Invoice 004010 X12 - Kroger EDI

Invoice 004010 X12 - Kroger EDI

Invoice 004010 X12 - Kroger EDI

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

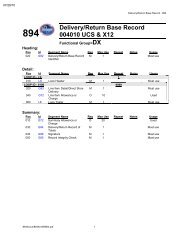

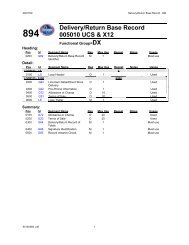

01/11/05 <strong>Invoice</strong> - 810810Heading:<strong>Invoice</strong> <strong>004010</strong> <strong>X12</strong>Functional Group=INPos Id Segment Name Req Max Use Repeat Notes Usage020 BIG Beginning Segment for M 1 Must use<strong>Invoice</strong>050 REF Reference Identification O 12 UsedLOOP ID - N1 200070 N1 Name O 1 Used090 N3 Address Information O 2 Used100 N4 Geographic Location O 1 Used130 ITD Terms of Sale/Deferred O >1 UsedTerms of Sale140 DTM Date/Time Reference O 10 Used150 FOB F.O.B. Related Instructions O 1 UsedDetail:Pos Id Segment Name Req Max Use Repeat Notes UsageLOOP ID - IT1 200000010 IT1 Baseline Item Data (<strong>Invoice</strong>) O 1 Used030 IT3 Additional Item Data O 5 Used040 TXI Tax Information O 10 UsedLOOP ID - PID 1000060 PID Product/Item Description O 1 Used100 PO4 Item Physical Details O 1 Used120 REF Reference Identification O >1 UsedLOOP ID - SAC 25180 SAC Service, Promotion,Allowance, or ChargeInformationO 1 UsedSummary:Pos Id Segment Name Req Max Use Repeat Notes Usage010 TDS Total Monetary Value M 1 Must useSummary020 TXI Tax Information O 10 Used030 CAD Carrier Detail O 1 UsedLOOP ID - SAC 25040 SAC Service, Promotion,Allowance, or ChargeInformationO 1 UsedLOOP ID - ISS >1060 ISS <strong>Invoice</strong> Shipment Summary O 1 Used070 CTT Transaction Totals O 1 N3/070 Used810N.ecs/810N.rft/810N.pdf 1

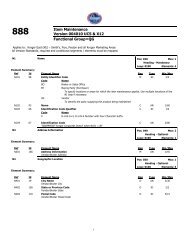

01/11/05 <strong>Invoice</strong> - 810BIGUser Option (Usage): Must useElement Summary:Beginning Segment for<strong>Invoice</strong>Pos: 020 Max: 1Heading - MandatoryLoop: N/A Elements: 4Ref Id Element Name Req Type Min/Max UsageBIG01 373 Date = <strong>Invoice</strong> Date M DT 8/8 Must useBIG02 76 <strong>Invoice</strong> Number M AN 1/22 Must useBIG03 373 Date – Purchase order date O DT 8/8 Must useBIG04 324 Purchase Order Number6 digit po number for Ralphs, all others 5digitsO AN 1/22 Must useREFReference Identification810N.ecs/810N.rft/810N.pdf 2Pos: 050 Max: 12Heading - OptionalLoop: N/A Elements: 2User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsageREF01 128 Reference Identification Qualifier M ID 2/3 Must useREF02 127 Reference Identification X AN 1/30 UsedN1NameUser Option (Usage): UsedElement Summary:Pos: 070 Max: 1Heading - OptionalLoop: N1 Elements: 6Ref Id Element Name Req Type Min/Max UsageN101 98 Entity Identifier CodeM ID 2/3 Must useRalphs must have the vendor remittanceinformationCode NameBT Bill-to-PartyRE Party to receive commercial invoice remittanceSF Ship FromST Ship ToN102 93 Name X AN 1/60 Must useN103 66 Identification Code Qualifier X ID 1/2 Must useCode Name9 D-U-N-S+4, D-U-N-S Number with Four Character SuffixN104 67 Identification Code X AN 2/80 UsedN105 706 Entity Relationship CodeO ID 2/2 UsedAll valid standard codes are used.N106 98 Entity Identifier CodeAll valid standard codes are used.O ID 2/3 UsedN3Address InformationPos: 090 Max: 2Heading - OptionalLoop: N1 Elements: 2User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsageN301 166 Address Information M AN 1/55 Must use

