SSP Brochure:Layout 1 - INSETA

SSP Brochure:Layout 1 - INSETA

SSP Brochure:Layout 1 - INSETA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

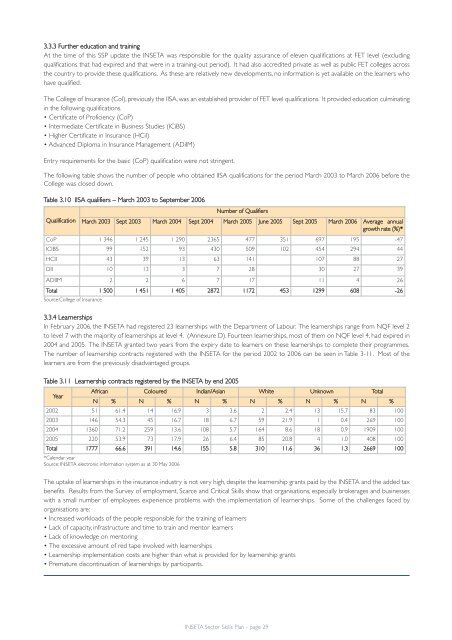

3.3.3 Further education and trainingAt the time of this <strong>SSP</strong> update the <strong>INSETA</strong> was responsible for the quality assurance of eleven qualifications at FET level (excludingqualifications that had expired and that were in a training-out period). It had also accredited private as well as public FET colleges acrossthe country to provide these qualifications. As these are relatively new developments, no information is yet available on the learners whohave qualified.The College of Insurance (CoI), previously the IISA, was an established provider of FET level qualifications. It provided education culminatingin the following qualifications.• Certificate of Proficiency (CoP)• Intermediate Certificate in Business Studies (ICiBS)• Higher Certificate in Insurance (HCiI)• Advanced Diploma in Insurance Management (ADiIM)Entry requirements for the basic (CoP) qualification were not stringent.The following table shows the number of people who obtained IISA qualifications for the period March 2003 to March 2006 before theCollege was closed down.Table 3.10 IISA qualifiers – March 2003 to September 2006QualificationNumber of QualifiersMarch 2003 Sept 2003 March 2004 Sept 2004 March 2005 June 2005 Sept 2005 March 2006 Average annualgrowth rate (%)*CoP 1 346 1 245 1 290 2365 477 351 697 195 -47ICIBS 99 152 93 430 509 102 454 294 44HCII 43 39 13 63 141 107 88 27DII 10 13 3 7 28 30 27 39ADIIM 2 2 6 7 17 11 4 26Total 1 500 1 451 1 405 2872 1172 453 1299 608 -26Source:College of Insurance.3.3.4 LearnershipsIn February 2006, the <strong>INSETA</strong> had registered 23 learnerships with the Department of Labour. The learnerships range from NQF level 2to level 7 with the majority of learnerships at level 4. (Annexure D). Fourteen learnerships, most of them on NQF level 4, had expired in2004 and 2005. The <strong>INSETA</strong> granted two years from the expiry date to learners on these learnerships to complete their programmes.The number of learnership contracts registered with the <strong>INSETA</strong> for the period 2002 to 2006 can be seen in Table 3-11. Most of thelearners are from the previously disadvantaged groups.Table 3.11 Learnership contracts registered by the <strong>INSETA</strong> by end 2005YearAfrican Coloured Indian/Asian White Unknown TotalN % N % N % N % N % N %2002 51 61.4 14 16.9 3 3.6 2 2.4 13 15.7 83 1002003 146 54.3 45 16.7 18 6.7 59 21.9 1 0.4 269 1002004 1360 71.2 259 13.6 108 5.7 164 8.6 18 0.9 1909 1002005 220 53.9 73 17.9 26 6.4 85 20.8 4 1.0 408 100Total 1777 66.6 391 14.6 155 5.8 310 11.6 36 1.3 2669 100*Calendar yearSource: <strong>INSETA</strong> electronic information system as at 30 May 2006The uptake of learnerships in the insurance industry is not very high, despite the learnership grants paid by the <strong>INSETA</strong> and the added taxbenefits. Results from the Survey of employment, Scarce and Critical Skills show that organisations, especially brokerages and businesseswith a small number of employees experience problems with the implementation of learnerships. Some of the challenges faced byorganisations are:• Increased workloads of the people responsible for the training of learners• Lack of capacity, infrastructure and time to train and mentor learners• Lack of knowledge on mentoring• The excessive amount of red tape involved with learnerships• Learnership implementation costs are higher than what is provided for by learnership grants• Premature discontinuation of learnerships by participants.<strong>INSETA</strong> Sector Skills Plan - page 29