srrv - Philippine Retirement Authority

srrv - Philippine Retirement Authority

srrv - Philippine Retirement Authority

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INFORMATION GUIDETO THESPECIAL RESIDENTRETIREE’S VISA (SRRV)1

Table of ContentsBackgrounderSRRV OptionsIntroductionVisionMissionPRA IconProduct MixDefinitionBasic Features of the different SRRV OptionsSRRV BenefitsQualifications and RequirementsProcedural Steps in obtaining the SRRVObligations of a Retiree-memberComparison of the different SRRV Options,I. Age QualificationII. Required Visa DepositIII. Convertibility of the Visa DepositIV. Application Fees to be paid upon joining the ProgramV. Other Fees to be paid upon joining the ProgramVI. Depository Bank for the Visa DepositVII. Documentary RequirementsFor Principal-applicantsFor Dependent-spouse applicantsFor Dependent-child/ren applicantsAdditional requirements for Principal applicants*Policies, Guidelines, Requirements, Fees and Procedures may be changed/revised,hence proper communication with PRA must be observed for updated information.2

BACKGROUNDERIntroductionThe <strong>Philippine</strong> <strong>Retirement</strong> <strong>Authority</strong> (PRA) is a government-owned and controlled corporationcreated by virtue of Executive Order No. 1037, signed by then President Ferdinand E. Marcos on04 July 1985. On 31 August 2001, through Executive Order No. 26, the control and supervisionof PRA was transferred to the Department of Trade and Industry - Board of Investments (BOI).And on 12 May 2009, through the passage of Republic Act No. 9593 otherwise known as theTourism Act of 2009, PRA became an attached agency of the Department of Tourism.PRA is mandated to develop end promote the <strong>Philippine</strong>s as a retirement haven as a means ofaccelerating the social and economic development of the country, strengthening its foreignexchange position,, at the same time providing further the best quality of life to the targetedretirees in a most attractive package.PRA’s core product is the Special Resident Retiree’s Visa (SRRV). The SRRV is a special nonimmigrantvisa which entitles foreign nationals and former Filipino citizens to reside in the<strong>Philippine</strong>s indefinitely with multiple-entry privileges.VisionTo make the <strong>Philippine</strong>s a leading and significant retirement destination for the world’s retirees,seniors and elderly.MissionTo continually develop PRA’s capabilities to enable and empower all segments of thegovernment and private sectors relevant to the <strong>Philippine</strong> <strong>Retirement</strong> Migration Agenda.The PRA IconThe <strong>Authority</strong> takes its corporate inspiration from President Aquino’sCampaign promises of pagbabago (change), pagbibigay pag – asa(hope inspired), paglutas sa kahirapan (poverty alleviation). This is thebase of the <strong>Authority</strong>’s values and initiatives.On the ground, PRA seeks the ultimate aspiration of “1 to 10 millionretirees in PNoy’s 6 years”. One million brings the retirement business to the level ofannual OFW remittances, three million pays for all <strong>Philippine</strong> foreign debt, four million pays forall public debt.PRA will continue to practice good governance: “GG4W”. In the <strong>Authority</strong>’s pursuit of goodgovernance, 1. Bawal magnakaw 2. Bawal magpanakaw 3. Bawal magwalang bahala pag maynagnanakaw and 4. Bawal makisawsaw sa ninakaw. Without necessarily having a witch huntingattitude, we will uphold integrity at all levels.3

