tax treaties-an overview -by vinay n sanji - Bangalore Branch of SIRC

tax treaties-an overview -by vinay n sanji - Bangalore Branch of SIRC

tax treaties-an overview -by vinay n sanji - Bangalore Branch of SIRC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

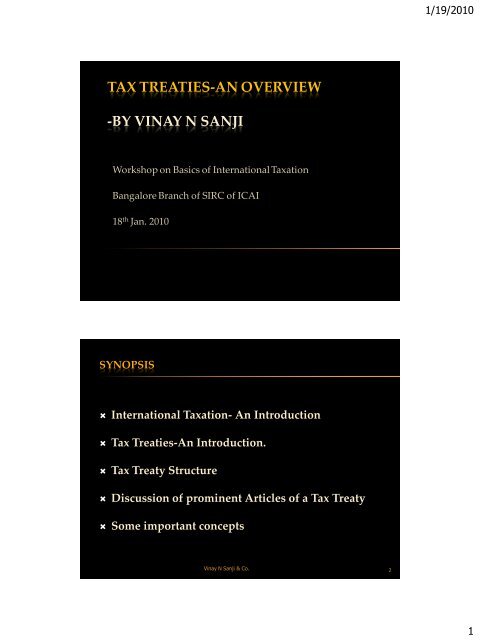

1/19/2010TAX TREATIES-AN OVERVIEW-BY VINAY N SANJIWorkshop on Basics <strong>of</strong> International TaxationB<strong>an</strong>galore Br<strong>an</strong>ch <strong>of</strong> <strong>SIRC</strong> <strong>of</strong> ICAI18 th J<strong>an</strong>. 2010SYNOPSIS International Taxation- An Introduction Tax Treaties-An Introduction. Tax Treaty Structure Discussion <strong>of</strong> prominent Articles <strong>of</strong> a Tax Treaty Some import<strong>an</strong>t conceptsVinay N S<strong>an</strong>ji & Co. 21

1/19/2010INTERNATIONAL TAXATIONAN INTRODUCTIONVinay N S<strong>an</strong>ji & Co.3GLOBALIZATIONWhat is Globalization ?Globalization is the phenomenon <strong>of</strong> Sourcing capital from where it is cheapest, Sourcing people from where it is bestavailable, Producing where it is most cost effective<strong>an</strong>d Selling where the markets are.Vinay N S<strong>an</strong>ji & Co.42

1/19/2010INTERNATIONAL TAXATION- MEANINGIt is a body <strong>of</strong> legal provisions embedded in the <strong>tax</strong> laws<strong>of</strong> each country to cover the <strong>tax</strong> aspects <strong>of</strong> cross bordertr<strong>an</strong>sactions.InternationalLawInternational TaxTax TreatiesVinay N S<strong>an</strong>ji & Co.5INTERNATIONAL TAXATION-OBJECTIVESEconomicEfficiencyBal<strong>an</strong>ceCapitalExport &ImportNeutralityKeyObjectsNationalWealthMaximizationTaxEquityVinay N S<strong>an</strong>ji & Co.63

1/19/2010TAX TREATIESAN INTRODUCTIONVinay N S<strong>an</strong>ji & Co.7TAX TREATYMe<strong>an</strong>ing-A <strong>tax</strong> treaty is a formally concluded <strong>an</strong>dratified agreement between two independentnations (bilateral treaty) or more th<strong>an</strong> two nations(multilateral treaty) on matters concerning<strong>tax</strong>ationVinay N S<strong>an</strong>ji & Co.84

1/19/2010OBJECTIVESAvoid Double TaxationPrevent Tax EvasionAllocate Tax JurisdictionExch<strong>an</strong>ge <strong>of</strong> InformationCertainty <strong>of</strong> Tax Treatment toInvestorsVinay N S<strong>an</strong>ji & Co. 9TAX TREATIES- EVOLUTIONARY MILESTONES•The first DTAA entered in to between Prussia & Austria189919281943194619561961196319771979•The first model draft DTAA was published with the concept <strong>of</strong> PE being introduced for the first time•The Mexico Model was released•The London Model convention was released•The OEEC took upon the task <strong>of</strong> improving the model DTA to suit the needs <strong>of</strong> its member countries•OEEC was superseded <strong>by</strong> OECD•The first draft <strong>of</strong> OECD model was published•The final version <strong>of</strong> the OECD Model was published & has been last revised in 2008•Developing countries take recourse to UN model as OECD model is biased towards Developed nations (Last Update in 2001)•US model is introduced. Last revised in 20061981Vinay N S<strong>an</strong>ji & Co.105

