03 GREATLINK ENHANCER FUND v19 - Great Eastern Life

03 GREATLINK ENHANCER FUND v19 - Great Eastern Life

03 GREATLINK ENHANCER FUND v19 - Great Eastern Life

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

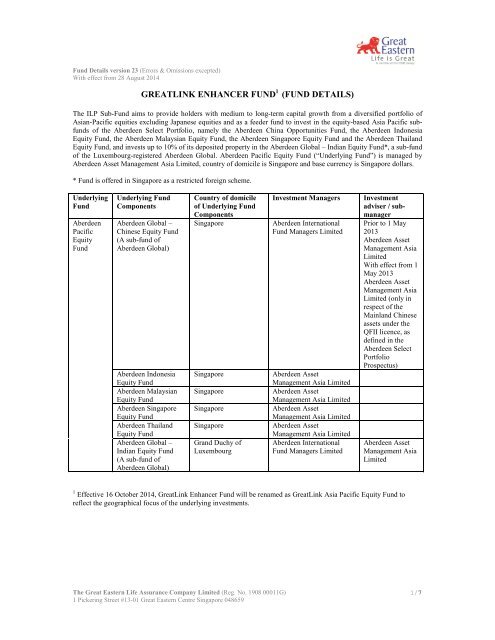

Fund Details version 23 (Errors & Omissions excepted)With effect from 28 August 2014<strong>GREATLINK</strong> <strong>ENHANCER</strong> <strong>FUND</strong> 1 (<strong>FUND</strong> DETAILS)The ILP Sub-Fund aims to provide holders with medium to long-term capital growth from a diversified portfolio ofAsian-Pacific equities excluding Japanese equities and as a feeder fund to invest in the equity-based Asia Pacific subfundsof the Aberdeen Select Portfolio, namely the Aberdeen China Opportunities Fund, the Aberdeen IndonesiaEquity Fund, the Aberdeen Malaysian Equity Fund, the Aberdeen Singapore Equity Fund and the Aberdeen ThailandEquity Fund, and invests up to 10% of its deposited property in the Aberdeen Global – Indian Equity Fund*, a sub-fundof the Luxembourg-registered Aberdeen Global. Aberdeen Pacific Equity Fund (“Underlying Fund”) is managed byAberdeen Asset Management Asia Limited, country of domicile is Singapore and base currency is Singapore dollars.* Fund is offered in Singapore as a restricted foreign scheme.UnderlyingFundAberdeenPacificEquityFundUnderlying FundComponentsAberdeen Global –Chinese Equity Fund(A sub-fund ofAberdeen Global)Aberdeen IndonesiaEquity FundAberdeen MalaysianEquity FundAberdeen SingaporeEquity FundAberdeen ThailandEquity FundAberdeen Global –Indian Equity Fund(A sub-fund ofAberdeen Global)Country of domicileof Underlying FundComponentsSingaporeSingaporeSingaporeSingaporeSingaporeGrand Duchy ofLuxembourgInvestment ManagersAberdeen InternationalFund Managers LimitedAberdeen AssetManagement Asia LimitedAberdeen AssetManagement Asia LimitedAberdeen AssetManagement Asia LimitedAberdeen AssetManagement Asia LimitedAberdeen InternationalFund Managers LimitedInvestmentadviser / submanagerPrior to 1 May2013Aberdeen AssetManagement AsiaLimitedWith effect from 1May 2013Aberdeen AssetManagement AsiaLimited (only inrespect of theMainland Chineseassets under theQFII licence, asdefined in theAberdeen SelectPortfolioProspectus)Aberdeen AssetManagement AsiaLimited1 Effective 16 October 2014, <strong>Great</strong>Link Enhancer Fund will be renamed as <strong>Great</strong>Link Asia Pacific Equity Fund toreflect the geographical focus of the underlying investments.The <strong>Great</strong> <strong>Eastern</strong> <strong>Life</strong> Assurance Company Limited (Reg. No. 1908 00011G) 1/71 Pickering Street #13-01 <strong>Great</strong> <strong>Eastern</strong> Centre Singapore 048659

