DEPARTMENT of TREASURY - Treasury - ACT Government

DEPARTMENT of TREASURY - Treasury - ACT Government

DEPARTMENT of TREASURY - Treasury - ACT Government

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DEPARTMENT</strong><strong>of</strong> <strong>TREASURY</strong>A U S T R A L I A N C A P I T A L T E R R I T O R Yannual report 2005-2006 volume 1

ISSN 0 642 60237 9© Australian Capital Territory, Canberra 2006This work is copyright. Apart from any use as permitted under the Copyright Act 1968, no part may be reproducedby any process without written permission from the Territory Records Office, Community and InfrastructureServices, Territory and Municipal Services, <strong>ACT</strong> <strong>Government</strong>.GPO Box 158, Canberra City <strong>ACT</strong> 2601.Produced by Publishing Services for the:Department <strong>of</strong> <strong>Treasury</strong>Enquiries about this publication should be directed to:Department <strong>of</strong> <strong>Treasury</strong>GPO Box 158Canberra <strong>ACT</strong> 2601www.treasury.act.gov.auPrinted on recycled paperPublication No 06/1019http://www.act.gov.auTelephone: Canberra Connect 132 281i i D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

Table <strong>of</strong> ContentsTransmittal CertificateMissionValuesOrganisation ChartChief Executive Review 1Analysis <strong>of</strong> Agency Performance 7Output 1.1 – Economic Management: 7Output 1.2 – Financial Management: 10Output 1.3 – Revenue Management: 15Output 1.4 – Procurement Support Services: 17Output EBT 1 – Central Financing Unit: 20Output EBT 1 – Superannuation Unit: 22Output 1.1 – Home Loan Portfolio: 24Output 1.1 – InT<strong>ACT</strong>: 25Human Rights Act 30Access to <strong>Government</strong> Strategy 31Community Engagement 33Multicultural Framework 35Aboriginal and Torres Strait Islander Reporting 38<strong>ACT</strong> Women’s Plan 39Management <strong>of</strong> the Organisation 40Managing Our People 40Human Resource Performance and Analysis 40Staffing Pr<strong>of</strong>ile 41Culture and Values 43Workplace Diversity 43Workplace Health and Safety 45Learning and Development 46Workplace Relations 48Governance 51Internal Accountability 51Fraud Prevention 52Risk Management and Internal Audit Arrangements 53External Scrutiny 54vviiviiviD E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6 i i i

Reports Required by Legislation 56Freedom <strong>of</strong> Information (FOI) 56Public Interest Disclosure 59Territory Records 59Sustainability and Environment 61Commissioner for the Environment Reporting 61Ecologically Sustainable Development 61Strategic Bushfire Management Plan 63Analysis <strong>of</strong> Financial Performance 64Management Discussion and Analysis 64Strategic Asset Management 65Capital Works Management 68<strong>Government</strong> Contracting 69External Sources <strong>of</strong> Labour and Services 70Appendices 78Legislative Reports 78Legislation administered by the department 78Legislative Assembly Committee Inquiries and Reports 79Annexed Reports 82Glossary <strong>of</strong> Acronyms 83Alphabetical Index 85Compliance Index 88iv D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

Transmittal CertificateD E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

<strong>ACT</strong> Department <strong>of</strong> <strong>Treasury</strong> organisation chartShared ServicesHeadUnder TreasurerDr Paul GrimesMichael VanderheideExecutive UnitManagerDr Merrilyn SernackPolicy Coordination& DevelopmentDivisionKhalid AhmedRevenueManagementDivisionCommissioner forRevenueGraeme DowellFinance & BudgetDivisionExecutive DirectorMegan SmithiesDirectorStephen MinersSenior ManagerHelen HillPolicy & SystemsManagerGlenn BainFinance & RecoveryManagerPhang LimRevenue AccountsManagerAngel MarinaCompliance ManagerCheryl OlleyAdvice andAssessmentManagerDavid ReadBudget Management& AnalysisDirectorNeil BullessSenior ManagersFloyd KennedyStuart FriendTony HaysDan StewartBudget Strategy& ReportingA/g DirectorLisa HolmesSenior ManagersDavid Morgan (A/g)Paul OgdenAccounting BranchDirectorPhil HextellSenior AccountingManagersAnita HargreavesSandra KennedyCorporateFinance Manager& ControllerKarl PhillipsInvestment andEconomics DivisionExecutive DirectorRoger BroughtonLegal and InsurancePolicy BranchDirectorTom McDonaldEconomics BranchDirectorJason McNamaraCth-State FinancesUnitSenior ManagerJohn PurcellCentral Financing UnitManagerPat McAuliffeSuperannuation UnitManagerGarry Cartwright<strong>ACT</strong> Procurement SolutionsExecutive DirectorJohn RobertsonInT<strong>ACT</strong>A/g General ManagerMick Chisnall<strong>ACT</strong> InsuranceAuthorityGeneral ManagerPeter MatthewsCorporateDevelopmentDivisionDirectorvacant until 1/7/06v i D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

Mission<strong>Treasury</strong>’s mission is:To inform <strong>Government</strong> decisions by providing the best advice and implementing those decisions toachieve the highest benefit for the <strong>ACT</strong> through the effective and efficient allocation and utilisation <strong>of</strong>its resources.Values<strong>Treasury</strong>’s values are to:• be responsive to the needs <strong>of</strong> the <strong>Government</strong> and the public;• work to achieve high-quality performance and outcomes;• be accountable and responsible for our performance;• strive to deliver efficiency and effectiveness in public administration;• promote open and effective communication with all stakeholders and improve communication andco-operation within the department;• promote trust, respect, fairness, integrity and transparency in all departmental activities; and• value pr<strong>of</strong>essional development, teamwork, individuals and clients.Further information can be obtained from:Manager, Executive UnitDr Merrilyn SernackPh: (02) 6207 0280Fax: (02) 6207 0304Under TreasurerDr Paul GrimesPh: (02) 6207 0260Fax: (02) 6207 0304Department <strong>of</strong> <strong>Treasury</strong>GPO Box 158Canberra <strong>ACT</strong> 2601http://www.treasury.act.gov.au/index.shtmlPublicationshttp://www.treasury.act.gov.au/about/publications.shtml<strong>ACT</strong> <strong>Government</strong> websitehttp://www.act.gov.au/D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6 v i i

v i i i D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

Chief Executive ReviewThe Organisation<strong>Treasury</strong> provides strategic taxation, financial and economic policy advice and services to the <strong>ACT</strong><strong>Government</strong> with the aim <strong>of</strong> improving the Territory’s financial position and economic management.<strong>Treasury</strong> plays a leading role in promoting accountability and transparency in the delivery <strong>of</strong> services tothe community and the management <strong>of</strong> resources.In addition to its traditional treasury functions, <strong>Treasury</strong> provides a number <strong>of</strong> key cross-governmentservices. These include InT<strong>ACT</strong>, the <strong>ACT</strong> <strong>Government</strong>’s in-sourced provider <strong>of</strong> IT infrastructureservices, and a range <strong>of</strong> tendering, risk management, infrastructure procurement and on-lineprocurement services provided by <strong>ACT</strong> Procurement Solutions. From February 2007, these tw<strong>of</strong>unctions, as well as the transactional and tactical elements <strong>of</strong> Human Resources and Financial services,will form part <strong>of</strong> a new “Shared Services” organisation that will sit within the department and provideservices on a whole-<strong>of</strong>-government basis.Overview and HighlightsI would like to pay tribute to the hard work and pr<strong>of</strong>essionalism <strong>of</strong> <strong>Treasury</strong>’s staff in 2005-06. Overthe past year, <strong>Treasury</strong> has successfully completed several significant and challenging projects. Thiscould not have been achieved without the dedication and commitment <strong>of</strong> our staff to <strong>Treasury</strong>’s mission,the well-being <strong>of</strong> the <strong>ACT</strong> community, and the future growth and development <strong>of</strong> the Territory.<strong>Treasury</strong> managed a significant work program during 2005-06 to record a number <strong>of</strong> importantachievements.In providing analytical, monitoring and reporting services on financial performance to the <strong>Government</strong>,key achievements included:• the 2004-05 Territory Annual Financial Statements released in October 2005;• the 2005-06 Budget Mid-Year Review released in February 2006; and• the 2006-07 Budget delivered on 6 June 2006.The 2006-07 Budget was presented on a <strong>Government</strong> Finance Statistics (GFS) basis. The GFS systemis used by all other Australian <strong>Government</strong>s and provides an improved framework for evaluating theeconomic sustainability <strong>of</strong> the <strong>ACT</strong> budget.The 2006-07 Budget also included a far-reaching program <strong>of</strong> structural changes to place the <strong>ACT</strong>budget on a long-term sustainable foundation. The preparation <strong>of</strong> the 2006-07 Budget was a farmore complex undertaking than usual, particularly as it involved the realignment <strong>of</strong> departmentalresponsibilities and accounts. This involved a considerable workload for <strong>of</strong>ficers in <strong>Treasury</strong>’s Financeand Budget Division, working closely with finance <strong>of</strong>ficers in other departments and agencies.The major structural changes delivered in the 2006-07 Budget were informed by the Strategicand Functional Review <strong>of</strong> the <strong>ACT</strong> Public Sector and Services, commissioned by the Executive inNovember 2005. <strong>Treasury</strong> made a significant contribution to the Review, hosting and providing the core<strong>of</strong> the secretariat for the Review. The Review’s report was presented to the Executive in April 2006.D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