01/11/05 <strong>Invoice</strong> - 810Ralphs must have the vendor remittanceinformationN302 166 Address InformationWhen sending the N101 = RE, must sendN301N4User Option (Usage): UsedElement Summary:Geographic LocationO AN 1/55 UsedPos: 100 Max: 1Heading - OptionalLoop: N1 Elements: 3Ref Id Element Name Req Type Min/Max UsageN401 19 City NameO AN 2/30 Must UseRalphs must have the vendor remittanceinformationN402 156 State or Province Code O ID 2/2 Must UseN403 116 Postal CodeWhen sending N101, = RE,must sendN401,N402 & N403O ID 3/15 Must UseITDUser Option (Usage): UsedElement Summary:Terms of Sale/DeferredTerms of SalePos: 130 Max: >1Heading - OptionalLoop: N/A Elements: 12Ref Id Element Name Req Type Min/Max UsageITD01 336 Terms Type CodeO ID 2/2 UsedITD must be sent in header levelITD02 333 Terms Basis Date Code O ID 1/2 UsedITD03 338 Terms Discount Percent O R 1/6 Must UseITD04 370 Terms Discount Due Date X DT 8/8 Must UseITD05 351 Terms Discount Days Due X N0 1/3 Must UseITD06 446 Terms Net Due Date O DT 8/8 Must UseITD07 386 Terms Net Days O N0 1/3 Must UseITD08 362 Terms Discount Amount O N2 1/10 Must UseITD09 388 Terms Deferred Due Date O DT 8/8 UsedITD10 389 Deferred Amount Due X N2 1/10 UsedITD11 342 Percent of <strong>Invoice</strong> Payable X R 1/5 UsedITD12 352 Description O AN 1/80 UsedDTM Date/Time ReferencePos: 140 Max: 10Heading - OptionalLoop: N/A Elements: 6User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsageDTM01 374 Date/Time Qualifier M ID 3/3 Must useDTM02 373 Date X DT 8/8 Must UseDTM03 337 Time X TM 4/8 UsedDTM04 623 Time Code O ID 2/2 UsedDTM05 1250 Date Time Period Format Qualifier X ID 2/3 UsedDTM06 1251 Date Time Period X AN 1/35 Used810N.ecs/810N.rft/810N.pdf 3

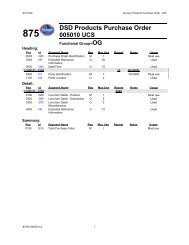

01/11/05 <strong>Invoice</strong> - 810FOB F.O.B. Related InstructionsUser Option (Usage): UsedElement Summary:Pos: 150 Max: 1Heading - OptionalLoop: N/A Elements: 3Ref Id Element Name Req Type Min/Max UsageFOB01 146 Shipment Method of PaymentM ID 2/2 Must useFOB must be sent in header levelCode NameCC CollectPB Customer Pick-up/BackhaulPP Prepaid (by Seller)FOB02 309 Location Qualifier X ID 1/2 Must UseCode NameDE Destination (Shipping)OR Origin (Shipping Point)PL PlantFOB03 352 Description O AN 1/80 UsedIT1 Baseline Item Data (<strong>Invoice</strong>)User Option (Usage): UsedElement Summary:Pos: 010 Max: 1Detail - OptionalLoop: IT1 Elements: 7Ref Id Element Name Req Type Min/Max UsageIT102 358 Quantity <strong>Invoice</strong>d X R 1/10 Must UseIT103 355 Unit or Basis for Measurement Code X ID 2/2 Must UseIT104 212 Unit Price X R 1/17 Must UseIT106 235 Product/Service ID QualifierIT110 must contain a valid Enterprise/PeytonUPC if “UA” is used in the IT106.X ID 2/2 Must UseIT101 should represent total weight to beinvoicedIT102 should be sent as LBIT110 REQUIRED when IT102 is other thanCA, send # of casesIT110 should be CA QualifierCode NameUA U.P.C./EAN Case Code (2-5-5)IT107 234 Product/Service ID = 2-5-5 X AN 1/48 Must UseIT108 235 Product/Service ID Qualifier X ID 2/2 UsedIT109 234 Product/Service ID X AN 1/48 UsedIT3Additional Item DataPos: 030 Max: 5Detail - OptionalLoop: IT1 Elements: 2User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsageIT301 382 Number of Units Shipped X R 1/10 Used810N.ecs/810N.rft/810N.pdf 4