In emphasising the primacy of corporate performance, the Manager tends to disregard the role of indices and theconcept of relative return. Market capitalisation appears an unsound theoretical basis for a ‘neutral’ portfolio position,being an inherently historical construct, while consensus-driven demand is potentially distorting. Absolute return isheld to be more important over the long term, with risks controlled primarily at the security level.The Manager may, in accordance with the provisions of the Trust Deed, invest in the securities of companies orinstitutions domiciled in, operating principally from, or deriving significant revenue from the relevant country orcountries (as the case may be).SOFT DOLLAR COMMISSIONS OR ARRANGEMENTSThe Manager does not receive soft-dollar commissions or arrangements for the Underlying Fund. In the management ofthe Underlying Fund, the investment managers/advisers/sub-managers may receive or enter into soft-dollarcommissions/arrangements for the Underlying Fund. The investment managers/advisers/sub-managers will complywith applicable regulatory and industry standards on soft-dollars. Any goods or services supplied under any soft-dollarcommissions/arrangements to the investment managers/ advisers/ sub-managers shall be directly relevant to investmentresearch, which is used in the provision of investment management services.The investment managers/advisers/sub-managers shall not receive goods and services such as travel, accommodation orentertainment costs, office administrative computer software, purchase or rental of standard office equipment orancillary facilities, employees’ salaries or any other goods and services prohibited by the applicable regulator.The investment managers/advisers/sub-managers shall ensure that the broker has agreed to provide best execution forthe transactions and that no unnecessary trades are entered into in order to qualify for such soft-dollar commissions/arrangements.CONFLICTS OF INTERESTThe Manager may from time to time have to deal with competing or conflicting interests of the Underlying Fund withother funds managed by the Manager. For example, the Manager may make a purchase or sale decision on behalf ofsome or all of the other funds managed by them without making the same decision on behalf of the Underlying Fund,as a decision whether or not to make the same investment or sale for the Underlying Fund depends on factors such asthe case availability and portfolio balance of the Underlying Fund. However, the Manager will use reasonableendeavours at all times to act fairly and in the interests of the Underlying Fund. In particular, after taking into accountthe availability of cash and relevant investment guidelines of the other funds managed by the Manager and UnderlyingFund, the Manager will endeavour to ensure that securities bought and sold will be allocated proportionately as far aspossible among the Underlying Fund and the other funds managed by the Manager.The factors which the Manager will take into account when determining if there are any conflicts of interest asdescribed in the paragraph above include the aggregation of the purchase of the assets of the Underlying Fund. To theextent that another fund managed by the Manager intends to purchase substantially similar assets, the Manager willensure that the assets are allocated fairly and proportionately and that the interests of all investors are treated equallybetween the Underlying Fund and the other funds.The Manager may purchase, hold or redeem units in the Underlying Fund for their own account. In the event of anyconflict of interest arising as a result of such dealing, the Manager and the Trustee will resolve the conflict in a just andequitable manner as they deem fit.The Manager and the Trustee shall conduct all transactions with or for the Underlying Fund on an arm’s length basis.Associates of the Trustee may be engaged to provide financial, banking and brokerage services to the Underlying Fund.Such services where provided, will be on an arm’s length basis.Associates of the Manager may be engaged to provide services such as financial, banking or brokerage services, to theUnderlying Fund. Such services where provided, will be on an arm’s length basis.General RisksThe value of the Underlying Fund may rise or fall. Investments in the Underlying Fund are subject to various risks suchas market risks, fluctuations in interest rates and foreign exchange rates, political instability, exchange controls,changes in taxation and foreign investment policies and other restrictions and controls which may be imposed by the3