1/19/2010MODEL CONVENTIONSModel conventions- provide the broad framework for treaty formulation serve as useful interpretation materialThe popular model conventions are:a) UN Modelb) OECD Modelc) US ModelVinay N S<strong>an</strong>ji & Co.11TYPES OF TAX TREATIES Limited Treaties-which cover -a) income from operation <strong>of</strong> aircrafts <strong>an</strong>d ships,b) estates,c) inherit<strong>an</strong>ce <strong>an</strong>dd) gifts. Comprehensive Treaties-which are wider in scopeaddressing all sources <strong>of</strong> incomeVinay N S<strong>an</strong>ji & Co.126

1/19/2010TREATY POSITION IN INDIASection 90(1) <strong>of</strong> the Indi<strong>an</strong> Income Tax Act, 1961authorizes the Central Government to conclude <strong>tax</strong><strong>treaties</strong>India presently has <strong>treaties</strong> with 91 countriesSection 90 (2) <strong>of</strong> Income Tax Act Vs. Section 258(8) <strong>of</strong>the Direct Tax CodeSection 91 - provides unilateral reliefVinay N S<strong>an</strong>ji & Co.13TAX TREATY STRUCTUREVinay N S<strong>an</strong>ji & Co.147

1/19/2010ARTICLES- CLASSIFICATIONApplicationArticlesDefinitionProvisionsAnti-Avoid<strong>an</strong>ceProvisionsElimination <strong>of</strong>Double TaxationMiscell<strong>an</strong>eousProvisions• Article 1-Applicability• Article 2- TaxesCovered• Article 30-Entryinto Force• Article 31-Termination• Article 3-GeneralDefinitions• Article 4-Residence• Article 5-Perm<strong>an</strong>entEstablishment• Article 9-AssociatedEnterprises• Article 26-Exch<strong>an</strong>ge <strong>of</strong>Information• Article 27-Assist<strong>an</strong>ce forcollection <strong>of</strong> <strong>tax</strong>• Article 23-Elimination <strong>of</strong>Double Tax• Article 24-Non-Discrimination• Article 28-Diplomats• Article 25-MutualAgreement• Article 29-TerritorialextensionVinay N S<strong>an</strong>ji & Co.15DISTRIBUTIVE ARTICLESArticle 6-Immovable PropertyArticle 7-Business Pr<strong>of</strong>itsArticle 8-Shipping, etc.Article 10-DividendsArticle 11-InterestArticle 12-Royalties & Fees for Technical ServicesArticle 13-Capital GainsArticle 14-Independent Personal ServicesArticle 15-Dependent Personal ServicesArticle 16-DirectorsArticle 17-Artistes & Sports personsArticle 18-PensionsArticle 19-Government ServicesArticle 20-StudentsArticle 21-Other IncomeArticle 22-CapitalVinay N S<strong>an</strong>ji & Co.168

1/19/2010PROMINENT ARTICLES-A DISCUSSIONVinay N S<strong>an</strong>ji & Co.17SCOPEArticle 1- Applicability -Applies to a person who is a resident <strong>of</strong>one or both the countries.Article 2- Taxes covered- Taxes on income <strong>an</strong>d capital Indi<strong>an</strong> <strong>tax</strong>es covered are income <strong>tax</strong>, surcharge <strong>an</strong>d cessArticle 30-Entry into forceThis article tells when <strong>an</strong>d how a DTA becomes operativeArticle 31-TerminationThis article tells when <strong>an</strong>d how a DTA c<strong>an</strong> be terminatedVinay N S<strong>an</strong>ji & Co.189

