficiency – Establishing efficient, collective processes forbuilding the relationship and engagement.Māori Advisory GroupThe Māori Advisory Group (MAG) was established in 2001 inrecognition of the stewardship role of Māori in relation to thesupply of water services in the Auckland region. The group’s rolewas to provide advice to <strong>Watercare</strong> from a Māori perspectiveon <strong>Watercare</strong>’s response to national and local policy and plansand the development of <strong>Watercare</strong>’s infrastructure projects.In addition, the MAG provided guidance to <strong>Watercare</strong>’s seniormanagers on cultural issues and facilitated relationship buildingand understanding between <strong>Watercare</strong> management and iwi.The MAG was not established to represent the different ManaWhenua groups, but rather to advise <strong>Watercare</strong> on mattersrelating to iwi, including how to approach and relate to themana whenua groups. Recent projects the MAG has providedadvice on include the Hunua No. 4 Watermain project, theCentral Interceptor project, wastewater network consents andthe management of biosolids.<strong>Watercare</strong> acknowledges and thanks the members of theMāori Advisory Group for their contribution to <strong>Watercare</strong> overthe last decade by assisting management in understandingMāori culture and protocols, the implications of the Treaty ofWaitangi, the history of the region from an iwi perspective, thevalue of water to Māori, and the significance of kaitiakitanga(guardianship and conservation). In particular, <strong>Watercare</strong> wishesto recognise the MAG Chairman, Bill Kapea, for his long-standingcommitment and support to <strong>Watercare</strong> and the MAG over years.The Māori Advisory Group members were:ChairmanWilliam KapeaMembersNorma Rae ArlidgePaul BrownGeorge KahiKowhai OlsenPita PouLucile RutherfurdHeta TobinPamera Warner<strong>Watercare</strong> wishes to thank Tame Te Rangi forhis contribution as Mana Whenua ForumInterim Chair.Return to contents pageengagement <strong>with</strong> tangata whenua PAGE 23

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTpercentageSedimentation beds atArdmore Water TreatmentPlant, where settlementof suspended solids takesplace as part of the watertreatment process.77FoCuSFoCuS66FoCuSFoCuS88 FoCuSFoCuSFoCuS 5FoCuS 5percentage100959085807570656055504540353025201510100959085807570656055504540353025201510FoCuSFoCuS44FoCuS 1FoCuS 1FoCuSFoCuS22FoCuSFoCuS33Overall scorefor focus arEA97 %See page 5<strong>Watercare</strong> is on schedule to complete a $22 million upgrade ofthe company’s Ardmore Water Treatment Plant which will provideadditional capacity and increased security of water supply toAucklanders. The upgrade works will enhance the plant’s ‘RapidRestart’ capability, reducing any disruption of Auckland’s watersupply following operational interruption. In addition, improvedsolids-handling systems will improve long-term capacity andprovide additional environmental protection against potentialoverflows. Contractors have already completed de-sludging,drainage and pipe-strengthening activities on site, and work iscontinuing on construction of overflow chambers and earthworks.Anin Nama (r), Operations Manager Networks,and Stuart Urquhart (l), Operations Controller,surveying the sedimentation beds at ArdmoreWater Treatment Plant.Return to contents pagesafe and reliable water PAGE 25

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORT1safe andreliablewater1a. Percentage of drinking water treated in <strong>Watercare</strong>’s plants that are graded ‘A’ by the Ministry of Health.Target: 100% by 2020.TARGET 100%10 20 30 40 50 60 70 80 90 1002012 SCORE92%Water quality has been maintained based on the 2010 grading assessment carried out by the Auckland District HealthBoard on behalf of the Ministry of Health 1 . All the metropolitan water treatment plants that supply the bulk of drinkingwater to the people in the Auckland region meet the ‘A’ grade standard.201192%Of the smaller non-metropolitan plants transferred to <strong>Watercare</strong> on 1 November 2010, nine remain ungraded. <strong>Watercare</strong>is continuing <strong>with</strong> a programme of work to ensure all plants meet the ‘A’ grade standard by 2020, at a capital cost of $100million for both water treatment plants and the distribution network.1b. Percentage of drinking water distributed through the <strong>Watercare</strong> network that is graded ‘a’ by theMinistry of Health. Target: 100% by 2020.TARGET 100%10 20 30 40 50 60 70 80 90 1002012 SCORE89%The same risk-based assessment used for water treatment plants also applies to the pipes and pump stations that makeup the water distribution networks. The metropolitan network is graded ‘a’ under the Ministry of Health’s standardsand supplies the bulk of the drinking water to the people in the Auckland region. Of the 15 non-metropolitan networks(inherited on 1 November 2010), three are ‘a’ graded, three are ‘b’ graded and nine are ungraded. <strong>Watercare</strong> has set inplace a programme to ensure that all the networks meet the ‘a’ grade standard by 2020.201189%1c. Percentage performance against Statement of Corporate Intent target: quality of drinking water.Target: 100% by 2020.TARGET 100%10 20 30 40 50 60 70 80 90 1002012 SCORE100%<strong>Watercare</strong> fully met the Ministry of Health’s Drinking Water Standards for New Zealand (DWSNZ), at Ministry ofHealth-graded water treatment plants (Ruler 1a). The DWSNZ standards are based on a quality assurance approach,underpinned by the requirement to develop public health risk-management plans. Information on DWSNZ is availableat www.moh.govt.nz\water.2011100%1The next grading assessment is due in the last calendar quarter of 2012.PAGE 26 safe and reliable waterReturn to contents page