elevant authorities in other countries. The risk factors set out herein may cause the investor to lose some or all of theinvestment. These risks are elaborated upon below.A. Market RiskThe usual risks of investing in listed and unlisted securities apply. Prices of securities may rise or fall in response tochanges in economic conditions, political conditions, interest rates, and market sentiment. These may cause the price ofunits in the Underlying Fund to go up or down as the price of units is based on the current market value of theinvestments of the Underlying Fund.B. Political RiskThe Underlying Fund that invest in countries with less stable political and economic environments and in securities’markets with lower levels of regulation and different accounting, commercial and market practices than those ofacceptable international standards are likely to increase the overall risk of the Underlying Fund.C. Liquidity RiskThe securities markets of some countries lack the liquidity, efficiency, regulatory and supervisory controls of moredeveloped markets. The lack of liquidity may adversely affect the value or ease of disposal of assets, thereby increasingthe risk of investing in such markets.D. Settlement Risk/Transactions RiskThe property of the Underlying Fund is held by the Trustee on behalf of the investors, separate from the Trustee’sassets. It is therefore protected in the event of the insolvency of the Trustee. There is, however, still a risk that theremay be a temporary delay in subscriptions and redemptions of the units.E. Regulatory RiskThe investment objectives and parameters of the underlying fund components are restricted by applicable legislationand regulatory guidelines. There may be a risk that legislative or regulatory changes may make it less likely for theUnderlying Fund to achieve its objectives.F. Currency Risk/Exchange Rate RiskThe assets and income of the underlying fund components will be substantially denominated in currencies other thanthe Singapore dollar. Currency fluctuations between foreign currencies and the Singapore dollar may affect the incomeand valuation of the assets of the relevant underlying fund components in ways unrelated to business performance.Investors should note that the Manager generally does not hedge the currency positions of the underlying fundcomponents unless circumstances require it and/or as mentioned in the Aberdeen Select Portfolio Prospectus.G. TaxationInvestors should note that the proceeds from the sale of securities in some markets or the receipt of any dividends orother income may be or may become subject to tax, levies, duties or other fees or charges imposed by the authorities inthat market, including taxation levied by withholding at source. Tax law and practice in certain countries into which theUnderlying Fund invests or may invest in the future (in particular Russia and other emerging markets) is not clearlyestablished. It is possible therefore that the current interpretation of the law or understanding of practice might change,or that the law might be changed with retrospective effect. It is therefore possible that the Underlying Fund couldbecome subject to additional taxation in such countries that is not anticipated either at the date of this Fund Details orwhen investments are made, valued or disposed of.H. Repurchase or Securities Lending AgreementsWhilst the value of the collateral of repurchase or securities lending agreements will be maintained to at least equal tothe value of the securities transferred, in the event of a sudden market movement there is a risk that the value of suchcollateral may fall below the value of the securities transferred. In relation to repurchase transactions, investors shouldnote that (A) in the event of the failure of the counterparty with which cash of the Underlying Fund has been placed,there is the risk that collateral received may yield less than the cash placed out, whether because of inaccurate pricingof the collateral, adverse market movements, a deterioration in the credit rating of issuers of the collateral, or theilliquidity of the market in which the collateral is traded; that (B) (i) locking cash in transactions of excessive size orduration, (ii) delays in recovering cash placed out, or (iii) difficulty in realising collateral may restrict the ability of theUnderlying Fund to meet redemption requests, security purchases or, more generally, reinvestment; and that (C)repurchase transactions will, as the case may be, further expose the Underlying Fund to risks similar to those associatedwith optional or forward derivative financial instruments, which risks are further described in other sections of thisdocument. Securities lending involves counterparty risk, including the risk that the loaned securities may not bereturned or returned in a timely manner and/or at a loss of rights in the collateral if the borrower or the lending agentdefaults or fails financially. This risk is increased when the Underlying Fund loans are concentrated with a single orlimited number of borrowers. Investors must notably be aware that (A) if the borrower of securities lent by theUnderlying Fund fail to return these, there is a risk that the collateral received may realise less than the value of the4

