Master Circular on Customer Service Table of Contents ... - Taxmann

Master Circular on Customer Service Table of Contents ... - Taxmann

Master Circular on Customer Service Table of Contents ... - Taxmann

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

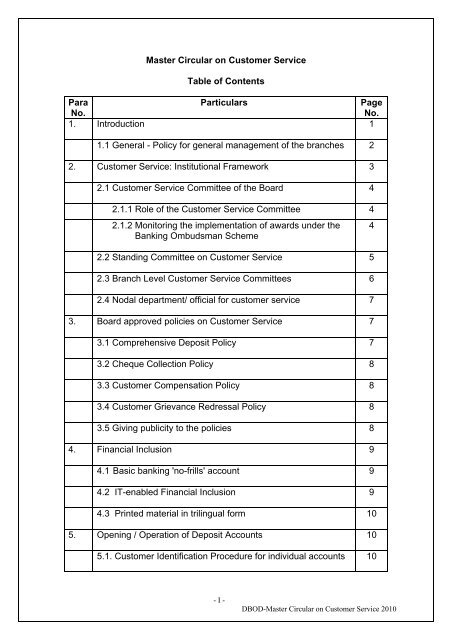

<str<strong>on</strong>g>Master</str<strong>on</strong>g> <str<strong>on</strong>g>Circular</str<strong>on</strong>g> <strong>on</strong> <strong>Customer</strong> <strong>Service</strong><strong>Table</strong> <strong>of</strong> C<strong>on</strong>tentsParaNo.ParticularsPageNo.1. Introducti<strong>on</strong> 11.1 General - Policy for general management <strong>of</strong> the branches 22. <strong>Customer</strong> <strong>Service</strong>: Instituti<strong>on</strong>al Framework 32.1 <strong>Customer</strong> <strong>Service</strong> Committee <strong>of</strong> the Board 42.1.1 Role <strong>of</strong> the <strong>Customer</strong> <strong>Service</strong> Committee 42.1.2 M<strong>on</strong>itoring the implementati<strong>on</strong> <strong>of</strong> awards under theBanking Ombudsman Scheme2.2 Standing Committee <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> 52.3 Branch Level <strong>Customer</strong> <strong>Service</strong> Committees 62.4 Nodal department/ <strong>of</strong>ficial for customer service 73. Board approved policies <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> 73.1 Comprehensive Deposit Policy 73.2 Cheque Collecti<strong>on</strong> Policy 83.3 <strong>Customer</strong> Compensati<strong>on</strong> Policy 83.4 <strong>Customer</strong> Grievance Redressal Policy 83.5 Giving publicity to the policies 84. Financial Inclusi<strong>on</strong> 94.1 Basic banking 'no-frills' account 94.2 IT-enabled Financial Inclusi<strong>on</strong> 94.3 Printed material in trilingual form 105. Opening / Operati<strong>on</strong> <strong>of</strong> Deposit Accounts 105.1. <strong>Customer</strong> Identificati<strong>on</strong> Procedure for individual accounts 104- I -DBOD-<str<strong>on</strong>g>Master</str<strong>on</strong>g> <str<strong>on</strong>g>Circular</str<strong>on</strong>g> <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> 2010

5.2. Savings Bank Rules 105.3 Photographs <strong>of</strong> Depositors 105.4 Minimum balance in savings bank accounts 125.5 Purchase <strong>of</strong> Local Cheques, Drafts, etc. duringsuspensi<strong>on</strong> <strong>of</strong> Clearing125.6 Statement <strong>of</strong> accounts / Pass Books 125.6.1 Issuance <strong>of</strong> Passbooks to Savings Bank Accountholders (Individuals)125.6.2 Updating passbooks 135.6.3 Entries in passbooks / statement <strong>of</strong> accounts 135.6.4 Maintenance <strong>of</strong> savings bank pass books:precauti<strong>on</strong>s145.6.5 Providing m<strong>on</strong>thly statement <strong>of</strong> accounts 145.6.6 Address / Teleph<strong>on</strong>e Number <strong>of</strong> the Branch in PassBooks / Statement <strong>of</strong> Accounts155.7 Issue <strong>of</strong> Cheque Books 155.7.1 Issuing large number <strong>of</strong> cheque books 155.7.2 Writing the cheques in any language 155.7.3 Dispatching the cheque book by courier 155.7.4 Acceptance <strong>of</strong> cheques bearing a date as perNati<strong>on</strong>al Calendar (Saka Samvat) for payment165.8 Term Deposit Account 165.8.1 Issue <strong>of</strong> term deposit receipt 165.8.2 Transferability <strong>of</strong> deposit receipts 165.8.3 Disposal <strong>of</strong> deposits 165. 8.4 Notifying the change in interest rates 165.8.5 Payment <strong>of</strong> interest <strong>on</strong> fixed deposit –Method <strong>of</strong> calculati<strong>on</strong> <strong>of</strong> interest17- II -DBOD-<str<strong>on</strong>g>Master</str<strong>on</strong>g> <str<strong>on</strong>g>Circular</str<strong>on</strong>g> <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> 2010

5.8.6 Premature withdrawal <strong>of</strong> term deposit 175.8.7 Renewal <strong>of</strong> Overdue deposits 185.8.8 Additi<strong>on</strong> or deleti<strong>on</strong> <strong>of</strong> the name/s <strong>of</strong> joint accountholders185.8.9 Payment <strong>of</strong> interest <strong>on</strong> accounts frozen by banks 185.9 Acceptance <strong>of</strong> cash over the counter 195.10 Opening accounts in the name <strong>of</strong> minors with Mothers asguardians205.11 Opening <strong>of</strong> Current Accounts – Need for discipline 215.12 Rec<strong>on</strong>ciliati<strong>on</strong> <strong>of</strong> transacti<strong>on</strong>s at ATMs failure-Time limit 215.13 Lodging <strong>of</strong> ATM related complaints 226. Levy <strong>of</strong> <strong>Service</strong> Charges 226.1 Fixing service charges by banks 226.2 Ensuring Reas<strong>on</strong>ableness <strong>of</strong> Bank Charges 237. <strong>Service</strong> at the counters 237.1 Banking hours / working days <strong>of</strong> bank branches 237.2 Changes in banking hours 237.3 Commencement / Extensi<strong>on</strong> <strong>of</strong> working hours 247.4 Extended business hours for n<strong>on</strong>-cash bankingtransacti<strong>on</strong>s248. Guidance to customers and Disclosure <strong>of</strong> Informati<strong>on</strong> 268.1 Assistance/guidance to customers 268.2. Display <strong>of</strong> time norms 268.3. Display <strong>of</strong> informati<strong>on</strong> by banks – Comprehensive NoticeBoard268.3.1. Notice Boards 278.3.2. Booklets/Brochures 28- III -DBOD-<str<strong>on</strong>g>Master</str<strong>on</strong>g> <str<strong>on</strong>g>Circular</str<strong>on</strong>g> <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> 2010

8.3.3. Website 288.3.4 Other modes <strong>of</strong> display 298.3.5 Other issues 298.4 Display <strong>of</strong> informati<strong>on</strong> relating to Interest Rates and<strong>Service</strong> Charges – Rates at a quick glance8.5 Disclosure <strong>of</strong> Informati<strong>on</strong> by banks in the public domain 299. Operati<strong>on</strong> <strong>of</strong> Accounts by Old & Incapacitated Pers<strong>on</strong>s 31299.1.Facility to sick/old/incapacitated n<strong>on</strong>-pensi<strong>on</strong> accountholders319.2 Types <strong>of</strong> sick / old / incapacitated account holders 319.3 Operati<strong>on</strong>al Procedure 319.4 Opini<strong>on</strong> <strong>of</strong> IBA in case <strong>of</strong> a pers<strong>on</strong> who can not sign due toloss <strong>of</strong> both hands9.5 Need for Bank branches / ATMs to be made accessible toPers<strong>on</strong>s with disabilities.323210. Providing banking facilities to Visually Impaired Pers<strong>on</strong>s 3310.1 Guidelines framed by IBA based <strong>on</strong> the judgement <strong>of</strong>Chief Commissi<strong>on</strong>er for Pers<strong>on</strong>s with Disabilities10.2 Talking ATMs with Braille keypads to facilitate use bypers<strong>on</strong>s with visual impairment11. Legal Guardianship Certificate issued under the Nati<strong>on</strong>al TrustAct, 1999 empowering the disabled pers<strong>on</strong>s with autism,cerebral palsy, mental retardati<strong>on</strong> and multiple disabilities11.1 Display <strong>of</strong> informati<strong>on</strong> regarding Local Level Committeesset up under the Nati<strong>on</strong>al Trust for Welfare <strong>of</strong> Pers<strong>on</strong>swith Autism, Cerebral Palsy, Mental Retardati<strong>on</strong> andMultiple Disabilities Act, 19993334343512. Remittance 3512.1.Remittance <strong>of</strong> Funds for Value Rs. 50,000/- and above 3512.2. Demand Drafts 3512.2.1 Issue <strong>of</strong> Demand Drafts 35- IV -DBOD-<str<strong>on</strong>g>Master</str<strong>on</strong>g> <str<strong>on</strong>g>Circular</str<strong>on</strong>g> <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> 2010