01/11/05 <strong>Invoice</strong> - 810IT302 355 Unit or Basis for Measurement CodeIT302 is used when the unti or basis formeasurement code shipped, differs from theunit or basis for measurement code invoice inIT103.TXITax InformationX ID 2/2 UsedPos: 040 Max: 10Detail - OptionalLoop: IT1 Elements: 4User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsageTXI01 963 Tax Type Code M ID 2/2 Must useTXI02 782 Monetary Amount X R 1/18 UsedTXI03 954 Percent X R 1/10 UsedTXI08 828 Dollar Basis For Percent O R 1/9 UsedPIDProduct/Item DescriptionPos: 060 Max: 1Detail - OptionalLoop: PID Elements: 2User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsagePID01 349 Item Description Type M ID 1/1 Must usePID05 352 Description X AN 1/80 Must UsePO4Item Physical DetailsPos: 100 Max: 1Detail - OptionalLoop: IT1 Elements: 3User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsagePO401 356 Pack O N0 1/6 UsedPO402 357 Size X R 1/8 UsedPO403 355 Unit or Basis for Measurement CodePO4 required information is not contained inthe PID05X ID 2/2 UsedREFReference IdentificationPos: 120 Max: >1Detail - OptionalLoop: IT1 Elements: 2User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsageREF01 128 Reference Identification Qualifier M ID 2/3 Must useREF02 127 Reference Identification X AN 1/30 UsedSAC Service, Promotion,Allowance, or ChargeInformationPos: 180 Max: 1Detail - OptionalLoop: SAC Elements: 10User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsageSAC01 248 Allowance or Charge Indicator M ID 1/1 Must use810N.ecs/810N.rft/810N.pdf 5

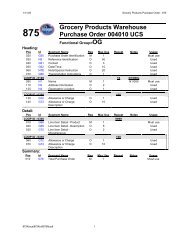

01/11/05 <strong>Invoice</strong> - 810Code NameAAllowanceCChargeSAC02 1300 Service, Promotion, Allowance, or Charge X ID 4/4 Must UseCodeSAC05 610 Amount O N2 1/15 UsedSAC06 378 Allowance/Charge Percent Qualifier X ID 1/1 UsedSAC07 332 Percent X R 1/6 UsedSAC08 118 Rate = if an allowance the rate should be O R 1/9 Usednegative (-)SAC09 355 Unit or Basis for Measurement Code X ID 2/2 UsedSAC10 380 QuantityX R 1/15 UsedIf SAC01 is ‘A’ or ‘C’ then at least one of theSAC05, SAC06 & SAC07 or SAC08 isrequired. SAC05 must have a minus sign ifSAC01 contains an “A” allowance. IF SAC07is present then SAC06, SAC09 and SAC10are also required. SAC09 will need to be“DO” for Dollar Basis AmountSAC12 331 Allowance or Charge Method of Handling O ID 2/2 UsedCodeCode Name02 Off <strong>Invoice</strong>06 Charge to be Paid by CustomerSAC15 352 Description X AN 1/80 UsedTDSUser Option (Usage): Must useElement Summary:Total Monetary ValueSummaryPos: 010 Max: 1Summary - MandatoryLoop: N/A Elements: 3Ref Id Element Name Req Type Min/Max UsageTDS01 610 Amount = Ralphs expect the Gross Amount M N2 1/15 Must useall others expect the Net amount.TDS02 610 Amount O N2 1/15 Must UseTDS03 610 AmountPrefer the elements TDS02 and TDS03 besentO N2 1/15 Must UseTXITax InformationPos: 020 Max: 10Summary - OptionalLoop: N/A Elements: 4User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsageTXI01 963 Tax Type Code M ID 2/2 Must useTXI02 782 Monetary Amount X R 1/18 UsedTXI03 954 Percent X R 1/10 UsedTXI08 828 Dollar Basis For Percent O R 1/9 UsedCAD Carrier DetailUser Option (Usage): UsedElement Summary:Pos: 030 Max: 1Summary - OptionalLoop: N/A Elements: 2810N.ecs/810N.rft/810N.pdf 6