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTSupporting informationFig. 1 Water and wastewater factsFig. 8 Grading of water treatment plants and networksFig. 9 Drinking water qualityFig. 10 Typical analysis of Auckland’s drinking waterFig. 11 Water supply interruptionsFig. 12 Water supply restorationFig. 13 Water quality complaintsKEYTarget metTarget not metGood performancebut could do betterPresentation of rulerupdated from 20111d. Percentage performance against Statement of Corporate Intent target: service interruption to customerconnection ratio. Target: less than 10 per 1,000 connections.TARGET 100%10 20 30 40 50 60 70 80 90 1002012 SCORE100%<strong>Watercare</strong> monitors the number of times the water supply to its customers is disrupted as a measure of reliability of service.The SCI target is set at achieving fewer than 10 interruptions per 1,000 connections for the year. The result for the year from1 July 2011 was 5.8, which was well <strong>with</strong>in the target.2010 2011100% 100%1e. Percentage performance against Statement of Corporate Intent target: service restorationfollowing unplanned shutdowns. Target: greater than or equal to 90%.TARGET 90%10 20 30 40 50 60 70 80 90 1002012 SCORE100%<strong>Watercare</strong> has a target of restoring greater than 90% of unplanned water shutdowns <strong>with</strong>in 5 hours. The result for the 2011/12period was 98%, achieving the target.2011100%1f. Percentage performance against Statement of Corporate Intent target: unaccounted–for water loss.Target: less than 17.7million m 3 per year.TARGET 100%10 20 30 40 50 60 70 80 90 1002012 SCORE100%<strong>Watercare</strong> operates a continuous process of identifying, assessing and addressing water losses from its system that cannot beaccounted for. For 2011/12 the volume of unaccounted-for water from the <strong>Watercare</strong> system was 15.2 million m³ against atarget of less than 17.7 million m³, achieving the target.2011100%1g. Percentage performance against Statement of Corporate Intent target: water quality complaints.Target: less than 5 complaints per 1,000 connections.TARGET 100%10 20 30 40 50 60 70 80 90 1002012 SCORE100%<strong>Watercare</strong> monitors the number and type of water quality complaints received from customers. The result of 4.1 complaints per1000 connections covering taste, odour and appearance per 1,000 connections was lower than the target of 5 per year.201188%Return to contents pagesafe and reliable water PAGE 27

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORT<strong>Watercare</strong> at workCost-effective investment providing clearerdrinking water for Pukekohe customers<strong>Watercare</strong> inherited the Franklin WaterTreatment Plant facilities on 1 November2010, and quickly began a retrofit upgradeproject to address a number of complaintsfrom Pukekohe customers about ongoingdiscolouration of local drinking water. Priorto the plant upgrade, naturally occurring ironand manganese particles in the bore waterwere reacting to the addition of chlorineas part of the treatment process, causing aslight (completely non-hazardous) orangetint in some Pukekohe residents’ treatedtap water.In mid-2011 <strong>Watercare</strong>’s Water SupplyProcess Engineering group began pilottesting of additional filtration systemsat Pukekohe to address the waterdiscolouration, a problem unique to thelocal water supply. Water Supply OperationsManager Shayne Cunis says that <strong>Watercare</strong>worked <strong>with</strong> contractor Canadian PacificLimited to reach a solution to the problemwhich utilises three containerised membranefiltration units. The containerised units weredesigned so that when they are no longerrequired at Pukekohe they can be relocatedand stored for emergency use, such asproviding a treated water supply in the eventof a natural disaster.The containerised membrane filtrationunits re-use several high-quality filtrationmembranes that had become available aspart of <strong>Watercare</strong>’s expansion project atthe Waikato Water Treatment Plant. Thisapproach allowed the company to reducethe overall equipment costs of the projectsignificantly, <strong>with</strong>out compromising on thequality of water treatment.The filtration process now in use at Pukekoheadvances the oxidation reaction <strong>with</strong>in thewater treatment plant, removing the ironand manganese solids by way of a filtrationbarrier and allowing <strong>Watercare</strong> to providePukekohe residents <strong>with</strong> vastly improveddrinking water. Shayne says the project wascompleted in January 2012, and <strong>Watercare</strong>has since seen a significant reduction inthe number of water quality complaintsfrom Pukekohe customers. “Since thecompletion of this project we’ve noticed ahuge reduction in the number of ‘dirty water’complaints being received from Pukekohecustomers, from almost 50 per month in late2010 to virtually none in 2012,” he says.Shayne explains, “<strong>Watercare</strong> is workingon a permanent long-term solution whichaddresses Pukekohe’s requirement foradditional water supply due to populationgrowth. We’re currently constructing a newwater supply pipeline which will drawPukekohe drinking water from the WaikatoTreated Watermain, and this is scheduled foroperation by June 2013.”Process Engineer Jeremy Booth says thePukekohe membrane plant project is justone aspect of <strong>Watercare</strong>’s innovativeapproach to upgrading the company’s watertreatment facilities in the Franklin district.“We’ve made a substantial investment intoautomated, online monitoring of watertreatment facilities in Franklin, which meanswe’re able to keep an eye on water qualityfrom our centralised control room and actquickly if there’s a problem.”Jeremy adds that at a number of smallerlocal facilities – such as the water treatmentplant at Glenbrook Beach – <strong>Watercare</strong> hasinstalled UV treatment systems, and thesehave been very successful in helping toprovide local communities <strong>with</strong> safe andreliable drinking water.Pictured left to right are:Process Engineer Jeremy Booth,Southern Area Water SupplyManager Gil Miers, and SeniorProcess Engineer Tom Surreyon site at <strong>Watercare</strong>’s PukekoheMembrane Plant.PAGE 28 safe and reliable waterReturn to contents page