12.2.2 Encashment <strong>of</strong> drafts 3612.2.3 Issue <strong>of</strong> Duplicate Demand Draft 3613. Cheque Drop Box Facility 3714. Collecti<strong>on</strong> <strong>of</strong> instruments 3714.1 Formulating Cheque Collecti<strong>on</strong> Policies 3714.1.2 Broad Principles 3814.1.3 Delays in Cheque Clearing - Case No. 82 <strong>of</strong> 2006before Nati<strong>on</strong>al C<strong>on</strong>sumer Disputes RedressalCommissi<strong>on</strong>14.2 Cheques / Instruments lost in transit / in clearingprocess / at paying bank's branch394014.3 Bills for collecti<strong>on</strong> 4114.3.1 Payment <strong>of</strong> interest for Delays in collecti<strong>on</strong> <strong>of</strong> bills 4115. Dish<strong>on</strong>our <strong>of</strong> Cheques – Procedure there<strong>of</strong> 4115.1 Returning dish<strong>on</strong>oured cheques 4115.2 Procedure for return/ despatch <strong>of</strong> dish<strong>on</strong>oured cheques 4215.3 Informati<strong>on</strong> <strong>on</strong> dish<strong>on</strong>oured cheque 4215.4 Dealing with incidence <strong>of</strong> frequent dish<strong>on</strong>our <strong>of</strong> cheques<strong>of</strong> value Rs. 1 crore and above15.5 Dealing with incidence <strong>of</strong> frequent dish<strong>on</strong>our <strong>of</strong> cheques<strong>of</strong> value <strong>of</strong> less than Rs. 1 crore434315.6 General 4415.7 Framing appropriate procedure for dealing with44dish<strong>on</strong>oured cheques16. Dealing with Complaints and Improving <strong>Customer</strong> Relati<strong>on</strong>s 4416.1 Complaints/suggesti<strong>on</strong>s box 4416.2 Complaint Book /Register 4516.3 Complaint Form 45- V -DBOD-<str<strong>on</strong>g>Master</str<strong>on</strong>g> <str<strong>on</strong>g>Circular</str<strong>on</strong>g> <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> 2010

16.4 Analysis and Disclosure <strong>of</strong> complaints -Disclosure <strong>of</strong> complaints / unimplemented awards <strong>of</strong>Banking Ombudsmen al<strong>on</strong>g with Financial Results4616.5 Grievance Redressal Mechanism 4716.6 Review <strong>of</strong> grievances redressal machinery 4917. Err<strong>on</strong>eous Debits arising <strong>on</strong> fraudulent or other transacti<strong>on</strong>s 5017.1 Vigilance by banks 5017.2 Compensating the customer 5018. Extensi<strong>on</strong> <strong>of</strong> Safe Deposit Locker / Safe Custody ArticleFacility5018.1 Allotment <strong>of</strong> Lockers 5118.1.1 Linking <strong>of</strong> Allotment <strong>of</strong> Lockers to placement <strong>of</strong> 51Fixed Deposits18.1.2 Fixed Deposit as Security for Lockers 5118.1.3 Wait List <strong>of</strong> Lockers 5118.1.4 Providing a copy <strong>of</strong> the agreement 5118.2 Security aspects relating to Safe Deposit Lockers 5118.2.1 Operati<strong>on</strong>s <strong>of</strong> Safe Deposit Vaults/Lockers 5118.2.2 <strong>Customer</strong> due diligence for allotment <strong>of</strong> lockers /Measures relating to lockers which have remainedUnoperated5218.3 Embossing identificati<strong>on</strong> code 5319. Nominati<strong>on</strong> Facility 5319.1 Legal Provisi<strong>on</strong>s 5319.1.1 Provisi<strong>on</strong>s in the Banking Regulati<strong>on</strong> Act, 1949 5319.1.2 The Banking Companies (Nominati<strong>on</strong>) Rules, 1985 5319.1.3 Nominati<strong>on</strong> facilities in respect <strong>of</strong> safedeposit locker / safe custody articles5419.1.4. Nominati<strong>on</strong> Facility – Sole Proprietary C<strong>on</strong>cern 54- VI -DBOD-<str<strong>on</strong>g>Master</str<strong>on</strong>g> <str<strong>on</strong>g>Circular</str<strong>on</strong>g> <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> 2010

19.2 Nominati<strong>on</strong> Facility in Single Deposit Accounts 5419.3 Acknowledgement <strong>of</strong> Nominati<strong>on</strong> 5519.4 Registering the nominati<strong>on</strong> 5619.5. Incorporati<strong>on</strong> <strong>of</strong> the legend “Nominati<strong>on</strong> Registered”in pass book, deposit receipt etc. and indicating theName <strong>of</strong> the Nominee in Pass Books / Fixed DepositReceipts19.6. Separate nominati<strong>on</strong> for savings bank account andpensi<strong>on</strong> Account565619.7 Nominati<strong>on</strong> Facility – Certain Clarificati<strong>on</strong>s 5719.7.1 Nominati<strong>on</strong> facility in respect <strong>of</strong> deposits 5719.7.2 Nominati<strong>on</strong> in Safe Deposit Lockers / Safe CustodyArticles19.8 <strong>Customer</strong> Guidance and Publicity Educating <strong>Customer</strong>s<strong>on</strong> the Benefits <strong>of</strong> nominati<strong>on</strong> / survivorship clause20. Settlement <strong>of</strong> claims in respect <strong>of</strong> deceased depositors –Simplificati<strong>on</strong> <strong>of</strong> procedure.57585920.1 Accounts with survivor/nominee clause 5920.2 Accounts without the survivor / nominee clause 6020.3 Premature Terminati<strong>on</strong> <strong>of</strong> term deposit accounts 6120.4 Treatment <strong>of</strong> flows in the name <strong>of</strong> the deceased depositor 6120.5 Interest payable <strong>on</strong> the deposit account <strong>of</strong> deceaseddepositor6120.6 Time limit for settlement <strong>of</strong> claims 6221. Access to the safe deposit lockers / safe custody articles return<strong>of</strong> Safe custody articles to Survivor(s) / Nominee(s) / Legalheir(s)21.1 Access to the safe deposit lockers / return <strong>of</strong> safe custodyarticles (with survivor/nominee clause)21.2 Access to the safe deposit lockers / return <strong>of</strong> safecustody articles (without survivor/nominee clause)626364- VII -DBOD-<str<strong>on</strong>g>Master</str<strong>on</strong>g> <str<strong>on</strong>g>Circular</str<strong>on</strong>g> <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> 2010

21.3 Preparing Inventory 6421.4 Simplified operati<strong>on</strong>al systems / procedures 6521.5 <strong>Customer</strong> guidance and publicity 6522. Settlement <strong>of</strong> claims in respect <strong>of</strong> missing pers<strong>on</strong>s 6623. Release <strong>of</strong> other assets <strong>of</strong> the deceased borrowers to theirlegal heirs6624. Unclaimed Deposits / Inoperative Accounts in banks 6725. <strong>Customer</strong> C<strong>on</strong>fidentiality Obligati<strong>on</strong>s 7025.1 Collecting Informati<strong>on</strong> from customers for cross-sellingpurposes7026. Transfer <strong>of</strong> account from <strong>on</strong>e branch to another 7127. Switching banks by customers 7128. Co-ordinati<strong>on</strong> with <strong>of</strong>ficers <strong>of</strong> Central Board <strong>of</strong> Direct Taxes 7229. Declarati<strong>on</strong> <strong>of</strong> Holiday under the Negotiable Instruments Act,18817230. Miscellaneous 7230.1 Sunday banking 7230.2 Accepting standing instructi<strong>on</strong>s <strong>of</strong> customers 7230.3 Clean Overdrafts for small amounts 7330.4 Rounding <strong>of</strong>f <strong>of</strong> transacti<strong>on</strong>s 7331. Various Working Groups / Committees <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> inBanks- Implementati<strong>on</strong> <strong>of</strong> the Recommendati<strong>on</strong>s7332. Code <strong>of</strong> Bank’s Commitment to customers 73- VIII -DBOD-<str<strong>on</strong>g>Master</str<strong>on</strong>g> <str<strong>on</strong>g>Circular</str<strong>on</strong>g> <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> 2010

AnnexuresAnnex I. Recommendati<strong>on</strong>s <strong>of</strong> the Working Group to Formulate a 74Scheme for Ensuring Reas<strong>on</strong>ableness <strong>of</strong> Bank Charges(Para 6.2)Annex II. Format <strong>of</strong> Comprehensive Notice Board (Para 8.3.1) 78Annex III. Rates at a quick glance – Format (Para 8.4) 80Annex IV. Format for Inventory <strong>of</strong> c<strong>on</strong>tents <strong>of</strong> Safety Locker /articles left in safe custody (Para 21.3)83AppendixAppendix - List <strong>of</strong> <str<strong>on</strong>g>Circular</str<strong>on</strong>g>s 86- IX -DBOD-<str<strong>on</strong>g>Master</str<strong>on</strong>g> <str<strong>on</strong>g>Circular</str<strong>on</strong>g> <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> 2010

- X -DBOD-<str<strong>on</strong>g>Master</str<strong>on</strong>g> <str<strong>on</strong>g>Circular</str<strong>on</strong>g> <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> 2010