The PRA Product MixAs a company, PRA relates to its environment and market, and satisfies its legal mandateembodied in Executive Order No. 1037, thru its products. In light of the above, the followingproduct mix for the <strong>Philippine</strong> <strong>Retirement</strong> <strong>Authority</strong> are adapted:A. SMILE <strong>Retirement</strong> Product: a retirement product that is simplified and simple, marketingoriented,integrated, long-lasting, efficient; this will be the main retirement product of PRA.B. Diplomats <strong>Retirement</strong> Product: an old retirement product that gives courtesy to formerFilipinos and former heads and officers of international organizations.C. Longstay Trial <strong>Retirement</strong> Product: a product to promote SMILE.D. Human Touch: a retirement product for the ailing retirees; both a substantial humanitarianand economic product; will use global telecommunication facilities and the soft faculties andqualities of Filipinos; will tap the health care, business and faith-based sectors.E. RADAR <strong>Retirement</strong> Program: a website-based program that puts every <strong>Philippine</strong> town andcity in the global RADAR; RADAR also incorporates LIRA (local integrated retirement area),Group Homes, home stay, retirement B and B, retirement franchising and retiremententrepreneurship; Geographic Information Systems (GIS) software will be used where possible.F. Services with a SMILE (SWS): a contact center that will eventually use various channels ofcommunication with retirees to answer their needs and offer the whole range of products andservices provided by PRA's accredited facilities and merchant partners; a veritable <strong>Retirement</strong>Mall.G. Deposit Management and Allied Services: consolidation of retiree deposits in the twogovernment banks, escrow accounts to facilitate retiree enrollment and the payment ofcommissions, collection of the annual maintenance and servicing fee, deposit withdrawals andprogram exits, collateral management, repatriation of withdrawn deposits.H. <strong>Retirement</strong> Public-Private Partnerships: PRA participation in public-private partnerships tobuild facilities and communities that cater to retirees; PRA will leverage, and bring to the tablevarious resources to facilitate construction and completion of such facilities and communities.SRRV OPTIONSOn 05 May 2011, the <strong>Philippine</strong> <strong>Retirement</strong> <strong>Authority</strong> introduced different SRRV Options forforeign retirees and former Filipinos who would like to make the <strong>Philippine</strong>s their retirementdestination.There are four (4) types of SRRV options, namely:1) SRRV Classic;2) SRRV SMILE;3) SRRV Courtesy; and4) SRRV Human Touch.4

The SRRV Classic, SRRV SMILE and SRRV Courtesy are SRRV Options for those activeretirees who want to bring their children to the <strong>Philippine</strong>s for education, to bring their familyfor business purposes, for medical reasons or just simply for retirement and relaxation.The SRRV Human Touch is an SRRV Option that allows foreign nationals with medicalneeds/assistance to retire in the <strong>Philippine</strong>s.Basic Features:1) SRRV SMILE – for active / healthy principal retirees 35 years old and above who wouldjust like to maintain their Visa deposit of US$20,000.00 in any of the PRA designated banks;2) SRRV CLASSIC – for active / healthy principal retirees who would opt to use their Visadeposit of US$10,000.00 or US$20,000.00 (50 years old & above) or US$50,000.00 (35 to49 years old) to purchase condominium units or use for long term lease of house and lot(both of which are ready for occupancy);3) SRRV HUMAN TOUCH – for ailing principal retirees, 35 years old and above, who areshown to have medical/clinical needs and services. Under this option, the retiree onlyneeds to have a Visa deposit of US$10,000.00, a monthly pension of at least US$1,500.00and a Health Insurance Policy; and4) SRRV COURTESY – for former Filipinos (35 years old & above), and foreign nationals (50years old & above) who have served in the <strong>Philippine</strong>s as diplomats, ambassadors,officers/staff of international organizations. The visa deposit is US$1,500.00.*Policies, Guidelines, Requirements, Fees and Procedures may be changed/revised,hence proper communication with PRA must be observed for updated information.5