The Financial Management Amendment Act 2005 (FMA)was tabled and passed during the Spring 2005sitting period to:• standardise and improve governance arrangements for Territory authorities;• introduce the ability to appropriate directly to Territory authorities and Territory OwnedCorporations;• support changes to the performance management framework implemented in the 2005-06Budget; and• facilitate access for Territory authorities to a credit facility from the Territory Banking Account.During 2005-06, <strong>Treasury</strong> implemented a number <strong>of</strong> improved financial procedures, including revisingthe model financial report for 2005-06 to adopt Australian equivalents to International FinancialReporting Standards. In addition, Territory-specific accounting policies were developed to assistagencies with accounting issues in relation to portable and attractive items, major bushfire replacementprojects, and property, plant and equipment.Other important financial achievements during 2005-06 included the restructuring <strong>of</strong> the generalgovernment debt portfolio to implement an interest rate swaps strategy, providing a better spread <strong>of</strong> risk.At the end <strong>of</strong> the year, borrowings were in line with the established benchmark targets. The Territoryinvestment portfolio also out-performed the benchmark index with a return <strong>of</strong> 5.37 per cent (net <strong>of</strong>fees).<strong>Treasury</strong> provided advice on the long-term funding strategy for the defined benefit superannuationliabilities <strong>of</strong> the Territory, with choice <strong>of</strong> fund arrangements completed to enable a 1 July 2006 startdate.In the 2006-07 Budget, the <strong>Government</strong> announced that the target for funding the Territory’ssuperannuation liabilities would be brought forward from the previous target <strong>of</strong> 90 per cent funding by2040, to 100 per cent funding by 2030.The Superannuation Provision Account investments achieved a return <strong>of</strong> 16.3 per cent (net <strong>of</strong> fees).In terms <strong>of</strong> financial management, in conjunction with agencies, <strong>Treasury</strong> provided financialand economic analysis <strong>of</strong> a number <strong>of</strong> projects and policy proposals, including the proposeddevelopment <strong>of</strong> City Hill. <strong>Treasury</strong> also provided forecasts for key economic variables and revenuesources for the 2005-06 Mid Year Review and the 2006-07 Budget, incorporating the results <strong>of</strong> arevised macroeconomic forecasting model. <strong>Treasury</strong> prepared the <strong>ACT</strong> <strong>Government</strong>’s primary andsupplementary annual reports on the implementation <strong>of</strong> National Competition Policy to the NationalCompetition Council. <strong>Treasury</strong> also represented the <strong>ACT</strong> <strong>Government</strong>’s views to the CommonwealthGrants Commission regarding the distribution <strong>of</strong> GST grants among the states and territories, both for2006-07 and into the future. In addition, <strong>Treasury</strong> implemented revised arrangements for financing andmanaging the <strong>ACT</strong> <strong>Government</strong> vehicle fleet.In 2005-06, <strong>Treasury</strong> developed the following policies to manage the Territory’s potential exposure topublic liability claims arising from dealings between Territory agencies and the general public:• policies supporting revised insurance Determinations under the FMA, under which all partiesdoing business with the <strong>ACT</strong> <strong>Government</strong> now have a consistent expectation <strong>of</strong> objective, riskbasedcertainty in relation to an appropriate level <strong>of</strong> public liability insurance the Territoryexpects from them;• policy proposals and objectives relating to the Enterprise Risk Management Framework;• policies and objectives developed by the <strong>ACT</strong> Insurance Authority (<strong>ACT</strong>IA) – these werepromulgated across agencies with the assistance <strong>of</strong> Legal and Insurance Policy Branch; and• risk awareness policies applied by <strong>ACT</strong>IA in <strong>of</strong>fering training to agencies.In 2005-06, <strong>Treasury</strong> also:• commenced work with agencies in relation to the essential linkages between risk managementand contract management;• integrated agency risk management activity with the budget and procedural related defencesavailable to the <strong>Government</strong> under the Civil Law (Wrongs) Act 2002; D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

• assisted community organisations and small businesses to obtain affordable insurance throughbetter risk management;• provided legal support for the winding up <strong>of</strong> Totalcare Industries Ltd (Totalcare); and• managed the legal aspects <strong>of</strong> outstanding superannuation issues for Totalcare and the AustralianInternational Hotel School.From 21 April 2006, <strong>Treasury</strong> became responsible for policies and oversight <strong>of</strong> Compulsory Third PartyInsurance arrangements and Part 10 <strong>of</strong> the Road Transport Act.In terms <strong>of</strong> financial policy advice, in 2005-06 <strong>Treasury</strong> was scheduled to conduct expenditure reviews<strong>of</strong> the Department <strong>of</strong> Education and Training, the Department <strong>of</strong> Disability, Housing and CommunityServices and the Emergency Services Authority. These reviews were subsumed within the Strategic andFunctional Review.<strong>Treasury</strong> also provided financial policy advice to other agencies and the <strong>Government</strong> on a range <strong>of</strong>policy issues including:• commissioning a review <strong>of</strong> the Home Loan Portfolio;• conducting an analysis <strong>of</strong> the pr<strong>of</strong>ile <strong>of</strong> recipients <strong>of</strong> the Home Buyer Concession Scheme;• assisting <strong>ACT</strong> Health with the renegotiation <strong>of</strong> the <strong>ACT</strong>/NSW Cross-Border Agreement onHealth Services; and• progressing the development and implementation <strong>of</strong> Triple Bottom Line/Sustainability reportingin the Territory.A major focus for <strong>Treasury</strong> is the management <strong>of</strong> the Territory’s taxation revenue system. The <strong>ACT</strong>Revenue Office commenced implementation <strong>of</strong> the Online Lodgment and Payment Service Project toprovide for the electronic lodgment <strong>of</strong> certain tax assessments.Maintaining the integrity <strong>of</strong> the taxation system is a key priority for the Revenue Office, which has adedicated unit to ensure taxpayers comply with their legal obligations. The 2005-06 target <strong>of</strong> $300,000revenue per inspector was slightly exceeded with an achievement <strong>of</strong> $360,078 per inspector. This wasdue mainly to investigations identifying undeclared properties liable for land tax. Also, a number <strong>of</strong>First Home Owner Grants were requested to be repaid due to the conditions <strong>of</strong> the grant not being metby recipients.The debt to revenue ratio was 1.5 per cent compared to the target <strong>of</strong> 2 per cent. The improvement indebt management by the Revenue Office is the result <strong>of</strong> on-going changes in procedures and practices.The Revenue Office has identified the timely resolution <strong>of</strong> taxpayer objections to their tax assessmentsas an area where improvements can be made. In 2005-06, additional resources were dedicated tothe determination <strong>of</strong> objections. While the complexity <strong>of</strong> many taxpayer objections means they willcontinue to take some time to resolve, the Revenue Office is striving to reduce the time it takes t<strong>of</strong>inalise the bulk <strong>of</strong> objections.For capital works, Procurement Solutions, on behalf <strong>of</strong> client agencies, managed a number <strong>of</strong> majorprojects, including the completion <strong>of</strong> the design and early ground works for the new <strong>ACT</strong> prison, andthe commencement <strong>of</strong> the construction <strong>of</strong> Gungahlin Drive Extension. Other projects included:• the commencement <strong>of</strong> the refurbishment <strong>of</strong> the Canberra Convention Centre;• the construction <strong>of</strong> Canberra Glassworks; and• the design <strong>of</strong> Harrison School.Overall, Procurement Solutions delivered construction activities costing $124 million (the majorcomponent <strong>of</strong> the whole-<strong>of</strong>-government capital works program). A total <strong>of</strong> 422 tenders were called onbehalf <strong>of</strong> <strong>ACT</strong> <strong>Government</strong> agencies, with 443 contracts being issued during 2005-06.In relation to information and communication technology (ICT), InT<strong>ACT</strong> managed a number <strong>of</strong>important initiatives during 2005-06, including:• completing the private optical fibre data network;• implementing Project unITy to aggregate the Territory’s ICT services;D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