1. Introducti<strong>on</strong><strong>Customer</strong> service has great significance in the banking industry. The banking system inIndia today has perhaps the largest outreach for delivery <strong>of</strong> financial services and isalso serving as an important c<strong>on</strong>duit for delivery <strong>of</strong> financial services. While thecoverage has been expanding day by day, the quality and c<strong>on</strong>tent <strong>of</strong> dispensi<strong>on</strong> <strong>of</strong>customer service has come under tremendous pressure mainly owing to the failure tohandle the soaring demands and expectati<strong>on</strong>s <strong>of</strong> the customers.The vast network <strong>of</strong> branches spread over the entire country with milli<strong>on</strong>s <strong>of</strong> customers,a complex variety <strong>of</strong> products and services <strong>of</strong>fered, the varied instituti<strong>on</strong>al framework –all these add to the enormity and complexity <strong>of</strong> banking operati<strong>on</strong>s in India giving rise tocomplaints for deficiencies in services. This is evidenced by a series <strong>of</strong> studiesc<strong>on</strong>ducted by various committees such as the Talwar Committee, Goiporia Committee,Tarapore Committee etc., to bring in improvement in performance and procedureinvolved in the dispensi<strong>on</strong> <strong>of</strong> hassle-free customer service.Reserve Bank, as the regulator <strong>of</strong> the banking sector has been actively engaged fromthe very beginning in the review, examinati<strong>on</strong> and evaluati<strong>on</strong> <strong>of</strong> customer service inbanks. It has c<strong>on</strong>stantly brought into sharp focus the inadequacy in banking servicesavailable to the comm<strong>on</strong> pers<strong>on</strong> and the need to benchmark the current level <strong>of</strong> service,review the progress periodically, enhance the timeliness and quality, rati<strong>on</strong>alize theprocesses taking into account technological developments, and suggest appropriateincentives to facilitate change <strong>on</strong> an <strong>on</strong>going basis through instructi<strong>on</strong>s/guidelines.Depositors' interest forms the focal point <strong>of</strong> the regulatory framework for banking inIndia. There is a widespread feeling that the customer does not get satisfactory serviceeven after demanding it and there has been a total disenfranchisement <strong>of</strong> the depositor.There is therefore, a need to reverse this trend and start a process <strong>of</strong> empowering thedepositor.Broadly, a customer can be defined as a user or a potential user <strong>of</strong> bank services. Sodefined, a ‘<strong>Customer</strong>’ may include:

• a pers<strong>on</strong> or entity that maintains an account and/or has a business relati<strong>on</strong>shipwith the bank;• <strong>on</strong>e <strong>on</strong> whose behalf the account is maintained (i.e. the beneficial owner);• beneficiaries <strong>of</strong> transacti<strong>on</strong>s c<strong>on</strong>ducted by pr<strong>of</strong>essi<strong>on</strong>al intermediaries, such asStock Brokers, Chartered Accountants, Solicitors etc., as permitted under thelaw, and• any pers<strong>on</strong> or entity c<strong>on</strong>nected with a financial transacti<strong>on</strong> which can posesignificant reputati<strong>on</strong>al or other risks to the bank, say, a wire transfer or issue<strong>of</strong> a high value demand draft as a single transacti<strong>on</strong>.1.1 GeneralPolicy for general management <strong>of</strong> the branchesBanks' systems should be oriented towards providing better customer service and theyshould periodically study their systems and their impact <strong>on</strong> customer service. Banksshould have a Board approved policy for general management <strong>of</strong> the branches whichmay include the following aspects:-(a) providing infrastructure facilities by branches by bestowing particular attenti<strong>on</strong> toproviding adequate space, proper furniture, drinking water facilities, with specificemphasis <strong>on</strong> pensi<strong>on</strong>ers, senior citizens, disabled pers<strong>on</strong>s, etc.(b) providing entirely separate enquiry counters at their large / bigger branches inadditi<strong>on</strong> to a regular recepti<strong>on</strong> counter.(c) displaying indicator boards at all the counters in English, Hindi as well as in thec<strong>on</strong>cerned regi<strong>on</strong>al language. Business posters at semi-urban and rural branches <strong>of</strong>banks should also be in the c<strong>on</strong>cerned regi<strong>on</strong>al languages.(d) posting roving <strong>of</strong>ficials to ensure employees' resp<strong>on</strong>se to customers and forhelping out customers in putting in their transacti<strong>on</strong>s.(e) providing customers with booklets c<strong>on</strong>sisting <strong>of</strong> all details <strong>of</strong> service and facilitiesavailable at the bank in Hindi, English and the c<strong>on</strong>cerned regi<strong>on</strong>al languages.(f) use <strong>of</strong> Hindi and regi<strong>on</strong>al languages in transacting business by banks withcustomers, including communicati<strong>on</strong>s to customers.

(g) reviewing and improving up<strong>on</strong> the existing security system in branches so as toinstil c<strong>on</strong>fidence am<strong>on</strong>gst the employees and the public.(h) wearing <strong>on</strong> pers<strong>on</strong> an identificati<strong>on</strong> badge displaying photo and name there<strong>on</strong> bythe employees.(i) Periodic change <strong>of</strong> desk and entrustment <strong>of</strong> elementary supervisory jobs.(j) Training <strong>of</strong> staff in line with customer service orientati<strong>on</strong>. Training in Technicalareas <strong>of</strong> banking to the staff at delivery points. Adopting innovative ways <strong>of</strong> training /delivery ranging from job cards to roving faculty to video c<strong>on</strong>ferencing.(k) visit by senior <strong>of</strong>ficials from c<strong>on</strong>trolling <strong>of</strong>fices and Head Office to branches atperiodical intervals for <strong>on</strong> the spot study <strong>of</strong> the quality <strong>of</strong> service rendered by thebranches.(l) rewarding the Best branches from customer service point <strong>of</strong> view by annualawards/running shield.(m) <strong>Customer</strong> service audit, customer surveys.(n) holding customer relati<strong>on</strong> programmes and periodical meetings to interact withdifferent cross secti<strong>on</strong>s <strong>of</strong> customers for identifying acti<strong>on</strong> points to upgrade thecustomer service with customers.(o) clearly establishing a New Product and <strong>Service</strong>s Approval Process which shouldrequire approval by the Board especially <strong>on</strong> issues which compromise the rights <strong>of</strong> theComm<strong>on</strong> Pers<strong>on</strong>.(p) appointing Quality Assurance Officers who will ensure that the intent <strong>of</strong> policy istranslated into the c<strong>on</strong>tent and its eventual translati<strong>on</strong> into proper procedures.2. <strong>Customer</strong> <strong>Service</strong>: Instituti<strong>on</strong>al FrameworkNeed for Board's involvementMatters relating to customer service should be deliberated by the Board to ensure thatthe instructi<strong>on</strong>s are implemented meaningfully. Commitment to hassle-free service tothe customer at large and the Comm<strong>on</strong> Pers<strong>on</strong> in particular under the oversight <strong>of</strong> theBoard should be the major resp<strong>on</strong>sibility <strong>of</strong> the Board.2.1 <strong>Customer</strong> <strong>Service</strong> Committee <strong>of</strong> the Board

Banks are required to c<strong>on</strong>stitute a <strong>Customer</strong> <strong>Service</strong> Committee <strong>of</strong> the Board andinclude experts and representatives <strong>of</strong> customers as invitees to enable the bank t<strong>of</strong>ormulate policies and assess the compliance there<strong>of</strong> internally with a view tostrengthening the corporate governance structure in the banking system and also tobring about <strong>on</strong>going improvements in the quality <strong>of</strong> customer service provided by thebanks.2.1.1 Role <strong>of</strong> the <strong>Customer</strong> <strong>Service</strong> Committee<strong>Customer</strong> <strong>Service</strong> Committee <strong>of</strong> the Board, illustratively, could address the following:-• formulati<strong>on</strong> <strong>of</strong> a Comprehensive Deposit Policy• issues such as the treatment <strong>of</strong> death <strong>of</strong> a depositor for operati<strong>on</strong>s <strong>of</strong> his account• product approval process with a view to suitability and appropriateness• annual survey <strong>of</strong> depositor satisfacti<strong>on</strong>• tri-enniel audit <strong>of</strong> such services.Besides, the Committee could also examine any other issues having a bearing <strong>on</strong> thequality <strong>of</strong> customer service rendered.2.1.2 M<strong>on</strong>itoring the implementati<strong>on</strong> <strong>of</strong> awards under the Banking OmbudsmanSchemeThe Committee should also play a more pro-active role with regard to complaints /grievances resolved by Banking Ombudsmen <strong>of</strong> the various States.The Scheme <strong>of</strong> Banking Ombudsman was introduced with the object <strong>of</strong> enablingresoluti<strong>on</strong> <strong>of</strong> complaints relating to provisi<strong>on</strong> <strong>of</strong> banking services and resolving disputesbetween a bank and its c<strong>on</strong>stituent through the process <strong>of</strong> c<strong>on</strong>ciliati<strong>on</strong>, mediati<strong>on</strong> andarbitrati<strong>on</strong> in respect <strong>of</strong> deficiencies in customer service. After detailed examinati<strong>on</strong> <strong>of</strong>the complaints / grievances <strong>of</strong> customers <strong>of</strong> banks and after perusal <strong>of</strong> the comments <strong>of</strong>banks, the Banking Ombudsmen issue their awards in respect <strong>of</strong> individual complaintsto redress the grievances. Banks should ensure that the Awards <strong>of</strong> the BankingOmbudsmen are implemented expeditiously and with active involvement <strong>of</strong> TopManagement.

