2010 Report - Pennsylvania Public Utility Commission

2010 Report - Pennsylvania Public Utility Commission

2010 Report - Pennsylvania Public Utility Commission

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

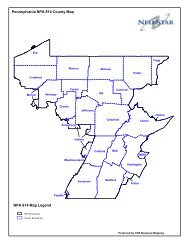

Section 4 - Conclusions<strong>Pennsylvania</strong> continues to benefit from a high level of electric service reliability.<strong>Pennsylvania</strong> outlook reflects the regional assessment of RFC.TheRFC reports that there is sufficient generation, transmission and distribution capacity in<strong>Pennsylvania</strong> to meet the needs of electric consumers for the foreseeable future. RFC anticipatesthat its reserve margin target will be satisfied through 2018, provided that proposed generationprojects will be completed in a timely manner and enhancements to the transmission network willbe capable of reliably delivering those resources. Summer reserve margins in RFC range from ahigh of 27.2 percent in 2009, declining to 18.2 percent in 2018. This assumes that 18.4 percent ofconceptual seasonal capability will become available during the last five years of the forecastperiod.The <strong>Commission</strong> continues to promote the development of alternative energy resources and pursuedemand side management, energy efficiency, and load management programs and technologies toaddress ways to encourage customers to reduce their demand. These efforts include theimplementation of the Alternative Energy Portfolio Standards and the Energy Efficiency andConservation Program. In the long term, these initiatives will improve overall energy efficiency,expand energy markets and maintain system reliability. Through demand side measures andoverall improvements in energy efficiency, EDCs and all customer classes will benefit.To summarize the relevant statistics in this report, aggregate <strong>Pennsylvania</strong> retail sales in 2009totaled 142,161 GWh, a 4.2 percent decrease from that of 2008. Residential sales accounted for35.4 percent of the total sales, followed by commercial (31.7 percent) and industrial (30.3 percent).Between 1994 and 2009, the state’s energy demand grew at an average annual rate of 1.0 percent.Residential sales grew at an annual rate of 1.5 percent and commercial sales increased at 2.1percent per year. Industrial sales declined at an annual rate of 0.4 percent, due mainly to a 9.4percent drop in sales from 2008. Average total sales growth from 2004 to 2009 was 0.1 percent.The current aggregate five-year projection of growth in energy demand is 1.4 percent. Thisincludes a residential growth rate of 0.9 percent, a commercial rate of 1.9 percent and an industrialrate of 1.6 percent.Over the past 15 years, the non-coincident peak load for the major EDCs increased at an averagerate of 0.7 percent per year. The peak load is expected to increase from 27,597 MW in 2009 to29,550 MW in 2014 at an average annual growth rate of 1.4 percent.* * * * *Electric Power Outlook for <strong>Pennsylvania</strong> 2009-2014 73