• the technical implementation <strong>of</strong> Chris21, the new payroll system for the <strong>ACT</strong> <strong>Government</strong>;• rolling out the SPAM filter to substantially reduce email spam traffic across the <strong>ACT</strong><strong>Government</strong>; and• implementing an <strong>ACT</strong> <strong>Government</strong> web site content management and hosting system for use byall <strong>ACT</strong> <strong>Government</strong> agencies, and the migration <strong>of</strong> over 20 sites to the new environment.Mr Ted Quinlan, MLA, resigned as Treasurer from 21 March 2006. Mr Jon Stanhope, MLA, acted asTreasurer from 22 March 2006. Mr Stanhope was appointed Treasurer on 20 April 2006 under <strong>ACT</strong>(Self-<strong>Government</strong>) Ministerial Appointments Notice 2006 (No 1).Also on 20 April 2006 under Administrative Arrangements 2006 (No 1), the reporting line for <strong>ACT</strong>TABand racing and gaming changed from the Minister for Economic Development to the Treasurer pendingthe abolition <strong>of</strong> the Department <strong>of</strong> Economic Development on 1 July 2006.Under Administrative Arrangements 2006 (No 2) <strong>of</strong> 16 June 2006, that reporting line to the Treasurerwas continued, with portfolio responsibility for <strong>ACT</strong>TAB and racing and gaming moving to <strong>Treasury</strong> on1 July 2006.Outlook<strong>Treasury</strong> will again play a central role in assisting the <strong>Government</strong> to deliver its agenda in 2006-07.A significant priority will be to implement the far-reaching measures stemming from the 2006-07Budget. Together with the Chief Minister’s Department, <strong>Treasury</strong> will monitor the implementation <strong>of</strong>budget measures by departments and agencies across the <strong>ACT</strong> public service.In addition and, most importantly, <strong>Treasury</strong> has been charged with primary responsibility forimplementing several specific measures, including:• the implementation <strong>of</strong> a strengthened Territory cash management framework, including moreeffective central management <strong>of</strong> the Territory’s cash assets;• a range <strong>of</strong> revenue measures, including the implementation <strong>of</strong> a new fire and emergency serviceslevy and a new fee for utility companies to occupy unleased Territory land for their infrastructure(cables and pipelines);• the introduction <strong>of</strong> new superannuation arrangements, bringing the <strong>ACT</strong> public sector in linewith other state and territory governments;• the development <strong>of</strong> improved whole-<strong>of</strong>-government capital budgeting and asset managementprocesses;• undertaking a scoping study to determine the most appropriate sale process for Rhodium AssetSolutions, in conjunction with the Rhodium Board; and• the strengthening <strong>of</strong> <strong>Treasury</strong>’s budget and financial policy advising capacity.A very significant priority for <strong>Treasury</strong> will be the implementation <strong>of</strong> a new shared services centre forthe <strong>ACT</strong> Public Service.The Shared Services Centre will become fully operational from 1 February 2007. It will bring togethercommon corporate service functions into one central area within the public service, including humanresource management, finance, information technology and communications, procurement, recordsmanagement, and publishing.The Shared Services Centre will incorporate InT<strong>ACT</strong> and Procurement Solutions and will operate on afee for service basis.The new Shared Services Centre will form part <strong>of</strong> the Department <strong>of</strong> <strong>Treasury</strong>. However, it is criticalthat the Shared Services Centre is focussed on the needs <strong>of</strong> its client departments and agencies, andoperates within a genuine shared responsibility model. In recognition <strong>of</strong> this, the Shared ServicesCentre will be guided by a board comprising all departmental Chief Executives, and chaired by theChief Executive <strong>of</strong> the Chief Minister’s Department. D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

From within the Shared Services Centre, both InT<strong>ACT</strong> and Procurement Solutions have severalimportant objectives in 2006-07:• InT<strong>ACT</strong> will assume responsibility for the provision <strong>of</strong> IT services in the Department <strong>of</strong>Education and Training and the Canberra Institute <strong>of</strong> Technology, including the provision <strong>of</strong> ITservices in schools. InT<strong>ACT</strong> will also be upgrading systems and processes in a number <strong>of</strong> areas,with a key priority being the implementation <strong>of</strong> an upgraded personal computer operating system(Micros<strong>of</strong>t XP) across departments and agencies.• Procurement Solutions will focus on completing the consolidation <strong>of</strong> procurement functions andresources across the <strong>ACT</strong> <strong>Government</strong>, building on the work undertaken in 2005-06. ProcurementSolutions will also have a major role to play in assisting agencies to achieve significant savings inthe procurement <strong>of</strong> goods and services. This will be achieved in a number <strong>of</strong> ways, includingthrough the greater aggregation <strong>of</strong> procurements and more strategic approaches to markets. Inaddition, Procurement Solutions will work to further improve procurement processes to reducecosts for government agencies and the costs to the private sector <strong>of</strong> doing business with the <strong>ACT</strong><strong>Government</strong>. A review <strong>of</strong> the <strong>Government</strong> Procurement Act 2001 will also be completed in2006-07, and Procurement Solutions will implement any government decisions arising from thereview.In 2006-07, <strong>Treasury</strong> will be responsible for the collection <strong>of</strong> around $750 million in taxation revenue.<strong>Treasury</strong>’s Revenue Management Division will be seeking to further improve its systems and processesto promote efficiency and integrity in the administration and collection <strong>of</strong> <strong>ACT</strong> taxes.Over the coming year, Revenue Management Division will work towards developing a new systemto allow for the electronic assessment and payment <strong>of</strong> many <strong>ACT</strong> taxes. The introduction <strong>of</strong> newelectronic assessment and collection systems will give taxpayers access to more efficient and convenientservices, and allow the <strong>ACT</strong> Revenue Office shopfront to be closed later in the year.Commonwealth-State financial relations will remain an important priority for <strong>Treasury</strong> in 2006-07. TheCommonwealth Grants Commission is conducting a major five year review <strong>of</strong> the arrangements fordistributing GST grants between the states and territories, and this will continue to require significantinput from <strong>Treasury</strong> to ensure that the <strong>ACT</strong>’s interests are properly represented. In addition, the Council<strong>of</strong> Australian <strong>Government</strong>s has recently committed to an ambitious National Reform Agenda (NRA)across a wide range <strong>of</strong> government functions. <strong>Treasury</strong> departments in all jurisdictions, including the<strong>ACT</strong>, are expected to be heavily involved in the development <strong>of</strong> the NRA.In 2006-07, <strong>Treasury</strong> will progress the <strong>ACT</strong> Economics and Finance Graduate Program to attract highquality graduates to the <strong>ACT</strong> <strong>Government</strong>. <strong>Treasury</strong> sees the recruitment and development <strong>of</strong> graduatesas a critical element <strong>of</strong> its overall workforce strategy, ensuring that the department maintains a highlyskilled workforce into the future.Dr Paul GrimesUnder TreasurerD E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

Analysis <strong>of</strong>Agency PerformanceOutput 1.1 – Economic ManagementRefer 2005-06 Budget Paper 4, page 102DescriptionDevelops and pursues initiatives to ensure the economic interests <strong>of</strong> the <strong>ACT</strong> and its residents areprotected and maximised through providing advice on economic and regulatory reform and evaluatingmajor projects, facilitates appropriate intergovernmental financial relations and provides communityinsurance support. Also oversights the Territory’s transactional banking arrangements, the motorvehicle financing facility, and manages the Territory Banking Account.Key Achievements• In conjunction with agencies, provided financial and economic analysis <strong>of</strong> a number <strong>of</strong> projectsand policy proposals including the proposed development <strong>of</strong> City Hill.• Provided forecasts for key economic variables and revenue heads for the 2005-06 Mid-YearReview and the 2006-07 Budget, incorporating the results <strong>of</strong> a revised macroeconomicforecasting model.• Produced the <strong>ACT</strong> <strong>Government</strong>’s primary and supplementary annual reports on theimplementation <strong>of</strong> National Competition Policy (NCP) to the National Competition Council.• Participated in a number <strong>of</strong> exercises associated with the distribution <strong>of</strong> GST grants among thestates and territories, both for 2006-07 and into the future.• Implemented revised arrangements for financing and managing the <strong>ACT</strong> <strong>Government</strong> vehiclefleet.OrganisationAs at 30 June 2006, Output 1.1, Economic Management comprised the Economics Branch,Commonwealth-State Finances Unit, Legal and Insurance Policy Branch, and Central Financing Unit, all<strong>of</strong> which are located in the Investment and Economics Division.Economics BranchThe Economics Branch comprises three units: Macroeconomics and Budget Forecasting, Major Projectsand Policy Analysis, and Microeconomic Reform. The Branch is <strong>Treasury</strong>’s chief source <strong>of</strong> economicanalysis and advice and deals with issues such as efficiency, public finances and economic development,together with providing advice on community issues, including social and environmental well-being.In 2005-06 the Branch:• prepared economic and revenue forecasts for the <strong>ACT</strong> Budget and Mid-Year review;• monitored and reported on the state <strong>of</strong> the <strong>ACT</strong> economy;• provided financial and economic analysis <strong>of</strong> policy proposals, including major capital works;• assisted agencies to improve the quality <strong>of</strong> financial and economic analysis in reports,submissions and other documents;D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