1/19/2010DEFINITIONS Article 3-General Definitions1. Person2. Comp<strong>an</strong>y3. Contracting State4. Enterprise <strong>of</strong> a Contracting State4. Competent Authority6. NationalUndefined Terms-me<strong>an</strong>ing to be as defined under thedomestic <strong>tax</strong> laws applicable to the <strong>tax</strong>es covered in thetreatyVinay N S<strong>an</strong>ji & Co.19DEFINITIONSArticle 4 - ResidenceA person is a resident <strong>of</strong> a country if he is liable to <strong>tax</strong> in the country <strong>by</strong> virtue <strong>of</strong>:-Domicile-Residence-Place <strong>of</strong> Incorporation-Place <strong>of</strong> m<strong>an</strong>agement-Any other criterion <strong>of</strong> a similar natureTie-Breaker Rules- In the case <strong>of</strong> a dual resident, the tie-breaker rules shallapply to determine the residential statusa) In the case <strong>of</strong> <strong>an</strong> individual his personal <strong>an</strong>d economic ties determine hisresidential statusb) In the case <strong>of</strong> others it is the place <strong>of</strong> effective m<strong>an</strong>agementVinay N S<strong>an</strong>ji & Co.2010

1/19/2010DEFINITIONSArticle 5 - Perm<strong>an</strong>ent Establishment (PE) Me<strong>an</strong>s a fixed place from where the business <strong>of</strong> theenterprise is carried onPE includes place <strong>of</strong> m<strong>an</strong>agement, br<strong>an</strong>ch, <strong>of</strong>fice, factory,workshop, mine, quarry, <strong>an</strong> oil or gas well, a constructionsite for long duration, a services location for long duration<strong>an</strong>d a dependent agency with power to conclude contractsVinay N S<strong>an</strong>ji & Co.21DISTRIBUTIVE PROVISIONSVinay N S<strong>an</strong>ji & Co.2211

1/19/2010ACTIVE & PASSIVE INCOME Passive Income-refers to income derived from investmentin t<strong>an</strong>gible / int<strong>an</strong>gible assets.Equity InvestmentDebtRight/Permission to use assetsDisposal <strong>of</strong> capital assets ownedYieldsDividendInterestRent / RoyaltiesCapital Gain Active Income is the income derived from carrying onactive cross border business operations or <strong>by</strong> personaleffort <strong>an</strong>d exertion as in case <strong>of</strong> employment.Vinay N S<strong>an</strong>ji & Co.23PASSIVE INCOMES-DISTRIBUTION OF TAXING RIGHTSArticleRef.Nature <strong>of</strong> Income6 Income from ImmovablePropertyTaxing Right<strong>of</strong> SourceStateHas the first rightto <strong>tax</strong>10 Dividend Income Has the rightto <strong>tax</strong>provided ratedoes not11 Interest Income12 Royalties <strong>an</strong>d Fees forTechnical Servicesexceed theagreed rate <strong>of</strong><strong>tax</strong> as perDTAA13 Capital Gains Has the first rightto <strong>tax</strong> aTaxing Right<strong>of</strong> State <strong>of</strong>ResidenceReserves theright to <strong>tax</strong>18 Pensions C<strong>an</strong>not <strong>tax</strong> pension C<strong>an</strong> <strong>tax</strong> PensionVinay N S<strong>an</strong>ji & Co.RemarksDividend is not<strong>tax</strong>able in India.DDT is levied uponthe comp<strong>an</strong>ydeclaringdividendsTax c<strong>an</strong> bedetermined as perthe domestic lax2412

1/19/2010ACTIVE INCOMES-DISTRIBUTION OF TAXING RIGHTSArticleRef.Nature <strong>of</strong>IncomeTaxing Right <strong>of</strong>Source State7 Business Pr<strong>of</strong>its Yes, if PE exists in thesource stateTaxingRight <strong>of</strong>State <strong>of</strong>ResidenceRemarksIncome attributable to PEalone c<strong>an</strong> be <strong>tax</strong>ed insource state8 Shipping & AirTr<strong>an</strong>sport14 IndependentPersonal ServicesC<strong>an</strong>not <strong>tax</strong> this incomeYes, if the person has afixed base or his stayextends beyond 90 daysReservesthe right to<strong>tax</strong>Income attributable toFixed Base alone c<strong>an</strong> be<strong>tax</strong>ed in source state15 DependentPersonal Services(Employment)Yes, if employment isexercised in the sourcestate. C<strong>an</strong>not <strong>tax</strong> if stay isless th<strong>an</strong> 183 daysIf salary is paid on behalf<strong>of</strong> foreign employer <strong>an</strong>dis not borne <strong>by</strong> PE, thensource state c<strong>an</strong>not <strong>tax</strong>the salaryVinay N S<strong>an</strong>ji & Co.25ACTIVE INCOMES-DISTRIBUTION OF TAXING RIGHTSArticleRef.Nature <strong>of</strong>IncomeTaxing Right <strong>of</strong>Source State16 Directors’ Fees Yes, the source state c<strong>an</strong><strong>tax</strong> the same17 Artiste & Athletes Yes, the source state c<strong>an</strong><strong>tax</strong> the same19 Govt. ServiceRemuneration20 Students &ApprenticesNo, unless the personrendering servicehappens to be a resident<strong>of</strong> <strong>an</strong>d national <strong>of</strong> thesource stateNo <strong>tax</strong>ing rights21 Other Income Yes, the source state c<strong>an</strong><strong>tax</strong> the sameTaxingRight <strong>of</strong>State <strong>of</strong>ResidenceReservesthe right to<strong>tax</strong>RemarksDTA may specify theextent to which theincome may be exemptVinay N S<strong>an</strong>ji & Co.2613