securities lent out, whether due to inaccurate pricing, adverse market movements, a deterioration in the credit rating ofissuers of the collateral, or the illiquidity of the market in which the collateral is traded; that (B) in case of reinvestmentof cash collateral such reinvestment may (i) create leverage with corresponding risks and risk of losses and volatility,(ii) introduce market exposures inconsistent with the objectives of the Underlying Fund, or (iii) yield a sum less thanthe amount of collateral to be returned; and that (C) delays in the return of securities on loans may restrict the ability ofthe Underlying Fund to meet delivery obligations under security sales.I. Potential Conflicts of InterestThe Manager and other companies in the Aberdeen Group may effect transactions in which they have, directly orindirectly, an interest which may involve a potential conflict with their duty to the Underlying Fund. Neither theManager nor other companies in the Aberdeen Group shall be liable to account to the Underlying Fund for any profit,commission or remuneration made or received from or by reason of such transactions or any connected transactions norwill the Manager’s fees, unless otherwise provided, be abated. The Manager will ensure that such transactions areeffected on terms which are not less favourable to the Underlying Fund than if the potential conflict had not existed.Such potential conflicting interests or duties may arise because the Manager or other members in the Aberdeen Groupmay have invested directly or indirectly in the Underlying Fund. More specifically, the Manager, under the rules ofconduct applicable to it, must try to avoid conflicts of interests and, where they cannot be avoided, ensure that itsclients (including the Underlying Fund) are fairly treated.J. Derivative UsageThe Underlying Fund may use financial derivative instruments for the purposes of hedging and/or efficient portfoliomanagement to the extent permitted in the Trust Deed. In no event are financial derivative instruments used to lever theUnderlying Fund.Total Derivatives ExposureThe Manager will ensure for the Underlying Fund that its exposure relating to financial derivative instruments does notexceed the total net value of its portfolio. The Manager will ensure that the global exposure of the Underlying Fund tofinancial derivative instruments or embedded financial derivative instruments will not exceed 100% of the net assetvalue of the Underlying Fund at all times. Such exposure will be calculated using the commitment approach asdescribed in, and in accordance with the provisions of, the Code on Collective Investment Schemes.Execution of TradesAn automated trading system provides for the capture of orders from the Manager for transmission to an independentdealing function which facilitates management of the dealing process and, once executed, onward transmission to theback office trade processing function. It is used for the execution of fixed and equity securities, exchange-tradedderivatives and OTC (over-the-counter) derivatives (as defined in paragraph (K) below).Investors should note that there are risks associated with the use of such financial derivative instruments. Some of therisks associated with financial derivative instruments include market risk (described in paragraph (A)), liquidity risk(described in paragraph (C)) and counterparty risk (described in paragraph (K)). Therefore, it is essential thatinvestments in financial derivative instruments are monitored closely.Description of Risk Management and Compliance Procedures and Controls Adopted by the ManagerAn electronic Compliance Guideline Monitoring system, which is integrated within the trading platform, gives pre-dealalerts to the Manager and post-deal exception reports to the Compliance Department in respect of actual and potentialbreaches of regulations and guideline restrictions. This includes total derivatives exposure and counterparty exposure.The Compliance Guideline Monitoring system is maintained independently of the Manager by the ComplianceDepartment. Monitoring for derivatives and physical assets takes place on a pre-trade basis.The Manager will ensure that the risk management and compliance procedures and controls adopted are adequate andhave been implemented and that it has the necessary expertise to control and manage the risks relating to the use offinancial derivatives.K. Counterparty RiskIn some markets there may be no secure method of delivery against payment which would avoid exposure tocounterparty risk. Each Underlying Fund may enter into transactions and other contracts that entail a credit exposure tocertain counterparties. To the extent that counterparty defaults on its obligation and the Underlying Fund is delayed orprevented from exercising its rights with respect to the investments in its portfolio, it may experience a decline in thevalue of its position, a loss of income and possible additional costs associated with asserting its rights. Where financialderivative instruments are dealt in over-the-counter markets (“OTC derivatives”), it may be necessary to make paymenton a purchase or deliver on a sale before receipt of the securities or, as the case may be, sale proceeds.Subject to the provisions of the Code of Collective Investment Schemes:5