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORTWater Utility Consumer Assistance Trust establishedto help support at-risk Auckland consumers<strong>Watercare</strong> established the Water UtilityConsumer Assistance Trust in late 2011 <strong>with</strong>the purpose of providing “financial support tocustomers of <strong>Watercare</strong> who are struggling tomanage their water and/or wastewater costs.”The trust has been granted a nominal budgetof up to $1 million per year. The Trust reliesheavily on advice from budgeting centresincluding the Otara, Otahuhu, Mangere andAuckland Central budgeting services. TheTrust has its own secretary and operates in afully independent manner.Customers (including tenants) are alertedto the trust via the <strong>Watercare</strong> credit team;our Customer Centre; in overdue accountreminder letters; on the <strong>Watercare</strong> and Trustwebsites www.waterassistance.org.nz; and viabudget advisory service and Citizens’ AdviceBureau offices.Trust results as of July 2012:• 150 <strong>Watercare</strong> customers registered<strong>with</strong> the Trust• 52 applications granted – total value$41,192Trustees:• John Lusk (chairman)– retired senior commercial lawyer(<strong>Watercare</strong> Services Limited appointee)• Dr Bruce Hucker (deputy chairman)– former Deputy Mayor of Auckland City(<strong>Watercare</strong> appointee)• Anne Candy– former Deputy Mayor of Manukau City(Maori Women’s Welfare League appointee)• Lauren Godsiff– Auckland City Mission appointee• Maureen Little– Presbyterian Support Services appointee<strong>Watercare</strong> Harbour Clean-Up Trust24,015,910Total estimated individualpieces of litter collected fromAuckland waterways sincethe Harbour Clean-Up Trust’sinception in December 2002,based on an average of8 individual pieces of trashper litre.3,001,989 litresVolume of litter collected sincethe inception of the HarbourClean-Up Trust across theAuckland region.2,076,320Total estimated individualpieces of litter collected fromAuckland waterways in the yearJuly 2011 – June 2012, basedon an average of 8 individualpieces of trash per litre.2923.5 hoursTime worked by the <strong>Watercare</strong>Harbour Clean-Up Trust duringthe year July 2011 – June 2012.16,342.5 hoursTotal number of volunteer hourswhich assisted the <strong>Watercare</strong>Harbour Clean-Up Trust duringthe year July 2011 – June 2012.<strong>Watercare</strong> is the principal sponsorof the <strong>Watercare</strong> Harbour Clean-Up Trust, which works to removelitter from Waitemata Harbourand the gulf islands. Central to theTrust’s activities is ‘The Phil Warren’boat, pictured here alongside theAuckland Ferry Terminal.Return to contents pagesafe and reliable water PAGE 29

<strong>Watercare</strong> Services Limited2012 ANNUAL REPORT2 HealthyWaterwaysManagement of wastewater discharges to maintainor improve the health of the environment.Maintaining the health of Auckland’s valuable harbours,estuaries, beaches and islands remains a fundamental partof <strong>Watercare</strong>’s role in the community. The company’s 20wastewater treatment plants and network of wastewaterpipes continue to treat the majority of Auckland’swastewater to a very high standard, helping to protect thehealth of Auckland’s waterways.<strong>Watercare</strong> closely monitors all wastewater discharges,dry-weather sewer overflows, unplanned sewerinterruptions, and rates for responding to urgentwastewater blockages.In 2011/12 <strong>Watercare</strong> performed at an extremely highlevel against the company’s performance targets andconsent conditions.PAGE 30 healthy waterwaysReturn to contents page