Real Estate Fraud Brochure - Sacramento County District Attorney

Real Estate Fraud Brochure - Sacramento County District Attorney

Real Estate Fraud Brochure - Sacramento County District Attorney

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

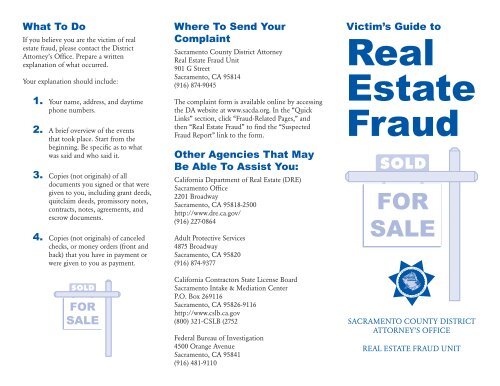

What To DoIf you believe you are the victim of realestate fraud, please contact the <strong>District</strong><strong>Attorney</strong>’s Office. Prepare a writtenexplanation of what occurred.Your explanation should include:1. Your name, address, and daytimephone numbers.2. A brief overview of the eventsthat took place. Start from thebeginning. Be specific as to whatwas said and who said it.3. Copies (not originals) of alldocuments you signed or that weregiven to you, including grant deeds,quitclaim deeds, promissory notes,contracts, notes, agreements, andescrow documents.4. Copies (not originals) of canceledchecks, or money orders (front andback) that you have in payment orwere given to you as payment.FORSALEWhere To Send YourComplaint<strong>Sacramento</strong> <strong>County</strong> <strong>District</strong> <strong>Attorney</strong><strong>Real</strong> <strong>Estate</strong> <strong>Fraud</strong> Unit901 G Street<strong>Sacramento</strong>, CA 95814(916) 874-9045The complaint form is available online by accessingthe DA website at www.sacda.org. In the “QuickLinks” section, click “<strong>Fraud</strong>-Related Pages,” andthen “<strong>Real</strong> <strong>Estate</strong> <strong>Fraud</strong>” to find the “Suspected<strong>Fraud</strong> Report” link to the form.Other Agencies That MayBe Able To Assist You:California Department of <strong>Real</strong> <strong>Estate</strong> (DRE)<strong>Sacramento</strong> Office2201 Broadway<strong>Sacramento</strong>, CA 95818-2500http://www.dre.ca.gov/(916) 227-0864Adult Protective Services4875 Broadway<strong>Sacramento</strong>, CA 95820(916) 874-9377California Contractors State License Board<strong>Sacramento</strong> Intake & Mediation CenterP.O. Box 269116<strong>Sacramento</strong>, CA 95826-9116http://www.cslb.ca.gov(800) 321-CSLB (2752Federal Bureau of Investigation4500 Orange Avenue<strong>Sacramento</strong>, CA 95841(916) 481-9110Victim’s Guide to<strong>Real</strong><strong>Estate</strong><strong>Fraud</strong>FORSALE<strong>Sacramento</strong> <strong>County</strong> <strong>District</strong><strong>Attorney</strong>’s officereal estate fraud unit

<strong>Real</strong> Property CrimesScam artists operate profitably in thecomplex world of real estate sales and loans.Criminals use false representations, fine printand obscure procedures to steal the equityin your home or to commit loan fraud. Ifyou have been the victim of real estate fraud,the <strong>Sacramento</strong> <strong>County</strong> <strong>District</strong> <strong>Attorney</strong>’sOffice wants to know. The <strong>District</strong> <strong>Attorney</strong>’sOffice will investigate complaints of realestate fraud that involve a recorded real estatedocument. If there is sufficient evidence toprove that a crime was committed, this officewill prosecute. Here are a few of the moreprevalent types of crime being perpetrated in<strong>Sacramento</strong> <strong>County</strong>.Foreclosure BailoutScamsVictims of this form of real estate fraud aregenerally homeowners who have lost theirincome or have negative equity (owe moremoney on their mortgage than the home isworth, also known as being “upside-down”).These homeowners are usually desperateand must either sell their home at a largeloss or let the lender foreclose, severelydamaging their credit. At this point so-called“foreclosure specialists” will offer victimsthe opportunity to arrange for a sale of theirhomes. In this form of fraud, the homeownerusually will be told that for a fee of about$2,000 the homeowner can deed their hometo the foreclosure specialist and then rent itback.The foreclosure specialist takes the money, doesnot arrange a sale, and fails to make any paymentson the mortgage. The end result is that loanpayments are not made and foreclosure continueswithout the victim being aware of any fraud.Ultimately, the lender forecloses on the home; thevictim is evicted, and loses both their home andthe $2,000 fee charged by the so-called specialist.“Straw Buyer” ScamsScam artists find ways to cash out equity ofreal property entrusted to them using creativefinancing. They may employ phony “straw buyers,”crooked escrow agents, real estate appraisers ornotary publics. The scam artist asks the straw buyerto sign loan papers using his or her good credit.The scam artist pockets the loan proceeds and failsto make the loan payments. The straw buyer mayhave committed both state and federal crimes. Hisor her credit is ruined and they are obligated to paythe loan amount.Forgery of DeedsThieves may assume the identity of a property’strue owner, or claim to represent the true owner, inorder to fraudulently obtain title to the property.They typically target properties with a large amountof equity, which often have elderly owners. Byforging names on grant and trust deeds, theyborrow against the property or sell the property,stealing the equity. Criminals may also alter deedsbefore they are recorded, changing ownershipinterests or amounts borrowed.Home Equity TheftsPeople who have built up equity in theirhomes are ripe targets for a variety ofconfidence games. High-pressure homeimprovement contractors offer homeownersunnecessary and overpriced homeimprovement on easy credit. Frequently,elderly and vulnerable adult homeowners aretargeted for these schemes.Victims report being asked to sign blankcontracts they were not allowed to readbefore signing, or that they were not givencopies of the contracts. Only later does thevictim realize that the contract containsterms completely different than promised.Too often it turns out the homeimprovement contract has “eaten up” all ofthe equity in the home. The homeownerlearns they have signed high interestmortgages with enormous loan fees andthe homeowner may be faced with loanpayments they cannot afford. Criminals maycommit outright forgery with the actual loandocuments tosecure the loanand/or gaincontrol of theloan proceeds.FORSALEYour best protection is to NEVER submit to pressure and ALWAYS obtain financial or legal advice before you commit to a contract orloan. Contact a trusted family member, friend, or neighbor before signing any documents. Never pay cash, no matter what the other partywants. Always insist on documentation of contracts and promises.