SRRV BENEFITSA Retiree-member or holder of the SRRV is accorded the following benefits:1. Special, non-immigrant status with multiple entry privilegesRetirees may stay in the <strong>Philippine</strong>s for as long as they want, and they may come in and go outof the <strong>Philippine</strong>s anytime they desire2. Exemption from customs duties and taxes for one-time importation of personaleffects, appliances, and household furniture worth US$7,000.00 which should not beof commercial quantity and must be availed of within 90 days upon issuance of theSRRVA retiree may dispose of the personal effects/household goods within three (3) years fromimportation. However, taxes due must be paid accordingly.Should the retiree decide to terminate the SRRV within three (3) years following the entry of thepersonal effects/household goods, retiree will be required to pay the necessary taxes and duties.However, retiree may opt to ship back the items to the country of origin to be exempted frompaying the taxes and duties.3. Exemption from the Bureau of Immigration ACR I-CardAs a PRA member, the retiree does not need to secure the yearly Alien Certificate ofRegistration Identification Card (ACR I-Card) from the Bureau of Immigration4. Exemption from payment of travel tax provided the retiree has not stayed in the<strong>Philippine</strong>s for more than one (1) year from date of last entry into the country5. Conversion of the requisite deposit into active investments such as the purchase ofcondominium units.Applicable only for retirees under the SRRV Classic6. Pensions and annuities remitted to the <strong>Philippine</strong>s are tax-free7. Exemption from securing the Student’s Visa/Study PermitA Retiree-member (Principal or dependent) may study in the <strong>Philippine</strong>s without securing theStudent’s Visa/Study Permit8. Free subscription of the PRN (PRA Newsletter)9. Free assistance in securing documents from other government agenciesDriver’s License from the Land Transportation Office (LTO)Alien Employment Permit (AEP) from the Department of Labor and Employment (DOLE)Tax Exemption/Exemption certificate from the Department of Finance (DOF)Tax Identification Number from the Bureau of Internal Revenue (BIR)Clearance from the National Bureau of Investigation (NBI)10. Availment of the Greet and Assist Program at selected ports of entry11. Participation in PRA Social Dynamics (social/community integration, educationaltours, etc)12. Availment of the 5% discount at selected Duty Free <strong>Philippine</strong>s (DFC) outlets duringscheduled Family Days13. Free use of the PRA Retiree’s Lounge6

QUALIFICATIONS & REQUIREMENTSI. AGE QUALIFICATIONSRRVCLASSICSRRVSMILESRRVCOURTESYSRRVHUMAN TOUCHPrincipal ApplicantPrincipal ApplicantPrincipal ApplicantPrincipal Applicant35 years old & above35 years old & aboveForeign Nationals50 years old& aboveFormer Filipinos35 years old& above35 years old & aboveDependentDependentDependentDependentSpouse: Should be oflegal ageSpouse: Should be oflegal ageSpouse: Should be oflegal ageSpouse: Should be oflegal ageChild: Below 21years oldChild: Below 21years oldChild: Below 21 yearsoldChild: Below 21 yearsold*Principal applicant may be joined by dependents (spouse & children)Spouse – legitimate spouse of the Principal ApplicantChild- legitimate or legally adopted child by the Principal, who must beunmarried and below 21 years when joining the PRA program*Principal may bejoined by only onedependent. Either bythe spouse or by thechild.*Upon joining the program, child-dependent must be below 21 years old. The child may only remainas dependent until the age of 34. Once child reaches the age of 35, the child-dependent may opt tojoin as a Principal retiree otherwise the SRRV is deemed cancelled.*A spouse/child may only remain as a dependent as long as the Principal retiree has a valid SRR Visa*In case a Principal Retiree suffers an untimely demise, the surviving retiree-spouse may opt tobecome the Principal retiree, and the children remain as dependents. If the spouse chooses not tobecome the Principal member, the spouse and children’s SRRV MUST be cancelled. The law onsuccession shall apply with regard to the visa deposit.*Under the SRRV Courtesy, the Principal Applicant (Foreign national) must have either worked as aformer staff member of an International Organization or previously rendered diplomatic services in the<strong>Philippine</strong>s (allowed officers and designations are those recognized Officials by the DFA)*As per PRA Circular No. 12 dated January 15, 2013, the SRRV Courtesy program has beenexpanded to include retired ambassadors & other members of the diplomatic corps even if they havenot rendered diplomatic services in the <strong>Philippine</strong>s, retirees of United National, World BankOrganization & International Monetary Fund, Honorary Consuls who have served in <strong>Philippine</strong>diplomatic posts; recipients of Nobel Prize, Ramon Magsaysay and other prestigious awards, scientists,physicists and top-rated engineers. Complete list may be found at www.pra.gov.ph.7