• monitored assistance to industry and assessed proposals for financial assistance under the <strong>ACT</strong>Business Incentive Fund, in compliance with the Interstate Investment Cooperation Agreement;• <strong>of</strong>fered comments on the regulatory impact <strong>of</strong> policy proposals and assistance in preparation <strong>of</strong>Regulatory Impact Statements (RIS);• completed a series <strong>of</strong> seminars across the <strong>ACT</strong> <strong>Government</strong> on the preparation <strong>of</strong> RIS statements;• represented the <strong>ACT</strong> on the Council <strong>of</strong> Australian <strong>Government</strong>s (COAG) competition andregulatory reform working groups;• provided advice to government on competition and regulatory matters, particularly in relation toenergy and water markets; and• established an economics and finance graduate recruitment stream within the main <strong>ACT</strong><strong>Government</strong> program.Commonwealth-State Finance UnitThe Commonwealth-State Finances Unit is responsible for overseeing the day-to-day operations <strong>of</strong>the <strong>ACT</strong> <strong>Government</strong>’s participation in Commonwealth-State financial arrangements, with Australian<strong>Government</strong> funding accounting for approximately 42 per cent <strong>of</strong> the <strong>ACT</strong>’s General <strong>Government</strong>Sector revenues in 2005-06.In 2005-06 the Unit:• provided advice on Commonwealth-State issues associated with the financing <strong>of</strong> the <strong>ACT</strong> in thecontext <strong>of</strong> Canberra as the national capital and seat <strong>of</strong> the Australian <strong>Government</strong>;• oversighted the <strong>ACT</strong>’s participation in Intergovernmental Agreement on the Reform <strong>of</strong>Commonwealth State Financial Relations (IGA);• managed the <strong>ACT</strong>’s participation in the deliberations <strong>of</strong> the Commonweath Grants Commission(CGC), which is responsible for recommending the States’ and Territories’ annual shares <strong>of</strong> theGST;• provided policy advice and monitored the Australian Tax Office’s (ATO) administration <strong>of</strong> theGST, through the GST Administration Sub-Committee (GSTAS); and• participated in various national intergovernmental forums and working parties and oversightedother Commonwealth grant funding arrangements, including Specific Purpose Payments (SPPs).Legal and Insurance Policy BranchThe Legal and Insurance Policy Branch is responsible for formulating the <strong>Government</strong>’s policy onbroader community insurance related matters.In 2005-06 the Branch:• developed policies to manage the Territory’s potential exposure to public liability claims arisingfrom dealings between Territory agencies and the general public;• assisted community organisations and small businesses to obtain affordable insurance throughbetter risk management; and• provided general internal legal support to <strong>Treasury</strong>, for example, in relation to the winding up <strong>of</strong>Totalcare Industries Ltd (Totalcare) and in managing legal aspects <strong>of</strong> outstanding superannuationissues for Totalcare and the Australian International Hotel School.From 21 April 2006, the Legal and Insurance Policy Branch assumed responsibility for policyformulation and oversighting Compulsory Third Party Insurance and Part 10 <strong>of</strong> the Road Transport Act.Central Financing UnitThe Central Financing Unit is responsible for managing the borrowing and investments <strong>of</strong> the General<strong>Government</strong> sector, managing the financing and fleet management arrangements for the Territory’svehicle fleet, and managing whole-<strong>of</strong>-government transactional banking arrangements. D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

Performance Against Accountability IndicatorsAgainst a target <strong>of</strong> 120 briefings on the <strong>ACT</strong> economy, 119 briefings were produced in 2005-06. Theestimated target <strong>of</strong> one submission to the <strong>ACT</strong>’s credit rating agency, Standard and Poor’s, was notmet due to a change in the timing <strong>of</strong> the 2006-07 <strong>ACT</strong> Budget, and subsequent rescheduling <strong>of</strong> thesubmission to the first quarter <strong>of</strong> 2006-07.Future DirectionsIn 2006-07 the Investment and Economics Division will work towards:• implementing the utilities land use permit arrangements to apply from 1 January 2007;• managing the <strong>ACT</strong>’s 2006 and 2007 submissions to Standard and Poor’s;• representing the <strong>ACT</strong> on the COAG National Reform Agenda Working Groups on infrastructureregulation, best practice regulation, and economic modeling;• progressing an <strong>ACT</strong> <strong>Government</strong> Economics and Finance Graduate Program in consultation withother <strong>ACT</strong> <strong>Government</strong> agencies;• managing the new <strong>ACT</strong> <strong>Government</strong> fleet financing arrangements applying from 1 July 2006.Fleet management oversight will be provided by Procurement Solutions;• oversighting the whole-<strong>of</strong>-government transactional banking arrangements;• participating in the annual update <strong>of</strong> GST distribution arrangements and the major review by theCGC <strong>of</strong> the distribution arrangements to apply from 2010-11; and• analysing the findings <strong>of</strong> the review <strong>of</strong> the interstate distribution <strong>of</strong> local road FinancialAssistance Grant – the CGC will report its findings to the Australian <strong>Government</strong> forconsideration. The outcome is likely to be material for the <strong>ACT</strong> as current indications reflect arevenue loss to the Territory.Further information can be obtained from:Roger Broughton Executive Director (02) 6207 6082 roger.broughton@act.gov.auInvestment andEconomics DivisionJason McNamara Director (02) 6207 0337 jasonp.mcnamara@act.gov.auEconomics BranchJohn Purcell Senior Manager (02) 6207 0269 john.purcell@act.gov.auCommonwealth StateFinances UnitTom McDonald Director (02) 6207 0284 tom.mcdonald@act.gov.auLegal and InsurancePolicy BranchPatrick McAuliffe Manager (02) 6207 0087 patrick.mcauliffe@act.gov.auCentral Finance UnitInvestment and Economics DivisionEconomic AnalysisCommonwealth State FinancesRisk AdvisoryRisk Guidehttp://www.treasury.act.gov.au/fig.shtmlhttp://www.treasury.act.gov.au/snapshot/index.shtmlhttp://www.treasury.act.gov.au/grants_commission/grants.htmlhttp://www.insuranceriskadvice.act.gov.au/http://www.treasury.act.gov.au/risktrain/index.htmlD E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