Further, with a view to enhancing the effectiveness <strong>of</strong> the <strong>Customer</strong> <strong>Service</strong> Committee,banks should also :a) place all the awards given by the Banking Ombudsman before the <strong>Customer</strong> <strong>Service</strong>Committee to enable them to address issues <strong>of</strong> systemic deficiencies existing in banks,if any, brought out by the awards; andb) place all the awards remaining unimplemented for more than three m<strong>on</strong>ths with thereas<strong>on</strong>s therefor before the <strong>Customer</strong> <strong>Service</strong> Committee to enable the <strong>Customer</strong><strong>Service</strong> Committee to report to the Board such delays in implementati<strong>on</strong> without validreas<strong>on</strong>s and for initiating necessary remedial acti<strong>on</strong>.2.2 Standing Committee <strong>on</strong> <strong>Customer</strong> <strong>Service</strong>The Committee <strong>on</strong> Procedures and Performance Audit <strong>of</strong> Public <strong>Service</strong>s (CPPAPS)examined the issues relating to the c<strong>on</strong>tinuance or otherwise <strong>of</strong> the Ad hoc Committeesand observed that there should be a dedicated focal point for customer service inbanks, which should have sufficient powers to evaluate the functi<strong>on</strong>ing in variousdepartments. The CPPAPS therefore recommended that the Ad hoc Committees shouldbe c<strong>on</strong>verted into Standing Committees <strong>on</strong> <strong>Customer</strong> <strong>Service</strong>.On the basis <strong>of</strong> the above recommendati<strong>on</strong>, banks are required to c<strong>on</strong>vert the existingAd hoc Committees into a Standing Committee <strong>on</strong> <strong>Customer</strong> <strong>Service</strong>. The Ad hocCommittees when c<strong>on</strong>verted as a permanent Standing Committee cutting acrossvarious departments can serve as the micro level executive committee driving theimplementati<strong>on</strong> process and providing relevant feedback while the <strong>Customer</strong> <strong>Service</strong>Committee <strong>of</strong> the Board would oversee and review / modify the initiatives. Thus the twoCommittees would be mutually reinforcing with <strong>on</strong>e feeding into the other.The c<strong>on</strong>stituti<strong>on</strong> and functi<strong>on</strong>s <strong>of</strong> the Standing Committee may be <strong>on</strong> the lines indicatedbelow :-i) The Standing Committee may be chaired by the CMD or the ED and includen<strong>on</strong>-<strong>of</strong>ficials as its members to enable an independent feedback <strong>on</strong> the quality <strong>of</strong>customer service rendered by the bank.

ii) The Standing Committee may be entrusted not <strong>on</strong>ly with the task <strong>of</strong> ensuringtimely and effective compliance <strong>of</strong> the RBI instructi<strong>on</strong>s <strong>on</strong> customer service, but alsothat <strong>of</strong> receiving the necessary feedback to determine that the acti<strong>on</strong> taken by variousdepartments <strong>of</strong> the bank is in tune with the spirit and intent <strong>of</strong> such instructi<strong>on</strong>s.iii) The Standing Committee may review the practice and procedures prevalentin the bank and take necessary corrective acti<strong>on</strong>, <strong>on</strong> an <strong>on</strong>going basis as the intent istranslated into acti<strong>on</strong> <strong>on</strong>ly through procedures and practices.iv) A brief report <strong>on</strong> the performance <strong>of</strong> the Standing Committee during its tenureindicating, inter alia, the areas reviewed, procedures / practices identified and simplified/ introduced may be submitted periodically to the <strong>Customer</strong> <strong>Service</strong>s Committee <strong>of</strong> theBoard.With the c<strong>on</strong>versi<strong>on</strong> <strong>of</strong> the Ad hoc Committees into Standing Committees <strong>on</strong> <strong>Customer</strong><strong>Service</strong>, the Standing Committee will act as the bridge between the variousdepartments <strong>of</strong> the bank and the Board / <strong>Customer</strong> <strong>Service</strong> Committees <strong>of</strong> the Board.2.3 Branch Level <strong>Customer</strong> <strong>Service</strong> CommitteesBanks were advised to establish <strong>Customer</strong> <strong>Service</strong> Committees at branch level. In orderto encourage a formal channel <strong>of</strong> communicati<strong>on</strong> between the customers and the bankat the branch level, banks should take necessary steps for strengthening the branchlevel committees with greater involvement <strong>of</strong> customers. It is desirable that branch levelcommittees include their customers too. Further as senior citizens usually form animportant c<strong>on</strong>stituent in banks, a senior citizen may preferably be included therein. TheBranch Level <strong>Customer</strong> <strong>Service</strong> Committee may meet at least <strong>on</strong>ce a m<strong>on</strong>th to studycomplaints/ suggesti<strong>on</strong>s, cases <strong>of</strong> delay, difficulties faced / reported by customers /members <strong>of</strong> the Committee and evolve ways and means <strong>of</strong> improving customer service.The branch level committees may also submit quarterly reports giving inputs /suggesti<strong>on</strong>s to the Standing Committee <strong>on</strong> <strong>Customer</strong> <strong>Service</strong> thus enabling theStanding Committee to examine them and provide relevant feedback to the <strong>Customer</strong><strong>Service</strong> Committee <strong>of</strong> the Board for necessary policy / procedural acti<strong>on</strong>.

2.4 Nodal department/ <strong>of</strong>ficial for customer serviceEach bank is expected to have a nodal department / <strong>of</strong>ficial for customer service in theHO and each c<strong>on</strong>trolling <strong>of</strong>fice, with whom customers with grievances can approach inthe first instance and with whom the Banking Ombudsman and RBI can liaise.3. Board approved policies <strong>on</strong> <strong>Customer</strong> <strong>Service</strong><strong>Customer</strong> service should be projected as a priority objective <strong>of</strong> banks al<strong>on</strong>g with pr<strong>of</strong>it,growth and fulfilment <strong>of</strong> social obligati<strong>on</strong>s. Banks should have a board approved policyfor the following:3.1 Comprehensive Deposit PolicyBanks should formulate a transparent and comprehensive policy setting out the rights <strong>of</strong>the depositors in general and small depositors in particular. The policy would also berequired to cover all aspects <strong>of</strong> operati<strong>on</strong>s <strong>of</strong> deposit accounts, charges leviable andother related issues to facilitate interacti<strong>on</strong> <strong>of</strong> depositors at branch levels. Such a policyshould also be explicit in regard to secrecy and c<strong>on</strong>fidentiality <strong>of</strong> the customers.Providing other facilities by "tying-up" with placement <strong>of</strong> deposits is clearly a restrictivepractice.3.2 Cheque Collecti<strong>on</strong> PolicyBanks should formulate a comprehensive and transparent policy taking into accounttheir technological capabilities, systems and processes adopted for clearingarrangements and other internal arrangements for collecti<strong>on</strong> through corresp<strong>on</strong>dents.The policy should cover the following three aspects:• Immediate Credit for local / outstati<strong>on</strong> cheques• Time frame for Collecti<strong>on</strong> <strong>of</strong> Local / Outstati<strong>on</strong> Instruments• Interest payment for delayed collecti<strong>on</strong>Broad principles enumerated in paragraph 14.1 should be taken into account whileformulating the policy.3.3 <strong>Customer</strong> Compensati<strong>on</strong> Policy

Banks must have a well documented <strong>Customer</strong> Compensati<strong>on</strong> Policy duly approved bytheir Boards. They could use the model policy formulated by the Indian Banks'Associati<strong>on</strong> (IBA) in this regard in formulating their own policy. Banks policy should, at aminimum, incorporate the following aspects:-(a)(b)(c)(d)Err<strong>on</strong>eous Debits arising <strong>on</strong> fraudulent or other transacti<strong>on</strong>sPayment <strong>of</strong> interest for Delays in collecti<strong>on</strong>Payment <strong>of</strong> interest for delay in issue <strong>of</strong> duplicate draftOther unauthorised acti<strong>on</strong>s <strong>of</strong> the bank leading to a financial loss to customer3.4 <strong>Customer</strong> Grievance Redressal PolicyBanks must have a well documented <strong>Customer</strong> Grievance Redressal Policy dulyapproved by their Boards. The Policy should be framed based <strong>on</strong> the broad principlesenumerated in paragraph 16 <strong>of</strong> this circular.3.5 Giving publicity to the policies(i) Banks should ensure that wide publicity is given to the above policies formulated bythem by placing them prominently <strong>on</strong> the web-site and also otherwise widelydisseminating the policies such as, displaying them <strong>on</strong> the notice board in theirbranches.(ii) The customers should be clearly apprised <strong>of</strong> the assurances <strong>of</strong> the bank <strong>on</strong> theservices <strong>on</strong> these aspects at the time <strong>of</strong> establishment <strong>of</strong> the initial relati<strong>on</strong>ship be it asa depositor, borrower or otherwise.(iii) Further, they may also take necessary steps to keep the customers duly informed <strong>of</strong>the changes in the policies formulated by them from time to time.4. Financial Inclusi<strong>on</strong>4.1 Basic banking 'no-frills' accountWith a view to achieving the objective <strong>of</strong> greater financial inclusi<strong>on</strong>, all banks shouldmake available a basic banking 'no-frills' account either with 'nil' or very low minimumbalances as well as charges that would make such accounts accessible to vast secti<strong>on</strong>s

