76 Financial Statements <strong>Aer</strong> <strong>Lingus</strong> Group Plc – Annual Report <strong>2009</strong>Notes to the Consolidated Financial Statements [continued]17 Loans and receivables [continued]Financial assets with a fair value of €100.7m were reclassified during 2008, with the fair value at that date becoming the assets’new carrying value for amortised cost.These assets are all denominated in US dollars. These unlisted securities are mainly held in order to meet certain finance leaseobligations denominated in the same currency and with the same maturity. Cash flows from these securities, including the interestreceivable thereon, are expected to be sufficient to meet the associated lease obligations.The maximum exposure to credit risk at the <strong>report</strong>ing dates is the carrying amount of the debt securities classified as loans andreceivables. None of the debt securities are either past due or expired.As at 31 December <strong>2009</strong> the fair value and carrying value of the financial assets reclassified were €71.3m (31 December 2008: €110.4m)and €77.3m (31 December 2008: €115.1m) respectively. If the financial assets had not been reclassified a fair value loss of €1.8m(2008: €6.3m) would have been recognised in equity. The fair values of unlisted securities are based on cash flows discounted using arate based on the market interest rate and the risk premium appropriate to the unlisted securities. €2.1m (2008: €1.6m) was amortisedfrom the available-for-sale reserve to the income statement in the period.The effective interest rates of the financial assets reclassified into loans and receivable at the date of reclassification were between2.8% and 4.5%.The estimated undiscounted cash flows that the Group expected to recover from the reclassified financial assets as at the dateof reclassification was:1 yearor lessBetween1 and 2 yearsBetween2 and 5 yearsOver5 years€’000 €’000 €’000 €’000Unlisted debt securities: 39,917 5,663 12,703 77,10018 Derivative financial instruments<strong>2009</strong> <strong>2009</strong> 2008 2008€’000 €’000 €’000 €’000Assets Liabilities Assets LiabilitiesCross-currency interest rate swap – 7,303 – 6,285Forward foreign exchange contracts 19,831 – 70,319 –Forward fuel price contracts 4,717 11,873 – 142,995Total 24,548 19,176 70,319 149,280Less non-current portion:Cross-currency interest rate swap – 7,303 – 6,285Forward foreign exchange contracts 5,348 – 39,447 –Forward fuel price contracts 1,501 – – 28,789Total non-current portion 6,849 7,303 39,447 35,074Current portion 17,699 11,873 30,872 114,206

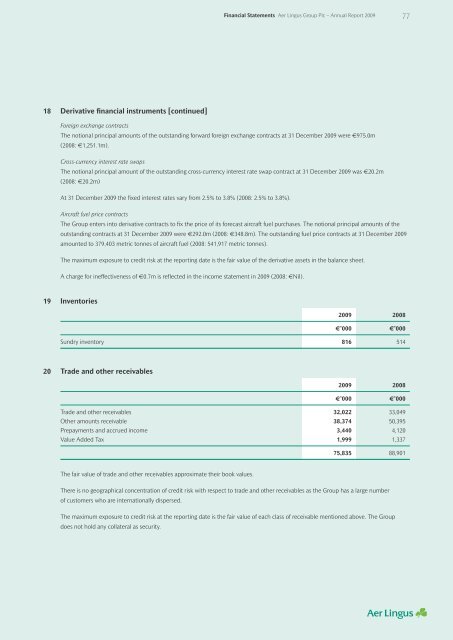

Financial Statements <strong>Aer</strong> <strong>Lingus</strong> Group Plc – Annual Report <strong>2009</strong>7718 Derivative financial instruments [continued]Foreign exchange contractsThe notional principal amounts of the outstanding forward foreign exchange contracts at 31 December <strong>2009</strong> were €975.0m(2008: €1,251.1m).Cross-currency interest rate swapsThe notional principal amount of the outstanding cross-currency interest rate swap contract at 31 December <strong>2009</strong> was €20.2m(2008: €20.2m)At 31 December <strong>2009</strong> the fixed interest rates vary from 2.5% to 3.8% (2008: 2.5% to 3.8%).Aircraft fuel price contractsThe Group enters into derivative contracts to fix the price of its forecast aircraft fuel purchases. The notional principal amounts of theoutstanding contracts at 31 December <strong>2009</strong> were €292.0m (2008: €348.8m). The outstanding fuel price contracts at 31 December <strong>2009</strong>amounted to 379,403 metric tonnes of aircraft fuel (2008: 541,917 metric tonnes).The maximum exposure to credit risk at the <strong>report</strong>ing date is the fair value of the derivative assets in the balance sheet.A charge for ineffectiveness of €0.7m is reflected in the income statement in <strong>2009</strong> (2008: €Nil).19 Inventories<strong>2009</strong> 2008€’000 €’000Sundry inventory 816 51420 Trade and other receivables<strong>2009</strong> 2008€’000 €’000Trade and other receivables 32,022 33,049Other amounts receivable 38,374 50,395Prepayments and accrued income 3,440 4,120Value Added Tax 1,999 1,33775,835 88,901The fair value of trade and other receivables approximate their book values.There is no geographical concentration of credit risk with respect to trade and other receivables as the Group has a large numberof customers who are internationally dispersed.The maximum exposure to credit risk at the <strong>report</strong>ing date is the fair value of each class of receivable mentioned above. The Groupdoes not hold any collateral as security.