Output 1.2 – Financial ManagementRefer 2004-05 Budget Paper 4 page 92DescriptionProvision <strong>of</strong> analysis, monitoring and reporting on financial performance to assist the <strong>Government</strong> toachieve its preferred outcomes.Key Achievements• 2004-05 Territory Annual Financial Statements released in October 2005.• 2005-06 Budget Mid-Year Review released in February 2006.• 2006-07 Budget delivered on 6 June 2006.OrganisationThis output relates to the Finance and Budget Division and the Policy Coordination and DevelopmentDivision.The Finance and Budget Division (FABD) is responsible for advising the <strong>Government</strong> and agencies on thedevelopment <strong>of</strong> the Territory’s budget, advising on financial issues relating to agencies and the Territory,and accounting policies and financial frameworks.FABD comprises three branches: Accounting, Budget Management and Analysis, and Budget Strategy andReporting.The Accounting Branch is responsible for improving the Territory’s financial management frameworkand providing accounting expertise and strategic financial advice. The Branch also has responsibility forundertaking significant amendments to the FMA, providing financial training to agencies, and issuingsources <strong>of</strong> relevant financial instructions for the whole-<strong>of</strong>-government.The Budget Management and Analysis Branch is responsible for assisting in the development <strong>of</strong> theTerritory’s annual budget, monitoring, analysing and reporting to the <strong>Government</strong> and other stakeholderson the financial position <strong>of</strong> a broad range <strong>of</strong> <strong>Government</strong> agencies and businesses, and advising<strong>Government</strong> and agencies on financial management, resource allocation, and budget development issues.The Budget Strategy and Reporting Branch is responsible for providing strategic advice on the<strong>Government</strong>’s financial position, the coordination and development <strong>of</strong> the <strong>Government</strong>’s budget, and theconsolidation <strong>of</strong> budget financial statements and financial outcome reporting. The Branch also providesperiodic reporting to the Australian Bureau <strong>of</strong> Statistics (ABS) and the CGC on behalf <strong>of</strong> the <strong>Government</strong>.The Branch distributes <strong>Treasury</strong> memoranda and is responsible for the administration <strong>of</strong> the FMA. TheBranch also provides policy advice about governance arrangements for those government businesses forwhich <strong>Treasury</strong> has direct portfolio responsibility.The Policy Coordination and Development Division is responsible for coordinating major policydevelopment within <strong>Treasury</strong> and advising the <strong>Government</strong> in respect <strong>of</strong> significant long-term financialissues and risks likely to impact on the Territory’s budget. The Division provided secretariat servicesfor the Strategic and Functional Review <strong>of</strong> the <strong>ACT</strong> Public Sector and Services commissioned by theExecutive in November 2005.The Division is also responsible for the development <strong>of</strong> a triple bottom line/sustainability assessmentframework for adoption by government agencies.1 0 D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

Performance Against Accountability IndicatorsPreparation and Delivery <strong>of</strong> the <strong>ACT</strong> BudgetThe 2006-07 Budget was delivered on 6 June 2006 and was debated in the Legislative Assembly inAugust 2006. The <strong>Government</strong> Financial Statistic Net Operating Balance is budgeted to be -$80.3million for 2006-07, then steadily improving in the forward years to $67.7 million in 2009-10.The 2006-07 Budget incorporates a new capital works program <strong>of</strong> $272.2 million, and provides fundingin 2006-07 for new works and work in progress <strong>of</strong> $337 million.The 2006-07 Budget was presented on a <strong>Government</strong> Finance Statistics (GFS) basis. The GFS systemis used by all other Australian <strong>Government</strong>s and provides an improved framework for evaluating theeconomic sustainability <strong>of</strong> the <strong>ACT</strong> budget.Whole <strong>of</strong> <strong>Government</strong> Consolidated Finance Report, Management Reports and Capital WorksQuarterly Territory consolidated financial reports and the Annual Territory Financial Statements wereprovided to the Legislative Assembly in line with statutory timeframes. The quarterly reports containeda detailed analysis <strong>of</strong> the Territory’s financial position.External <strong>Government</strong> ReportingThe Territory’s external financial reporting requirements to the ABS and CGC were met, fulfilling theTerritory’s obligations under the Uniform Presentation Framework (UPF) Agreement.Expenditure Reviews and Strategic and Functional ReviewThe Policy Coordination and Development Division is responsible for expenditure reviews <strong>of</strong> agencies.There were three agencies scheduled for examination by the Expenditure Review Committee in 2005-06: the Department <strong>of</strong> Education and Training, the Department <strong>of</strong> Disability, Housing and CommunityServices, and the Emergency Services Authority.These reviews were subsequently subsumed within the Strategic and Functional Review.The Managing Director <strong>of</strong> <strong>ACT</strong>EW Corporation, Michael Costello, headed the Review. Mr Costellowas assisted by former Australian <strong>Treasury</strong> <strong>of</strong>ficer Greg Smith, the Adjunct Pr<strong>of</strong>essor <strong>of</strong> Economics andSocial Policy at the Australian Catholic University.The Terms <strong>of</strong> Reference for the Review were to:• review the outlook for the <strong>ACT</strong> budget and identify the major medium term fiscal risks;• undertake a high level benchmarking <strong>of</strong> government expenditure in the <strong>ACT</strong> relative to otherjurisdictions in Australia, drawing on available data (including data published by the CGC andthe Steering Committee for the Review <strong>of</strong> <strong>Government</strong> Service Provision);• consider all major areas <strong>of</strong> government expenditure and identify programs that could be deliveredmore efficiently or could be scaled back to more effectively meet whole-<strong>of</strong>-governmentobjectives;• identify options to improve efficiency through more effective structures for governmentoperations;• make recommendations on specific options for reducing expenditures or increasing non-taxationrevenues; and• investigate and report on options in relation to taxation revenue.The Review Report was presented to the Executive in April 2006.D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6 1 1

Policy AdviceThe Policy Coordination and Development Division also provided policy advice to other agencies andthe <strong>Government</strong> on a range <strong>of</strong> policy issues including:Housing• commissioning a review <strong>of</strong> the Home Loan Portfolio; and• conducting an analysis <strong>of</strong> the pr<strong>of</strong>ile <strong>of</strong> recipients <strong>of</strong> the Home Buyer Concession Scheme, whichprovides stamp duty concessions on property purchases, primarily to first home-buyers.Health• assisting <strong>ACT</strong> Health with the renegotiation <strong>of</strong> the <strong>ACT</strong>/NSW Cross-Border Agreement onHealth Services. This agreement describes the methods used for both the <strong>ACT</strong> and NSW tocompensate each other for the use <strong>of</strong> local health services by residents <strong>of</strong> the other jurisdiction.The work involved providing quantitative analysis on the risks to the <strong>ACT</strong> under variouscompensation options provided by NSW; andTriple Bottom Line• progressing the development and implementation <strong>of</strong> Triple Bottom Line/Sustainability reportingin the Territory, with a Triple Bottom Line Assessment Framework discussion paper developedfor <strong>ACT</strong> <strong>Government</strong> agencies.Other Issues<strong>Government</strong> Business Enterprise Oversight and Governance Implementation <strong>of</strong> new governancearrangements for statutory authoritiesA comprehensive review <strong>of</strong> the governance arrangements for prescribed statutory authorities in 2004-05resulted in significant changes to the FMA, which were passed in the Legislative Assembly on18 October 2005. New Parts 8 and 9 <strong>of</strong> the FMA provide a standardised governance and accountabilityframework for prescribed statutory authorities, replacing various outdated and contrasting provisionspreviously contained in the enabling legislation <strong>of</strong> each statutory authority.Sale <strong>of</strong> the Australian International Hotel SchoolIn April 2005, a project management team was established to negotiate, on behalf <strong>of</strong> the Territory, theproposed acquisition <strong>of</strong> the Australian International Hotel School by the Blue Mountains InternationalHotel Management School (BMHS). The sale was conditional upon the BMHS being accredited todeliver the degree course to existing students and the repeal <strong>of</strong> the Hotel School Act 1996. BMHSgained accreditation effective from 3 August 2005, and the Hotel School Act 1996 was repealed on31 October 2005 to coincide with the transfer <strong>of</strong> ownership to the BMHS. Under the terms <strong>of</strong> the sale,the Australian International Hotel School name will be retained and the school will continue to operateat the Hotel Kurrajong under a long term sublease.<strong>ACT</strong> Financial FrameworkThe Financial Management Amendment Act 2005 was tabled and passed during the Spring 2005 sittingperiod. The amendments:• standardise and improve governance arrangements for Territory authorities;• introduce the ability to appropriate directly to Territory authorities and Territory OwnedCorporations (TOCs);• support changes to the performance management framework implemented in the 2005-06Budget; and• facilitate Territory authorities’ access to a credit facility from the Territory Banking Account.1 2 D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