II. REQUIRED VISA DEPOSITSRRVCLASSICSRRVSMILESRRVCOURTESYSRRVHUMAN TOUCH35 to 49 years old:US$50,000.0050 years old &above:35 years old & aboveUS$20,000.0035 years old & above:US$ 1,500.0035 years old &above:US$10,000.00A. With PensionUS$10,000.00B. Without PensionUS$20,000.00*Above visa deposit is for the Principal Retiree and 2 dependents. In excess of two (2) dependents, anadditional visa deposit of US$15,000.00 is needed for each additional dependent This rule does notapply to SRRV Human Touch since only one (1) dependent is allowed, and to Former Filipino citizenssince the additional deposit is waived.*The With Pension and Without Pension Schemes under the SRRV Classic are for those Principalretirees who are 50 years old and above.*If a Principal Applicant will join under the With Pension Scheme, Pension documents must bepresented as additional requirements including a proof of monthly pension of US$800 for a retiree orUS$1,000 for a couple.III.CONVERTIBILITY OF VISA DEPOSITSRRVSRRVCLASSICSMILESRRVCOURTESYSRRVHUMAN TOUCHThe Visa Deposit maybe used forinvestment/s in realestate properties(purchase/lease ofready for occupancycondominium units,lease of house/ house& lot) which is valuedat a minimum ofUS$50,000.00.The Visa Deposit isREQUIRED to bemaintained in a PRAdesignated bank andMAY only be withdrawn:-Upon cancellation of theSRRV-To satisfy end of termneeds or catastrophicobligations e.g. extrememedical condition, death,repatriationThe Visa deposit may beused for investment inreal estate properties(purchase/ lease ofcondominium units, leaseof house/ house & lot).An annual Visitorial Feeof US$15.00 must bepaid to PRA once the visadeposit has beenconverted to investment.The Visa Deposit MUSTonly be maintained in aPRA designated bankand MAY only bewithdrawn :-Upon cancellation of theSRRV-To satisfy end of termneeds or catastrophicobligations e.g. extrememedical condition, death,repatriation*A retiree that will opt to convert the visa deposit into active investment must submit the documentaryrequirements enumerated at the PRA Checklist.*For purchase/long-term lease of condominium units or other real estate properties, the CondominiumCertificate of Title (CCT) or Transfer Certificate of Title (TCT) must be annotated with the PRArestriction*Where the retiree opts to sell the investment made, retiree must re-deposit the proceeds of the sales(equivalent to the original visa deposit) to a PRA designated bank.8

IV. APPLICATION FEES TO BE PAID UPON JOINING THE PROGRAMSRRVCLASSICSRRVSMILESRRVCOURTESYSRRVHUMAN TOUCHPrincipal = US$1,400.00Dependent = US$ 300.00 (for each dependent)In case that an applicant discontinues his/her application, the Application Fee may be reimbursed butthe amount of US$200.00 will be deducted as service fee. Where the applicant discontinues while thedocuments are already filed with the Bureau of Immigration, total application fee is non-refundable.V. OTHER FEES TO BE PAID UPON JOINING THE PROGRAMSRRVCLASSICSRRVSMILESRRVCOURTESYSRRVHUMAN TOUCHPRA ANNUAL FEE(PAF) of US$360.00*For more than 3retiree members in afamily, an additionalPAF of US$100.00 foreach additionaldependent must bepaidPRA ANNUAL FEE(PAF) of US$360.00*For more than 3 retireemembers in a family, anadditional PAF ofUS$100.00 for eachadditional dependentmust be paidPRA ANNUAL FEE (PAF)of US$360.00 is notapplicableHowever, in case of morethan 2 dependents, US$10.00 for each dependentfor the issuance of the PRAID Card must be paidPRA ANNUAL FEE(PAF) ofUS$360.00*Policies, Guidelines, Requirements, Fees and Procedures may be changed/revised,hence proper communication with PRA must be observed for updated information.9