<strong>of</strong> populati<strong>on</strong>. The nature and number <strong>of</strong> transacti<strong>on</strong>s in such accounts could berestricted, but made known to the customer in advance in a transparent manner. Allbanks should also give wide publicity to the facility <strong>of</strong> such a 'no-frills' account including<strong>on</strong> their web sites indicating the facilities and charges in a transparent manner. Thenumber <strong>of</strong> such deposit accounts opened by the bank may be reported to Reserve Bank<strong>of</strong> India <strong>on</strong> a quarterly basis.4.2 IT-enabled Financial Inclusi<strong>on</strong>Though the banks make available a basic banking 'no-frills' account so as to achievethe objective <strong>of</strong> greater financial inclusi<strong>on</strong>, yet financial inclusi<strong>on</strong> objectives would not befully met if the banks do not increase the banking outreach to the remote corners <strong>of</strong> thecountry. This has to be d<strong>on</strong>e with affordable infrastructure and low operati<strong>on</strong>al costswith the use <strong>of</strong> appropriate technology. This would enable banks to lower thetransacti<strong>on</strong> costs to make small ticket transacti<strong>on</strong>s viable.A few banks have already initiated certain pilot projects in different remote parts <strong>of</strong> thecountry utilizing smart cards/mobile technology to extend banking services similar tothose dispensed from branches. Banks are, therefore, urged to scale up their financialinclusi<strong>on</strong> efforts by utilizing appropriate technology. Care may be taken to ensure thatthe soluti<strong>on</strong>s developed are:• highly secure,• amenable to audit and• follow widely accepted open standards to allow inter-operability am<strong>on</strong>g thedifferent systems adopted by different banks.4.3 Printed material in trilingual formIn order to ensure that banking facilities percolate to the vast secti<strong>on</strong>s <strong>of</strong> the populati<strong>on</strong>,banks should make available all printed material used by retail customers includingaccount opening forms, pay-in-slips, passbooks etc., in trilingual form i.e., English, Hindiand the c<strong>on</strong>cerned Regi<strong>on</strong>al Language.5. Opening / Operati<strong>on</strong> <strong>of</strong> Deposit Accounts5.1 <strong>Customer</strong> Identificati<strong>on</strong> Procedure for individual accounts

Banks should be generally guided by RBI instructi<strong>on</strong>s <strong>on</strong> KYC / AML for opening <strong>of</strong>accounts.5.2 Savings Bank RulesAs many banks are now issuing statement <strong>of</strong> accounts in lieu <strong>of</strong> pass books, theSavings Bank Rules must be annexed as a tear-<strong>of</strong>f porti<strong>on</strong> to the account opening formso that the account holder can retain the rules.5.3 Photographs <strong>of</strong> depositorsBanks should obtain and keep <strong>on</strong> record photographs <strong>of</strong> all depositors/account holdersin respect <strong>of</strong> accounts opened by them subject to the following clarificati<strong>on</strong>s:(i) The instructi<strong>on</strong>s cover all types <strong>of</strong> deposits including fixed, recurring, cumulative, etc.(ii) They apply to all categories <strong>of</strong> depositors, whether resident or n<strong>on</strong>-resident. Onlybanks, Local Authorities and Government Departments (excluding public sectorundertakings or quasi-Government bodies) will be exempt from the requirement <strong>of</strong>photographs.(iii) The banks may not insist <strong>on</strong> photographs in case <strong>of</strong> accounts <strong>of</strong> staff members <strong>on</strong>ly(Single/Joint).(iv) The banks should obtain photographs <strong>of</strong> all pers<strong>on</strong>s authorised to operate theaccounts viz., Savings Bank and Current accounts without excepti<strong>on</strong>(v) The banks should also obtain photographs <strong>of</strong> the ' Pardanishin' women.(vi) The banks may obtain two copies <strong>of</strong> photographs and obtaining photocopies <strong>of</strong>driving licences/passport c<strong>on</strong>taining photographs in place <strong>of</strong> photographs would notsuffice.(vii) The banks should not ordinarily insist <strong>on</strong> the presence <strong>of</strong> account holder for makingcash withdrawals in case <strong>of</strong> 'self' or 'bearer' cheques unless the circumstances sowarrant. The banks should pay 'self' or 'bearer' cheques taking usual precauti<strong>on</strong>s.

(viii) Photographs cannot be a substitute for specimen signatures.(ix) Only <strong>on</strong>e set <strong>of</strong> photographs need be obtained and separate photographs shouldnot be obtained for each category <strong>of</strong> deposit. The applicati<strong>on</strong>s for different types <strong>of</strong>deposit accounts should be properly referenced.(x) Fresh photographs need not be obtained when an additi<strong>on</strong>al account is desired to beopened by the account bolder.(xi) In the case <strong>of</strong> operative accounts, viz. Savings Bank and Current accounts,photographs <strong>of</strong> pers<strong>on</strong>s authorised to operate them should be obtained. In case <strong>of</strong> otherdeposits, viz., Fixed, Recurring, Cumulative, etc., photographs <strong>of</strong> all depositors inwhose names the deposit receipt stands may be obtained except in the case <strong>of</strong> depositsin the name <strong>of</strong> minors where guardians' photographs should be obtained.5.4 Minimum balance in savings bank accountsAt the time <strong>of</strong> opening the accounts, banks should inform their customers in atransparent manner the requirement <strong>of</strong> maintaining minimum balance and levying <strong>of</strong>charges etc., if the minimum balance is not maintained. Any charge levied subsequentlyshould be transparently made known to all depositors in advance with <strong>on</strong>e m<strong>on</strong>th’snotice. The banks should inform, at least <strong>on</strong>e m<strong>on</strong>th in advance, the existing accountholders <strong>of</strong> any change in the prescribed minimum balance and the charges that may belevied if the prescribed minimum balance is not maintained.5.5 Purchase <strong>of</strong> Local Cheques, Drafts, etc.,during suspensi<strong>on</strong> <strong>of</strong> ClearingThere may be occasi<strong>on</strong>s when Clearing House operati<strong>on</strong>s may have to be temporarilysuspended for reas<strong>on</strong>s bey<strong>on</strong>d the c<strong>on</strong>trol <strong>of</strong> the authorities c<strong>on</strong>cerned. Suchsuspensi<strong>on</strong> entails hardship to the c<strong>on</strong>stituents <strong>of</strong> the banks because <strong>of</strong> their inability torealize promptly the proceeds <strong>of</strong> cheques, drafts, etc., drawn <strong>on</strong> the local banks otherthan those with whom they maintain accounts. Some remedial acti<strong>on</strong> has to be takenduring such c<strong>on</strong>tingencies to minimise, as far as possible, the inc<strong>on</strong>venience andhardship to banks' c<strong>on</strong>stituents as also to maintain good customer service. Thus,

whenever clearing is suspended and it is apprehended that the suspensi<strong>on</strong> may beprol<strong>on</strong>ged, banks may temporarily accommodate their c<strong>on</strong>stituents, both borrowers anddepositors, to the extent possible by purchasing the local cheques, drafts, etc.,deposited in their accounts for collecti<strong>on</strong>, special c<strong>on</strong>siderati<strong>on</strong> being shown in respect<strong>of</strong> cheques drawn by Government departments/companies <strong>of</strong> good standing and repute,as also demand drafts drawn <strong>on</strong> local banks. While extending this facility, banks wouldno doubt take into c<strong>on</strong>siderati<strong>on</strong> such factors as creditworthiness, integrity, pastdealings and occupati<strong>on</strong> <strong>of</strong> the c<strong>on</strong>stituents, so as to guard themselves against anypossibility <strong>of</strong> such instruments being dish<strong>on</strong>oured subsequently.5.6 Statement <strong>of</strong> accounts / Pass Books5.6.1 Issuance <strong>of</strong> Passbooks to Savings Bank Account holders(Individuals)A passbook is a ready reck<strong>on</strong>er <strong>of</strong> transacti<strong>on</strong>s and is handy and compact and as such,is far more c<strong>on</strong>venient to the small customer than a statement <strong>of</strong> account. Use <strong>of</strong>statements has some inherent difficulties viz., (a) these need to be filed regularly (b) theopening balance needs to be tallied with closing balance <strong>of</strong> last statement (c) loss <strong>of</strong>statements in postal transit is not uncomm<strong>on</strong> and obtaining duplicates there<strong>of</strong> involvesexpense and inc<strong>on</strong>venience (d) ATM slips during the interregnum between twostatements does not provide a satisfactory soluti<strong>on</strong> as full record <strong>of</strong> transacti<strong>on</strong>s is notavailable and (e) there are a large number <strong>of</strong> small customers who do not have accessto computers / internet etc. As such, n<strong>on</strong>-issuance <strong>of</strong> pass-books to such smallcustomers would indirectly lead to their financial exclusi<strong>on</strong>.Banks are therefore advised to invariably <strong>of</strong>fer pass book facility to all its savings bankaccount holders (individuals) and in case the bank <strong>of</strong>fers the facility <strong>of</strong> sendingstatement <strong>of</strong> account and the customer chooses to get statement <strong>of</strong> account, the banksmust issue m<strong>on</strong>thly statement <strong>of</strong> accounts. The cost <strong>of</strong> providing such Pass Book orStatements should not be charged to the customer.5.6.2. Updating passbooks(i) <strong>Customer</strong>s may be made c<strong>on</strong>scious <strong>of</strong> the need <strong>on</strong> their part to get the passbooksupdated regularly and employees may be exhorted to attach importance to thisarea.