Improved Financial ProceduresTwo significant issues were progressed in 2005-06:• The Model Financial Report for 2005-06 was revised significantly, largely to address changesassociated with the adoption <strong>of</strong> Australian equivalents to International Financial ReportingStandards (AIFRS); and• <strong>ACT</strong>-specific accounting policies were developed to assist agencies with accounting issues inrelation to portable and attractive items, major bushfire replacement projects, and property, plantand equipment.Provision <strong>of</strong> Financial Management Training<strong>Treasury</strong> provided the following financial training modules during 2005-06:• Young Women’s Christian Association (YWCA) Women as Decision Makers;• Tax Managers Forum Training;• Budget Management for Program Managers;• FMA – Recent Financial Framework Amendments; and• Model Financial Report and Management Discussion and Analysis Update.Future DirectionsIn 2006-07, the Finance and Budget Division and the Policy Coordination and Development Divisionwill work towards:• implementing the <strong>Government</strong>’s new capital planning and development process announced in the2006-07 Budget;• undertaking the scoping study to examine the means by which Rhodium Asset Solutions will besold;• monitoring, reviewing and assessing the implementation <strong>of</strong> structural reforms to <strong>Government</strong>departments and agencies announced in the 2006-07 Budget;• amending the FMA to address changes to the Territory cash management frameworkimplemented in the 2006-07 Budget;• issuing a handbook stating the Territory’s revised financial framework, and providing associatedtraining to agencies;• expanding the range <strong>of</strong> <strong>ACT</strong>-specific accounting policies developed to assist agencies withaccounting issues; and• implementing a triple bottom line/sustainability assessment framework for the <strong>ACT</strong> <strong>Government</strong>.Further information can be obtained from:Megan Smithies Executive Director (02) 6207 0225 megan.smithies@act.gov.auFinance & BudgetDivisionNeil Bulless Director (02) 6207 0264 neil.bulless@act.gov.auBudget Management& Analysis BranchKirsten Thompson Director (02) 6207 0176 kirsten.thompson@act.gov.auBudget Strategy& Reporting BranchLisa Holmes A/g Director (02) 6207 5760 lisa.holmes@act.gov.auAccounting BranchD E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6 1 3

Khalid Ahmed Executive Director (02) 6207 0228 khalid.ahmed@act.gov.auPolicy Coordination& Development DivisionStephen Miners Director (02) 6207 5590 stephen.miners@act.gov.auPolicy Coordination& Development Division1 4 D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

Output 1.3 – Revenue ManagementRefer 2005-06 Budget Paper 4, page 103(includes the subsumed report <strong>of</strong> the Commissioner for <strong>ACT</strong> Revenue)DescriptionOptimise tax revenue concurrent with achieving a simple, equitable and efficient tax system, developpolicy, and advise and assist clients to meet their obligations.Key Achievements• Developed a Divisional Strategic Plan, which details vision, mission, values and strategicdirection for 2006-2010.• Finalised the implementation <strong>of</strong> the Territory Revenue System (TRS) in July 2005.• Commenced implementation <strong>of</strong> the Online Lodgment and Payment Service (OLPS) Project toprovide for electronic lodgment <strong>of</strong> certain tax assessments by the end <strong>of</strong> 2006.• Started the Property.Gov project, which will upgrade the Rates and Land Tax System(Community) with a modern Micros<strong>of</strong>t SQLServer database system.• Ceased duty on the acquisition <strong>of</strong> non-real core business assets and franchise arrangements(except long-term ones) on and from 1 July 2006.• Updated the Home Buyer Concession Scheme in July 2005 and January 2006 to reflect propertyand market fluctuations.• Introduced a facility to enable an applicant to lodge and pay for a Certificate <strong>of</strong> Rates, Land Taxand Other Charges online.• Completed new lodgment forms for certain transactions to assist taxpayers to provide all therelevant details at the time <strong>of</strong> lodgment.• Scanned rates and land tax documents. These documents will eventually be available on theIntegrated Document Management System.• Continued bushfire and drought relief through waivers <strong>of</strong> rates and land tax for affected propertyowners.• Achieved through compliance activity in 2005-06 the issue <strong>of</strong> 366 assessments and the collection<strong>of</strong> $4.4 million in revenue.• Reduced outstanding arrears to 1.5 per cent <strong>of</strong> total budget revenue; the target was 2 per cent,with the 2004-05 result being 1.8 per cent.OrganisationRevenue Management Division (www.revenue.act.gov.au) collects revenue, develops tax policy, andadministers taxation legislation in the <strong>ACT</strong>. The Division also administers a number <strong>of</strong> governmentfinancial assistance schemes, including the First Home Owner Grant Scheme and the Home BuyerConcession Scheme.Revenue Management Division comprises the following sections:• Policy and Systems is responsible for policy advice on <strong>ACT</strong> taxation matters, the developmentand amendment <strong>of</strong> the Territory’s taxation legislation, and the development and maintenance <strong>of</strong>IT systems used by the <strong>ACT</strong> Revenue Office (http://www.revenue.act.gov.au/policy.html).• Revenue Accounts administers Rates, Land Tax, Payroll Tax and other return taxes and maintainsrevenue accounts (http://www.revenue.act.gov.au/rates.html).• Advice and Assessments is responsible for the operation <strong>of</strong> the Customer Service Centre andadministers tax laws and provides advice relating to <strong>ACT</strong> taxes (http://www.revenue.act.gov.au/taxserv.html)D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6 1 5

• Compliance is responsible for maintaining and enforcing compliance with all taxes administeredby the <strong>ACT</strong> Revenue Office (http://www.revenue.act.gov.au/compli.html)• Finance and Recovery provides financial reporting, coordinates budget, manages arrears, andadministers the Home Loan Portfolio on behalf <strong>of</strong> the <strong>ACT</strong> Commissioner for Housing(http://www.revenue.act.gov.au/fandr.html).Performance Against Accountability IndicatorsCompliance revenue per inspectorThe 2005-06 target <strong>of</strong> $300,000 revenue per inspector was exceeded with an achievement <strong>of</strong> $360,078per inspector. This was due mainly to investigations identifying undeclared properties liable for landtax. Also, an unexpected number <strong>of</strong> First Home Owner Grants were requested to be repaid due to theconditions <strong>of</strong> the grant not being met by recipients.Debt management - level <strong>of</strong> outstanding debtThe debt to revenue ratio was 1.5 per cent compared to the target <strong>of</strong> 2 per cent. The improvement indebt management is the result <strong>of</strong> on-going changes in procedures and practices.Future DirectionsIn 2006-07, the Revenue Management Division will work towards:• reviewing legislation to protect revenue, to implement government decisions on tax reform, andto make administrative or compliance efficiency gains for taxpayers and government;• making greater use <strong>of</strong> technology for the provision <strong>of</strong> services, including greater taxpayer accessto information;• developing a system to allow for electronic service delivery, including electronic lodgment andpayment for many <strong>ACT</strong> taxes, and the closure <strong>of</strong> the Revenue Management Division shopfront;• upgrading the Rates and Land Tax System (Community) with a modern Micros<strong>of</strong>t SQLServerdatabase system; and• increasing the resources devoted to compliance activities and dealing with complex matters.Further information can be obtained from:Graeme Dowell Commissioner (02) 6207 0010 graeme.dowell@act.gov.aufor Revenue,Revenue ManagementDivisionAngel Marina Manager (02) 6207 0063 angel.marina@act.gov.auRevenue AccountsSectionDavid Read Manager (02) 6207 0066 david.read@act.gov.auAdvice &Assessments SectionCheryl Olley Manager (02) 6207 0103 cheryl.olley@act.gov.auCompliance SectionGlenn Bain Manager (02) 6207 0293 glenn.bain@act.gov.auPolicy & SystemsSectionPhang-Chun Lim Manager (02) 6207 0172 phang-chun.lim@act.gov.auFinance & RecoverySection1 6 D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