VI. DEPOSITORY BANKSRRVCLASSICSRRVSMILESRRVCOURTESYSRRVHUMAN TOUCHA Principal Retiree applicant must remit the visa deposit to any of the PRA accredited/ designatedbanks.Coordinate with PRA for the updated list of PRA designated bank/s.SAMPLE REMITTANCE INSTRUCTION TO THE DEVELOPMENT BANK OF THE PHILIPPINESTHRU: BANK NAME: JP MORGAN CHASE BANK, NYSwift Adress: CHASUS33For further credit to BENEFICIARY BANK:DEVELOPMENT BANK OF THE PHILIPPINESAccount No.: 811164961Swift Address: DBPHPHMMBENEFICIARY CUSTOMER NAME AND ADDRESS:REMITTANCE INFORMATION:Account No. 0405-027438-100PHILIPPINE RETIREMENT AUTHORITY29/F Citibank TowerPaseo de Roxas, Makati CitySRRV deposit of _(name of retiree applicant)ORTHRU: BANK NAME: CITIBANK NA, NYSwift Code: CITIUS33For further credit to BENEFICIARY BANK:DEVELOPMENT BANK OF THE PHILIPPINESAccount No.: 36117139Swift Address: DBPHPHMMBENEFICIARY CUSTOMER NAME AND ADDRESS:REMITTANCE INFORMATION:Account No. 0405-027438-100PHILIPPINE RETIREMENT AUTHORITY29/F Citibank TowerPaseo de Roxas, Makati CitySRRV deposit of _(name of retiree applicant)___10

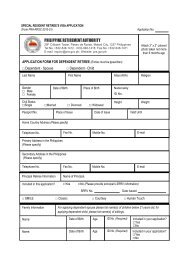

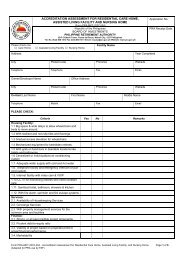

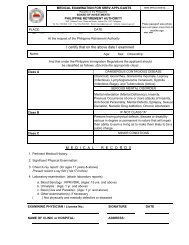

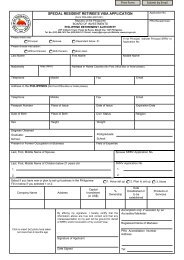

VII. DOCUMENTARY REQUIREMENTSSRRVCLASSICSRRVSMILESRRVCOURTESYSRRVHUMAN TOUCHFOR PRINCIPAL APPLICANTS1. Accomplished SRRV Application Form (downloadable at www.pra.gov.ph)Information must be typed written and ensure that all information requested are answered;2. Medical Certificate (downloadable at www.pra.gov.ph)May be secured from the country of origin. However, said document must be translated inEnglish, if necessary, and MUST BE authenticated by the <strong>Philippine</strong> Embassy/Consular Officenearest the place where the Certificate was secured from. Applicant may opt to secure theMedical Certificate in the <strong>Philippine</strong>s from any licensed physician/clinic/hospital. If the certificatehas been secured in the <strong>Philippine</strong>s, there is no need for any authentication. A Medical certificateis only valid within 6 months from the date it was secured. PRA may accompany retiree-applicantin a PRA accredited clinic.3. Police ClearanceApplicant needs to secure this clearance from the country of origin. Said document must betranslated in English, if necessary, and MUST BE authenticated by the <strong>Philippine</strong> Embassy/Consular Office nearest the place where the Clearance was secured from. A Police Clearance isonly valid within 6 months from date it was secured;4. National Bureau of Investigation (NBI) ClearanceNBI Clearance (<strong>Philippine</strong> document) is needed when an applicant has stayed in the <strong>Philippine</strong>sfor more than 30 days from date of last entry and prior to application for the SRRV. The NBIClearance is only valid within one (1) year from date it was secured. PRA may accompany theretiree-applicant to the NBI-Main Office;5. Bank Certification for the visa depositThe Bank will send PRA the notarized Bank Certificate after the remittance has been received bythe Bank. The amount of the Visa deposit depends on the SRRV Option that the applicant haschosen;In cases that an applicant will be joined by more than two (2) dependents, an additional visadeposit of US$15,000.00 for each additional dependent must be remitted under the name of thePrincipal applicant.;6. Original Passport with valid arrival/entry visa in the <strong>Philippine</strong>sAn applicant whether Principal or dependent MUST be in the <strong>Philippine</strong>s for the duration of theSRRV application.Where the Temporary Visitor’s Visa expires while the SRRV is being processed, the applicant musthave it extended. PRA may assist in the extension of the Temporary Visitor’s Visa;An applicant must have a Temporary Visitor’s Visa in order for PRA and the Bureau of Immigrationto accept the application for the SRRV. Other visa, except for the Balikbayan Visa which isbeing issued to former Filipinos and their dependents, must be downgraded to TEMPORARYVISITOR’S VISA. PRA may assist the applicant in downgrading the current visa to TemporaryVisitor’s Visa.;7. Photos – 2x2 (12 pieces).11