(ii) Wherever pass-books are held back for updating, because <strong>of</strong> large number <strong>of</strong>entries, paper tokens indicating the date <strong>of</strong> its receipt and also the date when it is to becollected should be issued.(iii) It is sometimes observed that customers submit their passbooks for updati<strong>on</strong>after a very l<strong>on</strong>g time. In additi<strong>on</strong> to the instructi<strong>on</strong>s printed in the passbook, whenever apassbook is tendered for posting after a l<strong>on</strong>g interval <strong>of</strong> time or after very large number<strong>of</strong> transacti<strong>on</strong>s, a printed slip requesting the depositor to tender it periodically should begiven.5.6.3 Entries in passbooks / statement <strong>of</strong> accounts(i) Banks should give c<strong>on</strong>stant attenti<strong>on</strong> to ensure entry <strong>of</strong> correct and legibleparticulars in the pass books and statement <strong>of</strong> accounts.(ii) The banks <strong>of</strong>ten show the entries in depositors' passbooks / Statements <strong>of</strong>accounts, as "by clearing" or "by cheque". Further, it is observed that in the case <strong>of</strong>Electr<strong>on</strong>ic Clearing System (ECS) and RBI Electr<strong>on</strong>ic Fund Transfer (RBIEFTR), banksgenerally do not provide any details even though brief particulars <strong>of</strong> the remittance areprovided by the receiving bank. In some cases, computerized entries use codes whichjust can not be deciphered. With a view to avoiding inc<strong>on</strong>venience to depositors, banksshould avoid such inscrutable entries in pass books / statement <strong>of</strong> accounts and ensurethat brief, intelligible particulars are invariably entered in pass books / statement <strong>of</strong>account.5.6.4 Maintenance <strong>of</strong> savings bank pass books: precauti<strong>on</strong>sNegligence in taking adequate care in the custody <strong>of</strong> savings bank pass booksfacilitates fraudulent withdrawals from the relative accounts. A few precauti<strong>on</strong>s in thisregard are given below:(i) Branches should accept the pass books and return them against tokens.(ii) Pass books remaining with the branches should be held in the custody <strong>of</strong>named resp<strong>on</strong>sible <strong>of</strong>ficials.(iii) While remaining with the branch pass books should be held under lock andkey overnight.

5.6.5 Providing m<strong>on</strong>thly statement <strong>of</strong> accounts(i)Banks may ensure that they adhere to the m<strong>on</strong>thly periodicity while sendingstatement <strong>of</strong> accounts.(ii)The statements <strong>of</strong> accounts for current account holders may be sent to thedepositors in a staggered manner instead <strong>of</strong> sending by a target date every m<strong>on</strong>th. Thecustomers may be informed about staggering <strong>of</strong> the preparati<strong>on</strong> <strong>of</strong> these statements.(iii) Further, banks should advise their Inspecting Officers to carry out samplecheck at the time <strong>of</strong> internal inspecti<strong>on</strong> <strong>of</strong> branches to verify whether the statements arebeing despatched in time.5.6.6 Address / Teleph<strong>on</strong>e Number <strong>of</strong> the Branch in Pass Books /Statement <strong>of</strong> AccountsIn order to improve the quality <strong>of</strong> service available to customers in branches, it would beuseful if the address / teleph<strong>on</strong>e number <strong>of</strong> the branch is menti<strong>on</strong>ed <strong>on</strong> the Pass Books/ Statement <strong>of</strong> Accounts.Banks are therefore advised to ensure that full address / teleph<strong>on</strong>e number <strong>of</strong> thebranch is invariably menti<strong>on</strong>ed in the Pass Books / Statement <strong>of</strong> Accounts issued toaccount holders.5.7 Issue <strong>of</strong> Cheque Books5.7.1 Issuing large number <strong>of</strong> cheque books(issued to Public Sector Banks)Banks may issue cheque books with larger number <strong>of</strong> (20/25) leaves if a customerdemands the same and also ensure that adequate stocks <strong>of</strong> such cheque books 20/25leaves maintained with all the branches to meet the requirements <strong>of</strong> the customers.Banks should take appropriate care while issuing large number <strong>of</strong> cheque books. Itshould be d<strong>on</strong>e in c<strong>on</strong>sultati<strong>on</strong> with c<strong>on</strong>trolling <strong>of</strong>fice <strong>of</strong> the bank.5.7.2 Writing the cheques in any languageAll cheque forms should be printed in Hindi and English. The customer may, however,write cheques in Hindi, English or in the c<strong>on</strong>cerned regi<strong>on</strong>al language.

5.7.3 Dispatching the cheque book by courierThe procedure <strong>of</strong> disallowing depositors to collect the cheque book at the branch andinsisting <strong>on</strong> dispatching the cheque book by courier after forcibly obtaining a declarati<strong>on</strong>from the depositor that a dispatch by the courier is at depositor's risk is an unfairpractice. Banks should refrain from obtaining such undertakings from depositors andensure that cheque books are delivered over the counters <strong>on</strong> request to the depositorsor his authorized representative.5.7.4 Acceptance <strong>of</strong> cheques bearing a date as perNati<strong>on</strong>al Calendar (Saka Samvat) for paymentGovernment <strong>of</strong> India have accepted Saka Samvat as Nati<strong>on</strong>al calendar with effect from22 March 1957 and all Government statutory orders, notificati<strong>on</strong>s, Acts <strong>of</strong> Parliament,etc. bear both the dates i.e., Saka Samvat as well as Gregorian Calendar. Aninstrument written in Hindi having date as per Saka Samvat calendar is a validinstrument. Cheques bearing date in Hindi as per the Nati<strong>on</strong>al Calendar (Saka Samvat)should, therefore, be accepted by banks for payment, if otherwise in order. The bankscan ascertain the Gregorian calendar date corresp<strong>on</strong>ding to the Nati<strong>on</strong>al Saka calendarin order to avoid payment <strong>of</strong> stale cheques.5.8 Term Deposit Account5.8.1 Issue <strong>of</strong> term deposit receiptBank should issue term deposit receipt indicating therein full details, such as, date <strong>of</strong>issue, period <strong>of</strong> deposit, due date, applicable rate <strong>of</strong> interest, etc.5.8.2 Transferability <strong>of</strong> deposit receiptsTerm deposits should be freely transferable from <strong>on</strong>e <strong>of</strong>fice <strong>of</strong> bank to another.5.8.3 Disposal <strong>of</strong> depositsAdvance instructi<strong>on</strong>s from depositors for disposal <strong>of</strong> deposits <strong>on</strong> maturity may beobtained in the applicati<strong>on</strong> form itself. Wherever such instructi<strong>on</strong>s are not obtained,banks should ensure sending <strong>of</strong> intimati<strong>on</strong> <strong>of</strong> impending due date <strong>of</strong> maturity well inadvance to their depositors as a rule in order to extend better customer service.

5.8.4 Notifying the change in interest ratesChange in interest rate <strong>on</strong> deposits should be made known to customers as well asbank branches expeditiously.5.8.5 Payment <strong>of</strong> interest <strong>on</strong> fixed deposit –Method <strong>of</strong> calculati<strong>on</strong> <strong>of</strong> interestIndian Banks’ Associati<strong>on</strong> (IBA) Code for Banking Practice has been issued by IBA foruniform adopti<strong>on</strong> by the Member Banks. The Code is intended to promote good bankingpractices by setting out minimum standards, which Member Banks should follow in theirdealings with customers. IBA, for the purpose <strong>of</strong> calculati<strong>on</strong> <strong>of</strong> interest <strong>on</strong> domestic termdeposit, has prescribed that <strong>on</strong> deposits repayable in less than three m<strong>on</strong>ths or wherethe terminal quarter is incomplete, interest should be paid proporti<strong>on</strong>ately for the actualnumber <strong>of</strong> days reck<strong>on</strong>ing the year at 365 days. Some banks are adopting the method<strong>of</strong> reck<strong>on</strong>ing the year at 366 days in a Leap year and 365 days in other years. Whilebanks are free to adopt their methodology, they should provide informati<strong>on</strong> to theirdepositors about the manner <strong>of</strong> calculati<strong>on</strong> <strong>of</strong> interest appropriately while accepting thedeposits and display the same at their branches.5.8.6 Premature withdrawal <strong>of</strong> term depositA bank, <strong>on</strong> request from the depositor, should allow withdrawal <strong>of</strong> a term deposit beforecompleti<strong>on</strong> <strong>of</strong> the period <strong>of</strong> the deposit agreed up<strong>on</strong> at the time <strong>of</strong> making the deposit.The bank will have the freedom to determine its own penal interest rate <strong>of</strong> prematurewithdrawal <strong>of</strong> term deposits. The bank should ensure that the depositors are madeaware <strong>of</strong> the applicable penal rate al<strong>on</strong>g with the deposit rate. While prematurely closinga deposit, interest <strong>on</strong> the deposit for the period that it has remained with the bank will bepaid at the rate applicable to the period for which the deposit remained with the bankand not at the c<strong>on</strong>tracted rate. No interest is payable, where premature withdrawal <strong>of</strong>deposits takes place before completi<strong>on</strong> <strong>of</strong> the minimum period prescribed. However, thebank, at its discreti<strong>on</strong>, may disallow premature withdrawal <strong>of</strong> large deposits held byentities other than individuals and Hindu Undivided Families. The bank should,