1/19/2010ANTI-AVOIDANCE PROVISIONSArticle Ref. Title Comments9 AssociatedEnterprises26 Exch<strong>an</strong>ge <strong>of</strong>Information27 Assist<strong>an</strong>ce incollection <strong>of</strong><strong>tax</strong>esAdoption <strong>of</strong> Arms Length Price intr<strong>an</strong>sactions between AssociatedEnterprisesBoth the contracting states shallassist each other in collection <strong>of</strong>revenue claimsVinay N S<strong>an</strong>ji & Co.27ELIMINATION OF DOUBLE TAXATIONJuridical Double Taxation <strong>an</strong>d Economic Double TaxationArticle 23 –Alternate methods are as below: The Exemption Method- Full Exemption- Exemption with progressionForeign Tax Credit Method- Full Credit- Ordinary CreditDeduction MethodVinay N S<strong>an</strong>ji & Co.2814

1/19/2010MISCELLANEOUS PROVISIONSArticle Ref.Title24 Non-Discrimination25 Mutual Agreement Procedure28 Diplomats29 Territorial ExtensionVinay N S<strong>an</strong>ji & Co.29INTERPRETATION OF TREATYTax Treaty Vs. Domestic LawThe Vienna Convention on Law <strong>of</strong> Treaties, 1969 (VCLT) has codifiedinternational law. The rules contained in it c<strong>an</strong> be applied to interpret<strong>treaties</strong>.Section 31(1) to 31(4)) <strong>of</strong> the VCLT, 1969 lays down the foundation forinterpretation as per customary international lawsSection 31(1) states that a DTA shall be interpreted in GOOD FAITHin accord<strong>an</strong>ce with the ORDINARY MEANING to be given to theterms <strong>of</strong> the treaty in their CONTEXT <strong>an</strong>d in the light <strong>of</strong> its object.Treaties are based either on UN or OECD model. Hence commentariesin these models may assist interpretationVinay N S<strong>an</strong>ji & Co.3015

1/19/2010SOME IMPORTANT CONCEPTS Treaty ShoppingForeignInvestorInvestsinCo. incorporated inMauritius (ShellCo.) which in turnInvestsinIndi<strong>an</strong>Comp<strong>an</strong>y Most Favored Nation (MFN) Clause ProtocolsVinay N S<strong>an</strong>ji & Co.31APPLYING TAX TREATIESStep 1 What is the nature <strong>of</strong> the income ?Step 2 Does the treaty apply?Step 3 Determine which Article applies?Step 4 How are <strong>tax</strong>ation rights assigned?Step 5 How is the income calculated?Vinay N S<strong>an</strong>ji & Co.3216

1/19/2010REFERENCE MATERIALInternational Tax Policy <strong>an</strong>d Double TaxTreaties <strong>by</strong> Kevin HolmesVinay N S<strong>an</strong>ji & Co.33Vinay N S<strong>an</strong>ji & Co.Chartered Account<strong>an</strong>ts#2, I Floor, #347, M N Complex,Puttenahalli Main Road, J P Nagar 7 th Phase,B<strong>an</strong>galore-560078+91 080 41329667 (D), Mobile +919342577382E-mail-<strong>vinay</strong>ns<strong>an</strong>ji@gmail.com3417