FOR DEPENDENT-SPOUSE APPLICANTSAll of the above documents must also be secured by the joining spouse except for the bankcertification.Additional requirement/s - Proof of Marriage (Marriage Contract, Marriage Certificate) which mustbe translated in English, if necessary, and MUST BE authenticated by the <strong>Philippine</strong>Embassy/Consular Office nearest the place where the Certificate/Contract was secured from.FOR DEPENDENT-CHILD APPLICANTSAll of the above documents must also be secured by the child applying for inclusion except for thebank certification. Dependent child below 18 years old does not need to secure the Police or NBIClearanceAdditional requirement/s - Proof of Relationship to the Principal (Birth Certificate,Family/household Register) which must be translated in English, if necessary, and MUST BEauthenticated by the <strong>Philippine</strong> Embassy/Consular Office nearest the place where the Certificate wassecured from.ADDITIONAL REQUIREMENTS FOR PRINCIPAL APPLICANTSFor Principal applicants joining under the SRRV Classic-With Pension Scheme, Certification of<strong>Retirement</strong> Benefits, equivalent to or more than US$1,000.00, issued by the concerned governmentand/or private entity authenticated by the <strong>Philippine</strong> Embassy or Consular Office;For Principal applicants joining under the SRRV Human Touch, 1) Medical Certificate showing preexistingcondition and in need of medical/clinical care and services, 2) Certification of <strong>Retirement</strong>Benefits, equivalent to or more than US$1,500.00, issued by the concerned government and/orprivate entity authenticated by the <strong>Philippine</strong> Embassy or Consular Office, 3) Health Insuranceportable to and acceptable in the <strong>Philippine</strong>s;For former Filipino citizens joining under the SRRV Courtesy, 1) Birth Certificate issued by theNational Statistics Office (NSO) or Old <strong>Philippine</strong> Passport or Naturalization documents form hostcountry;For foreign nationals joining under the SRRV Courtesy, 1) Certificate by the internationalorganization concerned that the applicant was a former officer/staff – stating position held and theduration/date of employmentFor foreign nationals eligible under the Expanded Scope of SRRV Courtesy, 1) Certificate by theinternational organization concerned that the applicant was a former officer/staff – stating positionheld and the duration/date of employment; 2) Proof of monthly pension or any other similar benefitsof at least US$1,000.00.All original documents must be submitted along with 3 sets of photocopied documents.12

PROCEDURAL STEPS IN OBTAINING THE SRRVThe retiree-applicant or the accredited marketer of the retiree-applicant files the documents and paysthe necessary fees to the PRA Makati Office or to any of the PRA Satellite Offices.PRA Office prepares endorsement letter and check payment to be filed and paid, respectively, to theBureau of Immigration – Makati Extension OfficeThe Immigration - Makati Extension Office evaluates and prepares Order for transmittal to the Bureauof Immigration – Main Office.The Immigration – Main Office approves and signs the Order and transmits back to Immigration -Makati Extension Office.The BI-Makati Extension Office furnishes PRA a copy of the approved Order and PRA prepares theSRRV sticker for the implementation of SRRV upon signing by the Officer-In-Charge, Immigration -Makati Extension Officebrought back to PRA.PRA-RRSC laminates the SRRV sticker on the retiree’s passport, prepares the PRA ID card andadministers the Oath of Affirmation to the new retiree-member.PRA-RRSC releases the passport and ID card.The processing time for the application for the SRRV usually takes 10 to 15 working days.Where the Temporary Visa expires during the application of the SRRVisa, the retiree-applicant needsto have the Temporary Visitor’s Visa extended. Retiree-applicant may just give payment to PRA forthe processing of the extension of the said Visa.Where the processing must be discontinued (needs to return to his country or for any otheremergency reasons), the documents including the passport may be pulled out from the Bureau ofImmigration. The applicant may proceed with his application later on but needs to pay anadditional revalidation fee of Php5,520.00 (Bureau of Immigration required fee).13