Output 1.4 – Procurement Support ServicesRefer 2005-06 Budget Paper 4. page 103DescriptionDevelops procurement policy, manages the buyers and sellers information service (basis), on-lineprocurement services, business opportunities, and supplier notification <strong>of</strong> tenders and contracts,supports <strong>ACT</strong> <strong>Government</strong> purchasing <strong>of</strong>ficers and the implementation <strong>of</strong> construction industry reforms,including pre-qualification <strong>of</strong> suppliers and provides risk management services to <strong>ACT</strong> <strong>Government</strong>agencies.Key Achievements• Established a restructured Procurement Solutions with the capability and capacity to deliverprocurement services to all <strong>ACT</strong> <strong>Government</strong> agencies and significant savings to the <strong>ACT</strong> budget.• Delivered construction activities costing $124 million, comprising the major component <strong>of</strong> thewhole-<strong>of</strong>-government capital works program.• Managed on behalf <strong>of</strong> client agencies, a number <strong>of</strong> major or significant projects, includingcompletion <strong>of</strong> the design and early ground works for the new <strong>ACT</strong> Prison, and thecommencement <strong>of</strong> the construction <strong>of</strong> the Gungahlin Drive Extension.• Managed the commencement <strong>of</strong> procurement services relating to the refurbishment <strong>of</strong> theCanberra Convention Centre, the construction <strong>of</strong> Canberra Glassworks, and the design <strong>of</strong>Harrison School.• Managed procurement services relating to the completion <strong>of</strong> the Multicultural Centre underbudget and on time, the Bushfire Memorial in Stromlo Forest Park, Woden Police Station, KippaxLibrary, several major upgrades for government schools, and a number <strong>of</strong> <strong>of</strong>fice fit-outs.• Called a total <strong>of</strong> 422 tenders on behalf <strong>of</strong> <strong>ACT</strong> <strong>Government</strong> agencies, and issued 443 contractsduring 2005-06.OrganisationIn 2005-06 <strong>ACT</strong> Procurement Solutions absorbed functions, staff and resources from across the <strong>ACT</strong>public sector. This followed the <strong>Government</strong>’s decision to consolidate key procurement actions forprocurements above $20,000 in Procurement Solutions. This supplemented Procurement Solutions’existing role and capabilities, as well as reinforcing its role as the Territory’s major source <strong>of</strong> expertiseon procurement-related issues.Procurement Solutions provides capital works delivery services, procurement advice, and tendering andcontracting services to the majority <strong>of</strong> <strong>ACT</strong> <strong>Government</strong> agencies. It provides secretariat support to the<strong>Government</strong> Procurement Board and operates the <strong>ACT</strong>’s major Approved Procurement Unit (APU). Inaccordance with the requirements <strong>of</strong> the <strong>Government</strong> Procurement Act 2001 and associated statutoryinstruments, the APU considers the vast majority <strong>of</strong> Procurement Plans.Procurement Solutions also manages a range <strong>of</strong> procurement support systems and services whichfacilitate private sector involvement in government contracts. These systems include the basis websiteand a range <strong>of</strong> pre-qualification schemes. Through its management <strong>of</strong> the Central Contracts Register,Procurement Solutions also facilitates public accountability and transparency <strong>of</strong> government contractingactivities.Infrastructure Procurement BranchThe Branch assisted <strong>ACT</strong> <strong>Government</strong> agencies with the procurement <strong>of</strong> capital works, includingpreparation <strong>of</strong> relevant documentation, obtaining regulatory approvals, conduct <strong>of</strong> tendering processes,D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6 1 7

tender evaluation, contract formation and management <strong>of</strong> project delivery. In addition, agencies werealso assisted to establish contracts for asset maintenance programs and <strong>of</strong>f-budget works. In late 2005the Branch became responsible for assisting the Department <strong>of</strong> Urban Services (now the Department <strong>of</strong>Territory and Municipal Services) in the delivery <strong>of</strong> the Gungahlin Drive Extension.Contracts & Tendering BranchThis group, following the consolidation <strong>of</strong> procurement activities, advised and assisted all <strong>ACT</strong><strong>Government</strong> agencies with the development <strong>of</strong> their procurement, risk management, negotiation andtender evaluation plans, advertising requests for tender, tender documentation and tender box services,tender evaluations, and contract documentation and execution services. The group also administeredand further developed the Supplier Pre-qualification Schemes in a number <strong>of</strong> sectors.Procurement Policy UnitThe Unit provided secretariat support to the <strong>Government</strong> Procurement Board, management <strong>of</strong> the APU,policy advice to agencies and executives, and administrative support to the Procurement ConsultativeCommittee. The Unit was the Territory’s primary participant in the activities <strong>of</strong> the AustralianProcurement and Construction Council.During 2005-06, a number <strong>of</strong> industry forums were held on a range <strong>of</strong> procurement policy andoperational issues. Forum participants included representatives from a wide range <strong>of</strong> industryassociations, unions and firms.In accordance with the requirements <strong>of</strong> the <strong>Government</strong> Procurement Act 2001, a review <strong>of</strong> theoperations <strong>of</strong> the Act commenced in June 2006. A report on the outcome <strong>of</strong> the review will be providedto the Legislative Assembly in late November 2006.Performance Against Accountability IndicatorsProportion <strong>of</strong> <strong>Government</strong> funded annual Capital Works program supported with projectprocurement services.During 2005-06, Procurement Solutions provided project procurement services to projects equivalentto 62 per cent <strong>of</strong> the <strong>Government</strong>’s Capital Works program. A total <strong>of</strong> $124 million was expended byProcurement Solutions on behalf <strong>of</strong> a wide range <strong>of</strong> <strong>ACT</strong> <strong>Government</strong> agencies on the construction <strong>of</strong>infrastructure and other public facilities. This amount was 68 per cent <strong>of</strong> the <strong>ACT</strong>’s total capital worksexpenditure during 2005-06.Quality Management Systems ComplianceDuring 2005-06, the compliance <strong>of</strong> Procurement Solutions and its Quality Management System withthe requirements <strong>of</strong> international quality standard ISO9001:2000 was re-certified for a further 3 years,subject to periodic surveillance audits. The Quality Management System covers the vast majority<strong>of</strong> Procurement Solutions’ activities. In early 2006, a category 1 non-conformance was identifiedrelating to the activities <strong>of</strong> a sub-unit which had transferred to Procurement Solutions as part <strong>of</strong> theprocurement centralisation process. The non-conformity arose because the quality auditor consideredthe underlying activities, which had transferred to Procurement Solutions, were outside the scope <strong>of</strong> itsexisting certification relating to construction activities. This non-conformity is being addressed throughdocumentation <strong>of</strong> relevant practices and procedures and expansion <strong>of</strong> the coverage <strong>of</strong> the QualitySystem.Future DirectionsIn 2006-07, <strong>ACT</strong> Procurement Solutions will work towards:• completing the review <strong>of</strong> the <strong>Government</strong> Procurement Act 2001 and implementing any<strong>Government</strong> decisions arising from the review;• completing the consolidation <strong>of</strong> key procurement functions and resources from across the <strong>ACT</strong>public sector and delivering high-quality procurement services to agencies;1 8 D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

• supporting agencies in the delivery <strong>of</strong> the vast majority <strong>of</strong> the <strong>ACT</strong> <strong>Government</strong>’s capital worksprogram, including substantial progress on delivery <strong>of</strong> the <strong>ACT</strong> Prison project and the GungahlinDrive Extension;• improving and further integrating the range <strong>of</strong> procurement support systems which are availableto assist <strong>ACT</strong> agencies and the business community; and• assisting agencies to achieve significant savings in the procurement <strong>of</strong> goods and services throughenhanced aggregation <strong>of</strong> procurements, more strategic approaches to markets, and furtherimproving procurement processes to reduce <strong>Government</strong> costs, and the costs to the private sector<strong>of</strong> doing business with the <strong>ACT</strong> <strong>Government</strong>.Further information can be obtained from:John Robertson Executive Director (02) 6207 0265 john.robertson@act.gov.auProcurementSolutionsRobyn Hardy Director (02) 6207 5876 robyn.hardy@act.gov.auProcurementSolutionsMike Berry Manager (02) 6207 5576 mike.berry@act.gov.auProcurementSolutionsBob Venables Manager (02) 6207 0226 bob.venables@act.gov.auProcurementSolutions<strong>ACT</strong> Contracts Registerhttp://www.contractsregister.act.gov.au/D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6 1 9

Output EBT 1 – Central Financing UnitRefer 2005-06 Budget Paper 4, page 123DescriptionManage the investment and borrowing activities <strong>of</strong> the <strong>ACT</strong> <strong>Government</strong>.Key Achievements• The procurement and the appointment <strong>of</strong> a replacement financial debt liability risk managementadvisor and a debt management system provider.• Restructuring <strong>of</strong> the government debt portfolio to align it with the debt management benchmarkby implementing an interest rate swaps strategy.OrganisationThe Central Financing Unit (CFU) manages the central finances <strong>of</strong> the Territory through theTerritory Banking Account. The Unit provides services to the <strong>Government</strong> that includesfinancial asset and liability management through the establishment <strong>of</strong> investment andborrowing policies and objectives, and the coordination <strong>of</strong> investment and borrowing activities.CFU manages the surplus cash balances <strong>of</strong> the Territory and invests funds through externalmanagers within known cashflow requirements, and establishes investment policies. The CFUis also responsible for the administration <strong>of</strong> the Territory’s debt portfolio and the management<strong>of</strong> the Territory’s debt servicing liabilities.The objective <strong>of</strong> the CFU is to effectively manage the capital markets functions throughthe maximisation <strong>of</strong> returns on investments within relevant risk tolerances, the achievement<strong>of</strong> competitive borrowing rates commensurate with the Territory’s credit rating, and thedevelopment <strong>of</strong> effective financial risk management strategies.The CFU, through the Territory Banking Account, recognises and manages the <strong>Government</strong>’sdebt liability and Territory unencumbered cash. Revenues on behalf <strong>of</strong> the Territory aretransferred to the Territory Banking Account, and fortnightly appropriation disbursements toagencies are made from the Territory Banking Account.Performance Against Accountability IndicatorsBorrowing ManagementAt the end <strong>of</strong> the 2005-06 financial year, the Territory’s debt portfolio was in line with benchmarkexpectations. During the year, the general government debt portfolio was restructured to align tothe benchmark by implementing an interest rate swaps strategy. The debt management result was asfollows:• a modified duration <strong>of</strong> 2.56 years was achieved against the benchmark target <strong>of</strong> three years(a policy range <strong>of</strong> ±0.5 years); and• a floating rate debt exposure <strong>of</strong> 16.15 per cent was achieved against the benchmark <strong>of</strong> afloating rate debt exposure <strong>of</strong> no more than 30 per cent.Investment ManagementDuring 2005-06, the Territory investment portfolio out-performed the target benchmark. Investmentreturns achieved (after fees) were as follows:• Cash Enhanced Fund: an investment return <strong>of</strong> 5.99 per cent was achieved against a benchmark<strong>of</strong> 5.76 per cent; and2 0 D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