however, notify such depositors <strong>of</strong> its policy <strong>of</strong> disallowing premature withdrawal inadvance, i.e., at the time <strong>of</strong> accepting such deposits.5.8.7 Renewal <strong>of</strong> Overdue depositsAll aspects c<strong>on</strong>cerning renewal <strong>of</strong> overdue deposits may be decided by individual bankssubject to their Board laying down a transparent policy in this regard and the customersbeing notified <strong>of</strong> the terms and c<strong>on</strong>diti<strong>on</strong>s <strong>of</strong> renewal including interest rates, at the time<strong>of</strong> acceptance <strong>of</strong> deposit. The policy should be n<strong>on</strong>-discreti<strong>on</strong>ary and n<strong>on</strong>discriminatory.5.8.8 Additi<strong>on</strong> or deleti<strong>on</strong> <strong>of</strong> the name/s <strong>of</strong> joint account holdersA bank may, at the request <strong>of</strong> all the joint account holders, allow the additi<strong>on</strong> or deleti<strong>on</strong><strong>of</strong> name/s <strong>of</strong> joint account holder/s if the circumstances so warrant or allow an individualdepositor to add the name <strong>of</strong> another pers<strong>on</strong> as a joint account holder. However, in nocase should the amount or durati<strong>on</strong> <strong>of</strong> the original deposit undergo a change in anymanner in case the deposit is a term deposit.A bank may, at its discreti<strong>on</strong>, and at the request <strong>of</strong> all the joint account holders <strong>of</strong> adeposit receipt, allow the splitting up <strong>of</strong> the joint deposit, in the name <strong>of</strong> each <strong>of</strong> the jointaccount holders <strong>on</strong>ly, provided that the period and the aggregate amount <strong>of</strong> the depositdo not undergo any change.Note: NRE deposits should be held jointly with n<strong>on</strong>-residents <strong>on</strong>ly. NRO accountsmay be held by n<strong>on</strong>-residents jointly with residents.5.8.9 Payment <strong>of</strong> interest <strong>on</strong> accounts frozen by banksBanks are at times required to freeze the accounts <strong>of</strong> customers based <strong>on</strong> the orders <strong>of</strong>the enforcement authorities. The issue <strong>of</strong> payment <strong>of</strong> interest <strong>on</strong> such frozen accountswas examined in c<strong>on</strong>sultati<strong>on</strong> with Indian Banks’ Associati<strong>on</strong> and banks are advised t<strong>of</strong>ollow the procedure detailed below in the case <strong>of</strong> Term Deposit Accounts frozen by theenforcement authorities:

(i) A request letter may be obtained from the customer <strong>on</strong> maturity. While obtaining therequest letter from the depositor for renewal, banks should also advise him to indicatethe term for which the deposit is to be renewed. In case the depositor does not exercisehis opti<strong>on</strong> <strong>of</strong> choosing the term for renewal, banks may renew the same for a term equalto the original term.(ii) No new receipt is required to be issued. However, suitable note may be maderegarding renewal in the deposit ledger.(iii) Renewal <strong>of</strong> deposit may be advised by registered letter / speed post / courierservice to the c<strong>on</strong>cerned Government department under advice to the depositor. In theadvice to the depositor, the rate <strong>of</strong> interest at which the deposit is renewed should alsobe menti<strong>on</strong>ed.(iv) If overdue period does not exceed 14 days <strong>on</strong> the date <strong>of</strong> receipt <strong>of</strong> the requestletter, renewal may be d<strong>on</strong>e from the date <strong>of</strong> maturity. If it exceeds 14 days, banks maypay interest for the overdue period as per the policy adopted by them, and keep it in aseparate interest free sub-account which should be released when the original fixeddeposit is released.Further, with regard to the savings bank accounts frozen by the enforcement authorities,banks may c<strong>on</strong>tinue to credit the interest to the account <strong>on</strong> a regular basis.5.9 Acceptance <strong>of</strong> cash over the counterSome banks have introduced certain products whereby the customers are not allowedto deposit cash over the counters and also have incorporated a clause in the terms andc<strong>on</strong>diti<strong>on</strong>s that cash deposits, if any, are required to be d<strong>on</strong>e through ATMs.Banking by definiti<strong>on</strong> means acceptance <strong>of</strong> deposits <strong>of</strong> m<strong>on</strong>ey from the public for thepurpose <strong>of</strong> lending and investment. As such, banks cannot design any product which isnot in tune with the basic tenets <strong>of</strong> banking. Further, incorporating such clauses in termsand c<strong>on</strong>diti<strong>on</strong>s which restricts deposit <strong>of</strong> cash over the counters also amounts to anunfair practice.

Banks are therefore advised to ensure that their branches invariably accept cash overthe counters from all their customers who desire to deposit cash at the counters.Further, they are also advised to refrain from incorporating clauses in the terms andc<strong>on</strong>diti<strong>on</strong>s which restricts deposit <strong>of</strong> cash over the counters.5.10 Opening accounts in the name <strong>of</strong> minors with Mothers as guardiansC<strong>on</strong>siderable difficulty was experienced by women customers in opening bank accountsin the names <strong>of</strong> minors, with mothers as their guardians. Presumably, the banks werereluctant to accept the mother as a guardian <strong>of</strong> a minor, while father is alive in view <strong>of</strong>secti<strong>on</strong> 6 <strong>of</strong> the Hindu Minority and Guardianship Act, 1956, which stipulates that thefather al<strong>on</strong>e should be deemed to be the guardian in such case. To overcome this legaldifficulty and to enable the banks to open freely such accounts in the name <strong>of</strong> minorsunder the guardianship <strong>of</strong> their mothers, it was suggested in some quarters that theabove provisi<strong>on</strong>s should be suitably amended. While it is true that an amendment <strong>of</strong> theabove Act may overcome the difficulty in the case <strong>of</strong> Hindus, it would not solve theproblem for other communities as minors bel<strong>on</strong>ging to Muslim, Christian, ParsiCommunities would still be left out unless the laws governing these communities arealso likewise amended.The legal and practical aspects <strong>of</strong> the above problem were, therefore, examined inc<strong>on</strong>sultati<strong>on</strong> with the Government <strong>of</strong> India and it was advised that if the idea underliningthe demand for allowing mothers to be treated as guardians relates <strong>on</strong>ly to the opening<strong>of</strong> fixed and savings bank accounts, there would seem to be no difficulty in meeting therequirements as, notwithstanding the legal provisi<strong>on</strong>s, such accounts could be openedby banks provided they take adequate safeguards in allowing operati<strong>on</strong>s in theaccounts by ensuring that the minors' accounts opened with mothers as guardians arenot allowed to be overdrawn and that they always remain in credit. In this way, theminors' capacity to enter into c<strong>on</strong>tract would not be a subject matter <strong>of</strong> dispute. If thisprecauti<strong>on</strong> is taken, the banks' interests would be adequately protected.Banks are advised to instruct their branches to allow minors' accounts (fixed andsavings <strong>on</strong>ly) with mothers as guardians to be opened, whenever such requests arereceived by them, subject to the safeguards menti<strong>on</strong>ed above.

5.11 Opening <strong>of</strong> Current Accounts – Need for discipline(i) Keeping in view the importance <strong>of</strong> credit discipline for reducti<strong>on</strong> in NPA level <strong>of</strong>banks, banks should, at the time <strong>of</strong> opening current accounts, insist <strong>on</strong> a declarati<strong>on</strong> tothe effect that the account holder is not enjoying any credit facility with any other bank.Banks should scrupulously ensure that their branches do not open current accounts <strong>of</strong>entities which enjoy credit facilities (fund based or n<strong>on</strong>-fund based) from the bankingsystem without specifically obtaining a No-Objecti<strong>on</strong> Certificate from the lendingbank(s). Banks should note that n<strong>on</strong>-adherence to the above discipline could beperceived to be abetting the siph<strong>on</strong>ing <strong>of</strong> funds and such violati<strong>on</strong>s which are eitherreported to RBI or noticed during our inspecti<strong>on</strong> would make the c<strong>on</strong>cerned banks liablefor penalty under Banking Regulati<strong>on</strong> Act, 1949.(ii) Banks may open current accounts <strong>of</strong> prospective customers in case no resp<strong>on</strong>se isreceived from the existing bankers after a minimum waiting period <strong>of</strong> a fortnight. If aresp<strong>on</strong>se is received within a fortnight, banks should assess the situati<strong>on</strong> with referenceto informati<strong>on</strong> provided <strong>on</strong> the prospective customer by the bank c<strong>on</strong>cerned and are notrequired to solicit a formal no objecti<strong>on</strong>, c<strong>on</strong>sistent with true freedom to the customer <strong>of</strong>banks as well as needed due diligence <strong>on</strong> the customer by the bank.(iii) In case <strong>of</strong> a prospective customer who is a corporate or large borrower enjoyingcredit facilities from more than <strong>on</strong>e bank, the banks should exercise due diligence andinform the c<strong>on</strong>sortium leader, if under c<strong>on</strong>sortium, and the c<strong>on</strong>cerned banks, if undermultiple banking arrangement.5.12 Rec<strong>on</strong>ciliati<strong>on</strong> <strong>of</strong> transacti<strong>on</strong>s at ATMs failure - Time limitReserve Bank has been receiving a number <strong>of</strong> complaints from bank customers,regarding debit <strong>of</strong> accounts even though the ATMs have not disbursed cash for variousreas<strong>on</strong>s. More importantly, banks take c<strong>on</strong>siderable time in reimbursing the amountsinvolved in such failed transacti<strong>on</strong>s to card holders. In many cases, the time taken is asmuch as 50 days. The delay <strong>of</strong> the magnitude indicated above is not justified, as itresults in customers being out <strong>of</strong> funds for a l<strong>on</strong>g time for no fault <strong>of</strong> theirs. Moreover,this delay can discourage customers from using ATMs. Banks are therefore advised to