01/11/05 <strong>Invoice</strong> - 810Ref Id Element Name Req Type Min/Max UsageCAD04 140 Standard Carrier Alpha Code X ID 2/4 UsedCAD05 387 Routing X AN 1/35 UsedSAC Service, Promotion,Allowance, or ChargeInformationPos: 040 Max: 1Summary - OptionalLoop: SAC Elements: 10User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsageSAC01 248 Allowance or Charge Indicator M ID 1/1 Must useCode NameAAllowanceCChargeSAC02 1300 Service, Promotion, Allowance, or Charge X ID 4/4 Must UseCodeSAC05 610 Amount O N2 1/15 UsedSAC06 378 Allowance/Charge Percent Qualifier X ID 1/1 UsedSAC07 332 Percent X R 1/6 UsedSAC08 118 Rate O R 1/9 UsedSAC09 355 Unit or Basis for Measurement Code X ID 2/2 UsedSAC10 380 Quantity X R 1/15 UsedSAC12 331 Allowance or Charge Method of Handling O ID 2/2 UsedCodeCode Name02 Off <strong>Invoice</strong>06 Charge to be Paid by CustomerTo transmit specific allowances or charges for the ‘Total <strong>Invoice</strong>”SAC05 must be a minus sign if SAC01 contains an “A” allowance. If SAC01 is“A” or “C” then at least one of the SAC05, SAC06 & SAC07, or SAC08 isrequired. If SAC07 is present than SAC06, SAC09 and SAC10 are requiredalso. SAC09 will need to be “DO” Dollar Basis AmountSAC15 352 Description X AN 1/80 UsedISS <strong>Invoice</strong> Shipment SummaryPos: 060 Max: 1Summary - OptionalLoop: ISS Elements: 6User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsageISS01 382 Number of Units Shipped X R 1/10 Must UseISS02 355 Unit or Basis for Measurement Code X ID 2/2 Must UseISS03 81 Weight X R 1/10 Must UseISS04 355 Unit or Basis for Measurement Code X ID 2/2 Must UseISS05 183 Volume X R 1/8 Must UseISS06 355 Unit or Basis for Measurement Code X ID 2/2 Must Use810N.ecs/810N.rft/810N.pdf 7

01/11/05 <strong>Invoice</strong> - 810CTTTransaction TotalsPos: 070 Max: 1Summary - OptionalLoop: N/A Elements: 1User Option (Usage): UsedElement Summary:Ref Id Element Name Req Type Min/Max UsageCTT01 354 Number of Line Items M N0 1/6 UsedDATA SAMPLEBIG*20040206*0090177071*20040203*73576~N1*BT*DILLONHUTCHINSON*9*0069428820000~N3*2700 E. 4TH STREET~N4*HUTCHINSON*KS*67501~N1*ST*DILLONHUTCHINSON*9*0069428820002~N3*2700 E. 4TH STREET~N4*HUTCHINSON*KS*67501~N1*VN*My Food*9*1234567890000~N3*Unit 123 P.O Box 1234~N4*DALLAS*OR*972108~N1*RE*My Food*9*1234567890000~N3*P.O Box 1234~N4*Tibit*OR*97210~ITD*08*3*2*20040216*10*20040221*15*2167~DTM*011*20040206~FOB*PP~IT1*001*105*CA*10.53**UA*001111111111~PID*F****BROWN GRAVY ~TDS*108354*108354*106187~SAC*A*I410***-2211*******02***Spoils %~ISS*105*CA*1039.5*lb~CTT*1~ Number of Line Items810N.ecs/810N.rft/810N.pdf 8