• Fixed Interest Fund: an investment return <strong>of</strong> 3.57 per cent was achieved against a benchmark <strong>of</strong>3.41 per cent.Future DirectionsIn 2006-07, the CFU will work towards:• the ongoing management <strong>of</strong> the <strong>Government</strong>’s debt portfolio;• the ongoing management <strong>of</strong> the General <strong>Government</strong> Sector’s investment portfolio; and• implementing new investment arrangements applying to agencies as a result <strong>of</strong> new cashmanagement arrangements. These arrangements will require agencies’ cash to be maintainedcentrally and disbursed on a needs basis.Further Information can be obtained from:Roger Broughton Executive Director (02) 6207 6082 roger.broughton@act.gov.auInvestment &Economic DivisionPatrick McAuliffe Manager (02) 6207 0187 patrick.mcauliffe@act.gov.auCentral FinancingUnitD E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6 2 1

Output EBT 1 – Superannuation UnitRefer 2005-06 Budget Paper 4, page 153DescriptionManagement <strong>of</strong> the Superannuation Provision Account (SPA) and administration <strong>of</strong> the superannuationarrangements for Members <strong>of</strong> the Legislative Assembly (MLAs).Key Achievements• Completed a review into the long-term funding strategy for the defined benefit superannuationliabilities <strong>of</strong> the Territory.• Completed the triennial actuarial review using salary and membership data as at 30 June 2005.• Investment portfolio return out-performed the established benchmark.• Establishment <strong>of</strong> choice <strong>of</strong> fund arrangements to apply from 1 July 2006.OrganisationThe Superannuation Unit is responsible for managing funds set aside to meet employer superannuationliabilities <strong>of</strong> the Territory and its agencies, and for administering superannuation arrangements forMLAs.Until 30 June 2006, permanent <strong>ACT</strong> <strong>Government</strong> employees are members <strong>of</strong> the various Commonwealthsuperannuation schemes. The Commonwealth Superannuation Scheme (CSS) and the Public SectorSuperannuation Scheme (PSS) closed to new membership on 30 June 1990 and 30 June 2005respectively. Both these schemes are, at least partially, defined benefit schemes. From 1 July 2005, newemployees have been provided with membership <strong>of</strong> the PSSap, a fully funded accumulation schemerequiring an employer contribution <strong>of</strong> 15.4 per cent. From 1 July 2006, fund <strong>of</strong> choice arrangements areavailable to new employees.The SPA was established in 1991 to assist the <strong>ACT</strong> <strong>Government</strong> in managing its superannuationliabilities. The SPA is not a superannuation scheme for <strong>ACT</strong> <strong>Government</strong> employees, but an <strong>ACT</strong><strong>Government</strong> account that receives appropriations and makes payments in connection with the <strong>ACT</strong><strong>Government</strong>’s superannuation liabilities to the Commonwealth and to MLAs.The SPA receives appropriations and contributions from the <strong>ACT</strong> Budget and complies with theTerritory Superannuation Provision Protection Act 2000. During 2005-2006, capital injections into theSPA amounted to $125 million.The key investment objective <strong>of</strong> the SPA is to achieve a long-term annual rate <strong>of</strong> return averaging fiveper cent real (net <strong>of</strong> fees). In conjunction with planned annual appropriations, SPA assets are estimatedto achieve a long-term objective <strong>of</strong> 100 per cent level <strong>of</strong> funding <strong>of</strong> the Territory’s superannuationliability by 2030.Performance Against Accountability IndicatorsRatio <strong>of</strong> the investment earnings return divided by the established benchmark:• The investment portfolio matched the benchmark for the 2005-06 financial year, returning16.3 per cent against an asset-weighted benchmark return <strong>of</strong> 16.3 per cent.Actuarial revision <strong>of</strong> Territory superannuation liability:• The triennial actuarial review <strong>of</strong> the Territory’s superannuation liability using membership data asat 30 June 2005 was completed. The revised superannuation liability estimates <strong>of</strong> this review arecontained within the 2005-06 financial year result and the 2006-07 Budget estimates.Production <strong>of</strong> annual member statements for MLAs:• Annual superannuation statements were issued for all MLAs during October 2005.2 2 D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6

Future DirectionsIn 2006-07 the Superannuation Unit will work towards:• undertaking an annual actuarial review <strong>of</strong> the Territory’s defined benefit superannuation liabilities;• undertaking a strategic investment review and implementing changes to the investment portfolioas required;• achieving an investment return greater than the established benchmark; and• achieving an average long-term investment return <strong>of</strong> five per cent real (net <strong>of</strong> inflation and fees).Further information can be obtained from:Roger Broughton Executive Director (02) 6207 6082 roger.broughton@act.gov.auInvestment andEconomics DivisionGarry Cartwright Manager (02) 6207 0178 garry.cartwright@act.gov.auSuperannuation UnitD E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6 2 3

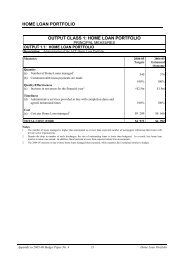

Output 1.1 – Home Loan PortfolioRefer 2005-06 Budget Paper 4, page 133DescriptionAdministration <strong>of</strong> the <strong>ACT</strong> Home Loan Portfolio.Key Achievements• Reduced the number <strong>of</strong> loans to 446 as at the end <strong>of</strong> June 2006 (46 less than the Budget target <strong>of</strong>492). There were 560 outstanding loans at the start <strong>of</strong> 2005-06.• Repaid Commonwealth loans in accordance with the payment schedule.• Issued bi-annual loan statements to loan borrowers.• Reduced the total number <strong>of</strong> loans in arrears.OrganisationThe Home Loan Portfolio is responsible for administering home loans granted by the Commissioner forHousing to assist low-income households in achieving home ownership. All <strong>ACT</strong> <strong>Government</strong> homebuyerlending ceased in 1996.The Portfolio’s objective is to administer the remaining home loans effectively and efficiently.Performance Against Output MeasuresIncrease in net assets for the financial yearThe increase in net assets <strong>of</strong> $3.4 million was higher than the Budget estimate <strong>of</strong> $2.5 million. Theincrease was due to the net effect <strong>of</strong> an increase in the amount <strong>of</strong> unbudgeted other revenue (because <strong>of</strong>a downward revision <strong>of</strong> provisioning for doubtful debts) and the decrease in market value <strong>of</strong> long-terminvestment and bad debt expenses.Administration Cost per Home LoanThe administration cost per managed home loan <strong>of</strong> $889 was higher than the Budget estimate <strong>of</strong> $816.The increase was due to a higher number <strong>of</strong> loan repayments being processed than expected.Other IssuesThe level <strong>of</strong> the Portfolio’s provision for doubtful debt in 2005-06 decreased from $12.5 million to$9.4 million as a result <strong>of</strong> the overall reduction <strong>of</strong> outstanding loans.Future DirectionsIn 2006-07, the Home Loan Portfolio will work towards:• continuing the development <strong>of</strong> policies and strategies for the effective and efficient management<strong>of</strong> home loans;• developing effective strategies for the reduction <strong>of</strong> outstanding arrears; and• upgrading the IT systems for home loans.Further information can be obtained from:Graeme Dowell Director (02) 6207 0010 graeme.dowell@act.gov.auRevenueManagement DivisionPhang-Chun Lim Manager (02) 6207 0172 phang-chun.lim@act.gov.auFinance & RecoverySection2 4 D E PA RT M E N T O F T R E A S U RY A N N U A L R E P O RT 0 5 - 0 6