eimburse to the customers the amount wr<strong>on</strong>gfully debited within a maximum period <strong>of</strong>12 days from the date <strong>of</strong> receipt <strong>of</strong> customer complaints.For any delay to recredit the customers account within 12 working days from the date<strong>of</strong> receipt <strong>of</strong> the complaint, the bank shall pay compensati<strong>on</strong> <strong>of</strong> Rs.100 per day to theaggrieved customer. This compensati<strong>on</strong> shall be credited to the customer's accountautomatically without any claim from the customer, <strong>on</strong> the same day when the bankaffords the credit for the failed ATM transacti<strong>on</strong>.5.13 Lodging <strong>of</strong> ATM related ComplaintsThe following informati<strong>on</strong> should be displayed prominently at the ATM locati<strong>on</strong>s:-(i) Informati<strong>on</strong> that complaints should be lodged at the branches where customersmaintain accounts to which ATM card is linked;(ii) Teleph<strong>on</strong>e numbers <strong>of</strong> help desk / c<strong>on</strong>tact pers<strong>on</strong>s <strong>of</strong> the ATM owning bank tolodge complaint / seek assistance.6. Levy <strong>of</strong> <strong>Service</strong> Charges6.1 Fixing service charges by banksThe practice <strong>of</strong> IBA fixing the benchmark service charges <strong>on</strong> behalf <strong>of</strong> member bankshas been d<strong>on</strong>e away with and the decisi<strong>on</strong> to prescribe service charges has been left toindividual banks. While fixing service charges for various types <strong>of</strong> services like chargesfor cheque collecti<strong>on</strong> etc., banks should ensure that the charges are reas<strong>on</strong>able and arenot out <strong>of</strong> line with the average cost <strong>of</strong> providing these services. Banks should also takecare to ensure that customers with low volume <strong>of</strong> activities are not penalised.Banks should make arrangements for working out charges with prior approval <strong>of</strong> theirBoards <strong>of</strong> Directors as recommended above and operati<strong>on</strong>alise them in their branchesas early as possible.6.2 Ensuring Reas<strong>on</strong>ableness <strong>of</strong> Bank Charges

In order to ensure fair practices in banking services, Reserve Bank <strong>of</strong> India hadc<strong>on</strong>stituted a Working Group to formulate a scheme for ensuring reas<strong>on</strong>ableness <strong>of</strong>bank charges and to incorporate the same in the Fair Practices Code, the compliance <strong>of</strong>which would be m<strong>on</strong>itored by the Banking Codes and Standards Board <strong>of</strong> India(BCSBI). Based <strong>on</strong> the recommendati<strong>on</strong>s <strong>of</strong> the Group, acti<strong>on</strong> required to be taken bybanks is indicated under the column 'acti<strong>on</strong> points for banks' in the Annex I to thiscircular.7. <strong>Service</strong> at the counters7.1 Banking hours / working days <strong>of</strong> bank branchesBanks should normally functi<strong>on</strong> for public transacti<strong>on</strong>s at least for 4 hours <strong>on</strong> week daysand 2 hours <strong>on</strong> Saturdays in the larger interest <strong>of</strong> public and trading community.Extensi<strong>on</strong> counters, satellite <strong>of</strong>fices, <strong>on</strong>e man <strong>of</strong>fices or other special class <strong>of</strong> branchesmay remain open for such shorter hours as may be c<strong>on</strong>sidered necessary.7.2 Changes in banking hoursNo particular banking hours have been prescribed by law and a bank may fix, after duenotice to its customers, whatever business hours are c<strong>on</strong>venient to it i.e., to work indouble shifts, to observe weekly holiday <strong>on</strong> a day other than Sunday or to functi<strong>on</strong> <strong>on</strong>Sundays in additi<strong>on</strong> to the normal working days, subject to observing normal workinghours for public transacti<strong>on</strong>s referred to in paragraph above.In order to safeguard banks' own interest, a bank closing any <strong>of</strong> its <strong>of</strong>fices <strong>on</strong> a dayother than a public holiday, will have to give due and sufficient notice to all the partiesc<strong>on</strong>cerned who are or are likely to be affected by such closure. Thus, in all the abovecases, it is necessary for a bank to give sufficient notice to the public/its customers <strong>of</strong> itsintenti<strong>on</strong>. What is sufficient or due notice is a questi<strong>on</strong> <strong>of</strong> fact, depending <strong>on</strong> thecircumstances <strong>of</strong> each case. It is also necessary to avoid any infringement <strong>of</strong> any otherrelevant local laws such as Shops and Establishment Act, etc.Further, the provisi<strong>on</strong>s, if any, in regard to the banks' obligati<strong>on</strong>s, to the staff under theIndustrial Awards / Settlements, should be complied with. Clearing House authority <strong>of</strong>the place should also be c<strong>on</strong>sulted in this regard.

The banks' branches in rural areas can fix the business hours (i.e., number <strong>of</strong> hours, aswell as timings) and the weekly holidays to suit local requirements. This may, however,be d<strong>on</strong>e subject to the guidelines given above.7.3 Commencement / Extensi<strong>on</strong> <strong>of</strong> working hoursCommencement <strong>of</strong> employees’ working hours 15 minutes before commencement <strong>of</strong>business hours could be made operative by banks at branches in metropolitan andurban centres. The banks should implement the recommendati<strong>on</strong> taking into accountthe provisi<strong>on</strong>s <strong>of</strong> the local Shops and Establishments Act.The branch managers and other supervising <strong>of</strong>ficials should, however, ensure that themembers <strong>of</strong> the staff are available at their respective counters right from thecommencement <strong>of</strong> banking hours and throughout the prescribed business hours so thatthere may not be any grounds for customers to make complaints.Banks should ensure that no counter remains unattended during the business hoursand uninterrupted service is rendered to the customers. Further, the banks shouldallocate the work in such a way that no Teller counter is closed during the bankinghours at their branches.All the customers entering the banking hall before the close <strong>of</strong> business hours should beattended to.7.4 Extended business hours for n<strong>on</strong>-cash banking transacti<strong>on</strong>sBanks should extend business hours for banking transacti<strong>on</strong>s other than cash, up till<strong>on</strong>e hour before close <strong>of</strong> the working hours.The following n<strong>on</strong>-cash transacti<strong>on</strong>s should be undertaken by banks during theextended hours, i.e., up to <strong>on</strong>e hour before the close <strong>of</strong> working hours:(a) N<strong>on</strong>-voucher generating transacti<strong>on</strong>s :(i) Issue <strong>of</strong> pass books/statement <strong>of</strong> accounts;(ii) Issue <strong>of</strong> cheque books ;

(iii) Delivery <strong>of</strong> term deposit receipts/drafts;(iv) Acceptance <strong>of</strong> share applicati<strong>on</strong> forms;(v) Acceptance <strong>of</strong> clearing cheques;(vi) Acceptance <strong>of</strong> bills for collecti<strong>on</strong>.(b) Voucher generating transacti<strong>on</strong>s:(i) Issue <strong>of</strong> term deposit receipts;(ii) Acceptance <strong>of</strong> cheques for locker rent due;(iii) Issue <strong>of</strong> travellers cheques;(iv) Issue <strong>of</strong> gift cheques;(v) Acceptance <strong>of</strong> individual cheques for transfer credit.Such n<strong>on</strong>-cash transacti<strong>on</strong>s to be d<strong>on</strong>e during the extended business hours should benotified adequately for informati<strong>on</strong> <strong>of</strong> the customers.Banks can have evening counters at the premises <strong>of</strong> existing branches inurban/metropolitan centres for providing facilities to the public bey<strong>on</strong>d the normal hours<strong>of</strong> business so as to bring about improvement in customer service. It is necessary thatin such cases the transacti<strong>on</strong>s c<strong>on</strong>ducted during such extended hours <strong>of</strong> business aremerged with the main accounts <strong>of</strong> the branch where it is decided to provide theaforesaid facilities.The c<strong>on</strong>cerned banks should give to their c<strong>on</strong>stituents due notice about the functi<strong>on</strong>s tobe undertaken during the extended banking hours through local newspapers, as also bydisplaying a notice <strong>on</strong> the notice board at the branch(es) c<strong>on</strong>cerned. Further, as andwhen the hours <strong>of</strong> business <strong>of</strong> any <strong>of</strong> the branches are extended, the c<strong>on</strong>cernedclearing house should be informed.8. Guidance to customers and Disclosure <strong>of</strong> Informati<strong>on</strong>8.1 Assistance/guidance to customersAll branches, except very small branches should have “Enquiry” or “May I Help You”counters either exclusively or combined with other duties, located near the entry point <strong>of</strong>the banking hall.