(a) the risk exposure of the Underlying Fund to a counterparty in an OTC derivative transaction may notexceed 10% of its net assets when the counterparty is a credit institution, which has its registered office ina country which is a EU Member State or if the registered office of the credit institution is situated in anon-EU Member State provided that it is subject to prudential rules equivalent to those in EU MemberStates(b) the Underlying Fund are restricted to dealing with OTC counterparties, which are rated between AAA andA- (S&P/Fitch) or Aaa and A3 (Moody’s), or such ratings as may be allowed by the Code, as amendedfrom time to time. Where multiple external ratings are available, the following is taken into account: (I) ifthere are any differences between ratings, the lowest published rating is used;(II) if there is no availableexternal rating at all (Fitch, S&P, Moody’s), then the full financial statements of the counterparty is to beprovided by the front office and reviewed by the counterparty credit risk team in order to formulate acredit opinion. The Underlying Fund should have the benefit of a guarantee by an entity which has a longtermrating of A (including sub-categories or gradations therein).Where financial instruments are dealt on cash “delivery versus payment” type transactions (DVP), there isa replacement risk if the counterparty is unable to deliver the securities or the cash to a fund. TheUnderlying Fund is restricted to dealing with DVP Cash brokerage counterparties, which are rated betweenAAA and BBB - (S&P/Fitch, Aberdeen Asset Management Broker Rating Model) or Aaa and Baa3(Moody’s). Such ratings may be reviewed and amended from time to time. If no rating is available at thelegal entity, but the entity is majority owned by a larger group, then the Group rating will apply.In addition to the general risk factors set out above, potential investors should be aware of the underlying funds’specific risks as set out below:Specific Risks(a) Exposure to specific regional market increases potential volatility because the concentration in specific regionalmarkets make the Underlying Fund less diversified compared to exposure to global markets.(b) Exposure to emerging markets increases potential volatility in the portfolio as emerging markets tend to be morevolatile than mature markets and the value of underlying investments could move sharply up or down. In somecircumstances, the underlying investments may become illiquid which may constrain the Manager’s ability torealise some or all of the assets. The registration and settlement arrangements in emerging markets may be lessdeveloped than in more mature markets so the operational risks of investing in emerging markets are also higher.In addition, the legal, judicial and regulatory infrastructures in emerging markets are still developing and politicalrisks and adverse economic circumstances are also more likely to arise.(c) Investment in some of the underlying fund components which invest in investments in China is subject to certainadditional risks. Investments in local Chinese securities are done through the use of a Qualified ForeignInstitutional investor ("QFII") licence and the QFII licence holder’s name is used to set up nominee accounts forwhich the securities and other assets are held on behalf of the relevant underlying fund components. There is arisk that creditors of the QFII may attempt to assert that the securities and other assets in the nominee accounts areowned by the QFII and not the relevant underlying fund components. If a court upholds such an assertion, thecreditors of the QFII may seek payment from the assets of the relevant underlying fund components which couldin turn affect the net asset value of the Underlying Fund.For efficient portfolio management purposes, a wholly-owned Mauritian subsidiary is utilised by Aberdeen Global tohold all the investments of the Aberdeen Global – Indian Equity Fund*, into which the Underlying Fund feeds.Mauritius is a widely used jurisdiction for investing on a collective basis into India and has developed an infrastructureto support such vehicles encompassing the full range of administration services. The Mauritian subsidiary is governedby the provisions of the India-Mauritius Double Taxation Avoidance Treaty. If it is no longer beneficial to investthrough the Mauritian subsidiary, the Underlying Fund may elect to invest directly in India or through another suitablevehicle.(*The Aberdeen Global – Indian Equity Fund is not authorized for public sale in Singapore)The use of the Mauritian subsidiary and the tax treaty was decided after review of the law and practice in force in Indiaand Mauritius at inception. It is subject to any future changes and any such changes may adversely affect the returns ofthe Aberdeen Global - Indian Equity Fund. This includes any circumstances where the India/Mauritius double taxationtreaty may not apply or cases to be applied, as a result of, inter alia, any future ruling by the Indian tax authorities.6

Should the treaty not be applied, interest earned on securities listed on the Indian Stock Exchange (earned by theMauritian subsidiary being treated as a Foreign Institutional Investor) would be subject to tax at a rate of 20%. Capitalgains on the disposal of such investments would be subject to tax and rates of 10% or 30% in respect of listed Indiansecurities depending on the length of time the investment has been held.The ILP Sub-Fund is also subject to the usual counterparty risks, such that the ability of the ILP Sub-Fund to makepayments may depend upon the due performance by the other parties, namely the Manager and/or the Custodian (as thecase may be). In the event of insolvency of the Manager, the investments are held by the Trustee on behalf of investorsand are not affected by the Manager’s insolvency.The above should not be considered to be an exhaustive list of the risk which investors should consider beforeinvesting in the ILP Sub-Fund. Investors should be aware that an investment in the ILP Sub-Fund may be exposedto other risks of an exceptional nature from time to time.EXPENSE RATIOExpense ratio is calculated in accordance with the Investment Management Association (IMAS) of Singapore’sguidelines on the disclosure of expense ratios. The expense ratio for the period 1 January 2013 to 31 December 2013 is1.43%.The following expenses (where applicable) as set out in the IMAS Guidelines (as may be updated from time to time)are excluded from the calculation of the expense ratio:(a) brokerage and other transaction costs associated with the purchase and sales of investments (such as registrarcharges and remittance fees);(b) interest expenses;(c) performance fee;(d) foreign exchange gains and losses of the ILP Sub-Fund, whether realised or unrealised;(e) front-end loads, back-end loads and other costs arising on the purchase or sale of a foreign exchange unittrust or mutual fund;(f) tax deducted at source or arising from income received, including withholding tax; and(g) dividends and other distributions paid to investors.TURNOVER RATIOTurnover ratio means a ratio calculated based on the lesser of purchases or sales expressed as a percentage of over'average net asset value'. Where 'average net asset value' means the net asset value for each day averaged over, as far aspossible, the same period used for calculating the expense ratio. The turnover ratio for the period 1 January 2013 to 31December 2013 is 53.01%.7