OBLIGATIONS OF A RETIREE-MEMBERSRRVCLASSICSRRVSMILESRRVCOURTESYSRRVHUMAN TOUCHThe rules and regulations of PRA are explained by the PRA Officer during the Oath of AffirmationPay the PRAANNUAL FEE (PAF)of US$360.00*For more than 3retiree members in afamily, an additionalPAF of US$100.00 foreach additionaldependent must bepaidPay the PRA ANNUALFEE (PAF) ofUS$360.00*For more than 3 retireemembers in a family, anadditional PAF ofUS$100.00 for eachadditional dependentmust be paidPay the PRA ANNUALFEE (PAF) of US$10.00*Each retiree member in afamily must pay the PAF ofUS$10.00Pay the PRA ANNUALFEE (PAF) ofUS$360.00*The PAF is due every anniversary month which corresponds to the SRRV issuance.*The PAF may be paid in its Peso equivalent based on the Banko Sentral ng Pilipinas (BSP) rate on theday of payment;*The PAF may be paid directly to the PRA Office or thru PRA’s Dollar or Peso Bank Account with theLand Bank of the <strong>Philippine</strong>s.Mode of Payment for the SRRV Application Fee and/or PAFA Retiree or representative (Marketer/Non-Marketer) may pay in cash or demand draft/manager’scheck directly to any PRA Office (Makati or Satellite Offices).A Retiree who is in the <strong>Philippine</strong>s may opt to deposit payment to any branch of Land Bank in the<strong>Philippine</strong>s. Below information should be indicated on the deposit slip which must be sent to PRA:Account NamePeso Account Number 0052-1054-63Branch Name<strong>Philippine</strong> <strong>Retirement</strong> <strong>Authority</strong>ForNAME OF RETIREE/SRRV NO.Buendia BranchTara Bldg., 3389 Sen. Gil Puyat, Makati City, <strong>Philippine</strong>sA Retiree who is out of the country or would like to pay in US Dollars may remit payment viatelegraphic transfer to:Bank NameLand Bank of the <strong>Philippine</strong>sAccount Name <strong>Philippine</strong> <strong>Retirement</strong> <strong>Authority</strong>For NAME OF RETIREE/SRRV NO.US Dollar Account Number 2204-0086-82Branch Name Buendia BranchTara Bldg., 3389 Sen. Gil Puyat Ave., Makati City, <strong>Philippine</strong>sSWIFT Code TLBPPHMMPlease send a photocopy and/or duplicate copy of the deposit slip to any PRA Office. An OfficialReceipt will be issued by PRA upon verification.As od August 201314

PRA CONTACT DETAILSMAIN OFFICE:PHILIPPINE RETIREMENT AUTHORITY29f Citibank Tower, 8741 Paseo de RoxasMakati City 1200, <strong>Philippine</strong>sTel. No. 8481412Fax. No. 848 1411Email Address: inquiry@pra.gov.phWebsite: www.pra.gov.phSATELLITE OFFICES:Unit 8, Bldg. 3 Nevada SquareNo. 2 Loakan RoadBaguio City, BaguioTel. No. +74.423.3123Fax. No. +74.424.1423Officer-In-Charge: Eric de Ausen PatiG/F City Tourism OfficeOlongapo Convention CenterOld Hospital Road, East TapinacOlongapo City, ZambalesOfficer-In-Charge: Carlo T. Zialcita2/F DTI-Region 3 OfficeAngeles Business Center Bldg.Teresa St., Nepomart ComplexAngeles City, PampangaMobile No. 0918-4480102Officer-In-Charge: Carlo T. ZialcitaUnit 202 Club Ultima Fuente Tower IICrown regency Hotel & TowersFuente Osmena, Jones Ave.Cebu City 6000, CebuTel. No. +32.238.5693Officer-In-Charge: Elma A. Corbeta2/F The Royal Mandaya HotelJ. Palma Gil St.Davao City, DavaoTel. No. +82.300.6063Officer-In-Charge: Jaime B. Llames15